Lincoln National Corporation

Lincoln National Corporation is a Fortune 250 American holding company, which operates multiple insurance and investment management businesses through subsidiary companies. Lincoln Financial Group is the marketing name for LNC and its subsidiary companies.[3]

| |

| Type | Public |

|---|---|

| NYSE: LNC S&P 500 Component | |

| Industry | Insurance, Asset management |

| Founded | 1905 |

| Founder | Perry Randall |

| Headquarters | Radnor, Pennsylvania, United States |

Key people | Dennis Glass, President & CEO |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 9,047 (2017) [2] |

| Website | Lincoln Financial Group |

LNC was organized under the laws of the state of Indiana in 1968, and maintains its principal executive offices in Radnor, Pennsylvania.[4] The company traces its roots to its earliest predecessor founded in 1905.

In addition, LNC is the naming rights sponsor of Lincoln Financial Field in Philadelphia, home field of the Philadelphia Eagles of the National Football League.

Operations

LNC divides operations into four business segments:

1) Annuities,

2) Life Insurance,

3) Retirement Plan Services,

4) Group Protection.

The principal Lincoln subsidiaries are

- Lincoln National Life Insurance Company

- Lincoln Life & Annuity Company of New York

- First Penn-Pacific Life Insurance Company

- Lincoln Financial Distributors

- Lincoln Financial Advisors

- Lincoln Financial Securities[5]

At December 31, 2016, LNC had consolidated assets under management of $262 billion and consolidated shareholders’ equity of $14.5 billion. They have over 27,000 insurance agents licensed in California.

History

Founding and early history

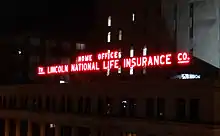

Lincoln traces its origin to June 12, 1905, in Fort Wayne, Indiana, as the Lincoln National Life Insurance Company. Perry Randall, a Fort Wayne attorney and entrepreneur, suggested the name "Lincoln," arguing that the name of Abraham Lincoln would powerfully convey a spirit of integrity. In August, 1905 Robert Todd Lincoln provided a photograph of his father, along with a letter authorizing the use of his father's likeness and name for company stationery and advertising.

In 1928, LNC president Arthur Hall hired Dr. Louis A. Warren, a Lincoln scholar, and in 1929, LNC acquired one of the largest collections of books about Abraham Lincoln in the United States. The Lincoln Museum in Fort Wayne was the second largest Lincoln museum in the country. The Abraham Lincoln Presidential Library and Museum in Springfield, Illinois is now the world's largest museum dedicated to the life and times of Abraham Lincoln, after the closing of the Fort Wayne Lincoln Museum June 30, 2008.

Ian Rolland started with Lincoln in 1956, and became president of Lincoln National Life in 1977. When Rolland retired in 1998, new president Jon A. Boscia moved LNC to Philadelphia and started using the Lincoln Financial Group name for marketing. Lincoln National Life, the largest subsidiary, and the Lincoln Museum remained in Fort Wayne.

1990–2007

Lincoln Reinsurance was the first US reinsurance company; it was sold to Swiss Re in 2001. K&K Insurance Specialties was the first to insure events like NASCAR races; it was sold to AON in 1993. Safeco bought American States, a property/casualty insurance business because Lincoln was primarily in life/health. However, LNC even sold a block of disability income business to MetLife in 1999, as it narrowed its focus.

Lincoln moved its headquarters from Indiana to Philadelphia in 1999.[6] In Philadelphia Lincoln was headquartered in the West Tower of Centre Square in Center City.[7]

Lincoln Financial was naming rights sponsor for the 2000 Rugby League World Cup which was held in England.

Lincoln Financial Group purchased the Administrative Management Group, Inc. based in Arlington Heights, Illinois in August 2002. Previously, AMG was a strategic partner of LFG for four years, providing recordkeeping services for the Lincoln Alliance product, a turnkey solution for "employer retirement and employee benefit programs, including investment choices, recordkeeping, plan design, compliance and employee retirement counseling and education."[8]

In 2007, the company moved 400 employees, including its top executives, to Radnor Township from Philadelphia.[6]

Jefferson-Pilot acquisition

Following the acquisition of Jefferson-Pilot Corporation in March 2006, Lincoln Financial acquired group life, disability, and dental insurance divisions. Jefferson-Pilot Corporation was a Fortune 500 company based in Greensboro, North Carolina founded in 1968 from the merger of Jefferson Standard Insurance (founded 1907 by Charles W. Gold and Pleasant D. Gold, Jr., sons of Pleasant Daniel Gold) and Pilot Life Insurance (founded 1903). The two companies' association actually dated to 1945, when Jefferson Standard bought majority control of Pilot Life.

Lincoln Financial also acquired Jefferson-Pilot's television and radio operations, which were renamed Lincoln Financial Media. The group owns 18 radio stations in Miami, Florida; San Diego, California; Denver, Colorado; and Atlanta, Georgia. It also owned WBTV, the CBS affiliate in Charlotte; WCSC-TV, the CBS affiliate in Charleston, South Carolina and WWBT, the NBC affiliate in Richmond, Virginia. In June 2007, the company publicly announced it would explore a sale of this division, and hired Merrill Lynch to assess its strategic options. It was announced on November 12 that Raycom Media purchased the three TV stations,[9] including its sports production division, which was the co-holder to football and basketball games in the Atlantic Coast Conference with Raycom and sole rightsholders to the Southeastern Conference until 2009, when ESPNPlus and CBS Sports acquired the rights. The Raycom Sports brand was merged with LFS as of January 1, 2008.

Though billed as a merger of equals, the merged company carries the LNC name, operates from the LNC offices, with current LNC stockholders holding 61% of the stock, and current LNC directors controlling the new board. The insurance division is based in Greensboro, North Carolina.

Recent activity

Lincoln purchased Newton County Loan and Savings in order to restructure as a bank holding company and qualify for Troubled Asset Relief Program (TARP) funding.

In January 2009, Lincoln sold its Delaware Investments subsidiary to Macquarie Group.[10] Delaware Investments was integrated into Macquarie's global asset management arm, Macquarie Funds Group effective January 5, 2010.

Insurance patent

Lincoln National is the owner of U.S. Patent 7,089,201, “Method and apparatus for providing retirement income benefits”. This patent covers methods for administering variable annuities. Lincoln's commercial products that are covered by this patent include their i4LIFE Advantage and 4LaterSM Advantage annuities.[11]

In September 2006, Lincoln filed a patent infringement lawsuit against Transamerica Life Insurance Company for allegedly infringing its insurance patent.[12] A similar lawsuit was filed against Jackson National Life in October 2007.[13]

On Feb. 19, 2009, a jury found the Lincoln patent valid and infringed by Transamerica et al. Damages were assessed at the "reasonable royalty rate" and Transamerica et al. were ordered to pay Lincoln $13 million, or 0.11% of the over $12 billion in assets they had under management by virtue of infringing the patent.[14]

Affiliations

Lincoln Financial Group is the grand sponsor of the National Forensic League and its National Speech and Debate Tournament.

See also

- Lincoln Financial Media - subsidiary of Lincoln National Corporation that owns radio stations in the United States

References

- https://www.lfg.com/wcs-static/pdf/2018%20LNC%20Annual%20Report.pdf

- "Lincoln National". Fortune. Retrieved 2019-02-18.

- "Lincoln Financial Group rules, regulations and disclaimers". lfg. Retrieved 2020-09-08.

- "Corporate Archived 2009-08-28 at the Wayback Machine." Lincoln National Corporation. Retrieved on August 24, 2009.

- "LINCOLN FINANCIAL SECURITIES CORPORATION - FORT WAYNE , IN | Get The Facts, Find The Best, And Avoid Fraud". investingreview.org. Retrieved 2019-06-18.

- Blumenthal, Jeff. "Lincoln sells Delaware Investments." Philadelphia Business Journal. Wednesday August 19, 2009. Modified Thursday August 20, 2009. Retrieved on August 24, 2009.

- "Contact Us." Lincoln National Corporation. June 22, 2000. Retrieved on August 24, 2009.

- Schneyer, Fred (August 13, 2002). "Lincoln Buys RK Firm". PlanSponsor (published January 8, 2003). Retrieved June 4, 2020.

turnkey solutions for employer retirement and employee benefit programs, including investment choices, recordkeeping, plan design, compliance and employee retirement counseling and education.

- Malone, Michael (November 12, 2007). "Raycom Grabs Lincoln Financial Stations". Broadcasting Cable. Archived from the original on November 16, 2007. Retrieved October 5, 2017.

- McFarland, Lyndal (August 20, 2009). "Macquarie to Acquire Delaware Investments". Wall Street Journal. Retrieved 4 June 2020.

- "LINCOLN NATIONAL CORP - LNC Annual Report (10-K) PART I". edgar-online.com. 15 July 2012. Archived from the original on 15 July 2012.

- David G. Luettgen, “Foley Sponsors Conference on Business Method Patents for the Financial Services Industry”, Sept. 12, 2006 Archived 2007-05-06 at the Wayback Machine

- "Lincoln National Life Insurance Company v. Jackson National Life Insurance Company et al". Justia Dockets & Filings.

- "Patent case ruling to cost Transamerica $13 million | DesMoinesRegister.com | The Des Moines Register". wayback.archive-it.org. Retrieved 2020-09-08.

External links

- Lincoln National Corporation (company website)

- Business data for Lincoln National Corporation:

- Lincoln Financial Foundation(company website)