Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that provide deposit insurance to depositors in U.S. depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. The FDIC is a United States government corporation providing deposit insurance to depositors in U.S. commercial banks and savings banks.[2]:15 The FDIC was created by the 1933 Banking Act, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common.[2]:15[3] The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. Since the passage of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2011, the FDIC insures deposits in member banks up to US$250,000 per ownership category.[4]

| |

| |

| Agency overview | |

|---|---|

| Formed | June 16, 1933 |

| Jurisdiction | Federal government of the United States |

| Headquarters | Washington, D.C. |

| Employees | 5,538 (March 2020)[1] |

| Agency executives |

|

| Website | www.fdic.gov |

| This article is part of a series on |

| Banking in the United States |

|---|

|

United States portal |

The FDIC and its reserves are not funded by public funds; member banks' insurance dues are the FDIC's primary source of funding.[5] The FDIC also has a US$100 billion line of credit with the United States Department of the Treasury.[6]

As of September 2019, the FDIC provided deposit insurance at 5,256 institutions.[7] The FDIC also examines and supervises certain financial institutions for safety and soundness, performs certain consumer-protection functions, and manages receiverships of failed banks.

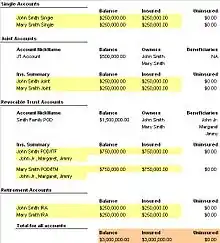

Ownership categories

Each ownership category of a depositor's money is insured separately up to the insurance limit, and separately at each bank. Thus a depositor with $250,000 in each of three ownership categories at each of two banks would have six different insurance limits of $250,000, for total insurance coverage of 6 × $250,000 = $1,500,000.[8] The distinct ownership categories are[8]

- Single accounts (accounts not falling into any other category)

- Certain retirement accounts (including Individual Retirement Accounts (IRAs))

- Joint accounts (accounts with more than one owner with equal rights to withdraw)

- Revocable trust accounts (containing the words "Payable on death", "In trust for", etc.)

- Irrevocable trust accounts

- Employee Benefit Plan accounts (deposits of a pension plan)

- Corporation/Partnership/Unincorporated Association accounts

- Government accounts

All amounts that a particular depositor has in accounts in any particular ownership category at a particular bank are added together and are insured up to $250,000.

For joint accounts, each co-owner is assumed (unless the account specifically states otherwise) to own the same fraction of the account as does each other co-owner (even though each co-owner may be eligible to withdraw all funds from the account). Thus if three people jointly own a $750,000 account, the entire account balance is insured because each depositor's $250,000 share of the account is insured.

The owner of a revocable trust account is generally insured up to $250,000 for each unique beneficiary (subject to special rules if there are more than five of them). Thus if there is a single owner of an account that is specified as in trust for (payable on death to, etc.) three different beneficiaries, the funds in the account are insured up to $750,000.

Former Chairmen

Walter J. Cummings September 11, 1933 - February 1, 1934

Leo Crowley February 1, 1934 - October 15, 1945

Preston Delano October 15, 1945 - January 5, 1946 (Acting)

Maple T. Harl January 5, 1946 - May 10, 1953

Henry E. Cook May 10, 1953 - September 6, 1957

Ray M. Gidney September 6, 1957 - September 17, 1957 (Acting)

Jesse P. Wolcott September 17, 1957 - January 20, 1961

Erle Cocke, Sr. January 20, 1961 - August 4, 1963

James J. Saxon August 4, 1963 - January 22, 1964 (Acting)

Joseph W. Barr January 22, 1964 - April 21, 1965

Kenneth A. Randall April 21, 1965 - March 9, 1970

William B. Camp March 9, 1970 - April 1, 1970 (Acting)

Frank Wille April 1, 1970 - March 16, 1976

James Smith March 16, 1976 - March 18, 1976 (Acting)

Robert E. Barnett March 18, 1976 - June 1, 1977

George A. LeMaistre June 1, 1977 - August 16, 1978

John G. Heimann August 16, 1978 - February 7, 1979 (Acting)

Irvine H. Sprague February 7, 1979 - August 2, 1981

William Isaac August 3, 1981 - October 21, 1985

L. William Seidman October 21, 1985 - October 16, 1991

Andrew C. Hove, Jr. October 17, 1991 - October 25, 1991 (Acting)

William Taylor October 25, 1991 - August 20, 1992

Andrew C. Hove, Jr. August 20, 1992 - October 7, 1994 (Acting)

Ricki R. Tigert October 7, 1994 - June 1, 1997

Andrew C. Hove, Jr. June 1, 1997 - May 26, 1998 (Acting)

Donna Tanoue May 26, 1998 - July 11, 2001

John N. Reich July 12, 2001 - August 29, 2001 (Acting)

Donald E. Powell August 29, 2001 - November 15, 2005

Martin J. Gruenberg November 16, 2005 - June 26, 2006 (Acting)

Sheila Bair June 26, 2006 - July 8, 2011

Martin J. Gruenberg July 9, 2011 - November 28, 2012 (Acting)

Martin J. Gruenberg November 29, 2012 - June 5, 2018

Board of directors

The Board of Directors of the FDIC is the governing body of the FDIC. The board is composed of five members, three appointed by the president of the United States with the consent of the United States Senate and two ex officio members. The three appointed members each serve six-year terms. No more than three members of the board may be of the same political affiliation. The president, with the consent of the Senate, also designates one of the appointed members as chairman of the board, to serve a five-year term, and one of the appointed members as vice chairman of the board. The two ex officio members are the Comptroller of the Currency and the director of the Consumer Financial Protection Bureau (CFPB).

As of March 2019, the members of the Board of Directors of the Federal Deposit Insurance Corporation were:

- Jelena McWilliams – Chairman of the Board

- Vacant – Vice Chairman

- Martin J. Gruenberg – Internal Director

- Brian P. Brooks – Acting Comptroller of the Currency

- Kathy Kraninger – Director, Consumer Financial Protection Bureau[9]

History

Panics of 1893 and 1907 and the Great Depression: 1893-1933

During the Panics of 1893 and 1907, many banks[note 1] filed bankruptcy due to bank runs caused by contagion. Both of the panics renewed discussion on deposit insurance. In 1893, William Jennings Bryan presented a bill to Congress proposing a national deposit insurance fund. No action was taken, as the legislature paid more attention to the agricultural depression at the time.[10]

After 1907, eight states established deposit insurance funds.[11] Due to the lax regulation of banks and the widespread inability of banks to branch, small, local unit banks—often with poor financial health—grew in numbers, especially in the western and southern states.[12] In 1921, there were about 31,000 banks in the US.[13] The Federal Reserve Act initially included a provision for nationwide deposit insurance, but it was removed from the bill by the House of Representatives. From 1893 to the FDIC's creation in 1933, 150 bills were submitted in Congress proposing deposit insurance.[14]

During the Great Depression there was widespread panic again over the American banking system due to fears over the strength of many banks; more than one-third of all U.S. banks were closed by bank runs.[3] Bank runs, sudden demands by large numbers of customers to withdraw all their funds at almost the same time, brought down many bank companies as depositors attempted to withdraw more money than the bank had available as cash. Small banks in rural areas were especially affected. Written and publicly announced reassurances and tightened regulations by the government failed to assuage depositors' fears.

Establishment of the FDIC: 1933

President Franklin D. Roosevelt himself was dubious about insuring bank deposits, saying, "We do not wish to make the United States Government liable for the mistakes and errors of individual banks, and put a premium on unsound banking in the future." But public support was overwhelmingly in favor, and the number of bank failures dropped to near zero.[15] On 16 June 1933, Roosevelt signed the 1933 Banking Act into law, creating the FDIC. The initial plan set by Congress in 1934 was to insure deposits up to $2,500 ($47,780 today)[16] adopting of a more generous, long-term plan after six months.[note 2] However, the latter plan was abandoned for an increase of the insurance limit to $5,000 ($95,560 today).[16][17]

The 1933 Banking Act:

- Established the FDIC as a temporary government corporation. The Banking Act of 1935 made the FDIC a permanent agency of the government and provided permanent deposit insurance maintained at the $5,000 level.

- Gave the FDIC authority to provide deposit insurance to banks

- Gave the FDIC the authority to regulate and supervise state non-member banks

- Funded the FDIC with initial loans of $289 million through the U.S. Treasury and the Federal Reserve, which were later paid back with interest

- Extended federal oversight to all commercial banks for the first time

- Separated commercial and investment banking (Glass–Steagall Act)

- Prohibited banks from paying interest on checking accounts

- Allowed national banks to branch statewide, if allowed by state law.

Historical insurance limits

The per-depositor insurance limit has increased over time to accommodate inflation.

- 1934 – $2,500

- 1935 – $5,000

- 1950 – $10,000

- 1966 – $15,000

- 1969 – $20,000

- 1974 – $40,000

- 1980 – $100,000

- 2008 – $250,000

Congress approved a temporary increase in the deposit insurance limit from $100,000 to $250,000, which was effective from October 3, 2008, through December 31, 2010. On May 20, 2009, the temporary increase was extended through December 31, 2013. The Dodd–Frank Wall Street Reform and Consumer Protection Act (P.L.111-203), which was signed into law on July 21, 2010, made the $250,000 insurance limit permanent.[18] In addition, the Federal Deposit Insurance Reform Act of 2005 (P.L.109-171) allows for the boards of the FDIC and the National Credit Union Administration (NCUA) to consider inflation and other factors every five years beginning in 2010 and, if warranted, to adjust the amounts under a specified formula.[19][20]

FDIC-insured institutions are permitted to display a sign stating the terms of its insurance — that is, the per-depositor limit and the guarantee of the United States government. The FDIC describes this sign as a symbol of confidence for depositors.[21] As part of a 1987 legislative enactment, Congress passed a measure stating "it is the sense of the Congress that it should reaffirm that deposits up to the statutorily prescribed amount in federally insured depository institutions are backed by the full faith and credit of the United States."[22]

S&L and bank crisis of the 1980s

Federal deposit insurance received its first large-scale test since the Great Depression in the late 1980s and early 1990s during the savings and loan crisis (which also affected commercial banks and savings banks).

The Federal Savings and Loan Insurance Corporation (FSLIC) had been created to insure deposits held by savings and loan institutions ("S&Ls", or "thrifts"). Because of a confluence of events, much of the S&L industry was insolvent, and many large banks were in trouble as well. FSLIC's reserves were insufficient to pay off the depositors of all of the failing thrifts, and fell into insolvency. FSLIC was abolished in August 1989 and replaced by the Resolution Trust Corporation (RTC). On December 31, 1995, the RTC was merged into the FDIC, and the FDIC became responsible for resolving failed thrifts. Supervision of thrifts became the responsibility of a new agency, the Office of Thrift Supervision (credit unions remained insured by the National Credit Union Administration). The primary legislative responses to the crisis were the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA), and the Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA). Federally chartered thrifts are now regulated by the Office of the Comptroller of the Currency (OCC), and state-chartered thrifts by the FDIC.

Final combined total for all direct and indirect losses of FSLIC and RTC resolutions was an estimated $152.9 billion. Of this total amount, U.S. taxpayer losses amounted to approximately $123.8 billion (81% of the total costs.)[23]

No taxpayer money was used to resolve FDIC-insured institutions.

2008

In 2008, twenty-five U.S. banks became insolvent and were closed by their respective chartering authorities.[24] The largest bank failure in terms of dollar value occurred on September 26, 2008, when Washington Mutual, with $307 billion in assets, experienced a 10-day bank run on its deposits.[25][26] Washington Mutual's collapse prompted a run on Wachovia, another large and troubled bank, as depositors drew their accounts below the $100,000 insurance limit. To avoid a panic and a drain on its insurance fund, the FDIC used exceptional authority to arrange a noncompetitive acquisition of Wachovia. It then established the Temporary Liquidity Guarantee Program (TLGP), which guaranteed deposits and unsecured debt instruments used for day-to-day payments. Congress temporarily raised the insurance limit to $250,000 to promote depositor confidence.

2009

On August 21, 2009, Guaranty Bank, in Texas, became insolvent and was taken over by BBVA Compass, the U.S. division of Banco Bilbao Vizcaya Argentaria, the second-largest bank in Spain. This was the first foreign company to buy a failed bank during the financial crisis. In addition, the FDIC agreed to share losses with BBVA on about $11 billion of Guaranty Bank's loans and other assets.[27] This transaction alone cost the FDIC Deposit Insurance Fund $3 billion.

At the end of the year, a total of 140 banks had become insolvent.[28] Although most of the failures were resolved through merger or acquisition, the FDIC's insurance fund was exhausted by late 2009. To continue meeting its obligations, it demanded three years of advance premiums from its members and operated the fund with a negative net balance.

2010 and beyond

In 2010, a new division within the FDIC, the Office of Complex Financial Institutions, was created to focus on the expanded responsibilities of the FDIC by the Dodd-Frank Act for the assessment of risk in the largest, systemically important financial institutions, or SIFIs.[29][30][31]

A total of 157 banks with approximately $92 billion in total assets failed during the year.[32] The Deposit Insurance Fund returned to a positive net balance near the start of 2011. The Dodd-Frank Act required the FDIC to increase it to 1.35% of total insured deposits, a goal that was reached in 2018. That year also saw no bank failures for the first time since the crisis.

Funds

Between 1989 and 2006, there were two separate FDIC funds – the Bank Insurance Fund (BIF), and the Savings Association Insurance Fund (SAIF). The latter was established after the savings and loans crisis of the 1980s. The existence of two separate funds for the same purpose led to banks' attempting to shift from one fund to another, depending on the benefits each could provide. In the 1990s, SAIF premiums were, at one point, five times higher than BIF premiums; several banks attempted to qualify for the BIF, with some merging with institutions qualified for the BIF to avoid the higher premiums of the SAIF. This drove up the BIF premiums as well, resulting in a situation where both funds were charging higher premiums than necessary.[33]

Then Chairman of the Federal Reserve Alan Greenspan was a critic of the system, saying, "We are, in effect, attempting to use government to enforce two different prices for the same item – namely, government-mandated deposit insurance. Such price differences only create efforts by market participants to arbitrage the difference." Greenspan proposed "to end this game and merge SAIF and BIF".[34] In February 2006, President George W. Bush signed into law the Federal Deposit Insurance Reform Act of 2005 (FDIRA). The FDIRA contains technical and conforming changes to implement deposit insurance reform, as well as a number of study and survey requirements. Among the highlights of this law was merging the Bank Insurance Fund and Savings Association Insurance Fund into a single fund, the Deposit Insurance Fund. This change was made effective March 31, 2006.

The FDIC maintains the insurance fund by assessing a premium on member institutions. The amount each institution is assessed is based both on the balance of insured deposits as well as on the degree of risk the institution poses to the fund. When the FDIC assumes control of a failed institution, it uses the insurance fund to pay depositors their insured balances. This results in a loss to the fund that must be replenished from the assets of the failed bank or from member bank premiums. In the event that the FDIC exhausts the insurance fund and cannot meet obligations with advances from member banks, it has a statutory $100 billion line of credit from the federal Treasury.

Insurance requirements

To receive this benefit, member banks must follow certain liquidity and reserve requirements. Banks are classified in five groups according to their risk-based capital ratio:

- Well capitalized: 10% or higher

- Adequately capitalized: 8% or higher

- Undercapitalized: less than 8%

- Significantly undercapitalized: less than 6%

- Critically undercapitalized: less than 2%

When a bank becomes undercapitalized, the institution's primary regulator issues a warning to the bank. When the number drops below 6%, the primary regulator can change management and force the bank to take other corrective action. When the bank becomes critically undercapitalized the chartering authority closes the institution and appoints the FDIC as receiver of the bank.

At Q4 2010, 884 banks had very low capital cushions against risk and were on the FDIC's "problem list".

Resolution of insolvent banks

Upon a determination that a bank is insolvent, its chartering authority—either a state banking department or the U.S. Office of the Comptroller of the Currency—closes it and appoints the FDIC as receiver. In its role as a receiver the FDIC is tasked with protecting the depositors and maximizing the recoveries for the creditors of the failed institution. The FDIC as receiver is functionally and legally separate from the FDIC acting in its corporate role as deposit insurer. Courts have long recognized these dual and separate capacities as having distinct rights, duties and obligations.

The goals of receivership are to market the assets of a failed institution, liquidate them, and distribute the proceeds to the institution's creditors. The FDIC as receiver succeeds to the rights, powers, and privileges of the institution and its stockholders, officers, and directors. It may collect all obligations and money due to the institution, preserve or liquidate its assets and property, and perform any other function of the institution consistent with its appointment. It also has the power to merge a failed institution with another insured depository institution and to transfer its assets and liabilities without the consent or approval of any other agency, court, or party with contractual rights. It may form a new institution, such as a bridge bank, to take over the assets and liabilities of the failed institution, or it may sell or pledge the assets of the failed institution to the FDIC in its corporate capacity.

The two most common ways for the FDIC to resolve a closed institution and fulfill its role as a receiver are:

- Purchase and Assumption Agreement (P&A), in which deposits (liabilities) are assumed by an open bank, which also purchases some or all of the failed bank's loans (assets). The bank's assets[35] that convey to the FDIC as receiver are sold and auctioned through various methods, including online, and using contractors.

- Deposit Payoff, as soon as the appropriate chartering authority closes the bank or thrift, the FDIC is appointed receiver. The FDIC as insurer pays all of the failed institution's depositors[36] with insured funds the full amount of their insured deposits. Depositors with uninsured funds and other general creditors (such as suppliers and service providers) of the failed institution do not receive either immediate or full reimbursement; instead, the FDIC as receiver issues them receivership certificates. A receivership certificate entitles its holder to a portion of the receiver's collections on the failed institution's assets.

In 1991, to comply with legislation, the FDIC amended its failure resolution procedures to decrease the costs to the deposit insurance funds. The procedures require the FDIC to choose the resolution alternative that is least costly to the deposit insurance fund of all possible methods for resolving the failed institution. Bids are submitted to the FDIC where they are reviewed and the least cost determination is made.

Covered Insured Depository Institutions Resolution Plans

To assist the FDIC in resolving an insolvent bank, the FDIC requires plans including the required submission of a resolution plan by covered institutions requirement under the Dodd Frank Act. In addition to the Bank Holding Company ("BHC") resolution plans required under the Dodd Frank Act under Section 165(d),[37] the FDIC requires a separate Covered Insured Depository Institution ("CIDI") resolution plan for US insured depositories with assets of $50 billion or more. Most of the largest, most complex BHCs are subject to both rules, requiring them to file a 165(d) resolution plan for the BHC that includes the BHC's core businesses and its most significant subsidiaries (i.e., "material entities"), as well as one or more CIDI plans depending on the number of US bank subsidiaries of the BHC that meet the $50 billion asset threshold.[38]

On December 17, the FDIC issued guidance for the 2015 resolution plans of CIDIs of large bank holding companies (BHCs).[39] The guidance provides clarity on the assumptions that are to be made in the CIDI resolution plans and what must be addressed and analyzed in the 2015 CIDI resolution plans including:[38]

- The assumption that the CIDI must fail.

- The cause of CIDI failure must be a core business loss or impairment.

- At least one "multiple acquirer strategy" is required in the plan.

- A deep level of granularity is expected in the plan.

- Sales strategies must be feasible and supported by considerable acquirer detail.

- A detailed financial and liquidity analysis is needed.

- Key legal issues must be considered.

- Resolution obstacles must be addressed.

- The CIDI must be insolvent at the start of resolution.

Insured products

FDIC deposit insurance covers deposit accounts, which, by the FDIC definition, include:

- demand deposits (checking accounts of a type that formerly could not legally pay interest), and negotiable order of withdrawal accounts (NOW accounts, i.e., savings accounts that have check-writing privileges)

- savings accounts and money market deposit accounts (MMDAs, i.e., higher-interest savings accounts subject to check-writing restrictions)

- time deposits including certificates of deposit (CDs)

- outstanding cashier's checks, interest checks, and other negotiable instruments drawn on the accounts of the bank

- accounts denominated in foreign currencies[40]

Accounts at different banks are insured separately. All branches of a bank are considered to form a single bank. Also, an Internet bank that is part of a brick and mortar bank is not considered to be a separate bank, even if the name differs. Non-US citizens are also covered by FDIC insurance as long as their deposits are in a domestic office of an FDIC-insured bank.[40]

The FDIC publishes a guide entitled "Your Insured Deposits",[41] which sets forth the general characteristics of FDIC deposit insurance, and addresses common questions asked by bank customers about deposit insurance.[42]

Items not insured

Only the above types of accounts are insured. Some types of uninsured products, even if purchased through a covered financial institution, are:[42]

- Stocks, bonds, and mutual funds including money funds

- The Securities Investor Protection Corporation, a separate institution chartered by Congress, provides protection against the loss of many types of such securities in the event of a brokerage failure, but not against losses on the investments.

- Further, as of September 19, 2008, the United States Treasury is offering an optional insurance program for money market funds, which guarantees the value of the assets.[43]

- Exceptions have occurred, such as the FDIC bailout of bondholders of Continental Illinois.

- Investments backed by the U.S. government, such as Treasury securities

- The contents of safe deposit boxes.

- Even though the word deposit appears in the name, under federal law a safe deposit box is not a deposit account – it is merely a secured storage space rented by an institution to a customer.

- Losses due to theft or fraud at the institution.

- These situations are often covered by special insurance policies that banking institutions buy from private insurance companies.

- Accounting errors.

- In these situations, there may be remedies for consumers under state contract law, the Uniform Commercial Code, and some federal regulations, depending on the type of transaction.

- Insurance and annuity products, such as life, auto and homeowner's insurance.

See also

- List of bank failures in the United States (2008–present)

- Banking Act of 1933

- Banking Act of 1935

- Canada Deposit Insurance Corporation (Canadian counterpart)

- Federal Deposit Insurance Reform Act

- Financial crisis of 2007-2010

- List of acquired or bankrupt United States banks in the late 2000s financial crisis

- List of largest U.S. bank failures

- Title 12 of the Code of Federal Regulations

- Too Big to Fail policy

- Volcker Rule

Related agencies and programs

- CAMELS Rating System – used by the FDIC's Division of Risk Management Supervision (RMS) examiners to rate each bank and the FDIC problem bank list

- FDIC Enterprise Architecture Framework

- National Credit Union Administration

- Temporary Liquidity Guarantee Program

Notes

- Around 491 commercial banks failed in 1893, and 243 between 1907 and 1908.[10]

- The latter plan was to insure all deposits up to $10,000 ($191,119), 75 percent of all deposits over $10,000 to $50,000 ($955,597), and 50 percent of anything over $50,000. Brackets indicate amount taking into account consumer price inflation from 1934.[16]

References

- http://www.fdic.gov/bank/statistical/stats/2012mar/fdic.html "Statistics At A Glance" Check

|archive-url=value (help). FDIC. Archived from the original on 27 June 2012. Retrieved 28 July 2020. - Van Loo, Rory (2018-08-01). "Regulatory Monitors: Policing Firms in the Compliance Era". Faculty Scholarship.

- Walter 2005, p. 39.

- "FDIC insurance limit of $250,000 is now permanent". Boston Globe.

- Bovenzi 2015, p. 69.

- Ellis, Diane. "Deposit Insurance Funding: Assuring Confidence" (PDF). fdic.gov.

- "Statistics at a Glance - December 31, 2018" (PDF). Federal Deposit Insurance Corporation. 2018-12-31. Archived (PDF) from the original on 2019-05-29.

- "FDIC: Understanding Deposit Insurance".

- "FDIC: Board of Directors & Senior Executives". Fdic.gov. Retrieved 2020-10-19.

- White 1981, p. 538.

- White 1981, pp. 537-538.

- White 1981, p. 539

- Walter 2005, p. 44.

- Golembe 1960, p. 188.

- Shaw 2015, p. 47.

- Federal Reserve Bank of Minneapolis. "Consumer Price Index (estimate) 1800–". Retrieved January 1, 2020.

- Golembe 1960, p. 193.

- "Changes in FDIC Deposit Insurance Coverage". fdic.gov. July 21, 2010. Archived from the original on November 22, 2010.

- "Reform of Deposit Insurance (including the adjustment to $250,000 and allowing for adjustments every five years)".

- "FDIC Interim rule" (PDF). gpo.gov.

- "FDIC: Symbol of Confidences".

- "4000 - Advisory Opinions: Full Faith and Credit of U.S. Government Behind the FDIC Deposit Insurance Fund". Retrieved 2009-01-16.

- "The Cost of the Savings and Loan Crisis" (PDF). Archived from the original (PDF) on 2008-10-29. Retrieved 2008-11-02.

- FDIC. "Failed Bank List". Retrieved 2009-06-27.

- Shen, Linda (2008-09-26). "WaMu's Bank Split From Holding Company, Sparing FDIC". Bloomberg. Archived from the original on 2012-10-23. Retrieved 2008-09-27.

- Dash, Eric (2008-04-07). "$5 Billion Said to Be Near for WaMu". The New York Times. Retrieved 2008-09-27.

- Barr, Colin (August 21, 2009). "Foreign banks can't save everyone". CNN. Archived from the original on October 2, 2009. Retrieved May 2, 2010.

- Dakin Campbell (2010-03-20). "Avanta Bank, Six other U.S. Banks Collapse Due to Bad Loans". Bloomberg. Retrieved 2010-03-19.

- James Wigand, the FDIC's Complexity Czar, By Yalman Onaran, Bloomberg Businessweek, October 13, 2011.

- FDIC Announces Organizational Changes to Help Implement Recently Enacted Regulatory Reform by Congress, FDIC press release, August 10, 2010.

- FDIC Creates Office of Complex Financial Institutions, by Steve Quinlivan, article at dodd-frank.com, private website, August 10, 2010.

- "Bank Failures in Brief: 2010". Retrieved 2019-05-22.

- Sicilia, David B. & Cruikshank, Jeffrey L. (2000). The Greenspan Effect, pp. 96–97. New York: McGraw-Hill. ISBN 0-07-134919-7.

- Sicilia & Cruikshank, pp. 97–98.

- "FDIC: Institution & Asset Sales". www.fdic.gov.

- "Archived copy" (PDF). Archived from the original (PDF) on 2013-03-17. Retrieved 2013-01-25.CS1 maint: archived copy as title (link)

- "First take: Resolution plan guidance to largest firms".

- "First take: Ten key points from the FDIC's resolution plan guidance" (PDF). PwC Financial Services Regulatory Practice, December, 2014.

- "Guidance for Covered Insured Depository Institution Resolution Plan Submissions" (PDF). PwC Financial Services Regulatory Practice, December, 2014.

- "FDIC Law, Regulations, Related Acts – Rules and Regulations". Fdic.gov. Retrieved 2011-09-15.

- fdic.gov Archived December 10, 2007, at the Wayback Machine

- "FDIC: Insured or Not Insured?". Fdic.gov. Retrieved 2011-09-15.

- Henriques, Diana B. (2008-09-19). "Treasury to Guarantee Money Market Funds". The New York Times. Retrieved 2008-09-20.

Bibliography

- Bovenzi, John (2015). Inside the FDIC: Thirty Years of Bank Failures, Bailouts, and Regulatory Battles. New York: John Wiley & Sons. ISBN 978-1-118-99408-5.

- Golembe, Carter, H. (1960). "The Deposit Insurance Legislation of 1933: An Examination of Its Antecedents and Its Purposes". Political Science Quarterly. 75 (2): 181–200. doi:10.2307/2146154. JSTOR 2146154.

- Shaw, Christopher (2015). "'The Man in the Street Is for It': The Road to the FDIC". Journal of Policy History. 27 (1): 36–60. doi:10.1017/S0898030614000359. S2CID 154303860.

- Walter, John (2005). "Depression-Era Bank Failures: The Great Contagion or the Great Shakeout?". Economic Quarterly. 91 (1). SSRN 2185582.

- White, Eugene, N. (1981). "State-Sponsored Insurance of Bank Deposits in the United States, 1907–1929". The Journal of Economic History. 41 (3): 537–557. doi:10.1017/S0022050700044326.

Further reading

- "Your Bank Has Failed: What Happens Next?"—60 Minutes

- Kaufman, George G. (2002). "Deposit Insurance". In David R. Henderson (ed.). Concise Encyclopedia of Economics (1st ed.). Library of Economics and Liberty. OCLC 317650570.

- History including Boards of Directors

- "Federal Deposit Insurance for Banks and Credit Unions"—Congressional Research Service

External links

| Wikimedia Commons has media related to Federal Deposit Insurance Corporation. |