History of bitcoin

Bitcoin is a cryptocurrency, a digital asset designed to work as a medium of exchange that uses cryptography to control its creation and management, rather than relying on central authorities.[1] It was invented and implemented by the presumed pseudonymous Satoshi Nakamoto, who integrated many existing ideas from the cypherpunk community. Over the course of bitcoin's history, it has undergone rapid growth to become a significant currency both on- and offline. From the mid 2010s, some businesses began accepting bitcoin in addition to traditional currencies.[2]

Pre-history

Prior to the release of bitcoin there were a number of digital cash technologies starting with the issuer based ecash protocols of David Chaum and Stefan Brands.[3][4][5] The idea that solutions to computational puzzles could have some value was first proposed by cryptographers Cynthia Dwork and Moni Naor in 1992. The idea was independently rediscovered by Adam Back who developed hashcash, a proof-of-work scheme for spam control in 1997.[6] The first proposals for distributed digital scarcity based cryptocurrencies were Wei Dai's b-money[7] and Nick Szabo's bit gold.[8][9] Hal Finney developed reusable proof of work (RPOW) using hashcash as its proof of work algorithm.[10]

In the bit gold proposal which proposed a collectible market-based mechanism for inflation control, Nick Szabo also investigated some additional aspects including a Byzantine fault-tolerant agreement protocol based on quorum addresses to store and transfer the chained proof-of-work solutions, which was vulnerable to Sybil attacks, though.[9]

Creation

On 18 August 2008, the domain name bitcoin.org was registered.[11] Later that year, on 31 October, a link to a paper authored by Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System[12] was posted to a cryptography mailing list.[13] This paper detailed methods of using a peer-to-peer network to generate what was described as "a system for electronic transactions without relying on trust".[14][15][16] On 3 January 2009, the bitcoin network came into existence with Satoshi Nakamoto mining the genesis block of bitcoin (block number 0), which had a reward of 50 bitcoins.[14][17] Embedded in the coinbase of this block was the text:

The Times Jan/03/2009 Chancellor on brink of second bailout for banks.[18]

The text refers to a headline in The Times published on 3 January 2009.[19] This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking.[20]:18

The first open source bitcoin client was released on 9 January 2009, hosted at SourceForge.[21][22]

One of the first supporters, adopters, contributors to bitcoin and receiver of the first bitcoin transaction was programmer Hal Finney. Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world's first bitcoin transaction on 12 January 2009 (bloc 170).[23][24] Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.[14]

In the early days, Nakamoto is estimated to have mined 1 million bitcoins.[25] Before disappearing from any involvement in bitcoin, Nakamoto in a sense handed over the reins to developer Gavin Andresen, who then became the bitcoin lead developer at the Bitcoin Foundation, the 'anarchic' bitcoin community's closest thing to an official public face.[26]

The value of the first bitcoin transactions were negotiated by individuals on the bitcoin forum with one notable transaction of 10,000 BTC used to indirectly purchase two pizzas delivered by Papa John's.[14]

On 6 August 2010, a major vulnerability in the bitcoin protocol was spotted. Transactions weren't properly verified before they were included in the transaction log or blockchain, which let users bypass bitcoin's economic restrictions and create an indefinite number of bitcoins.[27][28] On 15 August, the vulnerability was exploited; over 184 billion bitcoins were generated in a transaction, and sent to two addresses on the network. Within hours, the transaction was spotted and erased from the transaction log after the bug was fixed and the network forked to an updated version of the bitcoin protocol.[29] This was the only major security flaw found and exploited in bitcoin's history.[27][28][30]

Satoshi Nakamoto

"Satoshi Nakamoto" is presumed to be a pseudonym for the person or people who designed the original bitcoin protocol in 2008 and launched the network in 2009. Nakamoto was responsible for creating the majority of the official bitcoin software and was active in making modifications and posting technical information on the bitcoin forum.[14] There has been much speculation as to the identity of Satoshi Nakamoto with suspects including Dai, Szabo, and Finney – and accompanying denials.[31][32] The possibility that Satoshi Nakamoto was a computer collective in the European financial sector has also been discussed.[33]

Investigations into the real identity of Satoshi Nakamoto were attempted by The New Yorker and Fast Company. The New Yorker's investigation brought up at least two possible candidates: Michael Clear and Vili Lehdonvirta. Fast Company's investigation brought up circumstantial evidence linking an encryption patent application filed by Neal King, Vladimir Oksman and Charles Bry on 15 August 2008, and the bitcoin.org domain name which was registered 72 hours later. The patent application (#20100042841) contained networking and encryption technologies similar to bitcoin's, and textual analysis revealed that the phrase "... computationally impractical to reverse" appeared in both the patent application and bitcoin's whitepaper.[12] All three inventors explicitly denied being Satoshi Nakamoto.[34][35]

In May 2013, Ted Nelson speculated that Japanese mathematician Shinichi Mochizuki is Satoshi Nakamoto.[36] Later in 2013 the Israeli researchers Dorit Ron and Adi Shamir pointed to Silk Road-linked Ross William Ulbricht as the possible person behind the cover. The two researchers based their suspicion on an analysis of the network of bitcoin transactions.[37] These allegations were contested[38] and Ron and Shamir later retracted their claim.[39]

Nakamoto's involvement with bitcoin does not appear to extend past mid-2010.[14] In April 2011, Nakamoto communicated with a bitcoin contributor, saying that he had "moved on to other things".[18]

Stefan Thomas, a Swiss coder and active community member, graphed the time stamps for each of Nakamoto's 500-plus bitcoin forum posts; the resulting chart showed a steep decline to almost no posts between the hours of 5 a.m. and 11 a.m. Greenwich Mean Time. Because this pattern held true even on Saturdays and Sundays, it suggested that Nakamoto was asleep at this time, and the hours of 5 a.m. to 11 a.m. GMT are midnight to 6 a.m. Eastern Standard Time (North American Eastern Standard Time). Other clues suggested that Nakamoto was British: A newspaper headline he had encoded in the genesis block came from the UK-published newspaper The Times, and both his forum posts and his comments in the bitcoin source code used British English spellings, such as "optimise" and "colour".[14]

An Internet search by an anonymous blogger of texts similar in writing to the bitcoin whitepaper suggests Nick Szabo's "bit gold" articles as having a similar author.[31] Nick denied being Satoshi, and stated his official opinion on Satoshi and bitcoin in a May 2011 article.[40]

In a March 2014 article in Newsweek, journalist Leah McGrath Goodman doxed Dorian S. Nakamoto of Temple City, California, saying that Satoshi Nakamoto is the man's birth name. Her methods and conclusion drew widespread criticism.[41][42]

In June 2016, the London Review of Books published a piece by Andrew O'Hagan about Nakamoto.[43]

After a May 2020 YouTube documentary pointed to Adam Back as the creator of bitcoin,[44] widespread discussion ensued. The real identity of Satoshi Nakamoto still remains a matter of dispute.

Growth

2011

Based on bitcoin's open-source code, other cryptocurrencies started to emerge.[45]

The Electronic Frontier Foundation, a non-profit group, started accepting bitcoins in January 2011,[46] then stopped accepting them in June 2011, citing concerns about a lack of legal precedent about new currency systems.[47] The EFF's decision was reversed on 17 May 2013 when they resumed accepting bitcoin.[48]

In June 2011, WikiLeaks[49] and other organizations began to accept bitcoins for donations.

2012

In January 2012, bitcoin was featured as the main subject within a fictionalized trial on the CBS legal drama The Good Wife in the third-season episode "Bitcoin for Dummies". The host of CNBC's Mad Money, Jim Cramer, played himself in a courtroom scene where he testifies that he doesn't consider bitcoin a true currency, saying, "There's no central bank to regulate it; it's digital and functions completely peer to peer".[50]

In September 2012, the Bitcoin Foundation was launched to "accelerate the global growth of bitcoin through standardization, protection, and promotion of the open source protocol". The founders were Gavin Andresen, Jon Matonis, Patrick Murck, Charlie Shrem, and Peter Vessenes.[51]

In October 2012, BitPay reported having over 1,000 merchants accepting bitcoin under its payment processing service.[52] In November 2012, WordPress started accepting bitcoins.[53]

2013

In February 2013, the bitcoin-based payment processor Coinbase reported selling US$1 million worth of bitcoins in a single month at over $22 per bitcoin.[54] The Internet Archive announced that it was ready to accept donations as bitcoins and that it intends to give employees the option to receive portions of their salaries in bitcoin currency.[55]

In March, the bitcoin transaction log, called the blockchain, temporarily split into two independent chains with differing rules on how transactions were accepted. For six hours two bitcoin networks operated at the same time, each with its own version of the transaction history. The core developers called for a temporary halt to transactions, sparking a sharp sell-off.[56] Normal operation was restored when the majority of the network downgraded to version 0.7 of the bitcoin software.[56] The Mt. Gox exchange briefly halted bitcoin deposits and the exchange rate briefly dipped by 23% to $37 as the event occurred[57][58] before recovering to previous level of approximately $48 in the following hours.[59] In the US, the Financial Crimes Enforcement Network (FinCEN) established regulatory guidelines for "decentralized virtual currencies" such as bitcoin, classifying American bitcoin miners who sell their generated bitcoins as Money Service Businesses (or MSBs), that may be subject to registration and other legal obligations.[60][61][62]

In April, payment processors BitInstant and Mt. Gox experienced processing delays due to insufficient capacity[63] resulting in the bitcoin exchange rate dropping from $266 to $76 before returning to $160 within six hours.[64] Bitcoin gained greater recognition when services such as OkCupid and Foodler began accepting it for payment.[65]

On 15 May 2013, the US authorities seized accounts associated with Mt. Gox after discovering that it had not registered as a money transmitter with FinCEN in the US.[66][67]

On 17 May 2013, it was reported that BitInstant processed approximately 30 percent of the money going into and out of bitcoin, and in April alone facilitated 30,000 transactions,[68]

On 23 June 2013, it was reported that the US Drug Enforcement Administration listed 11.02 bitcoins as a seized asset in a United States Department of Justice seizure notice pursuant to 21 U.S.C. § 881.[69] This marked the first time a government agency claimed to have seized bitcoin.[70][71]

In July 2013, a project began in Kenya linking bitcoin with M-Pesa, a popular mobile payments system, in an experiment designed to spur innovative payments in Africa.[72] During the same month the Foreign Exchange Administration and Policy Department in Thailand stated that bitcoin lacks any legal framework and would therefore be illegal, which effectively banned trading on bitcoin exchanges in the country.[73][74]

On 6 August 2013, Federal Judge Amos Mazzant of the Eastern District of Texas of the Fifth Circuit ruled that bitcoins are "a currency or a form of money" (specifically securities as defined by Federal Securities Laws), and as such were subject to the court's jurisdiction,[75][76] and Germany's Finance Ministry subsumed bitcoins under the term "unit of account" – a financial instrument – though not as e-money or a functional currency, a classification nonetheless having legal and tax implications.[77]

In October 2013, the FBI seized roughly 26,000 BTC from website Silk Road during the arrest of alleged owner Ross William Ulbricht.[78][79][80] Two companies, Robocoin and Bitcoiniacs launched the world's first bitcoin ATM on 29 October 2013 in Vancouver, BC, Canada, allowing clients to sell or purchase bitcoin currency at a downtown coffee shop.[81][82][83] Chinese internet giant Baidu had allowed clients of website security services to pay with bitcoins.[84]

In November 2013, the University of Nicosia announced that it would be accepting bitcoin as payment for tuition fees, with the university's chief financial officer calling it the "gold of tomorrow".[85] During November 2013, the China-based bitcoin exchange BTC China overtook the Japan-based Mt. Gox and the Europe-based Bitstamp to become the largest bitcoin trading exchange by trade volume.[86]

In December 2013, Overstock.com[87] announced plans to accept bitcoin in the second half of 2014. On 5 December 2013, the People's Bank of China prohibited Chinese financial institutions from using bitcoins.[88] After the announcement, the value of bitcoins dropped,[89] and Baidu no longer accepted bitcoins for certain services.[90] Buying real-world goods with any virtual currency had been illegal in China since at least 2009.[91]

2014

In January 2014, Zynga[92] announced it was testing bitcoin for purchasing in-game assets in seven of its games. That same month, The D Las Vegas Casino Hotel and Golden Gate Hotel & Casino properties in downtown Las Vegas announced they would also begin accepting bitcoin, according to an article by USA Today. The article also stated the currency would be accepted in five locations, including the front desk and certain restaurants.[93] The network rate exceeded 10 petahash/sec. TigerDirect[94] and Overstock.com[95] started accepting bitcoin.

In early February 2014, one of the largest bitcoin exchanges, Mt. Gox,[96] suspended withdrawals citing technical issues.[97] By the end of the month, Mt. Gox had filed for bankruptcy protection in Japan amid reports that 744,000 bitcoins had been stolen.[98] Months before the filing, the popularity of Mt. Gox had waned as users experienced difficulties withdrawing funds.[99]

In June 2014 the network exceeded 100 petahash/sec. On 18 June 2014, it was announced that bitcoin payment service provider BitPay would become the new sponsor of St. Petersburg Bowl under a two-year deal, renamed the Bitcoin St. Petersburg Bowl. Bitcoin was to be accepted for ticket and concession sales at the game as part of the sponsorship, and the sponsorship itself was also paid for using bitcoin.[100]

In July 2014 Newegg and Dell[101] started accepting bitcoin.

In September 2014 TeraExchange, LLC, received approval from the U.S.Commodity Futures Trading Commission "CFTC" to begin listing an over-the-counter swap product based on the price of a bitcoin. The CFTC swap product approval marks the first time a U.S. regulatory agency approved a bitcoin financial product.[102]

In December 2014 Microsoft began to accept bitcoin to buy Xbox games and Windows software.[103]

In 2014, several light-hearted songs celebrating bitcoin such as the "Ode to Satoshi"[104] have been released.[105]

A documentary film, The Rise and Rise of Bitcoin, was released in 2014, featuring interviews with bitcoin users, such as a computer programmer and a drug dealer.[106]

2015

In January 2015 Coinbase raised US$75 million as part of a Series C funding round, smashing the previous record for a bitcoin company. Less than one year after the collapse of Mt. Gox, United Kingdom-based exchange Bitstamp announced that their exchange would be taken offline while they investigate a hack which resulted in about 19,000 bitcoins (equivalent to roughly US$5 million at that time) being stolen from their hot wallet.[107] The exchange remained offline for several days amid speculation that customers had lost their funds. Bitstamp resumed trading on 9 January after increasing security measures and assuring customers that their account balances would not be impacted.[108]

In February 2015, the number of merchants accepting bitcoin exceeded 100,000.[109]

In October 2015, a proposal was submitted to the Unicode Consortium to add a code point for the bitcoin symbol.[110]

2016

In January 2016, the network rate exceeded 1 exahash/sec.

In March 2016, the Cabinet of Japan recognized virtual currencies like bitcoin as having a function similar to real money.[111] Bidorbuy, the largest South African online marketplace, launched bitcoin payments for both buyers and sellers.[112]

In July 2016, researchers published a paper showing that by November 2013 bitcoin commerce was no longer driven by "sin" activities but instead by legitimate enterprises.[113]

In August 2016, a major bitcoin exchange, Bitfinex, was hacked and nearly 120,000 BTC (around $60m) was stolen.[114]

In November 2016, the Swiss Railway operator SBB (CFF) upgraded all their automated ticket machines so that bitcoin could be bought from them using the scanner on the ticket machine to scan the bitcoin address on a phone app.[115]

Bitcoin generates more academic interest year after year; the number of Google Scholar articles published mentioning bitcoin grew from 83 in 2009, to 424 in 2012, and 3580 in 2016. Also, the academic journal Ledger published its first issue. It is edited by Peter Rizun.

2017

The number of businesses accepting bitcoin continued to increase. In January 2017, NHK reported the number of online stores accepting bitcoin in Japan had increased 4.6 times over the past year.[116] BitPay CEO Stephen Pair declared the company's transaction rate grew 3× from January 2016 to February 2017, and explained usage of bitcoin is growing in B2B supply chain payments.[117]

Bitcoin gains more legitimacy among lawmakers and legacy financial companies. For example, Japan passed a law to accept bitcoin as a legal payment method,[118] and Russia has announced that it will legalize the use of cryptocurrencies such as bitcoin.[119]

Exchange trading volumes continue to increase. For the 6-month period ending March 2017, Mexican exchange Bitso saw trading volume increase 1500%. Between January and May 2017 Poloniex saw an increase of more than 600% active traders online and regularly processed 640% more transactions.[120]

In June 2017, the bitcoin symbol was encoded in Unicode version 10.0 at position U+20BF (₿) in the Currency Symbols block.[121]

Up until July 2017, bitcoin users maintained a common set of rules for the cryptocurrency.[122] On 1 August 2017 bitcoin split into two derivative digital currencies, the bitcoin (BTC) chain with 1 MB blocksize limit and the Bitcoin Cash (BCH) chain with 8 MB blocksize limit. The split has been called the Bitcoin Cash hard fork.[123]

On 6 December 2017 the software marketplace Steam announced that it would no longer accept bitcoin as payment for its products, citing slow transactions speeds, price volatility, and high fees for transactions.[124]

2018

On 22 January 2018, South Korea brought in a regulation that requires all the bitcoin traders to reveal their identity, thus putting a ban on anonymous trading of bitcoins.[125]

On 24 January 2018, the online payment firm Stripe announced that it would phase out its support for bitcoin payments by late April 2018, citing declining demand, rising fees and longer transaction times as the reasons.[126]

2019

As of September 2019, there were 5,457 bitcoin ATMs worldwide. In August of that year, the countries with highest number of bitcoin ATMs were the United States, Canada, the United Kingdom, Austria, and Spain.

2020

On 2 July 2020, the Indian company 21Shares started to quote a set of bitcoin exchange-traded products (ETP) on the Xetra trading system of the Deutsche Boerse.[127]

On 1 September 2020, the Wiener Börse listed its first 21 titles denominated in cryptocurrencies like bitcoin, including the services of real-time quotation and securities settlement.[128]

On 3 September 2020, the Frankfurt Stock Exchange admitted in its Regulated Market the quotation of the first bitcoin exchange-traded note (ETN), centrally cleared via Eurex Clearing.[129][130]

In October 2020, PayPal announced that it would allow its users to buy and sell bitcoin on its platform, although not to deposit or withdraw bitcoins.[131]

Prices and value history

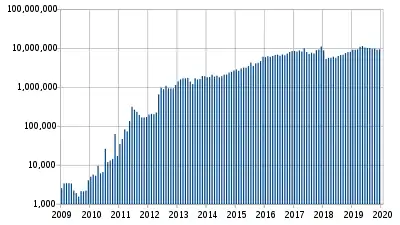

.png.webp)

Among the factors which may have contributed to this rise were the European sovereign-debt crisis – particularly the 2012–2013 Cypriot financial crisis – statements by FinCEN improving the currency's legal standing, and rising media and Internet interest.[132][133][134][135]

Until 2013, almost all market with bitcoins were in United States dollars (US$).[136][137][138]

As the market valuation of the total stock of bitcoins approached US$1 billion, some commentators called bitcoin prices a bubble.[139][140][141] In early April 2013, the price per bitcoin dropped from $266 to around $50 and then rose to around $100. Over two weeks starting late June 2013 the price dropped steadily to $70. The price began to recover, peaking once again on 1 October at $140. On 2 October, The Silk Road was seized by the FBI. This seizure caused a flash crash to $110. The price quickly rebounded, returning to $200 several weeks later.[142] The latest run went from $200 on 3 November to $900 on 18 November.[143] Bitcoin passed US$1,000 on 28 November 2013 at Mt. Gox.

| Date | USD : 1 BTC | Notes |

|---|---|---|

| Jan 2009 – Mar 2010 | basically nothing | No exchanges or market, users were mainly cryptography fans who were sending bitcoins for hobby purposes representing low or no value. In March 2010, user "SmokeTooMuch" auctioned 10,000 BTC for $50 (cumulatively), but no buyer was found.[144] |

| May 2010 | less than $0.01 | On 22 May 2010,[145] Laszlo Hanyecz made the first real-world transaction by buying two pizzas in Jacksonville, Florida, for 10,000 BTC, an amount that would be nearly $750,000 if held in March 2013.[146] |

| Feb 2011 – April 2011 | $1.00 |

Bitcoin takes parity with US dollar.[147] |

| Nov 2013 | $350–$1,242 |

Price rose from $150 in October to $200 in November, reaching $1,242 on 29 November 2013.[148] |

| Apr 2014 | $340–$530 |

The lowest price since the 2012–2013 Cypriot financial crisis had been reached at 3:25 AM on 11 April.[149] |

| 2-3 March 2017 | $1,290+ |

Price broke above the November 2013 high of $1,242[150] and then traded above $1,290.[151] |

| 20 May 2017 | $2,000 |

Price reached a new high, reaching $1,402.03 on 1 May 2017, and over $1,800 on 11 May 2017.[152] On 20 May 2017, the price passed $2,000 for the first time. |

| 1 September 2017 | $5,013.91 |

Price broke $5,000 for the first time.[153] |

| 17-20 November 2017 | $7,600-8,100 |

Briefly topped at $8004.59. This surge in bitcoin may be related to the 2017 Zimbabwean coup d'état. In one bitcoin exchange, 1 BTC topped at nearly $13,500, just shy of 2 times the value of the International market.[154][155] |

| 15 December 2017 | $17,900 |

Price reached $17,900.[156] |

| 17 December 2017 | $19,783.06 |

Price rose 5% in 24 hours, with its value being up 1,824% since 1 January 2017, to reach a new all-time high of $19,783.06.[157] |

| 22 December 2017 | $13,800 |

Price lost one third of its value in 24 hours, dropping below $14,000.[158] |

| 5 February 2018 | $6,200 |

Price dropped by 50% in 16 days, falling below $7,000.[159] |

| 31 October 2018 | $6,300 |

On the 10th anniversary of bitcoin, the price held steady above $6,000 during a period of historically low volatility.[160][161] |

| 7 December 2018 | $3,300 |

Price briefly dipped below $3,300, a 76% drop from the previous year and a 15-month low.[162] |

| 27 July 2020 | $10,944 |

Price surged to the highest in almost a year.[163] |

| 26 October 2020 | $13,000 |

Price stayed above the $10,000 mark for an unprecedented three-month stretch.[164] |

| 16 November 2020 | $16,800 |

Bitcoin has been more expensive in only five other instances in the past decade.[165] |

| 18 November 2020 | $18,000 |

Bitcoin rallies above $18,000 to trade near all-time highs.[166] |

| 24 November 2020 | $19,000 |

Bitcoin price reaches three-year high of more than $19,000.[167] |

| 30 November 2020 | $19,850.11 |

Bitcoin price reached new all-time high of $19,850.11.[168] |

| 16 December 2020 | $20,600 |

Bitcoin reaches all-time high of $20,600.[169] |

| 17 December 2020 | $23,421 |

Bitcoin hits new all-time high of $23,421.[170] |

| 27 December 2020 | $28,000+ |

Bitcoin hits new all-time high above $28,000.[171] |

| 3 January 2021 | $34,800 |

Bitcoin hit a new high of more than $34,800.[172] |

| 7 January 2021 | $40,324 |

Bitcoin's price crossed 40,000 for the first time.[173] |

| 8 January 2021 | $41,973 |

Bitcoin traded as high as $41,973.[174] |

| 11 January 2021 | $33,400 |

Price briefly fell as much as 26% but pared losses to trade around $33,400. [175] |

| 24 January 2021 | $33,078 |

Bitcoin price remains steady at $33,078 as of 10:35 a.m. in London.[176] |

| 3 February 2021 | $36,872 |

Following GameStop squeeze and Elon Musk twitter message "Bitcoin", Bitcoin and other experienced steady growth.[177] |

Forks

A fork referring to a blockchain is defined variously as a blockchain split into two paths forward, or as a change of protocol rules. Accidental forks on the bitcoin network regularly occur as part of the mining process. They happen when two miners find a block at a similar point in time. As a result, the network briefly forks. This fork is subsequently resolved by the software which automatically chooses the longest chain, thereby orphaning the extra blocks added to the shorter chain (that were dropped by the longer chain).

March 2013

On 12 March 2013, a bitcoin miner running version 0.8.0 of the bitcoin software created a large block that was considered invalid in version 0.7 (due to an undiscovered inconsistency between the two versions). This created a split or "fork" in the blockchain since computers with the recent version of the software accepted the invalid block and continued to build on the diverging chain, whereas older versions of the software rejected it and continued extending the blockchain without the offending block. This split resulted in two separate transaction logs being formed without clear consensus, which allowed for the same funds to be spent differently on each chain. In response, the Mt. Gox exchange temporarily halted bitcoin deposits.[178] The exchange rate fell 23% to $37 on the Mt. Gox exchange but rose most of the way back to its prior level of $48.[57][58]

Miners resolved the split by downgrading to version 0.7, putting them back on track with the canonical blockchain. User funds largely remained unaffected and were available when network consensus was restored.[179] The network reached consensus and continued to operate as normal a few hours after the split.[180]

August 2017

Two significant forks took place in August. One, Bitcoin Cash, is a hard fork off the main chain in opposition to the other, which is a soft fork to implement Segregated Witness.

Regulatory issues

On 18 March 2013, the Financial Crimes Enforcement Network (or FinCEN), a bureau of the United States Department of the Treasury, issued a report regarding centralized and decentralized "virtual currencies" and their legal status within "money services business" (MSB) and Bank Secrecy Act regulations.[62][67] It classified digital currencies and other digital payment systems such as bitcoin as "virtual currencies" because they are not legal tender under any sovereign jurisdiction. FinCEN cleared American users of bitcoin of legal obligations[67] by saying, "A user of virtual currency is not an MSB under FinCEN's regulations and therefore is not subject to MSB registration, reporting, and recordkeeping regulations." However, it held that American entities who generate "virtual currency" such as bitcoins are money transmitters or MSBs if they sell their generated currency for national currency: "...a person that creates units of convertible virtual currency and sells those units to another person for real currency or its equivalent is engaged in transmission to another location and is a money transmitter." This specifically extends to "miners" of the bitcoin currency who may have to register as MSBs and abide by the legal requirements of being a money transmitter if they sell their generated bitcoins for national currency and are within the United States.[60] Since FinCEN issued this guidance, dozens of virtual currency exchangers and administrators have registered with FinCEN, and FinCEN is receiving an increasing number of suspicious activity reports (SARs) from these entities.[181]

Additionally, FinCEN claimed regulation over American entities that manage bitcoins in a payment processor setting or as an exchanger: "In addition, a person is an exchanger and a money transmitter if the person accepts such de-centralized convertible virtual currency from one person and transmits it to another person as part of the acceptance and transfer of currency, funds, or other value that substitutes for currency."[61][62]

In summary, FinCEN's decision would require bitcoin exchanges where bitcoins are traded for traditional currencies to disclose large transactions and suspicious activity, comply with money laundering regulations, and collect information about their customers as traditional financial institutions are required to do.[67][182][183]

Jennifer Shasky Calvery, the director of FinCEN said, "Virtual currencies are subject to the same rules as other currencies. ... Basic money-services business rules apply here."[67]

In its October 2012 study, Virtual currency schemes, the European Central Bank concluded that the growth of virtual currencies will continue, and, given the currencies' inherent price instability, lack of close regulation, and risk of illegal uses by anonymous users, the Bank warned that periodic examination of developments would be necessary to reassess risks.[184]

In 2013, the U.S. Treasury extended its anti-money laundering regulations to processors of bitcoin transactions.[185][186]

In June 2013, Bitcoin Foundation board member Jon Matonis wrote in Forbes that he received a warning letter from the California Department of Financial Institutions accusing the foundation of unlicensed money transmission. Matonis denied that the foundation is engaged in money transmission and said he viewed the case as "an opportunity to educate state regulators."[187]

In late July 2013, the industry group Committee for the Establishment of the Digital Asset Transfer Authority began to form to set best practices and standards, to work with regulators and policymakers to adapt existing currency requirements to digital currency technology and business models and develop risk management standards.[188]

In 2014, the U.S. Securities and Exchange Commission filed an administrative action against Erik T. Voorhees, for violating Securities Act Section 5 for publicly offering unregistered interests in two bitcoin websites in exchange for bitcoins.[189]

By December 2017, bitcoin futures contracts began to be offered, and the US Chicago Board Options Exchange (CBOE) was formally settling the futures daily.[190][191] By 2019, multiple trading companies were offering services around bitcoin futures.[192]

Bitcoin faucets

A bitcoin faucet is a reward system, in the form of a website or software app, that dispenses rewards in the form of a satoshi, which is worth a hundredth of a millionth BTC, for visitors to claim in exchange for completing a captcha or task as described by the website. There are also faucets that dispense alternative cryptocurrencies. The first bitcoin faucet was called "The Bitcoin Faucet" and was developed by Gavin Andresen in 2010.[193] It originally gave out five bitcoins per person.

The rewards are dispensed at various predetermined intervals of time as rewards for completing simple tasks such as captcha completion and as prizes from simple games. Faucets usually give fractions of a bitcoin, but the amount will typically fluctuate according to the value of bitcoin. Some faucets also have random larger rewards. To reduce mining fees, faucets normally save up these small individual payments in their own ledgers, which then add up to make a larger payment that is sent to a user's bitcoin address.[194]

Because bitcoin transactions are irreversible and there are many faucets, they have become targets for hackers interested in stealing bitcoins. Advertisements are the main income source of bitcoin faucets. Faucets try to get traffic from users by offering free bitcoin as an incentive. Some ad networks also pay directly in bitcoin. This means that faucets often have a low profit margin. Some faucets also make money by mining altcoin in the background, using the user's CPU.

Theft and exchange shutdowns

Bitcoins can be stored in a bitcoin cryptocurrency wallet. Theft of bitcoin has been documented on numerous occasions. At other times, bitcoin exchanges have shut down, taking their clients' bitcoins with them. A Wired study published April 2013 showed that 45 percent of bitcoin exchanges end up closing.[195]

On 19 June 2011, a security breach of the Mt. Gox bitcoin exchange caused the nominal price of a bitcoin to fraudulently drop to one cent on the Mt. Gox exchange, after a hacker used credentials from a Mt. Gox auditor's compromised computer illegally to transfer a large number of bitcoins to himself. They used the exchange's software to sell them all nominally, creating a massive "ask" order at any price. Within minutes, the price reverted to its correct user-traded value.[196][197][198][199][200][201] Accounts with the equivalent of more than US$8,750,000 were affected.[198]

In July 2011, the operator of Bitomat, the third-largest bitcoin exchange, announced that he had lost access to his wallet.dat file with about 17,000 bitcoins (roughly equivalent to US$220,000 at that time). He announced that he would sell the service for the missing amount, aiming to use funds from the sale to refund his customers.[202]

In August 2011, MyBitcoin, a now defunct bitcoin transaction processor, declared that it was hacked, which caused it to be shut down, paying 49% on customer deposits, leaving more than 78,000 bitcoins (equivalent to roughly US$800,000 at that time) unaccounted for.[203][204]

In early August 2012, a lawsuit was filed in San Francisco court against Bitcoinica – a bitcoin trading venue – claiming about US$460,000 from the company. Bitcoinica was hacked twice in 2012, which led to allegations that the venue neglected the safety of customers' money and cheated them out of withdrawal requests.[205][206]

In late August 2012, an operation titled Bitcoin Savings and Trust was shut down by the owner, leaving around US$5.6 million in bitcoin-based debts; this led to allegations that the operation was a Ponzi scheme.[207][208][209] In September 2012, the U.S. Securities and Exchange Commission had reportedly started an investigation on the case.[210]

In September 2012, Bitfloor, a bitcoin exchange, also reported being hacked, with 24,000 bitcoins (worth about US$250,000) stolen. As a result, Bitfloor suspended operations.[211][212] The same month, Bitfloor resumed operations; its founder said that he reported the theft to FBI, and that he plans to repay the victims, though the time frame for repayment is unclear.[213]

On 3 April 2013, Instawallet, a web-based wallet provider, was hacked,[214] resulting in the theft of over 35,000 bitcoins[215] which were valued at US$129.90 per bitcoin at the time, or nearly $4.6 million in total. As a result, Instawallet suspended operations.[214]

On 11 August 2013, the Bitcoin Foundation announced that a bug in a pseudorandom number generator within the Android operating system had been exploited to steal from wallets generated by Android apps; fixes were provided 13 August 2013.[216]

In October 2013, Inputs.io, an Australian-based bitcoin wallet provider was hacked with a loss of 4100 bitcoins, worth over A$1 million at time of theft. The service was run by the operator TradeFortress. Coinchat, the associated bitcoin chat room, was taken over by a new admin.[217]

On 26 October 2013, a Hong Kong–based bitcoin trading platform owned by Global Bond Limited (GBL) vanished with 30 million yuan (US$5 million) from 500 investors.[218]

Mt. Gox, the Japan-based exchange that in 2013 handled 70% of all worldwide bitcoin traffic, declared bankruptcy in February 2014, with bitcoins worth about $390 million missing, for unclear reasons. The CEO was eventually arrested and charged with embezzlement.[219]

On 3 March 2014, Flexcoin announced it was closing its doors because of a hack attack that took place the day before.[220][221][222] In a statement that once occupied their homepage, they announced on 3 March 2014 that "As Flexcoin does not have the resources, assets, or otherwise to come back from this loss [the hack], we are closing our doors immediately."[223] Users can no longer log into the site.

Chinese cryptocurrency exchange Bter lost $2.1 million in BTC in February 2015.

The Slovenian exchange Bitstamp lost bitcoin worth $5.1 million to a hack in January 2015.

The US-based exchange Cryptsy declared bankruptcy in January 2016, ostensibly because of a 2014 hacking incident; the court-appointed receiver later alleged that Cryptsy's CEO had stolen $3.3 million.

In August 2016, hackers stole some $72 million in customer bitcoin from the Hong Kong–based exchange Bitfinex.[224]

In December 2017, hackers stole 4,700 bitcoins from NiceHash a platform that allowed users to sell hashing power.[225] The value of the stolen bitcoins totaled about $80M.[226]

On 19 December 2017, Yapian, a company that owns the Youbit cryptocurrency exchange in South Korea, filed for bankruptcy following a hack, the second in eight months.[227]

Taxation and regulation

In 2012, the Cryptocurrency Legal Advocacy Group (CLAG) stressed the importance for taxpayers to determine whether taxes are due on a bitcoin-related transaction based on whether one has experienced a "realization event": when a taxpayer has provided a service in exchange for bitcoins, a realization event has probably occurred and any gain or loss would likely be calculated using fair market values for the service provided."[228]

In August 2013, the German Finance Ministry characterized bitcoin as a unit of account,[77][229] usable in multilateral clearing circles and subject to capital gains tax if held less than one year.[229]

On 5 December 2013, the People's Bank of China announced in a press release regarding bitcoin regulation that whilst individuals in China are permitted to freely trade and exchange bitcoins as a commodity, it is prohibited for Chinese financial banks to operate using bitcoins or for bitcoins to be used as legal tender currency, and that entities dealing with bitcoins must track and report suspicious activity to prevent money laundering.[230] The value of bitcoin dropped on various exchanges between 11 and 20 percent following the regulation announcement, before rebounding upward again.[231]

Arbitrary blockchain content

Bitcoin's blockchain can be loaded with arbitrary data. In 2018 researchers from RWTH Aachen University and Goethe University identified 1,600 files added to the blockchain, 59 of which included links to unlawful images of child exploitation, politically sensitive content, or privacy violations. "Our analysis shows that certain content, e.g. illegal pornography, can render the mere possession of a blockchain illegal."[232]

Interpol also sent out an alert in 2015 saying that "the design of the blockchain means there is the possibility of malware being injected and permanently hosted with no methods currently available to wipe this data".[233]

References

- Jerry Brito; Andrea Castillo (2013). "Bitcoin: A Primer for Policymakers" (PDF). Mercatus Center. George Mason University. Retrieved 22 October 2013.

- A History of Bitcoin. Monetary Economics: International Financial Flows, Financial Crises, Regulation & Supervision eJournal. Social Science Research Network (SSRN). Accessed 8 January 2018.

- Chaum, David (1983). "Blind signatures for untraceable payments" (PDF). Advances in Cryptology Proceedings of Crypto. 82 (3): 199–203. doi:10.1007/978-1-4757-0602-4_18. ISBN 978-1-4757-0604-8.

- Chaum, David; Fiat, Amos; Naor, Moni. "Untraceable Electronic Cash" (PDF). Lecture Notes in Computer Science.

- Chaum, David; Brands, Stefan (4 January 1999). "'Minting' electronic cash". IEEE Spectrum special issue on electronic money, February 1997. IEEE. Retrieved 17 September 2018.

- Narayanan, Arvind; Bonneau, Joseph; Felten, Edward; Miller, Andrew; Goldfeder, Steven (2016). Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction. Princeton and Oxford: Princeton University Press. ISBN 978-0-691-17169-2.

- Dai, W (1998). "b-money". Archived from the original on 4 October 2011. Retrieved 5 December 2013.

- Szabo, Nick. "Bit Gold". Unenumerated. Blogspot. Archived from the original on 22 September 2011. Retrieved 5 December 2013.

- Tsorsch, Florian; Scheuermann, Bjorn (15 May 2015). "Bitcoin and Beyond: A Technical Survey of Decentralized Digital Currencies" (PDF). Retrieved 24 June 2015.

- "Reusable Proofs of Work". Archived from the original on 22 December 2007.

- Bernard, Zoë (2 December 2017). "Everything you need to know about Bitcoin, its mysterious origins, and the many alleged identities of its creator". Business Insider. Archived from the original on 15 June 2018. Retrieved 15 June 2018.

- Nakamoto, Satoshi (31 October 2008). "Bitcoin: A Peer-to-Peer Electronic Cash System" (PDF). Retrieved 20 December 2012.

- Finley, Klint (31 October 2018). "After 10 Years, Bitcoin Has Changed Everything—And Nothing". Wired. Retrieved 9 November 2018.

- Wallace, Benjamin (23 November 2011). "The Rise and Fall of Bitcoin". Wired. Archived from the original on 31 October 2013. Retrieved 13 October 2012.

- "Bitcoin P2P e-cash paper". 31 October 2008. Archived from the original on 13 December 2016. Retrieved 2 November 2013.

- "Satoshi's posts to Cryptography mailing list". Mail-archive.com. Retrieved 26 March 2013.

- "Block 0 – Bitcoin Block Explorer". Archived from the original on 15 October 2013. Retrieved 2 November 2013.

- Davis, Joshua (10 October 2011). "The Crypto-Currency". The New Yorker. Archived from the original on 23 August 2013. Retrieved 16 February 2013.

- Elliott, Francis; Duncan, Gary (3 January 2009). "Chancellor Alistair Darling on brink of second bailout for banks". The Times. Retrieved 27 April 2018.

- Pagliery, Jose (2014). Bitcoin: And the Future of Money. Triumph Books. ISBN 9781629370361. Archived from the original on 21 January 2018. Retrieved 20 January 2018.

- Nakamoto, Satoshi (9 January 2009). "Bitcoin v0.1 released". Archived from the original on 26 March 2014. Retrieved 2 November 2013.

- "SourceForge.net: Bitcoin". Archived from the original on 16 March 2013. Retrieved 2 November 2013.

- Peterson, Andrea (3 January 2014). "Hal Finney received the first Bitcoin transaction. Here's how he describes it". The Washington Post.

- Popper, Nathaniel (30 August 2014). "Hal Finney, Cryptographer and Bitcoin Pioneer, Dies at 58". NYTimes. Retrieved 2 September 2014.

- McMillan, Robert. "Who Owns the World's Biggest Bitcoin Wallet? The FBI". Wired. Condé Nast. Retrieved 7 October 2016.

- Bosker, Bianca (16 April 2013). "Gavin Andresen, Bitcoin Architect: Meet The Man Bringing You Bitcoin (And Getting Paid In It)". The Huffington Post. Retrieved 21 October 2016.

- Sawyer, Matt (26 February 2013). "The Beginners Guide To Bitcoin – Everything You Need To Know". Monetarism. Archived from the original on 9 April 2014. Retrieved 2 November 2013.

- "Vulnerability Summary for CVE-2010-5139". National Vulnerability Database. 8 June 2012. Archived from the original on 9 April 2014. Retrieved 22 March 2013.

- Nakamoto, Satoshi. "[bitcoin-list] ALERT – we are investigating a problem" (Mailing list). Archived from the original on 15 October 2013. Retrieved 15 October 2013.

- Lam, Eric; Leatherby, Lauren (3 October 2018). "From Pizza To Lambos: Charting Bitcoin's First Decade". Bloomberg. Retrieved 4 October 2018.

- "Satoshi Nakamoto is (probably) Nick Szabo". LikeInAMirror. WordPress. Archived from the original on 13 April 2014. Retrieved 5 December 2013.

- Weisenthal, Joe (19 May 2013). "Here's The Problem With The New Theory That A Japanese Math Professor Is The Inventor Of Bitcoin". Business Insider. Archived from the original on 3 November 2013. Retrieved 19 May 2013.

- Bitcoin Inventor Satoshi Nakamoto is Anonymous-style Cell from Europe Archived 17 December 2013 at the Wayback Machine

- Penenberg, Adam. "The Bitcoin Crypto-Currency Mystery Reopened". FastCompany. Archived from the original on 6 October 2013. Retrieved 16 February 2013.

- Greenfield, Rebecca (11 October 2011). "The Race to Unmask Bitcoin's Inventor(s)". The Atlantic. Archived from the original on 1 November 2013. Retrieved 16 February 2013.

- "I Think I Know Who Satoshi Is". YouTube TheTedNelson Channel. 18 May 2013. Archived from the original on 14 April 2014.

- John Markoff (23 November 2013). "Study Suggests Link Between Dread Pirate Roberts and Satoshi Nakamoto". New York Times.

- Trammell, Dustin D. "I Am Not Satoshi". Archived from the original on 5 December 2013. Retrieved 27 November 2013.

- Wile, Rob. "Researchers Retract Claim Of Link Between Alleged Silk Road Mastermind And Founder Of Bitcoin". Business Week. Archived from the original on 26 March 2014. Retrieved 17 December 2013.

- "Newsweek Thinks It Found the Real "Satoshi Nakamoto" ... and His Name Is Satoshi Nakamoto". slate.com. 6 March 2014. Archived from the original on 29 April 2014.

- Leah McGrath Goodman (6 March 2014). "The Face Behind Bitcoin". Newsweek. Archived from the original on 7 March 2014. Retrieved 6 March 2014.

- Greenberg, Andy (6 March 2014). "Bitcoin Community Responds To Satoshi Nakamoto's 'Uncovering' With Disbelief, Anger, Fascination". Forbes.com. Forbes. Archived from the original on 7 March 2014. Retrieved 3 April 2014.

- Nakamoto, Andrew O’Hagan on the many lives of Satoshi (30 June 2016). "The Satoshi Affair". pp. 7–28. Retrieved 3 March 2017 – via London Review of Books.

- "Latest Satoshi Nakamoto Candidate Buying Bitcoin No Matter What".

- Espinoza, Javier (22 September 2014). "Is It Time to Invest in Bitcoin? Cryptocurrencies Are Highly Volatile, but Some Say They Are Worth It". The Wall Street Journal. Retrieved 28 June 2016.

- Rainey Reitman (20 January 2011). "Bitcoin – a Step Toward Censorship-Resistant Digital Currency". Electronic Frontier Foundation. Retrieved 7 December 2017.

- EFF said they "generally don't endorse any type of product or service.""EFF and Bitcoin | Electronic Frontier Foundation". Eff.org. 20 June 2011. Archived from the original on 13 December 2013. Retrieved 7 December 2017.

- Cindy Cohn; Peter Eckersley; Rainey Reitman & Seth Schoen (17 May 2013). "EFF Will Accept Bitcoins to Support Digital Liberty". Electronic Frontier Foundation. Retrieved 7 December 2017.

- Greenberg, Andy (14 June 2011). "WikiLeaks Asks For Anonymous Bitcoin Donations". Forbes. Archived from the original on 27 June 2011. Retrieved 22 June 2011.

- Toepfer, Susan (16 January 2012). "'The Good Wife' Season 3, Episode 13, 'Bitcoin for Dummies': TV Recap". The Wall Street Journal. Archived from the original on 12 January 2014.

- Matonis, Jon. "Bitcoin Foundation Launches To Drive Bitcoin's Advancement". Forbes. Retrieved 20 May 2017.

- Browdie, Brian (11 September 2012). "BitPay Signs 1,000 Merchants to Accept Bitcoin Payments". American Banker. Archived from the original on 12 April 2014.

- Skelton, Andy (15 November 2012). "Pay Another Way: Bitcoin". WordPress. Retrieved 24 April 2014.

- Ludwig, Sean (8 February 2013). "Y Combinator-backed Coinbase now selling over $1M Bitcoin per month". VentureBeat. Archived from the original on 9 April 2014.

- Mandalia, Ravi (22 February 2013). "The Internet Archive Starts Accepting Bitcoin Donations". Parity News. Archived from the original on 3 June 2013. Retrieved 28 February 2013.

- Lee, Timothy (11 March 2013). "Major glitch in Bitcoin network sparks sell-off; price temporarily falls 23%". arstechnica.com. Retrieved 15 February 2015.

- Lee, Timothy (12 March 2013). "Major glitch in Bitcoin network sparks sell-off; price temporarily falls 23%". Ars Technica. Archived from the original on 22 April 2013. Retrieved 14 June 2017.

- Blagdon, Jeff (12 March 2013). "Technical problems cause Bitcoin to plummet from record high, Mt. Gox suspends deposits". The Verge. Archived from the original on 22 April 2013. Retrieved 21 March 2018.

- "Bitcoin Charts". Archived from the original on 9 May 2014.

- Lee, Timothy (20 March 2013). "US regulator Bitcoin Exchanges Must Comply With Money Laundering Laws". Ars Technica. Archived from the original on 21 October 2013. Retrieved 14 June 2017.

Bitcoin miners must also register if they trade in their earnings for dollars.

- "US govt clarifies virtual currency regulatory position". Finextra. 19 March 2013. Archived from the original on 26 March 2014. Retrieved 2 November 2013.

- "Application of FinCEN's Regulations to Persons Administering, Exchanging, or Using Virtual Currencies" (PDF). Department of the Treasury Financial Crimes Enforcement Network. Archived from the original (PDF) on 28 March 2013. Retrieved 19 March 2013.

- Roose, Kevin (8 April 2013) "Inside the Bitcoin Bubble: BitInstant's CEO – Daily Intelligencer". Archived from the original on 9 April 2014.. Nymag.com. Retrieved on 20 April 2013.

- "Bitcoin Exchange Rate". Bitcoinscharts.com. Archived from the original on 24 June 2012. Retrieved 15 August 2013.

- Van Sack, Jessica (27 May 2013). "Why Bitcoin makes cents". Archived from the original on 9 February 2014. Retrieved 15 August 2013.

- Dillet, Romain. "Feds Seize Assets From Mt. Gox's Dwolla Account, Accuse It Of Violating Money Transfer Regulations". Archived from the original on 9 October 2013. Retrieved 15 May 2013.

- Berson, Susan A. (2013). "Some basic rules for using 'bitcoin' as virtual money". American Bar Association. Archived from the original on 29 October 2013. Retrieved 26 June 2013.

- Taylor, Colleen. "With $1.5M Led By Winklevoss Capital, BitInstant Aims To Be The Go-To Site To Buy And Sell Bitcoins". TechCrunch. Retrieved 20 May 2017.

- Cohen, Brian. "Users Bitcoins Seized by DEA". Archived from the original on 9 October 2013. Retrieved 14 October 2013.

- "The National Police completes the second phase of the operation "Ransomware"". El Cuerpo Nacional de Policía. Retrieved 14 October 2013.

- Sampson, Tim (2013). "U.S. government makes its first-ever Bitcoin seizure". The Daily Dot. Archived from the original on 30 June 2013. Retrieved 15 October 2013.

- Jeremy Kirk (11 July 2013). "In Kenya, Bitcoin linked to popular mobile payment system". Cio.com. Archived from the original on 1 February 2014. Retrieved 15 August 2013.

- Andrew Trotman (30 July 2013). "Virtual currency Bitcoin not welcome in Thailand in possible setback to mainstream ambitions". The Daily Telegraph. London. Archived from the original on 1 November 2013. Retrieved 15 August 2013.

- Maierbrugger, Arno (30 July 2013). "Thailand first country to ban digital currency Bitcoin". Inside Investor. Archived from the original on 4 February 2014. Retrieved 3 August 2013.

- Farivar, Cyrus (7 August 2013). "Federal judge: Bitcoin, "a currency," can be regulated under American law". Ars Technica. Archived from the original on 20 October 2013. Retrieved 15 August 2013.

- "Securities and Exchange Commission v. Shavers et al, 4:13-cv-00416 (E.D.Tex.)". Docket Alarm, Inc. Archived from the original on 29 October 2013. Retrieved 14 August 2013.

- Vaishampayan, Saumya (19 August 2013). "Bitcoins are private money in Germany". Marketwatch. Archived from the original on 1 September 2013. Retrieved 2 November 2013.

- "After Silk Road seizure, FBI Bitcoin wallet identified and pranked". Archived from the original on 5 April 2014.

- "Silkroad Seized Coins". Archived from the original on 9 January 2014. Retrieved 2 November 2013.

- Hill, Kashmir. "The FBI's Plan For The Millions Worth Of Bitcoins Seized From Silk Road". Forbes. Archived from the original on 2 May 2014.

- "World's first Bitcoin ATM goes live in Vancouver Tuesday". CBC. Archived from the original on 28 October 2013. Retrieved 2 November 2013.

- "Vancouver to host world's first Bitcoin ATM". Archived from the original on 29 October 2013. Retrieved 27 January 2019.

- "The world's first Bitcoin ATM is coming to Canada next week". The Verge. Archived from the original on 29 October 2013. Retrieved 29 October 2013.

- Kapur, Saranya (15 October 2013). "China's Google Is Now Accepting Bitcoin". businessinsider.com. Business Insider, Inc. Retrieved 26 December 2013.

- "Cypriot University to Accept Bitcoin Payments". abc News. 21 November 2013. Archived from the original on 2 December 2013. Retrieved 24 November 2013.

- Natasha Lomas (18 November 2013). "As Chinese Investors Pile Into Bitcoin, China's Oldest Exchange, BTC China, Raises $5M From Lightspeed". TechCrunch. Retrieved 10 January 2014.

- Dante D'Orazio (21 December 2013). "Online retailer Overstock.com plans to accept Bitcoin payments next year". Archived from the original on 6 January 2014. Retrieved 5 January 2014.

- Kelion, Leo (18 December 2013). "Bitcoin sinks after China restricts yuan exchanges". bbc.com. BBC. Retrieved 20 December 2013.

- "China bans banks from bitcoin transactions". The Sydney Morning Herald. Reuters. 6 December 2013. Retrieved 31 October 2014.

- "Baidu Stops Accepting Bitcoins After China Ban". Bloomberg. New York. 7 December 2013. Retrieved 11 December 2013.

- "China bars use of virtual money for trading in real goods". English.mofcom.gov.cn. 29 June 2009. Retrieved 10 January 2014.

- Carl Franzen (4 January 2014). "Zynga tests Bitcoin payments for seven online games". Archived from the original on 6 January 2014. Retrieved 5 January 2014.

- Trejos, Nancy. "Las Vegas casinos adopt new form of currency: Bitcoins". USA Today. Retrieved 21 January 2014.

- Jane McEntegart (26 January 2014). "TigerDirect is Now Accepting Bitcoin As Payment". Tom's hardware. Retrieved 28 August 2014.

- Vaishampayan, Saumya (9 January 2014). "Bitcoin now accepted on Overstock.com through VC-backed Coinbase". marketwatch.com. Wall Street Journal. Retrieved 10 February 2014.

- "MtGox gives bankruptcy details". bbc.com. BBC. 4 March 2014. Retrieved 13 March 2014.

- Biggs, John (10 February 2014). "What's Going On With Bitcoin Exchange Mt. Gox?". TechCrunch. Retrieved 26 February 2014.

- "MtGox bitcoin exchange files for bankruptcy". bbc.com. BBC. 28 February 2014. Retrieved 18 April 2014.

- Swan, Noelle (28 February 2014). "MtGox bankruptcy: Bitcoin insiders saw problems with the exchange for months". csmonitor.com. The Christian Science Monitor. Retrieved 18 April 2014.

- Casey, Michael J. (18 June 2014). "BitPay to Sponsor St. Petersburg Bowl in First Major Bitcoin Sports Deal". The Wall Street Journal. Retrieved 18 June 2014.

- Flacy, Mike (19 July 2014). "Dell, Newegg Start Accepting Bitcoin as Payment". Digital Trends. Retrieved 5 August 2014.

- Callaway, Claudia; Greebel, Evan; Moriarity, Kathleen; Xethalis, Gregory; Kim, Diana. "First Bitcoin Swap Proposed". The National Law Review. Katten Muchin Rosenman LLP. Retrieved 15 September 2014.

- Warren, Tom (11 December 2014). "Microsoft now accepts Bitcoin to buy Xbox games and Windows apps".

- "Ode to Satoshi". Retrieved 4 December 2017.

- Paul Vigna (18 February 2014). "BitBeat: Mt. Gox's Pyrrhic Victory". Money Beat. The Wall Street Journal. Archived from the original on 6 October 2014. Retrieved 30 September 2014.

'Ode to Satoshi' is a bluegrass-style song with an old-timey feel that mixes references to Satoshi Nakamoto and blockchains (and, ahem, 'the fall of old Mt. Gox') with mandolin-picking and harmonicas.

- Kenigsberg, Ben (2 October 2014). "Financial Wild West". The New York Times. Archived from the original on 18 May 2015. Retrieved 8 May 2015.

- Srivastava, Shivam (6 January 2015). "Bitcoin exchange Bitstamp suspends service after security breach". reuters.com. Reuters. Retrieved 24 January 2015.

- Novak, Marja (9 January 2015). "Bitcoin exchange Bitstamp says to resume trading on Friday". reuters.com. Reuters. Retrieved 24 January 2015.

- Cuthbertson, Anthony (4 February 2015). "Bitcoin now accepted by 100,000 merchants worldwide". International Business Times. IBTimes Co., Ltd. Retrieved 20 November 2015.

- Shirriff, Ken (2 October 2015). "Proposal for addition of bitcoin sign" (PDF). unicode.org. Unicode. Retrieved 3 November 2015.

- "Japan OKs recognizing virtual currencies as similar to real money". 4 March 2016.

- "Activating and Using Bitcoin as a Payment Option". Archived from the original on 7 January 2017. Retrieved 15 January 2020.

- Tasca, Paolo; Liu, Shaowen; Hayes, Adam (1 July 2016), The Evolution of the Bitcoin Economy: Extracting and Analyzing the Network of Payment Relationships, p. 36, SSRN 2808762,

By November, 2013, the amount of inflows attributable to ”sin” entities had shrunk significantly to just 3% or less of total transactions.

- Coppola, Frances (6 August 2016). "Theft And Mayhem In The Bitcoin World". Forbes. Retrieved 15 August 2016.

- "SBB: Make quick and easy purchases with Bitcoin". Retrieved 3 March 2017.

- "ビットコイン 利用可能店舗が1年で4.6倍に". 9 January 2017. Archived from the original on 10 January 2017. Retrieved 9 January 2017.

- "The Bitcoin Fee Market". 7 March 2017.

our transaction growth of nearly 3x [...] Many of the businesses we’ve signed up over the years have started using BitPay for B2B supply chain payments.

- Kharpal, Arjun. "Bitcoin value rises over $1 billion as Japan, Russia move to legitimize cryptocurrency".

- Colibasanu, Antonia. "Here's why Russia is opening the door to cryptocurrencies".

- "INDUSTRY GROWTH AND ITS EFFECT ON POLONIEX". 16 May 2017.

- "Unicode 10.0.0". Unicode Consortium. 20 June 2017. Retrieved 20 June 2017.

- Popper, Nathaniel (25 July 2017). "Some Bitcoin Backers Are Defecting to Create a Rival Currency". The New York Times. ISSN 0362-4331. Retrieved 28 July 2017.

- Smith, Jake (11 August 2017). "The Bitcoin Cash Hard Fork Will Show Us Which Coin Is Best". Fortune. Retrieved 13 August 2017.

- Liao, Shannon (6 December 2016). "Steam no longer accepting bitcoin due to 'high fees and volatility'". The Verge. Retrieved 8 August 2019.

- "Bitcoin price latest: Cryptocurrency plunges as traders in South Korea forced to identify themselves". The Independent. Retrieved 1 February 2018.

- "Stripe to ditch Bitcoin payment support". BBC. 24 January 2018. Retrieved 25 January 2018.

- "21Shares Bitcoin ETP launches on Deutsche Boerse". 1 July 2020. Archived from the original on 3 September 2020. Retrieved 3 September 2020.

- "21Shares brings first crypto-currency products on Bitcoin and Ethereum to the official market". 1 September 2020. Archived from the original on 3 September 2020.

- "21Shares launches first short bitcoin ETP on Xetra". 2 September 2020. Archived from the original on 3 September 2020.

- "First Short Bitcoin ETP of 21Shares on Xetra". Deutsche Börse Cash Market. 1 September 2020. Archived from the original on 3 September 2020.

- "PayPal to open up network to cryptocurrencies". 6 November 2020.

- Traverse, Nick (3 April 2013). "Bitcoin's Meteoric Rise". Archived from the original on 9 April 2014.

- Bustillos, Maria (2 April 2013). "The Bitcoin Boom". Archived from the original on 13 March 2014.

- Seward, Zachary (28 March 2013). "Bitcoin, up 152% this month, soaring 57% this week". Archived from the original on 18 April 2014. Retrieved 9 April 2013.

- "A Bit expensive". The Economist. 1 March 2013. Archived from the original on 5 April 2014.

- (in English) Bitcoin Charts (price) Archived 28 March 2011 at WebCite

- (in English) History of Bitcoin (Bitcoin wiki) Archived 13 February 2014 at the Wayback Machine

- "History – Bitcoin". en.bitcoin.it. Archived from the original on 13 February 2014. Retrieved 4 December 2013.

- Estes, Adam (28 March 2013). "Bitcoin is now a billion dollar industry". Archived from the original on 11 October 2013. Retrieved 2 November 2013.

- Salmon, Felix. "The Bitcoin Bubble and the Future of Currency". Archived from the original on 21 February 2014. Retrieved 9 April 2013.

- Ro, Sam (3 April 2013). "Art Cashin: The Bitcoin Bubble". Archived from the original on 9 April 2014.

- "Bitcoin value drops after FBI shuts Silk Road drugs site". BBC News. 3 October 2013. Archived from the original on 6 October 2013. Retrieved 4 December 2013.

- "Mt. Gox graph". Bitcoinity.org. Archived from the original on 6 October 2013. Retrieved 4 December 2013.

- Vigna, Paul; Casey, Michael J. (27 January 2015). The age of cryptocurrency : how bitcoin and digital money are challenging the global economic order. New York: St. Martin's Press. p. 79. ISBN 9781250065636.

- "Why Bitcoin Matters". Retrieved 4 January 2016.

- Merchant, Brian (26 March 2013). "This Pizza Cost $750,000". Motherboard. Archived from the original on 28 March 2013. Retrieved 13 January 2017.

- Leos Literak. "Bitcoin dosáhl parity s dolarem". Abclinuxu.cz. Archived from the original on 22 February 2014. Retrieved 4 December 2013.

- "Bitcoin worth almost as much as gold". CNN.com. 29 November 2013. Retrieved 24 February 2017.

- BitcoinWisdom – Live Bitcoin/Litecoin charts Archived 11 May 2014 at the Wayback Machine

- "Bitcoin is now worth more than an ounce of gold for the first time ever". Marketwatch.com. 2 March 2017. Retrieved 2 March 2017.

- "Bitcoin price exceeds gold for first time ever". CNN.com. 3 March 2017. Retrieved 9 March 2017.

- "Bitcoin crosses $1,800 for the first time adding $3 billion in market cap in just four days". 11 May 2017.

- Boivard, Charles (1 September 2017). "Bitcoin Price Tops $5,000 For First Time". Forbes. Retrieved 9 October 2017.

- Robert Brand, Brian Latham, and Godfrey Marawanyika (15 November 2017). "Zimbabwe Doesn't Have Its Own Currency and Bitcoin Is Surging". Bloomberg L.P. Retrieved 16 November 2017.CS1 maint: multiple names: authors list (link)

- Riley, Charles. "Bitcoin costs as much as $13,000 in Zimbabwe". CNNMoney. Retrieved 16 November 2017.

- Kelly, Jemima (15 December 2017). "Bitcoin hits new record high as warnings grow louder". Reuters. Retrieved 15 December 2017.

- "Bitcoin Hits a New Record High, But Stops Short of $20,000". Fortune. Retrieved 8 December 2018.

- Shane, Daniel (22 December 2017). "Bitcoin lost a third of its value in 24 hours". CNN. Retrieved 23 December 2017.

- Cheng, Evelyn (5 February 2018). "Bitcoin continues to tumble, hitting its lowest point since November". CNBC. Retrieved 5 February 2018.

- Martin, Shane (31 October 2018). "Bitcoin is 10 years old today — here's a look back at its crazy history". BI. Retrieved 3 November 2018.

- Lee, Justina (30 October 2018). "Bitcoin Is Now the Least Volatile Since Late 2016". Bloomberg. Retrieved 3 November 2018.

- Rooney, Kate (7 December 2018). "Bitcoin price pain continues as the cryptocurrency plummets to a 15-month low". CNBC. Retrieved 18 December 2019.

- Saad, Amena; Ossinger, Joanna (27 July 2020). "Bitcoin Rides to Year High on Back of Gold Rally, Dollar Slump". Bloomberg. Retrieved 27 July 2020.

- Roberts, Jeff John (26 October 2020). "For years J.P. Morgan was skeptical of Bitcoin. Now the bank's analysts say its value could triple, challenging gold". Fortune. Retrieved 15 November 2020.

- Hajric, Vildana; Ballentine, Claire (16 November 2020). "Bitcoin's Gunning for a Record and No One's Talking About It". Bloomberg. Retrieved 16 November 2020.

- Szalay, Eva (18 November 2020). "Bitcoin rallies above $18,000 to trade near all-time highs". Financial Times. Retrieved 18 November 2020.

- Kollewe, Julia (24 November 2020). "Bitcoin price reaches three-year high of more than $19,000". The Guardian. Retrieved 24 November 2020.

- Popper, Nathaniel (30 November 2020). "Bitcoin Hits New Record, This Time With Less Talk of a Bubble". New York Times. Retrieved 30 November 2020.

- Browne, Ryan (16 December 2020). "Bitcoin breaks above $20,000 for the first time ever". CNBC. Retrieved 16 December 2020.

- Browne, Ryan (17 December 2020). "Bitcoin hits new all-time high above $23,000, extending its wild 2020 rally". CNBC. Retrieved 17 December 2020.

- Goldman, David (27 December 2020). "What the #)$*#@)($ is happening with Bitcoin's insane record run?". CNN. Retrieved 27 December 2020.

- Wearden, Graeme (3 January 2021). "Bitcoin hits record high on 12th anniversary of its creation". The Guardian. Retrieved 8 January 2021.

- Vigna, Paul (7 January 2021). "Bitcoin's Hot 2021 Continues With Move Above $40,000". The Wall Street Journal. Retrieved 8 January 2021.

- Browne, Ryan (8 January 2021). "Bitcoin hits fresh record high near $42,000, climbing 40% so far this year". CNBC. Retrieved 8 January 2021.

- Gordon, Amanda (11 January 2021). "Mike Novogratz Is Sticking With Crypto and His Bitcoin Tattoo #4Life". Bloomberg. Retrieved 11 January 2021.

- "Bitcoin Return to $40,000 in Doubt as Flows to Key Fund Slow". Bloomberg. 24 January 2021. Retrieved 27 January 2021.

- "Price of bitcoin jumps after Elon Musk says it is 'a good thing'". the Guardian. 1 February 2021. Retrieved 3 February 2021.

- Karpeles, Mark. "Bitcoin blockchain issue – bitcoin deposits temporarily suspended". Mt. Gox. Archived from the original on 9 February 2014. Retrieved 12 March 2013.

- "11/12 March 2013 Chain Fork Information". Bitcoin Project. Archived from the original on 14 February 2014. Retrieved 12 March 2013.

- "Bitcoin software bug has been rapidly resolved". ecurrency. 12 March 2013. Archived from the original on 31 March 2014.

- "Remarks From Under Secretary of Terrorism and Financial Intelligence David S. Cohen on 'Addressing the Illicit Finance Risks of Virtual Currency'". United States Department of the Treasury. 18 March 2014.

- Lee, Timothy (19 March 2013). "New Money Laundering Guidelines Are A Positive Sign For Bitcoin". Forbes. Archived from the original on 19 October 2013. Retrieved 21 March 2018.

- Faiola, Anthony; Farnam, T.W. (4 April 2013). "The rise of the bitcoin: Virtual gold or cyber-bubble?". The Washington Post. Archived from the original on 29 October 2013.

- "Virtual Currency Schemes" (PDF). European Central Bank. October 2012. Archived from the original (PDF) on 27 July 2013.

- "Bitcoin, the nationless electronic cash beloved by hackers, bursts into financial mainstream". Fox News. 11 April 2013. Archived from the original on 7 November 2013.. Fox News (11 April 2013). Retrieved on 20 April 2013.

- "Bitcoin Currency, Hackers Make Money, Investing in Bitcoins, Scams – AARP". Archived from the original on 22 March 2014.. Blog.aarp.org (19 March 2013). Retrieved on 20 April 2013.

- Coldewey, Devin (24 June 2013). "Bitcoin losing shine after hitting the spotlight". NBC News. Archived from the original on 27 July 2013.

- Tsukayama, Hayley (30 July 2013). "Bitcoin, others set up standards group". The Washington Post. Archived from the original on 1 August 2013.

- Casey, Brian (23 July 2014). "Bitcoin – Is Anyone In Charge?". The National Law Review. Retrieved 15 September 2014.

- Bloomberg (12 December 2017). "Winklevoss Twins Say Futures Are Just the Beginning for Bitcoin". Fortune. Retrieved 12 May 2020.

- Urban, Rob; Russo, Camila (9 December 2017). "Bitcoin Futures Trading Brings Crypto Into Mainstream". Bloomberg. Retrieved 12 May 2020.

- Leising, Matthew (6 September 2019). "Bitcoin Futures on ICE Grow Nearer With Custody Warehouse Start". Bloomberg. Retrieved 9 September 2019.

- Lee, Timothy B. (3 January 2014). "Five years of Bitcoin in one post". The Washington Post. ISSN 0190-8286. Retrieved 15 January 2016.

- Jason Mick (12 June 2011). "Cracking the Bitcoin: Digging Into a $131M USD Virtual Currency". Daily Tech. Archived from the original on 20 January 2013. Retrieved 30 December 2014.

- "Study: 45 percent of Bitcoin exchanges end up closing". Retrieved 28 April 2013.

© Condé Nast UK 2013

Wired.co.uk (26 April 2013). - Karpeles, Mark (30 June 2011). "Clarification of Mt Gox Compromised Accounts and Major Bitcoin Sell-Off". Tibanne Co. Ltd. Archived from the original on 10 February 2014.

- "Bitcoin Report Volume 8 – (FLASHCRASH)". YouTube BitcoinChannel. 19 June 2011. Archived from the original on 11 April 2014.

- Mick, Jason (19 June 2011). "Inside the Mega-Hack of Bitcoin: the Full Story". DailyTech. Archived from the original on 22 April 2013. Retrieved 24 November 2013.

- Lee, Timothy B. (19 June 2011) "Bitcoin prices plummet on hacked exchange". Archived from the original on 10 April 2012. Retrieved 14 June 2017., Ars Technica

- Karpeles, Mark (20 June 2011) Huge Bitcoin sell off due to a compromised account – rollback, Mt.Gox Support Archived 20 June 2011 at WebCite

- Chirgwin, Richard (19 June 2011). "Bitcoin collapses on malicious trade – Mt Gox scrambling to raise the Titanic". The Register. Archived from the original on 14 April 2014.

- Dotson, Kyt (1 August 2011) "Third Largest Bitcoin Exchange Bitomat Lost Their Wallet, Over 17,000 Bitcoins Missing". Archived from the original on 15 February 2014.. SiliconAngle

- Jeffries, Adrianne (8 August 2011) "MyBitcoin Spokesman Finally Comes Forward: "What Did You Think We Did After the Hack? We Got Shitfaced"". Archived from the original on 30 October 2013. Retrieved 24 November 2013.. BetaBeat

- Jeffries, Adrianne (19 August 2011) "Search for Owners of MyBitcoin Loses Steam". Archived from the original on 4 April 2014.. BetaBeat

- Geuss, Megan (12 August 2012) "Bitcoinica users sue for $460k in lost bitcoins". Archived from the original on 11 April 2014.. Ars Technica

- Peck, Morgen (15 August 2012) "First Bitcoin Lawsuit Filed In San Francisco". Archived from the original on 14 April 2014.. IEEE Spectrum

- Jeffries, Adrianne (27 August 2012). "Suspected multi-million dollar Bitcoin pyramid scheme shuts down, investors revolt". The Verge. Archived from the original on 11 October 2013. Retrieved 21 March 2018.

- Mick, Jason (28 August 2012). ""Pirateat40" Makes Off $5.6M USD in BitCoins From Pyramid Scheme". DailyTech. Archived from the original on 11 April 2014. Retrieved 24 November 2013.

- Mott, Nathaniel (31 August 2012). "Bitcoin: How a Virtual Currency Became Real with a $5.6M Fraud". PandoDaily. Archived from the original on 27 October 2013. Retrieved 24 November 2013.

- Foxton, Willard (2 September 2012) "Bitcoin 'Pirate' scandal: SEC steps in amid allegations that the whole thing was a Ponzi scheme". The Daily Telegraph. London. 27 September 2012. Archived from the original on 14 April 2014.. The Telegraph

- "Bitcoin theft causes Bitfloor exchange to go offline". BBC News. 25 September 2012. Archived from the original on 27 March 2014.

- Goddard, Louis (5 September 2012). "Bitcoin exchange BitFloor suspends operations after $250,000 theft". The Verge. Archived from the original on 11 February 2014.

- Chirgwin, Richard (25 September 2012). "Bitcoin exchange back online after hack". PC World. Archived from the original on 14 April 2014.

- Cutler, Kim-Mai (3 April 2013). "Another Bitcoin Wallet Service, Instawallet, Suffers Attack, Shuts Down Until Further Notice". TechCrunch. Archived from the original on 31 March 2014. Retrieved 12 April 2013.

- "Transaction details for bitcoins stolen from Instawallet". Archived from the original on 19 October 2013.. Blockchain.info (3 April 2013). Retrieved 20 April 2013.

- Chirgwin, Richard (12 August 2013). "Android bug batters Bitcoin wallets / Old flaw, new problem". The Register. Archived from the original on 17 August 2013. ● Original Bitcoin announcement: "Android Security Vulnerability". bitcoin.org. 11 August 2013. Archived from the original on 17 August 2013.

- "Australian Bitcoin bank hacked". The Sydney Morning Herald. Archived from the original on 30 December 2013. Retrieved 9 November 2013.. Retrieved 9 November 2013.

- "Hong Kong Bitcoin Trading Platform Vanishes with millions". Archived from the original on 5 April 2014. Retrieved 18 November 2013.

- "Ex-boss of MtGox bitcoin exchange arrested in Japan over lost $390m". The Guardian. 1 August 2015.

- "Flexcoin – flexing Bitcoins to their limit". malwareZero. Archived from the original on 9 March 2014. Retrieved 9 March 2014.

- "Bitcoin bank Flexcoin shuts down after theft". Reuters. 4 March 2014. Archived from the original on 9 March 2014. Retrieved 9 March 2014.

- "Bitcoin bank Flexcoin pulls plug after cyber-robbers nick $610,000". The Register. Archived from the original on 10 March 2014. Retrieved 9 March 2014.

- "Flexcoin homepage". Flexcoin. Archived from the original on 12 March 2014. Retrieved 9 March 2014.

- "All Bitfinex clients to share 36% loss of assets following exchange hack". The Guardian. 7 August 2016.

- "NiceHash". www.facebook.com. Retrieved 7 December 2017.

- Lee, Dave; Millions 'stolen' in NiceHash Bitcoin heist; BBC News; 8 December 2017; https://www.bbc.com/news/technology-42275523

- "A South Korean cryptocurrency exchange files for bankruptcy after hack, says users will get 75% of assets for now". CNBC. 19 December 2017.

- Stewart, David D.; Soong Johnston, Stephanie D. (29 October 2012). "2012 TNT 209-4 NEWS ANALYSIS: VIRTUAL CURRENCY: A NEW WORRY FOR TAX ADMINISTRATORS?. (Release Date: OCTOBER 17, 2012) (Doc 2012-21516)". Tax Notes Today. 2012 TNT 209-4 (2012 TNT 209–4).

- Nestler, Franz (16 August 2013). "Deutschland erkennt Bitcoins als privates Geld an (Germany recognizes Bitcoin as private money)". Frankfurter Allgemeine Zeitung. Archived from the original on 22 October 2013. Retrieved 24 November 2013.

- 2013-12-05, 中国人民银行等五部委发布《关于防范比特币风险的通知》, People's Bank of China Archived 22 January 2014 at the Wayback Machine

- 2013-12-06, China bans banks from bitcoin transactions, The Sydney Morning Herald Archived 23 March 2014 at the Wayback Machine

- Roman Matzutt; Jens Hiller; Martin Henze; Jan Henrik Ziegeldorf; Dirk Mullmann; Oliver Hohlfeld; Klaus Wehrle (2018). "A Quantitative Analysis of the Impact of Arbitrary Blockchain Content on Bitcoin" (PDF). Financial Cryptography and Data Security 2018. pp. 6–8.

- "INTERPOL cyber research identifies malware threat to virtual currencies". Interpol. Retrieved 25 March 2020.