Wald's maximin model

In decision theory and game theory, Wald's maximin model is a non-probabilistic decision-making model according to which decisions are ranked on the basis of their worst-case outcomes – the optimal decision is one with the least bad worst outcome. It is one of the most important models in robust decision making in general and robust optimization in particular.

It is also known by a variety of other titles, such as Wald's maximin rule, Wald's maximin principle, Wald's maximin paradigm, and Wald's maximin criterion. Often 'minimax' is used instead of 'maximin'.

Definition

Wald's generic maximin model is as follows:

where denotes the decision space; denotes the set of states associated with decision and denotes the payoff (outcome) associated with decision and state .

This model represents a 2-person game in which the player plays first. In response, the second player selects the worst state in , namely a state in that minimizes the payoff over in . In many applications the second player represents uncertainty. However, there are maximin models that are completely deterministic.

The above model is the classic format of Wald's maximin model. There is an equivalent mathematical programming (MP) format:

where denotes the real line.

As in game theory, the worst payoff associated with decision , namely

is called the security level of decision .

The minimax version of the model is obtained by exchanging the positions of the and operations in the classic format:

The equivalent MP format is as follows:

History

Inspired by maximin models of game theory, Abraham Wald developed this model in the early 1940s [1][2][3] as an approach to situations in which there is only one player (the decision maker). The second player represents a pessimistic (worst case) approach to uncertainty. In Wald's maximin model, player 1 (the player) plays first and player 2 (the player) knows player 1's decision when he selects his decision. This is a major simplification of the classic 2-person zero-sum game in which the two players choose their strategies without knowing the other player's choice. The game of Wald's maximin model is also a 2-person zero-sum game, but the players choose sequentially.

With the establishment of modern decision theory in the 1950s, the model became a key ingredient in the formulation of non-probabilistic decision-making models in the face of severe uncertainty.[4][5] It is widely used in diverse fields such as decision theory, control theory, economics, statistics, robust optimization, operations research, philosophy, etc.[6][7]

Example

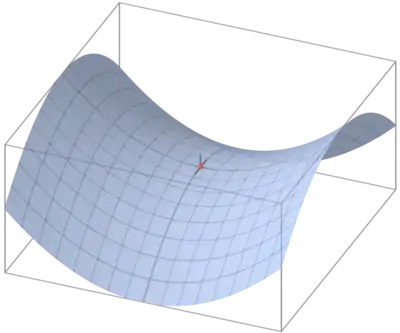

One of the most famous examples of a Maximin/Minimax model is

where denotes the real line. Formally we can set and . The picture is this

The optimal solution is the (red) saddle point .

Decision tables

There are many cases where it is convenient to 'organize' the Maximin/Minimax model as a 'table'. The convention is that the rows of the table represent the decisions, and the columns represent the states.

Example

Henri is going for a walk. The sun may shine, or it may rain. Should Henri carry an umbrella? Henri does not like carrying an umbrella, but he dislikes getting wet even more. His "payoff matrix", viewing this as a Maximin game pitting Henri against Nature, is as follows.

| Sun | Rain | |

|---|---|---|

| No umbrella | ||

| Umbrella |

Appending a Worst Payoff column and a Best Worst Payoff column to the payoff table, we obtain

| Sun | Rain | Worst Payoff | Best Worst Payoff | |

|---|---|---|---|---|

| No umbrella | ||||

| Umbrella |

The worst case, if Henri goes out without umbrella, is definitely worse than the (best) worst case when carrying an umbrella. Therefore, Henri takes his umbrella with him.

Variations on a theme

Over the years a variety of related models have been developed primarily to moderate the pessimistic approach dictated by the worst-case orientation of the model.[4][5][8][9][10] For example,

Savage's minimax regret

Savage's minimax regret model[11] is an application of Wald's minimax model to the 'regrets' associated with the payoffs. It can be formulated as follows:

where

is the regret of payoff associated with the (decision,state) pair .

Deterministic models

The sets of states need not represent uncertainty. They can represent (deterministic) variations in the value of a parameter.

Example

Let be a finite set representing possible locations of an 'undesirable' public facility (e.g. garbage dump), and let denote a finite set of locations in the neighborhood of the planned facility, representing existing dwellings.

It might be desirable to build the facility so that its shortest distance from an existing dwelling is as large as possible. The maximin formulation of the problem is as follows:

where denotes the distance of from . Note that in this problem does not vary with .

In cases where is it desirable to live close to the facility, the objective could be to minimize the maximum distance from the facility. This yields the following minimax problem:

These are generic facility location problems.

Maximin models in disguise

Experience has shown that the formulation of maximin models can be subtle in the sense that problems that 'do not look like' maximin problems can be formulated as such.

Example

Consider the following problem:

Given a finite set and a real valued function on , find the largest subset of such that for every in this subset.

The maximin formulation of this problem, in the MP format, is as follows:

Generic problems of this type appear in robustness analysis.[12][13]

It has been shown that the radius of stability model and info-gap's robustness model are simple instances of Wald's maximin model.[14]

Constrained maximin models

Constraints can be incorporated explicitly in the maximin models. For instance, the following is a constrained maximin problem stated in the classic format

Its equivalent MP format is as follows:

Such models are very useful in robust optimization.

The price of robustness

One of the 'weaknesses' of the Maximin model is that the robustness that it provides comes with a price.[10] By playing it safe, the Maximin model tends to generate conservative decisions, whose price can be high. The following example illustrates this important feature of the model.

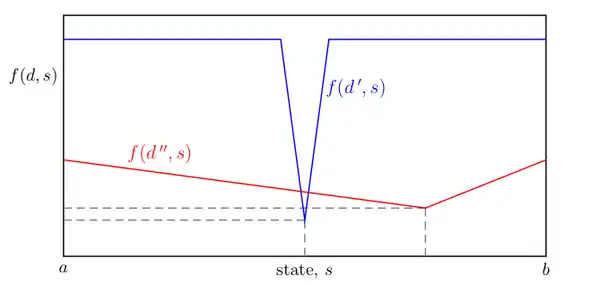

Example

Consider the simple case where there are two decisions, d' and d", and where S(d')=S(d")=[a,b]. The Maximin model is then as follows:

Now consider the instance shown by

Note that although the payoff associated with decision d' is larger than the payoff associated with decision d" over most of the state space S=[a,b], the best worst case according to Wald's model is provided by decision d". Hence, according to Wald's model decision d" is better than decision d'.

Algorithms

There are no general-purpose algorithms for the solution of maximin problems. Some problems are very simple to solve, others are very difficult.[9][10][15][16]

Example

Consider the case where the state variable is an "index", for instance let for all . The associated maximin problem is then as follows:

where .

If , all the functions are linear, and is specified by a system of linear constraints on , then this problem is a linear programming problem that can be solved by linear programming algorithms such as the simplex algorithm.

References

- Wald, A. (1939). Contributions to the theory of statistical estimation and testing hypotheses. The Annals of Mathematics, 10(4), 299-326.

- Wald, A. (1945). Statistical decision functions which minimize the maximum risk. The Annals of Mathematics, 46(2), 265-280.

- Wald, A. (1950). Statistical Decision Functions, John Wiley, NY.

- Resnik, M.D. (1987). Choices: an Introduction to Decision Theory, University of Minnesota Press, Minneapolis.

- French, S. (1986). Decision Theory: An Introduction to the Mathematics of Rationality, Ellis Horwood, Chichester.

- Sniedovich, M. (2007). The art and science of modeling decision-making under severe uncertainty. Decision Making in Manufacturing and Services, 1(1-2), 111-136.

- Sniedovich, M. (2008). Wald's maximin model: a treasure in disguise! Journal of Risk Finance, 9(3), 287-91.

- Kouvelis P, and Yu G. (1997). Robust Discrete Optimization and Its Applications, Kluwer, Boston.

- Ben-Tal, A, El Gaoui, L, Nemirovski, A. (2009). Robust Optimization. Princeton University Press, Princeton.

- Bertsimas D, and Sim, M. (2004). The price of robustness. Operations Research, 52(1), 35-53.

- Savage, L. (1951). The theory of statistical decision. Journal of the American Statistical Association, 46, 55–67.

- L. Joe Moffitt, John K. Stranlund, and Craig D. Osteen (2008). Robust detection protocols for uncertain introductions of invasive species. Journal of Environmental Management, 89(4), 293–299.

- Jonathan Rosenhead, Martin Elton, Shiv K. Gupta. (1972). Robustness and Optimality as Criteria for Strategic Decisions. Operational Research Quarterly, 23(4), 413-431.

- Sniedovich, M. (2010). A bird's view of info-gap decision theory. Journal of Risk Finance, 11(3), 268-283.

- Reemstem, R. and R\"{u}ckmann, J. (1998). Semi-Infinite Programming, Kluwer, Boston.

- Rustem, B. and Howe, M. (2002). Algorithms for Worst-case Design and Applications to Risk Management, Princeton University Press, Princeton.