Lost Decade (Peru)

The Lost Decade or the Crisis of the 80s (La Crisis de Los Ochentas) was a period of economic stagnation in Peru throughout the 1980s which was exacerbated to a severe macroeconomic crisis by the end of the decade.[1] Foreign debt accumulation throughout Latin America, a series of natural disasters, mass public expenditures, nationalizations of banks and financial institutions, and the shutting of Peru out of international credit markets led to a decade of macroeconomic decline. The financial crisis soon became adopted into the public sphere through hyperinflation in commodities, food shortages, and mass unemployment. By the end of the decade, Peru's gross domestic product (GDP) contracted over 20%, and poverty rose to 55%.[2]

The 1980s is often deemed as "The Lost Decade" in Peru, as the result of its social and economic crises. As a result of the crisis, large waves of Peruvians immigrated to countries such as the United States, Spain, Italy, Chile, Venezuela and Argentina. The financial crisis was ultimately subdued during the first year of the presidency of Alberto Fujimori, after a series of economic reforms that attempted resolve the foreign debt crisis and hyperinflation.[3]

Causes

Declining commodity prices and foreign debt accumulation

In the first half of the 1980s, the values copper and silver, Peru's two largest exports, had declined in price to a 40-year low.[4] From 1980 to 1982, the price of copper collapsed from nearly $3000 per tonne to $1300 per tonne. By 1987, the price of copper had only increased to $1380 per tonne.[5] Additionally, El Niño devastated Peru's fishing economy and led to destructive flooding and droughts in the region of Lima. As Peru's exports value began to decline, President Fernando Belaundé began to limit Peru's payments on its international debts in the first years of his administration. Belaúnde continued to increase Peru's investment into massive infrastructure projects, including interstate highways, railroads, and airports, increased spending in flood and drought aid, thus substantially increasing Peru's federal spending.

Belaúnde was faced by a series of strict austerity measures recommended by the International Monetary Fund (IMF) after the buildup of foreign debt in Peru and throughout South America. Such measures aimed to lower the Peruvian government's deficit through less public spending and increasing government revenue. Belaúnde gave the impression that his administration was following the austerity measures recommended by the IMF, while in reality Belaúnde would downplay the debt crisis as terrorism began to grow in Peru's highlands by the Shining Path. As a result, as economic stagflation began to occur and inflation grew to 60%.

Loss of international creditors

By 1983, Peru accumulated $13.5 billion (77.8% of GDP) in foreign debt and its gross domestic product had collapsed by 20%. Belaúnde argued that the military regimes preceding his presidency, particularly the military regimes of Juan Velasco Alvarado and Francisco Morales Bermudez, had been convinced by foreign banks to borrow billions of dollars.

Facing growing pressure, Belaúnde visited Washington, D.C. in 1984 in a last effort to beg President Ronald Reagan for help in his bankrupt administration. A White House aide commented that 'President Reagan only gave him half an hour,'' and suggested Belaúnde follow austerity programs outlined by banks and the IMF. Populism began to grow and the International Monetary Fund became a scapegoat for Peru's debt crisis.[6][7][8]

A surge in populism due to the crisis favored presidential candidate Alan García's economic proposals that would cut Peru's lines with international investors and banks. Following his election, García ordered the closing of the International Monetary Fund's office in Lima and ordered the nationalization of banks and other financial institutions in Peru. Viewed as a virtual default, investors soon pulled completely out of Peru and the Lima Stock Exchange suffered a significant drop.

Effects

Currency change

Peru's had switched its currency twice from 1985 to 1990. In 1985, President Alan Garcia introduced the Peruvian inti, a short-lived currency that valued 1000 Peruvian soles. Banknotes were initially printed in values of 10, 50, and 100 intis, however banknotes subsequently were printed in larger quantities due to continued hyperinflation. Peruvian intis were printed in values of 50,000, 100,000 and up to banknotes of 5,000,000 intis by the end of its circulation.

Despite Garcia's attempts to encourage Peruvians to circulate and trust the Peruvian inti, the public turned towards exchanging and relying on United States dollars, leading to foreign exchange controls and the usage of the dollar MUC, a separate currency instituted by the Peruvian government worth identically to the United States dollar, until keeping up with inflation bankrupted the Central Bank of Peru.

In 1990, Peru's currency was switched again from the Peruvian inti to the Peruvian nuevo sol as inflation began to decrease. A government initiative offered to exchange nuevo soles with Peruvians intis at the exchange rate of 1,000,000 Peruvian intis. Inflation continued to decline which contributed favorably to the new currency's circulation and reliability with the general public.

Peruvian intis and the original Peruvian sol were ousted out of circulation in 1991. As of 2020, the Peruvian nuevo sol remains Peru's national currency.

Price inflation

In 1988, the Peruvian government reported consumer prices rising 1,722%, or on average 143.5% per month.[8] The Garcia administration's policy of a self-sustainable economy caused imported goods to significantly increase in price. Pharmaceutical products increased nearly 600% and the price of petroleum quadrupled. In September 1988, economists declared that the inflation became hyperinflation. The middle and lower classes soon began to feel the subsequent effects of the protectionist policies. Peru experienced a shortage of raw materials and food, and long strikes in the mining industry led to falling exports, leading the trade deficit even further and increased unemployment.[9]

Consumer prices inflation by year[10]

Unemployment

Peru's fiscal policy in the late 1980s cut Peru off from the international market. As demand for manufactured goods in exports declined, the manufacturing industry began to lay off workers. Wages declined a reportedly 50% or more during the period. Unemployment had reached a threshold over 6% in the late 1980s, both in the country's formal and informal business sectors.[11][12]

Macroeconomic

Peru's gross domestic product at the start of the decade (in constant 2010 USD) was $64.7 billion. By 1990, Peru's gross domestic product had devalued to $58.5 billion. It would take until 1996 for the country's GDP to reach levels higher than those in the 1980s.[13] GDP growth averaged -0.72% annually from 1980 to 1990, although growth was mostly erratic in value. GDP growth peaked in 1987 at 9.7% and reached an all-time low in 1989 at -12.3%. GDP per capita peaked in 1981 at $1,203 and reached its low in 1988 at $729, significantly lower than the world average of $3772 in 1988.[14] In 1990, government debt reached 190% of GDP.[15]

Civil unrest and revolutionary movements

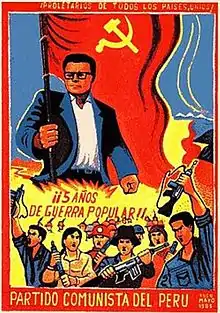

Groups throughout the rural areas of Peru viewed the economic crisis as evidence of the failure of a capitalist free-market economy. Socialist and communist groups began to spawn initially through Belaunde's term, and soon began to grow power and the backing of the Peruvian rural population by 1985, exacerbated by unemployment and hyperinflation which directly shook Peru's middle and lower classes.

Terror groups, such as the Shining Path and the MRTA grew popular support by promising aid to the lower social classes by shifting the Peruvian economy towards socialism. A number of communist groups, particularly the Shining Path used the economic crisis as an opportunity to advocate for revolution.[16] It was estimated that the Shining Path had some 5,000 full-time fighters and nearly 50,000 sympathizers by 1989.

Legacy

Immigration

The evident long-term effects of the financial crisis in the general public is accredited to starting a large wave of outwards migration from Peru. While in the 1970s immigration out of Peru ranged from 80,000 to 90,000 Peruvians, by 1992, immigration increased to around 354,000 Peruvians leaving the country annually towards primarily the United States, Argentina, and Spain.[17] Record migration out of Peru sparked further waves in the start of the 21st century, where immigration grew to nearly 910,000 and peaked at 1,200,000 in 2007. Currently in the United States, 39% of Americans of Peruvian origins had lived in the United States for over 20 years with a median age of 46, meaning that a vast majority of immigrants had travelled in the late 1980s and early 1990s.[18]

Political impact

Peru's economic recovery in the 1990s consequent to the Fujimori administration's neoliberal economic reforms has been a major victory for the Fujimorist faction. Fujimorists have often cited the recovery as being a result of Fujimori's fiscal policy. On the other hand, Garcia and his APRA faction have been often accredited with exacerbating the economic crisis during his term towards the end of the 1980s.

See also

References

- Portocarrero M., Felipe (1989). "La economía peruana en los años 80". Repositorio de la Universidad del Pacífico - UP. ISSN 2223-1757.

- "Historia de dos crisis". Instituto Peruano de Economía (in Spanish). 2017-08-14. Retrieved 2020-08-17.

- Echeverría, Javier Iguiñiz (1987). "PERÚ: CRISIS ECONÓMICA Y DEMOCRACIA". Investigación Económica. 46 (179): 223–253. ISSN 0185-1667.

- Diehl, Jackson (1982-11-02). "Economic Crisis in Peru Threatens Belaunde's Development Projects". Washington Post. ISSN 0190-8286. Retrieved 2020-07-19.

- "Copper". Market Index. Retrieved 2020-07-19.

- Riding, Alan (1984-12-30). "Debt Is Undermining Democracy in Peru". The New York Times. ISSN 0362-4331. Retrieved 2020-07-19.

- "Peru Asks IMF to Close Its Office There". Los Angeles Times. 1986-04-04. Retrieved 2020-07-19.

- "Peru's Inflation Put at 1,722%". The New York Times. Associated Press. 1989-01-04. ISSN 0362-4331. Retrieved 2020-07-19.

- PERÚ, NOTICIAS EL COMERCIO (2014-04-04). "Mirada de fondo: El fin de la hiperinflación peruana, por Iván Alonso | NOTICIAS EL COMERCIO PERÚ". El Comercio Perú (in Spanish). Retrieved 2020-07-23.

- "Inflation, consumer prices (annual %) - Peru | Data". data.worldbank.org. Retrieved 2020-07-29.

- "Unemployment, total (% of total labor force) (modeled ILO estimate) - Peru | Data". data.worldbank.org. Retrieved 2020-08-10.

- Riding, Alan (1989-05-14). "Peru Fights to Overcome Its Past". The New York Times. ISSN 0362-4331. Retrieved 2020-08-10.

- "GDP (constant 2010 US$) - Peru | Data". data.worldbank.org. Retrieved 2020-08-10.

- "GDP per capita (current US$) - Peru, World | Data". data.worldbank.org. Retrieved 2020-08-10.

- "Central government debt, total (% of GDP) - Peru | Data". data.worldbank.org. Retrieved 2020-08-10.

- "Looking back on Peru's Shining Path". The Economist. ISSN 0013-0613. Retrieved 2020-08-10.

- "Net migration - Peru | Data". data.worldbank.org. Retrieved 2020-07-27.

- "Hispanics of Peruvian Origin in the United States, 2013". Pew Research Center's Hispanic Trends Project. 2015-09-15. Retrieved 2020-07-27.