iZettle

iZettle AB is a Swedish financial technology company founded by Jacob de Geer and Magnus Nilsson in April 2010, and is now owned by PayPal.[1][2] Launching its first app and service in 2011,[4] the company offers a range of financial products including payments, point of sales, funding and partners applications.[5][6]

| |

| Type | Aktiebolag |

|---|---|

| Industry | Financial technology |

| Founded | April 2010 in Stockholm, Sweden |

| Founders | Jacob de Geer Magnus Nilsson |

| Headquarters | , |

| Parent | PayPal |

| Website | www |

| Footnotes / references [1][2][3] | |

The company was the first to develop chip-card reader and app for smartphone-based mobile commerce which meets international security requirements.[7]

History

In April 2010, Jacob de Geer and Magnus Nilsson founded iZettle and launched its first app and chip card reader in 2011.[6][8] The name “iZettle” derives from the expression “settling a debt.” The founders wanted a name that described what the company would do. They decided on a stylized combination of the words “I” and “Settle.” [9]

iZettle is de Geer's fourth start-up.[6] He was the first employee of TradeDoubler in 1999 and Ameibo and Tre Kronor Media in 2007.[10]

In August 2011, iZettle launched its mobile app for iOS in Sweden to meet the local demands of a market dominated by smart card technology.[11] The app worked initially with a Chip & Signature Card Reader.[10][12] The company launched the full version of the service in Sweden later that year.[12] Soon after launching, iZettle was listed as one of Tech Europe's Pick of Stockholm Start-ups.[13] In August 2012, the iZettle mobile app for Android was released .[14]

In February 2013, iZettle entered a partnership with Banco Santander, who would invest more than €5M in iZettle in June 2013, giving the company access to Santander's customers in the UK, Spain, Mexico and Brazil.

In June 2013, Visa signed iZettle to its Visa Ready Program, giving the startup access to tools for further developing mag stripe and mobile acceptance systems.[15] iZettle's solution achieved a MasterCard Best Practices certification in February 2013.[16] In September 2017, iZettle raised $36 million funding from the European Investment Bank.[17]

On May 17, 2018, it was reported that PayPal would be buying iZettle for $2.2 billion.[18]

Products and services

iZettle offers financial and other services to meet the needs of small businesses within the following four core areas.

Payments

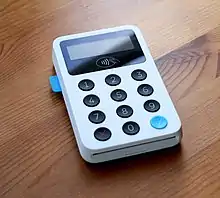

iZettle offers a card acceptance service which enables small businesses to take credit and debit card payments.[19][20][21][22] In 2013, iZettle upgraded its system to include a Chip and PIN device alongside its previous model, allowing it to accept all major credit cards, including MasterCard, American Express, and Visa.[23] In February 2015, iZettle introduced Lite Reader, a new card reader which was offered to merchants free of charge. It was used by plugging it into the audio jack of iPhone, iPad or Android devices.[24][25] In June 2016, iZettle launched a new card terminal. Just as its previous siblings the iZettle reader connects through Bluetooth and integrates both Chip and PIN and contactless payments.[26] The new card reader replaced all previous card readers in Europe and iZettle was the first mobile payments company to accept contactless payments in the UK.[27] This card reader also accepts all major cards including MasterCard, Visa and American Express.

Point of sale

iZettle offers a software solution, the iZettle app, to record, manage and analyze sales. The first version of the iZettle app was launched in 2011 but then only supported iOS. Since 2012 the iZettle app is also available for Android. With iZettle's app merchants can analyze credit card transactions and relay detailed information, i.e. top selling products and average payment volume.[5] In September 2016, iZettle acquired Intelligentpos to expand from mobile payments to broaden their suite of products within commerce solutions, and in particular within the hospitality sector. Intelligentpos, similar to iZettle, offers a cloud-based software solution that helps with inventory, loyalty programs and customer flow.[26]

Small business loans

In 2015, iZettle launched iZettle Advance, a small business financing service built upon the transaction data gathered at the point of sale. The offer is based on the user's sales history with iZettle. Repayment is tied to sales. The service is available in Europe.[28]

Partner applications

iZettle also offers access to third party applications such as accounting software. iZettle launched its first software development kit (SDK) in January 2014. The SDK provides developers with the ability to add payment services to iZettle's mobile apps. It can be used in any of the countries iZettle is currently live in, allowing for users to take payments via the app from iZettle's Chip and PIN reader, and return relevant information to the software to generate receipts.[29]

Markets

iZettle serves small businesses in 12 countries including Scandinavia, parts of Europe, the United Kingdom, Mexico and Brazil.[1][30][31][32][33][34]

The iZettle service was first launched in Sweden in 2011, followed by Denmark, Finland and Norway. In 2012, the company expanded into the United Kingdom, Germany, and Spain.[35] The company launched its service in Mexico in June 2013 and in Brazil in August 2013, marking the first time the company has operated outside of Europe.[1][31] iZettle later launched its service in the Netherlands, France and Italy.[36][37]

iZettle is based in their headquarters in Stockholm, Sweden, but also have offices in Germany, United Kingdom, Brazil and Mexico.

Funding and value

iZettle have had 5 rounds of Funding:[38] Series A, Series B, Series Undisclosed, Series C, and Series D.

In October 2011, iZettle raised €8.2 Million in Series A Funding, led by Index Ventures and Creandum.[6][12][39] In June 2012, the company received €25 Million in Series B Funding, led by 83North and Norhzone, MasterCard, SEB Private Equity, American Express, and Series A funders Index Ventures and Creandum.[40] In June 2013, iZettle received €5 Million in an Undisclosed Series with only Santander InnoVentures as funder. In May 2014, iZettle received €40 Million in Series C Funding, led by Zouk Capital LLP, followed by 83North, American Express Ventures, Creandum, Dawn Capital, Hasso Plattner Ventures, Index Ventures, Intel Capital, MaterCard, Northzone, Santander InnoVentures and SEB Private Equity.[41] In August 2015, the company raised €60 Million in the Series D Funding led by Intel Capital and Zouk Capital LLP and followed by 83North, American Express Ventures, Creandum, Dawn Capital, Hasso Plattner Ventures, Hermes GPE Environmental Innovation Fund, Index Ventures, MasterCard, MCI Capital SA, Northzone, Santander InnoVentures and SEB Private Equity.[42]

With the Series D round in August 2015, iZettle was valued for over US$500 million.[43]

In May 2018, iZettle announced that it intended to file for an IPO for $1.1 Billion on the Stockholm stock exchange sometime in 2018 but this was pre-empted by a $2.2 Billion acquisition offer by PayPal.[44]

In 2018 it expects to have revenues of $165 million through processing $6 billion in payment volume.

References

- Ben Rooney (18 Jun 2013). "iZettle Launches Card Service in Mexico". The Wall Street Journal. Retrieved 9 September 2013.

- "iZettle | Crunchbase". Retrieved 22 November 2018.

- Emily Bary (17 May 2018). "PayPal buys iZettle for $2.2 billion as it gears up against Square". Market Watch.

- "iZettle Raises €40 Million ($55.5 Million) Series C". Retrieved 22 November 2018.

- Liam Tung (4 Apr 2013). "iZettle adds new loyalty analytics features as it squares up to Square". ZDNet. Retrieved 9 September 2013.

- Peter Cohan (19 Oct 2011). "iZettle Let's Europe's Mom-and-Pops Take Chip-Cards". Forbes. Retrieved 9 September 2013.

- Ben Rooney (24 May 2011). "App Turns Any iPhone Into Credit Card Reader". The Wall Street Journal. Retrieved 9 September 2013.

- Dusan Belic (2 May 2011). "iZettle iPhone credit card reader works with smart cards". intomobile. Archived from the original on 14 January 2014. Retrieved 9 September 2013.

- Robin Wauters (13 Aug 2012). "Payment startups clash: Cease-and-desist letter from iZettle forces Settle to change name to Droplet". The Next Web. Retrieved 9 September 2013.

- Bill Robinson (20 November 2011). "High-Tech Startup Focus: iZettle -- the New, Better Square -- Coming Soon to America?". Huffington Post. Retrieved 9 September 2013.

- Michael Grothaus (18 Aug 2011). "iZettle credit card reader for iPhone now available in Sweden in limited numbers". Túaw. Retrieved 9 September 2013.

- Martin Bryant (14 Nov 2011). "Europe's Square rival iZettle officially launches its iOS card payments service". The Next Web. Archived from the original on 22 September 2013. Retrieved 9 September 2013.

- Ben Rooney (21 Sep 2011). "Tech Europe's Pick of Stockholm's Start-Ups". The Wall Street Journal. Retrieved 9 September 2013.

- Bobbie Johnson (21 Aug 2012). "iZettle goes to Android, lays out a challenge to Square and its rivals". GIGAOM. Retrieved 9 September 2013.

- "Mpos firms join Visa Ready Program". Finextra. 5 June 2013. Retrieved 9 July 2013.

- "19 Mobile Point-of-Sale (MPOS) Solutions Achieve MasterCard Best Practices Certification". MasterCard. 27 Feb 2013. Retrieved 9 September 2013.

- Lunden, Ingrid. "iZettle raises $36M from Europe, earmarked for AI and other new tech". TechCrunch. Retrieved 2017-11-20.

- Emily Bary (17 May 2018). "PayPal buys iZettle for $2.2 billion as it gears up against Square". Market Watch.

- "iZettle starts accepting AmEx in Sweden and Finland". Finextra. 8 May 2012. Retrieved 9 September 2013.

- Loek Essers (13 Nov 2012). "Startup iZettle settles mobile payments". Computer World. Retrieved 9 September 2013.

- Ingrid Lunden (12 June 2012). "Europe's Square, iZettle, Goes One Step Further: Launches API to Integrate Payments Into Apps". TechCrunch. Retrieved 9 September 2013.

- Henry Mance (11 Jun 2013). "Santander backs iZettle to promote paying by card" (PDF). Financial Times. Retrieved 9 September 2013.

- Mike Butcher (20 Feb 2013). "iZettle Launches Wireless Chip & Pin, Stars Taking Visa and Partners with Santander". TechCrunch. Retrieved 9 September 2013.

- https://www.izettle.com/gb/blog/111264793941/say-hello-to-card-reader-lite

- Sundar Kumar JVS (17 February 2015). "To Grow Merchant Customers, iZettle Slashes The Cost Of Its Card Readers To Zero". Techcrunch. Retrieved 24 February 2015.

- "iZettle buys intelligentpos to expand from mobile payments to commerce solutions". Techcrunch. 6 September 2016. Retrieved 18 December 2016.

- "iZettle brings first Apple Pay card readers to UK businesses". International Business Times. 19 May 2015. Retrieved 18 December 2016.

- "iZettle Gets $67M To Expand From Mobile Payments To Small Business Financing". Techcrunch. 28 August 2015. Retrieved 18 December 2016.

- "iZettle, Europe's Square, Releases An SDK For Direct Mobile Payment Integration On iOS". Techcrunch. 23 Jan 2014. Retrieved 11 February 2013.

- Rory Cellan-Jones (6 Nov 2012). "iZettle and the modernisation of money". BBC. Retrieved 9 September 2013.

- Robin Wauters (27 August 2013). "iZettle launches its card reader and mobile payment service in Brazil". The Next Web. Retrieved 22 October 2013.

- Mike Butcher (30 Oct 2012). "The Square-like iZettle Launches in Germany with DZ BANK and Deutsche Telekom, Puts Heat on Payleven". Techcrunch. Retrieved 9 September 2013.

- "about". iZettle. Retrieved 9 September 2013.

- Manuel Angel Mendez (20 Oct 2012). "They mobile payments iZettle". El Pais Technology. Retrieved 9 September 2013.

- Bobbie Johnson (16 May 2012). "iZettle, Europe's rival to Square hits the UK". GIGAOM. Retrieved 9 September 2013.

- "iZettle Arrives in Italy". Finextra. 3 November 2015. Retrieved 18 December 2016.

- "iZettle launches in the Netherlands". The Paypers. 21 November 2014. Retrieved 18 December 2016.

- "iZettle founding rounds". Crunchbase. 18 December 2016. Retrieved 18 December 2016.

- Leena Rao (18 Oct 2011). "Europe's Square iZettle Raises $11 Million For Mobile Payments Technology". Techcrunch. Retrieved 9 July 2013.

- "Funding Round - Series B". Crunchbase. 15 June 2012. Retrieved 18 December 2016.

- "Funding Round - Series C". Crunchbase. 9 May 2014. Retrieved 18 December 2016.

- "Funding Round - Series C". Crunchbase. 28 August 2015. Retrieved 18 December 2016.

- "Swedish payments company iZettle raises €60m on $500m valuation". Financial Times. 28 August 2015. Retrieved 18 December 2016.

- "PayPal acquires Swedish payments firm iZettle". BBC News. 2018-05-17. Retrieved 2020-12-29.