Price skimming

Price skimming is a pricing strategy in which a marketer sets a relatively high initial price for a product or service at first, then lowers the price over time.[1] It is a temporal version of price discrimination/yield management. It allows the firm to recover its sunk costs quickly before competition steps in and lowers the market price. It has become a relatively common practice for managers in new and growing market, introducing prices high and dropping them over time.[2]

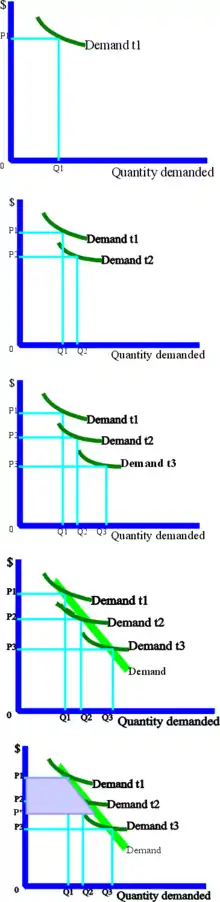

Price skimming is sometimes referred to as riding down the demand curve. The objective of a price skimming strategy is to capture the consumer surplus early in the product life cycle in order to exploit a monopolistic position or the low price sensitivity of innovators.[3]

- Price skimming is a product pricing strategy by which a firm charges the highest initial price that customers will pay. As the demand of the first customers is satisfied, the firm lowers the price to attract another, more price-sensitive segment.

Therefore, the skimming strategy gets its name from skimming successive layers of "cream," or customer segments, as prices are lowered over time.

Limitations of price skimming

There are several potential problems with this strategy.

- It is effective only when the firm is facing an inelastic demand curve. If the long run demand schedule is elastic (as in the adjacent diagram), market equilibrium will be achieved by quantity changes rather than price changes. Penetration pricing is a more suitable strategy in this case. Price changes by any one firm will be matched by other firms resulting in a rapid growth in industry volume. Dominant market share will typically be obtained by a low cost producer that pursues a penetration strategy.

- A price skimmer must be careful with the law. Price discrimination is illegal in many jurisdictions, but yield management is not. Price skimming can be considered either a form of price discrimination or a form of yield management. Price discrimination uses market characteristics (such as price elasticity) to adjust prices, whereas yield management uses product characteristics. Marketers see this legal distinction as quaint since in almost all cases market characteristics correlate highly with product characteristics. If using a skimming strategy, a marketer must speak and think in terms of product characteristics to stay on the right side of the law.

- The inventory turn rate can be very low for skimmed products. This could cause problems for the manufacturer's distribution chain. It may be necessary to give retailers higher margins to convince them to handle the product enthusiastically.

- Skimming encourages the entry of competitors. When other firms see the high margins available in the industry, they will quickly enter.

- Skimming results in a slower rate of product diffusion and adoption. This results in a higher level of untapped demand, giving competitors time to either imitate the product or leapfrog it with an innovation. If competitors do this, the window of opportunity will have been lost.

- The manufacturer could develop negative publicity if they lower the price too fast and without significant product changes. Some early purchasers will feel they have been ripped off. They will feel it would have been better to wait and purchase the product at a much lower price. This negative sentiment will be transferred to the brand and the company as a whole.

- High margins may make the firm inefficient. There will be less incentive to keep costs under control. Inefficient practices will become established making it difficult to compete on value or price.

Reasons for price skimming

Price skimming commonly occurs in technological markets as firms set a high price during the first stage of the product life cycle. The top segment of the market which are willing to pay the highest price are skimmed off first. When the product enters maturity the price is then gradually lowered.

Price skimming is frequently used when a new product just entered the market, the business may be able to charge high prices as some customers would want to be first to buy the product. Business usually start with a high price and it will lower over time so this strategy is mostly used by technology products.

Price skimming occurs for example in the luxury car and consumer electronics markets. In consumer electronics, there is a confounding factor that there is typically high price deflation due to continual reductions in manufacturing cost and improvements in product quality - for example, a printer priced at $200 today would have sold for a far higher price a decade ago.

The book market often combines price skimming with product versioning in the following way: a new book is published in hardback at a high price; if the book sells well it is subsequently published in paperback at a much reduced price (far lower than the difference in cost of the binding) to more price-sensitive customers. The hardback usually continues to be sold in parallel, to those consumers and libraries that have a strong preference for hardbacks. The skimming policy also affect the customer through the relative higher price of the product or services. This policy deals with the cross demand in the com-petite market.

When consider a new, trendy and relatively new product that has limited supply and a short life cycle, price skimming will be introduced as a strategy. Then the price will go down after a certain selling period, which is also referred to as market exit time. [4]

Research

In an empirical study, Martin Spann, Marc Fischer and Gerard Tellis analyze the prevalence and choice of dynamic pricing strategies in a highly complex branded market, consisting of 663 products under 79 brand names of digital cameras. They find that, despite numerous recommendations in the literature for skimming or penetration pricing, market pricing dominates in practice. In particular, the authors find five patterns: skimming (20% frequency), penetration (20% frequency), and three variants of market-pricing patterns (60% frequency), where new products are launched at market prices. Skimming pricing launches the new product 16% above the market price and subsequently lowers the price relative to the market price. Penetration pricing launches the new product 18% below the market price and subsequently increases the price relative to the market price. Firms exhibit a mix of these pricing paths across their portfolios. The specific pricing paths correlate with market, firm, and brand characteristics such as competitive intensity, market pioneering, brand reputation, and experience effects.[5]

See also

- Pricing

- Marketing

- Microeconomics

- Production, costs, and pricing

- Business model

- Product differentiation

References

- J Dean (1976). "Pricing Policies for New Products". Harvard Business Review. 54 (6): 141–153.

- Gebhardt, Gary (2006). "Price Skimming Paradoxes". ACR North American Advances. NA-33.

- MV Marn; EV Roegner; CC Zawada (2003). "Pricing New Products". The McKinsey Quarterly. 3 (July): 40–49.

- Toptal, Ayşegül; Çetinkaya, Sıla (2015). "The impact of price skimming on supply and exit decisions". Applied Stochastic Models in Business and Industry. 31 (4): 551–574. doi:10.1002/asmb.2058. hdl:11693/23647. ISSN 1526-4025.

- M Spann; M Fischer; GJ Tellis (2015). "Skimming or Penetration? Strategic Dynamic Pricing for New Products". Marketing Science. 34 (2): 235–249. doi:10.1287/mksc.2014.0891.