Economic history of the Philippines

The economic history of the Philippines chronicles the long history of economic policies in the nation over the years.

1973–1986

After experiencing years of positive growth, the Philippine economy between 1973 and 1986 suffered a downturn due to a mixture of domestic and international problems. Those were the years the country was under Ferdinand Marcos and martial law, witnessed the assassination of Benigno Aquino, Jr., saw changes to the Philippine energy law, and the popularity of the EDSA People Power Revolution.

Declaration of martial law

President Ferdinand E. Marcos declared martial law in the midst of rising student movements and an increasing number communist and socialist groups lobbying for reforms in their respective sectors. Leftists held rallies to express their frustrations to the government, this restiveness culminating in the First Quarter Storm, where activists stormed Malacañang Palace only to be turned back by the Philippine Constabulary. This event in particular left four people dead and many injured after heavy exchanges of gunfire. There was further unrest, and in the middle of the disorder on September 21, 1972, Marcos issued Proclamation No. 1081, effectively installing martial law in the Philippines, a declaration that suspended civil rights and imposed military rule in the country.

Marcos defended his actions stressing the need for extra powers to quell the rising wave of violence allegedly caused by the communists. He further justified the decree citing the provisions from the Philippine Constitution that martial law is in fact a strategic approach to legally defend the Constitution and protect the welfare of the Filipino people from the dangerous threats posed by vigilantes that place national security at risk. The emergency rule, according to Marcos's plan, was to lead the country into what he calls a "New Society".

The move was initially supported by most Filipinos and viewed by some critics as a change that would solve the massive corruption in the country. Indeed, it ended the clash between the executive and legislative branches of the government and a bureaucracy characterized by special interests. The declaration, however, eventually proved unpopular as excesses, continued corruption, and human rights abuses by the military emerged.

Gross domestic product

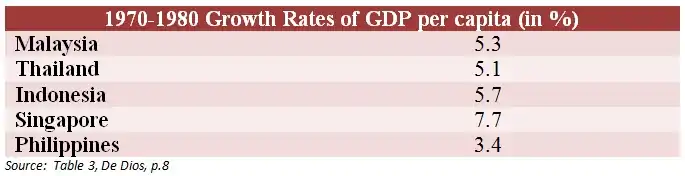

The GDP of the Philippines rose during the martial law, rising from P55 million to P19.3 billion in about 8 years. This growth was spurred by massive lending from commercial banks, accounting for about 62% percent of external debt.[1] As a developing country, the Philippines during the martial law was one of the heaviest borrowers. These aggressive moves were seen by critics as a means of legitimizing martial law by purportedly enhancing the chances of the country in the global market. Much of the money was spent on pump-priming to improve infrastructure and promote tourism. However, despite the aggressive borrowing and spending policies, the Philippines lagged behind its Southeast Asia counterparts in GDP growth rate per capita. The country, in 1970–1980, only registered an average 3.4 percent growth, while its counterparts like Thailand, Malaysia, Singapore, and Indonesia garnered a mean growth of 5.4 percent.[1] This lag, which became very apparent at the end of the Marcos Regime, can be attributed to the failures of economic management that was brought upon by State-run monopolies, mismanaged exchange rates, imprudent monetary policy and debt management, all underpinned by rampant corruption and cronyism. “[…]main characteristics distinguishing the Marcos years from other periods of our history has been the trend towards the concentration of power in the hands of the government, and the use of governmental functions to dispense economic privileges to some small factions in the private sector".[1]

Employment

Government efforts to pump-prime the economy to increase income and encourage spending, unemployment and underemployment grew. The unemployment rate decreased from 5.2 to 0.9 percent from 1978–1983, while employment was a problem, the latter tripling, in the same time period, from 10.2 to 29.0 percent. Concurrently, the labor force of the Philippines grew at an average 10.47 percent in 1970–1983.[1] This can be attributed to an increasing number of women seeking work in the market.

Poverty and income distribution

Income equality grew during the era of martial law as the richest 60% of the nation were able to contribute only 92.5% of the income in 1980, up from 25.0% in 1970. The richest 80%, meanwhile, took a larger share of the income at 91.7% in 1980, up from 57.1% in 1970.[1] These trends coincided with accusations of cronyism in the Marcos administration, as the administration faced allegations of favoring certain companies that were close to the ruling family.

According to the FIES (Family Income and Expenditure Survey) conducted from 1965 to 1985, poverty incidence in the Philippines rose from 11% in 1965 to 18.9% in 1985. This can be attributed to lower real agricultural wages and higher real wages for unskilled and skilled laborers. Real agricultural wages rose about 25% from their 1962 level, while real wages for unskilled and skilled laborers increased by about one-third of their 1962 level.

Main development strategies

In the two decades of Marcos's rule, Philippine economic development strategy had three central pillars: the Green Revolution, Export Agriculture and forestry, and foreign borrowing.[2]

The green revolution

Rice, the foundation of the Philippine economy, is the country’s single most important crop, and the staple food for much of the population. It is especially important to the country's poor majority, as both consumers and producers.

In 1973, the martial law regime merged all coconut-related, government operations within a single agency, the Philippine Coconut Authority (PCA). The PCA was empowered to collect a levy of P0.55 per 100 kilograms on the sale of copra to be used to stabilize the domestic price of coconut-based consumer goods, particularly cooking oil. In 1974, the government created the Coconut Industry Development Fund (CIDF) to finance the development of a hybrid coconut tree.[3] To finance the project, the levy was increased to P20.[5]

Also in 1974, coconut planters, led by the Coconut Producers Federation (Cocofed), an organization of large planters, took control of the PCA governing board. In 1975 the PCA acquired a bank, renamed the United Coconut Planters Bank, to service the needs of coconut farmers, and the PCA director, Eduardo Cojuangco, a business associate of Marcos, became its president. Levies collected by the PCA were placed in the bank, initially interest-free.[5]

The architects of this technology had one overriding objective: increased food production. Proponents of the strategy expected, however, that the new rice technology would also have a positive distributional impact on the poor. Three major benefits were taken to be virtually self-evident:

- 1. Increased rice output would, ceteris paribus, lower the price of rice.

- Since the poor spend a larger fraction of their income on food than the rich do, the idea is that they would benefit excessively.

- 2. Poor farmers would share in the gains to rice producers.

- The new technology was labor intensive. This would be a special advantage to smaller growers who have lower labor costs.

- 3. Landless agricultural workers would benefit too.

- Thanks to the increased demand for labor and the resulting increased employment and higher wages.

New rice technology: Three essential elements

The following key factors of the new rice technology were interdependent. That is, if one was absent, the productivity of the others was greatly reduced.

- 1. 'High-yielding' or 'modern' rice varieties originated at the IRRI

- 2. Chemical fertilizers, to which these varieties are highly responsive

- 3. Water control, notably irrigation in the Philippine setting

Among these, water control remains a key constraint in Philippine rice agriculture. Improvements in often "can be most efficiently achieved by the mobilization of community labor", but this poses problems with respect to public welfare. How will labor commitments and other costs be apportioned? How will irrigation water be fairly allocated? In some places, these problems have been resolved; but elsewhere, conflict and mistrust among individuals have "impeded collective action".

The green revolution brought temporary relief from this impasse, allowing the country to achieve substantial rice yield increases via the shift to new seed-fertilizer technology. But constraints in irrigation did not permit the new varieties to attain their full potential yields, nor did it permit much increase in multiple cropping.

Green revolution: Overall effect

In the early 1990s, the average coconut farm was a medium-sized unit of less than four hectares. Owners, often absentee, customarily employed local peasants to collect coconuts rather than engage in tenancy relationships. The villagers were paid on a piece-rate basis. Those employed in the coconut industry tended to be less educated and older than the average person in the rural labor force and earned lower-than-average incomes.[5] In addition, economic theory tells us that consumers in general, and poor consumers in particular, will benefit from increased output and the resulting price declines. Despite the positive impact of lower prices on poor consumers, absolute poverty increased. "Cheaper rice mitigated, but did not reverse the trend towards impoverishment".

Export agriculture and forestry

The year 1962 was a good one for Philippine export agriculture. Devaluation and deregulation of foreign exchange brought windfall profits to agro-exporters, and were widely seen as a "political triumph" for its main traditional exports.

In 1978 the United Coconut Planters Bank was given legal authority to purchase coconut mills, ostensibly as a measure to cope with excess capacity in the industry. At the same time, mills not owned by coconut farmers—that is, Cocofed members or entities it controlled through the PCA—were denied subsidy payments to compensate for the price controls on coconut-based consumer products. By early 1980, it was reported in the Philippine press that the United Coconut Oil Mills, a PCA-owned firm, and its president, Cojuangco, controlled 80 percent of the Philippine oil-milling capacity.[5] Minister of Defense Juan Ponce Enrile also exercised strong influence over the industry as chairman of both the United Coconut Planters Bank and United Coconut Oil Mills and honorary chairman of Cocofed. An industry composed of some 500,000 farmers and 14,000 traders was, by the early 1980s, highly monopolized.[5]

In principle, the coconut farmers were to be the beneficiaries of the levy, which between March 1977 and September 1981 stabilized at P76 per 100 kilograms. Contingent benefits included life insurance, educational scholarships, and a cooking oil subsidy, but few actually benefited. The aim of the replanting program, controlled by Cojuangco, was to replace aging coconut trees with a hybrid of a Malaysian dwarf and West African tall varieties. The new palms were to produce five times the weight per year of existing trees. The target of replanting 60,000 trees a year was not met.[5] In 1983, 25 to 30 percent of coconut trees were estimated to be at least 60 years old; by 1988, the proportion had increased to between 35 and 40 percent.[5]

When coconut prices began to fall in the early 1980s, pressure mounted to alter the structure of the industry. In 1985, the Philippine government agreed to dismantle the United Coconut Oil Mills as part of an agreement with the IMF to bail out the Philippine economy. Later in 1988, United States law requiring foods using tropical oils to be labeled indicating the saturated fat content had a negative impact on an already ailing industry and gave rise to protests from coconut growers that similar requirements were not levied on oils produced in temperate climates.[5] Philippine earnings, nevertheless, did not rise equally owing to worsening terms of trade. The country experienced severely declining terms of trade and great price instability for its agricultural exports from 1962 to 1985. These price movements were "the result of external political and economic forces over which the Philippines could exercise little control". Thus relying on export agriculture as an "engine of economic growth" proved unfeasible.

Export agriculture and forestry: Overall effect

The effects of this special treatment of favorites soon became apparent. Their products were of poor quality and were poor value of money. The traditional economic mainstay of the Philippine ruling elite has been export agriculture. Development strategy in the Marcos era continued to rely on this sector as a major source of income and foreign exchange, between 1962 and 1985, export crop acreage more than doubled. Earnings did not rise commensurately, however, owing to worsening terms of trade.

Foreign borrowing: The debt-for-development strategy

Foreign borrowing was a key element in Philippine development strategy during the Marcos era. The primary rationale was "borrowed money would speed the growth of the Philippine economy, improving the well-being of present and future generations of Filipinos".

Debt-driven growth, 1970–1983

The Marcos regime cornered an increasing share of the profits from the traditional export crops, sugar cane and coconut. The result was a redistribution of income from agro-export elite as a whole to a politically well-connected subset of that elite.

In declaring martial law, Marcos promised to save the country from "an oligarchy that appropriated for itself all power and bounty". But while he did indeed tame selected oligarchs most threatening to his regime, was a "new oligarchy" of Marcos and his relatives and cronies which achieved dominance within many economic sectors. While foreign loans sustained decrease in the 1970s, crony abuses brought economic disaster in the early 1980s (de Dios, 1984). Most fundamentally, martial law perpetuated important shortcomings of the Philippine capitalism, because Marcos was merely expanding earlier patterns of patrimonial plunder. Particularistic demands continued to prevail, the difference being that one ruler now appropriated a much larger proportion of the state apparatus toward the service of his own private end. As the economic crisis intensified – especially after the 1983 assassination of opposition leader Benigno S. Aquino – the IMF transformed itself from "doting parent" to" vengeful god"and forced a wrenching process of economic stabilization that induced severe recession. This heightened the regime's unpopularity, assisted the continuing growth of both leftist and moderate resistance throughout the archipelago, and paved away for the Marcos regime's demise amid the "people power" uprising of February 1986. More thoroughgoing attempts at reform awaited the advent of a new democratic era. Marcos increased the stature of technocrats within the government and, through their public rhetoric in favor of policy reform, help to ensure the continued flow of loans into the country. Over time, however, became increasingly clear that technocracy would have to give way to an acquisitive and more influential diversified family conglomerates. Marcos and his cronies used access to the political machinery to accumulate wealth, and – like the major families of the pre-martial law years – had little loyalty to the nation. The cronyism of the Marcos regime was more obvious than the cronyism of either the pre-1972 period or the post-1986 years, since the regime had more centralized control over the state apparatus and enjoyed much longer tenure in office. While special interest groups continued to prevail, the difference was that a dictator now had a much firmer grip on the state apparatus to service his own private end. Oligarchic plunder was manifest in the crony capitalists that controlled the industries during the dictatorial regime. Crony capitalists "were businessmen who walk the corridors of the presidency and by virtue of this proximity to Marcos drove policy making and by doing so were able to control specific sectors of the economy".

Battle for stabilization, 1983–1986

After the assassination of Benigno Aquino, the Philippines saw itself at the brink of an economic freefall.

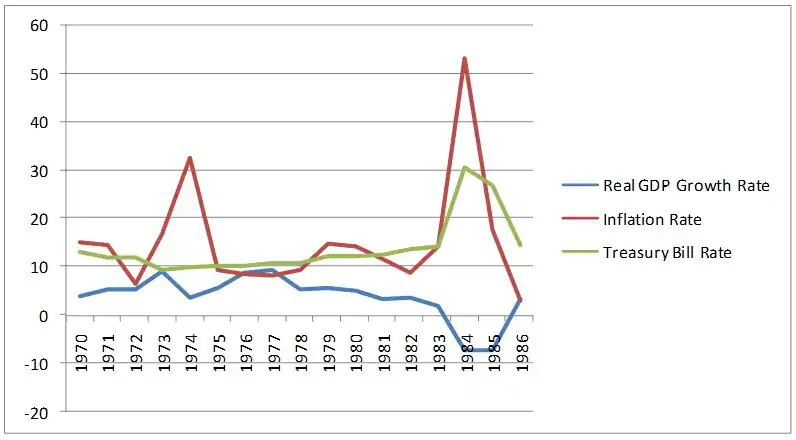

Due to the sudden collapse of confidence and credit ratings from international financial institutions, the Philippine government, had difficulty borrowing new capital to cut the increasing budget deficit, much of it payments to interest from debt. The government was thus forced to declare a debt moratorium[4] and started to impose import controls and implemented foreign exchange rationing, which temporarily halted its import liberalization program. The peso was again devalued in 1984 by almost 100 percent. The Central Bank was later forced to start a new program, issuing “Central bank bills ... at more than 50 percent interest rate – which most likely contributed to the high inflation in 1984 and 1985.”[4] This was aimed at attracting inflows of foreign currency due to the higher domestic interest rate and to lower deficit and aggregate demand. This resulted in a reduction in the balance of payments and national account deficits but at the same time also started an economic decline of about 7 percent in the years 1984 to 1985. Investments also fell by about 50 percent in 1985 due to lower economic growth.[4]

According to Lim, the government also employed measures to reduce overall government expenditures to reduce deficits. This effort, however, was partially caused by the fall in tax revenues during that time as public speculation about the weaknesses of the government was increasing. However, because of the large deficit incurred by the Central Bank due to bailouts and assumption of debts from bankrupt firms, this measure had relatively no effect on the overall deficit that the government had by the end of 1986.[4] the marcos regime has fallen.

External debt: magnitude and composition

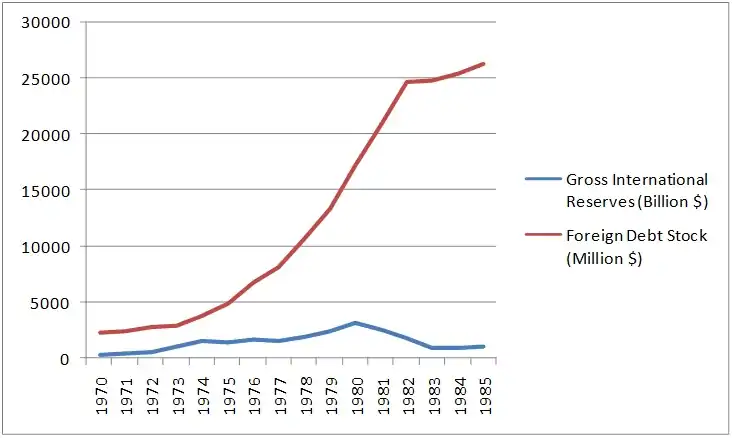

Between 1962 and 1986, the external debt of the Philippine grew from $355 million to $28.3 billion. By the end of the Marcos years, the Philippines was the "ninth most indebted nation in Asia, Africa, and Latin America in absolute terms".

Other development policies

The Marcos regime, during the early to mid-'70s, focused primarily on improving the economy and the country's public image through major increases in government spending particularly on infrastructures. Its main beneficiaries were the tourism industry, with numerous constructions, such as the Philippine International Convention Center, hotels, and even the hosting of international events like the Miss Universe and IMF forums to be able to improve the international status of the county. This policy generally continued even through the 1980s, when the world was experiencing stagflation, an international debt crisis, and high increases of interest rates.

The early effects of the increase in government spending were generally positive. Private businesses and firms, seeing this action by the government, felt bullish and also engaged in aggressive investment and spending patterns. Initially, the gross domestic capital formation to GDP rose up to 28% and foreign investments to the country also increased.

The government, in the 1970s, also focused on an "Export-led Industrialization Program" which focused on "non-traditional manufactured exports and foreign investments". This led to an increase of foreign direct investment in the country particularly to manufacture export-oriented goods. This program also allowed the government to be able to "shift the composition of exports toward a more balanced mix between non-traditional manufactures and primary/agricultural exports".

With this growth in the export sector, there also accompanied growth in the import sector particularly since imported raw materials (also known as intermediate imports) were sourced for domestically produced goods. This led to the worsening deficit at that time, especially by the end of the decade, accompanied by the second oil price shock.

Post-EDSA macroeconomics

The Post-EDSA macroeconomic history of the Philippines covers the period from 1986 to the present time, and takes off from the acclaimed People Power Revolution in the EDSA Revolution of 1986 (named after Epifanio de los Santos Avenue in Manila) that brought democracy and development potentials back to the country that was once in the perils of the Martial Law Era. From days, months, and even years of economic and financial collapse towards the end of that Martial Law Era came revolution, reform, and sustenance spearheaded by the Aquino, Ramos, Estrada, and Arroyo administrations that saw the Philippines get back on track and even through some of the wildest financial and political crises, such as the succeeding EDSA Revolutions, the Asian Financial Crisis, and the most recent "bubble bursts", among others. Revolutions, liberal ideas, and reforms aided the country towards robust growth, and crucial policies were conceptualized, developed, and enacted by the presidents and the advisers who supported them. The period also featured the emergence of civil society as important proponents of development, trade reforms and protections, improvements in exports and export-oriented manufacturing, and decentralization as an important take-off point for regional development.

GDP growth rates

| Year | Growth % | Year | Growth % | Year | Growth % | Year | Growth % | Year | Growth % |

|---|---|---|---|---|---|---|---|---|---|

| 1986 | 3.42 | 1991 | −0.58 | 1996 | 5.85 | 2001 | 1.76 | 2006 | 5.34 |

| 1987 | 4.31 | 1992 | 0.34 | 1997 | 5.19 | 2002 | 4.45 | 2007 | 7.08 |

| 1988 | 6.75 | 1993 | 2.12 | 1998 | −0.58 | 2003 | 4.93 | 2008 | 3.84 |

| 1989 | 6.21 | 1994 | 4.39 | 1999 | 3.40 | 2004 | 6.38 | 2009 | 0.92 |

| 1990 | 3.04 | 1995 | 4.68 | 2000 | 5.97 | 2005 | 4.95 | 2010 | 7.30 |

Table 1: GDP Growth Rates from 1986 to 2010

- data derived from GDP figures in the Philippine Statistical Yearbook

- growth for 2010 courtesy of Manila Bulletin (Lopez and Leyco)

Inflation rates

| Year | Growth % | Year | Growth % |

|---|---|---|---|

| 2001 | 6.80 | 2006 | 6 |

| 2002 | 3.00 | 2007 | 2.83 |

| 2003 | 3.45 | 2008 | 9.31 |

| 2004 | 5.98 | 2009 | 3.23 |

| 2005 | 7.63 | 2010 | 3.81 |

Table 2: Headline Inflation Rates from 1986 to 2010

- estimates derived from CPI figures in the Philippine Statistical Yearbook

Corazon Aquino administration

The Aquino administration takes over an economy that has gone through socio-political disasters during the People Power revolution, where there was financial and commodity collapse caused by an overall consumer cynicism, a result of the propaganda against cronies, social economic unrest resulting from numerous global shortages, massive protests, lack of government transparency, the opposition's speculations and alleged corruption in the government. At that point in time, the country had debt that began crippling the country which slowly made the Philippines the "Latin-American in East Asia" as it started to experience the worst recession since the post-war era.

Most of the immediate efforts of the Aquino administration was directed in reforming the image of the country and paying off all debts, including those that some governments were ready to write-off, as possible. This resulted in budget cuts and further aggravated the plight of the lower class because the jobs offered to them by the government was now gone. Infrastructure projects, including repairs, were halted in secluded provinces turning concrete roads into asphalt. Privatization of many government corporations, most catering utilities, was the priority of the Aquino administration which led to massive lay-offs and inflation. The Aquino administration however, was persistent in its belief that the problems were caused by the previous administration.

Growth gradually began in the next few years of the administration. Somehow, there was still a short-lived, patchy, and erratic recovery from 1987 to 1991 as the political situation stabilized a bit. With this, the peso became more competitive, confidence of investors was gradually regained, positive movements in terms of trade were realized, and regional growth gradually strengthened.

There were other key events in the administration that affected the economy. Perhaps the first most important, aside from the ratification of the 1987 Constitution, would be the administration's pushing for a more open political framework where the administration somehow gave in to the interests of new economic actors. This approach, which also proved important in regaining the confidence of investors, whether domestic or foreign, was definitely unthinkable during the Marcos era. The administration was also characterized by the rescheduling and management of international debts, an exhibition perhaps of the fact that other external entities also sympathized with what happened to the Philippines and also allowed the Philippines to get back on track before anything else.

Development in this administration, however, was slightly bothered by some unforeseen circumstances such as organized coups by the Reformed Armed Forces Movement in 1991. Negotiations with Mindanao also stalled development along with the coup attempts. The Philippines was also hit by the oil price hike effects of the Gulf War. Pressure on government spending and safety nets was intensified as natural calamities like earthquakes and the eruption of Mt. Pinatubo plagued the country, and the problem of daily power outages that affected the populace.

One of the most important policies of the administration is the launching of the Comprehensive Agrarian Reform Program in June 1988, which involved the acquisition and redistribution of all agricultural lands within a time frame of 10 years. So far, the law has already had numerous accomplishments since it was actually passed. There were setbacks, however, in the overall implementation of this reform program such as the Garchitorena scandal (1989) tainting the Department of Agrarian Reform (DAR) and supposedly exposing inefficiencies in the government bureaucracy. Another important breakthrough involved in the program was the fact that the program was also seen as a way to address poverty and equity issues.

Also important in the administration were the trade reforms. The trade reforms pushed by the administration were those that improved export growth and foreign trade through the abolishing of export taxes, the gradual liberalization of imports, and the imposition of an anti-export bias ideal.[5] The reforms also involved the reduction in trade barriers, more specifically by removing restrictions on imports and reforming the import-licensing system. Tariff rates were also eventually reduced to encourage more foreign trade.[6] The administration was also a big part in the realization of the ASEAN Free Trade Area which also served as encouragement for foreign trade.

Some other policies in the administration included fiscal contraction in order to control and manage inflation (Balisacan and Hill, "The Philippine Economy" 110). The administration was also able to reorganize the National Economic and Development Authority, or NEDA, to its present form last July 22, 1987 and the Philippine Exporters' Confederation (PHILEXPORT) in October 1991. The administration was also instrumental in introducing a new framework for infrastructure development which said that "the government should provide the enabling policy environment for greater private sector participation in infrastructure provision" (Balisacan and Hill, "The Dynamics" 330). As for industry dispersal and regional growth, the administration conceptualized and enforced the Local Government Code of 1991 which increased the autonomy and development of Local Government Units through decentralization.

Ramos administration

The Ramos administration basically served its role as the carrier of the momentum of reform and as an important vehicle in "hastening the pace of liberalization and openness in the country".[7] The administration was a proponent of capital account liberalization, which made the country more open to foreign trade, investments, and relations. It was during this administration when the Bangko Sentral ng Pilipinas was established, and this administration was also when the Philippines joined the World Trade Organization and other free trade associations such as the APEC. During the administration, debt reduction was also put into consideration and as such, the issuance of certain government bonds called Brady Bonds also came to fruition in 1992. Key negotiations with conflicting forces in Mindanao actually became more successful during the administration, which also highlighted the great role and contributions of Jose Almonte as the key adviser of this liberal administration.

By the time Ramos succeeded Corazon Aquino in 1992, the Philippine economy was already burdened with a heavy budget deficit. This was largely the result of austerity measures imposed by a standard credit arrangement with the International Monetary Fund and the destruction caused by natural disasters such as the eruption of Mt. Pinatubo. Hence, according to Canlas, pump priming through government spending was immediately ruled out due to the deficit. Ramos therefore resorted to institutional changes through structural policy reforms, of which included privatization and deregulation. He sanctioned the formation of the Legislative-Executive Development Advisory Council (LEDAC), which served as a forum for consensus building, on the part of the Executive and the Legislative branches, on important bills on economic policy reform measures (4).

The daily brownouts that plagued the economy were also addressed through the enactment of policies that placed guaranteed rates. The economy during the first year of Ramos administration suffered from severe power shortage, with frequent brownouts, each lasting from 8 to 12 hours. To resolve this problem, the Electric Power Crisis Act was made into law together with the Build-Operate-Transfer Law. Twenty power plants were built because of these, and in effect, the administration was able to eliminate the power shortage problems in December 1993 and sustained economic growth for some time.[8]

The economy seemed to be all set for long-run growth, as shown by sustainable and promising growth rates from 1994 to 1997. However, the Asian Crisis contagion which started from Thailand and Korea started affecting the Philippines. This prompted the Philippine economy to plunge into continuous devaluation and very risky ventures, resulting in property busts and a negative growth rate. The remarkable feat of the administration, however, was that it was able to withstand the contagion effect of the Asian Crisis better than anybody else in the neighboring countries. Most important in the administration was that it made clear the important tenets of reform, which included economic liberalization, stronger institutional foundations for development, redistribution, and political reform.[9]

Perhaps some of the most important policies and breakthroughs of the administration are the Capital Account Liberalization and the subsequent commitments to free trade associations such as APEC, AFTA, GATT, and WTO. The liberalization and opening of the capital opening culminated in full-peso convertibility in 1992.[10] And then another breakthrough is again, the establishment of the Bangko Sentral ng Pilipinas, which also involved the reduction of debts in that the debts of the old central bank were taken off its books.

In line with the administration's "Philippines 2000" platform, the administration gave more favor to privatization and targeted the proliferation of cartels and monopolies, especially in some key industries such as telecommunications. To further raise revenues, President Ramos also administered the privatization of Petron, Philippine National Bank (PNB), Metropolitan Waterworks and Sewage System (MWSS) and military-based lands such as Fort Bonifacio and Clark Air Base. As part of the administration's competition policy, the administration also advocated for deregulation of service industries to promote foreign investment and increase private sector participation.[11] For monetary policy, the administration focused on "inflating targeting and the imposition of a floating exchange rate with a managed band".[10] With this, inflation stayed under control in the 1990s and indeed, the 1990s became an era of reform and at the same time, a period of optimism.

For fiscal policy, on the other hand, the administration worked on bills to expand the scope of VAT.[12] Due to the need to reduce budget deficit, tax-enhancement measures were imposed. Among these were the "upward adjustment in the excise tax on cigarettes, withholding VAT or value-added tax on government contractors and suppliers, and establishment of a large taxpayers' unit in the Bureau of Internal Revenue" which increased tax revenue of government. There was even a budget surplus in the years 1994 to 1996 due to the effective tax-enhancement program by the administration.[13]

The Ramos administration basically continued the actions of the Aquino administration for infrastructures and industry dispersal. This administration, however, would also have some contributions to welfare. The administration's population policy promoted population management and family planning, while the administration's Social Reform Agenda (SRA) addressed poverty through flagship programs.[14] Completion of the CARP, or Comprehensive Agrarian Reform Program, was one such breakthrough incorporated in the SRA. By June 1998, it was reported by the government that it had only managed to accomplish 57%, a figure still far from the planned total ten-year target from the original timetable for land distribution (Ochoa 167).

Furthermore, Ramos was wholly focused on institutional reform in an attempt to capture the international community's perception of an improving a Philippine economy, with the agenda of increasing global competitiveness. The rural sector's interest was not much represented. Farmers had insufficient funding for rural infrastructure and support services while real estate developers agreed on better deals. To quote Ochoa, "the liberalization of agriculture ensured their dependence on so-called safety nets that could not significantly resuscitate the sector. Six years of 'dipping productivity, declining incomes, dwindling farmlands and pervasive poverty' will be hard to forget" (165).

In the end, the Philippine economy under the Ramos administration gained recognition in breaking out of its deficit-laden stature in Asia. "The confidence generated by the administration among local and international players and analysts resulted from wide‐ranging reforms rooted primarily in a sound macroeconomic and investor‐friendly regime as well as global competitiveness".[15] From 1993, one year's time after Ramos assumed presidency, the economy already started to recover from stagnation with real GDP growth peaking at 5.8% in 1996. Aside from this, it was also during his administration that allowed for the escape of the Philippine economy from recession, during the Asian Financial Crisis, unlike its Asian neighbors like Thailand, South Korea and Indonesia. His reforms have brought gains, broad spillover effects on the rest of the economy and possible positive long-term effects on economic growth. Surely, it is of no doubt that Ramos is commendable to have established strong political leadership that was mandatory in handling the reforms, prior to the weak state of the economy he inherited.

Estrada administration

Although Estrada's administration had to endure the continued shocks of the Asian Crisis contagion, the administration was also characterized by the administration's economic mismanagement and "midnight cabinets". As if the pro-poor rhetoric, promises and drama were not really appalling enough, the administration also had "midnight cabinets composed of 'drinking buddies' influencing the decisions of the 'daytime cabinet'”[16]). Cronyism and other big issues caused the country's image of economic stability to change towards the worse. And instead of adjustments happening, people saw further deterioration and hopelessness that better things can happen. Targeted revenues were not reached, implementation of policies became very slow, and fiscal adjustments were not efficiently conceptualized and implemented. All those disasters caused by numerous mistakes were made worse by the sudden entrance of the Jueteng controversy, which gave rise to the succeeding EDSA Revolutions.

Despite all these controversies, the administration still had some meaningful and profound policies to applaud. The administration presents a reprise of the population policy, which involved the assisting of married couples to achieve their fertility goals, reduce unwanted fertility and match their unmet need for contraception. The administration also pushed for budget appropriations for family planning and contraceptives, an effort that was eventually stopped due to the fact that the church condemned it.[17] The administration was also able to implement a piece of its overall Poverty Alleviation Plan, which involved the delivery of social services, basic needs, and assistance to the poor families. The Estrada administration also had limited contributions to Agrarian Reform, perhaps spurred by the acknowledgement that indeed, Agrarian Reform can also address poverty and inequitable control over resources. In that regard, the administration establishes the program "Sustainable Agrarian Reform Communities-Technical Support to Agrarian and Rural Development".[18] As for regional development, however, the administration had no notable contributions or breakthroughs.

Macapagal-Arroyo administration

The Arroyo administration, economically speaking, was a period of good growth rates simultaneous with the US, due perhaps to the emergence of the Overseas Filipino workers (OFW) and the Business Process Outsourcing (BPO). The emergence of the OFW and the BPO improved the contributions of OFW remittances and investments to growth. In 2004, however, fiscal deficits grew and grew as tax collections fell, perhaps due to rampant and wide scale tax avoidance and tax evasion incidences. Fearing that a doomsday prophecy featuring the [Argentina default] in 2002 might come to fruition, perhaps due to the same sort of fiscal crisis, the administration pushed for the enactment of the 12% VAT and the E-VAT to increase tax revenue and address the large fiscal deficits. This boosted fiscal policy confidence and brought the economy back on track once again.

Soon afterwards, political instability afflicted the country and the economy anew with Abu Sayyaf terrors intensifying. The administration's Legitimacy Crisis also became a hot issue and threat to the authority of the Arroyo administration. Moreover, the Arroyo administration went through many raps and charges because of some controversial deals such as the NBN-ZTE Broadband Deal. Due however to the support of local leaders and the majority of the House of Representatives, political stability was restored and threats to the administration were quelled and subdued. Towards the end of the administration, high inflation rates for rice and oil in 2008 started to plague the country anew, and this led to another fiscal crisis, which actually came along with the major recession that the United States and the rest of the world were actually experiencing.

The important policies of the Arroyo administration highlighted the importance of regional development, tourism, and foreign investments into the country. Therefore, apart from the enactment and establishment of the E-VAT policy to address the worsening fiscal deficits, the administration also pushed for regional development studies in order to address certain regional issues such as disparities in regional per capita income and the effects of commercial communities on rural growth.[19] The administration also advocated for investments to improve tourism, especially in other unexplored regions that actually need development touches as well. To further improve tourism, the administration launched the policy touching on Holiday Economics, which involves the changing of days in which we would celebrate certain holidays. Indeed, through the Holiday Economics approach, investments and tourism really improved. As for investment, the Arroyo administration would normally go through lots of trips to other countries in order to encourage foreign investments for the betterment of the Philippine economy and its development.

Benigno Aquino III administration

The Philippines consistently coined as one of the Newly Industrialized Countries has had a fair gain during the latter years under the Arroyo Presidency to the current administration. The government managed foreign debts falling from 58% in 2008 to 47% of total government borrowings. According to the 2012 World Wealth Report, the Philippines was the fastest growing economy in the world in 2010 with a GDP growth of 7.3% driven by the growing business process outsourcing and overseas remittances.[20]

The country marked slipped to 3.6% in 2011 less emphasis on exports and the government spent less on infrastructure. Also the disruption of the flow of imports for raw material from floods in Thailand and the tsunami in Japan have affected the manufacturing sector in the same year. "The Philippines contributed more than $125 million as of end-2011 to the pool of money disbursed by the International Monetary Fund to help address the financial crisis confronting economies in Europe.This was according to the Bangko Sentral ng Pilipinas, which reported Tuesday that the Philippines, which enjoys growing foreign exchange reserves, has made available about $251.5 million to the IMF to finance the assistance program—the Financial Transactions Plan (FTP)—for crisis-stricken countries."[21]

Remarkably the economy grew by 6.59% in 2012 the same year the Supreme Court Chief Justice Renato Corona was impeached for a failed disclosure of statements of assets, liabilities and network or SALN coherent to the anti-corruption campaign of the administration.[22] The Philippine Stock Exchange index ended in the year with 5,812.73 points a 32.95% growth from the 4,371.96-finish in 2011.[23]

BBB- investment grade by Fitch Ratings on the first quarter of 2013 for the country was made because of a resilient economy by remittances, growth despite the global economic crisis in the last five years reforms by the VAT reform law of 2005, BSP inflation management, good governance reforms under the Aquino administration.[24]

2008 economic crisis and response

The global economic crisis of 2008 pulled countries around the globe into a recession. Following the Asian economic crisis in 1997, the 2008 crisis imposed new challenges to the Philippines as a developing country. The following are expositions of the macroeconomic impacts of the crisis on the Philippines, its implications in the prevalent poverty scenario, and policies and programs undertaken by the government in response to the crisis.

Overview of the global economic crisis

The 2008 global economic crisis started upon the bursting of the United States housing bubble, which was followed by bankruptcies, bailouts, foreclosures, and takeovers of financial institutions by national governments. During a period of housing and credit booms, banks encouraged lending to home owners by a considerably high amount without appropriate level of transparency and financial supervision. As interest rates rose in mid-2007, housing prices dropped extensively, and all institutions that borrowed and invested found themselves suffering significant losses. Financial institutions, insurance companies, and investment houses either declared bankruptcy or had to be rescued financially. Economies worldwide slowed during this period and entered recession.[25]

The crisis, initially financial in nature, took on a full-blown economic and global scale affecting every country, both industrialized and developing.[25]

The Philippine situation before the crisis

The Philippines has long had long-term structural problems that interfere with sustainable economic development. The country has been dominated by a sequence of growth spurts, brief and mediocre, followed by sharp to very-sharp, severe, and extended downturns—a cycle that came to be known as the boom-bust cycle. As such, economic growth record of the country has been disappointing in comparison with its East Asian counterparts in terms of per capita GDP. In addition, in 2007, an absolute poverty incidence of 13.2 percent—higher than Indonesia's 7.7 and Vietnam's 8.4 percent—was recorded, illustrating the unequal distribution of wealth that inhibits growth and development for the Philippines.[25]

Macroeconomic impacts of the crisis

The Philippines was affected by the crisis in a decline in three aspects: exports, remittances from overseas Filipino workers, and foreign direct investments. Heavily dependent on electronic and semiconductor exports, the Philippines saw a downward trend in its export earnings as countries in demand of these exports entered recession. The recession also put at risk the jobs in the developed countries which include those where migrant workers are employed. Consequently, OFW remittances decreased and grew a meagre 3.3% in October 2008. Foreign direct investments (FDI) declined because of investors losing confidence in the financial market. Lower FDIs mean slower economic growth.[26]

Impacts on asset markets, financial sector, and real sector

The freeze in liquidity in US and European financial markets reversed capital flows to developing countries and induced a rise in the price of risk which entailed a drop in equity prices and exchange rate volatility. However, following the effects of an increase in the foreign currency government bond spread, the Philippine stock market was actually one of the least affected by the crisis with the main index of the stock market dropping only by 24 percent, a relatively low percentage change in comparison to those of other countries across Asia. Similarly, from the period between July 2008 and January 2009, the peso depreciated only by 3 percent, meaning that the peso was one of the currencies least affected by the crisis. This minimal effect on the stock market and the Philippine peso can be attributed to the recovery of asset prices across the Asia-Pacific region in early 2009 as foreign portfolio investments surged.[25]

Financially, the banking system in the Philippines was relatively stable, because of reforms that were put in place since Asian financial crisis in 1997. Maintenance of high levels of loan to deposit ratios together with the decline of the ratio of nonperforming loans to total loans kept profitability of local banking generally high despite the crisis. To the country's fortune, no meltdowns occurred as during the previous 1997 Asian crisis.[25]

Declines in the growth rate of personal consumption and expenditures and fixed investment occurred in 2008. Personal consumption expenditure, the largest contributor to GDP growth, showed a downward trend from a sharp drop from 5.8 percent in 2007 to 4.7 percent in 2008, and 3.7 percent in 2009.[27] GDP growth during the fourth quarter of 2008 and first quarter of 2009 fell to 1.7 percent, a staggering fall from a 5.7 percent average for the three previous years. Furthermore, a contraction of 29.2 percent occurred in the manufacturing sector involving electricity, gas, water, trade and finance services. The service sector also turned down as growth in the fourth quarter and first quarters of 2008 and 2009, respectively, was a meagre growth of 2.1 percent, a far contrast from the 6.7 percent average from the previous three years. However, the Philippines generally endured the smallest declines in comparison with other East Asian countries. For instance, OFW remittances, though at a slower pace, still grew in the first half of 2009.[25]

Impact on fiscal deficit and external accounts

To counter adverse effects of the crisis, the Philippine government felt the need to increase its expenditures. Apart from government expenditure, of primary concern was the weak revenues generated by the government with the fiscal deficit reaching P111.8 billion in the first quarter of 2009 as compared to P25.8 billion in the same period of the previous year. Despite suffering the least in terms of the stock exchange and financial markets among East Asian countries, the Philippines lagged in tax receipts in comparison to other nations. Meanwhile, private sector flows in the external account declined and led to a net outflow of $708 million in 2009, a sharp turning away from a net inflow of $507 million in 2008. This eventually led to a fall in stock prices and depreciation of the peso.[28]

Impacts on households and communities

An increasing number of Filipino workers became frustrated due to unemployment and low standards of living in the country. Thousands of Filipinos left the country every day to seize better income opportunities. Moreover, around five million Filipino children were unable to go to school and are forced to work on the streets or in other various workplaces where they could find some food.[29]

Impacts on wealth and income and its distribution across different social divisions

The country was having sound economic indicators before the 2008 economic crisis. Average income per capita was increasing while poverty incidence showed a downward trend. Average income per capita rose by 2% in 2007 and 2008, whereas poverty incidence dropped from 33.0% in 2006 to 31.8% in 2007 and 28.1% in 2008. Output growth plunged in 2009, causing real mean income to fall by 2.1%, resulting in an upward pressure on poverty incidence (which grew by 1.6%). Most hit were households with associations to industry resulting in the average income to drop to levels below that of 2007. Similarly, wage and salary workers were hit significantly. Surprisingly, the poorest 20% did not suffer the same fate they suffered in crises past. The global economic crisis put a halt on the highly promising growth trend of the Philippine economy and forced 2 million Filipinos into poverty.[27]

Coping strategies

i. Finances

Close to 22% of the population reduced their spending, 11% used their existing savings for consumption, 5% pawned assets, 2% sold assets, 36% borrowed money and 5% defaulted on debts.[28]

ii. Education

To reduce spending, households had to risk the quality of education of their children. Some children were transferred from private to public schools, while some were withdrawn from school. Moreover, parents reduced the allowance of the students, and resorted to secondhand uniforms, shoes and books.[28]

iii. Health

Coping strategies may have negative effects on their long-term health as these affected households commonly resort to self-medication, or shift to seeing doctors in government health centers and hospital. Many households in the urban sector shifted to generic drugs while rural households tended to use herbal medicines,[28] such as sambong for colds and kidney stones.

iv. Entertainment

Some people copied by watching popular "action films" such as Banta ng kahapon (1977).

Efforts of poverty alleviation, reduction, eradication

The Medium-Term Philippine Development Plan (MTPDP) was implemented during the Ramos Administration and later on continued by the following administrations to help reduce poverty in the country and improve on the economic welfare of the Filipinos. The Ramos Administration (1993–1998) targeted to reduce poverty from 39.2% in 1991 to about 30% by 1998. The Estrada Administration (1999–2004) then targeted to reduce poverty incidence from 32% in 1997 to 25–28% by 2004,[30] while the Arroyo government targeted to reduce poverty to 17% by creating 10 million jobs but this promise was not fulfilled by the administration.[31]

President Benigno Aquino III planned to expand the Conditional Cash Transfer (CCT) program from 1 to 2.3 million households, and several long-term investments in education and healthcare. Also, in September 2010, Aquino met with US Secretary of State, Hillary Clinton, during the signing of the $434-million Millennium Challenge Corporation (MCC) grant in New York. The MCC grant would fund infrastructure and rural development programs in the Philippines to reduce poverty and spur economic growth.[32]

Macroeconomic and social protection programs

To respond to the financial crisis, the Philippine government, through the Department of Finance and National Economic and Development Authority (NEDA), crafted a PhP 330-billion fiscal package, formally known as the Economic Resiliency Plan (ERP). The ERP was geared towards the stimulation of the economy through tax cuts, increased government spending, and public-private sector projects that could also prepare the country for the eventual upturn of the global economy.[28]

The implementation of ERP was spearheaded by NEDA with the following specific aims:[28]

- To ensure sustainable growth, attaining the higher end of the growth rates;

- To save and create as many jobs as possible;

- To protect the most vulnerable sectors: the poorest of the poor, returning OFWs, and workers in export industries;

- To ensure low and stable prices to supports consumer spending; and

- To enhance competitiveness in preparation for the global rebound.

Regional responses

The Network of East Asian Think Tanks proposed the establishment of the Asia Investment Infrastructure Fund (AIIF) to prioritize the funding of infrastructure projects in the region to support suffering industries. The AIIF, as well as multilateral institutions (especially the Asian Development Bank), also promotes greater domestic demand and intra-regional trade to offset the decline in exports to industrialized countries and narrow the development gap in the region.[28]

References

- De Dios, Emmanuel (1984). An analysis of the Philippine economic crisis. Diliman, Q.C.: University of the Philippines Press.

- Jesuits. Philippine Province; Ateneo de Manila University (1994). Philippine studies. Ateneo de Manila University Press. p. 407.

- Clarete, R.L. "An Analysis of the Economic Policies Affecting the Philippine Coconut Industry" (PDF). Philippine Institute of Development Studies (PIDS).

- Lim, J. Philippine Macroeconomic Developments 1970–1993. Quezon City: Philippine Center for Policy Studies, 1996.

- Balisacan and Hill, "The Philippine Economy" 141

- Balisacan and Hill, "The Dynamics" 374

- Balisacan and Hill, "The Philippine Economy" 106

- Canlas 4–5

- Balisacan and Hill, "The Philippine Economy" 57–59

- Balisacan and Hill, "The Philippine Economy" 21

- Balisacan and Hill, "The Philippine Economy" 157

- Balisacan and Hill, "The Dynamics" 194

- Canlas 5

- Balisacan and Hill, "The Philippine Economy" 315

- Bernardo and Tang v

- Balisacan and Hill, "The Philippine Economy" 19

- Balisacan and Hill, "The Philippine Economy" 299

- Villegas 646–647

- Balisacan and Hill, "The Dynamics" 378

- "Philippines, 6th fastest growing in the world: wealth report". Rappler. August 21, 2012. Retrieved August 21, 2012.

- "Philippines contributed $125M to IMF as of end-'11". Philippine Daily Inquirer. February 22, 2012. Retrieved February 22, 2012.

- "Senate votes 20–3 to convict Corona". Philippine Daily Inquirer. May 29, 2012. Retrieved May 30, 2012.

- "PSEi ends 2012 in the green, up 33% from last year". ABS-CBN News. December 28, 2012. Retrieved December 28, 2012.

- "A first: Investment grade rating for PH". PRappler. March 27, 2013. Retrieved March 27, 2013.

- Cuenca, Janet, Celia Reyes, Josef Yap, "Impact of the Global Financial Crisis on the Philippines", "(http://www.unicef.org/socialpolicy/files/Impact_of_the_Global_Finanical_and_Economic_Crisis_on_the_Philippines.pdf)", May 20, 2011

- Diokno, Benjamin, "Understanding the Global Economic Crisis", "(http://www.up.edu.ph/upforum.php?i=227 Archived 20 March 2012 at the Wayback Machine)", May 17, 2011

- Balisacan, Arsemio, et al., "Tackling Poverty and Social Impacts: Philippine Response to the Global Economic Crisis.", "(http://joeyssalceda.files.wordpress.com/2010/06/balisacan_study-revised_final_report_2jun20101.pdf Archived 24 March 2012 at the Wayback Machine)", May 20, 2011

- Cuenca, Janet, Celia Reyes, Josef Yap, "Impact of the Global Financial Crisis on the Philippines", "(http://www.unicef.org/socialpolicy/files/Impact_of_the_Global_Finanical_and_Economic_Crisis_on_the_Philippines.pdf)", May 15, 2011

- Fair Trade Alliance (FTA) Philippines, "A Nation in Crisis: Agenda for Survival", Fair Trade Alliance, 2004

- Reyes, Celia, Lani Valencia, "Poverty Reduction Strategy and Poverty Monitoring: Philippine Case Study", "(http://siteresources.worldbank.org/INTPAME/Resources/Country-studies/philippines_povmonitoring_casestudy.pdf)", May 15, 2011

- GMA News Research, "Arroyo’s 10-point legacy: Big words, broken promises", "(http://www.gmanews.tv/story/169848/Arroyos-10-point-legacy-Big-words-broken-promises)", May 15, 2011

- ABS-CBN, "Clinton, Aquino talk about anti-poverty programs", "(http://www.abs-cbnnews.com/nation/11/10/10/clinton-aquino-talk-about-anti-poverty-programs)", May 15, 2011

Bibliography

- Balisacan, Arsenio, and Hall Hill, eds. The Dynamics of Regional Development: The Philippines in East Asia. Quezon City: Ateneo de Manila UP, 2007. ISBN 978-971-550-532-1

- Balisacan, Arsenio, and Hall Hill, eds. The Philippine Economy: Development, Policies and Challenges. Quezon City: Ateneo de Manila UP, 2003. ISBN 971-550-430-2

- Bernardo, Romeo, and Marie-Christine Tang. "The Political Economy of Reform during the Ramos Administration (1992–98).” Commission on Growth and Development. May 16, 2011 <https://web.archive.org/web/20110724225207/http://www.growthcommission.org/storage/cgdev/documents/gcwp039web.pdf>.

- Canlas, Dante. "Political Governance, Economic Policy Reforms, and Aid Effectiveness: The Case of the Philippines with Lessons from the Ramos Administration". May 16, 2011 <http://www.grips.ac.jp/forum/pdf07/07june07/canlas1.pdf>.

- Lopez, Edu, and Chino Leyco. "GDP up by 7.3% in 2010". Manila Bulletin. January 31, 2011. May 18, 2011. <https://web.archive.org/web/20110303123643/http://www.mb.com.ph/node/301722/gdp-73-2010>.

- National Statistical Coordination Board. The Philippine Statistical Yearbook. 1994 ed. Makati: NSCB, 1994. ISSN 0118-1564

- National Statistical Coordination Board. The Philippine Statistical Yearbook. 2003 ed. Makati: NSCB, 2003. ISSN 0118-1564

- National Statistical Coordination Board. The Philippine Statistical Yearbook. 2010 ed. Makati: NSCB, 2010. ISSN 0118-1564

- Ochoa, Cecilia. "The Rural Sector and the Ramos Administration". May 16, 2011 <http://journals.upd.edu.ph/index.php/kasarinlan/article/download/1419/1376>.

- Villegas, Bernardo. Guide to Economics for Filipinos. Manila: Sinag-Tala, 2001. ISBN 971-554-138-0

- "Impact of the Global Financial Crisis on the Philippines" (PDF) (Press release). Philippine Institute for Development Studies. February 14, 2007. Retrieved May 17, 2011.