Single crossing condition

Single Crossing Condition in Probability

In economics, the single-crossing condition or single-crossing property refers to how the probability distribution of outcomes changes as a function of an input and a parameter.

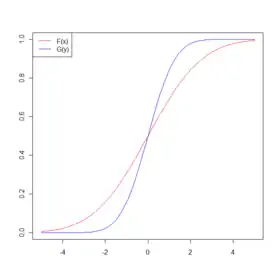

Cumulative distribution functions F and G satisfy the single-crossing condition if there exists a such that

and

;

that is, function crosses the x-axis at most once, in which case it does so from below.

This property can be extended to two or more variables. Given x and t, for all x'>x, t'>t,

and

.

This condition could be interpreted as saying that for x'>x, the function g(t)=F(x',t)-F(x,t) crosses the horizontal axis at most once, and from below. The condition is not symmetric in the variables (i.e., we cannot switch x and t in the definition; the necessary inequality in the first argument is weak, while the inequality in the second argument is strict).

The single-crossing condition was posited in Samuel Karlin's 1968 monograph 'Total Positivity'.[1] It was later used by Peter Diamond, Joseph Stiglitz,[2] and Susan Athey,[3] in studying the economics of uncertainty.[4] The single-crossing condition is also used in applications where there are a few agents or types of agents that have preferences over an ordered set. Such situations appear often in information economics, contract theory, social choice and political economics, among other fields.

Single Crossing Condition in Social Choice

In the study of social choice, the single-crossing condition is a condition on preferences. Specifically, a set of voters with some unidimensional characteristic and preferences over different policies q satisfy the single crossing property when the following is true:

If and or if and , then

where W is the indirect utility function.

An important proposition extends the median voter theorem, which states that when voters have single peaked preferences, a majority rule system has a Condorcet winner corresponding to the median voter's most preferred policy. With preferences that satisfy the single-crossing property, the most preferred policy of the voter with the median value of is the Condorcet winner.[5] In effect, this replaces the unidimensionality of policies with the unidimensionality of voter heterogeneity.

In this context, the single-crossing condition is sometimes referred to as the Gans-Smart condition [6]

Single Crossing Condition in Mechanism Design

The term Single-Crossing Condition (Spence Mirrlees property) refers to the requirement that the isoutility curve for agents of different types cross only once.[7] This condition guarantees that the transfer in an incentive-compatible direct mechanism can be pinned down by the transfer of the lowest type. This condition is similar to another condition called Strict Increasing Difference (SID). Formally, suppose the agent has a utility function , the SID says we have . The Spence-Mirrlees Property is characterized by .

See also

- Karlin, Samuel (1968). Total positivity. Stanford University Press.

- Diamond, Peter A. & Stiglitz, Joseph E. (1974). "Increases in risk and in risk aversion". Journal of Economic Theory, Elsevier, vol. 8(3), pages 337-360, July. Cite journal requires

|journal=(help)CS1 maint: multiple names: authors list (link) - Athey, Susan, 2001. "Single Crossing Properties and the Existence of Pure Strategy Equilibria in Games of Incomplete Information," Econometrica, Econometric Society, vol. 69(4), pages 861-89, July.

- Gollier, Christian (2001). The Economics of Risk and Time. The MIT Press. p. 103.

- Persson, Torsten; Tabellini, Guido (2000). Political Economics: Explaining Economic Policy. MIT Press. p. 23.

- Gans, Joshua S.; Smart, Michael (February 1996). "Majority voting with single-crossing preferences". Journal of Public Economics. 59 (2): 219–237. doi:10.1016/0047-2727(95)01503-5.

- Laffont, Jean-Jacques; Martimort, David (2002). The Theory of Incentives The Principal-Agent Model. Princeton, New Jersey: Princeton University Press. pp. 35. ISBN 9781400829453.