Welfare state in the United Kingdom

The welfare state of the United Kingdom began to evolve in the 1900s and early 1910s, and comprises expenditures by the government of the United Kingdom intended to improve health, education, employment and social security. The British system has been classified as a liberal welfare state system.[1]

History

The welfare state in the modern sense was anticipated by the Royal Commission into the Operation of the Poor Laws 1832 which found that the old poor law (a part of the English Poor laws) was subject to widespread abuse and promoted squalor, idleness and criminality in its recipients, compared to those who received private charity. Accordingly, the qualifications for receiving aid were tightened up, forcing many recipients to either turn to private charity or accept employment.

Opinions began to be changed late in the century by reports drawn up by men such as Seebohm Rowntree and Charles Booth into the levels of poverty in Britain. These reports indicated that in the massive industrial cities, between one-quarter and one-third of the population were living below the poverty line.

Liberal reforms

The Liberal Party launched the welfare state in Britain with a series of major Liberal welfare reforms in 1906–1914.[2] The reforms were greatly extended over the next forty years.[2]

The minimum wage was introduced in Great Britain in 1909 for certain low-wage industries and expanded to numerous industries, including farm labour, by 1920. However, by the 1920s, a new perspective was offered by reformers to emphasise the usefulness of family allowance targeted at low-income families was the alternative to relieving poverty without distorting the labour market.[3][4] The trade unions and the Labour Party adopted this view. In 1945, family allowances were introduced; minimum wages faded from view.

The experience of almost total state control during the Second World War had encouraged the belief that the state might be able to solve problems in wide areas of national life.[5]

The Liberal government of 1906–1914 implemented welfare policies concerning three main groups in society: the old, the young and working people.[2]

| Young | Old | Working |

|---|---|---|

|

|

|

Beveridge Report and Labour

The aftermath of the First World War boosted demands for social reform, and led to a permanent increase in the role of the state in British society. The end of the war also brought a slump, particularly in northern industrial towns, that deepened into the Great Depression by the 1930s.[5]

During the war, the government became much more involved in people's lives via governmental organisation of the rationing of foodstuffs, clothing and fuel and extra milk and meals being given to expectant mothers and children.[5] The wartime coalition , and the introduction of family allowances.[11] Many people welcomed this government intervention and wanted it to go further.[5]

The Beveridge Report of 1942, (which identified five "Giant Evils" in society: squalor, ignorance, want, idleness and disease) essentially recommended a national, compulsory, flat rate insurance scheme which would combine health care, unemployment and retirement benefits. Beveridge himself was careful to emphasise that unemployment benefits should be held to a subsistence level, and after six months would be conditional on work or training, so as not to encourage abuse of the system.[12] That was however predicated on the concept of the "maintenance of employment" which meant ‘it should be possible to make unemployment of any individual for more than 26 weeks continuously a rare thing in normal times’ [12] and recognised that the imposition of a training condition would be impractical if the unemployed were numbered by the million.[12] After its victory in the 1945 general election, the Labour Party pledged to eradicate the Giant Evils, and undertook policy measures to provide for the people of the United Kingdom "from the cradle to the grave."

Included among the laws passed were the National Assistance Act 1948, National Insurance Act 1946, and National Insurance (Industrial Injuries) Act 1946.

Impact

This policy resulted in increased expenditure and a widening of what was considered to be the state's responsibility. In addition to the central services of education, health, unemployment and sickness allowances, the welfare state also included the idea of increasing redistributive taxation, increasing regulation of industry, food, and housing (better safety regulations, weights and measures controls, etc.)

The foundation of the National Health Service (NHS) did not involve building new hospitals, but nationalisation of existing municipal provision and charitable foundations. The aim was not to substantially increase provision but to standardise care across the country; indeed William Beveridge believed that the overall cost of medical care would decrease, as people became healthier and so needed less treatment.

However, instead of falling, the cost of the NHS has risen by 4% annually on average due to an ageing population,[13] leading to a reduction in provision. Charges for dentures, and spectacles were introduced in 1951 by the same Labour government that had founded the NHS three years earlier, and prescription charges by the successive Conservative Government were introduced in 1952.[14] In 1988, free eye tests for all were abolished, although they are now free for the over-60s.[15]

Policies differ in different regions of the United Kingdom, but the provision of a welfare state is still a basic principle of government policy in the United Kingdom today. The principle of health care "free at the point of use" became a central idea of the welfare state, which later Conservative governments, although critical of some aspects of the welfare state, did not reverse.

Welfare spending on poor people dropped by 25% during the decade of austerity, cuts to benefits that disabled people receive were significant, Personal Independence Payments and Employment and Support Allowance have both dropped by 10%. Over half of families living below the breadline have at least one relative with a disability. Cuts include, tax credits (£4.6bn), universal credit (£3.6bn), child benefit (£3.4bn), disability benefits (£2.8bn), ESA and incapacity benefit (£2bn) and housing benefit (£2.3bn). Frank Field said, "A £37bn attack has been mounted on the living standards of many of our fellow citizens to such an extent that possibly millions struggle to keep on top of their rent, pay the bills and buy adequate food. Likewise, an unknown number are unable to clothe their children properly before sending them to school where all too many of these children not only rely on free school dinners as a cornerstone of their diet, but on breakfast and supper clubs as well."[16]

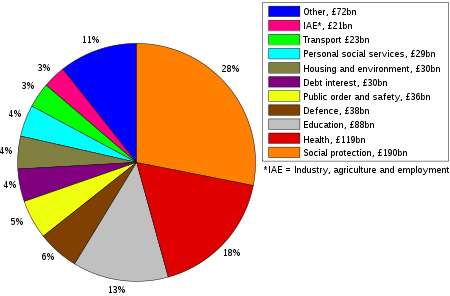

Expenditure

In the financial year 2014/15, state pensions were overwhelmingly the largest governmental welfare expense, costing £86,500,000,000 followed by housing benefit, which accounted for over £20,000,000,000[17] Expenditure in 2015–16 on benefits included: £2,300,000,000 paid to unemployed people and £27,100,000,000 to people on low incomes, and £27,600,000,000 for personal tax credits.[18][19]

UK Government welfare expenditure 2011–12 (percent)

| Benefit | Expenditure (£bn) |

|---|---|

| State pension | 86.5 |

| Tax credits (Working tax credits and Child tax credits) | 29.7 |

| Housing Benefit | 23.5 |

| Disability Living Allowance | 15.4 |

| Incapacity benefits | 14.1 |

| Child benefit | 11.6 |

| Pension Credit | 6.6 |

| Attendance Allowance | 5.4 |

| Jobseeker's allowance | 3.1 |

| Income Support | 2.6 |

| Maternity and paternity pay | 2.4 |

| Carer's allowance | 2.3 |

| Winter fuel payments | 2.1 |

| War pensions | 0.8 |

| Universal credit | 0.1 |

| Other | 5.9 |

| TOTAL | pounds 213.9 |

Criticisms

Conservative thinkers have debated the structural incompatibility between the liberal principles and welfare state’s principles. Certain sectors of society have argued that the welfare state creates a disincentive for working and investment.[20][21] Also suggesting that the welfare state at times does not eliminate the causes of individual contingencies and needs.[22] Economically, the net losers of the welfare state are often more against its values and role within society.[23]

Sometimes women who have nothing and cannot feed themselves or their children are forced into prostitution. Delays in benefit payments when claimants have no money to buy food or to pay rent can force claimants to crime or prostitution, Emma Mullins said, "We had just been made homeless and we had nothing, no food, nothing. I still feel angry when I think about it now that I had to degrade myself – but it was either that or see my children starve. I would do it again if I had to, but I hope I’m never in that situation again."[24]

In 2010, the Conservative-Lib Dem coalition government led by David Cameron argued for a reduction of welfare spending in the United Kingdom as part of their programme of austerity.[25] Government ministers have argued that a growing culture of welfare dependency is perpetuating welfare spending, and claim that a cultural change is required to reduce the welfare bill.[26] Public opinion in the UK appears to support a reduction in welfare spending, however commentators have suggested that negative public perceptions are founded on exaggerated assumptions about the proportion of spending on unemployment benefit and the level of benefit fraud.[27][28]

Figures from the Department for Work and Pensions show that benefit fraud is thought to have cost taxpayers £1.2 billion during 2012–13, up 9% on the year before.[29] This is lower than the £1.5 billion of benefit underpayment due to error.[30]

In some cases, relatives who bring up a child when the parents cannot bring up the child face sanctions and financial penalties, they can be left poor and homeless.[31] There are also widespread complaints from church groups and others that the UK welfare state does insufficient work to prevent poverty, deprivation even hunger.[32]

Support for raising taxes to finance more provision on health, education and social benefits is the highest it has been since 2002, NatCen Social Research maintains. Two-thirds of Labour supporters favour tax rises and 53% of Conservatives also favour that.[33]

In 2018 the House of Commons library estimated that by 2021, £37bn less would be spent on working-age social security than in 2010, despite rising prices and rising cost of living. Cuts to disability benefits, Personal Independence Payments (PIP) and employment and support allowance (ESA) are noteworthy, they will have fallen by 10%, since 2010. Over half of families with income below the breadline include at least one person with a disability. There are also cuts to tax credits Universal Credit child benefit disability benefits ESA and incapacity benefit and housing benefit. Alison Garnham of the Child Poverty Action Group said, "Cuts and freezes have taken family budgets to the bone as costs rise and there is more pain to come as the two-child limit for tax credits and universal credit, the bedroom tax, the benefit cap and the rollout of universal credit push families deeper into poverty."[34]

In 2019 Social security payments are the lowest they have been since the welfare state was started, millions are excluded from mainstream society and food bank use has increased. The Institute for Public Policy Research (IPPR) found £73 per week, (which is standard for Universal Credit that 2.3 million people claim) now amounts to 12.5% of median earnings. When unemployment benefit was introduced in 1948 it amounted 20%. Due to this millions of people are, "excluded from mainstream society, with the basic goods and amenities needed to survive let alone thrive increasingly out of their grip". A senior government adviser stated that economic insecurity was now, "the new normal." The IPPR urges all parties to add an emergency £8.4bn into the welfare system, which has become harder than previous systems because debt deductions are made from payments, there is increasing underpayment and strict sanctions are applied. One in three universal credit claimants are working. Clare McNeil of the IPPR said, "Social security should offer a safety net, not a tightrope over poverty. It is remarkable that in postwar Britain the support for those living in poverty was closer to average earnings than it is today. This is the very simple fact that lies behind the record levels of personal debt, rising use of food banks and increasing destitution that we see in the UK."[35]

Historical statistics on welfare trends

Benefit rates as a percentage of industrial earnings

| Year (month) | Single pension | Supplementary Benefit for single person | Family Allowance for four children |

|---|---|---|---|

| 1948 (October) | 18.9 | 17.5 | 10.9 |

| 1961 (April) | 19.1 | 17.8 | 9.3 |

| 1962 (April) | 18.4 | 17.1 | 8.9 |

| 1963 (May) | 20.8 | 19.5 | 8.6 |

| 1964 (April) | 19.2 | 18.1 | 8.0 |

| 1964 (October) | 18.7 | 17.6 | 7.7 |

| 1965 (April) | 21.2 | 20.1 | 7.4 |

| 1965 (October) | 20.4 | 19.4 | 7.1 |

| 1966 (April) | 19.8 | 18.8 | 6.9 |

| 1966 (October) | 19.7 | 20.0 | 6.9 |

| 1967 (April) | 19.4 | 19.7 | 6.8 |

| 1967 (October) | 21.0 | 20.1 | 7.7 |

| 1968 (April) | 20.2 | 19.3 | 11.9 |

| 1968 (October) | 19.6 | 19.8 | 12.6 |

| 1969 (April) | 18.8 | 19.3 | 12.1 |

| 1969 (November) | 20.0 | 19.2 | 11.7 |

| 1970 (April) | 19.0 | 18.3 | 11.3 |

| 1970 (November) | 17.6 | 18.3 | 10.2 |

| 1971 (March) (est.) | 17.3 | 18.0 | 10.0 |

Note on source, as quoted in the text: "based on statistics of weekly earnings, Employment and Productivity Gazette."

Changes in National Assistance/Supplementary Benefit

| Date of change | Real value single pensioner | Real value married man with three children (b) | Real take home pay for average worker |

|---|---|---|---|

| May 1963 | 100 | 100 | 100 |

| March 1965 | 111 | 112 | 106 |

| November 1966 | 117 | 110 | 106 |

| October 1967 | 122 | 115 | 108 |

| November 1969 | 122 | 115 | 110 |

- Notes

- (a) As quoted in the text: "the scale is calculated using the average discretionary addition (adjusted to spread winter fuel costs throughout the year) for retirement pensioners. It does not include any allowance for rent. The price index used for the single pensioner is that in the Employment and Productivity Gazette."

- (b) As quoted in the text: "it is assumed that the children are aged four, six, and eleven."

Increases in National Insurance benefits

| Date of increase | Real take home pay for average worker (a) | Real value of single pension (b) | Real value of unemployment benefit (man with wife and three children) (c) |

|---|---|---|---|

| March/May 1963 | 100 | 100 | 100 |

| January/March 1965 | 106 | 111 | 110 |

| October 1967 | 108 | 114 | 113 |

| November 1969 | 110 | 114 | 116 |

- Notes

- (a) As quoted by text: "Based on average earnings for adult male manual workers in manufacturing, allowing for income tax and national insurance contributions."

- (b) As quoted by text: "Calculated on the special price index for single pensioner households published by the Employment and Productivity Gazette adjusted for housing expenditure using the housing component of the retail price index. Since a disproportionate number of pensioners have controlled tenancies, this may overstate the increase in prices."

- (c) This column is deflated by use of the Retail Price Index

Social security benefits as a percentage of average earnings

| Government | Sickness/unemployment benefit a | a plus earnings related supplement | Retirement pensions c | Supplementary allowance/benefits d | Family allowance/child benefit e | |

|---|---|---|---|---|---|---|

| Labour (1951) | 25.7 | 25.7 | 30.4 | 30.4 | 8.0 | |

| Conservative (1963) | 33.8 | 33.8 | 33.0 | 31.6 | 5.3 | |

| Labour (1969) | 32.4 | 52.3 | 32.4 | 31.4 | 3.8 | |

| Conservative (1973) | 29.1 | 46.2 | 30.5 | 28.5 | 3.0 | |

| Labour (1978) | 30.5 | 44.4 | 37.4 | 30.2 | 3.7 | |

- a,b Man plus dependent wife.

- c Man plus dependent wife on his insurance.

- d Married couple.

- e For one child.

Social policy benefits and earnings under the Labour Government 1964–69

| Year | Unemployment, sickness, and retirement benefits (single) | Retirement pension (married) | National assistance/supplementary benefit (married couple) | Adult male manual workers (weekly earnings) | Adult male administrative, technical, and clerical employees (weekly earnings) |

|---|---|---|---|---|---|

| 1963 | 100 | 100 | 100 | 100 | 100 |

| 1969 | 148 | 149 | 150 | 154 | 148 |

Supplementary benefits rates as a proportion of income

| Year | End of year (a) | |

|---|---|---|

| As % of gross average earnings | ||

| Ordinary rate | Long term rate | |

| 1973 | 28.5 | 31.4 |

| 1974 | 28.1 | 33.6 |

| 1975 | 29.8 | 36.2 |

| 1976 | 30.8 | 37.1 |

| 1977 | 32.3 | 38.9 |

| 1978 | 30.6 | 37.8 |

| As % of net income (b) at average earnings | ||

| Ordinary rate | Long term rate | |

| 1973 | 37.9 | 41.8 |

| 1974 | 38.8 | 46.5 |

| 1975 | 42.4 | 51.5 |

| 1976 | 43.9 | 52.9 |

| 1977 | 44.1 | 53.1 |

| 1978 | 41.6 | 51.4 |

| Date of introduction | Single | Married couple |

|---|---|---|

| 1973 | 14.0 | 10.3 |

| 1974 | 23.8 | 19.8 |

| 1975 (April) | 25.0 | 20.4 |

| 1975 (November) | 25.7 | 21.4 |

| 1976 | 23.6 | 20.3 |

| 1977 | 23.4 | 20.4 |

| 1978 | 28.0 | 23.5 |

Households dependent on Supplementary Benefit

| Year | Pensioners | Under pensionable age family head or single parent | ||||

|---|---|---|---|---|---|---|

| (as % of total) | Unemployed | Normally in full-time work | Sick or disabled | Others | ||

| 1974 | 2,680 | (52%) | 450 | 360 | 480 | 1,170 |

| 1976 | 2,800 | (44%) | 1,080 | 890 | 280 | 1,300 |

Changes in real terms in social security benefits

| Year | Supplementary benefits (a) | Sickness/unemployment benefit (b) | Retirement pensions (c) | Family allowance/child benefit (d) |

|---|---|---|---|---|

| 1964 | 146 | 176 | 149 | 85 |

| 1965 | 166 | 199 | 168 | 85 |

| 1966 | 165 | 199 | 168 | 82 |

| 1967 | 173 | 318 | 173 | 80 |

| 1968 | 173 | 318 | 173 | 77 |

| 1969 | 172 | 329 | 172 | 72 |

| 1970 | 173 | 329 | 172 | 69 |

| 1971 | 178 | 354 | 177 | 80 |

| 1972 | 187 | 356 | 183 | 75 |

| 1973 | 186 | 342 | 191 | 68 |

| 1974 | 191 | 345 | 216 | 78 |

| 1975 | 187 | 327 | 215 | 69 |

| 1976 | 189 | 323 | 219 | 72 |

| 1977 | 190 | 326 | 221 | 69 |

| 1978 | 189 | 321 | 228 | 82 |

| 1979 | 190 | 308 | 232 | 102 |

- Notes

- (a) Refers to married couple.

- (b) Refers to man plus dependent wife.

- (c) Refers to man plus wife on his insurance. After 1971 refers to recipients under 80 years old.

- (d) Includes family allowance and tax allowance combined for second child up to 1977, when these were unified into the child benefit.

Percentage change in social security benefits, prices and earnings

| Date | Unemployment and sickness benefit (a) | Retirement pension (b) | Prices (c) | Average earnings (d) |

|---|---|---|---|---|

| July 1974 | 17.0 | 29.0 | 13.5 | 12.9 |

| April 1975 | 14.0 | 16.0 | 17.7 | 17.4 |

| November 1975 | 13.3 | 14.7 | 11.7 | 10.7 |

| November 1976 | 16.2 | 15.0 | 15.0 | 12.8 |

| November 1977 | 14.0 | 14.4 | 13.0 | 9.6 |

| November 1978 | 7.1 | 11.4 | 8.1 | 14.6 |

| Total increase October 1973 – 1978 | 114.3 | 151.6 | 109.6 | 107.9 |

- (a) Single person.

- (b) Single pensioner under age 80.

- (c) General index of retail prices.

- (d) Average gross weekly earnings of full-time adult male manual workers. For November 1978, October 1977 to October 1978 increase used.

Unemployment and sickness benefits as a percentage of income

| Year | Single person | Married couple | Married couple with two children | |||

|---|---|---|---|---|---|---|

| Excl. ERS | Inc. ERS (c) | Excl. ERS | Inc. ERS (c) | Excl. ERS | Inc. ERS (c) | |

| 1965 | 27.0 | 27.0 | 41.2 | 41.2 | 49.3 | 49.3 |

| 1970 | 25.0 | 53.3 | 38.4 | 65.2 | 48.3 | 72.7 |

| 1973 | 24.8 | 48.4 | 38.7 | 61.5 | 49.5 | 70.6 |

| 1974 | 25.6 | 48.6 | 39.5 | 61.6 | 50.2 | 70.3 |

| 1975 | 24.5 | 45.9 | 38.0 | 58.4 | 48.3 | 67.0 |

| 1976 | 24.9 | 46.7 | 38.3 | 59.1 | 48.4 | 67.3 |

| 1977 | 25.8 | 47.9 | 39.1 | 59.9 | 49.7 | 68.8 |

| 1978 | 25.4 | 45.1 | 38.8 | 57.4 | 49.6 | 66.9 |

- (a) After allowing for income tax and national insurance contributions.

- (b) Average earnings of adult male manual workers.

- (c) Earnings Related Supplement calculated using average earnings in October of the relevant tax year.

The real value of social security benefits, 1948–75

| Date | Unemployment benefit[40] | Retirement pension[40] | Supplementary benefit[40] | Child support: one child[40] | Child support: three children[40] |

|---|---|---|---|---|---|

| 1948, July | 19.64 | 19.64 | 17.93 | 4.87 | 17.60 |

| 1961, April | 26.88 | 26.88 | 25.31 | 4.36 | 16.62 |

| 1971, September | 34.96 | 34.96 | 33.39 | 4.27 | 15.36 |

| 1975, November | 36.47 | 42.96 | 35.10 | 3.67 | 13.81 |

References

- Gøsta Esping-Andersen (1998). The Three Worlds of Welfare Capitalism. Princeton, New Jersey: Princeton University Press; Polity Press. ISBN 9780745607962. https://books.google.com/books/about/?id=zW2ungEACAAJ

- "Britain 1905–1975: The Liberal reforms 1906–1914". GCSE Bitesize. BBC.

- Jane Lewis, "The English Movement for Family Allowances, 1917–1945." Histoire sociale/Social History 11.22 (1978) pp. 441–59.

- John Macnicol, Movement for Family Allowances, 1918–45: A Study in Social Policy Development (1980).

- Steve Schifferes (26 July 2005). "Britain's long road to the welfare state". BBC News.

- "Why were school dinners brought in?". National Archives.

- "1908 Children's Act was created to protect the poorest children in society from abuse". Intriguing History. 12 January 2012.

- Gazeley, Ian (17 July 2003). Poverty in Britain 1900–1945. Palgrave Macmillan. ISBN 978-0333716199.

- "Case Study: Working People" (PDF). National Archives. Retrieved 30 August 2015.

- David Taylor (1988). Mastering Economic and Social History. Macmillan Education. ISBN 978-0-333-36804-6.

- Spicker, Paul. "Social policy in the UK". spicker.uk. Retrieved 23 July 2015.

- "The Beveridge Report and the postwar reforms" (PDF). Policy Studies Institute. Retrieved 9 June 2012.

- "A history of NHS spending in the UK".

- "A brief history of health and care funding reform in England". Socialist Health Association. Retrieved 21 December 2013.

- "NHS Charges, Third Report of Session 2005–06" (PDF). publications.parliament.uk. House of Commons Health Committee. 18 July 2006. Retrieved 21 August 2017.

- Welfare spending for UK's poorest shrinks by £37bn The Guardian

- "Welfare spending p.132" (PDF). 4 December 2012. Retrieved 8 January 2016.

- "Benefits for unemployed people" (PDF). A Survey of the UK Benefit System. Institute for Fiscal Studies. November 2012. p. 16.

- "Benefits for people on low incomes" (PDF). A Survey of the UK Benefit System. Institute for Fiscal Studies. November 2012. p. 25.

- Bartholomew, James (2013). The Welfare State We're In (2nd ed.). Biteback Publishing. p. 480. ISBN 978-1849544504.

- Steffen Mau, "The Moral Economy of Welfare States: Britain and Germany Compared." Routledge, (2004) pp.7.

- Christopher Pierson and Francis Castles, "The Welfare State Reader" Polity (2006) pp.68-75

- Steffen Mau, "The Moral Economy of Welfare States: Britain and Germany Compared." Routledge, (2004) pp.2.

- ‘I degraded myself’: women driven to sex work by benefits system The Guardian

- "David Cameron: 'Don't complain about welfare cuts, go and find work'". 23 January 2012. Retrieved 5 January 2013.

- "Conservative conference: Welfare needs 'cultural shift'". 8 October 2012. Retrieved 5 January 2013.

- Grice, Andrew (4 January 2013). "Voters 'brainwashed by Tory welfare myths', shows new poll". The Independent. Retrieved 5 January 2013.

- "Support for benefit cuts dependent on ignorance, TUC-commissioned poll finds". TUC. Retrieved 5 January 2013.

- Dixon, Hayley (13 December 2013). "Majority of benefit cheats not prosecuted, official figures show". The Telegraph. Retrieved 24 February 2014.

- "Fraud and Error in the Benefit System: 2012/13 Estimates (Great Britain)" (PDF). gov.uk. Department for Work and Pensions. January 2014. Retrieved 21 August 2017.

- Kinship carers at risk of poverty and debt due to welfare cuts, says charity The Guardian

- Church of England bishops demand action over hunger

- Majority of Britons think empathy is on the wane The Guardian

- Welfare spending for UK's poorest shrinks by £37bn The Guardian

- UK social security payments 'at lowest level since launch of welfare state' The Guardian

- Labour and inequality: sixteen fabian essays edited by Peter Townsend and Nicholas Bosanquet

- The Labour Party in Crisis by Paul Whiteley

- Taxation, Wage Bargaining and Unemployment by Isabela Mares

- Labour and Equality : A Fabian Study of Labour in Power, 1974–79 edited by Nick Bosanquet and Peter Townsend

- The Welfare State in Britain since 1945 by Rodney Lowe

Bibliography

- Béland, Daniel, and Alex Waddan. "Conservatives, partisan dynamics and the politics of universality: reforming universal social programmes in the UK and Canada." Journal of Poverty and Social Justice 22#2 (2014): 83–97.

- Calder, Gideon, and Jeremy Gass. Changing Directions of the British Welfare State (University of Wales Press, 2012).

- Esping-Andersen, Gosta; The Three Worlds of Welfare Capitalism, Princeton NJ: Princeton University Press (1990).

- Ferragina, Emanuele and Seeleib-Kaiser, Martin. "Welfare Regime Debate: Past, Present, Futures?" Policy & Politics 39#4 pp. 583–611 (2011).http://www.ingentaconnect.com/content/tpp/pap/2011/00000039/00000004/art00010.**

- Fraser, Derek. The evolution of the British welfare state: a history of social policy since the Industrial Revolution (2nd ed. 1984).

- Gilbert, Bentley B. The Evolution Of National Insurance In Great Britain: The Origins of the Welfare State (1966).

- Harris, Bernard. The origins of the British welfare state: social welfare in England and Wales, 1800–1945 (Palgrave, 2004).

- Häusermann, Silja, Georg Picot, and Dominik Geering. "Review article: Rethinking party politics and the welfare state–recent advances in the literature." British Journal of Political Science 43.01 (2013): 221–40. online

- Hay, Roy. "Employers and social policy in Britain: The evolution of welfare legislation, 1905–14." Social History 2.4 (1977): 435–55.

- Hay, James Roy. Origins of the Liberal Welfare Reforms, 1906–14 (1975) 78pp full text online

- Levine-Clark, Marjorie. Unemployment, Welfare, and Masculine Citizenship: So Much Honest Poverty in Britain, 1870–1930 (Springer, 2015).

- Mommsen, Wolfgang J., and Wolfgang Mock, eds. The emergence of the welfare state in Britain and Germany, 1850–1950 (Taylor & Francis, 1981).

- Slater, Tom. "The myth of “Broken Britain”: welfare reform and the production of ignorance." Antipode 46.4 (2014): 948–69. online

- Weiler, Peter. The New Liberalism: Liberal Social Theory in Great Britain, 1889–1914 (Routledge, 2016).

- Welshman John. Underclass: A History of the Excluded, 1880–2000 (2006) excerpt

External links

- Text of the Beveridge Report

- The Welfare State – Never Ending Reform Brief history of the Welfare State by Frank Field (BBC website)

- The UK Economy at the Crossroads, research paper from the Center for Economic and Policy Research