Haw Par Corporation

Haw Par Corporation Limited is a Singapore-based company involved in healthcare, leisure products, property and investment. It is the company responsible for Tiger Balm branded liniment (ointment). Its brands also included Kwan Loong and it also owns and operates weekend and leisure time destinations such as oceanariums.[2]

| |

| Formerly | Haw Par Brothers International |

|---|---|

| Type | public |

| SGX: H02 | |

| Predecessor |

|

| Founded | 18 July 1969 |

| Founder | Aw Cheng Chye and family member |

Key people | Wee Cho Yaw (chairman) |

| Brands |

|

| Revenue | |

| Total assets | |

| Total equity | |

| Owner | Wee Cho Yaw family (35.86%) |

| Subsidiaries | Haw Par Healthcare |

| Website | |

| Footnotes / references in consolidated financial statement[1] | |

| Haw Par Corporation Limited | |||||||

|---|---|---|---|---|---|---|---|

| Traditional Chinese | 虎豹企業有限公司 | ||||||

| Simplified Chinese | 虎豹企业有限公司 | ||||||

| |||||||

| Haw Par Brothers International Limited | |||||||

| Traditional Chinese | 虎豹兄弟國際有限公司 | ||||||

| |||||||

| Eng Aun Tong | |||||||

|---|---|---|---|---|---|---|---|

| Traditional Chinese | 永安堂 | ||||||

| |||||||

| Tiger Balm | |||||||

|---|---|---|---|---|---|---|---|

| Traditional Chinese | 虎標 | ||||||

| Literal meaning | Tiger Brand | ||||||

| |||||||

| Kwan Loong | |||||||

|---|---|---|---|---|---|---|---|

| Traditional Chinese | 均隆 | ||||||

| |||||||

The Haw Par Group owns two oceanariums: the now-defunct Underwater World oceanarium attraction at Sentosa, Singapore, and Underwater World Pattaya in Thailand.[3]

History

Predecessors

The predecessor of Haw Par Corporation, Eng Aun Tong, was founded by Aw Chu Kin, father of Aw Boon Haw and Boon Par brothers. Eng Aun Tong was then relocated to Singapore and expanded its branch to many Chinese communities in Asia. Aw Boon Haw also built Haw Par Villas in Hong Kong, Singapore and in Yongding District, Longyan, China. A private company, Haw Par Brothers (Private) Limited was incorporated in 1932[4] as a holding company for a vast majority of the family assets.

After the death of Boon Par in 1944 and Boon Haw in 1954, the Haw Par Brothers (Private) Limited was owned by the descendant of the two brothers. However, companies such as Sin Poh Amalgamated (Hong Kong) (incorporated in 1951) and the publisher of Hong Kong Tiger Standard (incorporated in 1949) were owned by Aw family directly especially Sally Aw and Aw Toke Tone, son of Aw Hoe. Aw Hoe, adopted son of Aw Boon Haw, helped his father to establish Sing Tao Daily and Hong Kong Tiger Standard, died in a plane crash in 1951.

According to Gren Manuel, a reporter of South China Morning Post, citing Aw Boon Haw's will filed in Hong Kong Public Record Office, Sally Aw and her adopted mother Tan Kim-kee (Chinese: 陳金枝) would inherited Aw Boon Haw's assets, and requesting them to use them in whole or part for charitable and/or benevolent and/or philanthropic purpose,[5] while other sons and daughters of Aw Boon Haw, either received cash as heritage in 1954,[5] or already received some of the shares of the companies such as Sin Poh Amalgamated (Hong Kong)[6] and The Tiger Standard Limited[7] at the incorporation of the companies. Sally Aw's elder (adopted) brother, Aw Swan, was renounced by Aw Boon Haw as son in 1952.[8][9] Filing in Hong Kong Company Registries shown Sally inherited all the shares (220 out of 500 shares) of The Tiger Standard Limited that was owned by Aw Boon Haw, with the rest were owned by other member of Aw family as well as still under the name of late Aw Hoe (150 out of 500 shares) in early 1970s.[10][11]

At the same time that Haw Par Brothers (Private) Limited made an open invitation to sell the Tiger Balm Garden of Hong Kong,[12][13] Sally Aw and her mother Tan Kim-kee also sued Haw Par Brothers (Private) in order to reclaim deposits allegedly made by them in the company in 1961.[14][15] The lawsuit was dismissed in 1962.[16] Sally Aw also made another petition to wind up the company in 1961.[17] Sally Aw withdrew the petition in the same year,[18][19] after the barrister of Haw Par Brothers (Private) presented evidence on reclaiming Hong Kong Eng Aun Tong and its factory, which Sally Aw alleged that Hong Kong Eng Aun Tong (Limited) and another entity (Chinese: 虎標永安堂藥廠; lit. 'Tiger Balm Eng Aun Tong Pharmaceutical') were not the same and only the former was belongs to Haw Par Brothers (Private), with the rest was Aw Boon Haw's personal heritage.[19][20] Sally Aw also sued Haw Par Brothers (Private) in 1959.[21]

In 1962, Aw It Haw, younger (half) brother of Sally, was instated as the director of Hong Kong Tiger Balm Eng Aun Tong Pharmaceutical.[22] The lawsuit of the heritage of Aw Boon Haw was finally settled in 1967 by Sally Aw paying the company S$1.75 million.[23] However, just 2 years after the settlement of the ownership of the heritage, some of the Aw family decided to sell the assets to the public by initial public offering.

Establishment, IPO and family dispute

Haw Par Brothers International Limited was incorporated on 18 July 1969 by the Aw family (descendant of the late Aw Boon Haw and Boon Par brothers), in order to list most of the assets of Haw Par Brothers (Private) Limited on the Stock Exchange of Malaysia and Singapore.[24] The assets included the brand Eng Aun Tong and Tiger Balm for liniment products, Sin Poh (Star News) Amalgamated that publishes newspaper in Singapore and Malaysia, as well as subsidiaries in Hong Kong, Taiwan and Thailand.[nb 1][24] The company also owned an equity investment in Chung Khiaw Bank (Chinese: 祟僑銀行), as well as a lease contract that signed between Haw Par Brothers International and Haw Par Brothers (Private), to use the Tiger Balm Gardens in Hong Kong and Singapore that were owned by the latter.[24] The shares started to trade in the exchange in November 1969.[25][26]

The listed company made a major disinvestment in 1970, selling Hong Kong Eng Aun Tong building located in Wan Chai Road for HK$2.8 million, in order to raise fund the Hong Kong subsidiary for other investment.[27] Nevertheless, the actual price was disputed, as the buyer told the press in Hong Kong another figure.[28]

However, a year after IPO, Aw family sold the controlling stake of the family to Slater Walker,[29] At the same time Sin Poh (Star News) Amalgamated was privatized by Aw Cheng Chye (Chinese: 胡清才), eldest son of the late Aw Boon Par.[30] Aw Cheng Chye also bought back some of the shares from Slater Walker.[31] Haw Par Brothers International also sold 49.8% stake of Chung Khiaw Bank to United Overseas Bank for S$22 million.[32] Aw Cheng Chye was also re-elected as the chairman of Haw Par Brothers International despite the takeover.[33] After the sudden death of Aw Cheng Chye during a trip in Santiago de Chile in August 1971,[34] as well as re-election of the board of directors, it was reported that the listed company was chaired by Richard Tarling[35][28] while Haw Par Brothers (Private) Limited was chaired by Aw It Haw (Chinese: 胡一虎), the fourth and the first biological son of the late Aw Boon Haw.[35][36]

Aw Kow (Chinese: 胡蛟), the eldest (adopted) son of the late Aw Boon Haw, who resigned as the director of Sin Poh (Star News) Amalgamated and the managing director of Sin Chew Jit Poh in May 1971[37][38] due to his personal investment in Eastern Sun, also sued Haw Par Brothers (Private) Limited in 1972 for blocking him to read its accounts and financial statements, claiming under the late Aw Cheng Chye, the company allowed personal spending of Aw Cheng Chye, was invoiced by the company itself.[39] The lawsuit was settled in 1977, in favour Aw Kow.[40]

In the autobiography Escape from Paradise by John & May Chu Harding, they also claimed that Aw Cheng Chye's decision to make Haw Par Brothers International public, was against the wish of the part of the Aw family.[41]:42 May Chu Harding, née Lee, was the great-granddaughter of Aw Boon Par, or granddaughter of Lee Chee Shan and Aw Cheng Hu.[41]:18 Lee Chee Shan was the president of Chung Khiaw Bank in 1971.[37]

Under Aw Cheng Chye as chairman, Haw Par Brothers (Private) also attempted to sell Tiger Balm Garden of Hong Kong in 1961;[12] the last piece of the garden was sold to Cheung Kong in 1998 and the main building of the mansion was donated to the Hong Kong Government.

Expansion under Slater Walker

After Haw Par Brothers International was taken over by Slater Walker in June 1971, the new owner changed Haw Par Brothers International from a family-held business into a true business enterprise. [42] Slater Walker also sold 20% stake of Haw Par Brothers International to Slater Walker's associate company Australian Industrial and Mining Corporation (Austim) in November 1971, as well as a second listing of Haw Par Brothers International on the Hong Kong Stock Exchange[43] and in the London Stock Exchange.[44][45] Austim sold 55% stake of Motor and General Investment Underwriters Holdings Singapore to Haw Par Brothers International in August 1971.[46] It was announced that the Holdings would purchase a Singapore construction company Scott & English (Chinese: 錦泰) in September 1971.[35]

After the resignation of both Lee Aik Sim (Lee Santipongchai, Chinese: 李益森), and his wife Aw Cheng Sin (Suri Santipongchai, Chinese: 胡清心), the daughter of late Aw Boon Par as the directors of Haw Par Brothers (Thailand) in January 1972,[47] the subsidiary was sold in the same month to Jack Chia (Chinese: 謝志正).[48][49] Jack Chia and Haw Par Brothers International also formed a joint venture, which the joint venture have the rights to use "Tiger Balm" brand. In March 1972 Haw Par Brothers International acquired fellow pharmaceutical company in Chinese medicines, Hong Kong listed company Kwan Loong & Co.,[50] However, Slater Walker turned the Hong Kong company into an investment vehicle in financial market, which was known as Slater Walker Securities (Hong Kong).[51]

In April 1972, Haw Par Brothers International made a strategic investment on a property on 302 Orchard Road.[52]

In 1973 the company expanded to Japan[53] as well as bought 29% stake of a London-listed company London Tin Corporation.[54][55] Haw Par Brothers International financed the deal by a proposed recapitalization.[56] The stake was sold in 1976 and the sub-holding company that Haw Par Brothers International established in London, was sold in 1982.[57][58]

Collapse of Slater Walker

The parent company Slater Walker was collapsed after the secondary banking crisis of 1973–75; the company was bailed out by the Bank of England.[59] For Haw Par Brothers International itself, financial irregularities were exposed, for which former chairman Tarling was jailed for 6 months in 1979.[60] The company was then acquired by Singapore-local Wee Cho Yaw.

Subsidiaries, brands and products

Kwan Loong (Chinese: 均隆) originated from a different listed company of the same name (Kwan Loong & Co., Chinese: 均隆號), which was acquired in March 1972.[50] It produces medicated oil, specifically 驅風油, literally "oil that expels headaches."[nb 2]

Gallery

Former Eng Aun Tong in Singapore. Photographed in 2012

Former Eng Aun Tong in Singapore. Photographed in 2012 Eng Aun Tong Building in Xiamen, circa 1930s. It was nationalized by the People's Republic of China in 1949

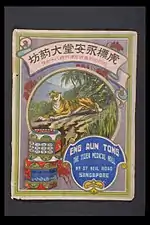

Eng Aun Tong Building in Xiamen, circa 1930s. It was nationalized by the People's Republic of China in 1949 Eng Aun Tong advertisement in 1930s

Eng Aun Tong advertisement in 1930s First issue of Sin Chew Jit Poh in 1929. Sin Chew Jit Poh was the product of Haw Par Brothers International from 1969 to 1971

First issue of Sin Chew Jit Poh in 1929. Sin Chew Jit Poh was the product of Haw Par Brothers International from 1969 to 1971

Footnotes

- Haw Par Brothers (Hong Kong) Limited, Haw Par Brothers Eng Aun Tong (Taiwan) Limited and Haw Par Brothers (Thailand) Limited respectively

- Word for word, Chinese: 風 means wind, but Chinese: 頭風; lit. '"head wind"' means headache; a less frequent usage was Chinese: 肚風; lit. '"stomach wind"', describing not feeling well in the stomach. However, Kwan Loong and another maker of 驅風油 claimed other medical applications of the oil, such as dizziness[61] and giddiness;[62] other companies translated the oil as "universal oil", such as the oil made by Axe Brand.

References

- "2016 Annual Report" (PDF). Haw Par Corporation. 28 March 2017. Retrieved 9 October 2017.

- "Leisure - Haw Par". www.hawpar.com. Retrieved 2020-05-23.

- "Leisure - Haw Par". Haw Par Corporation Limited. Retrieved 22 August 2019.

- "Application No. 5929/91: In the Matter of the Trademarks Ordinance (Cap. 43) and In the Matter of an application for registration of the Trademark AND..." (PDF). Hong Kong: Intellectual Property Department. 30 April 1996. Retrieved 9 October 2017.

- Manuel, Gren (5 April 1998). "Mogul's will puts end to mystery". South China Morning Post. Hong Kong – via Factiva.

- 1952 Annual Return of Sin Poh Amalgamated (H.K.) Limited. Hong Kong Company Registries. 30 December 1952.

- 1949 Annual Return of The Tiger Standard Limited. Hong Kong Company Registries. 17 March 1949.

- Written at Hong Kong. "胡文虎與胡山脫離關係 指其子用乃父名義向外借款". Nanyang Siang Pau (in Chinese). Singapore. 14 October 1952 [Written on 13 October 1952]. Retrieved 7 October 2017 – via Singapore National Library.

- "胡文虎登報聲明 與胡山脫離父子關係". Nanyang Siang Pau (in Chinese). Singapore. 17 October 1952. Retrieved 7 October 2017 – via Singapore National Library.

- 1971 Annual Return of The Tiger Standard Limited. Hong Kong Company Registries. 15 February 1971.

- 1972 Annual Return of The Tiger Standard Limited. Hong Kong Company Registries. 5 January 1972.

- "新聞人物胡一虎接見記者". Ta Kung Pao (in Chinese). Hong Kong. 24 October 1961. p. 6 – via Hong Kong Public Libraries.

- 端木, 惠 (21 October 1961). "虎豹別墅賣乎不賣?". Ta Kung Pao (in Chinese). Hong Kong – via Hong Kong Public Libraries.

- "$1m. suits by Aw widow, daughter". The Straits Times. Singapore. 10 October 1961. Retrieved 9 October 2017 – via Singapore National Library.

- "胡文虎遺孀與千金 陳金枝與胡仙小姐 票傳虎豹兄弟公司 索還存款一百十三萬元". Nanyang Siang Pau (in Chinese). Singapore. 11 October 1961. Retrieved 9 October 2017 – via Singapore National Library.

- "Parties Settle Haw Par Suits". The Straits Times. Singapore. 22 May 1962. Retrieved 9 October 2017 – via Singapore National Library.

- "Haw Par case on Tuesday". The Straits Times. Singapore. 9 December 1961. Retrieved 9 October 2017 – via Singapore National Library.

- Written at Singapore. "星洲虎豹產業官司 高院昨天結束審訊 胡仙提出撤銷該項控告". Ta Kung Pao (in Chinese). Hong Kong. Reuters. 14 December 1961 [Written on 13 December 1961] – via Hong Kong Public Libraries.

- "Miss Aw withdraws her action". The Straits Times. Singapore. 14 December 1961. Retrieved 9 October 2017 – via Singapore National Library.

- "虎豹兄弟公司訴訟案結束胡仙突撤回呈文官判答辯人勝訴胡小姐並須負担訟費". Nanyang Siang Pau (in Chinese). Singapore. 14 December 1961. Retrieved 9 October 2017 – via Singapore National Library.

- "Claim for $196,000". The Straits Times. Singapore. 17 April 1959. Retrieved 9 October 2017 – via Singapore National Library.

- "胡一虎主理永安堂第一炮推出新虎油他說別墅問題已經解決". Ta Kung Pao. Hong Kong. 16 May 1962. p. 4 – via Hong Kong Public Libraries.

- Written at Hong Kong. "Aw family dispute is settled for [S]$1.7 m". The Straits Times. Singapore. 9 May 1967. Retrieved 9 October 2017 – via Singapore National Library.

- Haw Par Brothers International (12 November 1969). "Prospectus". The Straits Times. Singapore. pp. 6 to 7. Retrieved 8 October 2017 – via Singapore National Library.

- "Shares slightly off on last sales". The Straits Times. Singapore. 12 November 1969. Retrieved 8 October 2017 – via Singapore National Library.

- "虎豹兄弟週一掛牌". Nanyang Siang Pau (in Chinese). Singapore. 15 November 1969. Retrieved 9 October 2017 – via Singapore National Library.

- "虎豹兄弟國際賣出灣仔產業得利一百五十餘萬港元". Nanyang Siang Pau (in Chinese). Singapore. 15 July 1970. Retrieved 9 October 2017 – via Singapore National Library.

- "Haw Par chief queried on sale accounts". New Nation. Singapore. 17 September 1971. Retrieved 9 October 2017 – via Singapore National Library.

- "Untitled". The Straits Times. Singapore. 11 June 1971. Retrieved 7 October 2017 – via Singapore National Library.

- "星系報業屬下三家報完全歸胡氏家族所有史勒特華克並未取得擁有權". Nanyang Siang Pau (in Chinese). Singapore. 13 June 1971. Retrieved 7 October 2017 – via Singapore National Library.

- "胡清才向史勒特華克公司購回一千五百二十萬股份". Nanyang Siang Pau (in Chinese). Singapore. 16 June 1971. Retrieved 9 October 2017 – via Singapore National Library.

- "大華銀行經已取得 崇僑銀行平衡股權 虎豹出售股權値二千二百萬元". Nanyang Siang Pau (in Chinese). Singapore. 19 June 1971. Retrieved 11 October 2017 – via Singapore National Library.

- "拿督胡清才博士續任虎豹兄弟國際有限公司主席". Nanyang Siang Pau (in Chinese). Singapore. 5 June 1971. Retrieved 8 October 2017 – via Singapore National Library.

- "星系報業暨虎豹兄弟公司主席胡淸才靈柩運返星 下月一日發引還山 李總理特函胡夫人致唁". Nanyang Siang Pau (in Chinese). Singapore. 30 August 1971. Retrieved 8 October 2017 – via Singapore National Library.

- "虎豹兄弟國際公司舉行常年股東大會新主席李查塔寧報告業務". Nanyang Siang Pau (in Chinese). Singapore. 16 September 1971. Retrieved 10 October 2017 – via Singapore National Library.

- "胡文虎在福建遗产获归还 和中国联络前胡一虎不愿置评". Lianhe Zaobao (in Chinese). Singapore: Singapore News and Publications. 1 June 1983. Retrieved 9 October 2017 – via Singapore National Library.

- "The Aw family". New Nation. Singapore. 23 July 1971. Retrieved 6 October 2017 – via Singapore National Library.

- "Still a director". New Nation. Singapore. 28 July 1971. Retrieved 8 October 2017 – via Singapore National Library.

- "胡蛟向高等法院請求發出命令禁止虎豹私人公司阻礙檢查賬目紀錄原告律師指故胡清才在任期問濫用職權利用公款充私人用途". Nanyang Siang Pau (in Chinese). Singapore. 12 September 1972. Retrieved 9 October 2017 – via Singapore National Library.

- "Aw suit settled". New Nation. Singapore. 23 February 1977. Retrieved 10 October 2017 – via Singapore National Library.

- Harding, John; Lee, May Chu (2001). Escape from Paradise: From Third World to First. Phoenix: IDKPress. ISBN 0-9710929-0-7.

- Nitin Pangarkar (11 December 2015). "Investing in Durable Assets to Achieve Superior Performance: Restoring Tiger Balm's Roar". Global Business and Organizational Excellence. 35 (2): 6–17. doi:10.1002/JOE.21651. ISSN 1932-2054. Wikidata Q104919623.

- "Austim buys stake in Haw Par". The Straits Times. Singapore. 11 November 1971. Retrieved 9 October 2017 – via Singapore National Library.

- Written at London. "Shares in Haw Par may be traded in London soon". New Nation. Singapore. 17 December 1971. Retrieved 9 October 2017 – via Singapore National Library.

- "Haw Par shares". The Straits Times. Singapore. 18 December 1971. Retrieved 9 October 2017 – via Singapore National Library.

- "Austim sells interest to Haw Par". The Canberra Times. 6 August 1971. Retrieved 9 October 2017 – via National Library of Australia.

- "虎豹兄弟國際公司宣佈委任三位新董事繼承辭職者遺缺". Nanyang Siang Pau (in Chinese). Singapore. 12 January 1972. Retrieved 9 October 2017 – via Singapore National Library.

- "A [S]$630,000 takeover". The Straits Times. Singapore. 25 January 1972. Retrieved 9 October 2017 – via Singapore National Library.

- "謝志正收購泰國虎豹兄弟公司". Nanyang Siang Pau (in Chinese). Singapore. 28 January 1972. Retrieved 9 October 2017 – via Singapore National Library.

- "虎豹兄弟國際公司與香港均隆簽協議購買均隆股票七百萬股從而取得該號之控制權". Nanyang Siang Pau (in Chinese). Singapore. 3 March 1972. Retrieved 11 October 2017 – via Singapore National Library.

- "haw-par-brothers-international-hk-limited-hkpxhke list". www.hongkongcompanieslist.com.

- "虎豹兄弟國際有限公司購買烏節路四層樓大廈". Nanyang Siang Pau. Singapore. 28 April 1972 [Written on 27 April 1972]. Retrieved 9 October 2017 – via Singapore National Library.

- "虎豹兄弟國際公司宣佈在港設一新公司計劃將業務擴展至日本". Nanyang Siang Pau (in Chinese). Singapore. 8 January 1973 [Written on 7 January 1973]. Retrieved 9 October 2017 – via Singapore National Library.

- "Haw Par clinches $83 mil deal". The Straits Times. Singapore. 19 May 1973. Retrieved 9 October 2017 – via Singapore National Library.

- Written at London. "虎豹兄弟國際公司出高價收購倫敦錫礦公司". Nanyang Siang Pau (in Chinese). Singapore. 20 May 1973 [Written on 18 May 1973]. Retrieved 9 October 2017 – via Singapore National Library.

- "EGM to decide on Haw Par acquisition". The Straits Times. Singapore. 12 June 1973. Retrieved 9 October 2017 – via Singapore National Library.

- "Haw Par Brothers Sells London Unit". Business Times. Singapore. 9 April 1982. Retrieved 9 October 2017 – via Singapore National Library.

- "Haw Par forges ahead with rationalisation". The Straits Times. Singapore. 12 April 1982. Retrieved 9 October 2017 – via Singapore National Library.

- "The provision of financial assistance to Slater Walker Bank in 1975". London: HM Treasury. 23 September 2005 [originally written in 1975–1977]. Archived from the original on 11 June 2007. Retrieved 29 October 2017.

- "Tarling released". New Nation. Singapore. 24 March 1980. Retrieved 29 October 2017 – via Singapore National Library.

- "Kwan Loong". www.kwanloongoil.com.

- "Leung Kai Fook - Axe Brand Universal Oil". www.axebrand.com.sg.