Philip Pilkington

Philip Pilkington is an Irish economist working in investment finance. He became well-known for his critiques of neoclassical economics on his popular blog Fixing the Economists.[1] Since then he has written a book entitled The Reformation in Economics outlining these critiques, developed an empirical methodology to assess general equilibrium theory and created a new means to estimate both potential output and inflationary pressure in the labor market.

Philip Pilkington | |

|---|---|

| Born | 5 July 1987 Dublin |

| Nationality | Irish |

| Field | Monetary economics |

| School or tradition | Post-Keynesian economics |

| Influences | John Maynard Keynes, Joan Robinson, Nicholas Kaldor, Roy Harrod, Wynne Godley, Leon Walras, Michal Kalecki |

| Contributions | Empirical estimate of General Equilibrium, capacity utilization-based estimate of potential output, worker bargaining index |

Life

Pilkington was born in Dublin. He attended CBC Monkstown.[2]

The Miracle of General Equilibrium

In his article The Miracle of General Equilibrium [3] Pilkington argues that all of contemporary macroeconomics is dominated by general equilibrium theory. He argues that both the New Keynesian and New Classical schools take as their starting point the assumption that general equilibrium can and eventually will be reached. Pilkington argues that they only disagree on how easy this is to achieve.

Pilkington then goes on to argue that this case has never been argued empirically. He points out that the theory emerges with the French economist Leon Walras in 1899 but that Walras never laid out clear empirical criteria for his theory. Pilkington proceeds to lay out a test case based on the 'hats-in-ring' problem in probability theory.[4] He summarizes this as such:

If we assume absolutely no information on the part of various agents, we are faced with a combinatorial problem known as hats-in-a-ring. A number of men check their hats into a cloakroom. The cloakroom assistant is not paying attention and mixes them up. When the men come to collect their hats, the assistant gives hats back to the men at random. If a given agent is acting with zero information about the decisions of other agents, his transactions will be undertaken blindly, in the same way as the cloakroom assistant picks hats blindly and hands them back to the men. The solution to this problem is

where n is the number of agents, k is the number of hats or transactions, and e is the base of the natural logarithm[5]

Pilkington's argument is that if we assume that the empirical problem of general equilibirum is at root a combinatorial problem and so can be approached by testing the probability of a general equilibrium being approached by chance - i.e. by agents undertaking transactions randomly. Pilkington calculates that in 2016 in the United States 263,745,653 adults undertook an average of 62 transactions per month. If these transactions were undertaken randomly the probability of a general equilibrium being reached would be approximately 10^(-130603480007). Pilkington argues that "these sorts of probabilities are in the region of miracles, not of science". He then goes on to argue that the onus is on those using general equilibrium based theories to outline how rational agents will arrive at such an equilibirum through non-chance-based means. Pilkington argues that until they do this "then economics does not possess any theory that tells is that market forces automatically produce optimal outcomes, no matter how often mathematical economists demonstrates that these optimal outcomes exist".

In response to this, general equilibrium theorist Donald Walker writes that Pilkington's critique is ultimately of the stability of the general equilibrium model. He writes that this means that economists working on real-world problems should "scrap the part [of economics] that is general equilibrium theory" and that "fortunately, economists do precisely what Pilkington recommends". In response to this, Pilkington argues that this is not the case. He points out that "all models that utilize general market clearing as a mechanism for explanation rely implicitly on general equilibrium theory". These include dynamic stochastic general equilibrium models, but also "neo-Keynesian models such as the IS-LM and the Solow Growth model and its offshoots". Pilkington summarizes:

This is where, although our assessment of GET is somewhat similar, Walker and I diverge. He believes that “economists do precisely what Pilkington recommends, and as a result are able to make sound prescriptions and predictions.” My contention is that they do not. Almost all their analytical techniques assume market clearing. And what my probabilities suggest is that, given the enormity of the reality that they are trying to wrap their arms around, they need to justify this assumption in concrete terms and with respect to the empirical data. Without that, they should stop using models that make use of general market clearing. But that would require rejecting much mainstream economics. Until then, they are babbling alone and in the dark.[6]

Potential Output Estimates

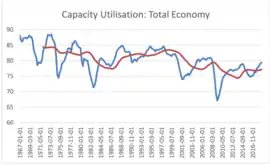

In his paper How Far Can We Push This Thing?[7] Pilkington develops a novel framework for estimating and understanding potential output. Pilkington argues that contemporary approaches to potential output either involve crude trend estimates that simply assume that economies usually operate at full capacity or they utilize the flawed NAIRU framework that has been disproved in practice in the past. He advocates a more intuitive and statistically-grounded approach to estimating potential output. Pilkington points out that statistics on capacity utilization are readily available for most countries. He argues that "the true constraint on economic growth at any moment in time is the utilisation rate of plant and machine" and so we should simply estimate the sensitivity of GDP to capacity utilization and in doing so derive an estimate of potential output.

After doing this, Pilkington raises the question of the potential for conflict inflation. He writes:

Inflation might get caught in the system is if workers bid up their wages to maintain their purchasing power in the face of inflation. Imagine that wages and inflation are both growing at 2% a year and so real wages are constant. Now imagine that, due to an increase in the fiscal deficit, inflation rises to 4% in a given year. If workers then try to raise their wages to 4% growth in that year then it is conceivable that businesses will raise their prices in order to pay these new higher wages. This could result in a wage-price spiral where the higher rate of inflation gets caught in the system.[8]

Pilkington argues that we can provide estimates of how prone the economy is to this type of inflation. He does so by using principle components analysis on three variables:

These three variables are: the unemployment rate, the rate of unionisation of the workforce and the number of strike days lost every year (a proxy for the unions’ willingness to use their power). The rate of unemployment negatively impacts worker bargaining, while the other two variables positively impact it.[9]

Doing this, Pilkington constructs what he calls a worker bargaining index that he says captures the potential for conflict inflation in the economy at any given moment in time. He notes that the index "does not tell us whether there will or will not be runaway inflation; it is not calibrated to predict inflation and should therefore not be correlated with it. Rather it is set up to determine whether the conditions are in place to have a once-off increase in prices translate into runaway inflation." He argues that when the workers bargaining index is giving a low reading for potential conflict inflation, policymakers should be more willing to engage in fiscal experimentation than they would be if it was giving a higher reading. This approach has been endorsed by Modern Monetary Theory proponent and Democratic Party policy economist Stephanie Kelton.[10]

References

- Pilkington, Philip. "Fixing the Economists". Fixing The Economists.

- Pilkington, Philip (19 February 2020). "New Review of My Book". Fixing The Economists.

- Pilkington, Philip (July 2019). "The Miracle of General Equilibrium". Inference Review.

- Journal, Software (9 January 2010). "10 People 10 Hats". Software Journal.

- Pilkington, Philip (July 2019). "The Miracle of General Equilibrium". Inference Review.

- Walker, Donald (December 2019). "A Prescription For The Present". Inference Review.

- Pilkington, Philip (19 April 2019). "How Far Can We Push This Thing?". Fixing The Economists.

- Pilkington, Philip (19 April 2019). "How Far Can We Push This Thing?". Fixing The Economists.

- Pilkington, Philip (19 April 2019). "How Far Can We Push This Thing?". Fixing The Economists.

- Kelton, Stephanie (25 August 2019). "Twitter". Twitter.