Fiscal cancel

In philately a fiscal cancel is a cancellation on a stamp that indicates that the stamp has been used for fiscal (taxation) purposes.[1]

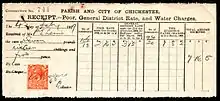

A 1929 receipt showing a British postage and revenue stamp with a fiscal cancel.

The stamp may either be a revenue stamp, intended purely for fiscal use, or it may be a dual-purpose stamp valid for either postal or fiscal use.

Varieties

Fiscal cancels take a variety of forms:

- Pen cancels with a simple cross, initials or other markings.

- Perfin or punched hole cancels.

- Embossing.

- Damaging the surface of the stamp using a serrated or ridged roller.

- Multiple parallel cuts.[2][3]

- Handstamp cancels similar to the postmark on a stamp and which may be in purple or red ink rather than the black favoured for cancels of postage stamps.

- Tearing or other physical damage to the stamp.

Examples:

A Russian revenue stamp with a fiscal pen cancel.

A Russian revenue stamp with a fiscal pen cancel. An Estonian revenue stamp with a handstamp cancel in purple.

An Estonian revenue stamp with a handstamp cancel in purple. A revenue stamp from Cochin cancelled by perforation.

A revenue stamp from Cochin cancelled by perforation. A French revenue stamp with a manuscript cancel.

A French revenue stamp with a manuscript cancel. A revenue stamp of Nepal for court fees with a punched cancel as well as handstamps.

A revenue stamp of Nepal for court fees with a punched cancel as well as handstamps. An Indian revenue stamp with a punched cancel.

An Indian revenue stamp with a punched cancel.

Values

Postage stamps valid for either fiscal or postal purposes are often worth less when fiscally used than when postally used. They are not, however, necessarily more common fiscally used than postally used.

References

- Ask Phil philatelic glossary. Retrieved 26 April 2010. Archived 16 March 2010 at the Wayback Machine

- From around 1900, United States revenue stamps were required to be mutilated by cutting, after being affixed to documents, and in addition to being cancelled in ink. A class of office equipment was created to achieve this which became known as "stamp mutilators". Revenue Stamp Mutilators. Archived 2012-06-15 at WebCite Early Office Museum, 2012. Retrieved 15 June 2012.

- United States Patent for a "Stamp Mutilator", 1900. No. 653366.

This article is issued from Wikipedia. The text is licensed under Creative Commons - Attribution - Sharealike. Additional terms may apply for the media files.