Plug-in electric vehicles in California

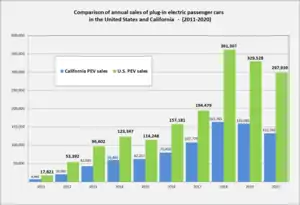

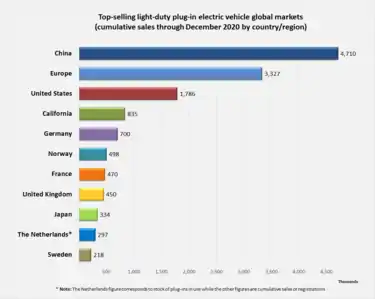

The stock of plug-in electric vehicles in California is the largest in the United States, with cumulative sales of almost 835,000 plug-in cars by the end of 2020.[1][2] California is the largest U.S. car market with about 10% of all new car sales in the country,[3] but has accounted for almost half of all plug-in cars sold in the American market since 2011.[2][4] Since November 2016, China is the only country market that exceeds California in terms of cumulative plug-in electric car sales.[5]

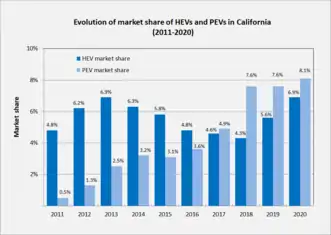

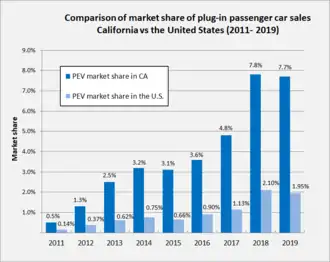

California's plug-in car market share reached 4.8% in 2017, while the national share was 1.1%. Also in 2017, the state's plug-in segment market share surpassed the take-rate of conventional hybrids (4.6%) for the first time.[6][7][8] The plug-in market share rose to 7.8% in 2018, again ahead of conventional hybrids (4.2%), and for the first time sales of all-electric cars outsold conventional hybrids.[9][10] The plug-in market share slightly declined in 2019 to 7.7%, while the take-rate of conventional hybrids rose to 5.5%.[11]

The Government of California has been actively supporting the adoption of plug-in electric vehicles (PEVs), and zero-emission vehicles in general, and has in place several financial and non-financial incentives to increase their market penetration. The Governor of California, Jerry Brown, issued an executive order in March 2012 that established the goal of getting 1.5 million zero-emission vehicles (ZEVs) on California roads by 2025.[12][13][14] In January 2018, Governor Brown set a new goal of getting a total of 5 million zero-emission vehicles in California by 2030.[8]

As part of the state's government incentives, in addition to the existing federal tax credit, plug-in electric vehicles (PEVs) and fuel cell electric vehicles (FCV) are eligible for a purchase rebate of up to US$2,500 through the Clean Vehicle Rebate Project (CVRP).[15][16] Also applicants that purchase or lease battery electric vehicles or a plug-in hybrid meeting California's Enhanced Advanced Technology Partial Zero Emission Vehicle (Enhanced AT PZEV) are entitled to a clean air sticker that allows the vehicle to be operated by a single occupant in California's carpool or high-occupancy vehicle lanes (HOV) up until January 1, 2019.[17][18]

Government mandate and support

ZEV regulation

California's zero-emission vehicles (ZEVs) regulation was first adopted in 1990 as part of the Low Emission Vehicle Program, and it has been modified several times over the years. The ZEV program is under the responsibility of the California Air Resources Board (CARB).[19] The program goal is to reduce the pervasive air pollution affecting the main metropolitan areas in the state, particularly in Los Angeles, where prolonged pollution episodes are frequent.[20] At the time, California's poor air quality was worse than the other 49 states combined.[21]

_cropped.jpg.webp)

The first ruling was the 1990 Low-Emission Vehicle (LEV I) Program.[20][22] CARB ruled that each of the U.S.'s seven largest carmakers— the largest of which was General Motors —would be required to make 2% of its fleet emission-free by 1998, 5% by 2001, and 10% by 2003, in accordance with consumer demand, in order to continue to sell cars in California.[23] Other members of what was then the American Automobile Manufacturers Association, along with Toyota, Nissan and Honda,[24] each also developed a prototype electric car in response to the new mandate: the General Motors EV1 (1996-2003), Toyota RAV4 EV (1997-2003), Honda EV Plus (1997-1999), Nissan Altra (1998-2001), Chrysler TEVan (1993-1995), Dodge Caravan EPIC (1999 to 2001), and Ford TH!NK City (1999-2003).

As the carmakers leasing electric cars believed that these vehicles occupied an unprofitable niche of the automobile market, an alliance of the major automakers litigated the CARB regulation in court, resulting in a slackening of the ZEV stipulation, permitting the companies to produce super-low-emissions vehicles, natural gas vehicles, and hybrid cars in place of pure electrics. Production was subsequently discontinued in 2002, and, with the exception of Toyota, all of the cars on the road were repossessed. Lessees were not given the option to purchase their cars.[25]

The ZEV regulation has evolved and been modified several times since 1990, and several new partial or low-emission categories were created.[22][26][27] The Low-Emission Vehicle Program was revised in 2008 to define modified ZEV regulations for 2015 models.[22][28][29] CARB estimates the ZEV program will result in 15% ZEV sales by 2025.[30][31]

Government goals

Governor Jerry Brown issued an executive order in March 2012 that established the goal of getting 1.5 million zero-emission vehicles (ZEVs) in California by 2025.[12][13] In addition, in September 2014, Governor Brown signed into law bill SB 1275 that created the Charge Ahead California Initiative, and set the goal of placing at least 1 million zero-emission vehicles and near-zero-emission vehicles on the road in California by January 1, 2023. He expects the initiative will help the state to reach the initial goal set for 2025.[13][32]

In January 2018, Governor Brown set a new goal of getting a total of 5 million zero-emission vehicles in California by 2030. As of September 2017, there were 337,483 zero-emission vehicles sold in California.[8]

Local initiatives

San Francisco Mayor Gavin Newsom, San Jose Mayor Chuck Reed and Oakland, California Mayor Ron Dellums announced a nine-step policy plan for transforming the Bay Area into the "Electric Vehicle (EV) Capital of the U.S."[33] and of the world.[34]

There are partnerships with Coulomb Technologies, Better Place, City Carshare,[35] Zipcar and others are also advancing. The first charging stations went up in San Jose.[34]

By early 2010, San Francisco and other cities in the San Francisco Bay Area and Silicon Valley, as well as some local private firms such as Google and Adobe Systems, already have deployed charging stations and have expansion plans to attend both plug-ins and all-electric cars.[36]

Electric utilities

- PG&E

PG&E is converting a number of company-owned Toyota Prius to be V2G PHEVs at Google's campus.

- Southern California Edison

Ford Motor Company CEO Alan Mulally said he expected Ford to sell plug-in hybrids in five to ten years, the launch date depending on advances in lithium-ion battery technology. Ford will provided Southern California Edison with 20 Ford Escape Hybrid sport utility vehicles reconfigured to work as plug-ins by 2009, with the first by the end of 2007.[37]

PHEV Research Center

The PHEV Research Center in the University of California, Davis, administered by ITS-Davis, was launched in 2007 with fundings from the California Air Resources Board and the California Energy Commission’s Public Interest Energy Research (PIER) Program. Its goals are to provide technology and policy guidance to the state, and to help solve research questions and address commercialization issues for PHEVs.

CalCars

CalCars (also known as The California Cars Initiative) was a charitable, non-profit organization founded in 2002 to promote plug-in hybrid electric vehicles (PHEVs) as a key to addressing global warming both nationally and internationally. CalCars envisions millions of plug-in hybrid electric vehicles, charged by off-peak electricity from renewable energy sources, and with their internal combustion engines powered by low-carbon alternative fuels, as a way to significantly reduce greenhouse gases that come from transportation. CalCars was active until 2010, when the first mass-produced PHEVs arrived.

In September 2004, the California Cars Initiative (CalCars) converted a 2004 Toyota Prius into a prototype of what it called the PRIUS+. With the addition of 130 kg (300 lb) of lead-acid batteries, the PRIUS+ achieved roughly double the fuel economy of a standard Prius and could make trips of up to 15 km (9 mi) using only electric power. The vehicle, which is owned by CalCars technical lead Ron Gremban, is used in daily driving, as well as a test bed for various improvements to the system.[38]

RechargeIT

RechargeIT is an effort within Google.org, the charitable arm of Google, that aims to reduce CO2 emissions, cut oil use, and stabilize the electrical grid by accelerating the adoption of plug-in electric vehicles.[39]

The program began in 2007, and by 2010 Google's Mountain View campus has 100 available charging stations for its share-use fleet of converted plug-ins available to its employees through a free car-sharing program.[36][40] Solar panels are used to generate the electricity, and this pilot program is being monitored on a daily basis and performance results are published in RechargeIT website.[40] In addition to the data collected for two years when the converted plug-ins were driven by Google employees, RechargeIT set up a controlled test using plug-in converted Ford Escape Hybrids and Toyota Prius. The results of the seven-week driving experiment showed an average fuel economy of 93 mpg average across all trips, and 115 mpg for city trips.[39][40] Consistently the converted Prius obtained a higher mileage than the Ford Escape.[40]

Government incentives

California has been a leader in the adoption of plug-in electric vehicles as the state has in place several financial and non-financial incentives. In addition to the existing federal tax credit, plug-in cars are eligible for a purchase rebate of up to US$2,500 through the Clean Vehicle Rebate Project (CVRP).[15] Also, battery electric vehicles and initially, the first 40,000 applicants that purchase or lease a plug-in hybrid meeting California's Enhanced Advanced Technology Partial Zero Emission Vehicle (Enhanced AT PZEV), are entitled to a clean air sticker that allows the vehicle to be operated by a single occupant in California's carpool or high-occupancy vehicle lanes (HOV). The white access sticker is reserved for zero-emissions vehicles, while plug-in hybrids use the green sticker.[41]

HOV access

In California a vehicle that meets specified emissions standards may be issued Clean Air Vehicle (CAV) decals that allow the vehicle to be operated by a single occupant in California's high-occupancy vehicle lanes (HOV), or carpool or diamond lanes. Battery electric vehicles and initially, the first 40,000 applicants that purchase or lease a plug-in hybrid meeting California's Enhanced Advanced Technology Partial Zero Emission Vehicle (Enhanced AT PZEV) or Transitional Zero-Emission Vehicle (TZEV) requirements, are entitled to a clean air sticker that allows the vehicle to be operated by a single occupant in California's carpool or high-occupancy vehicle lanes (HOV). The white access sticker is reserved for zero-emissions vehicles, while plug-in hybrids use the green sticker.[41]

Initially, the green and white clean air sticker were set to expire on January 1, 2015, but in 2013 the expiration date for both stickers was extended to January 1, 2019.[17][42] All-electric vehicles are classified as Federal Inherently Low Emission Vehicles (ILEVs), and as zero emissions vehicles are entitled to an unlimited number of white CAV stickers. The number of green stickers available has been increased several times.[41][32][43] In September 2016, the limit imposed to the Green Clean Air Vehicle Decal was removed.[18]

The number of green clean air stickers issued grew from about 10,900 in March 2013 to 28,739 by the end of 2013.[44] As a result, by mid March 2014 the California Department of Motor Vehicles (DMV) suspended the program allowing new car dealers to purchase and install green CAV stickers on eligible vehicles before they are sold. The DMV decided to reserve all remaining green stickers from the original 40,000 limit for individual consumer applications.[45] As of 9 May 2014, the initial 40,000 green stickers were issued.[17]

The San Francisco Bay Area Metropolitan Transportation Commission opposed the 2014 bill to expand the green stickers on the grounds that they "are concerned about further erosion of HOV lane capacity to vehicles that are neither reducing the number of trips on the road nor paying a toll. With congestion levels shooting up again, especially in the prosperous South Bay of the region where the purchase of such vehicles is more likely, we do not believe it is appropriate to give access to the region’s HOV lanes or express lanes away for free."[46]

The green sticker limit was increased by 15,000 beginning July 1, 2014, through the budget trailer bill SB 853.[17][47] In September 2014 Governor Jerry Brown signed the bill AB 2013 that raised the cap for the green stickers from 55,000 to 70,000 new plug-in hybrids.[32] As of June 2015, a total of 68,343 green stickers had been issued by the California Department of Motor Vehicles (DMV).[17] In June 2015, the bill AB 95 was approved by the State Legislature raising the upper limit from 70,000 to 85,000 green stickers.[48] By December 2015, the 85,000 limited was reached. The DMV continued to accept applications without payment to establish a queue for requesters should an additional amount of green decals be authorized.[49] In September 2016, the budget trailer bill SB-838, effective from September 13, 2016, removed the limit imposed to the Green Clean Air Vehicle Decal.[18]

Research performed by the UCLA Luskin Center for Innovation in 2015 found that access to HOV lanes has a significant impact on plug-in car sales. Researchers linked automobile sales to a sample of more than 7,000 of the 8,057 census tracts in California for the study, including Los Angeles, Sacramento, San Diego and San Francisco. They looked at the number of plug-in car sales and the miles of carpool lanes within a 30 mi (48 km) radius of each census tract. The study concluded that the ability to use potentially time-saving HOV lanes prompted the purchase of more than 24,000 plug-in electric cars and hybrids in the four urban areas from 2010 to 2013, or about 40% of the total of such vehicles. The UCLA researcher concluded that without the policy giving plug-in vehicles access to HOV lanes, total plug-in sales in the same study areas would have been only 36,692 for the three-year period.[50]

As part of a package of bills signed into law by Governor Brown in September 2014, through SB 1275 the California Air Resources Board was mandated to draft a financial plan to meet California's goal of 1 million vehicles on the road while making sure that disadvantaged communities can participate. For this purpose CARB has to change the Clean Vehicle Rebate program to provide an extra credit for low-income residents who wish to purchase or lease an electric car. CARB also should provide assistance to carsharing programs in low-income neighborhoods and install charging stations in apartment buildings in those communities. Under SB 1275, low-income residents who agree to scrap older, polluting cars will also get a clean vehicle rebate on top of existing payments for junking smog-producing vehicles.[13][32]

Another bill signed into law in September 2014, AB1721, grants clean air vehicles free or reduced rates in high-occupancy toll lanes (HOT) lanes. Drivers of clean vehicles already enjoyed discounted rates in some facilities, such the toll to cross the San Francisco Bay Area bridges and to use the State Route 91 Express Lanes in Orange and Riverside Counties.[13][51]

Clean Vehicle Rebate Project

In addition to the federal tax credit of up to US$7,500 depending on battery size,[52] California established the Clean Vehicle Rebate Project (CVRP) in order to promote the production and use of zero-emission vehicles (ZEVs), including plug-in electric and fuel cell vehicles. The program was created from Assembly Bill 118 that was signed by Governor Schwarzenegger in October 2007. The funding is provided on a first-come, first-served basis, and the project is expected to go through 2015.[53]

Eligible vehicles include only new California Air Resources Board-certified or approved zero-emission or plug-in hybrid electric vehicles. A list of eligible vehicles can be found on the California Center for Sustainable Energy web site.[54] Among the eligible vehicles are neighborhood electric vehicles, battery electric, plug-in hybrid electric, and fuel cell vehicles including cars, trucks, medium- and heavy-duty commercial vehicles, and zero-emission motorcycles. Vehicles must be purchased or leased on or after March 15, 2010.[53][55] Initially, the CVRP offered rebates of up to US$5,000 per light-duty vehicle, available for individuals and business owners who purchase or lease new eligible vehicles.[53][55] Once the initial funding was exhausted, the program offered a lower rebate of up to US$2,500.[15]

As of March 2014, the following six plug-in hybrids are eligible for a US$1,500 rebate in California: Cadillac ELR, Chevrolet Volt, Ford C-Max Energi, Ford Fusion Energi, Honda Accord Plug-in Hybrid, and Toyota Prius Plug-in Hybrid.[16] Only 2012 Volts manufactured after February 6, 2012, and later model year, are fitted with the low emission package that qualifies the plug-in hybrid as qualify as a California AT-PZEV.[56]

As of early March 2013, the California Air Resources Board (CARB) reported that 9,559 all-electric vehicle and 8,842 plug-in hybrid owners had applied for the state's Clean Vehicle Rebate since January 2011. However, about 2,300 Chevrolet Volts were sold in California before the Volt became eligible for the rebate in February 2012, and therefore, are not accounted in the CVRP database. According to these figures plug-in hybrid electric vehicles were outselling pure electric vehicles in California by early 2013.[57][58]

As of 10 March 2014, a total of 52,264 clean vehicle rebates had been issued, for a total of US$110,222,866 disbursed, with only US$3.8 million remaining for fiscal year 2013-2014. The distribution of the rebates issued correspond to 27,210 zero-emission vehicles (ZEVs), including both battery electric vehicles (BEVs) and fuel cell vehicles (FCVs); 24,657 plug-in hybrids (PHEVs); 49 commercial zero-emission vehicles (CZEVs); 210 zero-emission motorcycles (ZEMs); and 138 neighborhood electric vehicles (NEVs). Not all plug-in electric vehicles sold in California are captured in the CVRP database because not every PEV owner applies for the rebate. As of 8 June 2015, and without accounting for the 2,300 Volts sold before February 2012, plug-in hybrids represented 42.5% of the 107,855 clean vehicle rebates issued, while BEVs represented 56.9% of all rebates, and fuel cell vehicles represented 0.1% of the rebates issued. In terms of funding, plug-in hybrids have captured 30.1% of the total US$227,972,074 funded by early June 2015.[59]

As of April 2014, the CVRP was facing an estimated US$30 million funding shortfall for the 2013-14 fiscal year, and uncertainty about increases for the 2014-15 fiscal year. CARB staff presented a proposal to the board to overcome the funding shortage and also to facilitate the rebates to benefit buyers in disadvantaged communities who live in areas with bad air quality or who can't afford high-end electric cars. The options being considered were to reduce the rebate by US$500 and to set a US$60,000 cap to the manufacturer's suggested retail price of the vehicles, which would exclude the Cadillac ELR and the Tesla Model S from benefiting from the rebate.[61] A bill signed into law in September 2014, mandated the California Air Resources Board to draft a financial plan to meet California's goal of putting 1 million vehicles on the road while making sure that disadvantaged communities can participate. For this purpose CARB has to change the Clean Vehicle Rebate program to provide an extra credit for low-income drivers who wish to purchase or lease an electric car. CARB also should provide assistance to carsharing programs in low-income neighborhoods and install charging stations in apartment buildings in those communities. Under bill SB 1275, low-income residents who agree to scrap older, polluting cars will also get a clean vehicle rebate on top of existing payments for junking smog-producing vehicles.[32]

The Clean Vehicle Rebate Project (CVRP) notes their figures do not capture all plug-in electric vehicles sold in California because not every PEV owner applies for the rebate. Also, about 2,300 Chevrolet Volts were sold in California before the Volt became eligible for the rebate in February 2012, and therefore, these sales are not accounted in the CVRP database. In terms of market share, plug-in hybrids represented 47.2% of all clean vehicle rebates, while ZEVs, predominantly all-electric cars, represented 52.11% of all rebates issued since January 2011 through early March 2014. Accounting for sales of the 2,300 Volts, the distribution becomes 49.9% for ZEVs and 49.4% for PHEVs.[62] According to the Center for Sustainable Energy, the following are the top five brands receiving the rebates between 2010 and 2015: Chevrolet (21%), Nissan (20%), Tesla Motors (15%), Toyota (14%), and Ford Motor Company (12%).[63]

The following table presents the geographical distribution of the rebates by county and by type of vehicle (ZEV or PHEV) for the top 15 counties, which together represent 93% of all rebates issued by early March 2014.[62] Based on the CVRP database, Southern California is the leading region in plug-in electric vehicle adoption, with over 28,500 rebates issued for PEVs, while the San Francisco Bay Area has benefited with more than 18,300 rebates. Southern California has captured 54.7% of all rebated issued. The top five counties in the state by early March 2014 are Los Angeles (14,420), Santa Clara (7,735), Orange (6,182), San Diego (4,659), and Alameda (3,870). In Southern California plug-in hybrids (15,201) are outselling all-electric cars (13,200), while in the Bay Area electric cars (10,992) are outselling plug-in hybrids (7,249).[62]

| California Clean Vehicle Rebate Project (CVRP) beneficiaries by county with over 500 rebates issued as of 10 March 2014[62] | |||||

|---|---|---|---|---|---|

| County | Total rebates(1) | ZEVs (BEV/FCV) | PHEVs(2) | Rebate funding | % State |

| Top counties Southern California | |||||

| Los Angeles | 14,420 | 6,277 | 8,015 | $29,117,973 | 27.6% |

| Orange | 6,182 | 2,537 | 3,622 | $12,109,099 | 11.8% |

| San Diego | 4,659 | 3,060 | 1,563 | $10,827,189 | 8.9% |

| Riverside | 1,308 | 501 | 804 | $2,512,933 | 2.5% |

| Ventura | 1,083 | 488 | 593 | $2,214,494 | 2.1% |

| San Bernardino | 943 | 337 | 604 | $1,780,950 | 1.8% |

| Top counties SoCal | 28,595 | 13,200 | 15,201 | $58,562,638 | 54.7% |

| Top counties San Francisco Bay Area | |||||

| Santa Clara | 7,735 | 4,630 | 3,080 | $16,957,252 | 14.8% |

| Alameda | 3,870 | 2,291 | 1,552 | $8,354,469 | 7.4% |

| San Mateo | 2,123 | 1,419 | 657 | $4,865,466 | 4.1% |

| Contra Costa | 1,951 | 985 | 959 | $4,027,554 | 3.7% |

| San Francisco | 1,082 | 681 | 371 | $2,557,025 | 2.1% |

| Marin | 845 | 536 | 305 | $1,907,300 | 1.6% |

| Sonoma | 781 | 450 | 325 | $1,695,800 | 1.5% |

| Top counties Bay Area | 18,387 | 10,992 | 7,249 | $40,364,866 | 35.2% |

| Other top counties | |||||

| Sacramento | 1,062 | 634 | 427 | $2,272,609 | 2.0% |

| Santa Cruz | 542 | 330 | 204 | $1,193,900 | 1.0% |

| Total Top 15 counties | 48,586 | 25,156 | 23,081 | $102,394,013 | 93.0% |

| Total California(3) | 52,264 | 27,210 | 24,657 | $110,222,866 | 100% |

| Notes: (1) Total includes ZEVs (both BEVs and FCVs), PHEVs, CZEVs, ZEMs and NEVs. (2) About 2,300 Chevrolet Volts sold in California before the car became eligible for the rebate in February 2012 are not included. (3) Not all plug-in electric vehicles sold in California are captured in the CVRP database as not every PEV owner applies for the rebate. | |||||

In July 2015 California began analyzing to add income-based caps to its plug-in car rebate system. From data gathered through June 2015, it appears higher-income buyers are getting the majority of California rebates. A survey from the second quarter of 2015 showed that about three quarters of rebates went to households earning more than US$99,000 a year. Those with incomes above US$200,000 a year accounted for 26% of total rebates, while those with income under US$99,000 represented 27%. This policy change is expected to primarily affect Tesla Motors, whose lineup starts at US$75,000.[64]

In March 2016 California added income-based caps to its rebate system. Buyers with incomes less than 300% of the Federal poverty level will get up to US$3,000 for a plug-in hybrid, US$4,000 for an all-electric car, and US$6,500 for a hydrogen fuel-cell car and the rebate scales down until Californian buyers with incomes over US$250,000 are no longer are eligible for incentives on hybrids or electric cars, however can get US$5,000 for a hydrogen fuel-cell car .[64] As of March 2016, the Center for Sustainable Energy has issued more than $291 million in the CVRP for over 137,200 vehicles since 2010.[65] The income-base caps went into effect on 1 November 2016. Residents will not be eligible for rebates if their gross annual income exceeds US$150,000 for single tax filers, US$204,000 for head of household filers and US$300,000 for joint filers. These limits do not apply to the purchase of fuel cell electric vehicles, which represent less than 1% of rebate applications.[66][67]

Charging infrastructure

- Public access

As of March 2013, the United States had 5,678 charging stations across the country, a third of which were located in the three westernmost continental states. Deployments are led by California with 1,207 stations (21.3%), Texas with 432 stations (7.6%), Florida with 352 (6.2%), Washington with 326 (5.7%), and Oregon with 310 stations (5.5%).[68] As of October 2013, there were 378 DC quick charging stations across the country.[69] As of 21 January 2014, the United States had 21,548 public charging points available across the country, with California leading with 5,749 charging points (26.7%), followed by Texas with 1,704 (7.9%), Washington state with 1,412 (6.6%), and Florida with 1,064 (4.9%).[70]

- Private access

AB 2565 facilitates access to charging stations by requiring commercial and residential property owners to approve installation if the charging station meets requirements and complies with the owner's process for approving a modification to the property. The law makes a term in a lease of a commercial property, executed, renewed, or extended on or after 1 January 2015, void and unenforceable if it prohibits or unreasonably restricts the installation of an electric vehicle charging station in a parking space.[13][51][71]

Market outlook

Sales and market share

As of December 2020, cumulative registrations of plug-in electric passenger cars totaled 834,518 units, making California the leading plug-in market in the U.S.[1][11][9][2][75] While the state represents about 10% of nationwide new car sales,[3] California has accounted for almost half of cumulative plug-in sales in the American market.[2][76] Plug-in electric cars represented about 0.5% of the passenger fleet on California's roads by September 2015.[77]

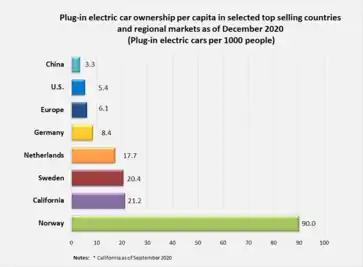

Until December 2014 California not only had more plug-in electric vehicles than any other American state but also more than any other country in the world.[78][79] In 2015 only two countries, Norway (22.4%) and the Netherlands (9.7%), achieved a higher plug-in market share than California.[80] Sales of plug-in electric cars in the state passed the 200,000 unit milestone in March 2016.[4] By November 2016, with about 250,000 plug-in cars sold in the state since 2010, China was the only country market that exceeded California in cumulative plug-in electric car sales.[5] Cumulative plug-in car registrations achieved the 500,000 unit milestone by the end of November 2018.[2]

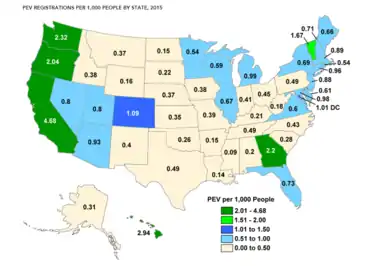

Annual registrations of plug-in electric vehicles in California increased from 6,964 units in 2011 to 20,093 in 2012, and reached 42,545 units in 2013.[72] In 2014, California's plug-in car market share reached 3.2% of total new car sales in the state, up from 2.5% in 2013, while the national plug-in market share in 2014 was 0.71%.[75] The state's plug-in market share fell to 3.1% in 2015, with the plug-in hybrid segment dropping from 1.6% in 2014 to 1.4%, while the all-electric segment increased to 1.7% from 1.6% in 2014.[72] Still, California's market share was 4.7 times higher than the U.S. market (0.66%), and registrations of plug-in electric cars in the state in 2015 represented 54.5% of total plug-in car sales in the U.S. that year.[80]

California's plug-in car market share rose to 3.5% of new car sales in 2016, while the U.S. take-rate was 0.90%.[81][82] In 2017, California's plug-in market share reached 4.8%, while the national share was 1.13%.[6][7][8] Also in 2017, the state's plug-in segment market share surpassed the take-rate of conventional hybrids (4.6%) for the first time.[7][83]

The plug-in market share rose to 7.8% in 2018, again ahead of conventional hybrids (4.2%), with the all-electric segment reaching for the first time a higher share than conventional hybrids.[9][10] In addition, the combined market share of pure electrics and plug-in hybrids surpassed the maximum share ever achieved by conventional hybrids, 6.9% in 2013.[9] The electrified segment attained a record 11.9% market share, passing the 10% mark for the first time.[9] The combined take-rate of plug-in cars in California slightly declined to 7.7% in 2019, while the market share of conventional hybrids rose to 5.5% from 4.2% in 2018. While the share of all electric cars rose to 5.3%, the rate of plug-in hybrids fell to 2.4% from 3.1% in 2018.[11]

The following table presents annual registrations and market share of new car sales for all-electric and plug-in hybrids sold in California between 2010 and 2019.

| Year | California[11][9][75] | U.S.[6][84][80][74][85][86][87][88][89] | CA share of U.S. PEV sales(3) | Ratio CA/US market shares | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| All-electric | BEV market share(1) | Plug-in hybrid | PHEV market share(1) | Total PEV California | PEV market share(1) | Total PEV sales | PEV market share(2) | |||||

| 2010 | 300 | 0.0% | 97 | 0.0% | 397 | 0.0% | 397 | 0.003% | 100% | - | ||

| 2011 | 5,302 | 0.4% | 1,662 | 0.1% | 6,964 | 0.5% | 17,821 | 0.14% | 39.1% | 3.57 | ||

| 2012 | 5,990 | 0.4% | 14,103 | 0.9% | 20,093 | 1.3% | 53,392 | 0.37% | 37.6% | 3.51 | ||

| 2013 | 21,912 | 1.3% | 20,633 | 1.2% | 42,545 | 2.5% | 96,602 | 0.62% | 44.0% | 4.03 | ||

| 2014 | 29,536 | 1.6% | 29,949 | 1.6% | 59,485 | 3.2% | 123,347 | 0.71% | 48.2% | 4.27 | ||

| 2015 | 34,477 | 1.7% | 27,740 | 1.4% | 62,217 | 3.1% | 114,248 | 0.66% | 54.5% | 4.70 | ||

| 2016 | 40,347 | 1.9% | 34,727 | 1.7% | 75,074 | 3.6% | 157,181 | 0.90% | 47.8% | 4.00 | ||

| 2017 | 53,500 | 2.6% | 45,040 | 2.2% | 98,540 | 4.8% | 194,479 | 1.13% | 50.7% | 4.23 | ||

| 2018 | 94,801 | 4.7% | 62,847 | 3.1% | 157,648 | 7.8% | 361,307 | 2.10% | 43.6% | 3.71 | ||

| 2019 | 99,704 | 5.3% | 46,160 | 2.4% | 145,864 | 7.7% | 329,528 | 1.95% | 44.3% | 3.96 | ||

| Total | 385,869 | n.a. | 282,958 | n.a. | 668,827 | n.a. | 1,448,250 | n.a. | 46.2% | n.a. | ||

| Notes: (1) Market share of total new car registrations in California. (2) U.S. market share of total nationwide sales. (3) California's market share of total nationwide registrations. | ||||||||||||

- Sales by model

California was the leading Volt market and accounted for almost 23% of Volt sales during the second quarter of 2012, followed by Michigan with 6.3% of national sales. The leading regional markets in California were San Francisco, Los Angeles, and San Diego, all metropolitan areas notorious for their high congestion levels and where free access to high-occupancy lanes for solo drivers has been a strong incentive to boost Volt sales in the state.[90] As of November 2011 over 60% of the Leafs sold in the U.S. were bought in California.[91] San Francisco-Oakland-San Jose, Los Angeles, San Diego and Sacramento were among the top selling markets for Leaf sales during the first eight months of 2013. Nissan noted that in San Francisco the Leaf is among the ten top selling vehicles regardless of powertrain.[92]

California is the largest American market for the Tesla Model S.[93] In March 2013, Tesla Motors reported the delivery of the 3,000th Model S in California, representing around 50% of total Model S sales in the U.S.[94][95] As of November 2013, with the Model S available nationwide, California continued to lead U.S. sales with a 48% share of national sales.[96] The Model S, with 8,347 units sold, ended 2013 as the third best selling luxury car in California after the Mercedes-Benz E-Class and BMW 5 Series sedans,[97] and captured a 9.8% market share of the Californian luxury and sports segment.[98] According to Edmunds.com, between January and August 2013 the Model S achieved a high market share of new car sales among the U.S. most expensive ZIP codes, as rated by Forbes. Among the top 25 wealthiest ZIP codes, the highest Model S market shares are all found in California, with Atherton ranking first in the U.S. with a 15.4% share, followed by Los Altos Hills with 11.9%, and Portola Valley with 11.2%. Edmunds' analysis also found that during this period the Model S was the most registered passenger car in 8 of the 25 most expensive American ZIP codes.[99]

California has also been the leading American market for the BMW i3, with about 3,000 units sold in the state in 2014, representing about half of total U.S. sales that year.[100] Registrations of the Tesla Model S totaled 10,723 units in 2015, representing a 12.1% market share of the state's luxury and sports segment, making the Model S the third best selling car in the segment after the Mercedes-Benz E-Class (12,324) and BMW 5 Series (11,133).[72]

The top selling models in 2017 were the Chevrolet Bolt (13,487), Tesla Model S (11,813), Tesla Model X (6,910), Fiat 500e (4,943), Nissan Leaf (4,418), and Volkswagen e-Golf (3,202).[83] Tesla Inc. listed as the best selling plug-in manufacturer in 2017, with combined sales of its Model S and X totaling 18,723 units (Model 3 sales were not reported).[83] The Model S listed in 2017 as the second best selling vehicle in state's luxury and sports segment, with a market share of 16.0%, only behind the Mercedes-Benz E-Class (12,326).[7] The Chevrolet Bolt led the state's subcompact segment in 2017, with 13,487 units sold, representing a market share of 14.7%, and 57.9% of nationwide sales (23,297).[6][7]

Tesla ended 2018 as the top selling plug-in car manufacturer with 70,338 units, representing 44% from all plug-in car registrations and 74% all-electric car sales.[10] The Tesla Model 3 was the best selling plug-in car in California in 2018, with 51,293 units registered. The Model 3 also led the near luxury category. Other plug-ins ranking among the top 5 selling models of their segment in 2018 were the Model S (10,120), third in the luxury and high-end sports car category, the Chevrolet Bolt (9,745), second in the subcompact segment, the Model X (8,925), second in the luxury mid-size SUV category, and the BMW i3 (3,988), third in the entry luxury segment.[9][10] Among passenger car models, the Model 3 ranked fourth, after the Honda Civic (80,190), Toyota Camry (61,553), and the Honda Accord (59,591), and sixth among across all categories, including SUVs and light trucks.[9]

Plug-in car sales in 2019 were led for a second consecutive year by the Tesla Model 3 with 59,514 units delivered, representing 59.7% of all pure electric cars registrations in California that year. Once again, the Model 3 also led the near luxury category in 2019 by an ample margin.[11] Among passenger car models registered in California, the Model 3 ranked third, after the Honda Civic (75,915) and the Toyota Camry (63,459).[11]

Geographical distribution

As of mid 2013, 52% of American plug-in electric car registrations are concentrated in five metropolitan areas, two of which are in California: San Francisco and Los Angeles. The others are Seattle, New York and Atlanta.[101]

According to Navigant Research, the Los Angeles metropolitan area was the world's largest plug-in electric car city market in 2014. A study from the International Council on Clean Transportation (ICCT) published in 2016 found that in 2015 there were 30 cities in California with a plug-in electric car market share between 6% to 18% of new vehicle sales in the state, representing 8 to 25 times that of the U.S. average plug-in market share in 2015. The study found these cities tend to be smaller, and the following twelve have a plug-in market share of 10% or more: Saratoga, Los Altos, Los Gatos, Palo Alto, Menlo Park, Cupertino, Fremont, Manhattan Beach, Campbell, Morgan Hill, Mountain View, and Berkeley. With the exception of Manhattan Beach, the other eleven cities are located in the San Francisco Bay Area.[104]

The ICCT study found that the 30 cities with the highest plug-in electric vehicle uptake underwent the implementation of abundant, wide-ranging electric vehicle promotion programs involving parking, permitting, fleets, utilities, education, and workplace charging. These cities on average have 5 times the public charging infrastructure per capita than the national average. In addition, workplace charging availability in the San Jose metropolitan area is far higher than elsewhere in the U.S. Also, major California public electric power utilities and workplaces are expanding the public charging network to further address consumer confidence and convenience.[104]

According to the ICCT study, higher income is found to be among the factors that are linked to higher electric vehicle uptake, with some cities where the Tesla Model S was the top-selling plug-in electric car with more than a third of overall plug-in sales. As of April 2016, out of the fourteen plug-in hybrid models available in the American market, nine are upscale models affordable only for high income customers, namely the BMW X5 xDrive, Audi A3 e-tron, Porsche Cayenne and Panamera, Volvo XC90, Mercedes S500, BMW i8 and 3 Series, and the Cadillac ELR, all priced above US$40,000.[105] Nevertheless, cities with median incomes below US$85,000, such as Berkeley, Alameda, San Jose, Santa Cruz, and Oakland might be more indicative of the growing mainstream plug-in electric vehicle market. These cities have a broader mix of plug-in car sales, such as the Nissan Leaf, Ford C-Max and Fusion Energi, Chevrolet Volt, and Volkswagen e-Golf.[104]

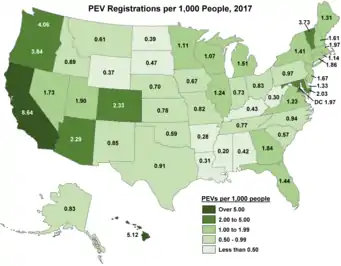

A 2018 study by ICCT found that California has four metropolitan areas among the world's top 25 cites in terms of electric vehicle penetration, which together accounted for 44% of the world's stock of plug-in electric cars in 2017. Los Angeles led the U.S. with a stock of 143,000 units, followed by San Francisco and San Jose, California, both with a plug-in car stock of more than 50,000 units. The fourth city is San Diego. Among these cities, San Jose has the highest market share of the plug-in segment, with over 10% of new car sales in 2017, followed by San Francisco with 7%.[106]

According to the California New Car Dealers Association (CNCDA), during the first half of 2018, Northern California led the state in terms of plug-in car market share, with a total plug-in take-rate of 8.7%, 5.0% for all-electrics (includes fuel cell) and 3.7% for plug-in hybrids. Southern California ranked next with a market share of 6.1%, 2.9% for all-electrics (includes fuel cell) and 3.2% for plug-in hybrids. Both regional markets surpassed the market share of conventional hybrids, 4.8% and 3.8% correspondingly.[102] The leading regional market is the San Francisco Bay Area, with a combined market share of 12.8% for the first half of 2018, 7.7% for all-electrics (includes fuel cell) and 5.1% for plug-in hybrids. Ranking next is Los Angeles and Orange counties with 6.9%, San Diego County with a combined market share of 6.8%, and Central Valley with 4.0%.[102]

Future trends

According to a 2011 study by Pike Research, annual sales of plug-in electric vehicles in the U.S. were predicted to reach 360,000 vehicles by 2017. The study projected that the highest sales between 2011 and 2017 would take place in California, New York and Florida.[109] In 2012, and as sales have fallen short of projections, Pike Research projected that annual sales of plug-in electric vehicles in the U.S. will reach 400,073 units in 2020, with California as the state with the highest PEV sales over the remainder of this decade, with nearly 25% of all PEVs sold in the United States between 2012 and 2020. In terms of market share, California will be followed by New York, Florida, Texas, and Washington, but Hawaii is expected by 2020 to have the highest penetration rate of PEVs as a percentage of all light duty vehicle sales. California is predicted to have four of the top ten metropolitan areas for PEV sales: Los Angeles–Long Beach, San Francisco Bay Area, Silicon Valley, and Greater Sacramento. Pike Research forecasts that cumulative sales of PEVs in the largest 102 American cities will reach more than 1.8 million from 2012 through 2020, with a share of more than 25% of all annual sales concentrated in the top five metropolitan areas for PEV sales: New York, Los Angeles, San Francisco, Seattle, and Portland.[110][111][112]

In a report published in April 2014, Navigant Research forecasts that the Los Angeles metropolitan area, the largest PEV city market in the world, will have over 15,000 PEV sales in 2014, and its PEV stock will grow from over 36,000 in 2014 to over 250,000 by 2023. Navigant predicts annual PEV sales in the Greater Tokyo Area will surpass Los Angeles by 2020, and Tokyo is expected to become the world's largest PEV city market with a PEV stock of around 260,000 in 2023.

See also

- CalCars

- Electric car use by country

- FreedomCAR

- Government incentives for plug-in electric vehicles

- List of modern production plug-in electric vehicles available in the United States

- New energy vehicles in China

- Plug In America

- Plug-in electric vehicle

- Plug-in electric vehicles in Canada

- Plug-in electric vehicles in Europe

- Plug-in electric vehicles in France

- Plug-in electric vehicles in Germany

- Plug-in electric vehicles in Japan

- Plug-in electric vehicles in the Netherlands

- Plug-in electric vehicles in Norway

- Plug-in electric vehicles in Sweden

- Plug-in electric vehicles in the United Kingdom

- Plug-in electric vehicles in the United States

- Plug-in Hybrid Electric Vehicle Research Center

- Plug-in hybrids in New York

References

- California New Car Dealers Association (CNCDA) (February 2021). "California Auto Outlook Covering Fourth Quarter 2020: State New Light Vehicle Registrations Predicted to Approach 1.8 Million Units in 2021" (PDF). CNCDA. Retrieved 2021-02-07. A total of 132,742 plug-in electric passenger cars (101,628 BEVs and 31,114 PHEVs) and were registered in 2020. Registration figures between 2016 and 2019 were revised, resulting in significantly higher estimates than previously reported thorugh 2019.

- Szczesny, Joseph (2018-12-11). "Sales of Electric Vehicles Growing Steadily in California". The Detroit Bureau. Retrieved 2018-12-13.

- California Energy Commission (2013-03-01). "California Energy Commission awards $4.5M to ARB for more clean vehicle rebates". Green Car Congress. Retrieved 2013-03-03.

- Cobb, Jeff (2016-03-14). "Californians Will Buy 200,000th Plug-in Car By This Month". HybridCars.com. Retrieved 2016-03-15. Sales of plug-in electric cars in California passed the 200,000 unit milestone in March 2016, representing 47% of the 425,000 plug-in electric cars sold in the U.S. through February 2016.

- Cobb, Jeff (2016-11-14). "California Celebrates One-Quarter Million Plug-in Cars Sold". HybridCars.com. Retrieved 2016-11-15.

- Cobb, Jeff (2018-01-04). "December 2017 Dashboard". HybridCars.com and Baum & Associates. Retrieved 2018-01-23. Plug-in electric car sales in the U.S. totaled 194,479 units in 2017, consisting of 104,487 all-electric cars and 89,992 plug-in hybrids. The plug-in car segment achieved a market share of 1.13% of new car sales.

- California New Car Dealers Association (CNCDA) (February 2018). "New Vehicle Registrations in State Predicted to Exceed 2 Million Units Again in 2018" (PDF). CNCDA. Retrieved 2018-02-17. Registrations through December 2017 since 2013.

- Scauzillo, Steve (2018-02-04). "California on path to meet goal of 1.5 million electric cars, but charging stations lag behind". Press-Telegram. Retrieved 2018-02-05.

- California New Car Dealers Association (CNCDA) (February 2019). "New Vehicle Registrations Remained Above 2 million Units in 2018" (PDF). CNCDA. Retrieved 2019-02-21. See section: "Electric Vehicle Registrations Increased Sharply in 2018" - Figures for 2017 were revised. Registrations since 2014 through 2018

- Kane, Mark (2019-02-21). "Electric Cars Outsell Hybrids In California: Tesla Model 3 Tops In Class". Inside EVs. Retrieved 2019-02-22.

- California New Car Dealers Association (CNCDA) (February 2020). "California Auto Outlook Covering Fourth Quarter 2019: State New Vehicle Market Predicted to Remain Strong in 2020" (PDF). CNCDA. Retrieved 2020-05-10. See section: "Hybrid Vehicle Market Share Increased to 5.5 Percent in 2019 " - registrations between 2015 and 2019. Figures for 2018 were revised.

- Staff (2012-03-23). "Governor Brown Announces $120 Million Settlement To Fund Electric Car Charging Stations Across California". Office of Governor Edmund G. Brown Jr. Retrieved 2014-09-22.

- Marisa Lagos (2014-09-22). "Brown signs several clean-air vehicle bills". San Francisco Chronicle. Retrieved 2014-09-22.

- "Office of Governor Edmund G. Brown Jr. - Newsroom". www.gov.ca.gov. Retrieved 2016-01-29.

- "Clean Vehicle Rebate Project FAQ: Changes in CVRP FY 2011-2012". Center for Sustainable Energy California. Archived from the original on 2011-10-15. Retrieved 2011-05-22.

- Clean Vehicle Rebate Project (CVRP) (March 2014). "Eligible Vehicles". California Center for Sustainable Energy. Retrieved 2014-03-26. The Fisker Karma is not eligible for the rebate. The BMW i3 with range extender option has not been certified by the ARB as of March 26, 2014. Only after it is certified the ARB will evaluate its eligibility to participate in CVRP.

- California Air Resources Board (CARB) (2016-09-19). "Eligible vehicle list: Single ocuupant carpool lane stickers". CARB. Retrieved 2016-09-19.

- Cobb, Jeff (2016-09-19). "California Removes 'Green Sticker' Cap For Unlimited PHEV Solo-HOV Lane Access". HybridCars.com. Retrieved 2016-09-19.

- "Zero-Emission Vehicle Legal and Regulatory Activities: The ZEV Program Timeline". California Air Resources Board. 2011-10-14. Archived from the original on 2014-10-06. Retrieved 2014-09-22.

- Sperling, Daniel and Deborah Gordon (2009). Two billion cars: driving toward sustainability. Oxford University Press, New York. pp. 22–26 and 114–139. ISBN 978-0-19-537664-7.

- Shnayerson, Michael (1996). The Car That Could. New York: Random House.

- "Zero-Emission Vehicle Legal and Regulatory Activities: The ZEV Program Timeline". California Air Resources Board. 2011-10-14. Archived from the original on 2014-10-06. Retrieved 2014-09-22.

- EV1 White Paper (2002-09-11), EV1 White Paper, archived from the original on 2009-07-26, retrieved 2009-07-21

- "Electric Vehicles UK". Evuk.co.uk. Retrieved 2010-10-20.

- Quiroga, Tony (August 2009). "Driving the Future". Car and Driver. p. 52.

- "Fact Sheet: California Vehicle Emissions" (PDF). California Air Resources Board. 2004-04-08. Archived from the original (PDF) on 2009-04-11. Retrieved 2009-04-21.

- Sherry Boschert (2006). Plug-in Hybrids: The Cars that will Recharge America. New Society Publishers, Gabriola Island, Canada. pp. 15–28. ISBN 978-0-86571-571-4. See the box "Zero-Emission Vehicle (ZEV) Mandate Timeline", pp. 23-28

- "California Air Resources Board Votes to Modify ZEV Program in Short-Term; Complete Overhaul to Begin for New ZEV II". Green Car Congress. 2008-03-27. Retrieved 2009-04-21.

- "Zero Emission Vehicle (ZEV) Program". California Air Resources Board. 2009-02-27. Retrieved 2009-04-21.

- Rory Carroll and Alexandria Sage (2016-09-01). "California's zero-emission vehicle program is stuck in neutral". Reuters. Archived from the original on 2016-10-12. Retrieved 2017-07-26.CS1 maint: uses authors parameter (link)

- "Zero-emission vehicle sales in the U.S".

- Melanie Mason and Patrick McGreevy (2014-09-21). "Gov. Jerry Brown signs bills to boost purchases of electric cars". Los Angeles Times. Retrieved 2014-09-21.

- San Francisco Office of the Mayor (November 20, 2008) "Mayors Aim to Make San Francisco Bay Area the Electric Vehicle Capital of the U.S." Archived 2009-10-03 at the Wayback Machine sfgov.org

- "SF Plug-In Vehicle Bonanza:Watch Video, Read About It". Calcars.org. Retrieved 2010-11-27.

- "San Francisco, Berkeley, Oakland, El Cerrito, Albany, Daly City, CA USA". City CarShare. Archived from the original on 2010-12-21. Retrieved 2010-11-27.

- Todd Woody and Clifford Krauss (2010-02-14). "Cities Prepare for Life With the Electric Car". New York Times. Retrieved 2010-03-07.

- Woodall, B. (July 10, 2007) "Ford sees plug-in hybrids in 5-10 years" Reuters'.' Retrieved 27 July 2007.

- "How We Green-Tuned an '04 Prius into a PRIUS+ Plug-In Hybrid!". CalCars.com - The California Cars Initiative. Retrieved January 11, 2006.

- "RechargeIT.org: A Google.org Project". Google.org. Archived from the original on 2010-12-09. Retrieved 2010-12-19.

- RechargeIT Driving Experiment - RechargeIT is a program sponsored by Google.org, a non-profit created by Google. Archived 2008-07-23 at the Wayback Machine

- California Department of Motor Vehicles (March 2014). "Clean Air Vehicle (CAV) Decals - High Occupancy Vehicle HOV Lane Usage". DMV California. Retrieved 2014-03-23.

- David Herron (2013-09-04). "California legislature extends HOV sticker access for plug-in vehicles". Torque News. Retrieved 2014-03-23.

- "Chevy Volt gets a Low Emissions Package for California; HOV lanes access". Green Car Congress. 2011-11-17. Retrieved 2011-11-17.

- John Voelcker (2014-02-27). "CA Carpool-Lane Stickers For Plug-In Hybrids Run Out By May--Or Sooner". Green Car Reports. Retrieved 2014-03-23.

- Eric Loveday (2014-03-19). "As Green HOV Stickers Dry Up, California DMV Reacts By Denying Dealer Pre-Registrations of Plug-Ins". InsideEVs.com. Retrieved 2014-03-23.

- Metropolitan Transportation Commission (San Francisco Bay Area) (2014-03-07). "MTC Memorandum to Legislation Committee - AB 2013 (Muratsuchi): Expansion of Access to High-Occupancy Vehicle Lanes by Low-Emission Vehicles" (PDF). Metropolitan Transportation Commission. Retrieved 2014-03-23.

- Jay Cole (2014-06-23). "California Ups HOV Green Sticker Program By 15,000 to 55,000 Total". InsideEVs.com. Retrieved 2014-07-12.

- Jeff Cobb (2015-06-18). "California Legislature Approves 15,000 More Green HOV Stickers". HybridCars.com. Retrieved 2015-06-21.

- Brian Ro (2015-12-21). "Max Limit For California Green HOV Stickers Reached Once Again". HybridCars.com. Retrieved 2015-12-22.

- Dan Weikel (2015-11-10). "Law expanding HOV access to plug-in cars drives higher sales, UCLA study says". Los Angeles Times. Retrieved 2015-11-22.

- Mike Millikin (2014-09-22). "California governor signs 6 bills to advance state's electric vehicle market; HOT and HOV benefits". Green Car Congress. Retrieved 2014-09-23.

- "Notice 2009-89: New Qualified Plug-in Electric Drive Motor Vehicle Credit". Internal Revenue Service. 2009-11-30. Retrieved 2010-04-01.

- "Clean Vehicle Rebate Project". Center for Sustainable Energy. Archived from the original on 2010-04-02. Retrieved 2010-04-01.

- "CVRP Eligible Vehicles". Center for Sustainable Energy California. Archived from the original on 2013-07-29. Retrieved 2013-01-21.

- "CVRP Eligible Vehicles". Center for Sustainable Energy California. Archived from the original on 2013-07-29. Retrieved 2010-06-08.

- Nikki Gordon-Bloomfield (2012-01-19). "Can Your 2012 Chevy Volt Use California HOV Lanes? It Depends". Green Car Reports. Retrieved 2012-01-20.

- "Clean Vehicle Rebate Project Statistics". California Center for Sustainable Energy. March 2013. Archived from the original on 2013-01-19. Retrieved 2013-03-03.

- Danny King (2012-12-17). "Plug-in hybrids outselling pure EVs in California". Autoblog Green. Retrieved 2013-02-12.

- Clean Vehicle Rebate Project (2015-06-08). "Clean Vehicle Rebate Project Statistics". California Center for Sustainable Energy. Retrieved 2015-06-22. Use the filter for application date to show figures for March 2014 and June 2015.

- Sebastian Blanco (2012-07-25). "Ford C-Max Energi plug-in hybrid priced at $33,745; or $29,995 after tax credit *UPDATED". Autoblog Green. Retrieved 2012-07-24.

- John Howard (2014-04-10). "ARB, Tesla at odds over rebate cuts for electric vehicles". Capitol Weekly. Retrieved 2014-04-12.

- Clean Vehicle Rebate Project (2014-03-10). "Clean Vehicle Rebate Project Statistics". California Center for Sustainable Energy. Retrieved 2014-03-23.

- Hansen, Louis (2016-04-15). "New state rules cap income levels for low-emission vehicle rebates". San Jose Mercury News. Retrieved 2016-04-21.

- Edelstein, Stephen (2015-07-15). "California Ends Electric-Car Rebates For Wealthiest Buyers, Boosts Them For Poorest". Green Car Reports. Retrieved 2015-07-28.

- Lambert, Fred (2016-03-15). "PSA: California Clean Vehicle Rebate is increasing for low- and moderate-income drivers, and going away for high-income drivers on March 29". Electrek. US. Retrieved 2016-08-24.

- Millikin, Mike (2016-11-08). "Berkeley study finds clean vehicle rebates have predominantly benefited wealthy, white Californians". Green Car Congress. Retrieved 2016-11-09.

- Nikolewski, Rob (2016-10-31). "California's electric-car rebates jump for lower-income buyers and vanish for more high earners". Los Angeles Times. Retrieved 2016-11-09.

- Danny King (2013-04-10). "US public charging stations increase by 9% in first quarter". Autoblog Green. Retrieved 2013-09-02.

- Antony Ingram (2013-10-26). "Where Are Electric-Car Charging Stations? Infographic Shows It All". Green Car Reports. Retrieved 2013-10-26.

- U.S. Department of Energy (2014-01-21). "Total Alternative Fueling Station Counts (Public and Private Stations)". Alternative Fuels Data Center (AFDC). Retrieved 2014-03-23. The AFDC counts electric charging units or points, or EVSE, as one for each outlet available, and does not include residential electric charging infrastructure.

- "Law section". leginfo.legislature.ca.gov. CA gov. Retrieved 3 April 2019.

- California New Car Dealers Association (CNCDA) (February 2016). "California New Vehicle Registrations Expected to Remain Above 2 Million Units in 2016" (PDF). CNCDA. Archived from the original (PDF) on 2016-02-17. Retrieved 2016-02-17. Registrations through December 2015 since 2011. Revised figures for 2014.

- HybridCars.com and Baum & Associates. "HybridCars Dashboard". HybridCars.com. Retrieved 2016-02-17.

- "Monthly Plug-In Sales Scorecard". InsideEVs.com. December 2018. Retrieved 2019-02-22. Sales figures for 2018.

- California New Car Dealers Association (CNCDA) (February 2015). "California Auto Outlook Covering Fourth Quarter 2014: New Light Vehicle Registrations Likely to Exceed 1.9 million units in 2015" (PDF). CNCDA. Archived from the original (PDF) on 2015-09-23. Retrieved 2015-03-15. Registrations through December 2014.

- California Air Resources Board (CARB) (2017-01-18). "California's Advanced Clean Cars Midterm Review: Summary Report for the Technical Analysis of the Light Duty Vehicle Standards" (PDF). CARB. Retrieved 2017-01-19. See pp. ES 44.

- Tony Barboza (2015-10-11). "Cutting ozone will require radical transformation of California's trucking industry". Los Angeles Times. Retrieved 2015-10-11.

- Jeff Cobb (2015-03-18). "Californians Bought More Plug-in Cars Than China Last Year". HybridCars.com. Retrieved 2015-03-18.

- Dana Hull (2014-09-08). "California charges ahead with electric vehicles". San Jose Mercury News. Retrieved 2015-03-15.

- Cobb, Jeff (2016-02-17). "California Plug-in Sales Led The US Last Year With Nearly Five-Times Greater Market Share". HybridCars.com. Retrieved 2016-02-18. California's plug-in electric car market share was 3.1%, ranking behind only two countries, the Netherlands (9.7%) and Norway (22.7%). The administrative territory of Hong Kong also had a higher market share of 4.8%.

- Cobb, Jeff (2017-01-05). "December 2016 Dashboard". HybridCars.com and Baum & Associates. Retrieved 2017-01-06. Plug-in electric car sales in the U.S. totaled 157,181 units, consisting of 84,246 all-electric cars and 72,935 plug-in hybrids. The plug-in car segment achieved a market share of 0.90% of new car sales. December sales totaled 23,288 units with a market share of 1.39%. The top selling model in 2016 was the Tesla Model S with 29,156 units sold, followed by the Chevrolet Volt (24,739) and the Tesla Model X (18,028).

- California New Car Dealers Association (CNCDA) (February 2017). "State New Vehicle Market Up Slightly in 2016; Similar Outlook for 2017" (PDF). CNCDA. Archived from the original (PDF) on 2018-02-17. Retrieved 2017-02-24. Registrations through December 2016 since 2012. Revised figures for 2015.

- Baker, David R. (2018-02-28). "Top-selling electric car in California is not a Tesla". San Francisco Chronicle. Retrieved 2018-03-04.

- Loveday, Steven (2020-01-17). "FINAL UPDATE: Quarterly Plug-In EV Sales Scorecard". InsideEVs.com. Retrieved 2020-05-10. See Chart: "2019 Monthly/Q4 Sales Chart : Annual" - Cumulative sales in the U.S. totaled 329,528 units in 2019.

- Jeff Cobb (2013-01-08). "December 2012 Dashboard". HybridCars.com and Baum & Associates. Retrieved 2013-01-14. See the section: U.S. Plug-in Electric sales for December 2012. A total of 53,172 plug-in electric vehicles were sold during 2012. Sales of the Fisker Karma, Coda and Wheego are not included in this figure, because these carmakers does not report monthly sales on a regular basis. Tesla Model S sales are estimated.

- Jeff Cobb (2014-01-06). "December 2013 Dashboard". HybridCars.com and Baum & Associates. Retrieved 2014-01-07.

- Cobb, Jeff (2016-01-06). "December 2015 Dashboard". HybridCars.com and Baum & Associates. Retrieved 2016-03-14. Plug-in electric car sales in the U.S. totaled 114,248 units in 2015, consisting of 71,105 all-electric cars and 43,143 plug-in hybrids, with corresponding market shares of 0.25% and 0.41%. Sales in 2014 totaled 123,347 units.

- Jeff Cobb (2015-01-06). "December 2014 Dashboard". HybridCars.com and Baum & Associates. Retrieved 2015-01-06.

- Brad Berman (2011-01-07). "December 2010 Dashboard: Year End Tally". HybridCARS.com. Retrieved 2014-09-20.

- Nathan Bomey (2012-06-05). "California can't get enough of the Chevy Volt as sales surge". Detroit Free Press. Retrieved 2012-06-06.

- AutoblogGreen (2011-11-30). "Nissan sells 20,000 Leafs worldwide, 10,000 in U.S. by end of the year". Retrieved 2012-06-11.

- Nissan News Release (2013-08-26). "Top 15 Nissan LEAF markets in US in 2013". Green Car Congress. Retrieved 2013-09-29.

- Angelo Young (2014-09-02). "Tesla Motors' Tesla Model S Is Outselling Nissan Leaf In Northern European Markets". International Business Times. Retrieved 2014-09-21.

- John Voelcker (2013-03-22). "Tesla Model S Update: 3,000th Electric Sedan Delivered In CA". Green Car Reports. Retrieved 2013-03-22.

- Jay Cole (2013-03-22). "Tesla: Model S Production Now More Than 500 Per Week, Over 12 Million Total Miles Driven So Far". Inside EVs. Retrieved 2013-03-22.

- Hull, Dana (2014-01-29). "With a registration in Jackson, Mississippi, Tesla's Model S now has sales in all 50 states". SiliconBeat. Retrieved 2014-06-05.

- Bloomberg (2014-02-13). "Toyota Prius keeps Calif. sales crown; Tesla moves up". Automotive News. Retrieved 2014-02-16.

- California New Car Dealers Association (CNCDA) (February 2014). "California Auto Outlook: Fourth Quarter 2013". CNCDA. Archived from the original on 2014-02-17. Retrieved 2014-02-16.

- Jessica Caldwell (2013-10-31). "Drive by Numbers - Tesla Model S is the vehicle of choice in many of America's wealthiest zip codes". Edmunds.com. Retrieved 2013-11-02.

- Nikki Gordon-Bloomfield (2015-03-24). "BMW: Incentives Key to Helping BMW i3, Other EV Sales Soar". Transport Evolved. Retrieved 2015-03-28.

- David C. Smith (2013-08-07). "Scrappage Rate Hits Historic High, Bodes Well for Future". Wards Auto. Archived from the original on 2013-08-13. Retrieved 2013-08-14.

- California New Car Dealers Association (CNCDA) (August 2018). "California Green Vehicle Report" (PDF). CNCDA. Retrieved 2018-11-24. Registrations during 2018 through June. Includes hybrid, plug in hybrid, electric, and fuel cell powered vehicles

- Searle, Stephanie; Pavlenko, Nikita; Lutsey, Nic (September 2016). "Leading Edge of Electric Vehicle Market Development in the United States: An Analysis of California Cities" (PDF). International Council on Clean Transportation. Retrieved 2016-09-27.

- Cobb, Jeff (2016-05-24). "18 Hurdles Electrified Vehicles Are Having To Overcome". HybridCars.com. Retrieved 2016-05-24.

- Dale Hall, Hongyang Cui, Nic Lutsey (2018-10-30). "Electric vehicle capitals: Accelerating the global transition to electric drive". The International Council on Clean Transportation. Retrieved 2018-11-01.CS1 maint: multiple names: authors list (link) Click on "Download File" to get the full report, 15 pp.

- U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy (EERE) (2016-08-01). "Fact #936: August 1, 2016 California had the highest concentration of plug-in vehicles relative to population in 2015". EERE. Retrieved 2016-08-14.

- U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy (EERE), Vehicle Technologies Office (2018-12-10). "Fact #1059: December 10, 2018 California had the most plug-in vehicle registrations per 1,000 people in 2017". Vehicle Technologies Office. Retrieved 2019-01-26.CS1 maint: multiple names: authors list (link)

- Pike Research (2011-09-23). "Electric Vehicle Penetration Rates to be Highest in Smaller States". Pike Research. Archived from the original on 2012-06-06. Retrieved 2012-06-27.

- Pike Research (2013-03-01). "Electric Vehicle Geographic Forecasts". Pike Research. Archived from the original on 2013-01-26. Retrieved 2013-03-03.

- Pike Research (2012-09-18). "Nearly 1 in 4 Plug-In Electric Vehicles Sold in the United States From 2012 to 2020 Will be Sold in California". Pike Research. Archived from the original on 2012-10-22. Retrieved 2013-03-03.

- Pike Research (2013-01-21). "More than 1.8 Million Plug-In Electric Vehicles Will Be Sold in the Largest 102 U.S. Cities From 2012 to 2020". Pike Research. Archived from the original on 2013-01-24. Retrieved 2013-03-03.

External links

- 2013 ZEV Action Plan: A roadmap toward 1.5 million zero-emission vehicles on California roadways by 2025, Office of the Governor of California, February 2013.

- A Roadmap to Climate-Friendly Cars: 2013, Climate Central, August 2013.

- California: Beyond cars? Bulletin of the Atomic Scientists, Tom Turrentine, August 2014.

- Driving Cleaner - More Electric Vehicles Mean Less Pollution, Environment North Carolina Research & Policy Center, June 2014.

- Effects of Regional Temperature on Electric Vehicle Efficiency, Range, and Emissions in the United States, Tugce Yuksel and Jeremy Michalek, Carnegie Mellon University. 2015

- EV Driver Survey Dashboard, California's Clean Vehicle Rebate Project (CVRP)

- Evaluating the Impact of High Occupancy Vehicle (HOV) Lane Access on Plug-In Vehicles (PEVs) Purchasing and Usage in California, University of California, Davis, Working Paper UCD-ITS-WP-14-01, April 2014

- Exploring the Impact of the Federal Tax Credit on the Plug-In Vehicle Market, Journal of the Transportation Research Board, 2016.

- Federal Tax Credits For Plug-In Hybrids, Electric Cars: What You Need To Know, The Washington Post, August 2014.

- Leading Edge of Electric Vehicle Market Development in the United States: An Analysis of California Cities, International Council on Clean Transportation, White Paper, September 2016.

- List of vehicles eligible for California's single occupant carpool lane stickers

- Modernizing vehicle regulations for electrification, International Council on Clean Transportation, October 2018.

- New Car Dealers and Retail Innovation in California’s Plug-In Electric Vehicle Market. Institute of Transportation Studies, University of California, Davis, Working Paper UCD-ITS-WP-14-04, 2014.

- Plug-In Electric Vehicles: A Case Study of Seven Markets (Norway, Netherlands, California, United States, France, Japan, and Germany), Institute of Transportation Studies, University of California, Davis, October 2014.

- State of the Plug-in Electric Vehicle Market, Electrification Coalition, July 2013.

- The Great Debate -- All-Electric Cars vs. Plug-In Hybrids