Platinum as an investment

Platinum as an investment has a much shorter history in the financial sector than gold or silver, which were known to ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold, on the basis of annual mine production. Since 2014, platinum rates have fallen significantly lower than gold rates.[1] More than 75% of global platinum is mined in South Africa.[2]

Overview

Platinum is relatively scarce even among the precious metals.[3] New mine production totals approximately only five million troy ounces (150 Mg) a year. In contrast, gold mine production runs approximately 82 million ounces (2,550 Mg) a year, and silver production is approximately 547 million ounces (17,000 Mg).[4] As such, it tends to trade at higher per-unit prices.

Platinum is traded on the New York Mercantile Exchange (NYMEX) and the London Platinum and Palladium Market. To be saleable on most commodity markets, platinum ingots must be assayed and hallmarked in a manner similar to the way gold and silver are.[5][6]

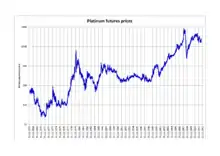

The price of platinum changes along with its supply and demand; during periods of sustained economic stability and growth, the price of platinum tends to be as much as twice the price of gold; whereas, during periods of economic uncertainty,[7] the price of platinum tends to decrease because of reduced demand, falling below the price of gold, partly due to increased gold prices. Platinum price peaked at US$2,252 per troy ounce in March 2008 driven on production concerns (brought about partly due to power delivery problems to South African mines). It subsequently fell to US$774 per troy ounce ($25/g) in November 2008.[8] As of 15 October 2018, the platinum spot price in New York was $845.10[9] per ounce, compared to $1,222 per ounce for gold[10] and $15.16 per ounce for silver.[11] Platinum is traded in the spot market with the code "XPT". When settled in United States Dollars, the code is "XPTUSD". As of 3/4/2018, the price of platinum has fallen below the price of gold, platinum being valued at US$963 an ounce vis-à-vis gold at US$1322 an ounce, respectively.[12] [13] As the cost of platinum per ounce fell, the cost per ounce for other metals in the platinum group - especially Palladium - rose strongly. As of September 2019, Palladium sits at around US$1600 per ounce, compared to US$950 for platinum.[14]

Investment vehicles

Exchange-traded products

Platinum is traded as an ETF (exchange-traded fund) on the London Stock Exchange under the ticker symbol LSE: PHPT and on the New York Stock Exchange as ticker symbols PPLT and PLTM[15] There are also several ETNs (exchange-traded note) available,[16] some of which are inverse to the price of platinum. A list can be found at ETFDB, stock encyclopedia.

Platinum coins and bars

Platinum bars are available from different foundries in different sizes, like 1 oz, 10 oz, 1 kg. Platinum coins are another way to invest in platinum, although relatively few varieties of platinum coins have been minted, due to its cost and difficulty in working.[17] Since 1997, the United States Mint has been selling American Platinum Eagle coins to investors.

Accounts

Most Swiss banks offer platinum accounts where platinum can be instantly bought or sold just like any foreign currency. Unlike physical platinum, the customer does not own the actual metal but rather has a claim against the bank for a certain quantity of metal.

Futures

Another investment option is to create a futures contract where a predetermined time and place is designated to buy or sell the platinum. Unlike options, the transaction is an obligation, and not a right. The New York Mercantile Exchange (NYMEX) and the Tokyo Commodity Exchange (TOCOM) trades in platinum futures with a minimum contract size of 50 troy ounces and 500 grams respectively.[18]

Others

Other ways of investing in platinum include spread betting or contracts for difference on the price of the metal, owning shares in mining companies with substantial platinum assets or exposure, owning traded options in platinum (only available in the US market).[2]

See also

References

- "Platinum v/s Gold – Historical Price Comparison Chart". Retrieved 2016-11-27.

- Louth, Nick (16 December 2011). "How to trade platinum and palladium". iii.co.uk. Retrieved 2015-03-25.

- "Platinum Evara Jewellery - Gold, White Gold Vs Platinum".

- "Futures & Options Trading".

- London/Zurich Good Delivery List

- "Futures & Options Trading – Brands of platinum". NYMEX.

- "Platinum versus Gold". The Speculative Invertor. Archived from the original on 2008-10-26.

- "Spot Price Charts – Silver Spot Prices,Gold Prices,Platinum Prices,Palladium Prices". nwtmint.com. Archived from the original on 2009-09-05. Retrieved 2008-07-30.

- "Platinum Prices | Platinum Price Chart History | Price of Platinum Today". APMEX. Retrieved 2018-10-15.

- "Gold Prices Today | Price of Gold Per Ounce | Gold Spot Price Chart". APMEX. Retrieved 2018-10-15.

- GmbH, finanzen.net. "Silver PRICE Today | Silver Spot Price Chart | Live Price of Silver per Ounce | Markets Insider". markets.businessinsider.com. Retrieved 2018-10-15.

- http://www.kitco.com/charts/livegold.html

- http://www.kitco.com/charts/liveplatinum.html

- "Platinum Price in USD per Troy Ounce for Last Week". www.bullionbypost.co.uk. Retrieved 2019-09-12.

- "ETF Securities to sell Platinum, Palladium shares". Commodity Online. April 27, 2010. Retrieved May 10, 2010.

- "Platinum ETF and ETN list". Platinum ETF. May 15, 2012. Archived from the original on May 11, 2012. Retrieved May 15, 2012.

- "Buy Platinum, Palladium, and Other Precious Metals | LPM". www.lpm.hk. Retrieved 2017-10-14.

- "Platinum Jan '19 (PLF19) Futures Profile - Barchart.com". Barchart.com. Retrieved 2018-10-15.