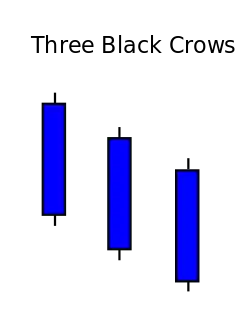

Three black crows

Three crows is a term used by stock market analysts to describe a market downturn. It appears on a candlestick chart in the financial markets. It unfolds across three trading sessions, and consists of three long candlesticks that trend downward like a staircase. Each candle should open below the previous day's open, ideally in the middle price range of that previous day. Each candlestick should also close progressively downward to establish a new near-term low. The pattern indicates a strong price reversal from a bull market to a bear market.[1]

The three crows help to confirm that a bull market has ended and market sentiment has turned negative. In Japanese Candlestick Charting Techniques, technical analyst Steve Nison says "The three crows would likely be useful for longer-term traders."[2]

This candlestick pattern has a counterpart known as the Three white soldiers, whose attributes help identify a bullish reversal or market upswing.

References

- "Stock market investing 101 - Simplified utilizing candlestick signals". Retrieved 16 June 2010.

- Nison, Steve (2001). Candlestick Charting Explained (2nd ed.). Paramus, New Jersey: New York Institute of Finance. p. 97. ISBN 0-7352-0181-1.