Cryptocurrency bubble

Predictions of a collapse of a speculative bubble in cryptocurrencies have been made by numerous experts in economics and financial markets.

Bitcoin and other cryptocurrencies have been identified as speculative bubbles by several laureates of the Nobel Memorial Prize in Economic Sciences, central bankers, and investors.

In 2018, there was a large sell-off of cryptocurrencies. From January to February 2018, the price of bitcoin fell 65 percent.[1] By September 2018, the MVIS CryptoCompare Digital Assets 10 Index had lost 80 percent of its value, making the decline of the cryptocurrency market, in percentage terms, larger than the bursting of the Dot-com bubble in 2002.[2] In November 2018, the total market capitalization for bitcoin fell below $100 billion for the first time since October 2017,[3][4] and the Bitcoin price fell below $4,000, representing an 80 percent decline from its peak the previous January.[5] From March 8–12, 2020, the Bitcoin price fell by 30 percent from $8,901 to $6,206 (with it down 22 percent on March 12 alone).[6] By October 2020, Bitcoin was worth approximately $13,200.[7]

In November of 2020, Bitcoin again surpassed its previous all time high of over $19,000.[8] After another surge on 3 January 2021 with $34,792.47, bitcoin crashed by 17 percent the next day.[9] Bitcoin traded above $40,000 for the first time on 8 January 2021.[10]

Bitcoin

Bitcoin has been characterized as a speculative bubble by eight winners of the Nobel Memorial Prize in Economic Sciences: Paul Krugman,[11] Robert J. Shiller,[12] Joseph Stiglitz,[13] Richard Thaler,[14] James Heckman,[15] Thomas Sargent,[15] Angus Deaton,[15] and Oliver Hart;[15] and by central bank officials including Alan Greenspan,[16] Agustín Carstens,[17] Vítor Constâncio,[18] and Nout Wellink.[19]

The investors Warren Buffett and George Soros have respectively characterized it as a "mirage"[20] and a "bubble";[21] while the business executives Jack Ma and Jamie Dimon have called it a "bubble"[22] and a "fraud",[23] respectively. J.P. Morgan Chase CEO Jamie Dimon said later he regrets calling bitcoin a fraud.[24]

Altcoins

Since the release of bitcoin, over 6,000 altcoins (alternative variants of bitcoin, or other cryptocurrencies) have been created.

A January 2018 article by CBS cautioned about a cryptocurrency bubble and fraud, citing the case of BitConnect, a British company, which received a cease-and-desist order from the Texas State Securities Board. BitConnect had promised very high monthly returns but hadn't registered with state securities regulators or given their office address.[25]

Initial coin offerings

Wired noted in 2017 that the bubble in initial coin offerings (ICOs) was about to burst.[26] Some investors bought ICOs in hopes of participating in the financial gains similar to those enjoyed by early bitcoin or Ethereum speculators.[27]

Binance has been one of the biggest winners in this boom as it surged to become the largest cryptocurrency trading platform by volume. It lists dozens of digital tokens on its exchange.[28]

In June 2018 Ella Zhang of Binance Labs, a division of the cryptocurrency exchange Binance, stated that she was hoping to see the bubble in ICOs collapse. She promised to help "fight scams and shit coins".[29]

2017 boom and 2018 crash

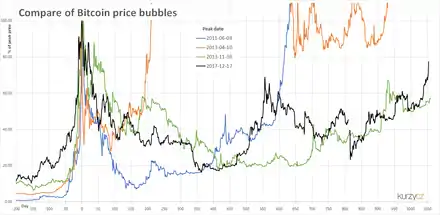

The 2018 cryptocurrency crash[30][31][32][33][34] (also known as the Bitcoin crash[35] and the Great crypto crash[36]) is the sell-off of most cryptocurrencies from January 2018. After an unprecedented boom in 2017, the price of bitcoin fell by about 65 percent during the month from 6 January to 6 February 2018. Subsequently, nearly all other cryptocurrencies also peaked from December 2017 through January 2018, and then followed bitcoin. By September 2018, cryptocurrencies collapsed 80% from their peak in January 2018, making the 2018 cryptocurrency crash worse than the Dot-com bubble's 78% collapse.[36] By 26 November, bitcoin also fell by over 80% from its peak, having lost almost one-third of its value in the previous week.[37]

Timeline of the crash

- December 17, 2017: bitcoin's price briefly reaches its all time high of $19,783.06.[38]

- December 22, 2017, bitcoin fell below $11,000, a fall of 45% from its peak.[39]

- January 12, 2018, Amidst rumors that South Korea could be preparing to ban trading in cryptocurrency, the price of bitcoin depreciated by 12 percent.[40][41]

- January 26, 2018, Coincheck, Japan's largest cryptocurrency OTC market, was hacked. 530 million US dollars of the NEM were stolen by the hacker, and the loss was the largest ever by an incident of theft, which caused Coincheck to indefinitely suspend trading.[42]

- From 26 January to 6 February, the price of bitcoin halved, and reached 6,000 US dollars. Additional negative news for the cryptocurrency market continued in the first quarter of 2018. The price remained low though the level slightly recovered in the first quarter of 2018.

- March 7, 2018, Compromised Binance API keys were used to execute irregular trades.[43]

- Late March 2018, Facebook, Google, and Twitter banned advertisements for initial coin offerings (ICO) and token sales.[44]

- November 15, 2018, bitcoin's market capitalization fell below $100 billion for the first time since October 2017 and the price of bitcoin fell to $5,500.[45][46]

Early 2021 Bitcoin boom

In early 2021, bitcoin price witnessed another boom, soaring more than 700% since March 2020[47] and surged above the $40,000 mark for the first time on 7 January. On 11 January, the UK Financial Conduct Authority warned investors against lending or investments in cryptoassets, that they should be prepared "to lose all their money".[48]

See also

References

- Popken, Ben (February 2, 2018). "Bitcoin loses more than half its value amid crypto crash". NBC News. Archived from the original on 2018-10-21.

- Patterson, Michael (September 12, 2018). "Crypto's 80% Plunge Is Now Worse Than the Dot-Com Crash". Bloomberg. Archived from the original on 2018-10-11.

- Huang, Eustance (November 14, 2018). "Bitcoin market cap falls below $100 billion for first time since October 2017". CNBC. Archived from the original on 2018-11-16.

- Meyer, David (November 15, 2018). "The Entire Cryptocurrency Scene—Including Bitcoin—Is Plummeting Again. These Might Be the Reasons Why". Fortune. Meredith Corporation. Archived from the original on 2018-11-15.

- Russilillo, Steven (26 November 2018). "Bitcoin Continues Steep Fall as Cryptocurrency Collapse Worsens". The Wall Street Journal. Archived from the original on 2018-11-27.

- Wilson, Tom (March 12, 2020). "Bitcoin plummets as cryptocurrencies suffer in market turmoil". Reuters. Thomson Reuters. Retrieved March 12, 2020.

- Nagarajan, Shalini. "Bitcoin doesn't care who wins the US election - it will rise in value regardless of the outcome, a cryptocurrency fund chief says | Currency News | Financial and Business News | Markets Insider". markets.businessinsider.com. Retrieved 2020-11-03.

- "Bitcoin Jumps to Record High as Bulls Say This Time Is Different". Bloomberg.com. 30 November 2020.

- Cooper, Amanda (2021-01-04). "Bitcoin plummets 17% for its biggest drop since March as its record-shattering rally stumbles". Business Insider France (in French). Retrieved 2021-01-05.

- "BTCUSD | Bitcoin USD Overview". MarketWatch. Retrieved 2021-01-10.

- Krugman, Paul (January 29, 2018). "Bubble, Bubble, Fraud and Trouble". The New York Times. Archived from the original on 2018-06-04.

- Shiller, Robert (1 March 2014). "In Search of a Stable Electronic Currency". New York Times. Archived from the original on 24 October 2014.

- Costelloe, Kevin (November 29, 2017). "Bitcoin 'Ought to Be Outlawed,' Nobel Prize Winner Stiglitz Says". Bloomberg. Archived from the original on 2018-06-12.

It doesn’t serve any socially useful function.

- "Economics Nobel prize winner, Richard Thaler: 'The market that looks most like a bubble to me is Bitcoin and its brethren'". ECO Portuguese Economy. 22 January 2018. Archived from the original on 2018-06-12.

- Wolff-Mann, Ethan (April 27, 2018). "'Only good for drug dealers': More Nobel prize winners snub bitcoin". Yahoo Finance. Archived from the original on 2018-06-12.

- Kearns, Jeff (4 December 2013). "Greenspan Says Bitcoin a Bubble Without Intrinsic Currency Value". bloomberg.com. Bloomberg LP. Archived from the original on 29 December 2013.

- "Central banker takes stab at bitcoin 'bubble'". Phys.org. AFP. February 6, 2018. Archived from the original on 2018-06-12.

- "Bitcoin is like Tulipmania, says ECB vice-president". The Financial Times. 22 September 2017. Archived from the original on 30 September 2017.

- "Bitcoin hype worse than 'tulip mania', says Dutch central banker". The Guardian. 4 December 2013. Archived from the original on 20 March 2017.

- Crippen, Alex (14 March 2014). "Bitcoin? Here's what Warren Buffett is saying". CNBC. Archived from the original on 13 January 2017. Retrieved 11 January 2017.

- Porzecanski, Katia (25 January 2018). "George Soros: Bitcoin is a bubble, Trump is a 'danger to the world'". Globe and Mail. Bloomberg News. Archived from the original on 9 June 2018. Retrieved 7 June 2018.

- Yang, Yingzhi (18 May 2018). "There's a bitcoin bubble, says Alibaba executive chairman Jack Ma". South China Morning Post. Archived from the original on 10 June 2018. Retrieved 10 June 2018.

- Cheng, Evelyn (7 June 2018). "Warren Buffett and Jamie Dimon on bitcoin: Beware". CNBC. Archived from the original on 9 June 2018. Retrieved 7 June 2018.

- Kim, Tae (2018-01-09). "Jamie Dimon says he regrets calling bitcoin a fraud and believes in the technology behind it". CNBC. Retrieved 2020-12-31.

- "5 reasons to tread carefully in cryptocurrencies". CBS. January 5, 2018. Archived from the original on 2018-01-14.

- "The ICO bubble is about to burst but that's a good thing, Expect a slowdown in ICOs in 2018, as token sales become less of a Wild West". Wired. 12 December 2017. Archived from the original on 2018-01-20.

- "Explaining the new cryptocurrency bubble—and why it might not be all bad Investors are pouring tens of millions of dollars into new cryptocurrencies". Arstechnica. October 5, 2017. Archived from the original on 2017-12-22.

- Camila, Russo (2018-06-04). "Binance's Venture Fund Head Is Waiting for ICO Bubble to Burst". Bloomberg. Archived from the original on 2018-06-23.

- Russo, Camila (4 June 2018). "Binance's Venture Fund Head Is Waiting for ICO Bubble to Burst". Bloomberg. Archived from the original on 2018-06-12.

- Popken, Ben (February 2, 2018). "Bitcoin loses more than half its value amid crypto crash". NBC News. Archived from the original on 2018-10-21.

- Silcoff, Sean (February 13, 2018). "OMERS-affiliated Ethereum Capital offering pinched, but not pulled, following choppy markets and cryptocrash". The Globe and Mail. The Woodbridge Company. Archived from the original on 2018-10-20.

- "Crypto crash: bitcoin drops to lowest point since November". The Week. February 2, 2018. Archived from the original on 2018-07-05.

- Smith, Noah (February 8, 2018). "Crypto Cynics Stand to Profit the Most". Bloomberg. Archived from the original on 2018-06-15.

- Chaparro, Frank (February 2, 2018). "ROUBINI: 'The Mother Of All Bubbles And Biggest Bubble in Human History Comes Down Crashing'". Business Insider. Archived from the original on 2018-10-23.

- Kaplan, Michael (September 11, 2018). "Bitcoin crash: This man lost his savings when cryptocurrencies plunged". CNN. Archived from the original on 2018-10-12.

- Patterson, Michael (September 12, 2018). "Crypto's 80% Plunge Is Now Worse Than the Dot-Com Crash". Bloomberg. Archived from the original on 2018-10-11.

- Russilillo, Steven (26 November 2018). "Bitcoin Continues Steep Fall as Cryptocurrency Collapse Worsens". The Wall Street Journal. Archived from the original on 2018-11-27.

- "Bitcoin Hits a New Record High, But Stops Short of $20,000". Fortune. Archived from the original on 2018-11-14.

- Martin, Will (December 22, 2017). "Bitcoin swings wildly as its price plunges". Business Insider. Archived from the original on 2018-10-18.

- Choudhury, Saheli Roy (January 11, 2018). "South Korea is talking down the idea a cryptocurrency trading ban is imminent". CNBC. Archived from the original on 2018-06-15.

- Kharpal, Arjun (January 11, 2018). "Over $100 billion wiped off global cryptocurrency market following talk of South Korea trading ban". CNBC. Archived from the original on 2018-10-15.

- Mochizuki, Takashi; Vigna, Paul (January 26, 2018). "Cryptocurrency Worth $530 Million Missing From Japanese Exchange". The Wall Street Journal. Archived from the original on 2018-06-15.

- "Summary of the Phishing and Attempted Stealing Incident on Binance". Binance. Archived from the original on 2019-07-28.

- Russo, Camila (March 26, 2018). "Twitter Joins Facebook, Google in Banning Crypto Coin Sale Ads". Bloomberg. Archived from the original on 2018-06-15.

- Huang, Eustance (2018-11-14). "Bitcoin market cap falls below $100 billion for first time since October 2017". CNBC. Archived from the original on 2018-11-16.

- "The Entire Cryptocurrency Scene—Including Bitcoin—Is Plummeting Again. These Might Be the Reasons Why". Fortune. Archived from the original on 2018-11-15.

- "Bitcoin boom threatens to turn it into pure gold". CNBC. 9 January 2021.

- "Crypto investors 'should be prepared to lose all their money,' top UK regulator warns". CNBC. 11 January 2021.

Further reading

- "Bitcoin Bulls and Bears". Bloomberg. 8 June 2018.