Carried interest

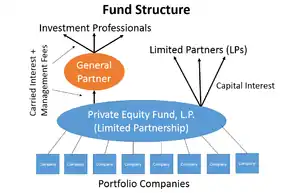

Carried interest, or carry, in finance, is a share of the profits of an investment paid to the investment manager in excess of the amount that the manager contributes to the partnership, specifically in alternative investments (private equity and hedge funds). It is a performance fee, rewarding the manager for enhancing performance.[3] The structure also takes advantage of favorable tax treatment in the United States.[4]

History

The origin of carried interest can be traced to the 16th century, when European ships were crossing to Asia and the Americas. The captain of the ship would take a 20% share of the profit from the carried goods, to pay for the transport and the risk of sailing over oceans.[5][6]

Definition and calculation

Carried interest is a share of the profits of an investment paid to the investment manager in excess of the amount that the manager contributes to the partnership, specifically in alternative investments i.e., private equity and hedge funds. It is a performance fee rewarding the manager for enhancing performance.[3] The structure also takes advantage of favorable tax treatment in the United States.[4]

Amount and calculation

The manager's carried-interest allocation varies depending on the type of investment fund and the demand for the fund from investors. In private equity, the standard carried-interest allocation historically has been 20% for funds making buyout and venture investments, but there is some variability. Notable examples of private equity firms with carried interest of more than 20% ("super carry") include Bain Capital and Providence Equity Partners. Hedge fund carry percentages have historically centered on 20%, but have had greater variability than those of private equity funds. In extreme cases performance fees have reached as high as 44% of a fund's profits[4] but is usually between 15% and 20%.

The distribution of fund returns is often directed by a distribution waterfall.[7][4] Returns generated by the investment are first spent to return each investor's initial capital contribution, including the manager.[7][4] This is not "carried interest," because it is a repayment of principal. Second, returns are paid to investors other than the managers, up to a certain previously agreed rate of return (the "hurdle rate" or "preferred return").[8] The customary hurdle rate is 7% to 9% per annum.[7][4] Third, returns are paid to the managers until they have also received a rate of return equal to the hurdle rate (the "catch-up").[7] Not every fund provides for a hurdle and a catch-up. Often, returns during the catch-up phase are split with the manager receiving the larger (e.g. 80%) share and the investors receiving a smaller (e.g. 20%) share, until the manager's catch-up percentage has been collected. Fourth, once the manager's returns equal the investor returns, the split reverses, with the manager taking a lower (often 20%) share and the investors taking the higher (often 80%) share.[4] All manager returns above the manager's initial contribution are "carry" or "carried interest."[9]

Timing

Private equity funds distribute carried interest to managers and other investors only upon a successful exit from an investment, which may take years. In a hedge fund environment, carried interest is usually referred to as a "performance fee" and because it invests in liquid investments, it is often able to pay carried interest annually if the fund has generated a profit. This has implications for both the amount and timing of the taxes on the interest.

Other fees

Historically, carried interest has served as the primary source of income for manager and firm in both private equity and hedge funds. Both private equity and hedge funds also tend to have an annual management fee of 1% to 2% of assets under management per year; the management fee is to cover the costs of investing and managing the fund.[4] The 1%-2% management fee, unlike the 20% carried interest, is treated as ordinary income in the United States.[10] As the sizes of both private equity and hedge funds have increased, management fees have become a more meaningful portion of the value proposition for fund managers as evidenced by the 2007 initial public offering of the Blackstone Group.[11]

Taxation

Private equity returns are tax-advantaged in several ways.

Private equity carried interest is treated as a long-term capital gain for tax purposes in many jurisdictions. Long-term capital gains are returns on financial and other investments that have been held for a certain statutorily determined amount of time before being sold.[12][11] They are taxed at a lower rate than ordinary income to promote investment.[12] Private equity funds' long time horizons allow their returns, including the manager's carried interest, to qualify as long-term capital gains.[12][11] Manager carried interest can be categorized as capital gains even if the return on the manager's initial investment is higher than the total rate of return for the asset.

Furthermore, taxes on the increase in value of an investor or manager's share of the fund are not due until a realization event, most commonly the sale of an investment, occurs.[11]

United States

Treatment of active partners' return on investment as capital gains in the United States originated in the oil and gas industry of the early 20th century. Oil exploration companies, funded by financial partners' investments, explored and developed hydrocarbon resources. The profits generated were split between the explorers and the investors. The explorers' profits were subject to favorable capital gains treatment alongside the investors'. The logic was that the non-financial partner's "sweat equity" was also an investment, since it entailed the risk of loss if the exploration was unsuccessful.[10]

Taxes on carried interest are deferred until a realization event due to the difficulties of measuring the present value of an interest in future profits.[11][13] The Internal Revenue Service affirmed this approach in 1993 as a general administrative rule,[14] and again in regulations proposed in 2005.[15]

Carried interest is tax advantaged in several other ways as well. Private equity and hedge funds are often structured as legal partnerships or other pass-through entities for tax purposes, which reduces taxes at the entity level (compared to corporations), although the investment managers are taxed on their individual tax returns.[16] Private equity funds also benefit from the interest deduction.[16][17][18]

The implication of treating private equity carried interest as capital gains is that investment managers face significantly lower tax burdens than others who would otherwise be in similar income brackets.[11] As of 2020, the maximum long-term capital gains rate (including the net investment income tax) is 23.8%[19] compared to the maximum 37% ordinary income rate.[20] This has generated significant criticism.

- Controversy and regulatory attempts

Critics of the carried interest system (as opposed to critics of the broader tax systems that affect private equity) primarily object to the ability of the manager to treat most of their return as capital gains, including amounts above and beyond the amount directly related to the capital contributed by the manager. Critics characterize this as managers taking advantage of tax loopholes to receive what is effectively a salary without paying the 37% marginal ordinary income tax rate. This controversy has been ongoing since the mid-2000s. This controversy has increased as the growth in assets under management by private equity and hedge funds has driven up manager compensation. As of September 2016, the carried interest tax regime's total tax benefit for private-equity partners is estimated to be from $2 billion to $16 billion dollars per year.

On June 22, 2007, U.S. Representative Sander M. Levin introduced H.R. 2834, which would have eliminated the ability of managers to receive capital-gains tax treatment on their income. On June 27, 2007, Henry Paulson said that altering the tax treatment of a single industry raises tax policy concerns, and that changing the way partnerships in general are taxed is something that should only be done after careful consideration, although he was not speaking only about carried interest.[21] In July 2007 the U.S. Treasury Department addressed carried interest in testimony before the U.S. Senate Finance Committee.[22] U.S. Representative Charles B. Rangel included a revised version of H.R. 2834 as part of the "Mother of All Tax Reform" and the 2007 House extenders package.

In 2009, the Obama Administration included a line item on taxing carried interest at ordinary income rates in the 2009 Budget Blueprint.[23] On April 2, 2009, Congressman Levin introduced a revised version of the carried interest legislation as H.R. 1935. Proposals were made by the Obama Administration for the 2010,[24] 2011,[25] and 2012[26] budgets.

Favorable taxation for carried interest generated national interest during the 2012 Republican primary race for president because 31% of presidential candidate Mitt Romney's 2010 and 2011 income was carried interest. Billionaire Warren Buffett, who also benefits from the capital gains system, famously opined that he should not be paying lower taxes than his assistant.[27] On May 28, 2010, the House approved carried interest legislation as part of amendments to the Senate-passed version of H.R. 4213.[28] On February 14, 2012, Congressman Levin introduced H.R. 4016.[28] On February 26, 2014, House Committee on Ways and Means chairman Dave Camp (R-MI) released draft legislation to raise the tax on carried interest from the current 23.8 percent to 35 percent.[29][30][31]

In June 2015, Sander Levin (D-MI) introduced the Carried Interest Fairness Act of 2015 (H.R. 2889) to tax investment advisers with ordinary income tax rates.[32] As of 2015 some in the private equity and hedge fund industries had been lobbying against changes, being among the biggest political donors on both sides of the aisle.[33] In June 2016 presidential candidate Hillary Clinton said that if Congress were to fail to act, as president she would ask the Treasury Department to use its regulatory authority to end a tax advantage.[34]

In 2018, under President Donald Trump's administration, tax legislation passed that increased the length of time assets must be held by investment managers in order to qualify for long-term capital gains treatment from one year to three years. The legislation also limited the amount of interest deduction that could be taken to 30% of earnings before interest and taxes.[17] The new rule had many exceptions including excepting the real estate sector.[17] Proposed Treasury guidance in August 2020 tightened certain of these exceptions.[35]

United Kingdom

The Finance Act 1972 provided that gains on investments acquired by reason of rights or opportunities offered to individuals as directors or employees were, subject to various exceptions, taxed as income and not capital gains. This may strictly have applied to the carried interests of many venture-capital executives, even if they were partners and not employees of the investing fund, because they were often directors of the investee companies. In 1987, the Inland Revenue and the British Venture Capital Association (BVCA[36]) entered into an agreement which provided that in most circumstances gains on carried interest were not taxed as income.

The Finance Act 2003 widened the circumstances in which investment gains were treated as employment-related and therefore taxed as income. In 2003 the Inland Revenue and the BVCA entered into a new agreement which had the effect that, notwithstanding the new legislation, most carried-interest gains continued to be taxed as capital gains and not as income.[37] Such capital gains were generally taxed at 10% as opposed to a 40% rate on income.

In 2007, the favorable tax rates on carried interest attracted political controversy.[38] It was said that cleaners paid taxes at a higher rate than the private-equity executives whose offices they cleaned.[39] The outcome was that the capital-gains tax rules were reformed, increasing the rate on gains to 18%, but carried interest continued to be taxed as gains and not as income.[40]

References

- Fleischer, Victor (2008). "Two and Twenty: Taxing Partnership Profits in Private Equity Funds". New York University Law Review. SSRN 892440.

- Batchelder, Lily. "Business Taxation: What is carried interest and how should it be taxed?". Tax Policy Center. Retrieved 5 March 2014.

- Lemke, Lins, Hoenig and Rube, Hedge Funds and Other Private Funds: Regulation and Compliance, §13:20 (Thomson West, 2013–2014 ed.).

- "Corporate Finance Institute 2 and 20 Hedge Fund Fees".

- James M. Kocis; James C. Bachman, IV; Austin M. Long, III; Craig J. Nickels (2009). Inside Private Equity. Wiley Finance. p. 22.

- "The term carried interest goes back to the medieval merchants in Genoa, Pisa, Florence and Venice". Rubicon.vc.

- "Investopedia : Distribution Waterfall".

- "Hurdle Rate" explained by mergers-acquisitions.org Archived 2011-04-29 at the Wayback Machine.

- "Investopedia : Carried Interest".

- Alec MacGillis (7 September 2016). "The Surreal Politics of a Billionaire's Tax Loophole". Pro Publica. Retrieved 10 September 2016.

- Marples, Donald (2 January 2014). "Taxation of Hedge Fund and Private Equity Managers" (PDF). Congressional Research Service. Retrieved 4 March 2014.

- "Capital Gains Tax 101". Retrieved 4 July 2020.

- See, e.g., Campbell v. Commissioner of Internal Revenue (8th Cir. 1991).

- Revenue Procedure 93-27, 1993 C.B. 343, clarified by Rev. Proc. 2001-43, 2001-2 C.B. 191, Internal Revenue Service, U.S. Dep't of the Treasury.

- Prop. Treas. Reg. section 1.83-3(l), 70 Fed. Reg. 29675, 29680-29681, Internal Revenue Service, U.S. Dep't of the Treasury (May 24, 2005).

- "How Private Equity and Hedge Funds Are Taxed". Retrieved 4 July 2020.

- William D. Cohan (19 Jan 2018). "Why Private Equity Isn't Cheering the Tax Overhaul"". New York Times. Retrieved 4 July 2020.

- Brenda Coleman, Andrew Howard and Leo Arnaboldi (19 Feb 2019). "Tax Issues on Private Equity Transactions". Ropes & Gray. Retrieved 4 July 2020.

- "Capital Gains Tax". Retrieved 4 July 2020.

- "2020 Tax Brackets". Retrieved 4 July 2020.

- Ryan J. Donmoyer; Kevin Carmichael (June 27, 2007). "Paulson Warns of 'Unintended' Fallout in Taxing Funds (Update2)". Bloomberg.

- 07.11.07 Testimony Solomon on Carried Interest.doc

- . See page 122 of the White House version of "A New Era of Responsibility – Renewing America’s Promise".

- "TPC Tax Topics – 2010 Budget – Tax Carried Interest as Ordinary Income". taxpolicycenter.org. Archived from the original on 2012-01-28.

- "TPC Tax Topics – 2011 Budget Page – Tax Carried Interest as Ordinary Income". taxpolicycenter.org. Archived from the original on 2012-01-29.

- "TPC Tax Topics – 2012 Budget – Tax Carried Interest as Ordinary Income". taxpolicycenter.org. Archived from the original on 2012-01-29.

- Warren Buffett (14 August 2011). "Stop Coddling the Super Rich". New York Times. Retrieved 4 July 2020.

- "H.R. 4016: Carried Interest Fairness Act of 2012". Democrats of the United States House Committee on Ways and Means. Archived from the original on 2014-04-18. Retrieved 17 April 2014.

- Alden, William (26 February 2014). "House Proposal Would Raise Taxes on Private Equity Income". DealBook. The New York Times. Retrieved 17 April 2014.

- Norris, Floyd (6 March 2014). "Republican's Tax Plan Awkwardly Aims at Rich". The New York Times. Retrieved 17 April 2014.

- "Camp Releases Tax Reform Plan to Strengthen the Economy and Make the Tax Code Simpler, Fairer and Flatter". United States House Committee on Ways and Means. Archived from the original on 16 April 2014. Retrieved 17 April 2014.

- "Baldwin, Levin Introduce Bill to Close Carried Interest Loophole". Ways and Means Committee Democrats U.S. House of Representatives. 25 June 2015. Archived from the original (press release) on 21 November 2015. Retrieved 11 September 2015.

- Alex Lazar (10 September 2015). "Attacks on low taxes for hedge fund managers will face fierce fight". The Center for Responsive Politics. Retrieved 11 September 2015.

- Przybyla, Heidi M. (June 16, 2016). "Clinton says she'll call Trump unfit to handle economy". USA TODAY. Archived from the original on 2016-06-15. Retrieved September 10, 2016.

- "Key Takeaways from the Proposed Regulations on Carried Interest". Proskauer Rose LLP. 6 Aug 2020. Retrieved 6 August 2020.

- "Our Mission". BVCA. 2009-04-05. Archived from the original on 2012-03-10. Retrieved 2012-02-09.

- "Memorandum of Understanding, 2003, Inland Revenue and BVCA" Archived March 20, 2009, at the Wayback Machine (PDF). HM Revenue and Customs.

- . BBC News. July 3, 2007.

- . BBC News. June 12, 2007.

- "HMRC PBRN 17" Archived March 20, 2009, at the Wayback Machine (PDF). HM Revenue and Customs. 9 October 2007.

Further reading

- Lily Batchelder, Business Taxation: What is carried interest and how should it be taxed?, Tax Policy Center (last updated June 25, 2008)

- Lily Batchelder, What are the options for reforming the taxation of carried interest?, Tax Policy Center (last updated June 25, 2008)

- Peter R. Orszag, The Taxation of Carried Interest: Statement of Peter R. Orszag, Director, Congressional Budget Office, before the Committee on Finance United States Senate, Congressional Budget Office (July 11, 2007).

- Chris William Sanchirico, The Tax Advantage to Paying Private Equity Fund Managers with Profit Shares—What is it? Why is it Bad?, University of Chicago Law Review, Vol. 75, pp. 1071–1153 (2008)