People's United Financial

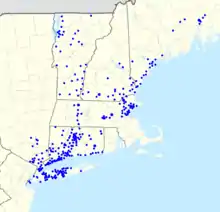

People's United Financial, Inc. is an American bank holding company that owns People's United Bank.[1] The bank operates 403 branches in Connecticut, southeastern New York State, Massachusetts, Vermont, Maine, and New Hampshire.[1] It is the second-largest full-service bank in New England, one of the largest in the northeast, and the 46th-largest in the United States.[2]

| |

| |

| Type | Public |

|---|---|

| Industry | Financial services |

| Founded | 1842 as Bridgeport Savings Bank 1927 as Bridgeport-People's Savings Bank 1955 as People's Savings Bank-Bridgeport 1983 as People's Bank 2007 as People's United Bank |

| Headquarters | , |

Number of locations | 403 branches |

Key people | George P. Carter, Chairman John P. Barnes, CEO R. David Rosato, CFO |

| Total assets | |

| Total equity | |

Number of employees | 5,188 (2017) |

| Website | www |

| Footnotes / references [1] | |

History

The company was founded in 1842 as Bridgeport Savings Bank in Bridgeport, Connecticut.[3] In 1955, the company acquired Southport Savings Bank.[4] In 1981, the bank became the first in the country to provide a telephone bill paying service. In 1981, the company acquired the assets of First Stamford Bank and Trust Company.[4][5] In 1982, the company acquired Guardian Federal Savings and Loan Association of Bridgeport.[4][5] In 1983, the company acquired People's Bank of Vernon and was renamed People's Bank.[4][5] In 1985, the company began issuing credit cards.[4] In 1986, the company acquired First Federal Savings Bank.[4][5] In 1989, the company moved to a new headquarters building designed by Richard Meier.[4] In 1991, the company acquired the deposits of Hartford-based Landmark Bank.[4] In 1998, the company acquired Norwich Financial Corporation for $164 million in cash.[6][7] In 2004, the bank sold its credit card division to the Royal Bank of Scotland at a premium of $360 million.[8][9][10] On November 22, 2010, the bank opened its first location in Boston.[11] On June 7, 2007, the bank changed its name to People's United Bank.[3][4] On January 1, 2008, the bank acquired Chittenden Corporation for $1.9 billion.[12][13] Also in 2008, the bank acquired Ocean Bank of New Hampshire, Maine Bank & Trust, Merrill Bank, Flagship Bank, and Bank of Western Massachusetts.[14] In February 2008, a data storage company, Archive America, lost backup tapes in transit containing the "names, birthdays, Social Security numbers and other information" of customers of the bank and of The Bank of New York Mellon.[15] In February 2010, the company acquired Financial Federal Corporation, an equipment financing company.[16] In April 2010, the company acquired Butler Bank, which was seized by the Federal Deposit Insurance Corporation.[17][18][19] In December 2010, the company acquired LSB Corporation and Smithtown Bancorp.[20] In July 2011, the company acquired Danvers Bancorp.[21] In 2012, the company acquired 57 branches in the greater New York metro area from Royal Bank of Scotland , including 53 branches in Stop & Shop supermarkets.[22] In October 2015, the company's insurance agency subsidiary acquired Kesten-Brown Insurance.[23] In November 2016, the bank was selected to manage the core bank accounts for the commonwealth of Massachusetts.[24] In April 2017, the company acquired Suffolk Bancorp and in July, it acquired LEAF Commercial Capital.[25][26] In August 2017, the bank was selected to manage the core bank accounts for the state of Vermont.[27] In June 2018, People's United Bank agreed to purchase Farmington Bank in a deal valued at $544 million.[28]

Headquarters

People's Bank Headquarters was built in 1989, designed by renowned architect Richard Meier. Rising 16 stories above the northern side of I-95, the People's Bank building (known officially as Bridgeport Center) is the tallest building in downtown Bridgeport, although it will soon be joined on the skyline by the over 12-story high big-top style roof rising along the southern side of I-95 on the site of Bridgeport's Harbor Yard Amphitheatre set to open in the summer of 2021. [29]

References

- "People's United Financial, Inc. 2017 Form 10-K Annual Report". U.S. Securities and Exchange Commission.

- "Largest Banks in the United States 2017". www.relbanks.com. Retrieved 2017-12-25.

- "People's United cedes its S&L charter". Hartford Business Journal. February 10, 2015.

- "People's Bank Changes Name to People's United Bank to Accommodate Growth Plans" (Press release). PRNewswire. June 7, 2007.

- "Bank Mergers and Acquisitions - 1980 to 1989". Connecticut Department of Banking.

- Gosselin, Kenneth R. (September 5, 1997). "People's To Buy Parent Firm Of Norwich Savings". Hartford Courant.

- "Connecticut Banks Agree To Merge $164 Million Deal". The New York Times. Dow Jones & Company. September 5, 1997.

- "People's Bank Will Sell Its Credit Card Business". The New York Times. Reuters. February 4, 2004.

- Higgins, Steve (February 4, 2004). "People's sells credit card division". New Haven Register.

- "RBS to Acquire Credit Card Business of People's Bank of Connecticut" (PDF) (Press release). Royal Bank of Scotland. February 3, 2004.

- Fitzgerald, Jay (November 20, 2010). "People's United bank opening up in Boston". The Boston Herald.

- "People's United Financial, Inc. to Acquire Chittenden Corporation" (Press release). Peoples United Bank. June 27, 2007 – via Business Wire.

- "Chittenden: People's United Financial to acquire Chittenden for $1.9 bln". Reuters. June 27, 2007.

- Sanders, Bob (July 1, 2010). "Ocean Bank to take People's name". New Hampshire Business Review.

- Fonseca, Brian (May 30, 2008). "Bank loses tapes with data on 4.5M clients". International Data Group.

- Stynes, Tess (November 24, 2009). "People's United to Acquire Financial Federal". The Wall Street Journal.

- "People's United Bank, Bridgeport, Connecticut, Assumes All of the Deposits of Butler Bank, Lowell, Massachusetts" (Press release). Federal Deposit Insurance Corporation. April 16, 2010.

- Gosselin, Kenneth R. (April 16, 2010). "People's Bank To Acquire Butler, A Failed Massachusetts Bank". Hartford Courant.

- Carter, Angela (April 17, 2010). "People's United Bank acquires Butler Bank". New Haven Register.

- "People's United Financial, Inc. Completes Acquisitions of LSB Corporation and Smithtown Bancorp, Inc" (Press release). PRNewswire. December 1, 2010.

- "People's United Financial, Inc. Completes Acquisition of Danvers Bancorp, Inc" (Press release). People's United Financial. July 1, 2011 – via PRNewswire.

- "People's United Completes Purchase of Citizens Bank Branches In New York". Hartford Courant. June 25, 2012.

- "People's United Insurance Agency Announces Acquisition Of Connecticut-Based Kesten-Brown Insurance" (Press release). People's United Financial. October 15, 2015 – via PRNewswire.

- "Treasurer Deborah Goldberg Announces New Banking Services Contract" (Press release). Treasurer of Massachusetts. November 10, 2016. Retrieved February 22, 2018.

- "People's United Financial, Inc. Completes Acquisition of Suffolk Bancorp" (Press release). People's United Financial. April 3, 2017 – via PRNewswire.

- "People's United Bank Completes Acquisition of LEAF Commercial Capital, Inc" (Press release). People's United Financial. July 31, 2017 – via PRNewswire.

- "People's United Bank is Selected to Manage Core Banking Services for the State of Vermont" (Press release). People's United Financial. August 15, 2017 – via PRNewswire.

- Gosselin, Kenneth R. "People's United CEO Says $544M Purchase Of Farmington Bank Signifies Confidence In Connecticut".

- Lockhart, Brian (November 27, 2017). "Developer promises late 2018 groundbreaking for Bridgeport theaters". Connecticut Post. Retrieved February 22, 2018.

External links

- Business data for People's United Financial, Inc.: