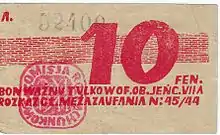

Token money

Token money, or token, is money that has little intrinsic value compared to its face value. Unlike fiat money, which also has little intrinsic value, it is limited legal tender.[1] It does not have free coinage.[2]

History

Plato distinguished between tokens and commodities.[3]

In the early nineteenth century, David Ricardo suggested issuing token money as long as it did not affect commodity standard.[4]

Physical tokens

.jpg.webp)

Token money has less commodity value compared to its face value.[1] If the token money is metallic it is commonly made out of cheaper metals such as copper and nickel.[2]

Token money is also money whose face value exceeds its cost of production, i.e. the intrinsic value is lower than the extrinsic value. This means that the actual worth of a note or coin is much less than what we use it for. The cost of production of token money is less than its actual value, for example with convertible currency, collector notes, souvenirs, coupons, some retired US banknotes and per 1986 banknotes printed in regulation size and only on one side with authorization are actually worth more dollars than when issued.

With token money, exchanges are not considered fully complete because the exchange of value is not equivalent.[5] Value is hoped to be rendered at some future time. Examples of this include bills of exchange or negotiable instrument and certificates.[5]

Token money does not have free coinage.[2]

Legal

Token money may be representative money, as well as having nominal value; that is, its owner has a legal claim to a fixed amount of a commodity that has intrinsic value.[6]

See also

References

- https://www.merriam-webster.com/dictionary/token%20money

- Mehta, B. K. (2000). Principles of Money and Banking. Motilal Banarsidass. pp. 33–34. ISBN 8120829166. Retrieved 2 January 2017.

- Karimzadi, Shahzavar (2012). Money and its Origins. Routledge. p. 139. ISBN 9781136239021.

- Sargent, Thomas. "Commodity and Token Monies" (PDF): 2. Cite journal requires

|journal=(help) - Kuzminski, Adrian (2013). The Ecology of Money: Debt, Growth, and Sustainability. Lexington Books. p. 54. ISBN 9780739177181. Retrieved 2 January 2017.

- F. A. Hayek (7 January 2015). "Denationalization of Money". Foundation for Economic Education. Retrieved 2 January 2017.