New energy vehicles in China

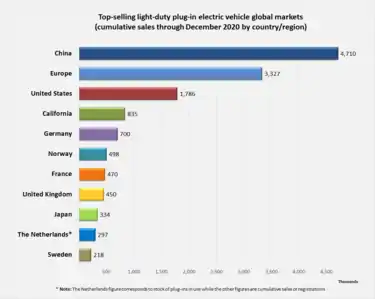

The stock of new energy vehicles in China is the world's largest, with cumulative sales of almost 4.2 million units through 2019. These figures include passenger cars and heavy-duty commercial vehicles such buses and sanitation trucks, and only accounts for vehicles manufactured in the country.[6][7][8][9][10] The Chinese government uses the term new energy vehicles (NEVs) to designate plug-in electric vehicles eligible for public subsidies, and includes only battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs) and fuel cell electric vehicles (FCEV).[11][12]

Sales of new energy vehicles since 2011 passed the 500,000 unit milestone in March 2016, and the 1 million mark in early 2017, both, excluding imports.[7][13] Cumulative sales of new energy passenger cars achieved the 500,000 unit milestone in September 2016, and 1 million by the end of 2017.[14][15] Domestically produced passenger cars account for 96% of new energy car sales in China.[15][16]

As of December 2019, China had the largest stock of highway legal plug-in passenger cars with 3.4 million units, 47% of the global plug-in car fleet in use.[17] China also dominates the plug-in light commercial vehicle and electric bus deployment, with its stock reaching over 500,000 buses in 2019, 98% of the global stock, and 247,500 electric light commercial vehicles, 65% of the global fleet. In addition, the country also leads sales of medium- and heavy duty electric trucks, with over 12,000 trucks sold, and nearly all battery electric.[17]

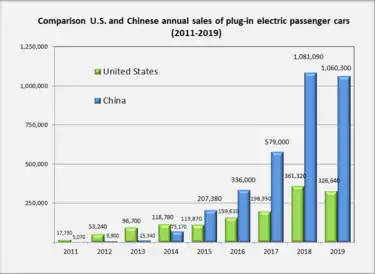

China has been the world's best-selling plug-in electric passenger car market for five years running, from 2015 to 2019, with annual sales rising from more than 207,000 plug-in passenger cars in 2015, to 579,000 in 2017, and just over million units both in 2018 and 2019.[17] A particular feature of the Chinese passenger plug-in market is the dominance of small entry level vehicles, in 2015 representing 87% of total pure electric car sales, while 96% of total plug-in hybrid car sales were in the compact segment.[18]

BYD Auto ended 2015 as the world's best selling manufacturer of highway legal light-duty plug-in electric vehicles,[19][20] and for a second year running was the world's top selling plug-in car manufacturer with over 100,000 units delivered in 2016.[21] During 2016 BYD became the world's all-time second largest plug-in electric passenger car manufacturer after the Renault-Nissan Alliance.[22][23] The BYD Qin was the top selling new energy passenger car for two years in a row, 2014 and 2015.[24][25] The BYD Tang was the best selling plug-in passenger car in 2016.[26] Until December 2016, the Qin ranked as the all-time top selling plug-in electric car in the country with 68,655 units sold since its inception.[24][25][27][28][26] The BAIC EC-Series all-electric city car was the top selling plug-in car in 2017, and with 78,079 units sold, it also listed as world's top selling plug-in car in 2017.[15]

The government's political support for the adoption of electric vehicles has four goals, to create a world-leading industry that would produce jobs and exports; energy security to reduce its oil dependence which comes from the Middle East; to reduce urban air pollution; and to reduce its carbon emissions.[29] In June 2012 the State Council of China published a plan to develop the domestic energy-saving and new energy vehicle industry. The plan set a sales target of 500,000 new energy vehicles by 2015 and 5 million by 2020.[30] As sales of new energy vehicles were slower than expected, in September 2013, the central government introduced a subsidy scheme providing a maximum of US$9,800 toward the purchase of an all-electric passenger vehicle and up to US$81,600 for an electric bus. The subsidies are part of the government's efforts to address China's problematic air pollution.[31]

Government policies and incentives

The Chinese government adopted in 2009 a plan to leapfrog current automotive technology, and seize the growing new energy vehicle (NEV) market to become of the world leaders in manufacturing of all-electric and hybrid vehicles. The government's political support for the adoption of electric vehicles has four goals, to create a world-leading industry that would produce jobs and exports; energy security to reduce its oil dependence which comes from the Middle East; to reduce urban air pollution; and to reduce its carbon emissions.[29][32] However, a study by McKinsey & Company found that even though local air pollution would be reduced by replacing a gasoline car with a similar-size electric car, it would reduce greenhouse gas emissions by only 19%, as China uses coal for 75% of its electricity production.[32] The Chinese government uses the term new energy vehicles (NEVs) to designate plug-in electric vehicles, and only pure electric vehicles and plug-in hybrid electric vehicles are subject to purchase incentives. Initially, conventional hybrids were also included.[11]

On June 1, 2010, the Chinese government announced a trial program to provide incentives for new energy vehicles of up to 60,000 yuan (~US$9,281 in June 2011) for private purchase of new battery electric vehicles and 50,000 yuan (~US$7,634 in June 2011) for plug-in hybrids in five cities.[33][34] The cities participating in the pilot program are Shanghai, Shenzhen, Hangzhou, Hefei and Changchun. The subsidies are paid directly to automakers rather than consumers, but the government expects that vehicle prices will be reduced accordingly. The amount of the subsidy will be reduced once 50,000 units are sold.[33][34] Electricity utilities have been ordered to set up electric car charging stations in Beijing, Shanghai and Tianjin.[32][35] The government set the goal to raise the country's annual production capacity to 500,000 plug-in hybrid or all-electric cars and buses by the end of 2011, up from 2,100 in 2008.[32]

In June 2012, the State Council of China published a plan to develop the domestic energy-saving and new energy vehicle industry. The plan set a sales target of 500,000 new energy vehicles by 2015 and 5 million by 2020.[30][36] According to a report by McKinsey & Company, electric vehicle sales between January 2009 and June 2012 represented less than 0.01% of new car sales in China. A mid-September 2013 joint announcement by the National Development and Reform Commission and finance, science, and industry ministries confirmed that the central government would provide a maximum of US$9,800 toward the purchase of an all-electric passenger vehicle and up to US$81,600 for an electric bus. The subsidies are part of the government's efforts to address China's problematic air pollution.[31]

A 2012 survey of Chinese and U.S. consumer preferences for different vehicle types found that regardless of the national subsidies and based solely on user preferences, Chinese consumers stated being willing to adopt BEVs and mid-range PHEVs at similar rates relative to their respective gasoline counterparts, whereas American consumers stated preferring low-range PHEVs over BEVs. The study highlights an increased preference of Chinese willingness to buy BEVs when compared to the U.S., implying a potential for earlier BEV adoption in China, given adequate supply.[38]

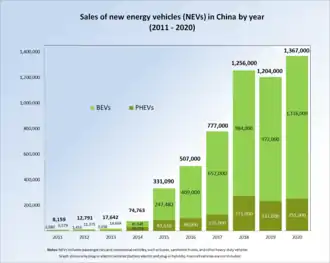

The China Association of Automobile Manufacturers (CAAM) expected that sales of electric and hybrid electric vehicles in China would reach 60,000 to 80,000 units in 2014.[3] As sales have been much lower than initially expected, and most of the deployed NEV stock has been purchased by the government for public fleets, new monetary incentives were issued in 2014, and the national government set a sales target of 160,000 units for 2014.[39][40] Although the goal was not achieved, new energy vehicles sales in 2014 totaled 74,763 units, up 324% from 2013. The China Industrial Association of Power Sources expected new energy vehicle sales to reach between 200,000 and 220,000 NEVs in 2015, and 400,000 units in 2016.[41] The surge in demand continued in 2015, with a total of 331,092 NEVs sold in 2015, rising 343% year-on-year.[4][5]

Initially, CAAM expected new energy vehicle sales to more than double 2015 sales and reach 700,000 NEVs in 2016.[42] After the government imposed penalties to several carmakers for defrauding the subsidy program out of almost 10 billion yuan, CAAM revised downward in September 2016 its 2016 sales target to 400,000 new energy vehicle orders.[43] Only 289,000 new energy vehicles had been sold during the first nine months of 2016.[44]

As intercity driving is rare in China, electric cars provide several practical advantages because commutes are fairly short and at low speeds due to traffic congestion. These particular local conditions make the range limitation of all-electric cars less of a problem, especially as the latest Chinese models have a top speed of 100 km/h (60 mph) and a range of 200 km (120 mi) between charges.[32] As of May 2010, Chinese automakers have developed at least 10 models of high-speed, all-electric cars with plans for volume production.[45]

The Chinese government reaffirmed their priority to promote new energy vehicles in its 13th Five-Year Plan (2016-2020). The Central Committee of the Communist Party of China approved the document that emphasizes boosting technological innovations in the manufacturing of new energy vehicles and promoting the use of electric cars, plug-in hybrids and fuel cell vehicles, included in its latest Five-Year Plan. The consulting firm PwC estimates the sales of new-energy vehicles in China will climb to 1.4 million units by 2020, and about 3.75 million units by 2025.[46]

As part of its commitment to promote electric vehicles, the Chinese government announced plans in September 2015 to build a nationwide charging-station network to fulfil the power demand of 5 million electric vehicles by 2020. This network will cover residential areas, business districts, public space and inter-city highways, according to a guideline released by the State Council. Also, the plan mandates that new residential complexes should build charging points or assign space for them, while public parking lots should have no less than 10% of parking spaces with charging facilities. According to the guideline, there should be at least one public charging station for every 2,000 NEVs.[47] Also the State Council ordered local governments not to restrict the sales or use of new energy cars.[46]

In October 2015, Tesla Motor announced the company is negotiating with the Chinese government on producing its electric cars domestically. Local production has the potential to reduce the sales prices of Tesla models by a third, and so improving the weak sales of the Model S.[48] A Model S starts at about US$76,000 in the U.S., while in China pricing starts at CN¥673,000 , about US$106,000, after duties and other taxes.[49] Foreign automakers are generally required to establish a joint venture with a Chinese company to produce cars domestically.[48]

In April 2016, the Traffic Management Bureau under the Ministry of Public Security announced the introduction of new green license plates to identify new energy vehicles, as opposed to the country's standard blue plates. The NEV plates include a Chinese character short for the provincial region where they are issued, and seven numbers and letters, compared to six on standard plates. The objective of the special plates is to facilitate police enforcement of the preferential policies that some local authorities apply to cleaner cars to help cut emissions and ease traffic. For example, central Beijing has in place a road space rationing scheme, a driving restriction regulation that bans conventional vehicles from entering the city for one day a week, but new energy vehicles are exempted from the restriction.[50] Beijing also introduced a vehicle quota system in 2011, awarding new car licenses through a lottery, with a ceiling of 6 million units for 2017. New energy vehicles were placed in a special category where the odds of winning a license plate are much higher than conventional autos.[51]

New energy vehicle sales

Cumulative domestically built new energy vehicle sales in China totaled 1,728,447 units between January 2011 and December 2017. These figures include heavy-duty commercial vehicles such buses and sanitation trucks, and only accounts for vehicles manufactured in the country because imports are not subject to government subsidies.[6][7][10] As of December 2017, the Chinese stock of plug-in electric vehicles consisted of 1,385,088 all-electric vehicles (80.1%) and 343,359 plug-in hybrid vehicles (19.9%) sold since 2011.[6][7][13][52] Most of the stock of new energy vehicles was sold during the last three years. Deliveries between 2015 and 2017 account for 93.4% of all domestically built new energy vehicle sales since 2011, of which, 45.0% were sold in 2017, 29.3% in 2016, and 19.2% in 2015.[1][2][3][4][5][6][7]

According to the Minister of Science and Technology, by mid-2013 more than 80% of the country's plug-in stock was on duty in public fleet vehicles, used mainly in public transport, for both bus and taxi services, and also in solid waste recollection services (sanitation trucks).[29][53][54] As of December 2014, a total of 83,198 plug-in electric passenger cars and 36,500 pure electric buses had been registered in the country since 2008.[55] A particular feature of the Chinese passenger plug-in market is the dominance of small entry level vehicles. In 2015, all-electric car sales in the mini and small segments (A-segment) represented 87% of total pure electric car sales, while 96% of total plug-in hybrid car sales were in the compact segment (C-segment). Among the electric drive segments, mid-size car (D-segment) sales were significant only in the conventional hybrid segment, representing about 50% of hybrid sales.[18]

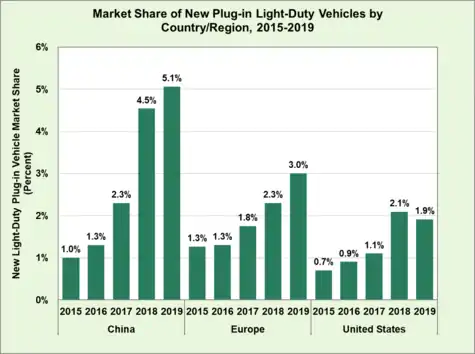

The country achieved record sales of 207,380 new energy passenger cars in 2015, making China the world's top selling plug-in passenger car country market in calendar year 2015, surpassing the European market and also the United States, the leading market in 2014.[56][57][58] A total of 320,081 new energy passenger cars were sold in 2016, ahead of both Europe (212,000) and the U.S. (157,181), allowing the country to remain as the world's top selling plug-in car market in 2016.[59] The domestic plug-in segment market share totaled 1.3% of new car sales in 2016.[59] These sales figures exclude imports, such as the Tesla Model S.[16] Domestically produced cars account for 96% of new energy car sales in China.[16]

China, together with the U.S., had the world's largest country stock of plug-in electric passenger cars until September 2016, with the Chinese plug-in stock representing 29.2% of the global stock of highway legal plug-in electric passenger cars.[60] In October 2016, with about 31,000 plug-in passenger cars sold in China, while U.S. sales totaled over 11,000 units, China became the country with the world's largest stock of plug-in passenger cars, totaling about 553,000 units versus almost 533,000 in the American market.[60][22][61][62] The gap between the two countries widened in November 2016, as 41,795 new energy passenger cars were sold in China, while only 14,124 were sold in the U.S.[63][64] By November 2016, China's cumulative total plug-in passenger vehicles sales also overtook Europe, making the country the global leader in the light-duty plug-in vehicle segment.[10][58] As of December 2016, sales of domestically produced new energy passenger cars since 2010 totaled 632,371 units.[56][65] IHS Automotive predicted Chinese annual plug-in car sales will reach 1 million in 2019, four years before the United States.[66] Chinese car buyers may also be more likely to adopt BEVs. A controlled survey experiment of car buyers in China and the U.S. suggest that U.S. consumer's willingness to buy a BEV is $10,000-$20,000 lower than an otherwise similar gasoline vehicle, whereas Chinese consumers' willingness to buy is within $10,000. [38]

As of December 2015, China listed as the world's leader in the plug-in heavy-duty segment, including electric buses and plug-in trucks, the latter, particularly sanitation/garbage trucks.[29][67] Over 160,000 heavy-duty new energy vehicles have been sold between 2011 and 2015, of which, 123,710 (77.2%) were sold in 2015.[5][55] Sales of commercial new energy vehicles in 2015 consisted of 100,763 all-electric vehicles (81.5%) and 22,947 plug-in hybrid vehicles (18.5%).[5]

Electric buses

The share of all-electric bus sales in the Chinese bus market climbed from 2% in 2010 to 9.9% in 2012, and was expected to be closed to 20% for 2013.[68] The global stock of plug-in electric buses in 2015 was estimated to be about 173,000 units, but almost entirely deployed in China, the world's largest electric bus market. Of these, almost 150,000 are all-electric buses. The Chinese electric bus stock grew nearly sixfold between 2014 and 2015.[56] The production of all-electric buses totaled 115,664 units in 2016, up 31% from 88,248 electric buses produced in 2015.[69]

The Chinese stock of plug-in buses reached 343,500 units in 2016, doubling the 2015 stock, with 300,000 units being all-electric vehicles. The global stock of electric buses was about 345,000 vehicles in 2016, with only 1,273 deployed in Europe and 200 in the U.S.[70] The city of Shenzhen is leading the modernization and electrification effort in China with hundreds of electric buses already in operation in 2016. Shenzhen set the goal of having a 100% electric bus fleet in 2017.[70] China had about 385,000 electric buses by the end of 2017, more than 99% of the global stock.[71]

Low-speed vehicles and other modes

- Low-speed electric vehicles

Sales of low-speed electric vehicles (LSEVs) experienced considerable growth in China between 2012 and 2016 due to their affordability and flexibility because they can be driven without a driver license. Most of these low-speed electric cars are used in small cities, but they are expanding to larger cities.[56][70] These small vehicles are not accounted by the government as new energy vehicles (NEVs) due to safety and environmental concerns, and are excluded from government NEV purchase subsidies.[3][72] LSEVs generally have a maximum speed of between 40 to 70 km/h (25 to 43 mph), have short ranges and, in some cases, use lead-acid batteries and basic motor technology.[70]

About 200 thousand low-speed small electric cars were sold in 2013,[3] and 750 thousand units in 2015.[72] LSEV sales in 2016 were estimated at 1.2 million, while highway capable plug-in passenger cars were over 300 thousand.[72] As of December 2016, the stock low-speed small electric car was estimated to be between 3 million and 4 million units.[70] However the sales ratio between LSEVs and passenger NEVs began to decrease beginning in 2015. In 2014, LSEVs sales were 15 times more than normal plug-in passenger cars, but the ratio declined to about four times in 2016, and fell to 2.5 times in 2018, when about 1.1 million normal passenger electric vehicles, compared to 1.4 million low-speed vehicles.[72]

The lack of regulations for LSEV manufacturers has led to poor safety performance. Traffic safety is also at stake. LSEVs struggle in large cities due to their poor acceleration and low top speeds. LSEVs could jeopardize the market for electric cars, one of China's priorities for industrial policy development. For these reasons, legislation to regulate and standardize low-speed electric vehicles began to be discussed by the Chinese government in 2016, including battery types (lead-acid versus lithium-ion batteries) and mandatory safety tests and vehicle dimensions.[70]

- Two-wheelers and three-wheelers

China continued to dominate both new registrations and the global stock of electric two-wheelers in 2016, with about 26 million units sold. The stock of electric two-wheelers is estimated in the 200-230 million range by the end of 2016, making China the global leader in this segment.[70]

The high growth rate in electric two-wheelers is partially due to the country's policies to limit air pollution hazards, such as its ban on gasoline-powered motorcycles, limits on the issuing of licences, and the division of lanes. In addition, two-wheelers have reached cost parity with internal combustion engine models, making them affordable and attractive to consumers.[70]

National market

2011–2013

A total of 8,159 new energy vehicles were sold in China during 2011, including passenger cars (61%) and buses (28%). Of these, 5,579 units were all-electric vehicles and 2,580 plug-in hybrids.[1] Electric vehicle sales represented 0.04% of total new car sales in 2011.[73] Sales of new energy vehicles in 2012 reached 12,791 units, which includes 11,375 all-electric vehicles and 1,416 plug-in hybrids.[2] New energy vehicle sales in 2012 represented 0.07% of the country's total new car sales.[74] During 2013 new energy vehicle sales totaled 17,642 units, up 37.9% from 2012 and representing 0.08% of the nearly 22 million new car sold in the country in 2013. Deliveries included 14,604 pure electric vehicles and 3,038 plug-in hybrids.[3][75]

The top selling new energy car in China between 2011 and 2013 was the Chery QQ3 EV city car, with 2,167 units sold in 2011, 3,129 in 2012, and 5,727 in 2013.[29] The JAC J3 EV ranked second in 2012 with 2,485 units sold, followed by the BYD e6 with 1,690 cars.[29] During 2013, the BYD e6 ranked second with 1,544 units sold, followed by the BAIC E150 EV with 1,466 units.[29] The BYD Qin plug-in hybrid was launched in the country in December 2013.[76] The Qin replaced the BYD F3DM, the world's first mass-produced plug-in hybrid automobile, launched in China in December 2008.[77][78][79]

2014

In April 2014, Dongfeng Nissan announced that retail sales of the Chinese manufactured version of the Nissan Leaf, the Venucia e30, were scheduled to begin in September 2014.[80] The Venucia e30 sold 582 units in 2014.[24]

The first Tesla Model S retail deliveries took place in Beijing on 22 April 2014.[81] About 2,800 Model S sedans have been imported by mid September 2014, but only 432 had received the license plates.[82] According to a Tesla spokesman, the major reasons for the discrepancy could be that registration rules were holding deliveries in Shanghai, and Tesla only recently was able to start delivering the electric cars to customers who bought them in Shanghai. Secondly, many Chinese customers have delayed taking possession of their Model S car while waiting for the government to add the Tesla to the list of electric vehicles exempt from its 8% to 10% purchase tax.[82][83] As of January 2015, a total of 2,968 Model S cars have been registered in China.[84][85]

New energy vehicle sales in China during 2014 totaled 74,763 units, consisting of 45,048 all-electric vehicles, and 29,715 plug-in hybrids. Of these, 71% were passenger cars, 27% buses, and 1% trucks.[24] Pure electric vehicle sales increased 210% from 2013 while plug-in hybrid sales grew 880% from the previous year. Production of new energy vehicles in the country in 2014 reached 78,499 units, up 350% from 2013. The plug-in electric segment market share reached 0.32% of the 23.5 million new car sales sold in 2014.[4] The BYD Qin ranked as the top selling plug-in electric car in China in 2014, with 14,747 units sold during the year,[24] and became the country's top selling plug-in passenger car ever.[28] The Qin was followed by the all-electrics Kandi EV with 14,398, Zotye Zhidou E20, with 7,341 units, and BAIC E150 EV with 5,234.[24][86]

2015

Domestically produced new energy vehicle sales in 2015 totaled a record 331,092 units, consisting of 247,482 all-electric vehicles and 83,610 plug-in hybrid vehicles, up 449% and 191% from 2014, respectively.[5] Sales of plug-in passenger cars, excluding imports, totaled 207,380 units in 2015, consisting of 146,720 all-electrics and 60,660 plug-in hybrids.[56] This record level of sales allowed China to rank as the world's best-selling plug-in electric car country market in 2015, ahead of the U.S., which was the top selling country in 2014.[57] The plug-in electric passenger car segment market share rose to 0.84% in 2015, up from 0.25% in 2014.[87] The top selling plug-in passenger models in 2015 were the BYD Qin plug-in hybrid with 31,898 units sold,[25] followed by the BYD Tang (18,375),[88] and the all-electrics Kandi EV (16,736), BAIC E150/160/200 EV (16,488), and the Zotye Z100 EV (15,467).[89]

September 2015 achieved the best monthly NEV sales volume on record, with 20,892 units sold.[90][91] BYD Auto also achieved record monthly sales volume, with 5,749 of its plug-in cars delivered in September 2015, consisting of 3,044 Tangs, 2,115 Qins, 465 e6s and 125 units of the new all-electric e5.[92] Sales of new energy vehicles in October 2015 totaled 34,316 units, a new sales record and five times higher year-on-year. Cumulative sales of NEVs reached 171,145 units during the first ten months of 2015.[93] Sales of new energy passenger cars also reached a record sales volume, with 21,375 plug-in cars sold in October 2015, up from 18,047 the previous month, and totaling 115,058 new energy cars sold during the first ten months of 2015.[94]

As of December 2015, with 31,898 units sold in 2015, the BYD Qin continued to rank as the all-time top selling plug-in passenger car in the country, with cumulative sales of 46,787 units since its introduction.[27][24][25][28] The BYD Qin was the world's second best selling plug-in hybrid car in 2015, and also ranked fifth among the world's top selling plug-in electric cars in 2015.[95] BYD Auto ended 2015 as the world's best selling manufacturer of highway legal light-duty plug-in electric vehicles, with 61,772 units sold in China, followed by Tesla Motors, with global sales of 50,580 units in 2015.[95][19][20] Accounting for heavy-duty vehicles, BYD total sales rises to 69,222 units.[20] BYD Auto net profits jumped 552.6% in 2015 to a total of CN¥2.829 billion (~ US$450 million ). Sales of new energy vehicles were the main driver for BYD's huge profit growth, with alternative energy vehicles accounting for half of the company's profits while the same percentage in 2014 was just 27%.[20]

2016

The stock of new energy vehicles sold in China since 2011 passed the 500,000 unit milestone in March 2016, including heavy-duty commercial vehicles such buses and sanitation trucks, and making the country the world's leader in the plug-in heavy-duty segment. This figure only includes vehicles manufactured in the country as imports are not subject to government subsidies.[13]

A total of about 507,000 new energy vehicles were sold in 2016, up 51.3% year-on-year, consisting of 409,000 pure electric vehicles, up 65.2% year-on-year, and 98,000 plug-in hybrid vehicles, up 17.2% from the same period the previous year.[6] Sales growth through September was lower than expected due to the government's inquiry about extensive fraud cases regarding subsidies granted to manufacturers in 2015. As a result of this inquiry, the government withheld the release of the electric bus subsidy scheme. CAAM considered that without this subsidy, the goal of 500,000 new energy vehicle sales for 2016 would not be met.[44]

Cumulative sales of plug-in passenger cars achieved the 500,000 unit milestone in September 2016. Imported plug-in cars, such as Tesla Model S or BMW i3s are not included.[14] A total of 320,081 new energy passenger cars were sold in 2016, ahead of both Europe (212,000) and the U.S. (157,181).[59] The domestic plug-in segment market share totaled 1.3% of new car sales in 2016.[59] Sales of BMW plug-in hybrid and i3 electric cars in China totaled 1,796 units during the first nine months of 2016.[96] Tesla Inc. sales totaled 10,399 vehicles in 2016, consisting of 6,334 Model S cars and 4,065 Model X SUVs.[97][98] In November 2016, with cumulative sales of about 600,000 plug-in electric passenger cars, China had overtook both Europe and the U.S., and became the market with the world's largest stock of light-duty plug-in vehicles.[10][58]

Three BYD Auto models topped the Chinese ranking of best-selling new energy passenger cars in 2016. The BYD Tang plug-in hybrid SUV was the top selling plug-in car with 31,405 units delivered, followed by the BYD Qin (21,868), BYD e6 (20,605), BAIC E-Series EV (18,814), and the SAIC Roewe e550 (18,805).[26] As of December 2016, the BYD Qin, with 68,655 units sold since its inception, remained the all-time top selling plug-in electric car in the country.[24][25][27][28][99] A lot of the sales of the BYD and Roewe electric vehicles were contributed by rental fleets to run on ride share app giant Didi.

In September 2016, BYD Auto surpassed Mitsubishi Motors as the third largest global plug-in car manufacturer with cumulative sales of 161,000 plug-in cars delivered in China since 2008, ranking behind Tesla Motors (164,000) and the Renault-Nissan Alliance (almost 369,000).[23] In October 2016, BYD passed Tesla Motors to become the world's all-time second largest plug-in electric passenger car manufacturer with more than 171,000 units delivered in China since 2008.[22][23] BYD Auto was the world's top selling plug-in car manufacturer for a second year in a row with more than 100,000 units delivered in China in 2016, up 64% from 2015, and ahead of Tesla by about 30,000 units.[21] However, in terms of sales revenue, Tesla ranked ahead with US$6.35 billion from its electric car sales in 2016, while BYD sales totaled US$3.88 billion from its electric car division.[100] Cumulative sales of domestically built new energy vehicles in China totaled 951,447 units between January 2011 and December 2016.[6][10]

2017

Chinese sales of domestically-built new energy vehicles in 2017 totaled 777,000 units, up 53% from 2016 consisting of 652,000 all-electric vehicles (up 59.4%) and 125,000 plug-in hybrid vehicles (up 27.6%). Sales of domestically-produced new energy passenger vehicles totaled 579,000 units, consisting of 468,000 all-electric cars and 111,000 plug-in hybrids.[7] Accounting for foreign brands, plug-in car sales rise to about 600,000 in 2017, representing about half of global plug-in car sales in 2017.[15] The plug-in segment achieved a record market share of 2.1% of new car sales.[15] Cumulative sales of domestically built new energy passenger cars totaled over 1.2 million units between 2011 and 2017.[7][15] Cumulative sales of domestically built new energy vehicles in China totaled 1,728,447 units between 2011 and 2017.[10][6][7]

The BAIC EC-Series all-electric city car was the Chinese top selling plug-in car in 2017 with 78,079 units sold, making the city car the world's top selling plug-in car in 2017. The top selling plug-in hybrid was the BYD Song PHEV with 30,920 units. BYD Auto was the top selling Chinese car manufacturer in 2017.[15] In 2017, General Motors sold about 11,000 Baojun E100s, 1,600 Buick Velite 5's and about 2,000 Cadillac CT6 plug-ins.[101]

2018

Sales of new energy vehicles, including commercial vehicles, totaled 1.256 million units in 2018, becoming the first time that annual sales pass the one million mark in any country.[8][102] Sales of plug-in passenger cars totaled 1,016,002 units,[103] and the plug-in passenger segment achieved a record market share of 4.2%, up from 2.1% in 2018.[104] For the second year running, the BAIC EC-Series was the best selling plug-in car in China with 90,637 units delivered.[103]

According to research carried out by Sina Corp, out of 886,000 plug-in passenger vehicles sold in China during the first 11 months of 2018, 201,000 units (22.6%) were delivered by the Chinese automakers to carsharing and vehicle for hire companies, with the rest to retail customers.[102]

At the end of 2018, the Chinese stock of new energy vehicles continued to be the world's largest, and totaled 2,984,447 units including heavy-duty commercial vehicles. About 80% of the total NEV stock are all-electric vehicles.[105][7][8] As of December 2018, cumulative sales of domestically produced highway legal plug-in electric passenger cars totaled 2,243,772 units since 2009.[103][106]

Regional and city markets

As of December 2017, 25 cities, including their broader surrounding metropolitan areas, accounted for 44% of the world's stock of plug-in electric cars, while representing just 12% of world passenger vehicle sales. Shanghai led the world with cumulative sales of over 162,000 electric vehicles since 2011, followed by Beijing with 147,000 and Los Angeles with 143,000. Ranking next, with a stock of more than 50,000 electric vehicles are Shenzhen, Oslo, Hangzhou, San Francisco, Tianjin, Tokyo, San Jose, California, and Qingdao.[71] Shanghai, Beijing, Shenzhen, Hangzhou, and Tianjin have market shares ranging from 9% to 13%.[71]

As of 2018, six Chinese cities have in place major restrictions on internal combustion vehicle purchases: Shenzhen, Shanghai, Beijing, Guangzhou, Hangzhou, and Tianjin. The local incentives and restrictions are different in each city, in the case of Shanghai most of the plug-in stock consist of plug-in hybrid vehicles, while in Beijing the stock is almost entirely all-electric.[72]

According to sales estimates made by Bloomberg New Energy Finance, the sales volume in these six cities is such, that they would rank among the world's largest plug-in electric car markets in 2018, if compared with the top selling countries in 2018, excluding China and the U.S.[72]

Passenger cars sales by model

The following table presents annual sales of new energy passenger cars by model between January 2011 and December 2015.

| Model | Total sales 2011–2015 | NEV segment market share(1) | Sales 2015[25][88][89][109] | Sales 2014[24][86][110] | Sales 2013[29][75] | Sales 2012[29][111] | Sales 2011[29][112][113] |

|---|---|---|---|---|---|---|---|

| BYD Qin | 46,787 | 10.5% | 31,898 | 14,747 | 142 | N/A | N/A |

| Kandi EV | 31,134 | 7.0% | 16,736 | 14,398 | N/A | N/A | N/A |

| BAIC E150/160/200 EV | 23,832 | 5.4% | 16,488 | 5,234 | 1,466 | 644 | |

| BYD Tang | 18,375 | 4.1% | 18,375 | N/A | N/A | N/A | N/A |

| Chery QQ3 EV | 16,247(2) | 3.7% | 3,208(2) | 2,016(3) | 5,727 | 3,129 | 2,167 |

| Zotye Cloud/Z100 EV | 15,467 | 3.5% | 15,467 | N/A | N/A | N/A | N/A |

| JAC J3/iEV | 15,279 | 3.5% | ~9,000 | ~1,000 | 1,309 | 2,485 | 1,585(4) |

| BYD e6 | 14,257(5) | 3.2% | 7,029 | 3,560 | 1,544 | 1,690 | 401 |

| Zotye Zhidou E20 | 13,726 | 3.1% | 6,385 | 7,341 | N/A | N/A | N/A |

| SAIC Roewe 550 PHEV | 11,711 | 2.6% | 10,711 | ~1,000 | N/A | N/A | N/A |

| Chery eQ | 7,804 | 1.8% | 7,262 | 542 | N/A | N/A | N/A |

| Tesla Model S[48][84][85] | 5,524(6) | 1.2% | 3,025(6) | 2,499 | N/A | N/A | N/A |

| Geely-Kandi Panda EV | 4,939 | 1.1% | 3,654 | 1,285 | N/A | N/A | N/A |

| Zhidou D2 | 3,777 | 0.8% | 3,777 | N/A | N/A | N/A | N/A |

| BYD F3DM | 3,284(5) | 0.7% | N/A | N/A | 1,005 | 1,201 | 613 |

| Denza EV | 3,020 | 0.7% | 2,888 | 132 | N/A | N/A | N/A |

| Zhidou D1 | 2,387 | 0.5% | 2,387 | N/A | N/A | N/A | N/A |

| Venucia e30 | 2,071 | 0.5% | 1,271 | 582 | N/A | N/A | N/A |

| BYD e5 | 1,426 | 0.3% | 1,426 | N/A | N/A | N/A | N/A |

| SAIC Roewe E50 | 1,227 | 0.3% | 412 | 168 | 409 | 238 | N/A |

| Zotye TT EV | 1,984 | 0.4% | 1,984 | N/A | N/A | N/A | N/A |

| Total new energy vehicles sales[1][2][3][4][5] | 444,447(7) | - | 331,092 | 74,763 | 17,642 | 12,791 | 8,159 |

| Notes:

(1) Model market share as percentage of the 444,447 new energy vehicles sold between 2011 and December 2015. | |||||||

See also

- Electric car

- Electric car use by country

- Electric vehicle industry in China

- Electric vehicles in Hong Kong

- Government incentives for plug-in electric vehicles

- List of modern production plug-in electric vehicles

- Plug-in electric vehicle

- Plug-in electric vehicles in Australia

- Plug-in electric vehicles in Canada

- Plug-in electric vehicles in California

- Plug-in electric vehicles in Europe

- Plug-in electric vehicles in France

- Plug-in electric vehicles in Germany

- Plug-in electric vehicles in Japan

- Plug-in electric vehicles in the Netherlands

- Plug-in electric vehicles in Norway

- Plug-in electric vehicles in Sweden

- Plug-in electric vehicles in the United Kingdom

- Plug-in electric vehicles in the United States

- Plug-in hybrid

References

- China Association of Automobile Manufacturers (2012-01-16). "5,579 electric cars sold in China in 2011". Wind Energy and Electric Vehicle Review. Retrieved 2014-01-12.

- Cars21.com (2013-02-13). "EV sales increase 103.9% in China in 2012- Electric China Weekly No 17". Cars21.com. Retrieved 2014-01-12.

- Jiang Xueqing (2014-01-11). "New-energy vehicles 'turning the corner'". China Daily. Retrieved 2014-01-12.

- China Association of Automobile Manufacturers (CAAM) (2015-01-14). "The sales and production of new energy vehicles boomed". CAAM. Retrieved 2015-01-14.

- China Association of Automobile Manufacturers (CAAM) (2016-01-20). "New energy vehicles enjoyed a high-speed growth". CAAM. Retrieved 2016-01-21.

- Liu Wanxiang (2017-01-12). "中汽协:2016年新能源汽车产销量均超50万辆,同比增速约50%" [China Auto Association: 2016 new energy vehicle production and sales were over 500,000, an increase of about 50%] (in Chinese). D1EV.com. Retrieved 2017-01-12. Chinese sales of new energy vehicles in 2016 totaled 507,000, consisting of 409,000 all-electric vehicles and 98,000 plug-in hybrid vehicles.

- Automotive News China (2018-01-16). "Electrified vehicle sales surge 53% in 2017". Automotive News China. Retrieved 2020-05-22. Chinese sales of domestically-built new energy vehicles in 2017 totaled 777,000, consisting of 652,000 all-electric vehicles and 125,000 plug-in hybrid vehicles. Sales of domestically-produced new energy passenger vehicles totaled 579,000 units, consisting of 468,000 all-electric cars and 111,000 plug-in hybrids. Only domestically built all-electric vehicles, plug-in hybrids and fuel cell vehicles qualify for government subsidies in China.

- "中汽协:2018年新能源汽车产销均超125万辆,同比增长60%" [China Automobile Association: In 2018, the production and sales of new energy vehicles exceeded 1.25 million units, a year-on-year increase of 60%] (in Chinese). D1EV.com. 2019-01-14. Retrieved 2019-01-15. Chinese sales of new energy vehicles in 2018 totaled 1.256 million, consisting of 984,000 all-electric vehicles and 271,000 plug-in hybrid vehicles.

- Kane, Mark (2020-02-04). "Chinese NEVs Market Slightly Declined In 2019: Full Report". InsideEVs.com. Retrieved 2020-05-30. Sales of new energy vehicles totaled 1,206,000 units in 2019, down 4.0% from 2018, and includes 2,737 fuel cell vehicles. Battery electric vehicle sales totaled 972,000 units (down 1.2%) and plug-in hybrid sales totaled 232,000 vehicles (down 14.5%). Sales figures include passenger cars, buses and commercial vehicles..

- Cobb, Jeff (2016-12-27). "China Takes Lead As Number One In Plug-in Vehicle Sales". HybridCars.com. Retrieved 2017-01-06. As of November 2016, cumulative sales of plug-in electric vehicles in China totaled 846,447 units, including passenger and commercial vehicles, making the country the world's leader in overall plug-in electric vehicle sales. With cumulative sales of about 600,000 plug-in electric passenger cars through November 2016, China is also the global leader in the plug-in passenger vehicle segment, ahead of Europe and the U.S.

- PRTM Management Consultants, Inc (April 2011). "The China New Energy Vehicles Program - Challenges and Opportunities" (PDF). World Bank. Retrieved 2013-04-22. See Acronyms and Key Terms, pp. v

- Samuel Shen, Norihiko Shirouzu (2013-11-22). "Electric vs. Hydrogen: China Is Battleground for Auto Giants". Reuters. Retrieved 2019-02-19.

- Cobb, Jeff (2016-05-11). "China Reports 500,000th Plug-in Vehicle Sold". HybridCars.com. Retrieved 2016-05-12. As of March 2016, a total of 502,572 new energy vehicles have been sold in China since 2011, consisting of 366,219 all-electric vehicles (72.9%) and 136,353 plug-in hybrids (27.1%). With 31,772 NEVs sold in April 2016, cumulative sales totaled 534,344 NEVs between January 2011 and April 2016.

- Cobb, Jeff (2016-09-28). "China Buys Half-Millionth Passenger Plug-in Car; On Track To Surpass US". HybridCars.com. Retrieved 2016-09-28. Sales of new energy vehicles totaled 689,447 units between 2011 and August 2016. Cumulative sales of new energy passenger cars totaled 493,290 units between 2010 and August 2016.

- Jose Pontes (2018-01-18). "China December 2017". EV Sales. Retrieved 2018-01-19. Sales of plug-in electric cars in China, including imports, totaled 600,174 units in 2017. The BAIC EC-Series was the top selling plug-in with 78,079 units sold in China, making the city car the world's top selling plug-in car in 2017. The top selling plug-in hybrid was the BYD Song PHEV with 30,920 units. BYD Auto was the top selling car manufacturer. Foreign brands captured only about 4% of plug-in sales in 2017, with about half by Tesla. The Chinese plug-in car market represented roughly half of the 1.2 million plug-ins sold worldwide in 2017.

- Dune, Michael J. (2016-12-14). "China's Automotive 2030 Blueprint: No. 1 Globally In EVs, Autonomous Cars". Forbes. Retrieved 2016-12-14.

- International Energy Agency (IEA), Clean Energy Ministerial, and Electric Vehicles Initiative (EVI) (June 2020). "Global EV Outlook 2020: Enterign the decade of electric drive?" (PDF). IEA Publications. Retrieved 2020-06-15.CS1 maint: multiple names: authors list (link) See Statistical annex, pp. 247–252 (See Tables A.1 and A.12). The global stock of plug-in electric passenger vehicles totaled 7.2 million cars at the end of 2019, of which, 47% were on the road in China. The stock of plug-in cars consist of 4.8 million battery electric cars (66.6%) and 2.4 million plug-in hybrids (33.3%). In addition, the stock of light commercial plug-in electric vehicles in use totaled 378 thousand units in 2019, and about half a million electric buses were in circulation, most of which are in China.

- Majeed, Abdul (2016-09-29). "China faces acid test in vehicle emissions". Business Line. Retrieved 2016-09-29.

- John Voelcker (2016-01-15). "Who Sold The Most Plug-In Electric Cars In 2015? (It's Not Tesla Or Nissan)". Green Car Reports. Retrieved 2016-01-17. BYD Auto delivered 31,898 Qins, 18,375 Tangs, and 7,029 e6s during 2015. Added to that are small numbers of the T3 small commercial van and e5 battery-electric compact sedan, along with 2,888 Denza EV compact hatchbacks built by its joint venture with Daimler. Altogether, BYD sold a total of 61,722 light-duty plug-in electric vehicles in China in 2015.

- Natasha Li (2016-03-04). "Alternative Energy Vehicles Account HALF of BYD's Profits for the Very First Time in 2015". Gasgoo Automotive News. Archived from the original on 2016-03-08. Retrieved 2016-03-07. BYD Auto delivered 69,222 new energy vehicles in China in 2015, including buses, of which, a total of 61,722 were passenger vehicles, mostly plug-in hybrids, led by the Qin and Tang.

- Jin Peiling (2017-01-10). "谁是2016年电动汽车市场的霸主?" [Who is the dominant electric vehicle market in 2016?] (in Chinese). Daily Observation Car. Archived from the original on 2017-01-16. Retrieved 2017-01-15. BYD sold more than 100,000 new energy passenger cars in China in 2016, about 30,000 more units than Tesla Motors. The BYD Tang was the top selling plug-in car in China in 2016 with 31,405 units delivered.

- Liu Wanxiang (2016-11-10). "乘联会:10月新能源乘用车销售3.1万辆 插电式车型环比下降44%" [By the Automobile Association: October new energy passenger car sales were 31,000, plug-in hybrids were down 44%] (in Chinese). D1EV.com. Archived from the original on 2016-11-12. Retrieved 2016-11-11. Sales of new energy passenger cars totaled 30,989 units in October 2016, consisting of 26,811 all-electric cars and 4,178 plug-in hybrids. BYD Auto sold 10,395 units consisting of 7,328 all-electric cars and 3,067 plug-in hybrids. A total of 3,118 e6s, 2,124 Qin EV300s, 1,943 e5s, 1,538 Qins and 1,529 Tangs were sold in October 2016.

- Cobb, Jeff (2016-11-07). "China's BYD Becomes World's Third-Largest Plug-in Car Maker". HybridCars.com. Retrieved 2016-11-07.

- Staff (2015-01-14). "2014 EV Sales Ranking". China Auto Web. Retrieved 2015-01-15.

- Staff (2016-01-14). "Best-selling Sedan in 2015". China Auto Web. Retrieved 2016-02-08. A total of 31,898 Qins were sold in China in 2015.

- Staff (2017-01-19). "Best-selling China-made EVs in 2016". China Auto Web. Retrieved 2017-01-25. Three BYD Auto models topped the Chinese ranking of best-selling new energy passenger cars in 2016. The BYD Tang SUV was the top selling plug-in electric car in China in 2016 with 31,405 units sold, followed by the BYD Qin with 21,868 units sold, and ranking third overall in 2016 was the BYD e6 with 20,605 units.

- Mat Gasnier (2014-01-14). "China December 2013: Focus on the all-new models". Best Selling Cars Blog. Retrieved 2014-01-16.

- Jeff Cobb (2015-02-11). "2014's Top-10 Global Best-Selling Plug-in Cars". HybridCars.com. Retrieved 2015-10-22.

- Henry Lee; Sabrina Howell & Adam Heal (June 2014). "Leapfrogging or Stalling Out? Electric Vehicles in China". Belfer Center, Harvard Kennedy School. Retrieved 2015-01-18. Download EVS in China (full report). See Table 2: Chinas's EV Sales by Brand, 2011-2013, pp.19.

- "Chinese cities open up green car markets as government battles pollution". Global Post. Reuters. 2014-03-03. Retrieved 2014-03-21.

- "China announces new electric car subsidy program". China Economic Review. 2013-09-18. Archived from the original on 2013-12-17. Retrieved 2013-09-18.

- Bradsher, Keith (2009-04-01), "China Vies to Be World's Leader in Electric Cars", The New York Times, retrieved 2009-04-05

- "China Announces Plan to Subsidize EVs and Plug-in Hybrids in Five Major Cities". Edmunds.com. 2010-06-01. Archived from the original on 2010-06-05. Retrieved 2010-06-14.

- Motavalli, Jim (2010-06-02). "China to Start Pilot Program, Providing Subsidies for Electric Cars and Hybrids". New York Times. Retrieved 2010-06-02.

- Shirouzu, Norihiko (15 December 2008), BYD to Introduce China's First Electric Car, Wall Street Journal, retrieved 2009-04-06

- Mike Millikin (2012-07-09). "China publishes plan to boost fuel-efficient and new energy vehicles and domestic auto industry; targeting 500K PHEVs and EVs in 2015, rising to 2M by 2020". Green Car Congress. Retrieved 2014-03-22.

- Helveston, John (2015). "Will subsides drive electric vehicle adoption? Measuring consumer preferences in the U.S. and China". Transportation Research. Part A. 73: 96–112. doi:10.1016/j.tra.2015.01.002.

- Xinhua (2014-02-15). "New energy vehicle sales set at 160,000 for 2014 in China". Want China Times. Archived from the original on 2014-03-22. Retrieved 2014-03-21.

- Gu Liping (2014-09-07). "China's Jan.-Aug. NEV production up 328 percent". Xinhua. ECNS. Retrieved 2014-09-07.

- Natasha Li (2015-10-15). "Forecasts:Sales of alternative energy cars to hit 200,000 this year in China". Gasgoo Automotive News. Retrieved 2015-10-22.

- Meng Meng & Jake Spring (2016-01-12). "China green car sales to double to 700,000 units in 2016: industry association". Beijing: Reuters. Retrieved 2016-02-12.

- Ge, Celine (2016-09-12). "Chinese auto group slashes new energy vehicle forecast in wake of subsidy fraud". South China Morning Post. Retrieved 2016-09-13.

- "EV sales growth, production slow down". China Daily. China.org.cn. 2016-10-17. Retrieved 2016-10-25.

- "10 Electric Models To Be Released This Year?". ChinaAutoWeb.com. 2010-05-14. Retrieved 2010-05-21.

- Li Fusheng (2015-11-09). "Central govt gives a jolt to new-energy auto industry". China Daily. Retrieved 2015-11-27.

- Xinhua (2015-10-09). "China to build chargers to power 5 mln electric cars by 2020". Xinhua News Agency. Retrieved 2015-10-25.

- Jake Spring (2015-10-23). "CORRECTED-(OFFICIAL)-UPDATE 2-Tesla CEO says negotiating with China on local production". Reuters. Retrieved 2015-10-25. Tesla sold sold 3,025 Model S cars in China from January to September 2015.

- Rose Yu (2015-10-23). "Tesla Aims to Build Its Electric Cars in China". The Wall Street Journal. Retrieved 2015-10-25.

- "New license plates to differentiate new energy vehicles". Xinhua. 2016-04-18. Retrieved 2016-04-19.

- "Beijing Seeks to Legislate Car Quotas as It Mulls Congestion Fee". Bloomberg News. 2016-05-25. Retrieved 2016-05-28.

- Staff (2016-05-11). "中汽协:4月新能源汽车产销同步破3万辆 同比增长近2倍" [Automobile Association: April sales of new energy vehicles sync break 30,000, an increase of nearly 2-fold] (in Chinese). D1EV.com. Retrieved 2016-07-31. Sales of new energy vehicles totaled 31,772 units in April 2016, consisting of 23,908 all-electric vehicles and 7,864 plug-in hybrids.

- Jack Perkowski (2013-06-24). "The Reality Of Electric Cars In China". Forbes. Retrieved 2013-11-10.

- Jiang Xueqing (2013-08-05). "New energy vehicles await fuel injection". China Daily. Retrieved 2014-03-22.

- International Energy Agency, Clean Energy Ministerial, and Electric Vehicles Initiative (EVI) (March 2015). "Global EV Outlook 2015" (PDF). Clean Energy Ministerial. Archived from the original (PDF) on 2015-04-02. Retrieved 2015-03-14.CS1 maint: multiple names: authors list (link) The EV Outlook 2015 figures include only plug-in electric passenger cars and SUVs (excludes light-weight utility vehicles) Archived 2015-04-02 at the Wayback Machine and total sales/registrations figures correspond to the 16 EVI countries, which are estimated to represent 95% of the global PEV stock. As of December 2014, the Japanese stock of plug-in cars totaled 108,241 units, and China had about 36,500 all-electric buses.

- International Energy Agency (IEA), Clean Energy Ministerial, and Electric Vehicles Initiative (EVI) (May 2016). "Global EV Outlook 2016: Beyond one million electric cars" (PDF). IEA Publications. Archived from the original (PDF) on 2016-08-24. Retrieved 2016-12-18.CS1 maint: multiple names: authors list (link) See pp. 24-25, and 34-36, Table 6. The stock of plug-in electric cars in China totaled 312,290 units at the end of 2015.

- Cobb, Jeff (2016-01-18). "Top Six Plug-in Vehicle Adopting Countries – 2015". HybridCars.com. Retrieved 2016-02-12. About 520,000 highway legal light-duty plug-in electric vehicles were sold worldwide in 2014, with cumulative global sales reaching 1,235,000. The United States is the leading market with 411,120 units sold since 2008, followed by China with 258,328 units sold since 2011.

- King, Danny (2016-12-29). "China far ahead of US, Europe in total electric vehicle sales". Autoblog.com. Retrieved 2017-01-08.

Last year, China overtook both the US and Europe in annual sales of electric vehicles and plug-in hybrids. This year, it will move ahead of both the US and Europe in cumulative plug-in vehicle sales.

- Cobb, Jeff (2017-01-17). "Top 10 Plug-in Vehicle Adopting Countries of 2016". HybridCars.com. Retrieved 2017-01-18.

- Cobb, Jeff (2016-10-17). "China Now Ties US For Leadership In Cumulative Global Plug-In Sales". HybridCars.com. Retrieved 2016-10-17. As of September 2016, the U.S. and China are technically tied for first place as the world's largest plug-in passenger car market. The U.S. has cumulative plug-in car sales of 522,519 units while China has 521,649 domestically produced plug-in cars. Europe is still the world's largest regional market with almost 50,000 more units sold that both countries, totaling about 570,000 light-duty plug-in vehicles. As of September 2016, cumulative sales of domestic new energy vehicles since 2011 totaled 733,447 units, making China the world's largest plug-in electric vehicle market when all automotive segments are accounted for.

- Cobb, Jeff (2016-11-02). "October 2016 Dashboard". HybridCars.com and Baum & Associates. Retrieved 2016-11-13.

- Cobb, Jeff (2016-11-14). "California Celebrates One-Quarter Million Plug-in Cars Sold". HybridCars.com. Retrieved 2016-11-15.

The U.S., counting sales back to 2008, has purchased 532,754 PEVs through October 2016.

- Liu Wanxiang (2016-12-09). "乘联会:11月新能源乘用车销售4.2万辆 众泰、比亚迪、吉利表现强劲" [By the Automobile Association: November new energy passenger car sales totaled 42,000 units. Zotye, BYD, Geely strong] (in Chinese). D1EV.com. Retrieved 2016-12-17. Sales of new energy passenger cars in China totaled 41,795 units in November 2016, consisting of 26,811 all-electric cars and 4,178 plug-in hybrids. Sales of new energy passenger car totaled 282,292 units between January and November 2016, consisting of 208,839 all-electric cars and 73,453 plug-in hybrids. BYD Auto sold 8,314 units in November 2016 consisting of 2,069 e6s, 2,113 e5s, 1,578 Tangs, 1,215 Qin EV300s, and 1,118 Qins.

- Cobb, Jeff (2016-12-02). "November 2016 Dashboard". HybridCars.com and Baum & Associates. Retrieved 2016-12-18.

- Liu Wanxiang (2017-01-11). "乘联会:新能源乘用车2016年销量32万辆 比亚迪\吉利\北汽稳居前三" [By the Federation: new energy passenger car sales in 2016 totaled 320,000 units. BYD, Geely and BAIC were the top three manufacturers] (in Chinese). D1EV.com. Retrieved 2017-01-12. Sales of new energy vehicles in China totaled 320,081 units, consisting of 239,830 all-electric cars and 80,251 plug-in hybrid vehicles.

- Frost, Laurence (2017-01-15). "China, Europe drive shift to electric cars as U.S. lags". Reuters. Retrieved 2017-01-15.

- Jeff Cobb (2015-09-16). "One Million Global Plug-In Sales Milestone Reached". HybridCars.com. Retrieved 2015-09-16. Cumulative global sales totaled over 1 million highway legal plug-in electric passenger cars and light-duty vehicles by mid-September 2015.

- Xinhua News Agency (2014-02-01). "Experts eye Tesla to spur China's electric vehicle market". Xinhua English News. Archived from the original on 2014-02-21. Retrieved 2014-02-16.

- "2016纯电动客车格局巨变:宇通比亚迪中通三足鼎立" [2016 pure electric bus pattern change: Yutong BYD in the tripod] (in Chinese). NEV.ofweek.com. 2017-01-18. Retrieved 2017-01-25.

- International Energy Agency (IEA), Clean Energy Ministerial, and Electric Vehicles Initiative (EVI) (June 2017). "Global EV Outlook 2017: Two million and counting" (PDF). IEA Publications. Archived from the original (PDF) on 2017-06-07. Retrieved 2018-01-21.CS1 maint: multiple names: authors list (link) See pp. 5–7, 12–22, 27–28, and Statistical annex, pp. 49–51.

- Dale Hall, Hongyang Cui, Nic Lutsey (2018-10-30). "Electric vehicle capitals: Accelerating the global transition to electric drive". The International Council on Clean Transportation. Retrieved 2018-11-01.CS1 maint: multiple names: authors list (link) Click on "Download File" to get the full report, 15 pp.

- Bullard, Nathaniel; McKerracher, Colin (2019-02-08). "Dispelling the Myths of China's EV Market". Bloomberg L.P. Retrieved 2019-02-09.

- Philippe Crowne (2012-11-23). "China To Sell Over 4 Million Electrified Vehicles in 2020". HybridCars.com. Archived from the original on 2012-11-28. Retrieved 2014-01-12.

- China Daily (2013-02-28). "China needs electric cars more than hybrid". China Economic Net. Retrieved 2013-03-12.

- Staff (2014-01-10). "Plug-in EV Sales in China Rose 37.9% to 17,600 in 2013". China Auto Web. Retrieved 2014-02-09.

- Chinese Car News (2013-12-19). "BYD Launches Qin Plugin Hybrid – 189,800RMB to 209,800RMB". China Car Times. Archived from the original on 2013-12-21. Retrieved 2013-12-19.

- John Voelcker (2012-04-20). "BYD Chin: World's First Plug-In Hybrid, Updated And Renamed". Green Car Reports. Retrieved 2012-04-21.

- Danny King (2012-04-19). "BYD's Qin sedan will replace poor-selling F3DM". Autoblog Green. Retrieved 2012-04-21.

- "Daimler/BYD joint venture introduces DENZA EV concept at Auto China 2012; BYD introduces new dual-mode Qin". Green Car Congress. 2012-04-22. Retrieved 2012-04-25.

- Sebastian Blanco (2014-04-21). "Chinese Nissan Leaf goes on sale in September as Venucia e30". Autoblog Green. Retrieved 2014-04-21.

- Julie Makinen (2014-04-22). "Tesla delivers its first electric cars in China; delays upset some". Los Angeles Times. Retrieved 2014-04-22.

- Charles Fleming (2014-09-26). "Are Teslas disappearing in China?". Los Angeles Times. Retrieved 2014-10-16.

- Sarita Pereira (2014-10-16). "Tesla Motors: The Road To China Is Getting Harder". Seeking Alpha. Retrieved 2014-10-17.

- Staff (2015-03-07). "Tesla cutting 30% of staff in China". Want China Times. Archived from the original on 2015-03-08. Retrieved 2015-03-09. Tesla imported 4,800 Model S cars in 2014, but only 2,499 of those vehicles were registered for road use in China.

- Colum Murphy (2015-03-09). "Tesla Runs Out of Charge in China". Wall Street Journal. Retrieved 2015-03-09. According to JL Warren Capital LLC, just under 2,500 Model S cars were sold in China in 2014, and an additional 469 units in January 2015. See graphs for monthly imports and registrations.

- Kandi Technologies Group (2015-01-07). "Kandi Technologies Announces the Expansion of Micro Public EV Sharing Program to Nine Chinese Cities With 14,398 Pure EVs Delivered as of the End of 2014" (Press release). Jinhua, China: NASDAQ. Retrieved 2015-02-07.

- Jose, Pontes (2016-01-12). "China December 2015 (3rd Update)". EVSales.com. Retrieved 2016-02-08.

- Staff (2016-01-14). "Best-selling China-made SUVs in 2015". China Auto Web. Retrieved 2016-01-17. A total of 18,375 Tangs were sold in China in 2015.

- Staff (2016-01-14). "Sales Ranking of China-made Pure-electric Cars in 2015". China Auto Web. Retrieved 2016-02-10. A total of 16,736 Kandi EVs, 16,488 BAIC E-Series EVs, and 15,467 Zotye Z100 EVs were sold in China in 2015.

- China Association of Automobile Manufacturers (CAAM) (2015-10-22). "New energy vehicles keeped [sic] a high-speed growth". CAAM. Retrieved 2015-10-22.

- AAStocks Financial News (2015-10-20). "China New Energy Car Single-Month Sales Volume Hits All-Time High in Sep". AAStocks.com. Retrieved 2015-10-25.

- Mark Kane (2015-10-23). "BYD Plug-In Electric Car Sales Up In China To Over 5,500 In September". InsideEVs.com. Retrieved 2015-10-25.

- China Association of Automobile Manufacturers (CAAM) (2015-11-17). "New energy vehicles enjoyed a high-speed growth". CAAM. Retrieved 2015-11-27.

- Staff (2015-11-10). "乘联会:10月新能源乘用车销售创新高至2.14万辆 康迪熊猫排第一" [According to the Federation: October new energy passenger car sales to 21,400 high - Condit Panda ranked first] (in Chinese). D1EV.com. Retrieved 2015-11-27. See graph with monthly sales.

- Cobb, Jeff (2016-01-12). "Tesla Model S Was World's Best-Selling Plug-in Car in 2015". HybridCars.com. Retrieved 2016-01-23. The Tesla Model S was the top selling plug-in electric car in 2015 (50,366), followed by the Nissan Leaf (about 43,000), the Mitsubishi Outlander P-HEV (over 40,000), the BYD Qin (31,898) and the BMW i3 (24,057). BYD Auto ended 2015 with 58,728 units sold in China (includes BYD Qin, Tang, e6 and e5 vehicles).

- Parkin, Brian; Jennen, Birgit (2016-11-03). "German Minister Snubs Automakers to Back China EV Quota Plan". Bloomberg News. Retrieved 2016-11-04.

- Schmitt, Bertel (2017-03-04). "Tesla's Sudden Chinese Billion, Where Are The Cars Behind It?". Forbes. Retrieved 2017-03-06.

- Schmitt, Bertel (2017-03-06). "Here Is What We Know About Tesla's Big China Bonanza". Forbes. Retrieved 2017-03-06. A total of 10,399 Tesla vehicles were sold in China in 2016 out of 12,303 imported to the country.

- Staff (2017-01-17). "Best-selling China-made Sedans in 2016". China Auto Web. Retrieved 2017-01-17. A total of 21,868 BYD Qins were sold in China in 2016.

- Fehrenbacher, Katie (2017-03-14). "Tesla, BYD Jockey for Electric Car World Domination". Green Tech Media. Retrieved 2017-03-15. Revenue figures from Bloomberg New Energy Finance.

- Gardner, Greg (17 Jan 2018). "GM is confident it can meet China's lofty electric vehicle target, despite lag in 2017". The Detroit Free Press. Retrieved 21 January 2018.

- Jian, Yang (2019-01-28). "Now we know who is really buying electric vehicles in China". Autonews. Retrieved 2019-01-29.

In 2018, electrified-vehicle sales in China for the first time topped 1 million, reaching 1.26 million

- "China's new energy PV wholesale volume in 2018 shoots up 83% year on year". Gasgoo. 2019-01-11. Retrieved 2019-01-21. Sales of new energy passenger cars totaled 1,016,002 units in 2018.The BAIC EC series ranked as China's top selling plug-in car in 2018 with 90,637 units delivered.

- Jose, Pontes (2019-01-22). "China December 2018". EVSales.com. Retrieved 2019-01-22.

- Cobb, Jeff (2017-01-16). "The World Just Bought Its Two-Millionth Plug-in Car". HybridCars.com. Retrieved 2017-01-17. An estimated 2,032,000 highway-legal plug-in passenger cars and vans have been sold worldwide at the end of 2016. The top selling markets are China (645,708 new energy cars, including imports), Europe (638,000 plug-in cars and vans), and the United States (570,187 plug-in cars). The top European country markets are Norway (135,276), the Netherlands (113,636), France (108,065), and the UK (91,000). Total Chinese sales of domestically produced new energy vehicles, including buses and truck, totaled 951,447 vehicles. China was the top selling plug-in car market in 2016, and also has the world's largest stock of plug-in electric cars.

- International Energy Agency (IEA), Clean Energy Ministerial, and Electric Vehicles Initiative (EVI) (May 2018). "Global EV Outlook 2017: 3 million and counting" (PDF). IEA Publications. Retrieved 2018-11-10.CS1 maint: multiple names: authors list (link) See pp. 9–10, 19–23, 29–28, and Statistical annex, pp. 107–113.

- European Automobile Manufacturers Association (ACEA) (2019-02-07). "New Passenger Car Registrations By Fuel Type In The European Union: Quarter 4 2018" (PDF). ACEA. Retrieved 2019-02-09. For sales in Norway, Germany, UK, France, the Netherlands and Sweden see table: "Total Electric Chargeable Vehicles (ECV) - New Passenger Car Registrations By Market In The EU + EFTA"

- Jose, Pontes (2019-01-30). "Markets Roundup December 2018". EVSales.com. Retrieved 2019-02-09. "Sales of plug-in electric cars in Japan totaled about 52,000 units and about 43,000 in Canada ."

- Jose, Pontes (2016-01-12). "China December 2015 (3rd Update)". EVSales.com. Retrieved 2016-02-13. A total of 10,711 SAIC Roewe 550 PHEVs were sold in China in 2015.

- Tim Harrup (2014-04-16). "Sales of EV's surge in China". Global Fleet. Archived from the original on 2014-10-20. Retrieved 2014-04-21.

- China Auto Web (2013-03-25). "Chinese EV Sales Ranking for 2012". China Auto Web. Retrieved 2013-04-20.

- Mat Gasnier (2013-01-14). "China Full Year 2012: Ford Focus triumphs". Best Selling Car Blog. Retrieved 2013-04-21.A total of 613 F3DMs and 401 e6s were sold during 2011 and 1,201 F3DMs and 1,690 e6s in 2012.

- China Auto Web (2012-09-30). "JAC Delivers 500 J3 EVs ("ievs")". China Auto Web. Retrieved 2014-05-31. A total of 1,585 of the first and second generation models were sold during 2010 and 2011..

- Staff (2015-07-17). "Chinese EV Sales Ranking in the First Half of 2015". China Auto Web. Retrieved 2015-10-21.

- "BYD Delivered Only 33 Units of e6, 417 F3DM in 2010". ChinaAutoWeb. 2011-02-23. Retrieved 2014-05-31.

- "BYD Plans to Start European Car Sales Next Year (Update 2)". Bloomberg News. 2010-03-08. Retrieved 2014-05-31. 48 F3DMs were sold in 2009.

External links

- Leapfrogging or Stalling Out? Electric Vehicles in China, Belfer Center for Science and International Affairs, Harvard University, May 2014

- Review of Beijing’s Comprehensive Motor Vehicle Emission Control Programs, White Paper (see Chapter 6), International Council on Clean Transportation (ICCT), October 2015.

- Electric cars in China:Charging Ahead, The Economist, 30 July 2016 (from the print edition)

- Driving a green future: A retrospective review of China’s electric vehicle development and outlook for the future, International Council on Clean Transportation (ICCT), January 2021.