Call option

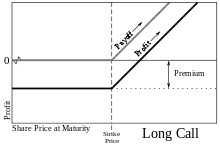

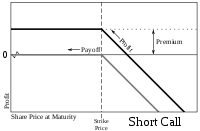

A call option, often simply labeled a "call", is a contract, between the buyer and the seller of the call option, to exchange a security at a set price.[1] The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument (the underlying) from the seller of the option at a certain time (the expiration date) for a certain price (the strike price). The seller (or "writer") is obliged to sell the commodity or financial instrument to the buyer if the buyer so decides. The buyer pays a fee (called a premium) for this right. The term "call" comes from the fact that the owner has the right to "call the stock away" from the seller.

Price of options

Option values vary with the value of the underlying instrument over time. The price of the call contract must act as a proxy response for the valuation of:

- the expected intrinsic value of the option, defined as the expected value of the difference between the strike price and the market value, i.e., max[S−X, 0].[2]

- the risk premium to compensate for the unpredictability of the value

- the time value of money reflecting the delay to the payout time

The call contract price generally will be higher when the contract has more time to expire (except in cases when a significant dividend is present) and when the underlying financial instrument shows more volatility. Determining this value is one of the central functions of financial mathematics. The most common method used is the Black–Scholes formula. Importantly, the Black-Scholes formula provides an estimate of the price of European-style options.[3]

Whatever the formula used, the buyer and seller must agree on the initial value (the premium or price of the call contract), otherwise the exchange (buy/sell) of the call will not take place.

Adjustment to Call Option: When a call has the strike price above the break even limit, i.e. when the buyer is making profit, there are many avenues to explore. Some of them are as follows:

- Sell the call and book profit.

- Continue to hold the position, if there is hope of making more money.

- Buy a protective "put" of the strike that suits, if there is interest in holding the position but having some protection.

- Sell a call of higher strike price and convert the position into "call spread" and thus limit loss if the market reverses.

Similarly, if the buyer is making loss on his or her position i.e. the call is out-of-the-money, where the market price is less than or equal to the exercise price.[2] The buyer can make several adjustments to limit the loss or even make some profit.

Options

See also

References

- O'Sullivan, Arthur; Sheffrin, Steven M. (2003). Economics: Principles in Action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. p. 288. ISBN 0-13-063085-3.CS1 maint: location (link)

- Hull, John (2017). Options, Futures, and Other Derivatives 10th Edition. Pearson. pp. 231–246. ISBN 978-0134472089.

- Fernandes, Nuno (2014). Finance for Executives: A Practical Guide for Managers. NPV Publishing. p. 313. ISBN 978-9899885400.