German public bank

The German banking system is structured in three different pillars, totally separated from each other.[1] They typically differ in their legal form and the ownership.[2] Private banks, represented by banks like Deutsche Bank or Commerzbank as listed companies, and Hauck & Aufhäuser or Bankhaus Lampe as less known private companies, are part of the first pillar. The second pillar is composed of co-operative banks like the numerous Volksbanken and Raiffeisenbanken.[1] They are based on a member-structure where each member, independently from its capital share, has one vote.[3] The third pillar consists of public banks, which are a legally defined arm of the banking industry in Germany. They are further divided into two main groups.

| Part of a series on financial services |

| Banking |

|---|

|

The German Savings Banks Finance Group (Sparkassen-Finanzgruppe) is the most numerous sub-sector with 431 savings banks using the Sparkasse brand,[4] 8 Landesbanken including the DekaBank using separate brands[5] and 10 real-estate financing banks using the LBS brand.[6] The Deutscher Sparkassen- und Giroverband (German Savings Banks and Clearing Association, DSGV) represents the interests of the Sparkassen-Finanzgruppe on a national and international level concerning law and the financial services industry. It also coordinates, promotes and harmonises the interests of Sparkassen.[7]

According to the OECD, the German public banking system had a 40% share of total banking assets in Germany.[8] This shows the significant role of this group of banks in Germany.

German public banks

Public banks in Germany are financial institutions typically held directly or indirectly by public sector entities such as the federal government, the states, administrative districts or cities. Not all these companies are fully publicly owned. They can also be defined as public because they provide services in the public interest.[9]

The public banks are represented through the Bundesverband Öffentlicher Banken Deutschlands (VÖB, Association of German Public Sector Banks), one of the leading associations in the German banking industry. The association counts 34 ordinary members, but the Landesbanken, as part of the Sparkassen-Finanzgruppe described below, are also members of this association.[10]

The typical public bank acts as a business development bank (Förderbank, Aufbaubank or Investitionsbank) or as an institution for the financing of international projects, infrastructure and exports. The best known representatives of this group are the KfW-Group, the NRW.Bank in North Rhine-Westphalia, the LfA Förderbank Bayern in Bavaria and the L-Bank, Staatsbank für Baden-Württemberg in Baden-Wuerttemberg.

The public development banks together manage assets of €880.9 billion. In total, 13,000 people work for the various institutions. (December 2010)[11]

The Sparkassen-Finanzgruppe / German Savings Bank Finance Group

Sparkassen

Savings banks in German-speaking countries are called Sparkasse (pl: Sparkassen). They work as commercial banks in a decentralized structure.[4] Each savings bank is independent, locally managed and concentrates its business activities on customers in the region in which it is situated. In general, savings banks are not profit oriented. Shareholders of the savings banks are usually single cities or numerous cities in an administrative district.[12] Some 6 savings banks (Bordesholmer Sparkasse AG, Spar- und Leihkasse zu Bredstedt AG, Sparkasse Bremen AG, Hamburger Sparkasse AG, Sparkasse zu Lübeck AG, Sparkasse Mittelholstein AG) are independent from municipalities, their shareholders and guarantors are charitable foundations; their association is the Verband der Deutschen Freien Öffentlichen Sparkassen.[13]

The first savings banks in Germany were founded at the beginning of the 18th century in its major trading cities. One of the first institutions with the business model of modern savings banks was the Ersparungscasse der Hamburgischen Allgemeinen Versorgungsanstalt in Hamburg in 1778. Founders were rich merchants, clerks and academics. They intended to develop solutions for people with low income to save small sums of money and to support business start-ups.[14] In 1801 the first savings bank with a municipal guarantor was founded in Göttingen to fight poverty.[15] Between 1850 and 1903 the idea of the municipal savings banks spread and the number of savings banks in Germany increased from 630 to 2834.[16] Fulfilling public interests is still one of the most significant characteristics of public banks in general and the savings banks in particular. Although public interest is very unspecific, objects of those companies are usually

- providing financial and monetary services in economically underdeveloped regions

- supporting saving processes and accumulation of capital

- strengthening competition in the banking industry[17]

The total assets of the Sparkassen amount to about €1 trillion. The 431 savings banks operate a network of over 15,600 branches and offices and employ over 250,000 people.[18] Savings banks are universal banks and provide the whole spectrum of banking services for private and commercial medium-sized customers.[4] 50 million customers maintain business activities with savings banks.[19] Although independent and regionally spread, the savings banks act as one unit under the brand Sparkasse with the famous logo and the well known red colour.

The size of savings banks differs widely depending on the economy in their region. While the biggest, Hamburger Sparkasse, had total assets of €37.7 billion and 5,500 employees in 2009, the smallest (Stadtsparkasse Bad Sachsa) had only €129.6 million in assets and 45 employees.[20]

The German Savings Banks Association (Deutscher Sparkassen- und Giroverband) was founded in 1924[21] as an umbrella organization to facilitate decision-making processes, coordinate strategy, and represent its members' political and regulatory interests at the national and international levels.[22]

The regional associations are statutory bodies, of which savings banks and their municipal owners (Gewährträger) are statutory members. They are responsible for coordination between savings banks in a region. They also act as auditors and operate regional savings bank academies for educational and training purposes.[23]

Landesbanken

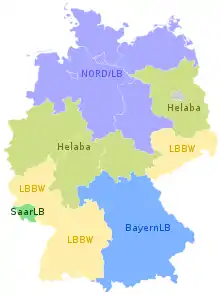

The Landesbanken are mostly owned by the regional savings banks through its regional association and the respective federal state.[5] After several mergers and acquisitions, there are seven Landesbanken-Groups left: BayernLB, Norddeutsche Landesbank (Nord/LB), HSH Nordbank, Landesbank Baden-Württemberg (LBBW), Landesbank Berlin (LBB), Landesbank Hessen-Thuringen - Girozentrale (Helaba), WestLB.[5] Bremer Landesbank Kreditanstalt Oldenburg - Girozentrale belongs with a share of 92.5% to the Nord/LB-Group. The rest is owned by the federal state of Bremen.[24] The Sachsen LB and the Landesbank Rheinland-Pfalz (LRP) since April 2008 are subsidiaries of the Landesbank Baden-Württemberg (LBBW).[25] Until 21.06.2010, the BayernLB was majority shareholder of the Landesbank Saar (SaarLB) with a share of 75.1%. Since June 2010, the Saarland has become shareholder with a stake of 35.2% and the BayernLB reduced its share to 49.9%. The remaining 14.9% are held by the Sparkassen through its regional confederation.[26]

The regional banks / clearing houses are the central banks of a savings bank association and act as the "main bank" of the states. They are also local banks, mortgage banks and general commercial banks. Their duties and powers are codified in the individual banking laws of the Länder (Landesbankengesetze). The specific tasks for the savings banks include the central clearing for cashless payments and liquidity funding for the regional savings banks. They also provide many services for the savings banks in the region in securities and cross-country businesses. In contrast to savings banks, they do "wholesale-banking" rather than retail-banking.[27] With combined total assets of €1.6 trillion as of December 2010, the seven Landesbanken-Groups employ some 44,000 people.[28]

DekaBank with its subsidiaries is the central asset manager of the German Savings Bank Finance Group. Based in Frankfurt and Berlin it provides asset management services for the Sparkassen and the Landesbanken and their customers.[29] With managed fund assets of about €155 billion, approximately five million customer deposits[30] and group locations in Luxembourg[31] and Switzerland,[32] the DekaBank Group is one of the largest asset managers in Germany. DekaBank's roots date back to 1918, when Deutsche Girozentrale (DGZ) was founded.[33] Deka as an investment company was founded in 1956 (17.08.1956) by DGZ with a share of 23% in 11 other regional Landesbanken.[34] Today's DekaBank was created in 1999 by a merger of DGZ and Deka.[35]

Until 8 June 2011, DekaBank was owned by the German Savings Banks and Giro Association Landesbanken which grouped the shares in the GLB GmbH & Co.OHG, which held the DekaBank shares.[36] On 7 April 2011, the Savings Banks bought the 50% stake from the landesbanken for €2.3 billion to become sole owner of the DekaBank.[37] The acquisition was closed on 8 June 2011 and DekaBank became fully, directly owned by the savings banks.[38]

3,700 people throughout the group work in one of the three business divisions AMK (Asset Management Capital Markets), AMI (Asset Management Real Estate Business), C&M (Corporates and Markets), the sales division or one of the corporate centers.[39]

Landesbausparkassen

The Landesbausparkassen are subsidiaries of the Sparkassen and its associations and are regionally organised focussing on real estate banking.[40] There are 10 Landesbausparkassen in Germany which employ around 8,900 people. Their combined balance sheet shows total assets of €52 billion as per December 2009.[18]

The core business of the Landesbausparkassen is collective real estate saving products (Bausparen) and low-interest residential mortgage loans.[41]

See also

External links

References

- Was Banken leisten Archived 2011-09-29 at the Wayback Machine publisher: Bundesverband deutscher Banken, Berlin 2010, P. 15.; accessed: 13.06.2011

- Felix Hüfner: The German Banking System: Lessons from the financial crisis, Economic Department Working Papers No.788, OECD 2010, P.8. OECD Workingpapers; accessed: 13.06.2011

- Felix Hüfner: The German Banking System: Lessons from the financial crisis, Economic Department Working Papers No.788, OECD 2010, P.9. OECD Workingpapers; accessed: 13.06.2011

- DSGV-Website-Organisation-Sparkassen; accessed: 13.06.2011

- DSGV-Website-Organisation-Landesbanken; accessed: 13.06.2011

- ; accessed: 13.06.2011

- Staff, Sparkassen, The Deutsche Sparkassen- und Giroverband, archived from the original on 2008-11-19, retrieved 2008-09-21

- Felix Hüfner: The German Banking System: Lessons from the financial crisis, Economic Department Working Papers No.788, OECD, P.7. ; accessed: 13.06.2011

- VÖB-Website ; accessed: 13.06.2011

- VÖB-Website - Members ; accessed: 13.06.2011

- Landesbanken in 2011 Archived 2012-03-25 at the Wayback Machine ; accessed: 13.06.2011

- Klaus Ulrich: Die deutsche Sparkassenorganisation, Deutscher Sparkassen Verlag GmbH, P.15/16.

- Verband der deutschen freien Sparkassen e.V. ; accessed: 13.06.2011

- Fakten, Analysen, Positionen: Zur Geschichte der Sparkassen in Deutschland Nr. 45, Publisher: Deutscher Sparkassen- und Giroverband, P.4., ; accessed: 13.06.2011

- Fakten, Analysen, Positionen: Zur Geschichte der Sparkassen in Deutschland Nr. 45, Publisher: Deutscher Sparkassen- und Giroverband, P.5., ; accessed: 13.06.2011

- Magarete Wagner-Braun: Die Deutsche Girozentrale als Antwort auf Finanzprobleme des frühen 20. Jahrhunderts: in:Die DekaBank seit 1918, Publisher: Institut für bankhistorische Forschung e.V., ISBN 978-3-09-303815-0, P.16/17.

- Andrea Kositzki: Das öffentlich-rechtliche Kreditgewerbe: eine empirische Analyse zur Struktureffizienz und zur Unternehmensgröße im Sparkassensektor, Dt. Universitäts-Verlag, Wiesbaden 2004, ISBN 3-8244-7887-0, P.13.; Maik Rösler: Der Genossenschaftliche Bankensektor, Grin-Verlag 2008, ISBN 978-3-640-71737-8, P.14

- Das Profil, Publisher: Deutscher Sparkassen- und Giroverband, P.3. ; accessed: 13.06.2011

- Das Profil, Publisher: Deutscher Sparkassen- und Giroverband, P.4. ; accessed: 13.06.2011

- "Sparkassenrangliste 2009" (PDF). Archived from the original (PDF) on 2012-03-25. Retrieved 2011-06-17.

- Fakten, Analysen, Positionen: Zur Geschichte der Sparkassen in Deutschland Nr. 45, Publisher: Deutscher Sparkassen- und Giroverband, P.10., ; accessed: 13.06.2011

- DSGV-Website ; accessed: 13.06.2011

- DSGV-Website-Organisation-Verbände ; accessed: 13.06.2011

- Website of Bremer Landesbank, Investor Relations – Über uns- Kurzportrait, ; accessed: 13.06.2011

- Website of the LBBW, History of the Group ; accessed: 13.06.2011

- Geschichte der SaarLB, P.7, ; accessed: 13.06.2011

- Klaus Ulrich: Die deutsche Sparkassenorganisation, Deutscher Sparkassen Verlag GmbH, P.36-38.

- Landesbanken in Deutschland – Beschäftigte, Bilanzsumme, Anteilseigner, Website of the Bundesverband öffentlicher Banken Deutschlands (VÖB), Archived 2012-03-25 at the Wayback Machine ; accessed: 13.06.2011

- DekaBank Group Annual Report 2010, P.18.

- DekaBank Group Annual Report 2010, P.1.

- DekaBank Luxembourg S.A.

- "Deka (Swiss) Privatbank AG". Archived from the original on 2011-07-06. Retrieved 2019-12-27.

- Magarete Wagner-Braun: Die Deutsche Girozentrale als Antwort auf Finanzprobleme des frühen 20. Jahrhunderts: in:Die DekaBank seit 1918, Publisher: Institut für bankhistorische Forschung e.V., ISBN 978-3-09-303815-0, P.28.

- Thorsten Beckers: Gründung und erste Jahre der Deutschen Kapitalanlagegesellschaft mbH 1956-1970 in:Die DekaBank seit 1918, Publisher: Institut für bankhistorische Forschung e.V., ISBN 978-3-09-303815-0, P.271.

- Chronik der DekaBank 1999-2007 in:Die DekaBank seit 1918, Publisher: Institut für bankhistorische Forschung e.V., ISBN 978-3-09-303815-0, P.463.

- DekaBank Group Annual Report 2010, P.19.

- DSGV press release No.36 on 07.04.2011 ; accessed: 13.06.2011

- DSGV press release No.55 on 08.06.2011 ; accessed: 13.06.2011

- DekaBank Group Annual Report, P.19-21.

- Overview of the regional based Landesbausparkassen ; accessed: 13.06.2011

- DSGV-Website-Organisation-Landesbausparkassen ; accessed: 13.06.2011

- DSGV-Website-Organisation-Öffentliche Versicherer