HBOS

HBOS plc was a banking and insurance company in the United Kingdom, a wholly owned subsidiary of the Lloyds Banking Group, having been taken over in January 2009. It was the holding company for Bank of Scotland plc, which operated the Bank of Scotland and Halifax brands in the UK, as well as HBOS Australia and HBOS Insurance & Investment Group Limited, the group's insurance division.

.svg.png.webp) | |

| Industry | Finance and Insurance |

|---|---|

| Fate | Acquired by Lloyds Banking Group |

| Founded | 2001 |

| Defunct | 2009 |

| Headquarters | |

Key people | James Crosby & Andy Hornby (former Chief Executives) Lord Stevenson of Coddenham (Chairman) |

| Products | Financial Services |

| Revenue | -(2009) |

| -(2009) | |

| -(2009) | |

Number of employees | 72,000 |

| Parent | Lloyds Banking Group |

| Subsidiaries | Bank of Scotland plc, HBOS Australia, HBOS Insurance & Investment Group |

HBOS was formed by the 2001 merger of Halifax plc and the Bank of Scotland.[1] The formation of HBOS was heralded as creating a fifth force in British banking as it created a company of comparable size and stature to the established Big Four UK retail banks. It was also the UK's largest mortgage lender.[2] The HBOS Group Reorganisation Act 2006 saw the transfer of Halifax plc to the Bank of Scotland, which had by then become a registered public limited company, Bank of Scotland plc.

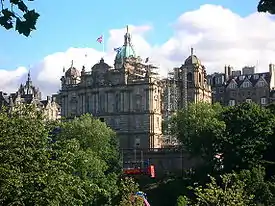

Although officially HBOS was not an acronym of any specific words, it is widely presumed to stand for Halifax Bank of Scotland. The corporate headquarters of the group were located on The Mound in Edinburgh, Scotland, the former head office of the Bank of Scotland. Its operational headquarters were in Halifax, West Yorkshire, England, the former head office of Halifax.[3]

On 19 January 2009, the group was acquired and folded into Lloyds Banking Group through a takeover by Lloyds TSB, after both sets of shareholders approved the deal.

Lloyds Banking Group stated that the new group would continue to use The Mound as the headquarters for its Scottish operations and would continue the issue of Scottish bank notes.[4][5]

History

HBOS was formed by a merger of Halifax and Bank of Scotland in 2001, Halifax having demutualised and floated four years prior.

HBOS Group Reorganisation Act 2006

In 2006, HBOS secured the passing of the HBOS Group Reorganisation Act 2006, a private Act of Parliament that rationalised the bank's corporate structure.[6] The act allowed HBOS to make the Governor and Company of the Bank of Scotland a public limited company, Bank of Scotland plc, which became the principal banking subsidiary of HBOS. Halifax plc transferred its undertakings to Bank of Scotland plc, and although the brand name was retained, Halifax then began to operate under the latter's UK banking licence.

The provisions in the Act were implemented on 17 September 2007.

The share price peaked at over 1150p in February 2007.[7]

2008 short selling and credit crunch

In 2004, Paul Moore, HBOS head of Group Regulatory Risk, warned senior directors at HBOS about excessive risk-taking. He was dismissed, and his concerns not acted on.

In March 2008, HBOS shares fell 17 percent amid false rumours that it had asked the Bank of England for emergency funding.[8] The Financial Services Authority conducted an investigation as to whether short selling had any links with the rumours. It concluded that there was no deliberate attempt to drive the share price down.[9]

On 17 September 2008, very shortly after the demise of Lehman Brothers, HBOS's share price suffered wild fluctuations between 88p and 220p per share, despite the FSA's assurances as to its liquidity and exposure to the wider credit crunch.[10]

However, later that day, the BBC reported that HBOS was in advanced takeover talks with Lloyds TSB to create a "superbank" with 38 million customers. That was later confirmed by HBOS. The BBC suggested that shareholders would be offered up to £3.00 per share, causing the share price to rise, but later retracted that comment.[11][12] Later that day, the price was set at 0.83 Lloyds shares for each HBOS share, equivalent to 232p per share,[13] which was less than the 275p price at which HBOS had raised funds earlier in 2008.[14] The price was later altered to 0.605 Lloyds shares per HBOS share.[15]

To avoid another Northern Rock-style collapse, the UK government announced that should the takeover go ahead, it would be allowed to bypass competition law.

Alex Salmond, Scotland's First Minister, previously an economist, said of the takeover:

"I am very angry that we can have a situation where a bank can be forced into a merger by basically a bunch of short-selling spivs and speculators in the financial markets."[16]

Acquisition by Lloyds TSB

On 18 September 2008, the terms of the recommended offer for HBOS by Lloyds TSB were announced. The deal was concluded on 19 January 2009.[17] The three main conditions for the acquisition were:

- Three quarters of HBOS shareholders voted in favour of the board's actions;[5]

- Half of Lloyds TSB shareholder voted to approve the takeover;[18]

- UK government dispensation with respect to competition law.

A group of Scottish businessmen challenged the right of the UK government to approve the deal by over-ruling UK competition law, but this was rejected. The takeover was approved by HBOS shareholders on 12 December.

Prime Minister Gordon Brown personally brokered the deal with Lloyds TSB. An official said: "It is not the role of a Prime Minister to tell a City institution what to do".[19] The Lloyds TSB board stated that merchant banks Merrill Lynch and Morgan Stanley were among the advisers recommending the takeover.[5]

Lloyds Banking Group said Edinburgh-based HBOS, which it had absorbed in January, made a pre-tax loss of £10.8bn in 2008. Andy Hornby, the former chief executive of HBOS, and Lord Stevenson of Coddenham, its former chairman, appeared before the Commons Treasury Committee to answer questions about the near-collapse of the bank. Hornby said: "I'm very sorry what happened at HBOS. It has affected shareholders, many of whom are colleagues, it's affected the communities in which we live and serve, it's clearly affected taxpayers, and we are extremely sorry for the turn of events that has brought it about."

Bailout

On 13 October 2008, Gordon Brown's announcement that government must be a "rock of stability" resulted to an "unprecedented but essential" government action: the Treasury would infuse £37 billion ($64 billion, €47 billion) of new capital into Royal Bank of Scotland Group Plc, Lloyds TSB and HBOS Plc, to avert financial sector collapse or UK "banking meltdown". He stressed that it was not "standard public ownership", as the banks would return to private investors "at the right time".[20][21] The Chancellor of the Exchequer, Alistair Darling, claimed that the British public would benefit from the rescue plan, because the government would have some control over RBS in exchange for about £20 billion of funding. Total State ownership in RBS would be 60%, and 40% for HBOS.[22] Royal Bank of Scotland said it intended to raise £20 billion ($34 billion) capital with the government's aid; its chief executive Fred Goodwin resigned. The government acquired $8.6 billion of preference shares and underwrote $25.7 billion of ordinary shares. Thus, it intended to raise £15 billion (€18.9 billion, $25.8 billion) from investors, to be underwritten by the government. The State would pay £5 billion for RBS, while Barclays Bank raised £6.5 billion from private sector investors, with no government help.[23] Reuters reported that Britain could inject £40 billion ($69 billion) into the three banks including Barclays.[24]

Investigation

In 2015, an investigation by the Prudential Regulation Authority and Financial Conduct Authority blamed the failure requiring the bailout on the bank's executives, as well as being critical of the Financial Services Authority (FSA), the then-regulator. A parallel investigation into the FSA's enforcement process concluded it was too late to fine responsible executives, but up to 10 former HBOS executives could be banned from the financial services industry.[25]

Causes of failure were identified as follows:

- The board failed to instil a culture within the firm that balanced risk and return appropriately, and it lacked sufficient experience and knowledge of banking.[25]

- There was a flawed and unbalanced strategy and a business model with inherent vulnerabilities arising from an excessive focus on market share, asset growth and short-term profitability.[25]

- The firm's executive management pursued rapid and uncontrolled growth of the Group's balance sheet. That led to an over-exposure to highly cyclical commercial real estate (CRE) at the peak of the economic cycle.[25]

- The board and control functions failed to challenge effectively the pursuit of that course by the executive management, or to ensure adequate mitigating actions.[25]

- The underlying weaknesses of HBOS's balance sheet made the Group extremely vulnerable to market shocks and eventual failure as the crisis in the financial system intensified.[25]

After putting the investigation on hold in 2013, in April 2017, the Financial Conduct Authority resumed its probe of "the way HBOS handled fraud allegations at its Reading branch".[26]

On 21 June 2019, the Financial Conduct Authority fined the Bank of Scotland £45.5 million over its failure to report suspicions of fraud at its Reading branch which led to the jailing of six people. The authority said that the bank "risked substantial prejudice to the interests of justice" by withholding information. The fine was reduced by almost £20m because the bank agreed to settle.[27]

Advertising

Controversy

Links to the arms trade

In December 2008, the British anti-poverty charity, War on Want, released a report documenting the extent to which HBOS and other UK commercial banks invested in, provided banking services for, and made loans to arms companies. The charity wrote that HBOS held shares in the UK arms sector totalling £483.4 million, and served as principal banker for Babcock International and Chemring.[28]

Mortgage fraud

During 2003, The Money Programme uncovered systemic mortgage fraud throughout HBOS. The Money Programme found that during the investigation, brokers advised the undercover researchers to lie on applications for self-certified mortgages from, among others, the Bank of Scotland, the Mortgage Business and Birmingham Midshires.[29] All three were part of the Halifax Bank of Scotland Group, Britain's biggest mortgage lender. James Crosby, head of HBOS at the time, refused to be interviewed in relation to the exposed mortgage fraud. Further examples of mortgage fraud have come to light, which has seen mortgage brokers take advantage of fast track processing systems, as seen at HBOS, by entering false details, often without the applicant's knowledge.

Bank of Wales

In 2002, HBOS dropped the Bank of Wales brand and absorbed the operations into Bank of Scotland Business Banking.

HBOS bad loans

On 13 February 2009, Lloyds Banking Group revealed losses of £10bn at HBOS, £1.6bn higher than Lloyds had anticipated in November because of deterioration in the housing market and weakening company profits.[30] The share price of Lloyds Banking Group plunged 32% on the London Stock Exchange, carrying other bank shares with it.[30]

In September 2012, Peter Cummings, the head of HBOS corporate banking from 2006 to 2008, was fined £500,000 by the UK financial regulator over his role in the bank's collapse. The Financial Services Authority (FSA) also banned Cummings from working in the banking industry. The losses in his division exceeded the initial taxpayer bailout for the bank in October 2008.[31][32]

Reading branch fraud and Operation Hornet

On 3 October 2010, Lynden Scourfield, former director of mid-market high-risk at Bank of Scotland Corporate, his wife Jacquie Scourfield, ex-director of Remnant Media Tony Cartwright, and ex-NatWest banker David Mills, were arrested on suspicion of fraud by the Serious Organised Crime Agency.[33][34] The scandal centred around Scourfield's use of his position to refer companies to Quayside Corporate Services, owned and operated by David Mills, for "turnaround" services which Quayside was unqualified to provide. Several members of Quayside's staff had criminal records for embezzlement. Customers were allegedly inappropriately pressured to take on excessive debt burdens and to make acquisitions benefiting Quayside.[35]

On 30 January 2017, following a four-month trial, former HBOS employees Scourfield and Mark Dobson were convicted of corruption and fraud involving a scheme that cost the bank £245m;[36] Scourfield pleaded guilty to six counts including corruption, and Dobson was found guilty of counts including bribery, fraud and money laundering.[37] The court also convicted David Mills, Michael Bancroft, Alison Mills, and John Cartwright for their parts in the conspiracy.[37] On 2 February 2017, David Mills was jailed for 15 years, Scourfield for 11 years and three months, and Bancroft for 10 years. Dobson was sentenced to four and a half years, and Alison Mills and Cartwright were given three-and-a-half-year sentences for money laundering.[38] Following the convictions, the BBC reported:

"Businessmen Bancroft and Mills arranged sex parties, exotic foreign holidays, cash in brown envelopes and other favours for Scourfield between 2003 and 2007. In exchange for the bribes, Scourfield would require the bank's small business customers to use Quayside Corporate Services, the firm of consultants run by Mills and his wife Alison. Quayside purported to be turnaround consultants, offering business experience and expertise to help small business customers improve their fortunes, but far from helping turn businesses around, Mills and his associates were milking them for huge fees and using their relationship with the bank to bully business owners and strip them of their assets. In cash fees alone, according to prosecutors in the trial, £28m went through the accounts of Mills, his wife and their associated companies. […] Mills and his associates used the bank's customers and the bank's money dishonestly to enrich themselves." [37]

The BBC added: "A decade on, HBOS's owner Lloyds Banking Group still has not acknowledged the full scale of the fraud - or offered to compensate its victims"; the broadcaster noted that the fraud was first discovered in 2007 by the bank's customers Nikki and Paul Turner, who used publicly available records to uncover it, but that after the Turners submitted their evidence to the bank it dismissed their claims and tried to repossess their home.[37] Following the convictions, the background to the case was reported on BBC Radio Four's File on Four programme on 31 January 2017.[39] Lloyds is taking a £100m hit paying compensation to the victims.[40]

Noel Edmonds, a celebrity victim of the scam, reached a settlement with the bank in July 2019.[41] Dame Linda Dobbs is chairing an independent inquiry into the investigation and reporting of the fraud.[41]

Operations

HBOS conducted all its operations through three main businesses:

- Bank of Scotland plc

- HBOS Australia

- HBOS Insurance & Investment Group Limited

Bank of Scotland plc

Bank of Scotland plc was the banking division of the HBOS group, and operated the following brands:

United Kingdom

- Bank of Scotland

- Bank of Scotland Private Banking

- Bank of Scotland Treasury Services

- Birmingham Midshires

- Halifax

- AA Savings (the same brand also used Bank of Ireland for some accounts)

- Halifax Financial Services (Holdings) Ltd

- Halifax Investment Fund Managers Ltd

- Halifax Share Dealing Limited

- Halifax Unit Trust Management Ltd

- Intelligent Finance

- Sainsbury's Bank (50%) – holding sold to J Sainsbury plc on 31 January 2014.

- The Mortgage Business (TMB)

- Blair, Oliver & Scott (Debt recovery)

- St James's Place Bank

International

- Banco Halifax Hispania – rebranded as Lloyds Bank International in 2010 and sold to Banco Sabadell in 2013.

- Bank of Scotland Corporate

- Bank of Scotland International – transferred to Lloyds TSB Offshore in 2012, which became Lloyds Bank International in 2013.

- Bank of Scotland Investment Services

- Bank of Scotland (Ireland), trading as Halifax since 2006 and closed down on 31 December 2010.

- Bank of Scotland, Amsterdam branch - trading as Lloyds Bank since 2013 (savings) and 2014 (mortgages).

- Bank of Scotland, Berlin branch

HBOS Australia

HBOS Australia was formed in 2004 to consolidate the group's holdings in Australia. It consisted of the following subsidiaries:

- Capital Finance Australia Limited

- BOS International Australia Ltd

On 8 October 2008, HBOS Australia sold its Bank of Western Australia and St Andrew's Australia Pty Ltd subsidiaries for approximately A$2bn to Commonwealth Bank of Australia.[42]

The group's businesses in Australia were sold to Westpac in October 2013.[43][44]

HBOS Insurance and Investment Group Limited

HBOS Insurance & Investment Group Limited manages the group's insurance and investment brands in the UK and Europe. It consisted of the following:

- St James's Place Capital (60%)

- Halifax General Insurance Services Ltd

- St Andrew's Group

- Clerical Medical

It also used to own UK investment manager Insight Investment Management Limited.[45] The Bank of New York Mellon acquired Insight in 2009.[46][47][48]

See also

References

Notes

- Bachelor, Lisa (4 May 2001). "HBOS: the issue explained". The Guardian. London. Retrieved 17 September 2008.

- "HBOS is the largest mortgage lender in the Isles". 7 August 2008. Retrieved 17 September 2008.

- "Bank of Scotland, Halifax tie knot". All Business. Retrieved 2 July 2007.

- "Lloyds TSB confirms deal to take over HBOS". 18 September 2008. Retrieved 18 September 2008.

- "Recommended acquisition of HBOS plc by Lloyds TSB Group plc" (PDF). Lloyds TSB. 17 September 2008. Archived from the original (PDF) on 23 September 2008. Retrieved 18 September 2008.

- "HBOS Group Reorganisation Act 2006". 2006. Retrieved 17 September 2008.

- "Share Price Chart – HBOS PLC (LSE:HBOS)". Retrieved 19 December 2010.

- Treanor, Jill (20 March 2008). "Authorities avert run on HBOS caused by false rumours". The Guardian. London. Retrieved 17 September 2008.

- "FSA concludes HBOS rumours investigation". 2008. Retrieved 17 September 2008.

- "HBOS Statement". 2008. Retrieved 11 October 2008.

- "HBOS in merger talks with Lloyds TSB". BBC News. 17 September 2008. Retrieved 17 September 2008.

- Hoskins, Paul (17 September 2008). "HBOS confirms in takeover talks with Lloyds TSB". Reuters. Retrieved 17 September 2008.

- "Lloyds seals deal for HBOS". Reuters. 18 September 2008. Retrieved 18 September 2008.

- Pratley, Nils (17 September 2008). "Lloyds TSB takeover talks with HBOS: the key issues". The Guardian. London. Retrieved 17 September 2008.

- http://webarchive.nationalarchives.gov.uk/20140402142426/http://www.oft.gov.uk/shared_oft/press_release_attachments/LLloydstsb.pdf

- "Salmond attacks financial 'spivs'". BBC News. 17 September 2008. Retrieved 17 September 2008.

- Lloyds: What happens next? Archived 26 October 2008 at the Wayback Machine

- "Lloyds TSB Your shareholder questions answered". Lloyds TSB. Retrieved 3 November 2008.

- Kennedy, Siobhan; Webster, Philip; Seib, Christine (17 September 2008). "Gordon Brown steps in to secure HBOS rescue". The Times. London. Retrieved 18 September 2008.

- "UK – UK Politics – Brown: We'll be rock of stability". BBC News. Retrieved 15 June 2015.

- "U.K. Stocks Rebound After Government Bank Bailout; Lloyds Gains". Retrieved 15 June 2015.

- Hélène Mulholland (13 October 2008). "Alistair Darling: UK taxpayer will benefit from banks rescue". The Guardian. Retrieved 15 June 2015.

- "Afp.google.com, Britain to invest up to 37 billion pounds in ailing banks". Archived from the original on 1 October 2012. Retrieved 13 October 2008.

- "British banks set for 40 billion pound rescue: sources". Reuters. Reuters. 12 October 2008. Retrieved 15 June 2015.

- Tim Wallace (19 November 2015). "Up to 10 former HBOS executives could be banned over collapse, damning report finds". Daily Telegraph. Retrieved 19 November 2015.

- Dunkley, Emma (7 April 2017). "UK watchdog restarts probe into HBOS fraud case". Financial Times. Retrieved 9 April 2017.

- "Bank of Scotland fined £45.5m by regulator over Reading fraud". The Guardian. Retrieved 21 June 2019.

- War on Want, Banking on Bloodshed Archived 17 April 2009 at the Wayback Machine

- "Press Office – Money Programme Mortgage Madness". BBC. Retrieved 15 June 2015.

- "Lloyds shares tumble as HBOS slumps to £10bn loss". The Daily Telegraph. London. 13 February 2009. Retrieved 28 February 2009.

- "HBOS banker Peter Cummings fined by regulator". BBC News. Retrieved 15 June 2015.

- Kossoff, Julian (12 September 2012). "Ex-HBOS Rainmaker Peter Cummings Hit with £500,000 FSA Fine and Life Ban". International Business Times. Retrieved 11 October 2012.

- "Former HBOS banker bailed over alleged money-laundering". The Herald. Glasgow. Retrieved 15 June 2015.

- Wilson, Harry (8 January 2013). "Former HBOS managers charged in £35m fraud investigation". The Daily Telegraph. London. Retrieved 31 January 2017.

- "The BoS Reading scandal that just will not go away – Ian Fraser". 2 October 2010. Retrieved 15 June 2015.

- Goodley, Simon (30 January 2017). "Cash, cruises and sex parties: inside ex-HBOS manager's £245m scam". The Guardian. London. Retrieved 30 January 2017.

- Verity, Andy; Lewis, David (30 January 2017). "Former HBOS manager found guilty of corruption and fraud". BBC News. Retrieved 30 January 2017.

- "Ex-HBOS banker 'sold his soul for swag'". BBC News Online. BBC. 2 February 2017. Retrieved 2 February 2017.

- Reporter: Andy Verity; Producer: David Lewis; Editor: Gail Champion (31 January 2017). "The Turnaround Game". File on Four. BBC. BBC Radio Four. Retrieved 31 January 2017.

- "Lloyds to pay £100m to victims of HBOS Reading fraud as FCA reopens probe". The Telegraph. 7 April 2017. Retrieved 9 April 2017.

- "Noel Edmonds reaches compensation deal with Lloyds over scam". BBC. 27 July 2019. Retrieved 30 July 2019.

- "Australia's CBA to buy HBOS's BankWest for $1.5 billion". Reuters. Reuters UK. 8 October 2008. Retrieved 15 June 2015.

- "Lloyds agrees to sell Australian assets to Westpac". BBC News. 11 October 2013. Retrieved 28 September 2014.

- "Lloyds International". Lloyds Banking Group. 2014. Archived from the original on 21 September 2014. Retrieved 28 September 2014.

- "Notification of major interest in shares" (Press release). Phorm Inc. 2 October 2009. Retrieved 2 October 2009.

- "Lloyds sells Insight Investment to Bank of New York Mellon", The Guardian, London, 12 August 2009. Retrieved 25 April 2012.

- "Lloyds disposals begin with £235m sale of Insight to BNY Mellon", The Daily Telegraph, London, 12 August 2009. Retrieved 25 April 2012.

- "Lloyds sells Insight to Bank of New York Mellon", The Daily Telegraph, London, 12m August 2009. Retrieved 25 April 2012.

External links

- Official website of HBOS plc (now redirects to Lloyds Banking Group website)

- Documents and clippings about HBOS in the 20th Century Press Archives of the ZBW