Four Asian Tigers

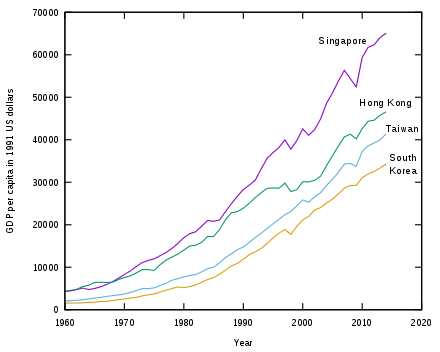

The Four Asian Tigers (also known as the Four Asian Dragons or Four Little Dragons in Chinese and Korean) are the economies of South Korea, Taiwan, Singapore and Hong Kong. Between the early 1960s and 1990s, they underwent rapid industrialization and maintained exceptionally high growth rates of more than 7 percent a year.

| Four Asian Tigers | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |||||||||||||||||||||||

| Chinese name | |||||||||||||||||||||||

| Traditional Chinese | 亞洲四小龍 | ||||||||||||||||||||||

| Simplified Chinese | 亚洲四小龙 | ||||||||||||||||||||||

| Literal meaning | Asia's Four Little Dragons | ||||||||||||||||||||||

| |||||||||||||||||||||||

| Korean name | |||||||||||||||||||||||

| Hangul | 아시아의 네 마리 용 | ||||||||||||||||||||||

| Hanja | 아시아의 네 마리 龍 | ||||||||||||||||||||||

| Literal meaning | Asia's four dragons | ||||||||||||||||||||||

| |||||||||||||||||||||||

| Malay name | |||||||||||||||||||||||

| Malay | Empat Harimau Asia | ||||||||||||||||||||||

| Tamil name | |||||||||||||||||||||||

| Tamil | நான்கு ஆசியப் புலிகள் | ||||||||||||||||||||||

By the early 21st century, these economies had developed into high-income economies, specializing in areas of competitive advantage. Hong Kong and Singapore have become leading international financial centres, whereas South Korea and Taiwan are leaders in manufacturing electronic components and devices. Their economic success have served as role models for many developing countries, especially the Tiger Cub Economies of southeast Asia.[1][2][3]

In 1993, the World Bank report The East Asian Miracle credited neoliberal policies to have caused the economic boom, including the maintenance of export-oriented policies, low taxes, and minimal welfare states. Institutional analyses found that some level of state intervention was involved.[4] Some analysts argued that industrial policy and state intervention had a much greater influence than the World Bank report suggested.[5][6]

Overview

Prior to the 1997 Asian financial crisis, the growth of the Four Asian Tiger economies (commonly referred to as "the Asian Miracle") has been attributed to export oriented policies and strong development policies. Unique to these economies were the sustained rapid growth and high levels of equal income distribution. A World Bank report suggests two development policies among others as sources for the Asian miracle: factor accumulation and macroeconomic management.[8]

The Hong Kong economy underwent industrialization with the development of a textile industry in the 1950s. By the 1960s, manufacturing in the British colony had expanded and diversified to include clothing, electronics, and plastics for export orientation.[9] Following Singapore's independence, the Economic Development Board formulated and implemented national economic strategies to promote the country's manufacturing sector.[10] Industrial estates were set up and foreign investment was attracted to the country with tax incentives. Meanwhile, Taiwan and South Korea began to industrialize in the mid-1960s with heavy government involvement including initiatives and policies. Both countries pursued export-oriented industrialization as in Hong Kong and Singapore.[11] The four countries were inspired by Japan's evident success, and they collectively pursued the same goal by investing in the same categories: infrastructure and education. They also benefited from foreign trade advantages that sets them apart from other countries, most significantly economic support from the United States; part of this is manifested in the proliferation of American electronic products in common households of the Four Tigers.

By the end of the 1960s, levels in physical and human capital in the four economies far exceeded other countries at similar levels of development. This subsequently led to a rapid growth in per capita income levels. While high investments were essential to their economic growth, the role of human capital was also important. Education in particular is cited as playing a major role in the Asian economic miracle. The levels of education enrollment in the Four Asian Tigers were higher than predicted given their level of income. By 1965, all four nations had achieved universal primary education.[8] South Korea in particular had achieved a secondary education enrollment rate of 88% by 1987.[8] There was also a notable decrease in the gap between male and female enrollments during the Asian miracle. Overall these advances in education allowed for high levels of literacy and cognitive skills.

%252C_2018.jpg.webp)

The creation of stable macroeconomic environments was the foundation upon which the Asian miracle was built. Each of the Four Asian Tiger states managed, to various degrees of success, three variables in: budget deficits, external debt and exchange rates. Each Tiger nation's budget deficits were kept within the limits of their financial limits, as to not destabilize the macro-economy. South Korea in particular had deficits lower than the OECD average in the 1980s. External debt was non-existent for Hong Kong, Singapore and Taiwan, as they did not borrow from abroad.[8] Although South Korea was the exception to this – its debt to GNP ratio was quite high during the period 1980–1985, it was sustained by the country's high level of exports. Exchange rates in the Four Asian Tiger nations had been changed from long-term fixed rate regimes to fixed-but-adjustable rate regimes with the occasional steep devaluation of managed floating rate regimes.[8] This active exchange rate management allowed the Four Tiger economies to avoid exchange rate appreciation and maintain a stable real exchange rate.

Export policies have been the de facto reason for the rise of these Four Asian Tiger economies. The approach taken has been different among the four nations. Hong Kong, and Singapore introduced trade regimes that were neoliberal in nature and encouraged free trade, while South Korea and Taiwan adopted mixed regimes that accommodated their own export industries. In Hong Kong and Singapore, due to small domestic markets, domestic prices were linked to international prices. South Korea and Taiwan introduced export incentives for the traded-goods sector. The governments of Singapore, South Korea and Taiwan also worked to promote specific exporting industries, which were termed as an export push strategy. All these policies helped these four nations to achieve a growth averaging 7.5% each year for three decades and as such they achieved developed country status.[12]

Dani Rodrik, economist at the John F. Kennedy School of Government at Harvard University, has in a number of studies argued that state intervention was important in the East Asian growth miracle.[13][5] He has argued "it is impossible to understand the East Asian growth miracle without appreciating the important role that government policy played in stimulating private investment".[5]

1997 Asian financial crisis

The Tiger economies experienced a setback in the 1997 Asian financial crisis. Hong Kong came under intense speculative attacks against its stock market and currency necessitating unprecedented market interventions by the state Hong Kong Monetary Authority. South Korea was hit the hardest as its foreign debt burdens swelled resulting in its currency falling between 35 and 50%.[14] By the beginning of 1997, the stock market in Hong Kong, Singapore, and South Korea also saw losses of at least 60% in dollar terms. Singapore and Taiwan were relatively unscathed. The Four Asian Tigers recovered from the 1997 crisis faster than other countries due to various economic advantages including their high savings rate (except South Korea) and their openness to trade.[14]

2008 financial crisis

The export-oriented tiger economies, which benefited from American consumption, were hit hard by the financial crisis of 2007–08. By the fourth quarter of 2008, the GDP of all four nations fell by an average annualized rate of around 15%.[12] Exports also fell by a 50% annualized rate.[12] Weak domestic demand also affected the recovery of these economies. In 2008, retail sales fell 3% in Hong Kong, 6% in Singapore and 11% in Taiwan.[12]

As the world recovered from the financial crisis, the Four Asian Tiger economies have also rebounded strongly. This is due in no small part to each country's government fiscal stimulus measures. These fiscal packages accounted for more than 4% of each country's GDP in 2009.[12] Another reason for the strong bounce back is the modest corporate and household debt in these four nations.[12]

A recent article published in Applied Economics Letters by financial economist Mete Feridun of University of Greenwich Business School and his international colleagues investigates the causal relationship between financial development and economic growth for Thailand, Indonesia, Malaysia, the Philippines, China, India and Singapore for the period between 1979 and 2009, using Johansen cointegration tests and vector error correction models. The results suggest that in the case of Indonesia, Singapore, the Philippines, China and India financial development leads to economic growth, whereas in the case of Thailand there exists a bidirectional causality between these variables. The results further suggest that in the case of Malaysia, financial development does not seem to cause economic growth.[15]

Gross domestic product (GDP)

In 2018, the combined economy of the Four Asian Tigers constituted 3.46% of the world's economy with a total Gross domestic product (GDP) of 2,932 billion US dollars. The GDP in Hong Kong, Singapore, South Korea and Taiwan was worth 363.03 billion, 361.1 billion, 1,619.42 billion and 589.39 billion US dollars respectively in 2018, which represented 0.428%, 0.426%, 1.911% and 0.696% of the world economy. Together, their combined economy surpassed the United Kingdom's GDP of 3.34% of the world's economy some time in the mid 2010s.

Education and technology

These four countries focused on investing heavily in their infrastructure as well as education to benefit their country through skilled workers and higher level jobs such as engineers and doctors. The policy was generally successful and helped develop the countries into more advanced and high-income industrialized developed countries. For example, all four countries have become global education centers with Singapore, Taiwan, South Korea and Hong Kong high school students scoring well on math and science exams such as the PISA exam and with Singaporean and Taiwanese students winning several medals in International Olympiads.

In relation to secondary / higher level educations, there are many prestigious colleges as in most developed countries. Notable schools include the National Taiwan University, Seoul National University, National University of Singapore, Nanyang Technological University and University of Hong Kong, Faculty of Dentistry, which as of 2017, was ranked as one of the top dental schools in the world.[16][17] All four countries have become leading financial centers and such, from multiple policies which focus on education.

Cultural basis

The role of Confucianism has been used to explain the success of the Four Asian Tigers. This conclusion is similar to the Protestant work ethic theory in the West promoted by German sociologist Max Weber in his book The Protestant Ethic and the Spirit of Capitalism. The culture of Confucianism is said to have been compatible with industrialization because it valued stability, hard work, discipline, and loyalty and respect towards authority figures.[18] There is a significant influence of Confucianism on the corporate and political institutions of the Asian Tigers. Prime Minister of Singapore Lee Kuan Yew advocated Asian values as an alternative to the influence of Western culture in Asia.[19] This theory was not without its critics. There was a lack of mainland Chinese economic success during the same time frame as the Four Tigers, and yet China was the birthplace of Confucianism. During the May Fourth Movement of 1919, Confucianism was blamed for China's inability to compete with Western powers.[18]

In 1996, the economist Joseph Stiglitz pointed out that, ironically, "not that long ago, the Confucian heritage, with its emphasis on traditional values, was cited as an explanation for why these countries had not grown."[20]

Territory and region data

Credit ratings

| Country or territory |

Fitch | Moody's | S&P |

|---|---|---|---|

| Hong Kong | AA[21] | Aa2[22] | AA+[23] |

| Singapore | AAA[24] | Aaa[25] | AAA |

| South Korea | AA-[26] | Aa2[27] | AA[28] |

| Taiwan | AA-[29] | Aa3[30] | AA- |

Demographics

| Country or territory |

Area (km2) |

Population (2018) |

Population density (per km2) |

Life expectancy at birth (2017)[31] |

Birth rate (2015) |

Death rate (2011) |

Fertility rate (2018) |

Net migration rate (2015–2020) |

Population growth rate (2015) |

|---|---|---|---|---|---|---|---|---|---|

| Hong Kong | 1,106 | 7,524,100 | 6,765 | 84.7 | 0.8% | 0.6% | 1.1 | 0.40% | 0.83 |

| Singapore | 728 | 5,703,600 | 7,815 | 82.9 | 0.9% | 0.45% | 1.2 | 0.47% | 1.40 |

| South Korea | 100,210 | 51,811,167 | 515 | 82.6 | 0.8% | 0.51% | 1.1 | 0.02% | 0.36 |

| Taiwan | 36,197 | 23,603,121 | 652 | 79.26 | 0.8% | 0.66% | 1.2 | 0.13% | 0.28 |

Economy

| Country or territory |

GDP (millions of USD, 2020 estimates) | GDP (millions of USD, 2017) | GDP per capita (USD, 2017) | Trade (billions of USD, 2016) |

(billions of USD, 2017) | Industrial growth rate (%) (2017) | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Nominal | PPP | Nominal | PPP | Nominal | PPP | Exports | Imports | |||

| Hong Kong | 341,319 | 439,459 | 341,659 | 454,912 | 46,109 | 61,016 | 1,236 | 496.9 | 558.6 | 1.2 |

| Singapore | 337,451 | 551,628 | 362,818 | 585,055 | 57,713 | 90,531 | 917 | 372.9 | 327.4 | -3.5 |

| South Korea | 1,586,786 | 2,293,475 | 1,538,030 | 2,029,032 | 29,891 | 39,387 | 1,103 | 577.4 | 457.5 | -1.5 |

| Taiwan | 635,547 | 1,275,805 | 579,302 | 1,185,480 | 24,577 | 49,827 | 604 | 344.6 | 272.6 | 1.2 |

Quality of life

| Country or territory |

Human Development Index (2019 data) |

Income inequality by Gini coefficient |

Median household income (2013), USD PPP[32] |

Median per-capita income (2013), USD PPP[32] |

Global Well Being Index (2010), % thriving[33] |

|---|---|---|---|---|---|

| Hong Kong | 0.949 (4th) | 53.9 (2016) | 35,443 | 9,705 | 19% |

| Singapore | 0.938 (11th) | 46.4 (2014) | 32,360 | 7,345 | 19% |

| South Korea | 0.916 (23rd) | 34.1 (2015) | 40,861 | 11,350 | 28% |

| Taiwan | 0.911 (25th)[34] | 33.6 (2014) | 32,762 | 6,882 | 22% |

Technology

| Country or territory |

Average Internet connection speed (2020)[35] |

Smartphone usage (2016) |

Use of renewable electricity |

|---|---|---|---|

| Hong Kong | 31.37 Mbit/s | 87%[36] | 0.3% |

| Singapore | 70.86 Mbit/s | 100%[37] | 3.3% |

| South Korea | 19.18 Mbit/s | 89% | 2.1% |

| Taiwan | 85.02 Mbit/s | 78%[38] | 4.4% |

Politics

| Country or territory |

Democracy Index (2019) |

Press Freedom Index (2020) |

Corruption Perceptions Index (2019) |

Global Competitiveness Index (2017–18) |

Ease of doing business index (2020) |

Property rights index (2015) |

Bribe Payers Index (2011) |

Current political status |

|---|---|---|---|---|---|---|---|---|

| Hong Kong | 6.02 | 30.01 | 76 | 5.53 | Very Easy (3th) | 7.6 | 7.6 | Executive-led Special Administrative Region of the People's Republic of China |

| Singapore | 6.02 | 55.23 | 85 | 5.71 | Very Easy (2nd) | 8.1 | 8.3 | Parliamentary Republic |

| South Korea | 8.00 | 23.70 | 59 | 5.07 | Very Easy (5th) | 5.9 | 7.9 | Presidential Republic |

| Taiwan | 7.73 | 23.76 | 65 | 5.33 | Very Easy (15th) | 6.9 | 7.5 | Semi-Presidential Republic |

See also

- Developed country

- Developmental state

- The Pacific Pumas

- Economic miracle (full list of miracles and "tigers")

- Asian Century

- Pacific Century

- Baltic Tiger

- Celtic Tiger

- Tatra Tiger

- Newly industrialized country

- Gulf Tiger

- Tiger economy

- Lee Kuan Yew

- Singapore model

- Korean Wave

- Japanese economic miracle

- Miracle on the Han River

- Taiwan Miracle

- Nylonkong

- List of country groupings

- List of multilateral free-trade agreements

References

- "Can Africa really learn from Korea?". Afrol News. 24 November 2008. Archived from the original on 16 December 2008. Retrieved 16 February 2009.

- "Korea role model for Latin America: Envoy". Korean Culture and Information Service. 1 March 2008. Archived from the original on 22 April 2009. Retrieved 16 February 2009.

- Leea, Jinyong; LaPlacab, Peter; Rassekh, Farhad (2 September 2008). "Korean economic growth and marketing practice progress: A role model for economic growth of developing countries". Industrial Marketing Management. 37 (7): 753–757. doi:10.1016/j.indmarman.2008.09.002.

- Derek Gregory; Ron Johnston; Geraldine Pratt; Michael J. Watts; Sarah Whatmore, eds. (2009). "Asian Miracle/tigers". The Dictionary of Human Geography (5th ed.). Malden, MA: Blackwell. p. 38. ISBN 978-1-4051-3287-9.

- Rodrik, Dani (1 April 1997). "The 'paradoxes' of the successful state". European Economic Review. 41 (3–5): 411–442. doi:10.1016/S0014-2921(97)00012-3. ISSN 0014-2921.

- Chang, Ha-Joon (2006). The East Asian Development Experience. ISBN 9781842771419.

- Data for "Real GDP at Constant National Prices" and "Population" from Economic Research at the Federal Reserve Bank of St. Louis Archived 3 October 2019 at the Wayback Machine.

- Page, John (1994). "The East Asian Miracle: Four Lessons for Development Policy". In Fischer, Stanley; Rotemberg, Julio J. (eds.). NBER Macroeconomics Annual 1994, Volume 9. NBER Macroeconomics Annual. 9. Cambridge, Massachusetts: MIT Press. pp. 219–269. doi:10.1086/654251. ISBN 978-0-262-06172-8. S2CID 153796598. Archived from the original on 2 February 2013.

- "Economic History of Hong Kong" Archived 17 April 2015 at the Wayback Machine, Schenk, Catherine. EH.net 16 March 2008.

- "Singapore Infomap – Coming of Age". Ministry of Information, Communications and the Arts. Archived from the original on 13 July 2006. Retrieved 17 July 2006.

- Michael H. Hunt (10 November 2003). The World Transformed: 1945 to the Present. Bedford/St. Martin's. p. 352. ISBN 978-0-312-24583-2.

- Anonymous (2009). "Troubled Tigers". The Economist. 390 (8616): 75–77. Archived from the original on 22 November 2018. Retrieved 6 September 2018.

- Rodrik, Dani; Grossman, Gene; Norman, Victor (1995). "Getting Interventions Right: How South Korea and Taiwan Grew Rich" (PDF). Economic Policy. 10 (20): 55–107. doi:10.2307/1344538. JSTOR 1344538. S2CID 56207031. Archived (PDF) from the original on 2 June 2018. Retrieved 27 August 2019.

- Pam Woodall (1998). "East Asian Economies: Tigers adrift". The Economist. London; US: The Economist Intelligence Unit: S3–S5. ISSN 0013-0613. ProQuest 224090151.

- Mukhopadhyaya, Bidisha; Pradhana, Rudra P.; Feridun, Mete (2011). "Finance-growth nexus revisited for some Asian countries". Applied Economics Letters. 18 (6): 1527–1530. doi:10.1080/13504851.2010.548771. S2CID 154797937.

- "HKU Faculty of Dentistry Ranked No.1 in the World – All News – Media – HKU". www.hku.hk. Archived from the original on 27 June 2016. Retrieved 12 June 2017.

- "Top Dental Schools in 2017". 23 March 2017. Archived from the original on 6 August 2017. Retrieved 12 June 2017.

- Lin, Justin Yifu (27 October 2011). Demystifying the Chinese Economy. Cambridge University Press. p. 107. ISBN 978-0-521-19180-7. Archived from the original on 29 July 2016.

- DuBois, Thomas David (25 April 2011). Religion and the Making of Modern East Asia. Cambridge University Press. pp. 227–228. ISBN 978-1-139-49946-0. Archived from the original on 3 January 2016.

- Some Lessons from the East Asian Miracle Archived 29 September 2018 at the Wayback Machine, a 27-page paper published by the World Bank, Joseph E. Stiglitz, Aug. 1996. In addition to the Four Asian Tigers, Stiglitz also lists the economies of Japan, Indonesia, Malaysia, and Thailand as part of the East Asian Miracle.

- "Hong Kong Credit Ratings". Fitch Ratings. Retrieved 6 April 2020.

- "Rating Action: Moody's changes outlook on Hong Kong's Aa2 rating to negative from stable; affirms rating". Moody's Investors Service. 16 September 2019. Retrieved 6 April 2020.

- Sin, Noah (8 October 2019). "S&P keeps Hong Kong's AA+ rating despite protests, cites strong finances". Reuters. Reuters. Retrieved 6 April 2020.

- "Singapore Credit Ratings". Fitch Ratings. Retrieved 6 April 2020.

- "Rating Action: Moody's affirms Singapore's Aaa ratings; maintains stable outlook". Moody's Investors Service. 12 November 2018. Retrieved 6 April 2020.

- "Korea Credit Ratings". Fitch Ratings. Retrieved 6 April 2020.

- "Announcement of Periodic Review: Moody's announces completion of a periodic review of ratings of Korea, Government of". Moody's Investors Service. 15 February 2020. Retrieved 6 April 2020.

- "S&P keeps Korea's rating at AA with stable outlook". Yonhap News Agency. Yonhap News Agency. 6 November 2019. Retrieved 6 April 2020.

- "Taiwan Credit Ratings". Fitch Ratings. Retrieved 6 April 2020.

- "Moody's announces completion of a periodic review of ratings of Taiwan, Government of". Moody's Investors Service. 15 February 2020. Retrieved 6 April 2020.

- "Life expectancy at birth, total (years)". The World Bank. Retrieved 6 April 2020.

- Gallup, Inc. "Worldwide, Median Household Income About $10,000". gallup.com. Archived from the original on 5 February 2016.

- "Gallup® Global Wellbeing: The Behavioral Economics of GDP Growth" (PDF). Gallup. Archived from the original (PDF) on 24 September 2015. Retrieved 16 August 2017.

- "Statistical Bulletin conditions" (PDF) (in Chinese). General Statistics Office, Taiwan. Archived from the original on 7 December 2013. Retrieved 3 December 2013.

- "Internet Speeds by Country". Cable. 2016. Retrieved 6 April 2020.

- "Visa Survey: Hongkongers choosing mobile to browse and purchase online". Visa Inc. 9 November 2015. Archived from the original on 4 September 2016. Retrieved 30 August 2016.

- "Singapore leads SEA in smartphone, MBB adoption". telecomasia.net. 8 June 2016. Archived from the original on 2 September 2016. Retrieved 30 August 2016.

- Carlon, Kris (26 June 2016). ""Made for Taiwan": the next billion-dollar app market". androidauthority.com. Archived from the original on 20 July 2016. Retrieved 30 August 2016.

- "HKMA joins SEACEN" (Press release). Hong Kong Government. Hong Kong Monetary Authority. 31 October 2014. Archived from the original on 17 February 2016. Retrieved 16 August 2017.

- Founding member of the United Nations and permanent member of the United Nations Security Council (1945–1971)

Further reading

- Ezra F. Vogel, The Four Little Dragons: The Spread of Industrialization in East Asia (Cambridge, Massachusetts: Harvard University Press, 1991).

External links

- BBC report on the Asian Tigers in the aftermath of the 1997 Financial Crisis (includes map of the Asian Tigers)

- ASEAN tigers

- The Elephant at the Gate in China Economic Review

.jpg.webp)

.svg.png.webp)