General Electric

General Electric Company (GE) is an American multinational conglomerate incorporated in New York City and headquartered in Boston. As of 2018, the company operates through the following segments: aviation, healthcare, power, renewable energy, digital industry, additive manufacturing and venture capital and finance.[2][3]

| |

| Type | Public |

|---|---|

| ISIN | US3696041033 |

| Industry | Conglomerate |

| Predecessor | Edison General Electric Thomson-Houston Electric |

| Founded | April 15, 1892 in Schenectady, New York, US |

| Founders | |

| Headquarters | Boston, Massachusetts, US |

Area served | Worldwide |

Key people | H. Lawrence Culp Jr. (Chairman & CEO) |

| Products | |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 205,000 (2020) |

| Subsidiaries | |

| Website | www |

| Footnotes / references [1] | |

In 2019, GE ranked among the Fortune 500 as the 21st-largest firm in the United States by gross revenue.[4] In 2011, GE ranked among the Fortune 20 as the 14th-most profitable company but has since very severely underperformed the market (by about 75%) as its profitability collapsed.[5][6][7] Two employees of GE—Irving Langmuir (1932) and Ivar Giaever (1973)—have been awarded the Nobel Prize.[8]

History

Formation

_001.jpg.webp)

During 1889, Thomas Edison had business interests in many electricity-related companies, including Edison Lamp Company, a lamp manufacturer in East Newark, New Jersey; Edison Machine Works, a manufacturer of dynamos and large electric motors in Schenectady, New York; Bergmann & Company, a manufacturer of electric lighting fixtures, sockets, and other electric lighting devices; and Edison Electric Light Company, the patent-holding company and the financial arm backed by J. P. Morgan and the Vanderbilt family for Edison's lighting experiments.[10]

In 1889, Drexel, Morgan & Co., a company founded by J.P. Morgan and Anthony J. Drexel, financed Edison's research and helped merge those companies under one corporation to form Edison General Electric Company, which was incorporated in New York on April 24, 1889. The new company also acquired Sprague Electric Railway & Motor Company in the same year.[11][12]

In 1880, Gerald Waldo Hart formed the American Electric Company of New Britain, Connecticut, which merged a few years later with Thomson-Houston Electric Company, led by Charles Coffin. In 1887, Hart left to become superintendent of the Edison Electric Company of Kansas City, Missouri.[13] General Electric was formed through the 1892 merger of Edison General Electric Company of Schenectady, New York, and Thomson-Houston Electric Company of Lynn, Massachusetts, with the support of Drexel, Morgan & Co.[12] Both plants continue to operate under the GE banner to this day.[14] The company was incorporated in New York, with the Schenectady plant used as headquarters for many years thereafter. Around the same time, General Electric's Canadian counterpart, Canadian General Electric, was formed.[15]

In 1893, General Electric bought the business of Rudolf Eickemeyer in Yonkers, New York, along with all of its patents and designs. One of the employees was Charles Proteus Steinmetz. Only recently arrived in the United States, Steinmetz was already publishing in the field of magnetic hysteresis and had earned worldwide professional recognition.[16] Led by Steinmetz, Eickemeyer's firm had developed transformers for use in the transmission of electrical power among many other mechanical and electrical devices. Steinmetz quickly became known as the engineering wizard in GE's engineering community.[16]

Public company

In 1896, General Electric was one of the original 12 companies listed on the newly formed Dow Jones Industrial Average,[17] where it remained a part of the index for 122 years, though not continuously.[18]

.jpg.webp)

In 1911, General Electric absorbed the National Electric Lamp Association (NELA) into its lighting business. GE established its lighting division headquarters at Nela Park in East Cleveland, Ohio. The lighting division has since remained in the same location.[19]

RCA and NBC

Owen D. Young, through GE, founded the Radio Corporation of America (RCA) in 1919, after purchasing the Marconi Wireless Telegraph Company of America. He aimed to expand international radio communications. GE used RCA as its retail arm for radio sales.[20] In 1926, RCA co-founded the National Broadcasting Company (NBC), which built two radio broadcasting networks. In 1930, General Electric was charged with antitrust violations and decided to divest itself of RCA.[21]

Television

In 1927, Ernst Alexanderson of GE made the first demonstration of his television broadcasts[22] at his General Electric Realty Plot home at 1132 Adams Rd, Schenectady, New York. On January 13, 1928, he made what was said to be the first broadcast to the public in the United States[22] on GE's W2XAD: the pictures were picked up on 1.5 square inch (9.7 square centimeter) screens in the homes of four GE executives. The sound was broadcast on GE's WGY (AM).

Experimental television station W2XAD evolved into the station WRGB which, along with WGY and WGFM (now WRVE), was owned and operated by General Electric until 1983.[23]

Power generation

Led by Sanford Alexander Moss, GE moved into the new field of aircraft turbo superchargers. This technology also led to the development of industrial gas turbine engines used for power production.[24] GE introduced the first set of superchargers during World War I, and continued to develop them during the interwar period. Superchargers became indispensable in the years immediately prior to World War II. GE supplied 300,000 turbo superchargers for use in fighter and bomber engines. This work led the U.S. Army Air Corps to select GE to develop the nation's first jet engine during the war.[25] This experience, in turn, made GE a natural selection to develop the Whittle W.1 jet engine that was demonstrated in the United States in 1941.[26] GE was ranked ninth among United States corporations in the value of wartime production contracts.[27] Although, their early work with Whittle's designs was later handed to Allison Engine Company. GE Aviation then emerged as one of the world's largest engine manufacturers, bypassing the British company, Rolls-Royce plc.

Some consumers boycotted GE light bulbs, refrigerators and other products during the 1980s and 1990s. The purpose of the boycott was to protest against GE's role in nuclear weapons production.[28]

In 2002, GE acquired the wind power assets of Enron during its bankruptcy proceedings.[29] Enron Wind was the only surviving U.S. manufacturer of large wind turbines at the time, and GE increased engineering and supplies for the Wind Division and doubled the annual sales to $1.2 billion in 2003.[30] It acquired ScanWind in 2009.[31][32]

In 2018, GE Power garnered press attention when a model 7HA gas turbine in Texas was shut down for two months due to the break of a turbine blade.[33] This model uses similar blade technology to GE's newest and most efficient model, the 9HA. After the break, GE developed new protective coatings and heat treatment methods. Gas turbines represent a significant portion of GE Power's revenue, and also represent a significant portion of the power generation fleet of several utility companies in the United States. Chubu Electric of Japan and Électricité de France also had units that were impacted. Initially, GE did not realize the turbine blade issue of the 9FB unit would impact the new HA units.[34]

Computing

GE was one of the eight major computer companies of the 1960s along with IBM, Burroughs, NCR, Control Data Corporation, Honeywell, RCA, and UNIVAC.[35] GE had a line of general purpose and special purpose computers, including the GE 200, GE 400, and GE 600 series general purpose computers,[35] the GE 4010, GE 4020, and GE 4060 real-time process control computers, and the DATANET-30 and Datanet 355 message switching computers (DATANET-30 and 355 were also used as front end processors for GE mainframe computers). A Datanet 500 computer was designed, but never sold.[36]

In 1962, GE started developing its GECOS (later renamed GCOS) operating system, originally for batch processing, but later extended to timesharing and transaction processing. Versions of GCOS are still in use today. From 1964 to 1969, GE and Bell Laboratories (which soon dropped out) joined with MIT to develop the Multics operating system on the GE 645 mainframe computer. The project took longer than expected and was not a major commercial success, but it demonstrated concepts such as single level store, dynamic linking, hierarchical file system, and ring-oriented security. Active development of Multics continued until 1985.

GE got into computer manufacturing because in the 1950s they were the largest user of computers outside the United States federal government,[35] aside from being the first business in the world to own a computer. Its major appliance manufacturing plant "Appliance Park" was the first non-governmental site to host one.[37] However, in 1970, GE sold its computer division to Honeywell, exiting the computer manufacturing industry,[35] though it retained its timesharing operations for some years afterwards. GE was a major provider of computer time-sharing services, through General Electric Information Services (GEIS, now GXS), offering online computing services that included GEnie.

In 2000, when United Technologies Corp. planned to buy Honeywell, GE made a counter-offer that was approved by Honeywell.[38] On July 3, 2001, the European Union issued a statement that "prohibit the proposed acquisition by General Electric Co. of Honeywell Inc.".[39] The reasons given were it "would create or strengthen dominant positions on several markets and that the remedies proposed by GE were insufficient to resolve the competition concerns resulting from the proposed acquisition of Honeywell".[39]

On June 27, 2014, GE partnered with collaborative design company Quirky to announce its connected LED bulb called Link. The Link bulb is designed to communicate with smartphones and tablets using a mobile app called Wink.[40]

Acquisitions and divestments

In December 1985, GE reacquired RCA, primarily for the NBC television network (also parent of Telemundo Communications Group) for $6.28 billion; this merger surpassed the Capital Cities/ABC merger that happened earlier that year as the largest non-oil merger in world business history.[41] The remainder was sold to various companies, including Bertelsmann (Bertelsmann acquired RCA Records) and Thomson SA, which traces its roots to Thomson-Houston, one of the original components of GE. Also in 1986, Kidder, Peabody & Co., a U.S.-based securities firm, was sold to GE and following heavy losses was sold to PaineWebber in 1994.[42]

In 2002, Francisco Partners and Norwest Venture Partners acquired a division of GE called GE Information Systems (GEIS). The new company, named GXS, is based in Gaithersburg, Maryland. GXS is a provider of B2B e-Commerce solutions. GE maintains a minority stake in GXS.[43] Also in 2002, GE Wind Energy was formed when GE bought the wind turbine manufacturing assets of Enron Wind after the Enron scandals.[29][30][44]

In 2004, GE bought 80% of Vivendi Universal Entertainment, the parent of Universal Pictures from Vivendi. Vivendi bought 20% of NBC forming the company NBCUniversal. GE then owned 80% of NBCUniversal and Vivendi owned 20%. In 2004, GE completed the spin-off of most of its mortgage and life insurance assets into an independent company, Genworth Financial, based in Richmond, Virginia.[45]

Genpact formerly known as GE Capital International Services (GECIS) was established by GE in late 1997 as its captive India-based BPO. GE sold 60% stake in Genpact to General Atlantic and Oak Hill Capital Partners in 2005 and hived off Genpact into an independent business. GE is still a major client to Genpact today, for services in customer service, finance, information technology, and analytics.

In May 2007, GE acquired Smiths Aerospace for $4.8 billion.[46] Also in 2007, GE Oil & Gas acquired Vetco Gray for $1.9 billion,[47][48] followed by the acquisition of Hydril Pressure & Control in 2008 for $1.1 billion.[49][50]

GE Plastics was sold in 2008 to SABIC (Saudi Arabia Basic Industries Corporation). In May 2008, GE announced it was exploring options for divesting the bulk of its consumer and industrial business.[51][52]

On December 3, 2009, it was announced that NBCUniversal would become a joint venture between GE and cable television operator Comcast. Comcast would hold a controlling interest in the company, while GE would retain a 49% stake and would buy out shares owned by Vivendi.[53]

Vivendi would sell its 20% stake in NBCUniversal to GE for US$5.8 billion. Vivendi would sell 7.66% of NBCUniversal to GE for US$2 billion if the GE/Comcast deal was not completed by September 2010 and then sell the remaining 12.34% stake of NBCUniversal to GE for US$3.8 billion when the deal was completed or to the public via an IPO if the deal was not completed.[54][55]

On March 1, 2010, GE announced plans to sell its 20.85% stake in Turkey-based Garanti Bank.[56] In August 2010, GE Healthcare signed a strategic partnership to bring cardiovascular Computed Tomography (CT) technology from start-up Arineta Ltd. of Israel to the hospital market.[57] In October 2010, GE acquired gas engines manufacture Dresser Inc. in a $3 billion deal and also bought a $1.6 billion portfolio of retail credit cards from Citigroup Inc.[58][59] On October 14, 2010, GE announced the acquisition of data migration & SCADA simulation specialists Opal Software.[60] In December 2010, for the second time that year (after the Dresser acquisition), GE bought the oil sector company Wellstream., an oil pipe maker, for 800 million pounds ($1.3 billion).[61]

In March 2011, GE announced that it had completed the acquisition of privately held Lineage Power Holdings, Inc., from The Gores Group, LLC.[62] In April 2011, GE announced it had completed its purchase of John Wood plc's Well Support Division for $2.8 billion.[63]

In 2011, GE Capital sold its $2 billion Mexican assets to Santander for $162 million and exit the business in Mexico. Santander additionally assumed the portfolio debts of GE Capital in the country. Following this, GE Capital focused in its core business and shed its non-core assets.[64]

In June 2012, CEO and President of GE Jeff Immelt said that the company would invest ₹3 billion to accelerate its businesses in Karnataka.[65] In October 2012, GE acquired $7 billion worth of bank deposits from Metlife Inc.[66]

On March 19, 2013, Comcast bought GE's shares in NBCU for $16.7 billion, ending the company's longtime stake in television and film media.[67]

In April 2013, GE acquired oilfield pump maker Lufkin Industries for $2.98 billion.[68]

In April 2014, it was announced that GE was in talks to acquire the global power division of French engineering group Alstom for a figure of around $13 billion.[69] A rival joint bid was submitted in June 2014 by Siemens and Mitsubishi Heavy Industries (MHI) with Siemens seeking to acquire Alstom's gas turbine business for €3.9 billion, and MHI proposing a joint venture in steam turbines, plus a €3.1 billion cash investment. In June 2014 a formal offer from GE worth $17 billion was agreed by the Alstom board. Part of the transaction involved the French government taking a 20% stake in Alstom to help secure France's energy and transport interests and French jobs. A rival offer from Siemens-Mitsubishi Heavy Industries was rejected. The acquisition was expected to be completed in 2015.[70] In October 2014, GE announced it was considering the sale of its Polish banking business Bank BPH.[71]

Later in 2014, General Electric announced plans to open its global operations center in Cincinnati, Ohio.[72] The Global Operations Center opened in October 2016 as home to GE's multifunctional shared services organization. It supports the company's finance/accounting, human resources, information technology, supply chain, legal and commercial operations, and is one of GE's four multifunctional shared services centers worldwide in Pudong, China; Budapest, Hungary; and Monterrey, Mexico.[73]

In April 2015, GE announced its intention to sell off its property portfolio, worth $26.5 billion, to Wells Fargo and The Blackstone Group.[74] It was announced in April 2015 that GE would sell most of its finance unit and return around $90 billion to shareholders as the firm looked to trim down on its holdings and rid itself of its image of a "hybrid" company, working in both banking and manufacturing.[75] In August 2015, GE Capital agreed to sell its Healthcare Financial Services business to Capital One for US$9 billion. The transaction involved US$8.5 billion of loans made to a wide array of sectors including senior housing, hospitals, medical offices, outpatient services, pharmaceuticals and medical devices.[76] Also in August 2015, GE Capital agreed to sell GE Capital Bank's on-line deposit platform to Goldman Sachs. Terms of the transaction were not disclosed, but the sale included US$8 billion of on-line deposits and another US$8 billion of brokered certificates of deposit. The sale was part of GE's strategic plan to exit the U.S. banking sector and to free itself from tightening banking regulations. GE also aimed to shed its status as a "systematically important financial institution".[77]

In September 2015, GE Capital agreed to sell its transportation-finance unit to Canada's Bank of Montreal. The unit sold had US$8.7 billion (CA$11.5 billion) of assets, 600 employees and 15 offices in the U.S. and Canada. Exact terms of the sale were not disclosed, but the final price would be based on the value of the assets at closing, plus a premium according to the parties.[78] In October 2015, activist investor Nelson Peltz's fund Trian bought a $2.5 billion stake in the company.[79]

In January 2016, Haier Group acquired GE's appliance division for $5.4 billion.[80] In October 2016, GE Renewable Energy agreed to pay €1.5 billion to Doughty Hanson & Co for LM Wind Power during 2017.[81]

At the end of October 2016, it was announced that GE was under negotiations for a deal valued at about $30 billion to combine GE Oil and Gas with Baker Hughes. The transaction would create a publicly traded entity controlled by GE.[82] It was announced that GE Oil and Gas would sell off its water treatment business as part of its divestment agreement with Baker Hughes.[83] The deal was cleared by the EU in May 2017, and by the DOJ in June 2017.[84][85] The merger agreement was approved by shareholders at the end of June 2017. On July 3, 2017, the transaction was completed and Baker Hughes became a GE company and was renamed Bake Hughes, A GE Company (BHGE).[86] In November 2018, GE reduced its stake in Baker Hughes to 50.4%.[87] On 18 October 2019, GE reduced its stake to 36.8% and the company was renamed back to Baker Hughes.[88][89]

In April 2017, GE announced the name of their $200 million corporate headquarters would be "GE Innovation Point". The groundbreaking ceremony for the 2.5-acre, 800-person campus was held on May 8, 2017, and the completion date is expected to be sometime in mid-2019.[90]

In May 2017, GE had signed $15 billion of business deals with Saudi Arabia.[91] Saudi Arabia is one of GE's largest customers.[92]

In September 2017, GE announced the sale of its Industrial Solutions Business to ABB. The deal closed on June 30, 2018.[93][94]

Fraud allegations and notice of possible SEC civil action

On August 15, 2019, Harry Markopolos, a financial fraud investigator known for his discovery of a Ponzi Scheme run by Bernard Madoff, accused General Electric of being a "bigger fraud than Enron", alleging $38 billion in accounting fraud. GE denied wrongdoing.[95][96][97]

On October 6, 2020, General Electric reported it received a Wells notice from the Securities and Exchange Commission stating the SEC may take civil action for possible violations of securities laws.[98]

Insufficient reserves for long-term care policies

It is alleged that GE is "hiding" (i.e. under-reserved) [99] $29 billion in losses related to its long-term care business.[100]

According to an August 2019 Fitch Ratings report, there are concerns that GE has not set aside enough money to cover its long-term care liabilities.[101]

In 2018, a lawsuit (the Bezio case) was filed in New York state court on behalf of participants in GE's 401(k) plan and shareowners alleging violations of Section 11 of the Securities Act of 1933 based on alleged misstatements and omissions related to insurance reserves and performance of GE's business segments.[102]

The Kansas Insurance Department (KID) is requiring General Electric to make $14.5 billion of capital contributions for its insurance contracts during the 7-year period ending in 2024.[103]

GE reported the total liability related to its insurance contracts increased significantly from 2016 to 2019:

- December 31, 2016 $26.1 billion

- December 31, 2017 $38.6 billion [104]

- December 31, 2018 $35.6 billion [105]

- December 31, 2019 $39.6 billion [106]

In 2018, GE announced the issuance of the new standard by the Financial Accounting Standards Board (FASB) regarding Financial Services - Insurance (Topic 944) will materially affect its financial statements.[107][108] Mr. Markopolos estimated there will be a $US 10.5 billion charge when the new accounting standard is adopted in the first quarter of 2021.[109]

Anticipated $8 billion loss upon disposition of Baker Hughes

In 2017, GE acquired a 62.5% interest in Baker Hughes (BHGE) when it combined its oil & gas business with Baker Hughes Incorporated.[110] In 2018, GE reduced its interest to 50.4%, resulting in the realization of a $2.1 billion loss. GE is planning to divest its remaining interest and has warned that the divestment will result in an additional loss of $8.4 billion (assuming a BHGE share price of $23.57 per share).[111] In response to the fraud allegations, GE noted the amount of the loss would be $7.4 billion if the divestment occurred on July 26, 2019.[112] Mr. Markopolos noted that BHGE is an asset available for sale and therefore mark-to-market accounting is required.[113]

Markopolos noted GE's current ratio was only 0.67.[100] He expressed concerns that GE may file for bankruptcy if there is a recession.[114]

Other

In 2018, the GE Pension Plan reported losses of US$3.3 billion on plan assets.[115]

In 2018, General Electric changed the discount rate used to calculate the actuarial liabilities of its pension plans. The rate was increased from 3.64% to 4.34%.[116] Consequently, the reported liability for the underfunded pension plans decreased by $7 billion year-over-year, from $34.2 billion in 2017 to $27.2 billion in 2018.[116]

In October 2018, General Electric announced it would "freeze pensions" for about 20,000 salaried U.S. employees. The employees will be moved to a defined-contribution retirement plan in 2021.[117]

On March 30, 2020, General Electric factory workers protested to convert jet engine factories to make ventilators during the COVID-19 crisis.[118]

In June 2020, GE made an agreement to sell its Lighting business to Savant Systems, Inc., an industry leader in the professional smart home space. Financial details of the transaction were not disclosed.[119]

In November 2020, General Electric warned it would be cutting jobs waiting for a recovery due to the COVID-19 pandemic.[120]

Financial performance

| Year | Revenue in mil. US$ |

Net income in mil. US$ |

Total assets in mil. US$ |

Price per share in US$ |

Employees |

|---|---|---|---|---|---|

| 2005[121] | 136,580 | 16,720 | 673,321 | 22.35 | |

| 2006[121] | 151,568 | 20,742 | 696,683 | 22.43 | |

| 2007[122] | 172,488 | 22,208 | 795,683 | 25.44 | |

| 2008[123] | 181,581 | 17,335 | 797,769 | 19.44 | |

| 2009[124] | 154,438 | 10,725 | 781,901 | 9.96 | |

| 2010[125] | 149,567 | 11,344 | 747,793 | 12.68 | |

| 2011[126] | 146,542 | 13,120 | 718,189 | 14.32 | |

| 2012[127] | 146,684 | 13,641 | 684,999 | 16.56 | |

| 2013[128] | 113,245 | 13,057 | 656,560 | 20.32 | 307,000 |

| 2014[129] | 117,184 | 15,233 | 654,954 | 22.72 | 305,000 |

| 2015[130] | 117,386 | −6,145 | 493,071 | 24.28 | 333,000 |

| 2016[131] | 123,693 | 8,176 | 365,183 | 28.36 | 295,000 |

| 2017[132] | 122,092 | −6,222 | 377,945 | 25.02 | 313,000 |

| 2018[133] | 121,615 | −22,802 | 309,129 | 12.71 | 283,000 |

Dividends

In 2018, GE reduced its quarterly dividend from $0.12 to $0.01 per share.[134]

Stock

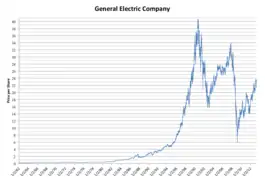

As a publicly-traded company on the New York Stock Exchange, GE stock was one of the 30 components of the Dow Jones Industrial Average from 1907 to 2018, the longest continuous presence of any company on the index, and during this time the only company which was part of the original Dow Jones Industrial Index created in 1896.[135] In August 2000, the company had a market capitalization of $601 billion, and was the most valuable company in the world.[136] On June 26, 2018, the stock was removed from the index and replaced with Walgreens Boots Alliance.[137] In the years leading to its removal, GE was the worst performing stock in the Dow, falling more than 55 percent year on year and more than 25 percent year to date.[138] The company continued to lose value after being removed from the index.[139]

Linear GE stock price graph 1962–2013

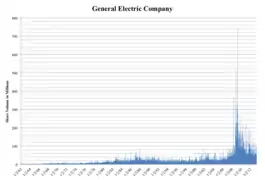

Linear GE stock price graph 1962–2013 GE trading volume graph

GE trading volume graph

Bribery

In July 2010, General Electric was willing to pay $23.4 million to settle an SEC complaint, as GE bribed Iraqi government officials to win contracts under the U.N. oil-for-food program. [140]

Corporate affairs

In 1959, General Electric was accused of promoting the largest illegal cartel in the United States since the adoption of the Sherman Antitrust Act. (1890) in order to maintain artificially high prices. In total, 29 companies and 45 executives would be convicted. Subsequent parliamentary inquiries revealed that "white-collar crime" was by far the most costly form of crime for the United States' finances.[141]

GE is a multinational conglomerate headquartered in Boston, Massachusetts.[142] However its main offices are located at 30 Rockefeller Plaza at Rockefeller Center in New York City, known now as the Comcast Building.[143] It was formerly known as the GE Building for the prominent GE logo on the roof; NBC's headquarters and main studios are also located in the building. Through its RCA subsidiary, it has been associated with the center since its construction in the 1930s. GE moved its corporate headquarters from the GE Building on Lexington Avenue to Fairfield, Connecticut in 1974.[144] In 2016, GE announced a move to the South Boston Waterfront neighborhood of Boston, Massachusetts, partly as a result of an incentive package provide by state and city governments. The first group of workers arrived in the summer of 2016, and the full move will be completed by 2018.[145][146][147] Due to poor financial performance and corporate downsizing, GE sold the land it planned to build its new headquarters building on, instead choosing to occupy neighboring leased buildings.[148]

GE's tax return is the largest return filed in the United States; the 2005 return was approximately 24,000 pages when printed out, and 237 megabytes when submitted electronically.[149] As of 2011, the company spent more on U.S. lobbying than any other company.[150]

In 2005, GE launched its "Ecomagination" initiative in an attempt to position itself as a "green" company. GE is one of the biggest players in the wind power industry and is developing environment-friendly products such as hybrid locomotives, desalination and water reuse solutions, and photovoltaic cells. The company "plans to build the largest solar-panel-making factory in the U.S.,"[150] and has set goals for its subsidiaries to lower their greenhouse gas emissions.[151]

On May 21, 2007, GE announced it would sell its GE Plastics division to petrochemicals manufacturer SABIC for net proceeds of $11.6 billion. The transaction took place on August 31, 2007, and the company name changed to SABIC Innovative Plastics, with Brian Gladden as CEO.[152]

In February 2017, GE announced that the company intends to close the gender gap by promising to hire and place 20,000 women in technical roles by 2020. The company is also seeking to have a 50:50 male to female gender representation in all entry-level technical programs.[153]

In October 2017, GE announced they would be closing research and development centers in Shanghai, Munich and Rio de Janeiro. The company spent $5 billion on R&D in the last year.[154]

On February 25, 2019, GE sold its diesel locomotive business to Westinghouse Air Brake Technologies Corporation (WAB), also known as Wabtec.[155]

CEO

As of October 2018, John L. Flannery was replaced by H. Lawrence Culp Jr. as Chairman and CEO in a unanimous vote of the GE Board of Directors.[156]

- Charles A. Coffin (1913–1922)

- Owen D. Young (1922–1939, 1942–1945)

- Philip D. Reed (1940–1942, 1945–1958)

- Ralph J. Cordiner (1958–1963)

- Gerald L. Phillippe (1963–1972)

- Fred J. Borch (1967–1972)

- Reginald H. Jones (1972–1981)

- Jack Welch (1981–2001)

- Jeff Immelt (2001–2017)

- John L. Flannery (2017–2018)[157]

- H. Lawrence Culp Jr. (2018–present)

Corporate recognition and rankings

In 2011, Fortune ranked GE the sixth-largest firm in the U.S.,[158] and the 14th-most profitable.[7] Other rankings for 2011/2012 include the following:[159]

- #18 company for leaders (Fortune)

- #6 best global brand (Interbrand)

- #82 green company (Newsweek)

- #91 most admired company (Fortune)

- #19 most innovative company (Fast Company).

In 2012, GE's brand was valued at $28.8 billion.[160] CEO Jeff Immelt had a set of changes in the presentation of the brand commissioned in 2004, after he took the reins as chairman, to unify the diversified businesses of GE.

The changes included a new corporate color palette, small modifications to the GE logo, a new customized font (GE Inspira) and a new slogan, "Imagination at work", composed by David Lucas, to replace the slogan "We Bring Good Things to Life" used since 1979.[161] The standard requires many headlines to be lowercased and adds visual "white space" to documents and advertising. The changes were designed by Wolff Olins and are used on GE's marketing, literature, and website. In 2014, a second typeface family was introduced: GE Sans and Serif by Bold Monday created under art direction by Wolff Olins.[162]

As of 2016, GE had appeared on the Fortune 500 list for 22 years and held the 11th rank.[163] GE was removed from the Dow Jones Industrial Average on June 28, 2018, after the value had dropped below 1% of the index's weight.[164]

| Year | Rank |

|---|---|

| 1996 | 7 |

| 1997 | 5 |

| 1998 | 5 |

| 1999 | 5 |

| 2000 | 6 |

| 2001 | 5 |

| 2002 | 6 |

| 2003 | 5 |

| 2004 | 5 |

| 2005 | 5 |

| 2006 | 7 |

| 2007 | 6 |

| 2008 | 6 |

| 2009 | 5 |

| 2010 | 4 |

| 2011 | 6 |

| 2012 | 6 |

| 2013 | 8 |

| 2014 | 9 |

| 2015 | 8 |

| 2016 | 11 |

| 2017 | 13 |

| 2018 | 18 |

| 2019 | 21 |

Businesses

GE's primary business divisions are:

- GE Additive

- GE Aviation

- GE Capital

- GE Digital

- GE Healthcare

- GE Power

- GE Renewable Energy

- GE Global Research

Through these businesses, GE participates in markets that include the generation, transmission and distribution of electricity (e.g. nuclear, gas and solar), lighting, industrial automation, medical imaging equipment, motors, railway locomotives, aircraft jet engines, and aviation services. Through GE Commercial Finance, GE Consumer Finance, GE Equipment Services, and GE Insurance it offers a range of financial services. It has a presence in over 100 countries.[165]

General Imaging manufacturers GE digital cameras.[167]

Even though the first wave of conglomerates (such as ITT Corporation, Ling-Temco-Vought, Tenneco, etc.) fell by the wayside by the mid-1980s, in the late 1990s, another wave (consisting of Westinghouse, Tyco, and others) tried and failed to emulate GE's success.[168]

As of August 2015 GE is planning to set up a silicon carbide chip packaging R&D center in coalition with SUNY Polytechnic Institute in Utica, New York. The project will create 470 jobs with the potential to grow to 820 jobs within 10 years.[169]

On September 14, 2015, GE announced the creation of a new unit: GE Digital, which will bring together its software and IT capabilities. The new business unit will be headed by Bill Ruh, who joined GE in 2011 from Cisco Systems and has since worked on GE's software efforts.[170]

Former divisions

GE Industrial was a division providing appliances, lighting and industrial products; factory automation systems; plastics, silicones and quartz products; security and sensors technology, and equipment financing, management and operating services. As of 2007 it had 70,000 employees generating $17.7 billion in revenue.[171] After some major realignments in late 2007, GE Industrial was organized in two main sub businesses:

- GE Consumer & Industrial

- Appliances

- Electrical Distribution

- Lighting

- GE Enterprise Solutions

The former GE Plastics division was sold in August 2007 and is now SABIC Innovative Plastics.

On May 4, 2008, it was announced that GE would auction off its appliances business for an expected sale of $5–8 billion.[172] However, this plan fell through as a result of the recession.[173]

The former GE Appliances and Lighting segment was dissolved in 2014 when GE's appliance division was attempted to be sold to Electrolux for $5.4 billion, but eventually sold it to Haier in June 2016 due to antitrust filing against Electrolux. GE Lighting (consumer lighting) and the newly created Current, powered by GE, which deals in commercial LED, solar, EV, and energy storage, became stand-alone businesses within the company,[174] until the sale of the later to American Industrial Partners in April 2019[175]

The former GE Transportation division merged with Wabtec on February 25, 2019, leaving GE with a 24.9% holding in Wabtec.[176]

Environmental record

Pollution

GE has a history of some of its activities giving rise to large-scale air and water pollution. Based on data from 2000,[177] researchers at the Political Economy Research Institute listed the corporation as the fourth-largest corporate producer of air pollution in the United States, with more than 4.4 million pounds per year (2,000 tons) of toxic chemicals released into the air.[178] GE has also been implicated in the creation of toxic waste. According to EPA documents, only the United States Government, Honeywell, and Chevron Corporation are responsible for producing more Superfund toxic waste sites.[179]

In 1983, New York State Attorney General Robert Abrams filed suit in the United States District Court for the Northern District of New York to compel GE to pay for the clean-up of what was claimed to be more than 100,000 tons of chemicals dumped from their plant in Waterford, New York.[180] In 1999, the company agreed to pay a $250 million settlement in connection with claims it polluted the Housatonic River (Pittsfield, Massachusetts) and other sites with polychlorinated biphenyls (PCBs) and other hazardous substances.[181]

In 2003, acting on concerns that the plan proposed by GE did not "provide for adequate protection of public health and the environment," the United States Environmental Protection Agency issued a unilateral administrative order for the company to "address cleanup at the GE site" in Rome, Georgia, also contaminated with PCBs.[182]

The nuclear reactors involved in the 2011 crisis at Fukushima I in Japan were GE designs,[183] and the architectural designs were done by Ebasco,[184] formerly owned by GE. Concerns over the design and safety of these reactors were raised as early as 1972, but tsunami danger was not discussed at that time.[185] As of 2014, the same model nuclear power reactors designed by GE are operating in the US;[186] however, as of May 31, 2019, the controversial Pilgrim Nuclear Generating Station, in Plymouth, Massachusetts, has been shut down and is in the process of decommission.

Pollution of the Hudson River

GE heavily contaminated the Hudson River with polychlorinated biphenyls (PCBs) between 1947 and 1977.[187] This pollution caused a range of harmful effects to wildlife and people who eat fish from the river or drink the water.[188] In response to the contamination, activists protested in various ways. Musician Pete Seeger founded the Hudson River Sloop Clearwater and the Clearwater Festival to draw attention to the problem. In 1983, the United States Environmental Protection Agency (EPA) declared a 200-mile (320 km) stretch of the river, from Hudson Falls to New York City, to be a Superfund site requiring cleanup. This Superfund site is considered to be one of the largest in the nation.[189] Other sources of pollution, including mercury contamination and sewage dumping, have also contributed to problems in the Hudson River watershed.[190][191]

Pollution of the Housatonic River

From c. 1932 until 1977, GE polluted the Housatonic River with PCB discharges from its plant at Pittsfield, Massachusetts. EPA designated the Pittsfield plant and several miles of the Housatonic to be a Superfund site in 1997, and ordered GE to remediate the site.[192] Aroclor 1254 and Aroclor 1260, made by Monsanto, was the primary contaminant of the pollution.[193][194] The highest concentrations of PCBs in the Housatonic River are found in Woods Pond in Lenox, Massachusetts, just south of Pittsfield, where they have been measured up to 110 mg/kg in the sediment.[194] About 50% of all the PCBs currently in the river are estimated to be retained in the sediment behind Woods Pond dam. This is estimated to be about 11,000 pounds (5,000 kg) of PCBs.[194] Former filled oxbows are also polluted.[195] Waterfowl and fish who live in and around the river contain significant levels of PCBs and can present health risks if consumed.[196][197][198]

Environmental initiatives

On June 6, 2011, GE announced that it has licensed solar thermal technology from California-based eSolar for use in power plants that use both solar and natural gas.[199]

On May 26, 2011, GE unveiled its EV Solar Carport, a carport that incorporates solar panels on its roof, with electric vehicle charging stations under its cover.[200]

In May 2005, GE announced the launch of a program called "Ecomagination", intended, in the words of CEO Jeff Immelt, "to develop tomorrow's solutions such as solar energy, hybrid locomotives, fuel cells, lower-emission aircraft engines, lighter and stronger durable materials, efficient lighting, and water purification technology".[201] The announcement prompted an op-ed piece in The New York Times to observe that, "while General Electric's increased emphasis on clean technology will probably result in improved products and benefit its bottom line, Mr. Immelt's credibility as a spokesman on national environmental policy is fatally flawed because of his company's intransigence in cleaning up its own toxic legacy."[202]

GE has said that it will invest $1.4 billion in clean technology research and development in 2008 as part of its Ecomagination initiative. As of October 2008, the scheme had resulted in 70 green products being brought to market, ranging from halogen lamps to biogas engines. In 2007, GE raised the annual revenue target for its Ecomagination initiative from $20 billion in 2010 to $25 billion following positive market response to its new product lines.[203] In 2010, GE continued to raise its investment by adding $10 billion into Ecomagination over the next five years.[204]

GE Energy's renewable energy business has expanded greatly, to keep up with growing U.S. and global demand for clean energy. Since entering the renewable energy industry in 2002, GE has invested more than $850 million in renewable energy commercialization. In August 2008, it acquired Kelman Ltd,[205] a Northern Ireland-based company specializing in advanced monitoring and diagnostics technologies for transformers used in renewable energy generation and announced an expansion of its business in Northern Ireland in May 2010.[206] In 2009, GE's renewable energy initiatives, which include solar power, wind power and GE Jenbacher gas engines using renewable and non-renewable methane-based gases,[207] employ more than 4,900 people globally and have created more than 10,000 supporting jobs.[208]

GE Energy and Orion New Zealand (Orion) have announced the implementation of the first phase of a GE network management system to help improve power reliability for customers. GE's ENMAC Distribution Management System is the foundation of Orion's initiative. The system of smart grid technologies will significantly improve the network company's ability to manage big network emergencies and help it to restore power faster when outages occur.

In June 2018, GE Volunteers, an internal group of GE Employees, along with Malaysian Nature Society, transplanted more than 270 plants from the Taman Tugu forest reserve so that they may be replanted in the forest trail which is under construction.

Educational initiatives

GE Healthcare is collaborating with The Wayne State University School of Medicine and the Medical University of South Carolina to offer an integrated radiology curriculum during their respective MD Programs led by investigators of the Advanced Diagnostic Ultrasound in micro-gravity study.[209] GE has donated over one million dollars of Logiq E Ultrasound equipment to these two institutions.[210]

Marketing initiatives

Between September 2011 and April 2013, GE ran a content marketing campaign dedicated to telling the stories of "innovators—people who are reshaping the world through act or invention". The initiative included 30 3-minute films from leading documentary film directors (Albert Maysles, Jessica Yu, Leslie Iwerks, Steve James, Alex Gibney, Lixin Fan, Gary Hustwit and others), and a user-generated competition that received over 600 submissions, out of which 20 finalists were chosen.[211]

Short Films, Big Ideas was launched at the 2011 Toronto International Film Festival in partnership with cinelan. Stories included breakthroughs in Slingshot (water vapor distillation system), cancer research, energy production, pain management and food access. Each of the 30 films received world premiere screenings at a major international film festival, including the Sundance Film Festival and the Tribeca Film Festival. The winning amateur director film, The Cyborg Foundation, was awarded a US$100,000 prize at the 2013 at Sundance Film Festival.[212] According to GE, the campaign garnered more than 1.5 billion total media impressions, 14 million online views, and was seen in 156 countries.[213]

In January 2017, GE signed an estimated $7 million deal with the Boston Celtics to have its corporate logo put on the NBA team's jersey.[214]

Political affiliation

In the 1950s, GE sponsored Ronald Reagan's TV career and launched him on the lecture circuit. GE has also designed social programs, supported civil rights organizations, and funds minority education programs.[215]

Notable appearances in media

In the early 1950s, Kurt Vonnegut was a writer for GE. A number of his novels and stories (notably Cat's Cradle and Player Piano) refer to the fictional city of Ilium, which appears to be loosely based on Schenectady, New York.[216] The Ilium Works is the setting for the short story "Deer in the Works".

In 1981, GE won a Clio award for its :30 Soft White Light Bulbs commercial, We Bring Good Things to Life.[217] The slogan "We Bring Good Things to Life" was created by Phil Dusenberry at the ad agency BBDO.[218]

GE was the primary focus of a 1991 short subject Academy Award-winning documentary, Deadly Deception: General Electric, Nuclear Weapons, and Our Environment,[219] that juxtaposed GE's "We Bring Good Things To Life" commercials with the true stories of workers and neighbors whose lives have been affected by the company's activities involving nuclear weapons.[220]

In 2013, GE received a National Jefferson Award for Outstanding Service by a Major Corporation.[221]

See also

References

- "FORM 10-K" (PDF). General Electric. Archived from the original (PDF) on March 24, 2020. Retrieved May 11, 2020.

- "Summary of Operating Segments" (PDF). GE. Archived from the original (PDF) on April 12, 2018. Retrieved April 12, 2018.

- Egan, Matt (13 June 2018). "Inside the dismantling of GE". CNN. Archived from the original on 13 June 2018.

- "Fortune 500". Fortune. Retrieved May 11, 2020.

- Mann, Thomas Gryta and Ted (December 14, 2018). "GE Powered the American Century—Then It Burned Out". Archived from the original on August 10, 2019. Retrieved August 11, 2019 – via www.wsj.com.

- "What the Hell Happened at GE?". Fortune. Archived from the original on August 11, 2019. Retrieved August 11, 2019.

- "Fortune 20 most profitable companies: IBM". Fortune. 2011. Archived from the original on May 8, 2011. Retrieved December 17, 2010.

- "Heritage of Research". General Electric. Archived from the original on August 10, 2016. Retrieved June 1, 2016.

- Arnold, Horace L. "Modern Machine-Shop Economics. Part II Archived January 27, 2016, at the Wayback Machine" in Engineering Magazine 11. 1896

- "Electricity". A Brief History of Con Edison. Con Edison. Archived from the original on October 30, 2012. Retrieved February 3, 2013.

- "Edison Companies". The Thomas Edison Papers. Rutgers University. Archived from the original on October 8, 2013. Retrieved February 3, 2013.

- "FAQs: How did the firm impact the advent of electricity?". J.P. Morgan. Archived from the original on November 13, 2012. Retrieved February 3, 2013.

- Connecticut History Makers, by Elias Robert Stevenson, 1930

- "Thomas Edison & GE". GE company web site. Archived from the original on February 12, 2010. Retrieved December 22, 2009.

- Marshall, Herbert; Southard, Frank; Taylor, Kenneth W. (January 15, 1976). Canadian-American Industry. McGill-Queen's Press – MQUP. p. 72. ISBN 9780773591363.

- "The Magnetic Force of Charles Proteus Steinmetz". IEEE Power Engineering Review. 16 (9): 7. February 1996. doi:10.1109/MPER.1996.535476. S2CID 44921529.

- Schaefer, Steve. "The First 12 Dow Components: Where Are They Now?". Forbes. Archived from the original on January 5, 2018. Retrieved January 5, 2018.

- "History of the Dow – Timeline of Companies". Quasimodos.com. January 4, 1984. Archived from the original on April 22, 2012. Retrieved April 23, 2012.

- "Nela Park holiday lights, Hower House Museum display and recycle holiday lights: Home and Garden News". cleveland.com. Archived from the original on June 21, 2017. Retrieved March 24, 2017.

- Mahon, Morgan E. A Flick of the Switch 1930–1950 (Antiques Electronics Supply, 1990), p.86.

- "Timeline: The History of NBC". NoCable.org. Archived from the original on June 19, 2018. Retrieved March 9, 2018.

- "Ernst Alexanderson". About.com Inventors. Archived from the original on January 16, 2013. Retrieved January 8, 2015.

- Schenectady Country Historical Society (2009). Niskayuna: Images of America. United States of America: Arcadia Publishing. ISBN 978-1439-63-7500.

- https://www.axcontrol.com/blog/2020/a-history-of-ge-speedtronic-turbine-control/27/01/

- Weber, Austin (March 28, 2017). "General Electric Pioneers Jet Engine Manufacturing". Assembly Magazine. BNP Media. Archived from the original on July 4, 2017. Retrieved January 5, 2018.

- Whittle, Sir Frank; Golley, John (2010). Gunston, Bill (ed.). Jet (illustrated ed.). Datum Publishing. pp. 181–182. ISBN 978-1907472008. Archived from the original on February 5, 2016. Retrieved January 26, 2016.

- Peck, Merton J. & Scherer, Frederic M. The Weapons Acquisition Process: An Economic Analysis (1962) Harvard Business School p.619

- Global Corruption Report 2009, Corruption and the Private Sector Archived March 20, 2012, at the Wayback Machine Transparency International 2009 page 148 (in English)

- "GE Completes Enron Wind Acquisition; Launches GE Wind Energy". Business Wire. May 10, 2002. Archived from the original on March 28, 2008. Retrieved August 9, 2010.

- Fairly, Peter. The Greening of GE Archived February 14, 2010, at the Wayback Machine IEEE Spectrum, July 2005. Retrieved: November 6, 2010.

- Arnott, Sarah (March 26, 2010). "GE to build £99m UK wind turbine plant". The Independent. UK. Archived from the original on September 22, 2011. Retrieved December 20, 2010.

- "GE Closes Acquisition of ScanWind". Renewableenergyworld.com. Archived from the original on March 10, 2018. Retrieved March 9, 2018.

- "GE GE's push to fix power turbine problem goes global: sources". reuters.com. Archived from the original on May 31, 2019. Retrieved June 11, 2019.

- Scott, Alwyn (January 25, 2019). "GE urges speedy fix for power turbine blades, says blade broke in 2015: sources". reuters.com. Archived from the original on January 25, 2019. Retrieved January 25, 2019.

- Guston, David H. (July 14, 2010). Encyclopedia of Nanoscience and Society. SAGE Publications. p. 272. ISBN 9781452266176. Retrieved May 5, 2017.

- "General Electric – Computing History". Computinghistory.org.uk. Archived from the original on March 10, 2018. Retrieved March 9, 2018.

- Hiner, Jason (November 30, 2012). "GE's $200 million bet to resurrect IT". TechRepublic. Archived from the original on May 22, 2013. Retrieved May 31, 2013.

- Elliott, Michael (July 8, 2001). "The Anatomy of the GE-Honeywell Disaster". TIME. GE-Honeywell-Disaster. Archived from the original on June 27, 2016. Retrieved June 27, 2016.

- "The Commission prohibits GE's acquisition of Honeywell". EU. July 3, 2001. EU-GE-Honeywell. Archived from the original on June 27, 2016. Retrieved June 27, 2016.

- "GE Link smart LED bulb can communicate with smart devices". TechOne3. Archived from the original on July 6, 2014. Retrieved July 2, 2014.

- "General Electric Co., in the largest non-oil merger in..." Archived from the original on August 22, 2017. Retrieved October 3, 2019.

- "Ge To Sell Kidder Unit To Paine". tribunedigital-chicagotribune. Archived from the original on January 6, 2018. Retrieved January 5, 2018.

- Kenneth E. Hendrickson. III (2015). The Encyclopedia of The Industrial Revolution in World History. United Kingdom: Rowman & Littlefield. p. 359. ISBN 978-0-8108-8887-6.

- Murphy, Dennis. GE completes Enron Wind acquisition; Launches GE Wind Energy Archived February 18, 2016, at the Wayback Machine Desert Sky Wind Farm, May 10, 2002. Retrieved: May 1, 2010.

- Murphy, Tara (May 25, 2004). "General Electric Completes Spinoff Of Genworth Financial". Forbes. Archived from the original on September 8, 2017. Retrieved September 5, 2017.

- Deutsch, Claudia H. (January 16, 2007). "G.E. Buying a British Aerospace Company". The New York Times. Archived from the original on March 20, 2017. Retrieved February 8, 2017.

- "General Electric to acquire Vetco Gray for $1.9 billion". ReliablePlant.com. January 8, 2007. Archived from the original on July 6, 2014. Retrieved June 11, 2014.

- "GE Oil & Gas buys Vetco Gray". E&P Magazine. January 8, 2007. Archived from the original on May 28, 2014. Retrieved June 11, 2014.

- Saitto, Serena; Kingsbury, Kevin (January 28, 2008). "From Tenaris". MarketWatch.com – The Wall Street Journal. Archived from the original on July 14, 2014. Retrieved June 11, 2014.

- "GE Oil & Gas Buys Hydril Pressure Control". January 29, 2008. Archived from the original on July 9, 2014. Retrieved June 11, 2014.

- admin (June 30, 2007). "Sabic acquires GE Plastics for $11.6 billion". PlasticsToday. Retrieved April 6, 2020.

- "A Brief History of G.E. Asset Sales: DealBook Briefing". The New York Times. May 21, 2018. ISSN 0362-4331. Retrieved April 6, 2020.

- Goldman, Davis; Pepitone, Julianne (December 3, 2009). "GE, Comcast announce joint NBC deal". CNNMoney.com. Archived from the original on March 30, 2010. Retrieved December 22, 2009.

- "Vivendi to Sell its Stake in NBCUniversal for US$5.8 billion". Vivendi SA. December 3, 2009. Archived from the original on December 6, 2009. Retrieved December 22, 2009.

- "Vivendi To Sell 20% Stake In NBCU To GE For $5.8 Bln". The Wall Street Journal. December 3, 2009. Archived from the original on November 5, 2013. Retrieved November 5, 2013.

- "General Electric to sell stake in Garanti Bank". March 1, 2010. Archived from the original on April 17, 2010. Retrieved March 2, 2010.

- "GE to get its heart tech from Israel". August 1, 2010. Archived from the original on August 25, 2010. Retrieved August 21, 2010.

- "— GE posts sales slump, rattles recovery hopes". Comcast.net. Archived from the original on October 23, 2010. Retrieved April 23, 2012.

- "General Electric in Russia". Archived from the original on March 25, 2014. Retrieved April 2, 2014.

- "GE Acquires Opal Software — Strengthens Smart Grid Software Portfolio". GE. Archived from the original on July 11, 2011. Retrieved October 19, 2010.

- NewsDaily: GE to buy UK oil pipe maker Wellstream for $1.3 billion reuters.com Archived December 16, 2010, at the Wayback Machine

- Business Wire (March 2, 2011). "Businesswire.com". Businesswire.com. Archived from the original on October 2, 2012. Retrieved April 23, 2012.

- Business Wire (April 26, 2011). "Businesswire.com". Businesswire.com. Archived from the original on March 3, 2013. Retrieved January 15, 2013.

- "GE Capital sells Mexican assets to Santander". Finance News. Archived from the original on March 19, 2012. Retrieved April 23, 2012.

- "GE to invest Rs 300 cr for expansion". June 7, 2012. Archived from the original on June 8, 2012. Retrieved June 7, 2012.

- "GE, MetLife tweak terms of deal for $7 bln in bank deposits". Reuters. Reuters. September 25, 2012. Archived from the original on September 25, 2012. Retrieved October 3, 2012.

- Lieberman, David (March 19, 2013). "Comcast Completes Acquisition Of GE's 49% Stake In NBCUniversal". Deadline. Archived from the original on March 27, 2019. Retrieved January 17, 2019.

- Ernest Scheyder (April 8, 2013). "GE to buy oil pump maker Lufkin for nearly $3 billion". Reuters. Archived from the original on November 27, 2015. Retrieved July 1, 2017.

- Natalie Huet (April 24, 2014). "GE in talks to buy Alstom's power arm". Reuters. Archived from the original on September 24, 2015. Retrieved July 1, 2017.

- "Alstom board votes for aquisition [sic] by GE". France News.Net. Archived from the original on July 9, 2014. Retrieved June 23, 2014.

- GE considers sale of Polish unit Bank BPH Archived September 24, 2015, at the Wayback Machine. Reuters, October 15, 2014

- "GE center, 2,000 jobs slated for downtown Cincinnati". Dayton Daily News. April 10, 2014. Archived from the original on August 14, 2018. Retrieved August 13, 2018.

- "Having already hired 1,400, GE's new operations center Downtown looks to hire 400 more". WCPO Cincinnati. July 19, 2017. Archived from the original on August 14, 2018. Retrieved August 13, 2018.

- "General Electric to sell $26.5bn property portfolio". BBC News. Archived from the original on December 16, 2018. Retrieved July 21, 2018.

- "GE to sell bulk of finance unit, return up to $90 billion to investors" (Press release). Reuters. April 11, 2015. Archived from the original on November 16, 2015. Retrieved July 1, 2017.

- "Capital One to Acquire GE Capital's U.S. Healthcare Finance Unit" (Press release). Capital One Financial. August 11, 2015. Archived from the original on January 1, 2016. Retrieved August 14, 2015.

- "Goldman Sachs to Acquire GE Capital Bank's on-line deposit platform". Bloomberg News. August 13, 2015. Archived from the original on February 20, 2017. Retrieved March 7, 2017.

- "BMO News Release BMO Financial to acquire GE Capital's transportation finance business" (Press release). September 10, 2015. Archived from the original on December 1, 2017. Retrieved September 16, 2015.

- "Nelson Peltz's Trian takes $2.5 billion stake in General Electric". Reuters. October 5, 2015. Archived from the original on November 2, 2015. Retrieved July 1, 2017.

- "China's Haier buying GE appliance unit for $5.4B". USA Today. Archived from the original on January 15, 2016. Retrieved January 15, 2016.

- "GE acquires LM Wind Power". Windpower Monthly. Archived from the original on October 12, 2016. Retrieved October 11, 2016.

- "GE to Combine Oil and Gas Business With Baker Hughes". The Wall Street Journal. Archived from the original on November 1, 2016. Retrieved October 31, 2016.

- GE explores sale of Water & Process Technologies business Archived August 7, 2017, at the Wayback Machine, World Pumps, November 1, 2016

- "EU clears GE's Baker Hughes purchase without conditions". Reuters. Archived from the original on May 31, 2017. Retrieved May 31, 2017.

- "U.S. DoJ Approves Baker Hughes – GE Merger". Subseaworldnews.com. Archived from the original on June 13, 2017. Retrieved June 21, 2017.

- "GE, Baker Hughes complete merger". Oedigital.com. Archived from the original on December 26, 2018. Retrieved December 26, 2018.

- "Archived copy". Archived from the original on August 20, 2019. Retrieved August 20, 2019.CS1 maint: archived copy as title (link)

- "Archived copy". Archived from the original on October 21, 2019. Retrieved October 21, 2019.CS1 maint: archived copy as title (link)

- "Archived copy". Archived from the original on October 22, 2019. Retrieved October 21, 2019.CS1 maint: archived copy as title (link)

- Carlock, Catherine (April 27, 2017). "Why is GE naming its Boston headquarters 'Innovation Point'?". Boston Business Journal. Archived from the original on April 28, 2017. Retrieved April 28, 2017.

- "GE announces $15 billion of business deals with Saudi Arabia". Reuters. May 20, 2017. Archived from the original on July 19, 2018. Retrieved July 19, 2018.

- "Exclusive: General Electric's power unit faces threat in Saudi Arabia". Reuters. July 19, 2018. Archived from the original on July 18, 2018. Retrieved July 19, 2018.

- "ABB buys GE business for $2.6 billion in bet it can boost margins". Reuters. Archived from the original on September 28, 2017. Retrieved September 27, 2017.

- "ABB completes acquisition of GE Industrial Solutions". New.abb.com. Archived from the original on July 13, 2018. Retrieved July 13, 2018.

- "General Electric, A Bigger Fraud Than Enron". gefraud.com. Archived from the original on August 15, 2019. Retrieved August 15, 2019.

- Hotten, Russell (August 15, 2019). "General Electric: Madoff Investigator alleges $38bn in fraud". BBC. Archived from the original on August 16, 2019. Retrieved August 16, 2019.

- Paul R. La Monica (August 15, 2019). "GE stock has worst day in 11 years after Madoff whistleblower calls it a bigger fraud than Enron". CNN Business. Archived from the original on August 15, 2019. Retrieved August 15, 2019.

- Jonathan Ponciano (October 6, 2020). "General Electric Says SEC Has Issued 'Wells Notice' Recommending Civil Action Over Shaky Accounting Practices". www.Forbes.com. Retrieved October 15, 2020.

- Alwyn Scott (August 20, 2019). "General Electric insurance called 'risky' by Fitch; shares fall again". Reuters.com. Archived from the original on August 22, 2019. Retrieved August 22, 2019.

The Fitch report, which the credit rating agency produces annually, echoed concerns raised last week by financial investigator Harry Markopolos, who estimated that GE has under-reserved by $29 billion for its long-term care policies.

- "General Electric whistleblower: 'I think I have a few smoking guns' Harry Markopolos reveals fraud". YouTube.com. Yahoo Finance. August 15, 2019. Event occurs at M:SS=1.47. Archived from the original on August 20, 2019. Retrieved August 21, 2019.

GE is hiding $29B in long-term care losses

- Alwyn Scott (August 20, 2019). "General Electric insurance called 'risky' by Fitch; shares fall again". Reuters.com. Archived from the original on August 22, 2019. Retrieved August 22, 2019.

General Electric Co (GE.N) ranks among the riskiest backers of long-term care insurance, suffering from both high exposure to claims and a relatively small cash pile to pay them, Fitch Ratings said in a report on Tuesday

- General Electric. "2018 Annual Report - General Electric" (PDF). GE.com. p. 87. Archived from the original (PDF) on September 23, 2019. Retrieved August 20, 2019.

- General Electric. "2018 Annual Report - General Electric" (PDF). GE.com. p. 67. Archived from the original (PDF) on September 23, 2019. Retrieved August 20, 2019.

The adverse impact on our statutory AAR arising from our revised assumptions in 2017, including the collectability of reinsurance recoverables, is expected to require GE Capital to contribute approximately $14.5 billion additional capital, to its run-off insurance operations in 2018-2024. For statutory accounting purposes, KID approved our request for a permitted accounting practice to recognize the 2017 AAR increase over a seven-year period. GE Capital provided capital contributions to its insurance subsidiaries of approximately $3.5 billion and $1.9 billion in the first quarter of 2018 and 2019, respectively. GE Capital expects to provide further capital contributions of approximately $9 billion through 2024, subject to ongoing monitoring by KID.

- General Electric. "2017 GE Annual Report" (PDF). www.AnnualReports.com. General Electric. p. 152. Retrieved October 19, 2020.

- General Electric. "2018 Annual Report - General Electric" (PDF). GE.com. p. 61. Archived from the original (PDF) on September 23, 2019. Retrieved August 20, 2019.

- General Electric. "2019 Annual Report - General Electric" (PDF). GE.com. p. 87. Retrieved October 15, 2020.

- General Electric. "Follow Up From Last Week's Note" (PDF). GE.com. Archived from the original (PDF) on August 20, 2019. Retrieved August 21, 2019.

We have stated in disclosures beginning with our 3Q’18 10-Q (page 48) that, following the issuance of the new standard by the FASB in August 2018, we anticipate that the adoption of the new standard will materially affect our financial statements.

- "FORM 10-Q September 2018" (PDF). GE.com. General Ledger. Archived from the original (PDF) on August 20, 2019. Retrieved August 21, 2019.

In August 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2018-12, Financial Services - Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts. We are evaluating the effect of the standard on our consolidated financial statements and anticipate that its adoption will significantly change the accounting for measurements of our long-duration insurance liabilities. The ASU requires cash flow assumptions used in the measurement of various insurance liabilities to be reviewed at least annually and updated if actual experience or other evidence indicates previous assumptions need to be revised with any required changes recorded in earnings. The discount rate, equivalent to the upper-medium grade (i.e., single A) fixed-income instrument yield reflecting the duration characteristics of the liability, is required to be updated in each reporting period with changes recorded in accumulated other comprehensive income. In measuring the insurance liabilities, contracts shall not be grouped together from different issue years. While we continue to evaluate the effect of the standard on our ongoing financial reporting, we anticipate that the adoption of the ASU may materially affect our financial statements.

- "General Electric whistleblower: 'I think I have a few smoking guns' Harry Markopolos reveals fraud". YouTube.com. Yahoo Finance. August 15, 2019. Event occurs at M:SS=3.25. Archived from the original on August 20, 2019. Retrieved August 21, 2019.

GE is hiding $29B in long-term care losses

- "2017 Annual Report" (PDF). GE.com. p. 21. Archived from the original (PDF) on April 12, 2018. Retrieved August 20, 2019.

- General Electric. "2018 Annual Report - General Electric" (PDF). GE.com. p. 139. Archived from the original (PDF) on September 23, 2019. Retrieved August 20, 2019.

As previously announced, we plan an orderly separation of our ownership interest in BHGE over time. In November 2018, BHGE completed an underwritten public offering in which we sold 101.2 million shares of BHGE Class A common stock. BHGE also repurchased 65.0 million BHGE LLC units from GE. As a result, our economic interest in BHGE reduced from 62.5% to 50.4% and we recognized a loss of $2,169 million ($1,696 million after-tax), which decreased the Other Capital component of shareowners' equity. Sale of Class A common stock resulted in an increase in noncontrolling interests of $4,214 million. Any reduction in our ownership interest below 50% will result in us losing control of BHGE. At that point, we would de-consolidate our Oil & Gas segment, recognize any remaining interest at fair value and recognize any difference between carrying value and fair value of our interest in earnings. Depending on the form and timing of our separation, and if BHGE’s stock price remains below our current carrying value, we may recognize a significant loss in earnings. Based on BHGE's share price on January 31, 2019, of $23.57 per share, the incremental loss upon deconsolidation by a sale of our interest would be approximately $8,400 million.

- "follow-up-from-last-weeks-note". GE.com. General Electric. Archived from the original on August 20, 2019. Retrieved August 20, 2019.

- "Harry Markopolos explains fraud accusations against GE". YouTube.com. MM:SS=5:17: CNN Business. August 16, 2019. Archived from the original on August 18, 2019. Retrieved August 21, 2019.

They should have marked it to market

CS1 maint: location (link) - "Madoff whistleblower Harry Markopolos details fraud allegations against General Electric". M:SS=5:56: YouTube / CNBC. August 15, 2019. Archived from the original on August 20, 2019. Retrieved August 21, 2019.

Harry Markopolos on GE "Heading for bankruptcy"

CS1 maint: location (link) - General Electric. "2018 General Electric Annual Report" (PDF). GE.com. General Electric. p. 130. Archived from the original (PDF) on September 23, 2019. Retrieved August 21, 2019.

Actual gain (loss) on plan assets - 2018 Principal pension plans ($2,996) millions 2018 Other pension plans ($299) millions

- General Electric. "2018 Annual Report - General Electric" (PDF). GE.com. p. 39. Archived from the original (PDF) on September 23, 2019. Retrieved August 20, 2019.

- Alwyn Scott; Ankit Ajmera (October 7, 2019). "GE to freeze, pre-pay pensions to save up to $8 billion, cut debt". Reuters. Retrieved October 12, 2019.

- Ongweso, Edward Jr (March 30, 2020). "General Electric Workers Launch Protest, Demand to Make Ventilators". Vice. Retrieved March 31, 2020.

- Sabol, Ben (May 27, 2020). "GE to Sell Lighting Business to Savant Systems, Inc". GE. Retrieved March 31, 2020.

- Singh, Rachit Vats, Rajesh Kumar (November 24, 2020). "GE warns of more job cuts at aviation business amid sluggish recovery". Reuters. Retrieved November 25, 2020.

- "2006 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on October 16, 2017.

- "2007 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on October 16, 2017.

- "2008 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on October 16, 2017.

- "2009 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on October 16, 2017.

- "2010 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on October 16, 2017.

- "2011 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on October 16, 2017.

- "2012 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on October 16, 2017.

- "2013 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on October 16, 2017.

- "2014 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on October 16, 2017.

- "2015 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on November 18, 2018.

- "2016 Annual Report" (PDF). Annualreports.com. Archived (PDF) from the original on November 18, 2018.

- "2017 Annual Report" (PDF). Annualreports.com. Archived from the original (PDF) on November 18, 2018.

- "2018 Annual Report" (PDF). Annualreports.com. Archived from the original (PDF) on April 14, 2019.

- "2018 Annual Report" (PDF). General Electric. General Electric. p. 8. Archived from the original (PDF) on September 23, 2019. Retrieved August 20, 2019.

- "GE Fact Sheet". GE. Archived from the original on January 26, 2017. Retrieved January 25, 2017.

- Seiffert, Don (October 30, 2018). "GE is no longer the most valuable public company in Massachusetts". Boston Business Journal. Retrieved September 3, 2020.

- "GE Says Goodbye to the Dow". Nasdaq.com. June 20, 2018. Archived from the original on June 21, 2018. Retrieved June 21, 2018.

- Michelle Fox (June 20, 2018). "Worst isn't over for General Electric, predicts ex-GE transportation CEO".

- Salmon, Felix (September 3, 2020). "GE heads towards zero". Axios. Retrieved September 3, 2020.

- "GE to settle SEC charges of foreign bribery". Archived from the original on December 19, 2016. Retrieved January 27, 2019.

- The American Way of Crime: From Salem to Watergate

- "US SEC: Form 10-K General Electric Company". U.S. Securities and Exchange Commission. Archived from the original on February 24, 2018. Retrieved June 11, 2018.

- "Company Search, EDGAR System, Securities and Exchange Commission". header. Archived from the original on January 1, 2016. Retrieved December 21, 2015.

- "As G.E. fumes over Connecticut tax hike, New York calls - Capital New York". August 12, 2015. Archived from the original on August 12, 2015. Retrieved December 27, 2018.

- "Boston lands new GE headquarters". Boston Globe. Archived from the original on December 2, 2017. Retrieved January 13, 2016.

- Mann, Ted; Kamp, Jon (January 13, 2016). "General Electric to Move Headquarters to Boston". The Wall Street Journal. Archived from the original on January 13, 2016. Retrieved January 13, 2016.

- "GE Moves Headquarters to Boston" (Press release). General Electric. January 13, 2016. Archived from the original on September 23, 2016. Retrieved September 22, 2016.

- "GE Sells Fort Point HQ For $252 Million". wbur.org. Archived from the original on September 2, 2019. Retrieved August 11, 2019.

- "IRS e-file Moves Forward; Successfully Executes Electronic Filing of Nation's Largest Tax Return" (PDF) (Press release). United States Department of the Treasury—Internal Revenue Service. May 31, 2006. Archived (PDF) from the original on May 4, 2017. Retrieved December 23, 2018.

- Carney, Tim (April 7, 2011). "Want to know how GE paid $0 income taxes? Think green". Washington Examiner. Retrieved September 3, 2020.

- "GE Launches Ecomagination to Develop Environmental Technologies; Company-Wide Focus on Addressing Pressing Challenges" (Press release). General Electric. May 9, 2005. Archived from the original on January 23, 2012. Retrieved January 15, 2007.

- Deutsch, Claudia (May 22, 2007). "General Electric to Sell Plastics Division". The New York Times. Archived from the original on April 17, 2009. Retrieved December 25, 2009.

- O'Reilly, Lara (February 8, 2017). "'What if female scientists were celebrities?': GE says it will place 20,000 women in technical roles by 2020". Business Insider. Archived from the original on February 9, 2017. Retrieved February 9, 2017.

- Gryta, Thomas; Lublin, Joann S. (October 18, 2017). "GE's New Chief Makes Cuts, Starting With Old Favorites". The Wall Street Journal. Archived from the original on October 18, 2017. Retrieved October 19, 2017.

- Jones, Daniel (March 1, 2019). "General Electric: The Deed Is Done". Seeking Alpha. Archived from the original on May 5, 2019. Retrieved August 11, 2019.

- "H. LAWRENCE CULP, JR. NAMED CHAIRMAN AND CEO OF GE". GE Newsroom. General Electric. October 1, 2018. Archived from the original on October 1, 2018. Retrieved October 1, 2018.

- "JOHN FLANNERY NAMED CHAIRMAN AND CEO OF GE" (PDF). GE Investor Relations. General Electric. June 12, 2017. Archived from the original (PDF) on January 12, 2018. Retrieved June 12, 2017.

- "Fortune 500 2017". Fortune. 2017. Archived from the original on June 14, 2017. Retrieved June 14, 2017.

- "GE rankings". Ranking the Brands. Archived from the original on June 3, 2011. Retrieved December 17, 2010.

- "Best Global Brands Ranking for 2010". Interbrand. Archived from the original on February 12, 2011. Retrieved February 15, 2011.

- Tara Murphy (January 16, 2003). "GE Drops Its Slogan". Forbes. Archived from the original on July 29, 2017. Retrieved August 28, 2017.

- "Bold Monday – independent font foundry of high quality type". Boldmonday.com. Archived from the original on July 22, 2015. Retrieved July 18, 2015.

- "General Electric". Beta.fortune.com. Fortune 500. 2015. Archived from the original on July 9, 2016. Retrieved July 19, 2016.

- Oyedele, Akin (June 20, 2018). "GE is getting booted from the Dow Jones industrial average". BusinessInsider.com. Archived from the original on August 3, 2018. Retrieved August 2, 2018.

- "Fact Sheet". General Electric. Archived from the original on March 22, 2016. Retrieved April 21, 2016.

- "Welcome to Saskrailmuseum.org". Contact Us. September 11, 2008. Archived from the original on October 15, 2008. Retrieved October 3, 2008.

- "VIDEO – General Imaging's blink detection cameras". TG Daily. February 6, 2008. Archived from the original on June 16, 2012. Retrieved April 23, 2012.

- "Westinghouse RIP". The Economist. November 27, 1997. Archived from the original on August 26, 2016. Retrieved April 21, 2016.

- "GE putting silicon carbide chip packaging R&D center in Utica". timesunion.com. Archived from the original on August 20, 2015. Retrieved August 20, 2015.

- "GE forms digital unit, says energy management head to retire". Reuters. September 14, 2015. Archived from the original on October 6, 2015. Retrieved October 5, 2015.

- "GE Industrial Fact Sheet". Archived from the original on September 19, 2008. Retrieved June 27, 2008.

- "GE confirms it's exiting appliance business". NBC News. May 16, 2008. Archived from the original on December 25, 2013. Retrieved December 25, 2009.

- Wason, Eleanor. "GE's planned spin-off signals failed auction". Reuters. Archived from the original on May 7, 2016. Retrieved April 21, 2016.

- THOMPSON, ASHLEE CLARK. "It's official: GE Appliances belongs to Haier". cnet. Archived from the original on August 8, 2018.

- "American Industrial Partners Completes Acquisition of Current, powered by GE". currentbyge.com. Archived from the original on April 26, 2019. Retrieved August 11, 2019.

- "Next Stop, Wabtec: GE Completes Spin-Off And Merger Of Its Transportation Unit". General Electric. Archived from the original on April 28, 2019. Retrieved April 28, 2019.

- "Political Economy Research Institute Toxic 100 Corporate Toxics Information Project Technical Notes". Archived from the original on September 2, 2006. Retrieved June 1, 2016.. Retrieved November 9, 2007.

- "Political Economy Research Institute". September 27, 2007. Archived from the original on September 27, 2007. Retrieved April 23, 2012.

- EPA Document Lists Firms Tied to Superfund Sites The Center for Public Integrity Archived February 14, 2009, at the Wayback Machine

- The Region; G.E. Plant Accused Of Water Pollution" Archived July 8, 2017, at the Wayback Machine, The New York Times, January 21, 1983

- GE agrees to $250 million Settlement to Clean Up PCBs in Housatonic River Archived October 28, 2011, at the Wayback Machine, Department of Justice news release, October 7, 1999

- EPA issues unilateral administrative order to General Electric Company in Rome, Georgia Archived December 24, 2010, at the Wayback Machine United States Environmental Protection Agency

- "General Electric-designed reactors in Fukushima have 23 sisters in U.S". Openchannel.msnbc.msn.com. Archived from the original on March 20, 2012. Retrieved April 23, 2012.

- "Nuclear Reactor Maps: Fukushima-Daiichi". Nuctrans.org. Archived from the original on January 15, 2013. Retrieved April 23, 2012.

- "Fukushima: Mark 1 Nuclear Reactor Design Caused GE Scientist To Quit In Protest". US: ABC. March 15, 2011. Archived from the original on April 22, 2012. Retrieved April 23, 2012.

- "Archives | The Philadelphia Inquirer". inquirer.com. Archived from the original on August 11, 2019. Retrieved August 11, 2019.

- "Hudson River PCBs – Background and Site Information". United States Environmental Protection Agency. Archived from the original on July 6, 2008. Retrieved December 31, 2007.

- "National Priorities List Fact Sheets: Hudson River PCBs" (PDF). EPA. Archived from the original (PDF) on December 1, 2007. Retrieved December 31, 2007.

- Harrington, Gerry (January 31, 2014). "Movement afoot to name bridge after Pete Seeger". United Press International. Archived from the original on February 3, 2014. Retrieved February 3, 2014.