Okun's law

In economics, Okun's law is an empirically observed relationship between unemployment and losses in a country's production. It is named after Arthur Melvin Okun, who first proposed the relationship in 1962.[1] The "gap version" states that for every 1% increase in the unemployment rate, a country's GDP will be roughly an additional 2% lower than its potential GDP. The "difference version"[2] describes the relationship between quarterly changes in unemployment and quarterly changes in real GDP. The stability and usefulness of the law has been disputed.[3]

Imperfect relationship

Okun's law may more accurately be called "Okun's rule of thumb" because it is an approximation based on empirical observation rather than a result derived from theory. Okun's law is approximate because factors other than employment, such as productivity, affect output. In Okun's original statement of his law, a 2% increase in output corresponds to a 1% decline in the rate of cyclical unemployment; a 0.5% increase in labor force participation; a 0.5% increase in hours worked per employee; and a 1% increase in output per hours worked (labor productivity).[4]

Okun's law states that a one-point increase in the cyclical unemployment rate is associated with two percentage points of negative growth in real GDP. The relationship varies depending on the country and time period under consideration.

The relationship has been tested by regressing GDP or GNP growth on change in the unemployment rate. Martin Prachowny estimated about a 3% decrease in output for every 1% increase in the unemployment rate.[5] However, he argued that the majority of this change in output is actually due to changes in factors other than unemployment, such as capacity utilization and hours worked. Holding these other factors constant reduces the association between unemployment and GDP to around 0.7% for every 1% change in the unemployment rate. The magnitude of the decrease seems to be declining over time in the United States. According to Andrew Abel and Ben Bernanke, estimates based on data from more recent years give about a 2% decrease in output for every 1% increase in unemployment.[6]

There are several reasons why GDP may increase or decrease more rapidly than unemployment decreases or increases:

As unemployment increases,

- a reduction in the multiplier effect created by the circulation of money from employees

- unemployed persons may drop out of the labor force (stop seeking work), after which they are no longer counted in unemployment statistics

- employed workers may work shorter hours

- labor productivity may decrease, perhaps because employers retain more workers than they need

One implication of Okun's law is that an increase in labor productivity or an increase in the size of the labor force can mean that real net output grows without net unemployment rates falling (the phenomenon of "jobless growth")

Okun's Law is sometimes confused with Lucas wedge.

Mathematical statements

The gap version of Okun's law may be written (Abel & Bernanke 2005) as:

- , where

- is actual output

- is potential GDP

- is actual unemployment rate

- is the natural rate of unemployment

- is the factor relating changes in unemployment to changes in output

In the United States since 1955 or so, the value of c has typically been around 2 or 3, as explained above.

The gap version of Okun's law, as shown above, is difficult to use in practice because and can only be estimated, not measured. A more commonly used form of Okun's law, known as the difference or growth rate form of Okun's law, relates changes in output to changes in unemployment:

- , where:

- and are as defined above

- is the change in actual output from one year to the next

- is the change in actual unemployment from one year to the next

- is the average annual growth rate of full-employment output

At the present time in the United States, k is about 3% and c is about 2, so the equation may be written

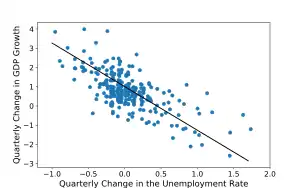

The graph at the top of this article illustrates the growth rate form of Okun's law, measured quarterly rather than annually.

Derivation of the growth rate form

We start with the first form of Okun's law:

Taking annual differences on both sides, we obtain

Putting both numerators over a common denominator, we obtain

Multiplying the left hand side by , which is approximately equal to 1, we obtain

We assume that , the change in the natural rate of unemployment, is approximately equal to 0. We also assume that , the growth rate of full-employment output, is approximately equal to its average value, . So we finally obtain

Usefulness

Through comparisons between actual data and theoretical forecasting, Okun's law proves to be an invaluable tool in predicting trends between unemployment and real GDP. However, the accuracy of the data theoretically proved through Okun's law compared to real world numbers proves to be generally inaccurate. This is due to the variances in Okun's coefficient. Many, including the Reserve Bank of Australia, conclude that information proved by Okun's law to be acceptable to a certain degree.[7] Also, some findings have concluded that Okun's law tends to have higher rates of accuracy for short-run predictions, rather than long-run predictions. Forecasters have concluded this to be true due to unforeseen market conditions that may affect Okun's coefficient.

As such, Okun's law is generally acceptable by forecasters as a tool for short-run trend analysis between unemployment and real GDP, rather than being used for long run analysis as well as accurate numerical calculations.

The San Francisco Federal Reserve Bank determined through the use of empirical data from past recessions in the 1970s, 1990s, and 2000s that Okun’s law was a useful theory. All recessions showed two common main trends: a counterclockwise loop for both real-time and revised data. The recoveries of the 1990s and 2000s did have smaller and tighter loops.[8]

See also

Notes

- Okun, Arthur M. "Potential GNP: Its Measurement and Significance," American Statistical Association, Proceedings of the Business and Economics Statistics Section 1962. Reprinted with slight changes in Arthur M. Okun, The Political Economy of Prosperity (Washington, D.C.: Brookings Institution, 1970)

- Knotek, 75

- Knotek, 93

- Okun, 1962

- Prachowny, Martin F. J. (1993). "Okun's Law: Theoretical Foundations and Revised Estimates". The Review of Economics and Statistics. 75 (2): 331–336. doi:10.2307/2109440. ISSN 0034-6535.

- Abel, Andrew; Bernanke, Ben (2005). Macroeconomics (5th ed.). Boston: Pearson/Addison Wesley. ISBN 0-321-16212-9. OCLC 52943097.

- Lancaster, David; Tulip, Peter (2014–2015). "Okun's Law and Potential Output" (PDF).

- https://www.frbsf.org/economic-research/publications/economic-letter/2014/april/okun-law-deviation-unemployment-recession/

References

- Ball, Laurence; Tovar Jalles, João; Loungani, Prakash. "Do Forecasters Believe in Okun's Law? An Assessment of Unemployment and Output Forecasts" (PDF). imf.org. International Monetary Fund. Retrieved 2016-07-11.

- Abel, Andrew B. & Bernanke, Ben S. (2005). Macroeconomics (5th ed.). Pearson Addison Wesley. ISBN 0-321-16212-9.

- Baily, Martin Neil & Okun, Arthur M. (1965) The Battle Against Unemployment and Inflation: Problems of the Modern Economy. New York: W.W. Norton & Co.; ISBN 0-393-95055-7 (1983; 3rd revised edition).

- Case, Karl E. & Fair, Ray C. (1999). Principles of Economics (5th ed.). Prentice-Hall. ISBN 0-13-961905-4.

- Okun, Arthur M. (1962). "Potential GNP, its measurement and significance". Cowles Foundation, Yale University.

- Plosser, Charles I. and Schwert, G. William (1979). "Potential GNP: Its measurement and significance: A dissenting opinion", Carnegie-Rochester Conference Series on Public Policy

- Knotek, Edward S. "How Useful Is Okun's Law." Economic Review, Federal Reserve Bank of Kansas City, Fourth Quarter 2007, pp. 73–103.

- Prachowny, Martin F. J. (1993). "Okun's Law: Theoretical Foundations and Revised Estimates," The Review of Economics and Statistics, 75 (2), pp. 331–336.

- Gordon, Robert J., Productivity, Growth, Inflation and Unemployment, Cambridge University Press, 2004

- McBride, Bill (11 October 2010). "Real GDP Growth and the Unemployment Rate". Calculated Risk. Retrieved 5 December 2010.

- Goto, Eiji; Burgi, Constantin. "Sectoral Okun's Law and Cross-Country Cyclical Differences" (PDF). Retrieved 2020-09-09.

- Ball, Laurence; Leigh, Daniel; Loungani, Prakash. "Okun's Law: Fit at 50?" (PDF). Retrieved 2020-09-09.