Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government of the United Kingdom, it is the world's eighth-oldest bank. It was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry.[4][5]

Seal of the Bank of England | |

| Headquarters | Threadneedle Street, London, England, United Kingdom |

|---|---|

| Coordinates | 51.5142°N 0.0885°W |

| Established | 27 July 1694 |

| Ownership | Owned by HM Government through the Government Legal Department[1][2] |

| Governor | Andrew Bailey (since 2020) |

| Central bank of | United Kingdom |

| Currency | Pound sterling GBP (ISO 4217) |

| Reserves | 101 590 million USD[2] |

| Bank rate | 0.1%[3] |

| Website | www |

In 2009, a request made to HM Treasury under the Freedom of Information Act sought details about the 3% Bank of England stock owned by unnamed shareholders whose identity the Bank is not at liberty to disclose.[6] In a letter of reply dated 15 October 2009, HM Treasury explained that. 'Some of the 3% Treasury stock which was used to compensate former owners of Bank stock has not been redeemed. However, interest is paid out twice a year and it is not the case that this has been accumulating and compounding.' [7]

The Bank became an independent public organisation in 1998, wholly owned by the Treasury Solicitor on behalf of the government,[1] but with independence in setting monetary policy.[8][9][10][11]

The Bank is one of eight banks authorised to issue banknotes in the United Kingdom, has a monopoly on the issue of banknotes in England and Wales and regulates the issue of banknotes by commercial banks in Scotland and Northern Ireland.[12]

The Bank's Monetary Policy Committee has a devolved responsibility for managing monetary policy. The Treasury has reserve powers to give orders to the committee "if they are required in the public interest and by extreme economic circumstances", but such orders must be endorsed by Parliament within 28 days.[13] The Bank's Financial Policy Committee held its first meeting in June 2011 as a macroprudential regulator to oversee regulation of the UK's financial sector.

The Bank's headquarters have been in London's main financial district, the City of London, on Threadneedle Street, since 1734. It is sometimes known as The Old Lady of Threadneedle Street, a name taken from a satirical cartoon by James Gillray in 1797.[14] The road junction outside is known as Bank junction.

As a regulator and central bank, the Bank of England has not offered consumer banking services for many years, but it still does manage some public-facing services such as exchanging superseded bank notes.[15] Until 2016, the bank provided personal banking services as a privilege for employees.[16]

History

Founding

England's crushing defeat by France, the dominant naval power, in naval engagements culminating in the 1690 Battle of Beachy Head, became the catalyst for England to rebuild itself as a global power. William III's government wanted to build a naval fleet that would rival that of France; however, the ability to construct this fleet was hampered both by a lack of available public funds and the low credit of the English government in London. This lack of credit made it impossible for the English government to borrow the £1,200,000 (at 8% per annum) that it wanted for the construction of the fleet.[17]

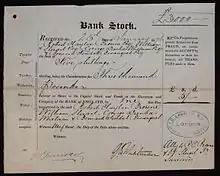

To induce subscription to the loan, the subscribers were to be incorporated by the name of the Governor and Company of the Bank of England. The Bank was given exclusive possession of the government's balances, and was the only limited-liability corporation allowed to issue bank notes.[18] The lenders would give the government cash (bullion) and issue notes against the government bonds, which can be lent again. The £1.2 million was raised in 12 days; half of this was used to rebuild the navy.

As a side effect, the huge industrial effort needed, including establishing ironworks to make more nails and advances in agriculture feeding the quadrupled strength of the navy, started to transform the economy. This helped the new Kingdom of Great Britain – England and Scotland were formally united in 1707 – to become powerful. The power of the navy made Britain the dominant world power in the late 18th and early 19th centuries.[19]

The establishment of the bank was devised by Charles Montagu, 1st Earl of Halifax, in 1694. The plan of 1691, which had been proposed by William Paterson three years before, had not then been acted upon.[20] 58 years earlier, in 1636, Financier to the king, Philip Burlamachi, had proposed exactly the same idea in a letter addressed to Sir Francis Windebank.[21] He proposed a loan of £1.2 million to the government; in return the subscribers would be incorporated as The Governor and Company of the Bank of England with long-term banking privileges including the issue of notes. The royal charter was granted on 27 July through the passage of the Tonnage Act 1694.[22] Public finances were in such dire condition at the time[23] that the terms of the loan were that it was to be serviced at a rate of 8% per annum, and there was also a service charge of £4,000 per annum for the management of the loan. The first governor was Sir John Houblon, who is depicted in the £50 note issued in 1994. The charter was renewed in 1742, 1764, and 1781.

18th century

The Bank's original home was in Walbrook, a street in the City of London, where during reconstruction in 1954 archaeologists found the remains of a Roman temple of Mithras (Mithras is – rather fittingly – said to have been worshipped as, amongst other things, the God of Contracts);[24] the Mithraeum ruins are perhaps the most famous of all 20th-century Roman discoveries in the City of London and can be viewed by the public.

The Bank moved to its current location in Threadneedle Street in 1734,[25] and thereafter slowly acquired neighbouring land to create the site necessary for erecting the Bank's original home at this location, under the direction of its chief architect Sir John Soane, between 1790 and 1827. (Sir Herbert Baker's rebuilding of the Bank in the first half of the 20th century, demolishing most of Soane's masterpiece, was described by architectural historian Nikolaus Pevsner as "the greatest architectural crime, in the City of London, of the twentieth century".)

When the idea and reality of the national debt came about during the 18th century, this was also managed by the Bank. During the American war of independence, business for the Bank was so good that George Washington remained a shareholder throughout the period.[26] By the charter renewal in 1781 it was also the bankers' bank – keeping enough gold to pay its notes on demand until 26 February 1797, when war had so diminished gold reserves that – following an invasion scare caused by the Battle of Fishguard days earlier – the government prohibited the Bank from paying out in gold by the passing of the Bank Restriction Act 1797. This prohibition lasted until 1821.

19th century

In 1825-26, the bank was able to avert a liquidity crisis when Nathan Mayer Rothschild succeeded in supplying it with gold.[27]

The 1844 Bank Charter Act tied the issue of notes to the gold reserves and gave the Bank sole rights with regard to the issue of banknotes. Private banks that had previously had that right retained it, provided that their headquarters were outside London and that they deposited security against the notes that they issued. A few English banks continued to issue their own notes until the last of them was taken over in the 1930s. Scottish and Northern Irish private banks still have that right.

The bank acted as lender of last resort for the first time in the panic of 1866.[28]

The last private bank in England to issue its own notes was Thomas Fox's Fox, Fowler and Company bank in Wellington, which rapidly expanded, until it merged with Lloyds Bank in 1927. They were legal tender until 1964. There are nine notes left in circulation; one is housed at Tone Dale House, Wellington.

20th century

Britain was on the gold standard until 1931, when the Bank of England unilaterally and abruptly took Britain off the gold standard.[29]

During the governorship of Montagu Norman, from 1920 to 1944, the Bank made deliberate efforts to move away from commercial banking and become a central bank. In 1946, shortly after the end of Norman's tenure, the bank was nationalised by the Labour government.

The Bank pursued the multiple goals of Keynesian economics after 1945, especially "easy money" and low interest rates to support aggregate demand. It tried to keep a fixed exchange rate, and attempted to deal with inflation and sterling weakness by credit and exchange controls.[30]

In 1977, the Bank set up a wholly owned subsidiary called Bank of England Nominees Limited (BOEN), a now defunct private limited company, with two of its hundred £1 shares issued. According to its Memorandum & Articles of Association, its objectives were: "To act as Nominee or agent or attorney either solely or jointly with others, for any person or persons, partnership, company, corporation, government, state, organisation, sovereign, province, authority, or public body, or any group or association of them...." Bank of England Nominees Limited was granted an exemption by Edmund Dell, Secretary of State for Trade, from the disclosure requirements under Section 27(9) of the Companies Act 1976, because "it was considered undesirable that the disclosure requirements should apply to certain categories of shareholders." The Bank of England is also protected by its royal charter status, and the Official Secrets Act.[31] BOEN was a vehicle for governments and heads of state to invest in UK companies (subject to approval from the Secretary of State), providing they undertake "not to influence the affairs of the company".[32][33] In its later years, BOEN was no longer exempt from company law disclosure requirements.[34] Although a dormant company,[35] dormancy does not preclude a company actively operating as a nominee shareholder.[36] BOEN had two shareholders: the Bank of England, and the Secretary of the Bank of England.[37]

The reserve requirement for banks to hold a minimum fixed proportion of their deposits as reserves at the Bank of England was abolished in 1981: see reserve requirement for more details. The contemporary transition from Keynesian economics to Chicago economics was analysed by Nicholas Kaldor in The Scourge of Monetarism.[38]

On 6 May 1997, following the 1997 general election that brought a Labour government to power for the first time since 1979, it was announced by the Chancellor of the Exchequer, Gordon Brown, that the Bank would be granted operational independence over monetary policy.[39] Under the terms of the Bank of England Act 1998 (which came into force on 1 June 1998), the Bank's Monetary Policy Committee was given sole responsibility for setting interest rates to meet the Government's Retail Prices Index (RPI) inflation target of 2.5%.[40] The target has changed to 2% since the Consumer Price Index (CPI) replaced the Retail Prices Index as the Treasury's inflation index.[41] If inflation overshoots or undershoots the target by more than 1%, the Governor has to write a letter to the Chancellor of the Exchequer explaining why, and how he will remedy the situation.[42]

The success of inflation targeting in the United Kingdom has been attributed to the Bank's focus on transparency.[43] The Bank of England has been a leader in producing innovative ways of communicating information to the public, especially through its Inflation Report, which have been emulated by many other central banks.[44]

Independent central banks that adopt an inflation target are known as Friedmanite central banks. This change in Labour's politics was described by Skidelsky in The Return of the Master[45] as a mistake and as an adoption of the Rational Expectations Hypothesis as promulgated by Walters.[46] Inflation targets combined with central bank independence have been characterised as a "starve the beast" strategy creating a lack of money in the public sector.

The handing over of monetary policy to the Bank had been a key plank of the Liberal Democrats' economic policy since the 1992 general election.[47] Conservative MP Nicholas Budgen had also proposed this as a private member's bill in 1996, but the bill failed as it had the support of neither the government nor the opposition.

21st century

Mark Carney assumed the post of Governor of the Bank of England on 1 July 2013. He succeeded Mervyn King, who took over on 30 June 2003. Carney, a Canadian, was to serve an initial five-year term rather than the typical eight. He became the first Governor not to be a UK citizen, but has since been granted citizenship.[48] At Government request, his term was extended to 2019, then again to 2020.[49] As of January 2014, the Bank also has four Deputy Governors.

BOEN was dissolved, following liquidation, in July 2017.[50]

Functions

Two main areas are tackled by the Bank to ensure it carries out these functions efficiently:[51]

Monetary stability

Note: It is important to note that "monetary" and "financial" are synonyms.

Stable prices and confidence in the currency are the two main criteria for monetary stability. Stable prices are maintained by seeking to ensure that price increases meet the Government's inflation target. The Bank aims to meet this target by adjusting the base interest rate, which is decided by the Monetary Policy Committee, and through its communications strategy, such as publishing yield curves.[52]

- Maintaining financial stability involves protecting against threats to the whole financial system. Threats are detected by the Bank's surveillance and market intelligence functions. The threats are then dealt with through financial and other operations, both at home and abroad. In exceptional circumstances, the Bank may act as the lender of last resort by extending credit when no other institution will.

The Bank works together with other institutions to secure both monetary and financial stability, including:

- HM Treasury, the Government department responsible for financial and economic policy; and

- Other central banks and international organisations, with the aim of improving the international financial system.

The 1997 memorandum of understanding describes the terms under which the Bank, the Treasury and the FSA work toward the common aim of increased financial stability.[53] In 2010, the incoming Chancellor announced his intention to merge the FSA back into the Bank. As of 2012, the current director for financial stability is Andy Haldane.[54]

The Bank acts as the government's banker, and it maintains the government's Consolidated Fund account. It also manages the country's foreign exchange and gold reserves. The Bank also acts as the bankers' bank, especially in its capacity as a lender of last resort.

The Bank has a monopoly on the issue of banknotes in England and Wales. Scottish and Northern Irish banks retain the right to issue their own banknotes, but they must be backed one-for-one with deposits at the Bank, excepting a few million pounds representing the value of notes they had in circulation in 1845. The Bank decided to sell its banknote-printing operations to De La Rue in December 2002, under the advice of Close Brothers Corporate Finance Ltd.[55]

Since 1998, the Monetary Policy Committee (MPC) has had the responsibility for setting the official interest rate. However, with the decision to grant the Bank operational independence, responsibility for government debt management was transferred in 1998 to the new Debt Management Office, which also took over government cash management in 2000. Computershare took over as the registrar for UK Government bonds (gilt-edged securities or gilts) from the Bank at the end of 2004.

The Bank used to be responsible for the regulation and supervision of the banking and insurance industries. This responsibility was transferred to the Financial Services Authority in June 1998, but after the financial crises in 2008 new banking legislation transferred the responsibility for regulation and supervision of the banking and insurance industries back to the Bank.

In 2011, the interim Financial Policy Committee (FPC) was created as a mirror committee to the MPC to spearhead the Bank's new mandate on financial stability. The FPC is responsible for macro prudential regulation of all UK banks and insurance companies.

To help maintain economic stability, the Bank attempts to broaden understanding of its role, both through regular speeches and publications by senior Bank figures, a semiannual Financial Stability Report,[56] and through a wider education strategy aimed at the general public. It currently maintains a free museum and ran the Target Two Point Zero competition for A-level students, closing in 2017.[57]

Asset purchase facility

The Bank has operated, since January 2009, an Asset Purchase Facility (APF) to buy "high-quality assets financed by the issue of Treasury bills and the DMO's cash management operations" and thereby improve liquidity in the credit markets.[58] It has, since March 2009, also provided the mechanism by which the Bank's policy of quantitative easing (QE) is achieved, under the auspices of the MPC. Along with the managing the £200 billion of QE funds, the APF continues to operate its corporate facilities. Both are undertaken by a subsidiary company of the Bank of England, the Bank of England Asset Purchase Facility Fund Limited (BEAPFF).[58]

Banknote issues

The Bank has issued banknotes since 1694. Notes were originally hand-written; although they were partially printed from 1725 onwards, cashiers still had to sign each note and make them payable to someone. Notes were fully printed from 1855. Until 1928 all notes were "White Notes", printed in black and with a blank reverse. In the 18th and 19th centuries White Notes were issued in £1 and £2 denominations. During the 20th century White Notes were issued in denominations between £5 and £1000.

Until the mid-19th century, commercial banks were allowed to issue their own banknotes, and notes issued by provincial banking companies were commonly in circulation.[59] The Bank Charter Act 1844 began the process of restricting note issue to the Bank; new banks were prohibited from issuing their own banknotes and existing note-issuing banks were not permitted to expand their issue. As provincial banking companies merged to form larger banks, they lost their right to issue notes, and the English private banknote eventually disappeared, leaving the Bank with a monopoly of note issue in England and Wales. The last private bank to issue its own banknotes in England and Wales was Fox, Fowler and Company in 1921.[60][61] However, the limitations of the 1844 Act only affected banks in England and Wales, and today three commercial banks in Scotland and four in Northern Ireland continue to issue their own banknotes, regulated by the Bank.[12]

At the start of the First World War, the Currency and Bank Notes Act 1914 was passed, which granted temporary powers to HM Treasury for issuing banknotes to the values of £1 and 10/- (ten shillings). Treasury notes had full legal tender status and were not convertible into gold through the Bank; they replaced the gold coin in circulation to prevent a run on sterling and to enable raw material purchases for armament production. These notes featured an image of King George V (Bank of England notes did not begin to display an image of the monarch until 1960). The wording on each note was:

UNITED KINGDOM OF GREAT BRITAIN AND IRELAND – Currency notes are Legal Tender for the payment of any amount – Issued by the Lords Commissioners of His Majesty's Treasury under the Authority of Act of Parliament (4 & 5 Geo. V c.14).

Treasury notes were issued until 1928, when the Currency and Bank Notes Act 1928 returned note-issuing powers to the banks.[62] The Bank of England issued notes for ten shillings and one pound for the first time on 22 November 1928.

During the Second World War the German Operation Bernhard attempted to counterfeit denominations between £5 and £50, producing 500,000 notes each month in 1943. The original plan was to parachute the money into the UK in an attempt to destabilise the British economy, but it was found more useful to use the notes to pay German agents operating throughout Europe. Although most fell into Allied hands at the end of the war, forgeries frequently appeared for years afterwards, which led banknote denominations above £5 to be removed from circulation.

In 2006, over £53 million in banknotes belonging to the Bank was stolen from a depot in Tonbridge, Kent.[63]

Modern banknotes are printed by contract with De La Rue Currency in Loughton, Essex.[64]

Gold vault

The bank is custodian to the official gold reserves of the United Kingdom and around 30 other countries.[65] As of April 2016, the bank held around 400,000 bars, which is equivalent to 5,134 tonnes (5,659 tons) of gold. These gold deposits were estimated in August 2018 to have a current market value of approximately £200 billion.[66] These estimates suggest the vault could hold as much as 3% of the gold mined throughout human history.[67]

Governance of the Bank of England

Governors

Following is a list of the Governors of the Bank of England since the beginning of the 20th century:[68]

| Name | Period |

|---|---|

| Samuel Gladstone | 1899–1901 |

| Augustus Prevost | 1901–1903 |

| Samuel Morley | 1903–1905 |

| Alexander Wallace | 1905–1907 |

| William Campbell | 1907–1909 |

| Reginald Eden Johnston | 1909–1911 |

| Alfred Cole | 1911–1913 |

| Walter Cunliffe | 1913–1918 |

| Brien Cokayne | 1918–1920 |

| Montagu Norman | 1920–1944 |

| Thomas Catto | 1944–1949 |

| Cameron Cobbold | 1949–1961 |

| Rowland Baring (3rd Earl of Cromer) | 1961–1966 |

| Leslie O'Brien | 1966–1973 |

| Gordon Richardson | 1973–1983 |

| Robert Leigh-Pemberton | 1983–1993 |

| Edward George | 1993–2003 |

| Mervyn King | 2003–2013 |

| Mark Carney | 2013–2020 |

| Andrew Bailey | 2020–present |

Court of Directors

The Court of Directors is a unitary board that is responsible for setting the organisation's strategy and budget and taking key decisions on resourcing and appointments. It consists of five executive members from the Bank plus up to 9 non-executive members, all of whom are appointed by the Crown. The Chancellor selects the Chairman of the Court from among the non-executive members. The Court is required to meet at least 7 times a year.[69]

The Governor serves for a period of eight years, the Deputy Governors for five years, and the non-executive members for up to four years.

| Name | Function |

|---|---|

| Bradley Fried | Chairman of Court. Managing Partner of Grovepoint Capital LLP |

| Mark Carney | Governor |

| Benjamin Broadbent | Deputy Governor, Monetary Policy |

| Sir Jon Cunliffe | Deputy Governor, Financial Stability |

| Sam Woods | Deputy Governor, Prudential Regulation & Chief Executive of the Prudential Regulation Authority |

| Sir David Ramsden | Deputy Governor, Markets and Banking |

| Anne Glover | Chief Executive and Co-Founder of Amadeus Capital Partners |

| Diana Noble | Non-Executive Director |

| Diana 'Dido' Harding | Member of the House of Lords |

| Dave Prentis | General Secretary of UNISON |

| Don Robert | Chairman, Experian plc |

| Dorothy Thompson | Chair of Tullow Oil plc, |

| Ron Kalifa | Board Director of Worldpay and Chairman of Network International |

| Frances O'Grady | General Secretary of the British Trades Union Congress |

| Hanneke Smits | CEO of Newton Investment Management |

Other staff

Since 2013, the Bank has had a chief operating officer (COO).[71] As of 2017, the Bank's COO has been Joanna Place.[72]

As of 2014, the Bank's chief economist is Andrew Haldane.[73]

See also

- List of British currencies

- Bank of England Act

- Bank of England club

- Coins of the pound sterling

- East India Company shareholders

- Financial Sanctions Unit

- Fractional-reserve banking

- Commonwealth banknote-issuing institutions

- Bank of England Museum

- Deputy Governor of the Bank of England

- List of directors of the Bank of England

References

- "Freedom of Information – disclosures". Bank of England. Retrieved 29 September 2013.

- https://d-nb.info/1138787981/34

- Bank of England. "Monetary policy summary for the special monetary policy committee meeting on 19 March 2020". Retrieved 19 March 2020.

- "House of Commons Debate 29th October 1945, Second Reading of the Bank of England Bill". Hansard.millbanksystems.com. Retrieved 12 October 2012.

- "Bank of England Act 1946". Retrieved 19 November 2019.

- Keogh, Joseph (17 September 2009). "Named and unnamed shareholders of the Bank of England". What do they know.

- Morran, Paul (15 October 2009). "Re: Freedom of Information Act 2000: Bank of England Unnamed 3% Stock Holding Not Redeemed" (PDF). What do they know.

- 1 June 1998, The Bank of England Act 1998 (Commencement) Order 1998 s 2

- "BBC On This Day - 6-1997: Brown sets Bank of England free". 6 May 1997. Retrieved 14 September 2014.

- "Bank of England - About the Bank". Archived from the original on 31 December 2014. Retrieved 14 September 2014.

- "Bank of England: Relationship with Parliament". Archived from the original on 8 July 2009. Retrieved 14 September 2014.

- "The Bank of England's Role in Regulating the Issue of Scottish and Northern Ireland Banknotes". Bank of England website. Retrieved 18 November 2019.

- "Act of Parliament gives devolved responsibility to the MPC with reserve powers for the Treasury". Opsi.gov.uk. Retrieved 10 May 2010.

- Bank of England, "Who is The Old Lady of Threadneedle Street? Archived 15 January 2018 at the Wayback Machine". Accessed 15 January 2018.

- "Exchanging old banknotes". Bank of England. Retrieved 19 October 2019.

- Topham, Gwyn. "Bank of England to close personal banking service for employees". The Guardian. Retrieved 8 November 2016.

- Nichols, Glenn O. (1971). "English Government Borrowing, 1660-1688". Journal of British Studies. 10 (2): 83–104. doi:10.1086/385611. ISSN 0021-9371. JSTOR 175350.

- Bagehot, Walter (1873). Lombard Street : a description of the money market. London: Henry S. King and Co.

- "BBC: Empire of the Seas programme". webcache.googleusercontent.com. Archived from the original on 20 December 2019. Retrieved 10 May 2010.

- Committee of Finance and Industry 1931 (Macmillan Report) description of the founding of Bank of England. 1 January 1979. ISBN 9780405112126. Retrieved 10 May 2010. "Its foundation in 1694 arose out the difficulties of the Government of the day in securing subscriptions to State loans. Its primary purpose was to raise and lend money to the State and in consideration of this service it received under its Charter and various Act of Parliament, certain privileges of issuing bank notes. The corporation commenced, with an assured life of twelve years after which the Government had the right to annul its Charter on giving one year's notice. '''Subsequent extensions of this period coincided generally with the grant of additional loans to the State'''"

- Calendar Of State Papers Domestic Series p. 73 1636-1637

- H. Roseveare, /The Financial Revolution 1660–1760/ (1991, Longman), pp. 34

- III, Kenneth E. Hendrickson (25 November 2014). The Encyclopedia of the Industrial Revolution in World History. Rowman & Littlefield. ISBN 9780810888883.

- "MITHRA i. MITRA IN OLD INDIAN – Encyclopaedia Iranica". www.iranicaonline.org. Retrieved 20 September 2016.

- "Bank of England: Buildings and Architects". The Bank of England. Archived from the original on 10 September 2015. Retrieved 31 July 2015.

- "The many, often competing, jobs of the Bank of England". The Economist. 16 September 2017.

- Wilson, Harry (4 February 2011). "Rothschild: history of a London banking dynasty". The Telegraph.

- "From lender of last resort to global currency? Sterling lessons for the US dollar". VOX. 23 July 2011. Retrieved 8 May 2014.

- Morrison, James Ashley (2016). "Shocking Intellectual Austerity: The Role of Ideas in the Demise of the Gold Standard in Britain" (PDF). International Organization. 70 (1): 175–207. doi:10.1017/S0020818315000314. ISSN 0020-8183.

- John Fforde, The Role of the Bank of England, 1941–1958 (1992)

- "27 July 1694: the Bank of England is created by Royal Charter". MoneyWeek. 27 July 2015. Retrieved 2 January 2018.

- "Proceedings of the House of Commons, 21st April 1977".

- "Guardian article on Queen's private wealth, 30th May 2002". The Guardian. London. 30 May 2002.

- "Proceedings of the House of Lords, 26th April 2011".

- "Bank of England Nominees Company Accounts".

- "Example of a Dormant Nominee Company". Archived from the original on 25 April 2012. Retrieved 12 September 2011.

- "Freedom of Information Act response regarding Bank of England Nominees Limited" (PDF). Archived from the original (PDF) on 28 August 2016. Retrieved 31 May 2011.

- The Scourge of Monetarism. Oxford University Press. 1 January 1982. ISBN 9780198771876. Retrieved 19 August 2016.

- Sattler, Thomas; Brandt, Patrick T.; Freeman, John R. (April 2010). "Democratic accountability in open economies". Quarterly Journal of Political Science. 5 (1): 71–97. CiteSeerX 10.1.1.503.6174. doi:10.1561/100.00009031.

- "Key Monetary Policy Dates Since 1990". Bank of England. Archived from the original on 29 June 2007. Retrieved 20 September 2007.

- "Remit of the Monetary Policy Committee of the Bank of England and the New Inflation Target" (PDF). HM Treasury. 10 December 2003. Archived (PDF) from the original on 26 September 2007. Retrieved 20 September 2007.

- "Monetary Policy Framework". Bank of England. Retrieved 31 October 2016.

- "Targeting Inflation: The United Kingdom in Retrospect" (PDF). IMF. Retrieved 31 October 2016.

- "Inflation Targeting Has Been A Successful Monetary Policy Strategy". National Bureau of Economic Research. Retrieved 31 October 2016.

- The Return of the Master. Public Affairs. 2009. ISBN 978-1610390033. Retrieved 19 August 2016.

- Walters, A.A. (June 1971). "Consistent expectations, distributed lags and the quantity theory". The Economic Journal. 81 (322): 273–281. doi:10.2307/2230071. JSTOR 2230071.

- Liberal Democrat election manifesto, 1992

- "Mark Carney named new Bank of England governor". BBC News. 26 November 2012. Retrieved 26 November 2012.

- "Carney to stay at Bank of England until 2020". BBC News. 11 September 2018.

- "BANK OF ENGLAND NOMINEES LIMITED - Filing history (free information from Companies House)".

- "The Bank's core purposes" (PDF). Annual Report 2011. Bank of England. Retrieved 24 October 2011.

- Bank of England – Yield Curves by Internet Archive.

- "Memorandum of Understanding between the HM Treasury, the Bank of England and the Financial Services Authority" (PDF). Archived from the original (PDF) on 3 December 2010. Retrieved 10 May 2010.

- Hannah Kuchler and Claire Jones (30 October 2012). "BoE's Haldane says Occupy was right". Financial Times. Retrieved 30 October 2012.(registration required)

- "Sale of Bank Note Printing". Bank of England. Retrieved 10 June 2006.

- Archived 11 February 2012 at the Wayback Machine

- "Bank of England: Education". Bank of England. Archived from the original on 29 March 2007. Retrieved 28 March 2007.

- "Asset Purchase Facility". Bank of England. Archived from the original on 26 July 2010. Retrieved 12 August 2010.

- "£2 note issued by Evans, Jones, Davies & Co". British Museum. Archived from the original on 18 January 2012. Retrieved 31 October 2011.

- "A brief history of banknotes". Bank of England website. Retrieved 31 October 2011.

- "Fox, Fowler & Co. £5 note". British Museum. Archived from the original on 2 October 2011. Retrieved 31 October 2011.

- Trevor R Howard. "Treasury notes". Archived from the original on 5 December 2007. Retrieved 12 October 2007.

- "Record £53m stolen in depot raid". 27 February 2006. Retrieved 14 September 2014.

- "Banknote Production". bankofengland.co.uk. Bank of England. Archived from the original on 10 March 2012.

- Belton, Pádraig. "The city with $248 billion beneath its pavement". www.bbc.com. Retrieved 9 November 2020.

- "Value of all forms of gold".

- 5,134 tonnes / 171,300 tonnes = 2.997%

- "Governors of the Bank of England: A chronological list (1694 – present)" (PDF). Bank of England. Retrieved 17 July 2014.

- "Court of Directors". Bank of England. Retrieved 8 January 2018.

- "Court of Directors". www.bankofengland.co.uk. Retrieved 11 June 2019.

- "News Release - Appointment of Chief Operating Officer". Bank of England. 18 June 2013. Retrieved 3 September 2015.

- "Joanna Place - Chief Operating Officer". Bank of England. Retrieved 6 March 2020.

- "Bank of England Keeps Rates Steady". ABC News. Associated Press. 22 October 2014. Archived from the original on 27 October 2014. Retrieved 26 October 2014.

Further reading

- Brady, Robert A. (1950). Crisis in Britain. Plans and Achievements of the Labour Government. University of California Press., on nationalisation 1945–50, pp 43–76

- Capie, Forrest. The Bank of England: 1950s to 1979 (Cambridge University Press, 2010). xxviii + 890 pp. ISBN 978-0-521-19282-8 excerpt and text search

- Clapham, J. H. Bank of England (2 vol 1944) for 1694–1914

- Fforde, John. The Role of the Bank of England, 1941–1958 (1992) excerpt and text search

- Francis, John. History of the Bank of England: Its Times and Traditions excerpt and text search

- Hennessy, Elizabeth. A Domestic History of the Bank of England, 1930–1960 (2008) excerpt and text search

- Kynaston, David. 2017. Till Time's Last Sand: A History of the Bank of England, 1694–2013. Bloomsbury.

- Lane, Nicholas. "The Bank of England in the Nineteenth Century." History Today (Aug 1960) 19#8 pp 535-541.

- Roberts, Richard, and David Kynaston. The Bank of England: Money, Power and Influence 1694–1994 (1995)

- Sayers, R. S. The Bank of England, 1891–1944 (1986) excerpt and text search

- Schuster, F. The Bank of England and the State

- Wood, John H. A History of Central Banking in Great Britain and the United States (Cambridge University Press, 2005)

External links