British Columbia carbon tax

British Columbia's carbon tax and accompanying tax shift has been in place since 2008. It is a British Columbia policy which adds additional carbon taxes to fossil fuels burned for transportation, home heating, and electricity, and reduces personal income taxes and corporate taxes by a roughly equal amount. The carbon tax is collected at the point of retail consumption (for example, at the pump for gasoline and diesel). British Columbia's policy is unique in North America; only Quebec has a similar retail tax but it is set at a much lower rate and does not include a matching tax shift.[1] Unlike most governments, British Columbia's electricity portfolio largely consists of hydroelectric power and their energy costs, even with the tax, are lower than most countries.[2][3]

History

Public opinion polls in 2007 showed that the environment had replaced the economy and healthcare at the most important issue to a majority of respondents. This cultural change, brought about by greater media and political attention both inside and outside of Canada, changed the political dynamic of British Columbia. Traditionally the left-leaning BC New Democratic Party (NDP) had been seen as the greener of the two largest parties, as opposed to the more free market BC Liberal Party. However, in 2008 it was the Liberals who introduced the carbon tax and tax shift, which was thought to be a more market-friendly method of regulating carbon than the competing idea of cap-and-trade which the NDP supported. During the 2009 British Columbia election the NDP (which suggested replacing the tax with a cap-and-trade system) as well as the BC Conservatives made repealing the carbon tax part of their platform, but the Liberals won another majority government.

In 2016, a similar measure was put on the ballot in the neighboring State of Washington. Washington Initiative 732 would have, like the British Columbia carbon tax, impose a steadily rising tax on carbon emissions, while offsetting the state's sales tax and business tax, while expanding the state's tax credit for low-income families. The ballet initiative did not pass; however, another carbon tax plan, Washington Initiative 1631, has been proposed.[4]

Initial implementation

On February 19, 2008, the Government of British Columbia announced its intention to implement a carbon tax of C$10 per tonne of Carbon dioxide equivalent (CO2e) emissions (2.41 cents per litre on gasoline) beginning July 1, 2008, making BC the first North American jurisdiction to implement such a tax. The tax was to increase each year until 2012, reaching a final price of $30 per tonne (7.2 cents per litre at the pumps).[5][6] Unlike previous proposals, legislation was to keep the pending carbon tax revenue neutral by reducing corporate and income taxes at an equivalent rate.[7] The government also planned to reduce taxes above and beyond the carbon tax offset by $481 million over three years.[5]

2010 expansion

In January 2010, the carbon tax was applied to biodiesel. Before the tax actually went into effect, the government of British Columbia sent out "rebate cheques" from expected revenues to all residents of British Columbia as of December 31, 2007.[8] In January 2013, the carbon tax was collecting about $1 billion each year which was used to lower other taxes in British Columbia. Terry Lake, the minister of the environment of British Columbia, said "It makes sense, it's simple, it's well accepted,"[9]

Rates

Selected carbon tax rates by fuel.[10] In April 2019, the carbon tax increased to $40 per tonne, which is translated below into different fuel types. This will increase by $5 per tonne per year, until it reaches $50 per tonne in 2021.

| Type of Fuel | Unit | Tax Rate: July 1, 2012 | Tax Rate: 2019[11] |

|---|---|---|---|

| Gasoline | ¢/litre | 6.67 | 8.89 |

| Diesel (light fuel oil) | ¢/litre | 7.67 | 10.23 |

| Jet fuel | ¢/litre | 7.83 | 10.44 |

| Natural gas | ¢/cubic metre | 5.70 | 7.6 |

| Propane | ¢/litre | 4.62 | 6.16 |

| Coal - high heat value | $/tonne | 62.31 | 83.08 |

| Coal - low heat value | $/tonne | 53.31 | 71.08 |

Effects

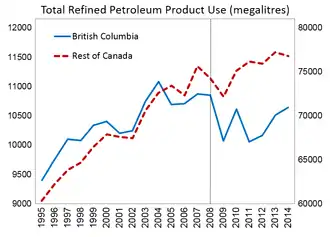

According to the World Bank, British Columbia's carbon tax policy has been very effective in spurring fuel efficiency gains. Further, the resulting decreases in fuel consumption did not harm economic growth; on the contrary, the province has outperformed the rest of Canada's since 2008.[12]

Five-year review

A July 2013 report by Sustainable Prosperity entitled BC's Carbon Tax Shift After Five Years: An Environmental (and Economic) Success Story suggested that the policy had been a major success. During the time the tax had been in place, fossil fuel consumption had dropped 17.4% per capita (and fallen by 18.8% relative to the rest of Canada). These reductions occurred across all the fuel types covered by the tax (not just vehicle fuel). BC's rate of economic growth (measured as GDP) kept pace with the rest of Canada's over that time. The tax shift enabled BC to have one of Canada's lowest income tax rates as of 2012. The aggregate effect of the tax shift was positive of taxpayers as a whole, in that cuts to income and other taxes exceeded carbon tax revenues by $500 million from 2008-12.[13]

This report was released to coincide with an internal review of the policy by the BC government, which ultimately decided to freeze the tax at 2012 levels for five years.[14] It was also aimed to influence energy policy discussion as the First Ministers met at Niagara-on-the-Lake, Ontario. Critics of the report debated its findings in media. Jock Finlayson of the BC Business Council pointed out that the drop in fuel consumption might be due to cross-border shopping, as many BC residents are able to drive into Washington or Alberta to fuel their cars and trucks, as well as to a much larger gasoline levy implemented Greater Vancouver (accounting for much of BC's population) to fund public transit development (TransLink), and that businesses were receiving less tax advantages from the plan than individuals.[15] Aldyen Donnelly of WDA Consulting suggested that the success of the tax in reducing fuel consumption would cannibalize the potential revenue it could generate, creating a tax waste, and that it fell more on the middle and lower-middle classes than on the rich, making it a regressive tax.[16] Supporter Mark Jaccard of Simon Fraser University, defended the tax by saying that BC's aviation fuel usage, which is not subject to the carbon tax, "did not diverge from the Canadian pattern, supporting the argument that the carbon tax really did have an effect. And BC's disconnect from the rest of the country was evident for all taxed fuels, not just gasoline; so the argument that BC's divergence is caused by increased cross-border shopping for gasoline is not supported." And further that, statistical analysis can factor out things like weather, background economic conditions, and other policies.[17]

Although fossil fuel consumption initially dropped rapidly, the recession in 2008 was also involved in lower consumption globally. A report in 2015 suggested an 8.5% reduction to date in greenhouse gas emissions, which may also be affected by cross border purchases of vehicle fuel.[18] Stats Canada reports that between 2007 and 2018 fuel consumption of Gasoline in British Columbia has increased by 5.2% while Canada as a whole 9.8%. [19]

References

- Sustainable Prosperity, p. 5

- "Overview of Electricity Sector - PeoplePowerPlanet". PeoplePowerPlanet. Retrieved 2017-09-07.

- Mines, Ministry of Energy and. "B.C.'s Electricity Rates - Province of British Columbia". www2.gov.bc.ca. Archived from the original on 2017-09-08. Retrieved 2017-09-07.

- Bauman, Yoram; Ryan, Joe (26 April 2018). "Will Washington voters warm to a new carbon tax initiative?". Seattle Times. Retrieved 20 July 2018.

- "B.C. introduces carbon tax". CanWest MediaWorks Publications. 22 February 2008. Archived from the original on 10 November 2012. Retrieved 9 January 2013.

- "British Columbia Carbon Tax" (PDF). Ministry of Small Business and Revenue. February 2008. Archived from the original (PDF) on 2013-05-13.

- "B.C.'s Revenue-neutral Carbon Tax". Balanced Budget 2008 Backgrounder. Province of British Columbia. 1 July 2008. Retrieved 5 May 2011.

- CTV News (23 June 2008). "B.C. tax rebate cheques due out this week". CTV British Columbia News. Retrieved 9 January 2013.

- Ahearn, Ashley (7 January 2013). "Talk Of A Carbon Tax In The Northwest". EarthFix · Oregon Public Broadcasting. Archived from the original on 2013-01-16. Retrieved 9 January 2013.

"It makes sense, it's simple, it's well accepted," says Terry Lake, the minister of the environment of British Columbia.

- "British Columbia's Carbon Tax". Province of British Columbia. Retrieved 14 July 2018.

- "Ministry of Finance Tax Bulletin Revised April 2019" (PDF). Retrieved April 25, 2019.

- Elgie, Stewart; Beaty, Ross; Lipsey, Richard. "British Columbia's carbon tax shift: An environmental and economic success". worldbank.org. The World Bank. Retrieved 1 September 2016.

- http://institute.smartprosperity.ca/library/publications/bc-s-carbon-tax-shift-after-five-years

- "Province of British Columbia".

- Finlayson, ,Jock. "B.C.’s carbon tax hurting businesses".

- Donnelly, ,Aldyen. "Fantasy carbon-tax modelling overcomes arithmetic".

- "Archived copy". Archived from the original on 2017-02-23. Retrieved 2017-08-25.CS1 maint: archived copy as title (link)

- https://nicholasinstitute.duke.edu/sites/default/files/publications/ni_wp_15-04_full.pdf pg 8

- https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=2310006601#timeframe