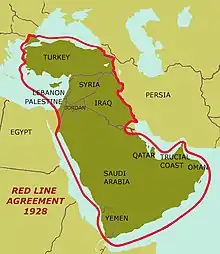

Red Line Agreement

The Red Line Agreement is an agreement signed by partners in the Iraq Petroleum Company (IPC) on July 31, 1928.[1] The agreement was signed between Anglo-Persian Company (later renamed British Petroleum), Royal Dutch/Shell, Compagnie Française des Pétroles (later renamed Total), Near East Development Corporation (later renamed ExxonMobil) and Calouste Gulbenkian (an Armenian businessman). The aim of the agreement was to formalize the corporate structure of IPC and bind all partners to a "self-denial clause" that prohibited any of its shareholders from independently seeking oil interests in the ex-Ottoman territory. It marked the creation of an oil monopoly, or cartel, of immense influence, spanning a vast territory. The cartel preceded easily by three decades the birth of another cartel, the Organization of Petroleum Exporting Countries (OPEC), which was formed in 1960.[2]

As Giacomo Luciani (2013) writes:

"Having formed IPC, [Calouste] Gulbenkian insisted that participants in the consortium sign what became known as the Red Line Agreement (Yergin 1991: 203–6). The red line was drawn on a map to define the territories formerly under the sovereignty of the Ottoman Empire, and the agreement stated that participants in the IPC consortium pledged to be involved in the exploitation of any oil to be discovered within the red line exclusively through consortia with the same composition as the IPC. Hence, if one of the IPC consortium members were to discover any oil or obtain a concession elsewhere within the red line, it would have to offer this asset to the remaining members in the same ‘geometry’ as in the IPC."[3]

It has been said that, at a meeting in 1928, Calouste Gulbenkian, an Armenian businessman and philanthropist, drew a red line on a map of the Middle East demarcating the boundaries of the area where the self-denial clause would be in effect.[4] Gulbenkian said this was the boundary of the Ottoman Empire he knew in 1914. He should know, he added, because he was born in it and lived in it. The other partners looked on it attentively and did not object. They had already anticipated such a boundary. (According to some accounts, the “red line” was not drawn by Gulbenkian but by a French representative.) Except for Gulbenkian, the partners were the supermajors of today. Within the “red line” lie the entire ex-Ottoman territory in the Middle East including the Arabian Peninsula (plus Turkey) but excluding Kuwait. Kuwait was excluded as it was meant to be a preserve for the British.

Years later, Walter C. Teagle of Standard Oil of New Jersey remarked that the agreement was “a damn bad move”.[5] However, it served to define the sphere of operations of TPC's successor, the Iraq Petroleum Company (IPC). The writer Stephen Hemsley Longrigg, a former IPC employee, noted that "the Red Line Agreement, variously assessed as a sad case of wrongful cartelization or as an enlightened example of international co‑operation and fair-sharing, was to hold the field for twenty years and in large measure determined the pattern and tempo of oil development over a large part of the Middle East".[6] Apart from Saudi Arabia and Bahrain where ARAMCO and BAPCO prevailed, IPC monopolized oil exploration inside the Red Line during this period.

American oil companies Standard Oil of New Jersey and Socony-Vacuum were partners in IPC and therefore bound by the Red Line Agreement. When they were offered a partnership with ARAMCO to develop the oil resources of Saudi Arabia, their partners in IPC refused to release them from the agreement. After the Americans claimed that World War II had ended the Red Line Agreement, protracted legal proceedings with Gulbenkian followed.[7] Eventually the case was settled out of court and the American partners were allowed to join ARAMCO.[8] The Red Line Agreement became a legacy document after this date, as IPC continued to operate existing concessions under its terms but the shareholder companies were allowed independently to seek new oil concessions across the Middle East.[9]

References

- Morton, Michael Quentin (6 April 2013). "Once Upon a Red Line: The Iraq Petroleum Company Story". GeoExpro. Retrieved 26 August 2019.

- United States Office of the Historian: The 1928 Red Line Agreement

- Luciani, Giacomo (2013), "Corporations vs. States in the Shaping of Global Oil Regimes", Global Resources, Palgrave Macmillan UK, pp. 119–139, doi:10.1057/9781137349149_7, ISBN 9781349347827

- "The Emergence of the Arabian Oil Industry" by Rasoul Sorkhabi, Ph.D., University of Utah's Energy & Geoscience Institute, GeoExpro, No. 6 of 2008.

- Bennett H. Wall and George S. Gibb, Teagle of Jersey Standard, New Orleans, 1974, p. 209

- Oil in the Middle East by S. H. Longrigg, 2nd Edition, published by the Oxford University Press, 1961, p.70

- Daniel Yergin, The Prize: The Epic Quest for Oil, Money and Power, New York, 1991, pp. 413-9

- "Oil: Share the Wealth”, Time, 23 December 1946

- Morton, Michael Quentin (2014). The Third River: Aspects of Oil in the Middle East 1887-1979 (First ed.). United Arab Emirates: National Archives. p. 331. ISBN 978-9948-05-146-6. Retrieved 30 January 2015.

Sources

- Demirmen, "Oil in Iraq: The Byzantine Beginnings: Part II: The Reign of a Monopoly", Global Policy Forum, April 26, 2003.

- Black, Edwin. Banking on Baghdad (John Wiley and Sons, New York 2003) and the only available map and transcription see www.bankingonbaghdad.com . For a complete minute to minute history of the Red Line Agreement see the referenced book.

- Black, Edwin. British Petroleum and the Red Line Agreement: The West's Secret Pact to Get Mideast Oil (Dialog Press 2011).