Moneytree

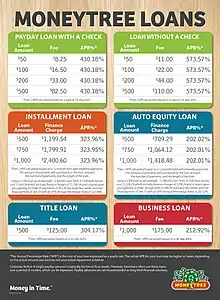

Moneytree, Inc. is a retail financial services provider headquartered in Tukwila, Washington, with branches in Washington, California, Colorado, Idaho, Nevada, and British Columbia. Moneytree offers payday loans, installment loans, prepaid debit cards, money orders, bill payment, Western Union transfers, auto equity and title loans. In 2013, Moneytree won "Best Place to Work in Colorado" in the small business category.[3]

| |

| Type | Private |

|---|---|

| Industry | Financial services |

| Founded | October 31, 1983 |

| Headquarters | Tukwila, Washington, United States |

Number of locations | 121 stores |

Area served | United States |

Key people | Dennis Bassford (CEO) |

| Services | Financing |

Number of employees | 980 (2013) |

| Website | www |

| Footnotes / references [1][2] | |

Origins

Moneytree first opened on October 31st, 1983 in Renton, Washington as a check cashing store. Over the years, the business expanded its product lines to what it offers today. Dennis Bassford, an Idaho native and Boise State University alum, has been the CEO and owner since the inception, along with his brother David and his wife Sara.

Controversy

Criticism of the company and their practices are commonly based on the claim that Moneytree creates a "debt trap" that encourages irresponsible borrowing.[4][5] Bassford has stated that Moneytree's products are not predatory in nature, but instead that "for the most part, they are [a] responsible business" and "there are people who misuse all kinds of products in society."[6] The company also claims to promote financial literacy for customers, with Bassford saying he sponsors a group of students at the University of Washington who "deliver financial literacy in schools" though he could not recall any specific programs. Asked whether he works to improve financial education among potential clients, he said, "We're not conducting programs with our customers."[7]

In 2010, Moneytree was accused of "skirting" consumer laws which prohibit borrowers from taking out more than eight payday loans in a 12-month period. When pressed by the Kitsap Sun, Moneytree CEO Dennis Bassford responded by saying that Moneytree and Washington State Department of Financial Institutions “just interpret[ed] the statute differently.”[8]

In March 2016, Moneytree fell victim to a CEO Email scam. A scammer impersonating Bassford send an email to the payroll department requesting names, home addresses, social security numbers, birthdates and W2 information of employees.[9] In a letter to employees detailing the breach, Bassford said the following:

"Unfortunately, this request was not recognized as a scam, and the information about current and former Team Members who worked in the US at Moneytree in 2015 or were hired in early 2016 was disclosed. The good news is that our servers and security systems were not breached, and our millions of customer records were not affected. The bad news is that our Team Members’ information has been compromised."[9]

In 2016, the Consumer Financial Protection Bureau fined Moneytree $505,000 for deceptive advertising and collections practices.[10] The fine consisted of a consumer refund of $255,000, and a civil penalty of $250,000.[11] The CFBP alleged that Moneytree broke the law twice: in 2014 and 2015, Moneytree sent out mailers that threatened to repossess the cars and trucks of 490 customers who were delinquent on loans. The next year, in March 2015, Moneytree left a percent sign off of an advertisement for their check cashing services in what the CFBP called "misleading," though Moneytree insisted it was an isolated incident and purely accidental.[12]

Impact of COVID-19

In 2020, during the COVID-19 pandemic, Dennis Bassford stated in an interview that the company was facing dire straits. He told KUOW, Seattle's public radio affiliate, that business had decreased by 75% saying "We laid off 160 people this week. I laid off 35 people at the end of March. I’m closing over 20 stores."[13]

See also

References

- "BBB Business Review: Contact Information". BBB. Retrieved 8 February 2012.

- Myke, Folger (July 2009). "Treating Them Right". Seattle Business Magazine. Retrieved 8 February 2012.

- "Best Companies to Work for 2013"

- ogosenseadmin (2018-04-05). "Stop the Debt Trap: Preserve the Consumer Financial Protection Bureau's Payday Loan Rule". National Consumer Law Center. Retrieved 2020-07-18.

- "Moneytree asks Washington state legislators for new payday-lending product". www.bizjournals.com. Retrieved 2020-07-22.

- "Meet Payday Lender Dennis "Shell Game" Bassford of MoneyTree, Inc". Payday Lending Facts. 2016-06-21. Retrieved 2020-07-18.

- Valdez, Angela. "The Color of Money". The Stranger. Retrieved 2020-07-18.

- "State accuses Moneytree of skirting new law". The Columbian. Retrieved 2020-07-18.

- "Thieves Phish Moneytree Employee Tax Data — Krebs on Security". Retrieved 2020-07-18.

- Hayashi, Yuka (2016-12-16). "CFPB Fines Payday Lender Moneytree for Deceptive Advertising, Collection Practices". Wall Street Journal. ISSN 0099-9660. Retrieved 2020-05-04.

- "CFPB Takes Action Against Moneytree for Deceptive Advertising and Collection Practices". Consumer Financial Protection Bureau. Retrieved 2020-05-04.

- "Payday lender Moneytree hit with $500,000 in fines and refunds". The Seattle Times. 2016-12-21. Retrieved 2020-07-18.

- "Payday lending falls off a cliff as pandemic continues in Washington state". www.kuow.org. 2020-06-01. Retrieved 2020-07-18.