Capital levy

A capital levy is a tax on capital rather than income, collected once, rather than repeatedly (regular collection would make it a wealth tax). For example, a capital levy of 30% will see an individual or business with a net worth of $100,000 pay a one-off sum of $30,000, regardless of income. Capital levies are considered difficult for a government to implement.

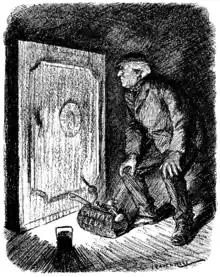

Paisley humanitarian. "If I could only be quite sure that I shouldn't be discouraging him from saving."

"Mr. Asquith has pronounced himself cautiously in favour of a capital levy, on the condition, amongst others, that it must not be allowed to discourage the habit of saving." Cartoon from Punch magazine (February 11, 1920), illustrating part of the dilemma for governments pondering the use of a capital levy.

Some economists argue that capital levies are a disincentive to savings and investment, and cause capital flight, but others argue that in theory this need not be the case. The latter view was popular in the World Wars; in the 2010s, it has also gained some acceptance as more heavily indebted nations struggle to raise revenues.

Examples of capital levies

Ancient democracies

In ancient Athens during its democracy, there was a form of capital levy known as a liturgy (Ancient Greek: λειτουργία, romanized: leitourgia, lit. '"work for the people"; from litos ergos, "public service"').[1] The liturgy might anything from financing a public play to supplying and manning a trireme for the navy. An Athenian could volunteer for such a levy, but if no-one volunteered, a wealthy person meeting the eligibility requirements would be ordered to supply it. They could escape by nominating someone wealthier to take over the duty; if the nominated person disputed this, the nominator could take the liturgy, or offer to exchange property with their nominee (antidosis). If the nominee refused, the matter went to court, and the liturgy was assigned whoever the court case determined to be wealthier. Athenians often concealed their wealth to escape taxation, and sycophants who discovered concealed wealth might use it as blackmail material. Antidosis helped the state identify the wealthiest people, and kept the rich suspicious of one another.[2][3] Athens also had a wealth tax called eisphora (see symmoria), and for this purpose the city required each rich person give an estimate of his fortune (τίμημα). These self-assessments were not very accurate.[4]:p.159 The liturgy has not been much studied by economists.[2]

20th century

During both World Wars, capital levies were introduced, with the generally-stated aim of distributing the sacrifices required by the war more evenly. This had a significant effect on both income and wealth distributions, lasting decades into the post-war period. Such policies were commonly referred to as the "conscription of wealth".[5]

a fundamental objection to the government's policy of conscription is that it conscripts human life only, and that it does not attempt to conscript wealth...

— Liberal party election platform, autumn 1917, Canada

The Economist, a British publication, opposed capital levies, but supported "direct taxation heavy enough to amount to rationing of citizens' incomes"; similarly, the American economist Oliver Mitchell Wentworth Sprague, in the Economic Journal, argued that that "conscription of men should logically and equitably be accompanied by something in the nature of conscription of current income above that which is absolutely necessary".[5]

21st century

The Italian government of Giuliano Amato imposed a 0.6 percent levy on all bank deposits on 11 July 1992.[6]

In 1999, Donald Trump proposed for the United States a one off 14.25% levy on the net worth of individuals and trusts worth $10 million or more. Trump claimed that this would generate $5.7 trillion in new taxes, which could be used to eliminate the national debt.[7]

The Cypriot government levied 47.5 percent of Bank of Cyprus deposits over one hundred thousand Euros in July 2013.[8][9] In October 2013, the International Monetary Fund released a report[10] stating, "The sharp deterioration of the public finances in many countries has revived interest in a 'capital levy' – a one-off tax on private wealth – as an exceptional measure to restore debt sustainability. The appeal is that such a tax, if it is implemented before avoidance is possible and there is a belief that it will never be repeated, does not distort behavior."[11][10] The next year the Bundesbank proposed that Eurozone countries should attempt a one-off levy of bank deposits to avoid bankruptcy.[12][13]

A February 2014 report by Reuters showed the idea had gained traction in the European Commission, which will ask its insurance watchdog later that year for advice on a possible draft law "to mobilize more personal pension savings for long-term financing".[14]

See also

References

- Roberts, Jim (6 September 2015). "Ancient Greek Theatre: Choregos [χορηγός]". Ancient Greek Theatre.

- Carmichael, Calum M. "Public munificence for private benefit: liturgies in classical Athens. - Free Online Library". www.thefreelibrary.com.

- McCannon, Bryan C. (1 December 2017). "Who pays taxes? Liturgies and the Antidosis procedure in Ancient Athens". Constitutional Political Economy. 28 (4): 407–421. doi:10.1007/s10602-017-9249-7. ISSN 1572-9966.

- Christ, Matthew R. (1990). "Liturgy Avoidance and Antidosis in Classical Athens". Transactions of the American Philological Association. 120: 147–169. doi:10.2307/283983. JSTOR 283983.

- https://web.stanford.edu/group/scheve-research/cgi-bin/wordpress/wp-content/uploads/2013/08/ScheveStasavage_IO_2010.pdf

- "SCUSATE, MA ERAVAMO SUL BARATRO" (in Italian). la Repubblica. 1992-07-11. Retrieved 8 August 2015.

Così dice Giuliano Amato per spiegare il nuovo balzello: 6 mila lire di imposta ogni milione

- "Trump proposes massive one-time tax on the rich". CNN. November 9, 1999.

- Bensasson, Marcus; Georgios Georgiou (2013-07-30). "Cyprus Sets Levy on Bank of Cyprus Uninsured Depositors at 47.5%". Bloomberg. Retrieved 8 August 2015.

- Conway, Edmund (2013-03-16). "The tragedy of Cyprus". Retrieved 8 August 2015.

- IMF Fiscal Monitor: "Taxing Times" Oct 2013, p.49

- Opdyke, Jeff. "A Confiscation Tax is Headed Your Way". The Sovereign Investor. The Sovereign Investor. Archived from the original on 27 December 2013. Retrieved 27 December 2013.

- Vasagar, Jeevan; Peter Spiegel (2014-01-27). "Bundesbank proposes wealth tax for EU states facing bankruptcy". Financial Times. Retrieved 8 August 2015.

- "Monatsbericht Januar: Anpassungen in den Peripherieländern schreiten voran" (in German). Deutsche Bundesbank. 2014-01-27. Retrieved 8 August 2015.

diskutiert der Monatsbericht die Vor- und Nachteile einer einmaligen Abgabe auf private Vermögen zur Reduktion der staatlichen Schuldenstände

- reuters.com: "Exclusive: EU executive sees personal savings used to plug long-term financing gap" (Jones) 12 Feb 2014

Further reading

- The Capital Levy in Theory and Practice, Eichengreen, Barry The Capital Levy in Theory and Practice (September 1989). NBER Working Paper No. w3096.

- Capital Levies—A Step Towards Improving Public Finances in Europe, Bach, Stefan, 3 August 2012, DIW Berlin—Deutsches Institut für Wirtschaftsforschung