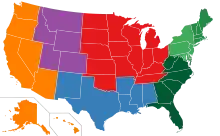

Petroleum Administration for Defense Districts

The United States is divided into five Petroleum Administration for Defense Districts, or PADDs. These were created during World War II under the Petroleum Administration for War to help organize the allocation of fuels derived from petroleum products, including gasoline and diesel (or "distillate") fuel. Today, these regions are still used for data collection purposes.

The Petroleum Administration for War was established in 1942 by executive order, and abolished in 1946. The districts are now named for the later Petroleum Administration for Defense which existed during the Korean War. It was established by the Defense Production Act of 1950, then abolished in 1954, with its role taken over by the U.S. Department of Interior's Oil and Gas Division.

PAD Districts

- PADD I (East Coast) is composed of the following three subdistricts:

- Subdistrict A (New England): Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont.

- Subdistrict B (Central Atlantic): Delaware, District of Columbia, Maryland, New Jersey, New York, and Pennsylvania.

- Subdistrict C (Lower Atlantic): Florida, Georgia, North Carolina, South Carolina, Virginia, and West Virginia.

- PADD II (Midwest): Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Ohio, Oklahoma, Tennessee, and Wisconsin.

- PADD III (Gulf Coast): Alabama, Arkansas, Louisiana, Mississippi, New Mexico, and Texas.

- PADD IV (Rocky Mountain): Colorado, Idaho, Montana, Utah, and Wyoming.

- PADD V (West Coast): Alaska, Arizona, California, Hawaii, Nevada, Oregon, and Washington.

For administrative purposes the US government divides the US into five Petroleum Administration for Defense Districts (PADDs). These were created during World War II to help organize the allocation of fuels, including gasoline and diesel fuel. Today, these regions are still used for data collection purposes.

PADD 1 (East Coast)

PADD 1 covers the East Coast of the United States. Due to their location, refineries in the central US have enjoyed cheap domestic tight oil and discounted oil sands production from Canada. Meanwhile, refineries on the East Coast have been forced to buy oil from overseas at higher world prices due to North American pipeline bottlenecks. Five refineries on the US East Coast have been forced to close since 2010, and three more were threatened with closure before they sold at discounted prices. Pipelines are the cheapest and safest method of oil transportation in North America. However, due to the lack of pipelines, East Coast refineries must bring in domestic North Dakota Bakken oil and imported Western Canadian oil sands production by rail.[1] Imports account for the vast majority of PADD 1 refinery feedstock, but only a small portion of it comes from Canada, mostly Canadian Atlantic offshore production. Very little comes from the Canadian oil sands. Most of the refineries can handle only sweet, light crude oil, so even heavy, sour Western Canadian Select would not be a good feedstock. Imports of heavy oil from Western Canada could rise in the next few years via deliveries by rail, but it is unlikely that much oil sands production will be processed there.[2]

PADD 2 (Midwest)

PADD 2 covers the Midwestern United States. In recent years, many of the refiners in PADD 2 added coker units to handle heavier Canadian feedstocks to replace declining domestic oil production. Canadian oil was readily available since Canadian oil pipelines from Alberta to Ontario ran through the US Midwest, and it has almost completely backed out competing sources of imported oil due to its lower cost. US Midwest refiners have become by far the largest refiners of Canadian oil sands production. Unexpectedly, North Dakota production also increased because of hydraulic fracturing in the Bakken formation, making ND the second largest US producing state after Texas. Oil production from ND was delivered through the Canadian pipeline system, so the glut of new oil forced feedstock prices to US refineries on the Canadian pipelines down and made them much more profitable than refineries elsewhere in the US or Europe.[1][2]

PADD 3 (Gulf Coast)

PADD 3 (United States Gulf Coast) has half of the oil refining capacity in the US. The vast majority of the refineries are in Texas and Louisiana. Crude oil demand by Gulf Coast refineries was almost 8,000,000 bbl/d (1,300,000 m3/d) in 2012, of which 2,200,000 bbl/d (350,000 m3/d) was imported heavy oil.[2]

Most of the Gulf Coast refineries have the capacity to process very heavy crude oils from Venezuela and Mexico. However, exports from those countries has been declining in recent years, and more of Venezuela's exports are going to other countries, notably China. US domestic oil production has been increasing since 2010 due to horizontal drilling and hydraulic fracturing in tight oil fields, notably the Eagle Ford Formation of Texas. Some Gulf Coast refineries have completely replaced imported light and medium oil with new Texas tight oil. Unfortunately, most of it is too light for the Gulf refineries. Much new US tight oil is being exported to Canada for use as oil sands diluent and returning in blends which are a better feedstock for heavy oil refineries.

For Canadian oil sands producers this is a chance to back Venezuelan, Mexican, and Arabian heavy oil out of the Gulf Coast market and help achieve North American energy independence. The main problem has been pipeline capacity. As a result of delays in US government approval of the Keystone XL system and other pipelines, only 100,000 bbl/d (16,000 m3/d) of Canadian crude reached the Gulf Coast in 2012. Since Canadian heavy oil and bitumen was much lower in price than heavy oil from other countries, oil companies started buying up and reversing idle pipelines which used to carry imported oil from the Gulf Coast to the Midwest to carry Canadian oil in the other direction. Canadian exports of oil by rail increased 900% from early 2012 to late 2013. This was more expensive and arguably more hazardous than moving oil by pipeline, but cost-effective for refineries given the lower cost of heavy oil imports from Canada versus other countries.

PADD 4 (Rocky Mountain)

PADD 4 covers the Rocky Mountain States of the US. Refineries in the region have been in a similar position to Midwest refineries, having access to cheap Canadian imports. Recent increases in North Dakota production has also flooded the market with domestic oil and reduced prices. Although their market volumes have been much less than in other regions, refineries in the Rocky Mountains have generally sold fuel at the lowest prices in the US due to their lower feedstock costs. If Canadian heavy oil continues to be priced at an attractive discount, refineries are expected to continue to take large volumes despite the light crude oil surplus in the region.[2]

PADD 5 (West Coast)

PADD 5 (West Coast of the United States) is a large potential market for increasing Canadian oil sands output as production of oil from its historic sources in Alaska and California has declined steeply in recent decades, and it has no pipeline access to new US production in North Dakota or Texas. Imports from countries outside North America have been increasing in volume although most of it is significantly more expensive than Canadian or domestic American oil. Many of the refineries in California and Washington State are capable of processing heavy oil because much of the oil production in California is heavy, as is much imported oil. They have also noted that a mix of 55% North Dakota Bakken oil and 45% Western Canadian Select is a reasonable substitute for badly diminished supplies of Alaska North Slope oil. PADD V is physically disconnected from the pipeline systems of the rest of the United States, but the Trans Mountain Pipeline delivers oil of all types from Alberta across British Columbia to refineries in Washington, which in 2012 processed 240,000 bbl/d (38,000 m3/d) of imported oil, 60% of which came from Canada. If the Trans Mountain Expansion and Northern Gateway pipelines are completed, total capacity from Western Canada to the West Coast could exceed 1,400,000 bbl/d (220,000 m3/d) by 2018.[2][3]

California has no pipeline connections that could deliver oil from other producing states or Canada, and in 2012 imported 780,000 bbl/d (124,000 m3/d) of oil, only 5% of which came from Canada and two-thirds from Saudi Arabia. Canadian (and North Dakota) oil has been much cheaper than Arabian oil so potential exists for delivering oil sands production to California from the West Coasts of British Columbia and Washington by tanker. However, a big question mark hanging over the California refining market is the California Low Carbon Fuel Standard.

References

- PADD Definitions. Energy Information Administration.

- Records of the Petroleum Administration for Defense. National Archives and Records Administration.

- Records of the Petroleum Administration for War. National Archives and Records Administration.

- Specific

- Robbins, Oliver (March 23, 2013). "Refining's Renaissance". Ivey Business Review. Retrieved 2014-05-11.

- "Crude Oil Forecast, Markets & Transportation". Canadian Association of Petroleum Producers. June 5, 2013. Archived from the original on 2014-03-30. Retrieved 2014-05-14.

- Hackett, David; Noda, Leigh; Moore, Michal C.; Winter, Jennifer (February 2013). "Pacific Basin Heavy Oil Refining Capacity" (PDF). SPP Research Papers. University of Calgary School of Public Policy. Retrieved 2014-05-22.