Silver as an investment

Silver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4,000 years, although it lost its role as legal tender in developed countries when the use of the silver standard came to a final end in 1935. Some countries mint bullion and collector coins, however, such as the American Silver Eagle with nominal face values.[1] In 2009, the main demand for silver was for industrial applications (40%), jewellery, bullion coins, and exchange-traded products.[2][3] In 2011, the global silver reserves amounted to 530,000 tonnes.[4]

Collectors of silver and other precious metals who collect for the purpose of investment (either as their sole motivation or as one of several) are commonly nicknamed stackers, with their collections dubbed as stacks. The motivations for stacking silver varies between collectors.

Millions of Canadian Silver Maple Leaf coins and American Silver Eagle coins are purchased as investments each year. The Silver Maple Leaf is legal tender at its face value of CA$5, the American Silver Eagle has a face value of US$1, the Britannia has a face value of between £0.20p and £10, and there are many other silver coins with higher legal tender values, such as CA$20 silver coins of Canada. However, while these bullion coins are considered legal tender, they are rarely accepted by shops[5] and not typically found in circulation, as opposed to pre-debasement 'junk' or 'constitutional' silver coins, which still occur in circulation on occasion.

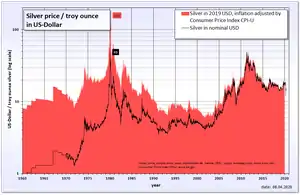

Price

The price of silver is driven by speculation and supply and demand, like most commodities. The price of silver is notoriously volatile compared to that of gold because of the smaller market, lower market liquidity and demand fluctuations between industrial and store of value uses. At times, this can cause wide-ranging valuations in the market, creating volatility.[6]

Silver often tracks the gold price due to store of value demands, although the ratio can vary. The crustal ratio of silver to gold is 17.5:1.[7] The gold/silver price ratio is often analyzed by traders, investors, and buyers.[8] In Roman times, the price ratio was set at 12 (or 12.5) to 1.[9] In 1792, the gold/silver price ratio was fixed by law in the United States at 15:1,[10] which meant that one troy ounce of gold was worth 15 troy ounces of silver; a ratio of 15.5:1 was enacted in France in 1803.[11] The average gold/silver price ratio during the 20th century, however, was 47:1.[12]

Physical bullion in coins or bars may have a premium of 20 percent or more when purchased from a dealer. Silver bullion bars have been available for purchase at a premium of less than 7% over the Comex spot price for much of 2015 and early 2016, while government-minted coins still command a much higher premium.

Physical coins generally have a higher premium. For example, one troy ounce (ozt) American Silver Eagle Coins are released from the US mint at a $2 premium over the fluctuating silver spot price to official distributors who then sell these most popular silver bullion coins for a mark up of $2.30 to $3.50 oz over silver spot prices depending on market conditions.

| Year | Silver price (yearly cum. avg.[13]) US$/ozt |

Gold price (yearly cum. avg.[14]) US$/ozt |

Gold/silver ratio |

World Silver Reserves (in tons)[15] |

World Mining Production (tons) |

Reserve/Production Ratio |

|---|---|---|---|---|---|---|

| 1840 | 1.29 | 20 | 15.5 | N/A | N/A | N/A |

| 1900 | 0.64 | 20 | 31.9 | N/A | N/A | N/A |

| 1920 | 0.65 | 20 | 31.6 | N/A | N/A | N/A |

| 1940 | 0.34 | 33 | 97.3 | N/A | N/A | N/A |

| 1960 | 0.91 | 35 | 38.6 | N/A | N/A | N/A |

| 1970 | 1.63 | 35 | 22.0 | N/A | N/A | N/A |

| 1980 | 16.39 | 612 | 37.4 | N/A | N/A | N/A |

| 1990 | 4.06 | 383 | 94.3 | N/A | N/A | N/A |

| 2000 | 4.95 | 279 | 56.4 | 430,000 | 17,700 | 24.3 |

| 2001 | 4.37 | 271 | 62.0 | 520,000 | 18,700 | 27.8 |

| 2002 | 4.60 | 310 | 67.4 | 570,000 | 20,000 | 28.5 |

| 2003 | 4.88 | 363 | 74.4 | 570,000 | 18,800 | 30.3 |

| 2004 | 6.67 | 410 | 61.5 | 570,000 | 19,700 | 28.9 |

| 2005 | 7.32 | 445 | 60.8 | 570,000 | 19,300 | 29.5 |

| 2006 | 11.55 | 603 | 52.2 | 570,000 | 20,200 | 28.2 |

| 2007 | 13.38 | 695 | 52.0 | 570,000 | 20,800 | 27.4 |

| 2008 | 14.99 | 872 | 58.1 | 570,000 | 21,300 | 26.8 |

| 2009 | 14.67 | 972 | 66.3 | 550,000 | 21,800 | 25.2 |

| 2010 | 20.19 | 1,225 | 60.7 | 525,000 | 23,100 | 22.7 |

| 2011 | 35.12 | 1,572 | 44.7 | 550,000 | 23,300 | 23.6 |

| 2012 | 31.15 | 1,669 | 53.6 | 560,000 | 25,500 | 22.0 |

| 2013 | 23.79 | 1,411 | 59.3 | 540,000 | 26,000 | 20.8 |

| 2014 | 19.64 | 1,280 | 65.2 | 550,000 | 26,800 | 20.5 |

| 2015 | 15.68 | 1,160 | 74.5 | 570,000 | 25,100 | 22.7 |

| 2016 | 17.17 | 1,252 | 72.9 | 570,000 | 25,700 | 22.2 |

| 2017 | 17.07 | 1,260 | 73.8 | 530,000 | 25,000 | 21.2 |

| 2018 | 15.71 | 1,269 | 80.8 | |||

| 2019 | 15.24 | 1,298 | 85.2 |

Gold and silver prices for the years 2016 to 2019 (in the table above) is based on information from www.macrotrends.net on the 10th of June 2019.

The price of silver has risen fairly steeply since September 2005, being initially around $7 per troy ounce but reaching $14 per troy ounce for the first time by late April 2006. The monthly average price of silver was $12.61 per troy ounce during April 2006, and the spot price was around $15.78 per troy ounce on November 6, 2007. As of March 2008, it hovered around $20 per troy ounce.[16] However, the price of silver plummeted 58% in October 2008, along with other metals and commodities, due to the effects of the credit crunch.[17] By April 2011, silver had rebounded to reach a 31-year high at $49.21 per ounce on April 29, 2011 due to monetary inflation, and concerns about the solvency of governments in the developed world, particularly in the Eurozone.[18]

History

1979–1980

The Hunt Brothers (Nelson Bunker Hunt and William Herbert Hunt) took a huge position in silver using leverage (borrowed capital, such as margin debt), to become some of the largest private holders of silver in the world.

Because of their unusually large stake in the rapidly appreciating commodity, Nelson Bunker Hunt and William Herbert Hunt, the sons of Texas oil billionaire Haroldson Lafayette Hunt, Jr., were accused of attempting to "corner" the market in silver in order to manipulate its price.

From 1973 the Hunt brothers began what was seen as an attempt at cornering the market in silver, potentially contributing to a spike in price on January 18, 1980 of the London Silver Fix to $49.45 per troy ounce. Silver futures reached an intraday COMEX all-time high of $50.35 per troy ounce (intraday CBOT all-time high was $52.80) and a reduction of the gold/silver ratio down to 1:17.0 (gold also peaked the same day in 1980, at $850 per troy ounce).[19][20]

In the last nine months of 1979, the brothers were estimated to be holding over 100 million troy ounces of silver and several large silver futures contracts.[21] However, a combination of changed trading rules on the New York Mercantile Exchange (NYMEX) and the intervention of the Federal Reserve put an end to both their holdings and their potential for profit on the commodity. By 1982, the London Silver Fix had collapsed by 90% to $4.90 per troy ounce.[22]

In 1979, the price for silver Good Delivery Bars jumped from about $6 per troy ounce to a record high of $49.45 per troy ounce (on January 18, 1980),[23] which represents an increase of 724%. The highest price of silver itself [that is, silver not eligible to be delivered to an exchange to cover a short position] is hard to determine, but based on the price of common silver coin, it peaked at about $40/oz.[24] The fact that Good Delivery Bars sold at about a 25% premium would indicate it was primarily a short squeeze of Good Delivery Bars, not silver per se. The brothers were estimated to hold one third of the entire world supply of privately held silver (not counting the silver held by governments). The situation for other prospective buyers of silver who had not stocked up on the metal in advance of its bull run was so dire that the jeweler Tiffany's took out a full page ad in The New York Times, blaming the Hunt Brothers for the increase in price and stating that "We think it is unconscionable for anyone to hoard several billion, yes billion, dollars' worth of silver and thus drive the price up so high that others must pay artificially high prices for articles made of silver".

On January 7, 1980, in response to the Hunts' accumulation, the exchange rules regarding leverage were suddenly changed, and the COMEX adopted "Silver Rule 7", placing heavy restrictions on the purchase of the commodity on margin, causing massive liquidations and enormous downward pressure on the price. The Hunt brothers had borrowed heavily to finance their purchases, and as the price began to fall again, dropping over 50% in just four days due to the sudden forced liquidation of margin positions, they became unable to meet their obligations, causing further panic in the precious metal markets.

The Hunts were never found guilty of any criminal wrongdoing, though later on, they lost a civil suit to a Peruvian mining company who had lost money during the events of the silver boom and bust. Throughout the 1980s, the Hunts' considerable fortune dwindled in the aftermath of these events, and they eventually filed for bankruptcy. In 1989, they agreed to a civil settlement with the Commodity Futures Trading Commission, paying out fines, and agreeing to a ban from trading commodities.

2010–2011

There was such immense risk to the world economy that investors drove the prices up by buying defensive commodities (e.g. silver or gold). When the short-term risks were believed to have subsided, many investors reallocated their assets back into yielding (dividend or interest) investments such as stocks or bonds.

The 2011 United States debt ceiling crisis was a major factor in the rise of silver prices. The 2010, U.S., midterm elections highlighted policy differences between President Obama vs. the Tea Party movement. The price of silver concurrently rose from $17 to $30 as the elections approached. In late 2010 and 2011, silver found a "new normal" between $25 and $30.

In 2011, Republicans in Congress demanded deficit reduction be part of legislation raising the nation's debt-ceiling. The resulting contention was resolved on 2 August 2011 by the Budget Control Act of 2011.

During the first few months of 2011, Moody's and S&P both downgraded the outlook on US finances; this was a major shock to the financial world and resulted in silver's climb to $50.

- On April 18, 2011, U.S.-based rating agency S&P issued a "negative" outlook on the U.S.'s "AAA" (highest quality) sovereign-debt rating for the first time since the rating agency began in 1860, indicating there was a one-in-three chance of an outright reduction in the rating over the next two years.

- On April 25, 2011, silver traded $49.80 per ounce in the New York spot market.

On 5 August 2011, S&P issued the first ever downgrade in the federal government's credit rating, citing their April warnings, the difficulty of bridging the parties and that the resulting agreement fell well short of the hoped-for comprehensive 'grand bargain'.[25] The credit downgrade and debt ceiling debacle contributed to the Dow Jones Industrial Average falling nearly 2,000 points in late July and August. Following the downgrade itself, the DJIA had one of its worst days in history and fell 635 points on August 8.[26]

Then as it became likely that U.S. Secretary of Treasury Timothy Geithner would order the treasury to use extraordinary measures to delay the crisis, silver settled back at $35. As the debacle continued during the summer, silver moved in the range of $33 to $43.

As it became clear that the "financial apocalypse" would be delayed by late summer, many investors dumped silver and commodities and moved back into U.S. equities. The price of silver quickly went back to $30 and declined below 2010 levels in the next few years.

Whether classifying silver's movement as a 'bubble' (seen when comparing silver with gold) has been debatable, with Peter Schiff denying that a bubble ever existed and asserting that the factors that led to the increase in the silver price have not yet been resolved.

Highest Recorded Silver Price

| 1980 | 2011 | |

| London LBMA (Close) | $49.45 (Jan 18) | $48.70 (April 28) |

| London LBMA (Intraday) | $50.50 (Jan 18) | |

| New York COMEX (Close) | $48.70 (Jan 17) | $48.55 (April 29) |

| New York COMEX (Intraday) | $50.36 (Jan 18) | $49.82 (April 25) |

| Chicago CBOT (Close) | ||

| Chicago CBOT (Intraday) | $52.80 (Jan 18) |

Factors that influence the price of silver

Large traders or investors

The silver market is much smaller in value than the gold market. The London gold bullion market turns over 18 times more monetary value than silver.[27] With physical demand estimated at only $15.2 billion per year, it may be possible for a large trader or investor to influence the silver price either positively or negatively. For example:

In 1979, The Hunt brothers were accused of attempting to "corner" the silver market and were estimated to have accumulated over 100 million troy ounces of silver, potentially contributing to the increase in price from $6 to $48.40/ozt.

In April 2006, iShares launched a silver exchange-traded fund, called the iShares Silver Trust, which as of November 2010 held 344 million troy ounces of silver as reserves.[28]

A big driver for silver sales in 2012 was Morgan Stanley and their short position holdings. This has influenced the silver market, along with an apparent shortage of above ground silver available for investment. As silver continues to boom for industrial uses, less of the metal is available for physical bullion for investment. That, coupled with paper investment uncertainty, has driven the market prices wildly.

Short selling

In April 2007, Commitments of Traders Report revealed that four or fewer traders held 90% of all short silver futures contracts totalling 245 million troy ounces, which is equivalent to 140 days of production. According to Ted Butler, one of these banks with large silver shorts, JPMorgan Chase, is also the custodian of the SLV silver exchange-traded fund (ETF). Some silver analysts have pointed to a potential conflict of interest, as close scrutiny of Comex documents reveals that ETF shares may be used to "cover" Comex physical metal deliveries. This led analysts to speculate that some stores of silver have multiple claims upon them. On September 25, 2008 the Commodity Futures Trading Commission (CFTC) relented and probed the silver market after persistent complaints of foul play.[29]

In April 2010, Andrew Maguire, a former Goldman Sachs trader, went public with assertions of market manipulation by JPMorgan Chase and HSBC of the gold and silver markets, prompting a number of lawsuits.[30] In response to allegations of market manipulation from silver investors such as Max Keiser, Blythe Masters, Head of Global Commodities for JP Morgan, told CNBC in April 2012 "often when customers have metal stored in their facility, they hedge it through JP Morgan on a forward basis who in turn hedges itself in the commodity markets. If you see only the hedges and our activity in the futures market, but you aren't aware of the underlying client position that we're hedging then it would suggest inaccurately that we are running a large directional position."[31]

Industrial, commercial, and consumer demand

The traditional use of silver in photographic development has been dropping since 2000 due to the decline of film photography.[2] However, silver is also used in electrical appliances (silver has the lowest resistance of industrial metals), photovoltaics (one of the highest reflectors of light), RoHS compliant solder, clothing and medical uses (silver has antibacterial properties). Other new applications for silver include RFID tags, wood preservatives, water purification and food hygiene.[32] The Silver Institute have seen a noticeable increase in silver-based biocide products coming onto the market, as they explain:

Currently we’re seeing a surge of applications for silver-based biocides in all areas: industrial, commercial and consumer. New products are being introduced almost daily. Established companies are incorporating silver based products in current lines - clothing, refrigerators, mobile phones, computers, washing machines, vacuum cleaners, keyboards, countertops, furniture handles and more. The newest trend is the use of nano-silver particles to deliver silver ions.

— [33]

Data from 2010 reveals that a majority of silver is being used for industry (487.4 million ounces), jewelry (167.0 million ounces), and investments (101.3 million ounces).[34]

The expansion of the middle classes in emerging economies aspiring to Western lifestyles and products may also contribute to a long-term rise in industrial and jewelry usage.

Hedge against financial stress

Silver, like all precious metals, may be used as a hedge against inflation, deflation or devaluation.[35] As Joe Foster, portfolio manager of the New York-based Van Eck International Gold Fund, explained in September 2010:

The currencies of all the major countries, including ours, are under severe pressure because of massive government deficits. The more money that is pumped into these economies – the printing of money basically – then the less valuable the currencies become.

— [36]

Investment vehicles

Bars

A traditional way of investing in silver is by buying actual bullion bars. In some countries, like Switzerland and Liechtenstein, bullion bars can be bought or sold over the counter at major banks.

The flat, rectangular shape of silver bars makes them ideal for storage in a home safe, a safe deposit box at a bank, or placed in allocated (also known as non-fungible) or unallocated (fungible or pooled) storage with a bank or dealer. Silver is traded in the spot market with the code "XAG". When settled in United States Dollars, the code is "XAGUSD".

Silver bars, like silver rounds, can either be cast or poured, or minted; both categories often involve the production of bars with intricate decorative designs that attractive to collectors, often referred to as 'art bars'; these types of bars are often given as gifts.

Various sizes of silver bars

- 1000 oz troy bars – These bars, 999 fine, weigh about 68.6 pounds avoirdupois (31 kg) and vary about 10% as to weight, as bars range from 900 ozt to about 1,100 ozt (28 to 34 kg). These are COMEX and LBMA good delivery bars.

- 100 oz troy bars – These bars weigh 6.86 pounds (3.11 kg).

- Odd weight retail bars – These bars cost less and generally have a wider spread, due to the extra work it takes to calculate their value and the extra risk due to the lack of a good brand name.

- 1 kilogram bars (32.15 oz troy)

- 100 gram bars (3.215 oz troy)

- 10 oz troy bars (311 g) and 1 oz troy bars (31.1 g), which are the least expensive (other than fractional bars) and normally collected in bulk by collectors and small-scale investors.

- Fractional bars – These come in a variety of weights smaller than 1 ozt, including 1, 2, 5 and 10 grams, but are typically stored in large amounts as significantly more of them need to be collected to accrue value.

Coins and rounds

Silver coins include the one ounce 99.99% pure Canadian Silver Maple Leaf and the one ounce 99.93% pure American Silver Eagle. Coins may be minted as either fine silver or junk silver, the latter being older coins made of 90% silver. U.S. coins 1964 and older (half dollars, dimes, and quarters) are generally accepted to weigh 24.71 grams of silver per dollar of face value, which at their nominal silver content of 90%, translates to 22.239 g of silver per dollar. All U.S. dimes, quarters, halves and 1 dollar pieces contained 90% silver since their introduction up until 1964 when they were discontinued. The combined mintage of these coins by weight exceeds by far the mintages of all other silver investment coins.

All United States 1965-1970 and one half of the 1975-1976 Bicentennial San Francisco proof and mint set Kennedy half dollars are "clad" in a silver alloy and contain 40% silver.

Junk-silver coins are also available as sterling silver coins, which were officially minted until 1919 in the United Kingdom and Canada and 1945 in Australia. These coins are 92.5% silver and are in the form of (in decreasing weight) Crowns, Half-crowns, Florins, Shillings, Sixpences, and threepence. The tiny threepence weighs 1.41 grams, and the Crowns are 28.27 grams (1.54 grams heavier than a US$1). Canada produced silver coins with 80% silver content from 1920 to 1967.

Other hard money enthusiasts use .999 fine silver rounds as a store of value. A cross between bars and coins, silver rounds are produced by a huge array of mints, generally contain a troy ounce of silver in the shape of a coin, but have no status as legal tender which makes them lose favorable VAT status in those countries where lower or zero-rate VAT exists for silver coins. Produced in a wide variety of different designs, ranging from reproductions of existing coin designs to wholly original shapes and patterns, rounds can be ordered with a custom design stamped on the faces or in assorted batches.

Exchange-traded products

Silver exchange-traded products represent a quick and easy way for an investor to gain exposure to the silver price, without the inconvenience of storing physical bars. Silver ETPs include:

- iShares Silver Trust launched by iShares is the largest silver ETF on the market with over 340 million troy ounces of silver in storage.[37]

- ETFS Physical Silver and ETFS Silver Trust launched by ETF Securities.

- Sprott Physical Silver Trust is a closed-end fund created by Sprott Asset Management. The initial public offering was completed on November 3, 2010.[38]

Certificates

A silver certificate of ownership can be held by investors instead of storing the actual silver bullion. Silver certificates allow investors to buy and sell the security without the difficulties associated with the transfer of actual physical silver. The Perth Mint Certificate Program (PMCP) is the only government-guaranteed silver-certificate program in the world.

The U.S. dollar has been issued as silver certificates in the past, each one represented one silver dollar payable to the bearer on demand. The notes were issued in denominations of $10, $5, and $1; however, since 1968, they can no longer be redeemed for physical silver; nor for any other form of lawful money, except Federal Reserve Notes (or their coin-equivalents) - on a dollar for dollar basis. However, due to the fact that there was a limit to their issue, and the fact that no more are issued for circulation, there is a collector's premium over face value for these notes. Series dates and issues, as well as condition, are factors which determine such value.

Accounts

Most Swiss banks offer silver accounts where silver can be instantly bought or sold just like any foreign currency. Unlike holding physical silver, the customer has a claim against the bank for a certain quantity of metal. Digital gold currency providers and internet bullion exchanges, such as OneGold, BullionVault or GoldMoney, offer silver as an alternative to gold. Some of these companies allow investors to redeem their investment through the delivery of physical silver.[39]

Derivatives, CFDs and spread betting

Derivatives, such as silver futures and options, currently trade on various exchanges around the world. In the U.S., silver futures are primarily traded on COMEX (Commodity Exchange), which is a subsidiary of the New York Mercantile Exchange. In November 2006, the National Commodity and Derivatives Exchange (NCDEX) in India introduced 5 kg silver futures.

Firms such as Cantor Index, CMC Markets, IG Index and City Index, all from the UK, provide contract for difference (CFD) or spread bets on the price of silver.

Mining companies

These do not represent silver at all, but rather are shares in silver mining companies. Companies rarely mine silver alone, as normally silver is found within, or alongside, ore containing other metals, such as tin, lead, zinc or copper. Therefore, shares are also a base metal investment, rather than solely a silver investment. As with all mining shares, there are many other factors to take into account when evaluating the share price, other than simply the commodity price. Instead of personally selecting individual companies, some investors prefer spreading their risk by investing in precious metal mining mutual funds.

Taxation

In many tax regimes, silver does not hold the special position that is often afforded to gold. For example, in the European Union the trading of recognized gold coins and bullion products is VAT exempt, but no such allowance is given to silver. This makes investment in silver coins or bullion less attractive for the private investor, due to the extra premium on purchases represented by the irrecoverable VAT (charged at 20% in the United Kingdom and 19% for bars and 7% for bullion products with face value, e.g. The US Silver Eagle and the Canadian Maple Leaf, in Germany). Norwegian companies can legally deliver free of VAT to the rest of Europe within certain annual limits or can arrange for local pickup.

Other taxes such as capital gains tax may apply for individuals depending on country of residence (tax status) and whether the asset is sold at increased nominal value. For example, in the United States, silver is taxed only when sold for a profit, at a special collectibles capital gain tax rate (the normal income tax rate, subject to a maximum of 28% for silver held over 1 year[40]). In 2011, the Utah Legal Tender Act recognized U.S.-minted silver and gold coins as legal tender within Utah, so that they may be used to pay any debt in Utah without being subject to Utah's capital gains tax (although such a tax would still apply for federal tax purposes, as such a state law cannot override federal law).[41]

See also

References

- "American Silver Eagle". The United States Mint. Archived from the original on December 2, 2013. Retrieved November 24, 2013.

- "Supply & Demand". The Silver Institute. Archived from the original on December 4, 2011. Retrieved September 29, 2010.

- "2000pres". The Silver Institute. Archived from the original on November 29, 2011. Retrieved September 29, 2010.

- Silberreserven und Preise Retrieved 28. December 2012. Archived December 2, 2013, at the Wayback Machine

- "Legal Tender Guidelines | The Royal Mint". www.royalmint.com. Retrieved February 16, 2020.

- "The Case for Silver | Gold News". Goldnews.bullionvault.com. March 25, 2010. Archived from the original on May 12, 2013. Retrieved September 29, 2010.

- Stanley W. Ivosevic (1984). Gold and Silver Handbook on Geology, Exploration, Development, Economics of Large Tonnage, Low Grade Deposits. University of California. p. 160. ISBN 0961135239.

- "Is Silver Nailed to Gold? | Gold News". Goldnews.bullionvault.com. September 20, 2010. Archived from the original on December 2, 2013. Retrieved September 29, 2010.

- Morteani, Giulio; Jeremy Peter Northover (1994). Prehistoric Gold in Europe: Mines, Metallurgy and Manufacture. New York: Springer-Verlag. p. 37. ISBN 978-0-7923-3255-8.

- http://www.constitution.org/uslaw/coinage1792.txt Archived October 29, 2013, at the Wayback Machine

- "The ratio gold and silver from 1800 1900". Dani2989.com. Archived from the original on September 6, 2013. Retrieved September 29, 2010.

- "Study of the report enters the ratio production and price since 1900 of the gold and the silver". Dani2989.com. Archived from the original on September 6, 2013. Retrieved September 29, 2010.

- "London Fix Historical Silver". Archived from the original on March 14, 2014.

- "London Fix Historical Gold". Archived from the original on August 21, 2006.

- "Silver Statistics and Information". USGS. Archived from the original on October 5, 1999.

- "24-hour Spot Chart - Silver". Kitco.com. Archived from the original on November 17, 2006. Retrieved September 29, 2010.

- "Mineweb.com - The world's premier mining and mining investment website Where are the silver bulls? - SILVER NEWS". Mineweb. Archived from the original on April 23, 2014. Retrieved September 29, 2010.

- "Wall Street Journal - PRECIOUS METALS: Economic, Political Worry Fuel Gold, Silver Rally". Wall Street Journal. April 8, 2011. Archived from the original on June 21, 2011. Retrieved April 10, 2011.

- http://www.silverinstitute.org/hist_priceuk.php Archived November 3, 2011, at the Wayback Machine

- Nguyen, Pham-Duy; Larkin, Nicholas (September 24, 2010). "Silver Futures Jump to 30-Year High: Gold Is Steady After Topping ,300". Bloomberg. Archived from the original on February 9, 2014.

- H.L. Hunt and the Circle K Cowboys Archived May 10, 2012, at the Wayback Machine

- http://www.silverfixing.com/timeline.pdf

- http://about.ag/SilverHigh.htm

- https://coinsite.com/us-silver-coins-when-they-ended-and-what-theyre-worth

- "United States of America Long-Term Rating Lowered To 'AA+' Due To Political Risks, Rising Debt Burden; Outlook Negative".

- Sweet & 8 August 2011.

- BullionVault.com The Case for Silver - 25th March 2010 Archived May 12, 2013, at the Wayback Machine

- iShares Silver Trust Archived February 9, 2014, at the Wayback Machine

- Cui, Carolyn (September 25, 2008). "CFTC Relents and Probes Silver Market". The Wall Street Journal. Archived from the original on November 8, 2012.

- Michael Gray, "Ex-Goldman trader blows whistle on silver and gold manipulation by JPMorgan, HSBC" New York Post (April 11, 2010). Retrieved May 5, 2011 Archived October 23, 2012, at the Wayback Machine

- Are Market Events A Cover For Silver Manipulation?

- http://www.lbma.org.uk/assets/alc57_prospects_silver_supply.pdf

- "Medical Applications". The Silver Institute. Archived from the original on November 22, 2011. Retrieved September 29, 2010.

- Silver Essentials | The Silver Institute Archived April 3, 2014, at the Wayback Machine

- "History of Silver as an Investment". Cornerstone Asset Metals. Archived from the original on March 16, 2014. Retrieved October 7, 2011.

- Why gold, silver are up while inflation is low, The Dallas Morning News, September 26, 2010 Archived November 30, 2010, at the Wayback Machine

- "iShares Silver Trust". Archived from the original on February 9, 2014.

- "Sprott Completes Initial Public Offering of Sprott Physical Silver Trust". Archived from the original on March 15, 2012.

- Silver, Buy or Sell? Archived April 23, 2014, at the Wayback Machine

- http://about.ag/28Percent.htm

- Utah Law Makes Coins Worth Their Weight in Gold (or Silver), The New York Times, May 29, 2011.