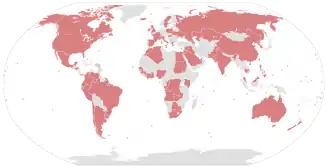

Panama Papers (North America)

The Panama Papers are 11.5 million leaked documents that detail financial and attorney–client information for more than 214,488 offshore entities.[1][2] The documents, some dating back to the 1970s, were created by, and taken from, Panamanian law firm and corporate service provider Mossack Fonseca,[3] and were leaked in 2015 by an anonymous source.[4]

| Taxation |

|---|

|

| An aspect of fiscal policy |

This page details related allegations, reactions, and investigations, in North America.

Canada

Canadian prime minister Justin Trudeau has denied any involvement in the affair, saying he had "entirely and completely been transparent about mine and my family's finances. That is something I learned early on that Canadians expect from their leaders."[5] Canada Revenue Agency said in a statement that its current tax evasion audits include "some Canadian clients associated with law firm Mossack Fonseca,"[6] and added that it would "communicate" with its treaty partners to obtain any further information that may not currently be in its possession." The CRA has tax treaties with 92 different countries and 22 Tax Information Exchange Agreements.[5][6] The CRA has begun or completed 116 audits and 234 more are planned. These investigations are expected to recoup at least $11 million in taxes and fines. Fewer than 10 related criminal investigations are in progress.[7]

The Royal Bank of Canada (RBC) denied any wrongdoing associated with the 370+ clients it had referred to Mossack Fonseca over the years."We have an extensive due diligence process... RBC works within the legal and regulatory framework of every country in which we operate," said a bank spokesman.[8] CEO David McKay said the bank will review the four decades of documentation for any problems.[9][10] CEO Bill Downe of the Bank of Montreal said "Canadian banks have 'dramatically' beefed up anti-money laundering control over the last seven to 10 years,"[11] and added that any link between Canadian businesses and the Panama Papers companies would have originated a long time ago, before Canadian banks took action to stop money laundering.[9]

Some individuals did surface in the leaked documents, according to ICIJ partner in the investigation Toronto Star.[12]

- John Mark Wright, a mutual fund broker, had three shell companies in the British Virgin Islands for handling profits from a mine in the Democratic Republic of Congo.

- Eric Van Nguyen, a Montreal resident with registered companies in Samoa and another in the British Virgin Islands. He also faces fraud charges in the New York state in a penny stock scheme.[13]

- Brian Shamess, a sports physician from Sault Ste Marie, used a Mossack Fonseca company to buy a condo on Panama Bay in 2011.

- Eric Marc Levine operates fitness clubs in Asia and has registered at least 15 companies in the British Virgin Islands through Mossack Fonseca. The Thai Anti-Money Laundering Office froze some of his business assets following fraud allegations; Levine responded with a defamation suit.

- Former Newfoundland Cabinet minister Chuck Furey incorporated in Panama to buy a condo in 2008. He said no longer has overseas holdings.

- Mixed martial arts trainer Dave Feser of Vancouver set up a business in British Anguilla with an office in Switzerland. "There's nothing even associated with this company," Feser told the Star.

Canadians for Tax Fairness had calculated that legal tax avoidance by corporations alone cost the Canadian treasury almost $8 billion Canadian a year.[14] When it calculated the 2015 numbers, they found that corporations and individuals combined sent CAN$40 billion of declared assets to tax havens, and the ten most popular alone now held $270 billion Canadian in assets.[15]

Costa Rica

The administration of President Luis Guillermo Solís suggested that some of the activity unveiled by the leaked documents suggests attempts to evade taxes. His administration's effort to implement tax increases and reforms has met strong resistance from opposition and business figures.[16]

Leaked documents suggest that Mossack Fonseca helped tuna export company Borda Azul set up a shell company in the British Virgin Islands in order to avoid Costa Rican taxes. The firm, now out of business, was headed by Hermes Navarro, president of the Costa Rican Football Federation from 1999 to 2006.[16] In the late 1990s the Finance Ministry and Prosecutor's Office investigated Borda Azul and other export companies for allegedly misusing tax credit certificates; in 1997 dozens of companies had been accused of using the certificates for fraud and to launder drug profits.[16]

According to ICIJ investigative partners DataBaseAR and Seminario Universidad, Mossack Fonseca helped Borda Azul fabricate invoices to allow it to report both inflated costs—to reduce its taxes—and inflated exports, to allow it to continue to qualify for the tax credit certificates. In a letter dated October 19, 1998, a Mossack Fonseca lawyer explained the investigation to the Panama City office and concluded:

In the worst of circumstances, being very fatalistic, the Costa Rican government could, after years of investigation, suspend the transfer of CATs to Borda Azul for irregularities but never send anyone to jail.

— a Mossack Fonseca lawyer[16]

More than thirty Costa Rican law firms are mentioned in the Panama Papers as referring clients to Mossack Fonseca, resulting in the creation of more than 360 shell companies. in particular Gonzalo Fajardo & Asociados, founded by former Finance Ministry official and later Economy Minister Gonzalo Fajardo Salas, and over nearly two decades helped Costa Rican companies set up 82 offshore corporations in tax havens, according to DataBaseAR.[16]

Finance Vice Minister Fernando Rodríguez said Costa Rica will push to sign a Tax Information Exchange Agreement with Panama.[17] Legislators from several parties are trying to line up political consensus to seek approval of the administration's tax fraud bill and to form a legislative commission to investigate those named in the Panama Papers, according to Emilia Molina Cruz of the Citizens' Action Party.[17] While opposition parties have maintained that the country's financial problems stem from excess spending, according to the Finance Department, the sums Costa Rica loses to tax evasion equal about 8% of the country's gross domestic product, while its deficits have run at about 6%.[17]

Mexico

Aristóteles Núñez, in charge at the time of the government's tax administration, Servicio de Administración Tributaria, said that people involved in the Panama Papers case can still make tax declarations and pay taxes on their investments. Being Mexican and having foreign investments or bank accounts is not a crime, but having income and not declaring it is illegal. If investments are categorized as tax evasion, fines of up to 100% of the omitted tax payment can result, as well as three months to nine years imprisonment.[19]

- Mexican actress Edith González is linked to the scandal through her husband Lorenzo Lazo Margáin.[20]

- Ricardo Salinas Pliego, president of Grupo Salinas, which includes Azteca, Banco Azteca and Azteca Foundation among others, used an offshore company set up in the Virgin Islands to purchase a yacht, Azteca II, flagged in the Cayman Islands.[21] Felicitas Holdings Limited, registered in the British Virgin Islands, spent £261 million in 2014 on art by Francisco de Goya and also bought works by Mexican painter Manuel Serrano; the press director of Grupo Salinas told Forbes that all of Pliego's transactions complied with the law.[21]

- Juan Armando Hinojosa Cantú, a close friend of former Mexican president Enrique Peña Nieto, enlisted Mossack Fonseca to create trusts for accounts worth US$100 million[22] after he was investigated for allegedly giving special favours to the former Mexican president and his wife, according to an analysis by ICIJ, who said that the documents showed "a complex offshore network" of nine companies in New Zealand, the United Kingdom, and the Netherlands. Described as Peña Nieto's "favorite contractor", Hinojosa's companies have won more than eighty government contracts and received at least US$2.8 billion in state money, The New York Times reported last year.[23]

According to Forbes, "Hinojosa and other prominent Mexicans, mostly businessmen with close ties to the government, including at least one member of the Forbes billionaires list, were the subject of extensive articles published online by ICIJ investigation partners Proceso and Aristegui Noticias Sunday."[24] Proceso also said that the Mexicans mentioned in the leaked documents included individuals linked to drug cartels.[22]

Trinidad and Tobago

Ken Emrith, a member of the opposition United National Congress (UNC), is linked to a bribery scandal in Brazil through Panamanian shell companies used to transfer millions of US dollars to offshore bank accounts.[25] The Brazilian construction company Grupo OAS was awarded a contract in 2011 through the National Infrastructure Development Company (NIDCO) by the People's Partnership administration to build a highway in Trinidad for TT$5.2 billion.[note 1] The highway is 49% complete, but it is now estimated that the highway will cost TT$8 billion when done.[25] Investigators have found that Emirth's companies received $6 million from NIDCO and that Emirth was also a director of Pembury Consultants (Trinidad and Tobago) Limited, which OAS hired on the highway project as a consultant at $44,800 a month.[25] Through May 2013 OAS paid Pembury at least TT$896,000; totals beyond that date are not currently available.[25]

Emrith, described as a low-level UNC party official, had a second Mossack Fonseca company, Pendrey Associates. Speaking in Parliament, Attorney General Faris Al-Rawi said the leaked documents tied this offshore company to key players in the Petrobras scandal in Brazil, including the convicted Joao Procopio, and Jose Luiz Pires of Queluz, who had dealings with Swiss PKB Privatbank AG. Pires is under investigation, he said.[25]

According to ICIJ investigative partner Trinidad Express, Emrith was a close associate of Jack Warner and also owns half the shares in Proteus Holding SA, an investment he refuses to discuss because he says he has a responsibility of confidentiality to fellow shareholders.[26] The Express also says that OAS used a Namibian port development project as camouflage for a $1 million payment from Procopio shell company Santa Tereza Services Ltd to Emirth.[26]

United States

President Barack Obama was critical of Caribbean tax havens in his 2008 election campaign.[27] In 2010, the United States implemented the Foreign Account Tax Compliance Act; the law required financial firms around the world to report accounts held by US citizens to the Internal Revenue Service.

The US on the other hand refused to sign on to the Common Reporting Standard set up by the Organisation for Economic Co-operation and Development, alongside Vanuatu and Bahrain.[28] This means the US receives tax and asset information for American assets and income abroad, but does not share information about what happens in the United States with other countries, which in other words means that the United States has become attractive as a tax haven.

At least 2,400 US-based clients were found in the papers; while many of their transactions were legal, Mossack Fonseca offered advice to many of its US clients on how to evade US tax and financial disclosure laws.[29] On 7 February 2020, federal prosecutors announced that they will obtain their first conviction in relation to the disclosures.[30] On 18 February 2020, Harald Joachim von der Goltz, an 82 year old former businessman and former U.S. resident who was a client for Mossack Fonseca, pleaded guilty to nine counts, including charges of conspiracy to evade taxes and commit money laundering and wire fraud. He is the first to plead guilty in the U.S. in connection to the Panama Papers leak.[31] On February 28, 2020, a Massachusetts accountant, Richard Gaffey, became the second person to plead guilty to charges related to the Panama Papers.[32] Judgments against both von der Goltz and Gaffey were delivered in September 2020 in the United States District Court for the Southern District of New York, resulting in 87 months imprisonment and over $17.7 million in asset forfeitures, restitutions, and fines between the two defendants.[33][34]

Panama Free Trade Agreement

The Panama Free Trade Agreement, supported by Obama and Clinton, has been accused of enabling the practices detailed within the Panama Papers through regulatory oversight.[35] However, an Obama administration official said the argument has "zero merit".[36] John Cassidy of The New Yorker, said the Panama Free Trade Agreement actually forced Panama to release information to the American regulatory authorities on "the ownership of companies, partnerships, trusts, foundations, and other persons".[37]

Citing leaked diplomatic cables, Fortune writer Chris Matthews speculated that Obama and Clinton may have supported the agreement, after opposing it while campaigning for office, because it was a quid pro quo for Panamanian support of US efforts against drug trafficking. In any event, he notes, while it is true that the agreement abolished limits on fund transfers between the US and Panama, the Obama administration insisted that the two countries first sign a Tax Information and Exchange Agreement as well, which facilitated the exchange of tax information between the countries.[38]

After the leak

President Barack Obama addressed the overseas shell companies listed by the leak in a press conference: "It's not that they're breaking the laws," he said, "it's that the laws are so poorly designed that they allow people, if they've got enough lawyers and enough accountants, to wiggle out of responsibilities that ordinary citizens are having to abide by."[39] Although no leader in the US was mentioned in the Panama Papers, Obama said that "Frankly, folks in America are taking advantage of the same stuff".[40]

Senators Sherrod Brown and Elizabeth Warren have requested that the Treasury Department investigate any US-linked companies that appeared in the leaks, in addition to the Justice Department, given its role in the financial markets.[41]

Former Secretary of State and 2016 Democratic presidential candidate Hillary Clinton condemned "outrageous tax havens and loopholes ... in Panama and elsewhere"[42] at a Pennsylvania AFL–CIO event. Clinton added that "some of this behavior is clearly against the law, and everyone who violates the law anywhere should be held accountable", but it was "scandalous how much is actually legal".[42] Clinton promised that "We are going after all these scams and make sure everyone pays their fair share here in America."[42]

Manhattan US Attorney Preet Bharara has opened a criminal investigation on matters related to the Panama Papers and sent a letter April 3 to the International Consortium of Investigative Journalists (ICIJ) saying his office "would greatly appreciate the opportunity to speak as soon as possible."[43] The ICIJ received many such requests from many countries and ICIJ Director Gerard Ryle has said its policy is not to turn over any materials.[44][45]

New York's Department of Financial Services has asked 13 foreign banks, including Deutsche Bank AG, Credit Suisse Group AG, Commerzbank AG, ABN Amro Group NV and Societe Generale SA, for information about their dealings with Mossack Fonseca. The banks are not accused of wrongdoing but must provide telephone logs and records of other transactions between their New York branches and the law firm.[46]

Americans

McClatchy Newspapers initially found four Americans with offshore shell companies named in the documents. All had previously been either accused or convicted of financial crimes such as fraud or tax evasion.[47] Three reasons have been suggested to explain the scarcity of Americans in the leak:[48]

- Shell companies can be created in the United States.

- Major international banks based in America tend to have offshore accounts in the Cayman Islands instead.

- US laws like the Foreign Account Tax Compliance Act (FATCA) and the Tax Information Exchange Agreements (TIEAs) of 2010 have meant that the "tax evasion game [was] principally over for American taxpayers".

Asked about the paucity of American individuals in the documents, digital editor of Süddeutsche Zeitung, Stefan Plöchinger, said via Twitter: "Just wait for what is coming next."[49] Plöchinger later clarified that he was just advocating not jumping to conclusions.[50] Copies of at least 200 American passports – indicating that their owners applied for banking services – have been discovered in the Papers, but no US politicians have yet been named in the leak.[51][47] The names of a few Americans are however mentioned:

- Puerto Rican recording artist Ramón Luis Ayala, better known as Daddy Yankee, appears in the leaked documents.[52]

- CEO and then Chairman of Citibank (1998–2006) Sanford I. Weill appears in the documents as sole shareholder of April Fool, a company based in the British Virgin Islands that managed a yacht of the same name from 2001 to 2005. Weill's second company, Brightao, includes Chinese and American investors and holds share in a Chinese insurance and risk-management firm, Mingya Insurance Brokers.

- Jerry Slusser, a fundraiser for Republican Mitt Romney, initially said he did not recall opening an offshore company, but then called his accountant and said it was for an investment in Hong Kong that eventually showed a loss.[53]

- Donors to former US President Bill Clinton and former Secretary of State Hillary Clinton, including Marc Rich and Ng Lap Seng.[54]

- Thousands of mentions of Donald Trump. Several "Trump" companies mentioned in the Panama Papers have completely different principals, such as "a young woman whose LinkedIn profile describes her as merchandising supervisor at a small clothing retailer" in Palembang, Indonesia.[55] The "Trump Ocean Club International Hotel & Tower Panama" mentioned in the papers "is not [now] owned, developed or sold by Donald J. Trump, the Trump Organization or any of their principals or affiliates", according to the resort website.[55]

- Central Intelligence Agency operatives - a number of "front" companies and contractors for the CIA used "offshore companies for personal and private gain,” as well as employing them as instruments for their official work as “spy chiefs, secret agents, or operatives.”[56]

Notes

- TT$1~US$0.16 as of April 15, 2016.

References

- "Giant leak of offshore financial records exposes global array of crime and corruption". OCCRP. The International Consortium of Investigative Journalists. April 3, 2016. Archived from the original on April 4, 2016.

- Schmidt, Michael S.; Myers, Steven Lee (April 3, 2016). "Panama Law Firm's Leaked Files Detail Offshore Accounts Tied to World Leaders". The New York Times. ISSN 0362-4331. Archived from the original on March 29, 2017. Retrieved March 25, 2017.

- Vasilyeva, Natalya; Anderson, Mae (April 3, 2016). "News Group Claims Huge Trove of Data on Offshore Accounts". The New York Times. Associated Press. Retrieved April 4, 2016.

- Garside, Juliette; Watt, Holly; Pegg, David (April 3, 2016). "The Panama Papers: how the world's rich and famous hide their money offshore". The Guardian. Archived from the original on April 3, 2016. Retrieved April 3, 2016.

- Fife, Robert (April 7, 2016). "Trudeau says he does not have money in offshore accounts". The Globe and Mail. The Globe and Mail Inc. Archived from the original on April 11, 2016. Retrieved April 9, 2016.

- "CRA seeks Panama Papers to search for new clues about tax cheats". CBC News. April 5, 2016. Archived from the original on April 17, 2016. Retrieved April 18, 2016.

- Dalby, Douglas; Wilson-Chapman, Amy. "Panama Papers Helps Recover More Than $1.2 Billion Around The World". International Consortium of Investigative Journalists. The International Consortium of Investigative Journalists. Retrieved 18 May 2019.

- "RBC t wrongdoing after being named in Panama Papers:'There are a number of legitimate reasons' to set up foreign holding companies, bank spokesman says". CBC News. April 4, 2016. Archived from the original on April 18, 2016. Retrieved April 18, 2016.

- "Royal Bank and BMO defend Canada's banking sector amid Panama Papers and Fintrac fine". CBC News. CBC/Radio-Canada. April 7, 2016. Archived from the original on April 9, 2016. Retrieved April 9, 2016.

Canadian banks have "dramatically" beefed up anti-money laundering controls over the last seven to 10 years

- Scuffham, Matt (April 6, 2016). "Royal Bank of Canada sets up team to scrutinize data exposed in Panama Papers leak". Financial Post. O Canada. Archived from the original on April 9, 2016. Retrieved April 9, 2016.

- ABC Color. "Conmebol renovó con mismos dueños de investigada T&T". Archived from the original on April 14, 2016.

- Robert Cribb; Marco Chown Oved (April 4, 2016). "How offshore banking is costing Canada billions of dollars a year: An unprecedented leak of secretive offshore tax-haven data contains stunning new revelations about the diversion of wealth from government coffers to hidden bank accounts". Archived from the original on April 24, 2016. Retrieved May 2, 2016.

- Chris Dolmetsch (September 11, 2014). "Eight Charged by N.Y. in $290 Million Pump-and-Dump Plot". Bloomberg. Archived from the original on May 7, 2016. Retrieved April 30, 2016.

- Thomas Walkom (April 6, 2016). "Homegrown loopholes cost Canada more than Panama tax havens: Walkom". The Star. Archived from the original on April 11, 2016. Retrieved April 30, 2016.

- Marco Chown Oved (April 27, 2016). "Canadians put $40 billion in tax havens last year: The Panama Papers revelations of widespread use of tax havens are corroborated by Statistics Canada data". Toronto Star. Archived from the original on April 29, 2016. Retrieved April 30, 2016.

- "Costa Rica in the Panama Papers leak". The Tico Times News. April 5, 2016. Archived from the original on April 25, 2016. Retrieved April 29, 2016.

- L.Arias (April 6, 2016). "Panama Papers scandal cracks open window for Costa Rica tax reform". The Tico Times News. Archived from the original on April 25, 2016. Retrieved April 29, 2016.

- A well-connected Mexican tycoon stashes a fortune overseas Archived April 6, 2016, at the Wayback Machine". The McClatchy DC. April 3, 2016.

- AN, Redaccion (April 4, 2016). "Aún pueden pagar impuestos los mexicanos involucrados en Panama Papers: SAT". Aristegui Noticias. Archived from the original on April 6, 2016. Retrieved April 4, 2016.

- "Revista Proceso – Al desnudo, el tráfico clandestino de las fortunas de prominentes mexicanos, 3 abril 2016". Proceso.com.mx. April 3, 2016. Archived from the original on May 4, 2016. Retrieved May 3, 2016.

- Kerry A. Dolan (April 14, 2016). "Billionaires From Brazil And Mexico Named In The Panama Papers Leak". Forbes. Archived from the original on April 22, 2016. Retrieved April 23, 2016.

- AFP (April 4, 2016). "Officials in Latin America linked to 'Panama Papers'". The Tico Times News. Archived from the original on April 25, 2016. Retrieved April 29, 2016.

- "Leaked documents show the former Mexican president's close friend moved $100 million offshore after a corruption probe". Business Insider. April 5, 2016. Archived from the original on April 7, 2016.

- "Mexican Government Contractor Who Built First Lady's Mansion Is Exposed In The Panama Papers Archived October 18, 2017, at the Wayback Machine" April 4, 2016.

- CMC (April 15, 2016). "T&T Gov't seeking assistance in probing local link to Panama Papers". Jamaica Observer. Archived from the original on April 21, 2016. Retrieved April 30, 2016.

- Camini Marajh (April 16, 2016). "CHEAP DUMMIES: Emrith paid US$750 for fake directors in shell company Panama..." Trinidad Express. Archived from the original on April 21, 2016. Retrieved April 30, 2016.

- Hockney, Mike (September 12, 2014). All the Rest Is Propaganda. Lulu.com. p. 168. ISBN 978-1-326-01638-8. Archived from the original on November 22, 2016.

- Swanson, Ana (April 5, 2016). "How the U.S. became one of the world's biggest tax havens". Washington Post. Archived from the original on April 21, 2016. Retrieved April 23, 2016.

- ERIC LIPTON and JULIE CRESWELL (June 5, 2016) Panama Papers Show How Rich United States Clients Hid Millions Abroad Archived February 26, 2017, at the Wayback Machine The New York Times, Retrieved June 6, 2016.

- Tokar, Dylan (February 7, 2020). "Panama Papers Case to Net First U.S. Conviction". The Wall Street Journal. Retrieved February 11, 2020.

- Tokar, Dylan (February 18, 2020). "Former Law Firm Client Pleads Guilty in Panama Papers Case". The Wall Street Journal. Retrieved February 25, 2020.

- Tokar, Dylan (28 February 2020). "Accountant Pleads Guilty Ahead of Trial in Panama Papers Case". The Wall Street Journal. The Wall Street Journal. Retrieved 4 March 2020.

- "U.S. Taxpayer in Panama Papers Investigation Sentenced to Prison". Office of Public Affairs − United States Department of Justice. September 21, 2020.

- "U.S. Accountant in Panama Papers Investigation Sentenced to Prison". Office of Public Affairs − United States Department of Justice. September 24, 2020.

- Mindock, Clark (April 4, 2016). "Panama Papers: Obama, Clinton Pushed Trade Deal Amid Warnings It Would Make Money Laundering, Tax Evasion Worse". International Business Times. Archived from the original on April 25, 2016.

- Mauldin, William; Viswanatha, Aruna (April 7, 2016). "Sanders Says U.S. Helped Panama as a Tax Haven But Skips Over Tax Pact". Wall Street Journal. Archived from the original on April 23, 2016. Retrieved April 24, 2016.

- Cassidy, John (April 5, 2016). "Panama Papers: Why Aren't There More American Names?". The New Yorker. ISSN 0028-792X. Archived from the original on April 24, 2016. Retrieved April 18, 2016.

- Matthews, Chris (April 8, 2016). "Panama Papers: Why Did Clinton and Obama Flip Flop on Trade with Panama". Fortune. Archived from the original on April 23, 2016. Retrieved April 20, 2016.

- Boland-Rudder, Hamish; Holmes, Allan; Chittum, Ryan. "Impact of Panama Papers rockets around the world; U.S. officials react cautiously". Center for Public Integrity. Archived from the original on May 29, 2016. Retrieved April 7, 2016.

- Revesz, Rachael (April 5, 2016). "Obama says Americans are doing the same Panama Papers tax avoidance as everyone else". The Independent. New York, United States. Archived from the original on April 24, 2016. Retrieved April 23, 2016.

- Steven T. Dennis (April 7, 2016). "Treasury Should Probe U.S. Banks on Panama Papers, Warren and Brown Say". Archived from the original on May 9, 2016. Retrieved May 9, 2016.

- Hannah Fraser-Chanpong (April 6, 2016). "Hillary attacks Sanders, China in speech to union". CBS News. Archived from the original on April 15, 2016. Retrieved April 24, 2016.

- AFP (April 20, 2016). "US opens criminal probe linked to Panama Paper revelations: ICIJ". i24 News. Archived from the original on May 5, 2016. Retrieved April 20, 2016.

- Hamilton, Martha M. (April 12, 2016). "Global joint investigation to be proposed at special tax meeting". Archived from the original on May 5, 2016. Retrieved April 21, 2016.

- "NY banks ordered to provide information on Panama dealings" Archived May 4, 2016, at the Wayback Machine. Curaçao Chronicle.

- Farrell, Greg; Schoenberg, Tom; Chiglinsy, Katherine (April 20, 2016). "New York Wants Foreign Banks to Hand Over Panama Records". Bloomberg. Archived from the original on April 21, 2016. Retrieved April 20, 2016.

- Hall, Kevin G.; Taylor, Marisa (April 4, 2016). "Americans, including a Bellevue man, show up in Panama Papers". Seattle Times. Archived from the original on April 5, 2016. Retrieved April 5, 2016.

- "Panama Papers: Where are the Americans?". BBC News. April 6, 2016. Archived from the original on April 6, 2016. Retrieved April 6, 2016.

- "Everyone is freaking out about the Panama Papers—but the biggest fallout is yet to come". Mother Jones. April 4, 2016. Archived from the original on April 7, 2016. Retrieved April 7, 2016.

- Mills, Jen (April 4, 2016). "Why are there no US people in the Panama papers?". Metro. Archived from the original on April 4, 2016.

- "Panama Papers: The Power Players". International Consortium of Investigative Journalists. Archived from the original on April 4, 2016. Retrieved April 3, 2016.

- Wiener-Bronner, Danielle; Matthews, David; Fusion Investigative Unit (April 6, 2016). "Here are the most famous celebrities with ties to the huge Panama Papers leak". Archived from the original on April 16, 2016. Retrieved April 17, 2016.

- Marisa Taylor; Kevin G. Hall; McClatchy Washington Bureau (TNS) (April 6, 2016). "Panama Papers revelations expose ultra-rich Americans". The Seattle Times. Archived from the original on April 17, 2016. Retrieved April 27, 2016.

- Kumar, Anita; Taylor, Marisa; Hall, Kevin G. (April 16, 2016). "Inside Panama Papers: Multiple Clinton connections". McClatchy Newspapers. McClatchy Washington Bureau. Archived from the original on May 7, 2016. Retrieved May 8, 2016.

- Kevin G. Hall; Franco Ordonez; Vera Bergenruen (April 29, 2016). "What Panama Papers say – and don't say – about Trump". McClatchy DC. Archived from the original on June 15, 2016.

- Will Fitzgibbon and Nicolas Richter: Panama Papers: CIA-Agents used companies from Panama Operation Goldfinger, Süddeutsche Zeitung

Further reading

- Bastian Obermayer; Frederik Obermaier (2016). The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their Money. ISBN 978-1786070470.

External links

| Look up trust or look-through company in Wiktionary, the free dictionary. |

- A manifest by Panama Papers leaker

- Panama Papers Portal of International Consortium of Investigative Journalists (US)

- Panama Papers Portal of Süddeutsche Zeitung (Germany)

- Panama Papers Portal of The Guardian (United Kingdom)

- Panama Papers Portal of Financial Times (United Kingdom)

- Panama Papers Portal of Le Monde (France)

- Panama Papers Portal of Sveriges Television (Sweden)

- Portal of the African Network of Centers for Investigative Reporting (ANCIR) (Africa)

- Panama Papers Portal of Inkyfada (Tunisia)

- Panama Papers Portal of Semanario Universidad at the University of Costa Rica

- Panama Papers Portal of the Organized Crime and Corruption Reporting Project

- Panama Papers Portal of Le Desk (Morocco)

- Panama Papers Portal of Reykjavík Media (Iceland)

- Panama Papers Portal of Armando.info (Venezuela)

- New Zealand IR607:Foreign trust disclosure