Music industry of East Asia

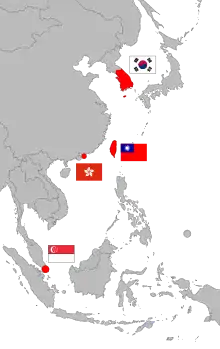

The music industry of East Asia, a region that includes Mainland China, Hong Kong, Macau, Japan, Mongolia, North Korea, Singapore, South Korea and Taiwan is developed economic sector that is home to some of the world's largest music markets.

Milestones

In 2003, South Korea became the world's first music market where digital music sales surpassed those of physical formats.[1][2]

In 2012, Japan surpassed the United States as the world's largest recorded music market for the first time, according to the International Federation of the Phonographic Industry. Though the U.S. remained the largest if licensing fees are included into the figures.[3] However, in the following year, Japan fell back to the second-largest music market after experiencing a 16.7 per cent decrease due to the country's reliance of CDs and slow adoption of digital services.[4][5]

In 2015, the digital music market in China is expected to be worth US$4.1 billion .[6] China is expected to become one of the largest music markets in the world by 2020.[7]

Contrast with the global music industry

Although global physical music sales (such as CDs) have been declining in recent years, in East Asia (particularly Japan, Singapore and South Korea), however, physical music sales have been stable.[8]

The International Federation of the Phonographic Industry credits this phenomenon to "K-Pop fans who want high-quality physical formats and deluxe box sets".[8]

According to a music executive from Universal Music Group, CDs are becoming "the new merchandise in Asia".[9]

Controversy

Several controversies have arrived based on the way the industry has been treating its artists.

Control of artists personal lives

It is not uncommon for record labels to prohibit their pop artists from dating for a certain period of time or for as long as they have a contract with the company.[10] In Japan managers may attempt to discourage their artists from dating or engaging in behavior that may tarnish their images by keeping a busy schedule and only letting artists know about their schedules a day at a time.[10] Artists who break this contract, as in the case of Minami Minegishi from AKB48, run the risk of getting dropped from their music group or contract.[11]

Korea has similar rules for musical pop artists. Artists have more freedom to date and get married, however managers have strong control over their personal lives and behaviors.[11] In Taiwan, artists are also expected to behave in certain ways, as they cannot discuss taboo topics such as politics.[11]

Ranking

The following table lists the total revenues of the music markets of East Asia:

| Rank | Country | Revenue in 2017 (in million USD) |

Source |

|---|---|---|---|

| 1 | 2,727.5 | [12] | |

| 2 | 494.4 | [12] | |

| 3 | 292.3 | [12] | |

| 4 | N/A[a] | ||

| 5 | N/A[a] | ||

| 6 | N/A[a] | ||

| 7 | N/A[a] |

Notes^

See also

References

- Marchand, Ruby. "Trade Mission Engages Key Korean Music Professionals". Grammy Award. Archived from the original on 2012-10-25. Retrieved 2013-01-14.

...It's also the first country where digital surpassed physical sales.

- McClure, Steve (2006). Billboard Vol. 118, No. 18. Billboard. p. 23. ISSN 0006-2510. Archived from the original on 2017-09-27. Retrieved 2016-09-24.

- Kyodo News (9 April 2013). "Japan surpasses US as world's biggest recorded music market". ABS-CBN News Channel. Archived from the original on 15 April 2013. Retrieved 7 May 2013.

- "Japan drags down global music market". BBC News. 18 March 2014. Archived from the original on 4 May 2015. Retrieved 6 June 2015.

- Karp, Hannah; Inada, Miho (18 March 2014). "Japan Hits a Sour Note on Music Sales". The Wall Street Journal. Archived from the original on 25 June 2015. Retrieved 6 June 2015.

- Steven Millward (December 4, 2015). "Already bigger than Spotify, China's search engine giant doubles down on streaming music". Tech In Asia. Archived from the original on December 8, 2015. Retrieved December 4, 2015.

- Chen Nan (December 21, 2015). "Music industry dreaming of China streaming". China Daily. Archived from the original on November 30, 2016. Retrieved August 13, 2016.

- "Francis Keeling, Universal Music's Global Head of Digital Business: Google Streaming Service 'Is the Biggest Funnel We Can Have'". Billboard magazine. Archived from the original on 20 May 2013. Retrieved 7 May 2013.

According to IFPI, global physical format sales declined from 61% in 2011 to an estimated 58% in 2012. However, in Japan, CD and DVD sales posted strong increases (sales numbers or percentages were not provided). While in South Korea physical sales are expected to rise for the third consecutive year, with IFPI crediting K-Pop fans who want high-quality physical formats and deluxe box sets, with driving the format's sustained popularity.

- Lindvall, Helienne. "How K-Pop & J-Pop Are Saving Physical Music Sales". Digital Music News. Archived from the original on 18 May 2013. Retrieved 7 May 2013.

- "3 ways the Japanese entertainment industry keeps idol singers from dating". Japan Today. Archived from the original on 2017-12-13. Retrieved 2017-12-12.

- Oi, Mariko (2016). "The dark side of Asia's pop music industry". BBC News. Archived from the original on 2017-12-16. Retrieved 2017-12-04.

- "RIAJ Yearbook 2018: IFPI Global Music Report 2018" (PDF). Recording Industry Association of Japan. p. 4. Archived from the original on 2018-06-18. Retrieved 2019-03-18.

- "RIAJ: Yearbook 2012, IFPI 2010 Report: 31. Global Sales of Recorded Music by Country in 2010 (Page 24)" (PDF). Recording Industry Association of Japan. Archived (PDF) from the original on 2012-10-27. Retrieved 2012-04-26.

.svg.png.webp)