Buy-write

The term buy-write is used to describe an investment strategy in which the investor buys stocks and writes call options against the stock position. The writing of the call option provides extra income for an investor who is willing to forgo some upside potential.

History

Investors have used exchange-listed options to engage in buy-write strategies since the 1970s, and descriptive articles were published in the Journal of Portfolio Management in 1978 by Henry Pounds and in 1980 by Yates and Kopprasch (see references section below). However, prior to 2002 there was no major benchmark for buy-write strategies. To help in the development of the CBOE S&P 500 BuyWrite Index (ticker BXM), the Chicago Board Options Exchange commissioned Professor Robert Whaley of Vanderbilt University to compile and analyze relevant data from the time period from June 1988 through December 2001. In April 2002, the index was announced with the publication of "Return and Risk of CBOE Buy-Write Monthly Index" in Journal of Derivatives (Winter 2002). The BXM Index is designed to show the hypothetical performance of a strategy in which an investor buys a portfolio of the S&P 500 stocks, and also sells (or writes) covered call options on the S&P 500 Index.

Investors have used covered call strategies for more than three decades. As noted in a magazine article “Buy Writing Makes Comeback as Way to Hedge Risk.” Pensions & Investments, (May 16, 2005), two developments have enhanced the interest in covered call strategies in recent years: (1) in 2002 the Chicago Board Options Exchange introduced the first major benchmark index for covered call strategies, the CBOE S&P 500 BuyWrite Index (ticker BXM), and (2) in 2004 the Ibbotson Associates consulting firm published a case study on buy-write strategies. In 2006 Callan Associates published A Review of the CBOE S&P 500 BuyWrite Index.

The BXM Index won the Most Innovative Benchmark Index award at the 2004 Super Bowl of Indexing Conference.

More than forty new buy-write investment products have been introduced since mid-2004 (see Samples section below).

With the performance of the strategy in the late 2000s decade, people are not very interested anymore.[1]

Call writing works well in flat markets, but it loses a lot in downturns, then does not get it back when the market turns up.[2]

Understanding the Expiry Payout of Buy-Write

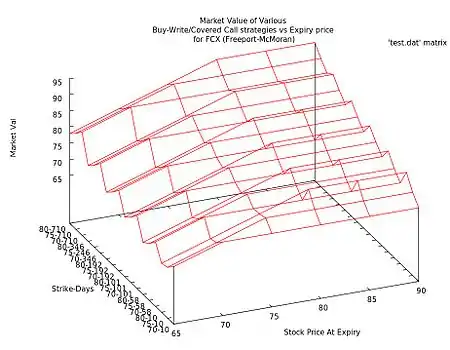

[3] "The Figure above shows a 3-Dimensional plot of expiry value versus stock price for FCX on expiry saturday versus the option purchased. Please take a few moments to study the chart making careful note of the yaxis which represents the option purchased in the format of (Strike Price)-(Days to Expiry), e.g. 70-10 would be 70 dollars and 10 days to expiry, and 85-101 would be an 85 dollar strike price with 101 days to expiry."[4]

Benchmark Indexes for BuyWrite Strategies

- CBOE S&P 500 BuyWrite Index

- CBOE DJIA BuyWrite Index

- CBOE Russell 2000 BuyWrite Index (BXR)

- CBOE NASDAQ-100 BuyWrite Index (BXN)

- CBOE S&P 500 2% OTM BuyWrite Index (BXY)

- S&P/ASX Buy-Write Index (Australia) (XBW)

References

- "'Buy-Write' Managers Feel a Chill - WSJ". The Wall Street Journal.

- "Twelve Yield Illusions, Part II". Forbes.

- Entering a Buy-Write Strategy www.quantprinciple.com

- QuantPrinciple's Buy-Write Strategy www.quantprinciple.com

Further reading

- Blake, R. "Investors Are Dusting Off an Old Strategy, Options Overlay; When It Works, It Offers Both Yield Enhancement and Risk Management." Institutional Investor, (Sept. 2002), pp. 173 – 174.

- Callan Associates. A Review of the CBOE S&P 500 BuyWrite Index (BXM). (October 2006).

- Crawford, Gregory. “Buy Writing Makes Comeback as Way to Hedge Risk.” Pensions & Investments, (May 16, 2005).

- Demby, E. R. “Maintaining Speed -- In a Sideways or Falling Market, Writing Covered Call Options Is One Way To Give Your Clients Some Traction.” Bloomberg Wealth Manager, (February 2005).

- Feldman, Barry and Dhuv Roy. "Passive Options-Based Investment Strategies: The Case of the CBOE S&P 500 BuyWrite Index." The Journal of Investing, (Summer 2005).

- Ferry, John. "An Array of Options - A Buy-write Strategy Can Add Some Octane to Portfolios When the Markets Lack Direction." Worth Magazine, (April 2005), pp. 102 – 104.

- Renicker, Ryan, Devapriya Mallick. "Enhanced Call Overwriting." Lehman Brothers Equity Derivatives Strategy. (Nov 17, 2005).

- Hadi, Mohammed. "Buy-Write Strategy Could Help in Sideways Market." The Wall Street Journal. (April 29, 2006) pg. B5.

- Hill, Joanne, Venkatesh Balasubramanian, Krag (Buzz) Gregory, and Ingrid Tierens. "Finding Alpha via Covered Index Writing." Financial Analysts Journal. (Sept.-Oct. 2006). pp. 29–46.

- Keenan, C. “Mass Appeal It's Still a Niche Market, But More Assets Are Flowing Into Mutual Funds That Use Hedge Fund Techniques.” Institutional Investor, ( July 2004).

- Moran, Matthew. “Risk-adjusted Performance for Derivatives-based Indexes – Tools to Help Stabilize Returns.” The Journal of Indexes. (Fourth Quarter, 2002) pp. 34 – 40.

- Pounds, Henry M. “Covered Call Option Writing: Strategies and Results.” The Journal of Portfolio Management (Winter 1978).

- Roeder, David. "New Funds Try Options to Boost Stock Income." Chicago Sun-Times, (October 10, 2004).

- Schneeweis, Thomas, and Richard Spurgin. "The Benefits of Index Option-Based Strategies for Institutional Portfolios" The Journal of Alternative Investments, (Spring 2001), pp. 44 – 52.

- SIRCA. Return and Risk of Buy-Write Strategies using Index Options -- Australian Evidence (February 2004)

- Smith, Steven. "Covered Calls Move Closer to the Masses" TheStreet.com (April 2003)

- Smith, Steven. “Options on Covered Calls.” RealMoney, (Dec. 20, 2006).

- Tan, Kopin, "Yield Boost -- Firms Market Covered-call Writing to Up Returns." Barron's, (Oct. 25, 2004).

- Tergesen, Anne. "Taking Cover with Covered Calls." Business Week, (May 21, 2001), pp. 132.

- Wasik, J. “Used Wisely, Options Can Help Dodge Stock Losses.” Bloomberg News, (May 15, 2005).

- Whaley, Robert. "Risk and Return of the CBOE BuyWrite Monthly Index" The Journal of Derivatives, (Winter 2002), pp. 35 – 42.

- Woolley, S. “Squeeze Your Portfolio Harder,” BusinessWeek, (December 27, 2004).

- Yates, James, and; Robert W. Kopprasch Jr. “Writing Covered Call Options: Profits And Risks” The Journal of Portfolio Management (Fall 1980).