Nasdaq

The Nasdaq Stock Market, /ˈnæzˌdæk/ (![]() listen) also known as Nasdaq or NASDAQ, is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.[4] The exchange platform is owned by Nasdaq, Inc.,[5] which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

listen) also known as Nasdaq or NASDAQ, is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.[4] The exchange platform is owned by Nasdaq, Inc.,[5] which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

| |

| Type | Stock exchange |

|---|---|

| Location | New York City, New York, U.S. |

| Founded | February 8, 1971 |

| Owner | Nasdaq, Inc. |

| Key people | Adena T. Friedman (CEO)[1] |

| Currency | United States dollar |

| No. of listings | Approximately 8,100[2] |

| Market cap | |

| Website | www |

History

1971–2000

"Nasdaq" was initially an acronym for the National Association of Securities Dealers Automated Quotations.[6]

It was founded in 1971 by the National Association of Securities Dealers (NASD), now known as the Financial Industry Regulatory Authority (FINRA).[7]

On February 8, 1971, the Nasdaq stock market began operations as the world's first electronic stock market.[7] At first, it was merely a "quotation system" and did not provide a way to perform electronic trades.[8] The Nasdaq Stock Market helped lower the bid–ask spread (the price difference between sellers and buyers), but was unpopular among brokers as it reduced their profits.

The NASDAQ Stock Market eventually assumed the majority of major trades that had been executed by the over-the-counter (OTC) system of trading, but there are still many securities traded in this fashion. As late as 1987, the Nasdaq exchange was still commonly referred to as "OTC" in media reports[9] and also in the monthly Stock Guides (stock guides and procedures) issued by Standard & Poor's Corporation.[10]

Over the years, the Nasdaq Stock Market became more of a stock market by adding trade and volume reporting and automated trading systems.

In 1981, Nasdaq traded 37% of the U.S. securities markets' total of 21 billion shares. By 1991, Nasdaq's share had grown to 46%.[11]

In 1998, it was the first stock market in the United States to trade online, using the slogan "the stock market for the next hundred years".[12] The Nasdaq Stock Market attracted many companies during the dot-com bubble.

Its main index is the NASDAQ Composite, which has been published since its inception. The QQQ exchange-traded fund tracks the large-cap NASDAQ-100 index, which was introduced in 1985 alongside the NASDAQ Financial-100 Index, which tracks the largest 100 companies in terms of market capitalization.

In 1992, the Nasdaq Stock Market joined with the London Stock Exchange to form the first intercontinental linkage of capital markets.[13]

In 2000, the National Association of Securities Dealers spun off the Nasdaq Stock Market to form a public company.

2000–present

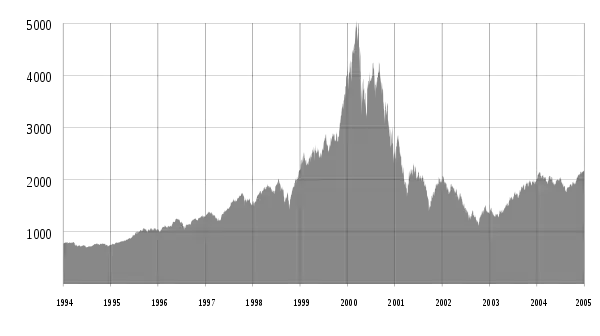

On March 10, 2000, the NASDAQ Composite stock market index peaked at 5,132.52, but fell to 3,227 by April 17,[14] and, in the following 30 months, fell 78% from its peak.[15]

In a series of sales in 2000 and 2001, FINRA sold its stake in the Nasdaq.

On July 2, 2002, Nasdaq Inc. became a public company via an initial public offering.[16]

In 2006, the status of the Nasdaq Stock Market was changed from a stock market to a licensed national securities exchange.[17]

In 2007, Nasdaq merged with OMX, a leading exchange operator in the Nordic countries, expanded its global footprint, and changed its name to the NASDAQ OMX Group.[18]

To qualify for listing on the exchange, a company must be registered with the United States Securities and Exchange Commission (SEC), must have at least three market makers (financial firms that act as brokers or dealers for specific securities) and must meet minimum requirements for assets, capital, public shares, and shareholders.

In February 2011, in the wake of an announced merger of NYSE Euronext with Deutsche Börse, speculation developed that NASDAQ OMX and Intercontinental Exchange (ICE) could mount a counter-bid of their own for NYSE. NASDAQ OMX could be looking to acquire the American exchange's cash equities business, ICE the derivatives business. At the time, "NYSE Euronext's market value was $9.75 billion. Nasdaq was valued at $5.78 billion, while ICE was valued at $9.45 billion."[19] Late in the month, Nasdaq was reported to be considering asking either ICE or the Chicago Mercantile Exchange to join in what would probably have to be, if it proceeded, an $11–12 billion counterbid.[20]

In December 2005, NASDAQ acquired Instinet for $1.9 billion, retaining the Inet ECN and subsequently selling the agency brokerage business to Silver Lake Partners and Instinet management.[21][22][23]

The European Association of Securities Dealers Automatic Quotation System (EASDAQ) was founded as a European equivalent to the Nasdaq Stock Market. It was purchased by NASDAQ in 2001 and became NASDAQ Europe. In 2003, operations were shut down as a result of the burst of the dot-com bubble.[24] In 2007, NASDAQ Europe was revived first as Equiduct, and later that year, it was acquired by Börse Berlin.[25]

On June 18, 2012, Nasdaq OMX became a founding member of the United Nations Sustainable Stock Exchanges Initiative on the eve of the United Nations Conference on Sustainable Development (Rio+20).[26][27]

In November 2016, chief operating officer Adena Friedman was promoted to chief executive officer, becoming the first woman to run a major exchange in the U.S.[28]

In 2016, Nasdaq earned $272 million in listings-related revenues.[29]

In October 2018, the SEC ruled that the New York Stock Exchange and Nasdaq did not justify the continued price increases when selling market data.[30][31][32]

In December 2020, NASDAQ announced that it would strip its indexes of four Chinese companies in response to Executive Order 13959.[33]

Quote availability

Nasdaq quotes are available at three levels:

- Level 1 shows the highest bid and lowest ask—inside quote.

- Level 2 shows all public quotes of market makers together with information of market dealers wishing to buy or sell stock and recently executed orders.[34]

- Level 3 is used by the market makers and allows them to enter their quotes and execute orders.[35]

Trading schedule

The Nasdaq Stock Market sessions, with times in the Eastern Time Zone are:

4:00 a.m. to 9:30 a.m. Extended-hours trading session (premarket)

9:30 a.m. to 4:00 p.m. normal trading session

4:00 p.m. to 8:00 p.m. Extended-hours trading session (postmarket)[36]

The Nasdaq Stock Market averages about 253 trading days per year.

Market tiers

The Nasdaq Stock Market has three different market tiers:

- Capital Market (NASDAQ-CM small cap) is an equity market for companies that have relatively small levels of market capitalization. Listing requirements for such "small cap" companies are less stringent than for other Nasdaq markets that list larger companies with significantly higher market capitalization.[37]

- Global Market (NASDAQ-GM mid cap) is made up of stocks that represent the Nasdaq Global Market. The Global Market consists of 1,450 stocks that meet Nasdaq's strict financial and liquidity requirements, and corporate governance standards. The Global Market is less exclusive than the Global Select Market.[38]

- Global Select Market (NASDAQ-GS large cap) is a market capitalization-weighted index made up of US-based and international stocks that represent the Global Select Market Composite. The Global Select Market consists of 1,200 stocks that meet Nasdaq's strict financial and liquidity requirements and corporate governance standards. The Global Select Market is more exclusive than the Global Market. Every October, the Nasdaq Listing Qualifications Department reviews the Global Market Composite to determine if any of its stocks have become eligible for listing on the Global Select Market.[39][40]

See also

References

- "Nasdaq". Fortune.

- "Nasdaq Companies". Archived from the original on February 1, 2011.

- "NASDAQ Stock Exchange". www.tradinghours.com. Retrieved December 11, 2020.

- "Monthly Reports". World-Exchanges.org. World Federation of Exchanges. Archived from the original on August 17, 2014.

- "Nasdaq – Business Solutions & Services". nasdaq.com. Archived from the original on October 20, 2016. Retrieved June 16, 2016.

- Frequently Asked Questions. NASDAQ.com. NASDAQ, n.d. Web. December 23, 2001. Archived April 29, 2010, at the Wayback Machine

- Terrell, Ellen. "History of the American and Nasdaq Stock Exchanges". Library of Congress. Archived from the original on April 14, 2013.

- KENNON, JOSHUA (March 26, 2019). "What Is the NASDAQ?". Dotdash.

- Gilpin, Kenneth N. (July 3, 1987). "Company News: An Erratic Quarter for Stock Markets". The New York Times. ISSN 0362-4331. Archived from the original on August 1, 2017.

- Salinger, Lawrence M. (June 14, 2013). Encyclopedia of White-Collar and Corporate Crime. SAGE Publications. ISBN 978-1-4522-7616-8.

- WIDDER, PAT (May 24, 1992). "NASDAQ HAS EYE ON NEXT 100 YEARS". Chicago Tribune.

- "Feb 8, 1971 CE: 'Stock Market for the Next 100 Years' Opens". National Geographic. Archived from the original on July 19, 2016. Retrieved September 16, 2019.

- Odekon, Mehmet (March 17, 2015). Booms and Busts: An Encyclopedia of Economic History from the First Stock Market Crash of 1792 to the Current Global Economic Crisis: An Encyclopedia of Economic History from the First Stock Market Crash of 1792 to the Current Global Economic Crisis. Routledge. ISBN 9781317475750. Archived from the original on August 3, 2017.

- "NASDAQ Composite daily index". Archived from the original on November 22, 2010.

- Glassman, James K. (February 11, 2015). "3 Lessons for Investors From the Tech Bubble". Kiplinger's Personal Finance. Archived from the original on April 15, 2017.

- "INVESTOR FAQS". Nasdaq.

- Walsh, Michelle. "Nasdaq Stock Market Becomes A National Securities Exchange; Changes Market Designations". Archived from the original on December 17, 2013.

- Lucchetti, Aaron; MacDonald, Alistair (May 26, 2007). "Nasdaq Lands OMX for $5.7 Billion; Are More Merger Deals on the Way?". The Wall Street Journal. ISSN 0099-9660. Archived from the original on July 31, 2017.

- De la Merced, Michael J., "Nasdaq and ICE Hold Talks Over Potential N.Y.S.E. Bid" Archived January 20, 2012, at the Wayback Machine, The New York Times Dealbook, February 18, 2011.

- Fraser, Michelle E., "Nasdaq May Ask CME or ICE for Help in NYSE Counterbid, WSJ Says" Archived July 29, 2014, at the Wayback Machine, Bloomberg News, February 26, 2011.

- "NASDAQ COMPLETES ACQUISITION OF INET" (Press release). Nasdaq. December 8, 2005.

- Authers, John (December 8, 2005). "Nasdaq completes purchase of Instinet exchange". Financial Times.

- "Nasdaq to Acquire Instinet in $1.9 Billion Deal". The New York Times. April 22, 2005. ISSN 0362-4331.

- "Nasdaq Might Shut Down German Exchange". Deutsche Welle. August 11, 2003.

- "Easdaq Makes A Comeback As Equiduct". Archived from the original on January 6, 2011. Retrieved February 3, 2011.

- "SUSTAINABLE STOCK EXCHANGES INITIATIVE: EXCHANGES LISTING OVER 4,600 COMPANIES COMMIT TO PROMOTING SUSTAINABILITY" (Press release). GlobeNewswire. June 18, 2012.

- JUNGCURT, STEFAN (June 29, 2012). "Five Stock Exchanges Commit to Promoting Sustainability". International Institute for Sustainable Development.

- "Nasdaq's New CEO Attributes Her Success to an 'Eclectic' Career Path". Fortune. November 15, 2016. Archived from the original on November 17, 2016.

- Osipovich, Alexander (October 26, 2017). "Startup Exchange Cleared to Take on NYSE, Nasdaq for Stock Listings". The Wall Street Journal. Archived from the original on October 26, 2017.

- Osipovich, Alexander; Michaels, Dave; Morgenson, Gretchen (October 16, 2018). "SEC Ruling Takes Aim at Stock-Exchange Profits". The Wall Street Journal.

- "SEC rules NYSE and Nasdaq did not justify data fee increases". Financial Times. October 16, 2018.

- Michaels, Dave (October 19, 2018). "NYSE, Nasdaq Take It on the Chin in Washington". The Wall Street Journal. ISSN 0099-9660.

- Singh, Kanishka; Kerber, Ross (December 12, 2020). "Nasdaq to remove four Chinese companies' shares from indexes after U.S. order". Reuters. Retrieved December 16, 2020.

- "Order Book, Level 2 Market Data, and Depth of Market". Daytrading. About.com. Archived from the original on January 14, 2011.

- "Nasdaq Level III Quote". Archived from the original on April 13, 2014.

- "Nasdaq Trading Schedule". Nasdaq.com. Archived from the original on April 17, 2014.

- "Definition of 'Nasdaq SmallCap Market', now known as Nasdaq Capital Market". Investopedia. Archived from the original on August 4, 2013.

- "Definition of 'Nasdaq Global Market Composite'". Investopedia. Archived from the original on September 17, 2013.

- "Definition of 'Nasdaq Global Select Market Composite'". Investopedia. Archived from the original on October 4, 2013.

- Pinto, Jerald E.; Henry, Elaine; Robinson, Thomas R.; Stowe, John D. (2010). Equity Asset Valuation. CFA Institute Investment Series. 27 (2 ed.). John Wiley & Sons. p. 6. ISBN 9780470579657. Archived from the original on May 10, 2013.

[...] NASDAQ-GS stands for 'Nasdaq Global Select Market,' [...]