Public research and development

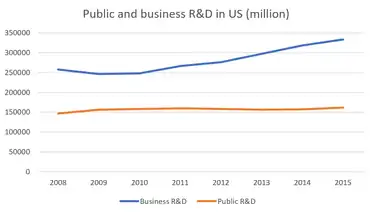

Public research and development (Public R&D) refers to the R&D activities related to public sectors, including governments, colleges and non-profit organizations.[1] Public R&D include academic fundamental research, applied research and R&D grants and contracts to private sectors, where later two are known as 'R&D subsidy'. Public R&D could be understood as a funder or a performer of an R&D activity. According to National Science Foundation in U.S., in 2015, R&D expenditures performed by federal governments, local governments, colleges and non-profit organizations are 54, 0.6, 64, and 20 billions of dollars, respectively. Meanwhile, industries perform R&D expenditures of 356 billion dollars. Moreover, R&D expenditures funded by federal governments, local governments, colleges and non-profit organizations are 121, 4.3, 17, and 19 billions of dollars, respectively. R&D expenditures funded by industries are 333 billion dollars.[2] In terms of R&D funders, public R&D to private R&D ratio is about 0.5.

Economic impacts

Economists have made significant strides to understand the dynamics of public R&D, along with its cascading effects.

Productivity

Scholars generally propose that public R&D enhances industrial productivity (e.g., Levy and Terleckyj, 1983;[3] Nadiri and Mamuneas, 1994[4]).However, the improvement of productivity could result in R&D spill-over of public sectors, researcher movements and co-operation between public and private sectors.

R&D investment of private sectors

Economists are particularly concerned about whether public R&D stimulates or crowds out the private sector R&D. It is generally known as a 'policy success', if the public R&D (especially the government R&D subsidy) could stimulate the R&D investment of private sectors. So far, there is no conclusive viewpoint in the literature (e.g., Toole, 2007[5] ;Cohen, Coval, and Malloy, 2011;[6] Azoulay, Zivin, Li, and Sampat, 2018[7]).

Stock returns

Public R&D is also positively related to stock returns of industrial firms (Chen, Chen, Liang, and Wang, 2020).[1] Although they show that abnormal returns based on public R&D ratio generate about 0.9% abnormal returns per month, and suggest that the positive relation could be interpreted by increased cash flow risks.

References

- Chen, Sheng-Syan; Yan-Shing Chen; Woan-lih Liang; Yanzhi Wang. (2020). "Public R&D spending and cross-sectional stock returns". Research Policy. 49: forthcoming. doi:10.1016/j.respol.2019.103887.

- "Research and Development: U.S. Trends and International Comparisons, National Science Foundation" (PDF).

- Levy, David M.; Nestor E. Terleckyj (1983). "Effects of government R&D on private R&D investment and productivity: A macroeconomic analysis". The Bell Journal of Economics. 14 (2): 551–561. doi:10.2307/3003656. JSTOR 3003656.

- Mamuneas, Theofanis P.; M. Ishaq Nadiri (1996). "Public R&D policies and cost behavior of the US manufacturing industries" (PDF). Journal of Public Economics. 63: 57–81. doi:10.1016/S0047-2727(96)01588-5.

- Toole, Andrew A. (2007). "Does public scientific research complement private investment in research and development in the pharmaceutical industry?". The Journal of Law and Economics. 50: 81–104. doi:10.1086/508314.

- Cohen, Lauren; Joshua Coval; Christopher Malloy (2011). "Do powerful politicians cause corporate downsizing?" (PDF). Journal of Political Economy. 119 (6): 1015–1060. doi:10.1086/664820.

- Azoulay, P.; Graff Zivin, J. S.; Li, D.; Sampat, B. N. (2019). "Public R&D investments and private-sector patenting: evidence from NIH funding rules". The Review of Economic Studies. 86 (1): 117–152. doi:10.1093/restud/rdy034. PMC 6818650. PMID 31662587.

/ref>; Nadiri and Mamuneas, 1994