Iran Mercantile Exchange

Iran Mercantile Exchange (IME) is a commodities exchange located in Tehran, Iran.

| Type | Commodities exchange |

|---|---|

| Location | Tehran, Iran |

| Founded | 2007[1] |

| Owner | IME is 30% owned by individuals and 70% by legal and financial entities.[2] |

| Currency | Iranian rial |

| Commodities | Industrial products, agricultural products, petrochemicals[1] |

| Website | http://en.ime.co.ir/ |

At a Glance

Established on 20 September 2007 from the merger of the Tehran Metal Exchange and the Iran Agricultural Exchange, IME trades in agricultural, metal and mineral, oil and petrochemical products in the spot market and gold coin in the futures market. The Exchange handles over 26 million tonnes of commodities on an annual basis worth in excess of US$14 billion. IME caters to both the domestic and regional markets, bringing together a host of trade participants and market makers from the capital market community, trade and industrial sectors, hedgers, retail and institutional investors.

The Exchange uses advanced technology in providing trading infrastructure as well as facilitating other services. IME has global ambitions and currently provides price referencing for the regional market in main commodities and intermediaries.

[3]

Services & Trading

In order to organize and promote commodity trade and optimal allocation of resources and capital, the Iran Mercantile Exchange offers a variety of services to the economic sector of the country. The most important functions and services of IME are as follows:

- Creating and developing the market, discovering fair prices and creating price reference

- Price fluctuations risk management: the ability to hedge and improve production planning for producers

- Improving the investment environment

- Facilitating physical exchanges through increasing quality standards and guaranteeing contractual obligations

- Strengthening the infrastructure for maintaining and storing goods and commodities

- Facilitating financing

- Establishing the possibility of regulating the market and regulating strategic stocks of goods for public institutions

Risk management: Competent risk management ensures market integrity and continuity. IME views risk from two standpoints; firstly, the risk management of exchange-traded contracts is administered by the clearing houses in the spot and derivatives markets using instruments including collaterals and margins. Secondly, the Exchange provides tools to manage the risk of price volatility as well as changes in production. The IME is active in the area of risk hedging tools, presenting a range of standardized derivatives contracts.

Futures contracts, options contracts, SALAM contracts, and standard parallel SALAM contracts are the hedging instruments on the IME. Among these instruments, futures and options contracts are designed primarily for risk coverage and therefore, as compared to other tools, have the highest efficiency in this regard. In SALAM contracts, in addition to providing financing for a product vendor, because the merchandise is pre-sold at a specified rate, then the producer will in fact safeguard itself against price fluctuations.

Price discovery: In all IME's markets, competition determines the price of goods or commodity-based securities. This price is discovered by fair competition between supply and demand and based on real market transactions. Therefore, the IME can be considered as a price reference for commodities. This price discovery will provide opportunities for economic operators to plan and analyze, especially when prices are set for the future. When commodity prices are transparent in the economy, the flow of commodities will be less problematic, and trade, as the most important communication link between production and consumption, will be booming. In addition, futures and options contracts will determine the general orientation of prices for economic agents in the future and will provide them opportunity for long-term planning.

Markets

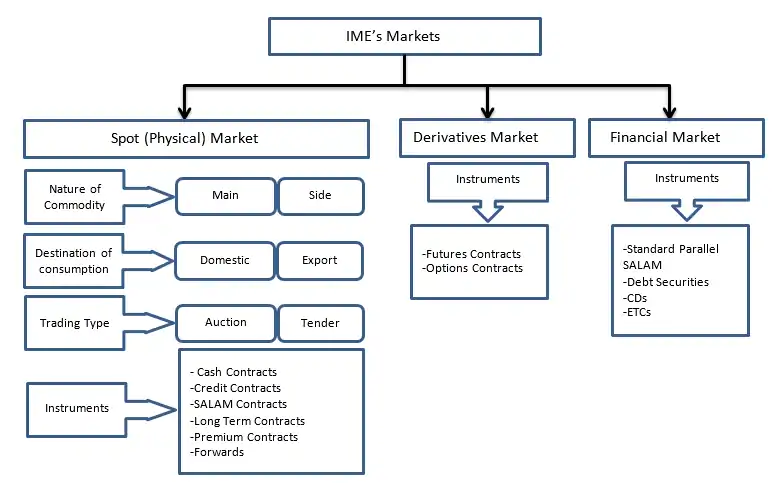

Commodities and commodity-based securities are traded on the IME in the spot market, derivatives markets and financial markets.

On the trade platform transactions are performed as auctions and prices are discovered based on the supply and demand orders of participants. The international side of IME transactions is performed in the Persian Gulf for export-transactions.

1) Physical Market: Commodities are traded on the main market of IME in the form of cash, credit and SALAM contracts. Types of products are traded in the agricultural sector, metal and mineral sector, and oil and petrochemicals products. Products that have the proper standard and the condition of continued supply are traded on the main market, otherwise they will be offered in the side market. Also, in order to meet customers' needs, IME has also recently launched Premium discovery contracts.

Transactions are conducted in the form of auction, and the price and timing priority determines the winners of the auction. Commodities in this market are priced and traded through a one-way auction consisting of four stages, namely, green periods (pre-opening), yellow period (auction), red period (competition), and a blue period (supervision) as a transparent discovery of rates and trades.

Side market: IME's side market is launched in order to create a more convenient and diverse trading environment. Commodities that are traded on this market, due to the lack of availability of the continuity of supply or standardization, cannot be listed and traded on the main spot market. The side market accepts goods in the shortest possible time, and the trading approach in this market is like the main physical market.

Export Pit: The export pit of the IME was launched in 2007. Commodities that are offered on the export ring are solely for the purpose of exporting to the outside the borders of Iran and it is not possible to use and transfer it within the country. The transactions in the export ring are similar to the domestic ring and the export trading floor is located in Kish Island.

2) Derivatives market: Comprises futures and options trading. A futures contract is a contract between two parties where both parties agree to buy and sell a particular asset of specific quantity and at a predetermined price, at a specified date in future. An option is a contract which gives the buyer (the owner or holder of the option) the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price on a specified date, depending on the form of the options. IME has launched futures and option contracts on gold coins and saffron and is now developing new standalone and combination products for currency, agriculture and other commodities.

Financial market: The financial market is based on financial instruments such as standard parallel SALAM, CDs and ETCs. The purpose of these tools in this market is to finance producers. Through various instruments, it has been tried to encourage other investors, in addition to the commodity sector activists, to participate in funding the producers. Reducing transaction costs, reducing storage costs, reducing financial costs and attracting non-expert investors are among the most important benefits of this market for commodity actors.

Commodities

IME facilitates the trading of commodities and products through its markets.

IME's Listed Commodities on Different Trading Floors

| Main Group | Sub-Group | Commodities |

| Physical Market | Industrial & Mineral | Steel, Copper, Iron Ore, Aluminum, Zinc and rare metals concentrate, Gold bar |

| Agricultural Products | Barley, Wheat, Maize, Sugar, Crude Vegetable Oil, Frozen Chicken, and Meals, Saffron, Cumin Seed, Pistachios | |

| Petrochemical Products | PP, PE, LDPE, aromatics, SBR feed stocks, MS, PS | |

| Oil Products | Lube Cut, Insulation, Oil, Bitumen, Vacuum Bottom, Lube Cut, Slap Wax | |

| Side Market | Side Market | Various Products with Non-Continuous Offering: Steel, Scraps, Polymers, Zinc, Chemicals, Minerals, Feeds, Copper, Sulfate, Lime |

| Derivatives Market | Futures Contracts | Saffron, Cumin Seed, Pistachios |

| Options Contracts | Gold Coins | |

| Financial Market | Standard Parallel SALAM Contracts | Cement, Steel, Iron Ore, Ethylene, Concentrate, Wheat, Frozen Chicken, PVC |

| Certificates of Deposit | Gold Coins, Maize, Barley, Pistachios, Saffron | |

| Investment Funds | Gold Coins. See also: Iranian gold coin |

Types of Trading

1- Physical Market

The Exchange has developed a solid infrastructure for transactions using various methods of sales including: Cash, Credit and SALAM contracts. IME employs Certificates of Deposit (CDs) as instruments facilitating the physical delivery of commodities.

• Cash trades: After matching the trade the buyer pays the full amount of the contract value. The clearing house issues the warehouse warrant (receipt) and the customer takes the delivery of the commodity within 72 hours as standard. This can be extended to a maximum of 10 days as per the offering notice on the delivery information.

• Credit trades: Credit contract is a kind of transaction whereby the goods are delivered to the buyer within a maximum of three days after the conclusion of the contract, and the price is paid to the seller at the expiry date. This kind of contract is a kind of financing tool for buyers, and buyers with insufficient liquidity can purchase their goods with a fairly reasonable financial cost. In credit contracts, the financial documents, accepted by the seller, for settlement must be included in the notice of offering. The buyer's broker is required to provide the seller's broker the documents referred to in the notice of offering until the settlement deadline and to submit the seller's confirm and its broker's acceptance of the transaction settlement obligations in accordance with the notification form to the clearing house.

• SALAM trades: The Exchange has provided the opportunity for suppliers and producers to sell their commodity in the spot market in the form of cash forward delivery contracts. Sellers are paid the full transaction value by the clearing house at a discounted rate and are supposed to deliver the commodity to the buyer at contract maturity. This way the listed producers can raise the required capital for production. The exchange has facilitated the raising of US$8 billion for the listed industries on the physical market since 2008. In this type of trading, the buyer pays in advance the contract's effective value after matching the trade. The buyer is issued a warrant by the clearing house and receives the commodity within the period specified in the offering notice. The seller receives the contract value within a standard 72 hours or within the time specified in the offering notice up to a maximum of 10 days. The offering details and delivery date are announced to the brokers by the trading floor supervisor before the trade.

• Premium discovery trades: Premium discovery contract is a kind of contract, whereby a certain amount of difference compared to the base price agreed by the parties to the transaction. The parties undertake that, at a specified time in the future, the goods will be trade based on the final price, which is the base price plus the agreed difference. Accordingly, at the beginning of the agreement, the parties must transfer part of the value of the transaction to the clearing house's account as a withholding. Premium discovery contracts are transactions in which a base price (for example, the price of a product on one of the world markets) is announced for the price quote at the maturity date on the notice of offering, and buyers only compete on the price discount or premium. Therefore, the price at the maturity of the contract for the settlement of the transaction is equal to the last base price plus a premium or minus a discount at the time of the conclusion of the contract.

2- Derivatives Market

• Futures Trading: In futures trading clients place their orders through one of the brokers licensed for futures trading. The initial margins are paid by the clients to their own specific account but the clearing house is the sole authority for transferring the margins between client accounts.

Bids and offers are placed electronically with clients able to adjust bids through their broker based on market movements. By matching the prices of bids against asks, open positions or open interests are formed which can remain open only up to the end of the trading session.

At the end of the trading hour a daily settlement price is calculated and announced by the clearing house for the settlement of the contracts. The clearing house issues margin calls for the lower-than-the-maintenance-amount client accounts to bring the amounts of their accounts to the initial margin level. At the maturity date clients scheduled for physical delivery of underlying assets may perform their delivery subject to contract.

To become a customer of the futures market, one should:

- Open an account with IME clearing house via a broker

- Have an initial margin payment

- Place orders

- Match orders based on the price and order in the trading system (CDN)

- Deliver the underlying asset

• Options Trading: An options contract is an agreement between two parties to facilitate a potential transaction on the underlying security at a preset price, referred to as the strike price, prior to the expiration date. The two types of contracts are put and call options. Call options can be purchased as a leveraged bet on the appreciation of a stock or commodity, while put options are purchased to profit from price declines. The buyer of a call option has the right but not the obligation to buy the stock or commodity covered in the contract at the strike price. Put buyers have the right but not the obligation to sell stock or commodity at the strike price in the contract. Option sellers, on the other hand, are obligated to transact their side of the trade if a buyer decides to execute a call option to buy the underlying security or execute a put option to sell. Currently, these contracts are traded only on gold coins and the process of participating in these transactions is similar to futures contracts.

3- Financial Market

• Standard Parallel SALAM (SPS) is another innovative solution launched for the first time by the exchange. The instrument comprises an initial offering and a daily secondary market within the contract period. The seller issues units of investment using volumes of an underlying asset. These units are able to make capital gains or accumulate interest for the owner; such that the underlying assets allocated only need to be delivered at a specified maturity date. An investment bank pays the producer in advance with the expectation it will be delivered by a set maturity date.

Investors who would like to close out their investment can sell these units at a higher price and earn the interest for their investment. Investors that choose to keep the units up to maturity date would receive the physical delivery of the commodity/underlying asset from the issuer. IME has raised working capital for industries based on this solution worth US$2 billion annually.

• Certificates of Deposit (CDs) are financial contracts based on commodities stored in the Exchange's licensed warehouses. The initial trade of the commodity is implemented through IME's platforms and the receipt is issued to the buyer. IME provides the opportunity for secondary trading of warehouse receipts through Tehran Securities Exchange Technology Management Company (TSETMC). These receipts could be accepted by banks as collateral for financing and obtaining loans.

• Exchange-Traded Commodity Funds (ETCs)

ETC is a financial instrument that allows you to follow the return on the price changes of one or more specified commodities and their units are tradable on the exchange. The main task of these funds is investment in commodities based securities that are considered as the fund's base assets. Therefore, the performance of the fund depends on the performance of its base assets.

ETCs are one of the new financial instruments that not only provide financing to producers, but also offer attractive financing opportunities for investors. These funds allow investors to buy securities in their portfolios rather than buying and storing the goods in question and bearing the costs of transportation, storage, and possible damages. By purchasing these securities, the investor, while possessing the goods in question, is not responsible for the maintenance of that commodity. In other words, these funds allocate a significant part of their funds to investing in a specific commodity, and those interested in investing in that particular commodity are purchasing units of these funds.

Trading Process

A. Offer Announcement Procedure

To offer commodities on IME, the supplier's broker should fill in the order placement form and deliver it to the exchange along with the following documents by 12 a.m. at the latest on the working day before the offering day:

1. Product specifications

2. Quantity of product

3. Maximum increase in offering by supplier

4. Type of trade (cash, SALAM or credit)

5. Base price

6. Offering date

7. Name of supplier and producer

8. Settlement information

9. Timing and place of delivery

10. Packaging

11. Other information

Offerings for commodities in the spot market are announced 24 hours before the trading takes place; this happens through the Exchange's website allowing clients to place orders with their brokers and ensure trades will be matched and cleared. Clients in the derivatives market perform trades in line with specifications covering futures contract, order type, validity and price.

B. Preliminary Stages before Trading Floor

The buyers shall choose from the active brokers approved by IME to place their order. They will go through the following stages for their first purchase via IME:

1. Choosing a broker

2. Receiving trading identification code for the exchange (for the first purchase)

3. Receiving a bank account (for the first purchase)

4. Placing the order through the broker

C. The Clearing House

The Central Securities Depository of Iran (CSDI) acts as the clearing house for IME. CSDI acts as a central counterparty to every trade on the Exchange, and ensures; collateral management, settlements of trades, and fulfilment of the contractual commitments for all parties.

Clearing Process: In accordance with the instructions, regardless of type of contracts (cash,

SALAM or credit) the clearing process is possible in one of two forms i.e. cash or credit settlement.

In cash settlements, the buyer is required to deposit the amount stated on the contract to the settlement account, within the deadline (maximum of three working days).

In the credit settlement method, the credit settlement document and other documents on official company format are rendered by the buyer to the clearing house, after getting confirmation of the seller, the buyer and buyer's broker.

The Settlement Deadline: The settlement deadline is three working days after completion of trading. The timing of settlement would be determined based on the IME's Board of Directors resolution. Accordingly, the last time to deposit the amount stated on the contract is 1 p.m. of the third day. The receipt of deposit and all contract documents should be submitted to the clearing house by brokers before 3 p.m. of each day through the system (TTS).

Operating Account is a banking account for the settlement based on the Clearing House instructions.

Branding and Warehouses

IME seeks to contribute to the branding and benchmarking of Iranian commodities at an international level. It uses Custodian Depository Receipt (CDR) instruments and export warehouses to establish direct and long-term relations between Iranian manufacturers/producers and international buyers. This initiative will cover bitumen and petrochemicals for which Iran has a huge market share.

The warehousing standards will comply with global stipulations, providing quality and full conformity with analytical specifications. The IME's assurance is set to best practices applicable to IME's renowned quality control currently implemented for warehousing companies, with severe penalties for any deviation.

Products

Industrial

Agricultural

- Grains Group: various kinds of corn, grain, wheat, rice, bran

- Dried and Trans Products: various kinds of pistachio, date, raisins, saffron, cumin, tea, sugar

- Oil Meals and Seeds Group: various kinds of oily seeds like soybean and oil cake seeds like soybean, colza, cotton seed, sunshade, Safflower cake, corn, palm

- Cereals Group: pea, lentil

- Frozen Chicken

New products

In 2016, IME introduced gold futures and options (as hedging tools).[4]

Supervision and regulation

The Securities and Exchange Organization (SEO) is the sole regulatory entity for the regulation and development of the capital market in Iran.[5] In 2013 Iran Mercantile Exchange joined the Federation of Euro-Asian Stock Exchanges (FEAS) as a full member. It is also a member of Association of Futures Markets (AFM).

Tradable contracts

- Spot contract

- Forward contract

- Contract on Credit

- Futures contract (since 2008)

- Options contract

Trading system

Trading in IME is based on open outcry auction using electronic trading platform, an interaction of bids and offers made by the buying and selling brokers. Orders, already placed by the clients, are entered in the system by the brokers sitting behind their stations in the trading floor. The system processes the orders and executes the transaction upon matching of the bid and offer prices.

IME Statistics

| IME Exchange (Including spot, credit and forward transactions) | 2007/08 | 2008/09 | 2009/10 | 2010/111 | 2011/12 | 2012/13 | 2013/14 |

|---|---|---|---|---|---|---|---|

| Agricultural - Volume (thousand tons) | 273.0 | 173.5 | 175.2 | 1,633.9 | 549.6 | 184.5 | 266.2 |

| Agricultural - Value (billion rials) | 772.6 | 3,729.7 | 484.8 | 3,729.7 | 3,792.8 | 1,346.5 | 2,748.5 |

| Manufacturing and Metal - Volume (thousand tons) | 6,443.8 | 6,679.7 | 7,438.5 | 8,694.0 | 11,685.8 | 13,172.0 | 13,555.2 |

| Manufacturing and Metal - Value (billion rials) | 58,044.2 | 62,120.6 | 53,842.0 | 75,235.5 | 102,534.1 | 197,341 | 226,211.0 |

| Oil and Petrochemical - Volume (thousand tons) | 89.7 | 4,339.2 | 7,052.9 | 6,662.6 | 8,116.6 | 8,352.0 | 10,572.0 |

| Oil and Petrochemical - Value (billion rials) | 352.7 | 19,921.0 | 36,450.7 | 41,478.0 | 64,360.8 | 116,387.0 | 199,113.0 |

| Grand Total - Volume (thousand tons) | 6,806.5 | 11,192.4 | 14,666.6 | 16,990.5 | 20,352.0 | 21,708.5 | 24,393.4 |

| Grand Total - Value (billion rials) | 59,169.4 | 82,685.3 | 90,777.5 | 120,443.2 | 170,687.7 | 315,074.5 | 428,072.5 |

1 Due to the reclassification of "cement" under "manufacturing and mining products", figures for 2010/11 have been revised. Previously, "cement" was classified under "oil and petrochemical products".

References

- "Archived copy". Archived from the original on 2010-11-04. Retrieved 2010-08-27.CS1 maint: archived copy as title (link)

- Nasseri, Ladane (2008-05-27). "Iranian Exchange to Start Commodity Futures in July; Oil Later". Bloomberg. Archived from the original on 2012-11-03. Retrieved 2010-08-27.

- "IME Financial Statements". http://en.ime.co.ir. Archived from the original on 4 January 2020. Retrieved 4 January 2020. External link in

|website=(help) - "Options Trading to Make Debut With Gold Coins". 10 December 2016. Archived from the original on 1 August 2018. Retrieved 13 January 2018.

- Archived July 22, 2011, at the Wayback Machine

- http://www.cbi.ir/page/7575.aspx

- Central Bank of The Islamic Replic of Iran. Cbi.ir. Retrieved on 2013-10-29.

- "Annual Review". Central Bank of The Islamic Republic of Iran. Retrieved 13 January 2018.

- http://www.cbi.ir/page/11992.aspx

- http://www.cbi.ir/Newestdoc.aspx?id=0&dn=AnnualReview_en&dl=1

External links

- (in English) Iran Mercantile Exchange