Customs declaration

A Customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory (country's borders).[1] Most countries require travellers to complete a customs declaration form when bringing notified goods (alcoholic drinks, tobacco products, animals, fresh food, plant material, seeds, soils, meats, and animal products) across international borders. Posting items via international mail also requires the sending party to complete a customs declaration form.

The declaration form helps the customs to control the goods that entered the country, which can affect the country's economy, security or environment. A levy duty may be applied.

Travellers have to declare everything they acquired abroad and possibly pay customs duty tax on goods. Some countries offer a duty-free allowance of certain products which may not need to be declared explicitly.[2]

Types of forms

- When an individual is transporting the goods, the form is called a customs arrival card, or a landing card, or an entry voucher. The traveller is required to fill out the form, sign and submit to the customs or border protection officer before entering the country.[3]

- When an individual or an organization ships goods across the borders, one must use other customs declaration forms, such as a commercial invoice, or a proforma invoice, an import declaration form, an ATA Carnet, or a re-export declaration. Incoterms on these forms define the shipment and customs declaration. A Harmonized System Code (Hs code or harmonized code) might be required to define the type of goods and their associated tax rate. The importer is usually required to provide information about the goods' country of origin and the certificate of origin. Errors on the forms can cause delays or confiscation of the goods. For that reason, importers often use a customs brokerage to clear goods through customs.[4]

Some nations require a customs declaration form from each person crossing the border, while other nations require one form per family traveling together. A family is usually defined as family members residing in the same household, who are related by marriage, adoption, blood, or domestic relationship.[5][6][7]

Selected jurisdictions

Kuwait

The Kuwait Customs

- Alcohol of all kinds is forbidden to enter.

- Materials containing packaging. In quantities. Will be considered commercial and require a temporary import license

- Fees for commercial materials 5%

- Customs Broker https://www.eqab.net

Australia

The Department of Immigration and Border Protection handles the customs imports and exports of Australia. Incoming passengers are required to declare for inspection all food, plant material and animal products on arrival in Australia.[8]

Canada

Customs declaration managed by the Canada Border Services Agency:

- Each Canadian resident returning to Canada can have a personal exception on goods and gifts purchased or received in another country. Personal exceptions are based on the length of the absence from the country. 24 hours, 48 hours, or 7 days.

- Alcohol limitations: 1.5 L of wine or 1.14 L of liquor or 24 x 355 ml cans or bottles (8.5 L) of beer or ale. (Must be of legal age in the province of importation.) Tobacco limitations, 200 cigarettes, 200 tobacco sticks, 50 cigars or cigarillos and 200 grams of manufactured tobacco (Special Duty may apply).

- Each individual must declare travelling with $10,000 or more in cash.[9][10]

China

General Administration of Customs handles the customs imports and exports for the Government of China.[11][12]

European Union

The European Union has a European Commission for Taxation and Customs Union. The European Union Customs Union sets trade in the EU. The European Customs Information Portal is an importing and exporting service provided by the EU.[13][14] Some territories within the EU do not participate in the customs union, usually as a result of their geographic circumstances. Through agreements, the EU has customs unions with Andorra, San Marino, and Turkey respectively, with the exceptions of certain goods.[15][16]

Hong Kong

The Customs and Excise Department handles the customs imports and exports for Hong Kong.[17] [18]

India

The Central Board of Indirect Taxes and Customs handles the customs imports and exports of India.[19]

Items prohibited for import:[20]

- Maps and literature where Indian external boundaries have been shown incorrectly

- Narcotic drugs and psychotropic substances

- Goods violating any of the legally enforceable intellectual property rights

- Wildlife products

- Counterfeit currency notes/coin or fake currency notes

- Specified Live Birds and animals

Indonesia

The Directorate General of Customs and Excise handles the customs imports and exports of Indonesia.[21]

New Zealand

The New Zealand Customs Service handles the customs imports and exports of New Zealand.[22][23]

Pakistan

Pakistan Customs handles the customs imports and exports for Pakistan and control of the list of tariffs in Pakistan.[24]

Philippines

The Bureau of Customs handles the customs imports and exports for Philippines.[25]

Poland

The Customs Service of Poland handles the customs imports and exports for Poland[26]

Russia

The Federal Customs Service of Russia handles the customs imports and exports for the Russia. Russian Customs Tariff cover the Federal Customs Service of Russia [27]

Singapore

Singapore Customs handles the customs imports and exports for Singapore.[28]

South Korea

Korea Customs Service handles the customs imports and exports for South Korea.[29]

Sri Lanka

Sri Lanka Customs handles the customs imports and exports for Sri Lanka[30]

Sweden

The Swedish Customs Service handles the customs imports and exports for Sweden.[31]

United Kingdom

The UK Border Agency handles customs in the United Kingdom. The UK Border Agency works with HM Revenue and Customs.[32][33] HMRC's Customs Declaration Service (CDS) is replacing the long-standing CHIEF system of customs declaration.[34]

When the Northern Ireland Protocol comes into effect on 1 January 2021, the Customs Declaration Service will also be used for declarations on goods movements to or from Northern Ireland, including goods moving from Great Britain to Northern Ireland,[34] but other customs declarations will continue to use CHIEF pending a longer-term move to the CDS. HMRC explains that "CHIEF is a reliable and robust platform" but "its age means it can’t easily keep pace with new technology".[35]

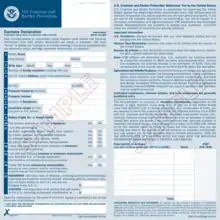

United States

- U.S. Customs asks the Head of a household to complete the form (CBP Form 6059B as of July 2016). Family members residing in the same household, who are related by marriage, adoption, blood, or domestic relationship, can use one form.

- For returning U.S. residents: The personal duty exemption for each family member is $800.00. For example, a family of five members returning is allowed a combined personal duty exemption of $4,000 (calculated as $800 for each family member multiplied by 5).[5][36]

- For international visitors: US laws allow visitors some exemptions, like tobacco, gifts, personal effects, etc. The head of a household can complete a form for a family. It is good to check the current duties and exemptions to avoid tax or loss of goods.

- Anyone travelling with more than $10,000 must declare it.[5][37][38]

- At some international airports, the US operates United States border preclearance stations, where U.S. Immigration and Customs Enforcement is done before boarding the international flight.[39]

- If exporting goods that are valued more than $2,500, an extra form is required: the Electronic Export Information (EEI) form. The Automated Export System (AES) is the system used by U.S. exporters to electronically declare their international exports. This information is used by the Census Bureau to help compile U.S. export and trade statistics.[40]

See also

References

- "Customs declaration". European Commission.

- "Bringing goods into the UK". GOV.UK.

- "Carnet Countries". atacsrnet.com - Corporation for International Business.

- "Importers - Who needs a Customs Broker to Help Clear Goods Through CBP?". US Customs and Border Patrol.

- "Declaration Form 6059B, CBP Issues New Customs Declarations Form, Features Expanded Definition of Family Members". U.S. Customs and Border Protection. Archived from the original on 2016-09-15. Retrieved 2016-08-31.

- "NZIS431 - New Zealand Passenger Departure Card". Statistics New Zealand. Archived from the original on 2008-10-15.

- Department of Immigration and Citizenship. "Passenger Cards". Australian Government. Archived from the original on 2015-02-13. Retrieved 2016-08-31.

- Australian Customs Service

- Canada Customs declaration

- Canada Customs, Travelers, Visitors to Canada

- China, General Administration of Customs

- People's Republic of China, Standards on Completion of Customs Declaration Forms for Import/Export Goods, 08/26/2005

- European Commission for Taxation and Customs Union

- FAQ: Customs, Taxation and Customs Union, European Commission, Retrieved 20 August 2016.

- EU Customs unions, Taxation and Customs Union, European Commission. Retrieved 20 August 2016.

- EU, Customs declaration

- Hong Kong Customs and Excise (official website) (in English and Chinese)

- Hong Kong, Types of Declaration Forms

- "India, Arriving at consensus with states critical to implement GST: Hasmukh Adhia", Live Mint, 6 August 2016

- "cs-bgge-declare-form1-ason19feb2014.pdf" (PDF). cbic.gov.in/ (pdf). Central Board of Indirect Taxes and Customs. p. 2. Retrieved 19 April 2020.

- Indonesia Customs and Excise (official website) (in English and Indonesian)

- New Zealand Customs Service

- "New Zealand commercial declaration". Archived from the original on 2016-08-25. Retrieved 2016-09-01.

- Pakistan Customs

- Philippines Bureau of Customs

- Customs Service of Poland

- Federal Customs Service of Russia

- Singapore Customs

- Korea Customs Service, Official website (in Korean)

- Sri Lanka Customs at www.customs.gov.lk

- Swedish Customs Service

- Cabinet Office, Security in a global hub – Establishing the UK’s new border arrangements Archived 2008-09-06 at the Wayback Machine", last updated 16 June 2009.

- "UK Border Agency". GOV.UK. 2013. Retrieved 27 March 2013.

- HMRC, Customs Declaration Service, updated 14 December 2018, accessed 8 November 2020

- HMRC, Customs Declaration Service Toolkit, published October 2020, accessed 8 November 2020

- cbp.gov, US Customs, US Citizens travelling

- cbp.gov, US Customs, US international visitors

- cbp.gov, US Customs, For Canadian and Mexican Citizens

- Batrawy, Aya. (January 26, 2014.) "US Customs passenger facility opens in UAE". Associated Press. Seattle Post Intelligencer. Archived from the original Archived January 26, 2014, at the Wayback Machine on January 26, 2014.

- cbp.gov, US Customs, When to apply for an Electronic Export Information (EEI)

External links

- U.S. Customs and Border Protection at cbp.gov

- U.S. The Department of Homeland Security at dhs.gov

- US Coastguard at gocoastguard.com

- Canada Border Services Agency at cbsa-asfc.gc.ca

- Customs Declaration Form / Bill of Entry Export for South Africa

- Customs, How to complete the customs declaration for Belize

- Customs Declaration for Japan

- Japan customs declaration form

Gallery

International Customs sign

International Customs sign Detroit Customs stop

Detroit Customs stop US Forces Customs patch

US Forces Customs patch Customs control at Sheremetyevo-2 international airport

Customs control at Sheremetyevo-2 international airport Canadian Customs and Immigration sign

Canadian Customs and Immigration sign U.S. CBP officer directing a truck

U.S. CBP officer directing a truck US CBP Badge

US CBP Badge Tape used by U.S. Customs and Border Protection to reseal packages that they have searched, and to indicate that they have done so

Tape used by U.S. Customs and Border Protection to reseal packages that they have searched, and to indicate that they have done so