Multinational corporation

A multinational company (MNC)[lower-alpha 1][10] is a corporate organization that owns or controls production of goods or services in at least one country other than its home country.[11][12] Black's Law Dictionary suggests that a company or group should be considered a multinational corporation if it derives 25% or more of its revenue from out-of-home-country operations. However, a firm that owns and controls 51% of a foreign subsidiary also controls production of goods or services in at least one country other than its home country and therefore would also meet the criterion, even if that foreign affiliate generates only a few percent of its revenue.[13] A multinational corporation can also be referred to as a multinational enterprise (MNE), a transnational enterprise (TNE), a transnational corporation (TNC), an international corporation, or a stateless corporation.[14] There are subtle but real differences between these terms.

Most of the largest and most influential companies of the modern age are publicly traded multinational corporations, including Forbes Global 2000 companies. Multinational corporations are subject to criticisms for lacking ethical standards. They have also become associated with multinational tax havens and base erosion and profit shifting tax avoidance activities.

Overview

A multinational corporation (MNC) is usually a large corporation incorporated in one country which produces or sells goods or services in various countries.[15] Two common characteristics shared by MNCs are their large size and the fact that their worldwide activities are centrally controlled by the parent companies.[16]

- Importing and exporting goods and services

- Making significant investments in a foreign country

- Buying and selling licenses in foreign markets

- Engaging in contract manufacturing — permitting a local manufacturer in a foreign country to produce its products

- Opening manufacturing facilities or assembly operations in foreign countries

MNCs may gain from their global presence in a variety of ways. First of all, MNCs can benefit from the economy of scale by spreading R&D expenditures and advertising costs over their global sales, pooling global purchasing power over suppliers, and utilizing their technological and managerial know-how globally with minimal additional costs. Furthermore, MNCs can use their global presence to take advantage of underpriced labor services available in certain developing countries, and gain access to special R&D capabilities residing in advanced foreign countries.[17]

The problem of moral and legal constraints upon the behavior of multinational corporations, given that they are effectively "stateless" actors, is one of several urgent global socioeconomic problems that emerged during the late twentieth century.[18]

Potentially, the best concept for analyzing society's governance limitations over modern corporations is the concept of "stateless corporations". Coined at least as early as 1991 in Business Week, the conception was theoretically clarified in 1993: that an empirical strategy for defining a stateless corporation is with analytical tools at the intersection between demographic analysis and transportation research. This intersection is known as logistics management, and it describes the importance of rapidly increasing global mobility of resources. In a long history of analysis of multinational corporations we are some quarter century into an era of stateless corporations - corporations which meet the realities of the needs of source materials on a worldwide basis and to produce and customize products for individual countries.[19]

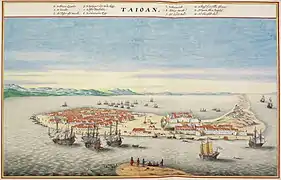

One of the first multinational business organizations, the East India Company, was established in 1601.[20] After the East India Company, came the Dutch East India Company, founded March 20, 1603, which would become the largest company in the world for nearly 200 years.[21]

The main characteristics of multinational companies are:

- In general, there is a national strength of large companies as the main body, in the way of foreign direct investment or acquire local enterprises, established subsidiaries or branches in many countries;

- It usually has a complete decision-making system and the highest decision-making centre, each subsidiary or branch has its own decision-making body, according to their different features and operations to make decisions, but its decision must be subordinated to the highest decision-making centre;

- MNCs seek markets in worldwide and rational production layout, professional fixed-point production, fixed-point sales products, in order to achieve maximum profit;

- Due to strong economic and technical strength, with fast information transmission, as well as funding for rapid cross-border transfers, the multinational has stronger competitiveness in the world;

- Many large multinational companies have varying degrees of monopoly in some area, due to economic and technical strength or production advantages.

Foreign direct investment

When a corporation invests in the country which it is not domiciled, it is called foreign direct investment (FDI).[30] Countries may place restrictions on direct investment; for example, China has historically required partnerships with local firms or special approval for certain types of investments by foreigners,[31] although some of these restrictions were eased in 2019.[32] Similarly, the United States Committee on Foreign Investment in the United States scrutinizes foreign investments.

In addition, corporations may be prohibited from various business transactions by international sanctions or domestic laws. For example, Chinese domestic corporations or citizens have limitations on their ability to make foreign investments outside of China, in part to reduce capital outflow.[33] Countries can impose extraterritorial sanctions on foreign corporations even for doing business with other foreign corporations, which occurred in 2019 with the United States sanctions against Iran; European companies faced with the possibility of losing access to the US market by trading with Iran.[34]

International investment agreements also facilitate direct investment between two countries, such as the North American Free Trade Agreement and most favored nation status.

Legal domicile

Multinational corporations can select from a variety of jurisdictions for various subsidiaries, but the ultimate parent company can select a single legal domicile; The Economist suggests that the Netherlands has become a popular choice, as its company laws have fewer requirements for meetings, compensation, and audit committees,[35] and Great Britain had advantages due to laws on withholding dividends and a double-taxation treaty with the United States.[35]

Corporations can legally engage in tax avoidance through their choice of jurisdiction, but must be careful to avoid illegal tax evasion.

Stateless or transnational

Corporations that are broadly active across the world without a concentration in one area have been called stateless or "transnational" (although "transnational corporation" is also used synonymously with "multinational corporation"[36]), but as of 1992, a corporation must be legally domiciled in a particular country and engage in other countries through foreign direct investment and the creation of foreign subsidiaries.[37]:115 Geographic diversification can be measured across various domains, including ownership and control, workforce, sales, and regulation and taxation.[37]

Regulation and taxation

Multinational corporations may be subject to the laws and regulations of both their domicile and the additional jurisdictions where they are engaged in business.[38] In some cases, the jurisdiction can help to avoid burdensome laws, but regulatory statutes often target the "enterprise" with statutory language around "control".[38]

As of 1992, the United States and most OECD countries have legal authority to tax a domiciled parent corporation on its worldwide revenue, including subsidiaries;[37]:117 as of 2019, the US applies its corporate taxation "extraterritorially",[39] which has motivated tax inversions to change the home state. By 2019, most OECD nations, with the notable exception of the US, had moved to territorial tax in which only revenue inside the border was taxed; however, these nations typically scrutinize foreign income with controlled foreign corporation (CFC) rules to avoid base erosion and profit shifting.[39]

In practice, even under an extraterritorial system taxes may be deferred until remittance, with possible repatriation tax holidays, and subject to foreign tax credits.[37]:117 Countries generally cannot tax the worldwide revenue of a foreign subsidiary, and taxation is complicated by transfer pricing arrangements with parent corporations.[37]:117

Alternatives and arrangements

For small corporations, registering a foreign subsidiary can be expensive and complex, involving fees, signatures, and forms;[40] a professional employer organization (PEO) is sometimes advertised as a cheaper and simpler alternative,[40] but not all jurisdictions have laws accepting these types of arrangements.[41]

Dispute resolution and arbitration

Disputes between corporations in different nations is often handled through international arbitration.

Theoretical background

The actions of multinational corporations are strongly supported by economic liberalism and free market system in a globalized international society. According to the economic realist view, individuals act in rational ways to maximize their self-interest and therefore, when individuals act rationally, markets are created and they function best in free market system where there is little government interference. As a result, international wealth is maximized with free exchange of goods and services.[42]

To many economic liberals, multinational corporations are the vanguard of the liberal order.[43] They are the embodiment par excellence of the liberal ideal of an interdependent world economy. They have taken the integration of national economies beyond trade and money to the internationalization of production. For the first time in history, production, marketing, and investment are being organized on a global scale rather than in terms of isolated national economies.[44]

International business is also a specialist field of academic research. Economic theories of the multinational corporation include internalization theory and the eclectic paradigm. The latter is also known as the OLI framework.

The other theoretical dimension of the role of multinational corporations concerns the relationship between the globalization of economic engagement and the culture of national and local responses. This has a history of self-conscious cultural management going back at least to the 60s. For example:

Ernest Dichter, architect, of Exxon's international campaign, writing in the Harvard Business Review in 1963, was fully aware that the means to overcoming cultural resistance depended on an "understanding" of the countries in which a corporation operated. He observed that companies with "foresight to capitalize on international opportunities" must recognize that "cultural anthropology will be an important tool for competitive marketing". However, the projected outcome of this was not the assimilation of international firms into national cultures, but the creation of a "world customer". The idea of a global corporate village entailed the management and reconstitution of parochial attachments to one's nation. It involved not a denial of the naturalness of national attachments, but an internationalization of the way a nation defines itself.[45]

Multinational enterprise

"Multinational enterprise" (MNE) is the term used by international economist and similarly defined with the multinational corporation (MNC) as an enterprise that controls and manages production establishments, known as plants located in at least two countries.[46] The multinational enterprise (MNE) will engage in foreign direct investment (FDI) as the firm makes direct investments in host country plants for equity ownership and managerial control to avoid some transaction costs.[47]

Colonialism

.jpg.webp)

The history of multinational corporations is closely intertwined with the history of colonialism, the first multinational corporations being founded to undertake colonial expeditions at the behest of their European monarchical patrons.[57] Prior to the era of New Imperialism, a majority of European colonies not held by the Spanish and Portuguese crowns were administered by chartered multinational corporations.[58] Examples of such corporations include the British East India Company,[59] the Dutch East India Company, the Swedish Africa Company, and the Hudson's Bay Company.[60] These early corporations facilitated colonialism by engaging in international trade and exploration, and creating colonial trading posts.[61] Many of these corporations, such as the South Australia Company and the Virginia Company, played a direct role in formal colonization by creating and maintaining settler colonies.[61] Without exception these early corporations created differential economic outcomes between their home country and their colonies via a process of exploiting colonial resources and labour, and investing the resultant profits and net gain in the home country.[62] The end result of this process was the enrichment of the colonizer and the impoverishment of the colonized.[63] Some multinational corporations, such as the Royal African Company, were also responsible for the logistical component of the Atlantic slave trade,[64] maintaining the ships and ports required for this vast enterprise. During the 19th century, formal corporate rule over colonial holdings largely gave way to state-controlled colonies,[65][66] however corporate control over colonial economic affairs persisted in a majority of colonies.[61][65]

During the process of decolonization, the European colonial charter companies were disbanded,[61] with the final colonial corporation, the Mozambique Company, dissolving in 1972. However the economic impact of corporate colonial exploitation has proved to be lasting and far reaching,[67] with some commentators asserting that this impact is among the chief causes of contemporary global income inequality.[63]

Contemporary critics of multinational corporations have charged that some present day multinational corporations follow the pattern of exploitation and differential wealth distribution established by the now defunct colonial charter corporations, particularly with regards to corporations based in the developed world that operate resource extraction enterprises in the developing world,[68] such as Royal Dutch Shell, and Barrick Gold. Some of these critics argue that the operations of multinational corporations in the developing world take place within the broader context of neocolonialism. However, as of 2015, multinational corporations from emerging markets are playing an ever-greater role, increasingly impacting the global economy.[69]

Criticism

Anti-corporate advocates criticize multinational corporations for being without a basis in a national ethos, being ultimately without a specific nationhood, and that this lack of an ethos appears in their ways of operating as they enter into contracts with countries that have low human rights or environmental standards.[70] In the world economy facilitated by multinational corporations, capital will increasingly be able to play workers, communities, and nations off against one another as they demand tax, regulation and wage concessions while threatening to move. In other words, increased mobility of multinational corporations benefit capital while workers and communities lose. Some negative outcomes generated by multinational corporations include increased inequality, unemployment, and wage stagnation.[71]

The aggressive use of tax avoidance schemes, and multinational tax havens, allows multinational corporations to gain competitive advantages over small and medium-sized enterprises.[72] Organizations such as the Tax Justice Network criticize governments for allowing multinational organizations to escape tax, particularly by using base erosion and profit shifting (BEPS) tax tools, since less money can be spent for public services.[73]

See also

Notes

- It is important to note the difference between a "corporation" and a "company" in general, hence the difference between a "multinational corporation" and a "multinational company" in its modern sense.

- Note the difference between a "multinational/transnational company" in general and a "multinational/transnational corporation" in particular.

References

- Brook, Timothy: Vermeer's Hat: The Seventeenth Century and the Dawn of the Global World. (Bloomsbury Press, 2008, pp. 288, ISBN 978-1596915992)

- Sayle, Murray (5 April 2001). "Japan goes Dutch". London Review of Books. Vol. 23 no. 7.

The Netherlands United East Indies Company (Verenigde Oostindische Compagnie, or VOC), founded in 1602, was the world's first multinational, joint-stock, limited liability corporation – as well as its first government-backed trading cartel. Our own East India Company, founded in 1600, remained a coffee-house clique until 1657, when it, too, began selling shares, not in individual voyages, but in the Company itself, by which time its Dutch rival was by far the biggest commercial enterprise the world had known.

- Phelan, Ben (7 Jan 2013). "Dutch East India Company: The World's First Multinational". PBS.org. Retrieved 8 August 2017.

- Hagel, John; Brown, John Seely (12 March 2013). "Institutional Innovation: Creating Smarter Organizations". Deloitte Insights.

[...] In 1602, the Dutch East India Company was formed. It was a new type of institution: the first multinational company, and the first to issue public stock. These innovations allowed a single company to mobilize financial resources from a large number of investors and create ventures at a scale that had previously only been possible for monarchs.

- Taylor, Bryan (6 Nov 2013). "The Rise and Fall of the Largest Corporation in History". BusinessInsider.com. Retrieved 8 August 2017.

- Roberts, Keith (15 March 2015). "Corporate Colonization of Wisconsin, Part IV — The Dutch East India Company and the Koch Wisconsin Company". MiddleWisconsin.org. Retrieved 25 May 2018.

- Partridge, Matthew (20 March 2015). "This day in history: 20 March 1602: Dutch East India Company formed". MoneyWeek.com. Retrieved 20 May 2018.

- Grenville, Stephen (3 November 2017). "The first global supply chain". Lowy Institute. Retrieved 28 May 2018.

- Hennigan, Michael (22 January 2018). "First Modern Economy: Myths on tulips & most valuable firm in history". Finfacts.ie (Irish Finance and Business Portal). Retrieved 22 May 2018.

- "Conference proceedings literature added to ISI's chemistry citation index". Applied Catalysis A: General. 107 (1): N4–N5. December 1993. doi:10.1016/0926-860x(93)85126-a. ISSN 0926-860X.

- Pitelis, Christos; Roger Sugden (2000). The nature of the transnational firm. Routledge. p. H72. ISBN 0-415-16787-6.

- "Multinational Corporations".

- What is MULTINATIONAL CORPORATION (MNC)?, accessed 18 August 2018

- Roy D. Voorhees, Emerson L. Seim, and John I. Coppett, "Global Logistics and Stateless Corporations," Transportation Practitioners Journal 59, 2 (Winter 1992): 144-51.

- Doob, Christopher M. (2014). Social Inequality and Social Stratification in US Society. Pearson Education Inc.

- "Role of Multinational Corporations". T. Romana College. Archived from the original on 27 November 2016. Retrieved 3 January 2019.

- Eun, Cheol S.; Resnick, Bruce G. (2014). International Financial Management,6th Edition. Beijing Chengxin Weiye Printing Inc.

- Koenig-Archibugi, Mathias. "Transnational Corporations and Public Accountability" (PDF). Gary 2004: 106. Archived from the original (PDF) on 22 February 2016. Retrieved 2 February 2016. Krugman, Paul (20 March 1998). "In Praise of Cheap Labor: Bad Jobs at Bad Wages Are Better than No Jobs at All". Slate. Retrieved 2 February 2016.

- Holstein, William J. et al., "The Stateless Corporation", Business Week (May 14, 1991), p. 98. Roy D. Voorhees, Emerson L. Seim, and John I. Coppett, "Global Logistics and Stateless Corporations", Transportation Practitioners Journal 59, 2 (Winter 1993): 144-51.

- "GlobalInc. An Atlas of The Multinational Corporation" Medard Gabel & Henry Bruner, New York: The New Press, 2004. ISBN 1-56584-727-X". Archived from the original on 2003-12-22.

- http://www.kb.nl/themas/geschiedenis-en-cultuur/koloniaal-verleden/voc-1603-1800. Retrieved 2016-07-05. Missing or empty

|title=(help) - Brenner, Reuven (1994). Labyrinths of Prosperity: Economic Follies, Democratic Remedies. (University of Michigan Press, 1994), p. 57-60

- Moore, Jason W. (2010b). "'Amsterdam is Standing on Norway' Part II: The Global North Atlantic in the Ecological Revolution of the Long Seventeenth Century," Journal of Agrarian Change, 10, 2, p. 188–227

- Chen, Piera; Gardner, Dinah: Lonely Planet: Taiwan [10th edition]. (Lonely Planet, 2017, ISBN 978-1786574398).

- Shih, Chih-Ming; Yen, Szu-Yin (2009). The Transformation of the Sugar Industry and Land Use Policy in Taiwan, in Journal of Asian Architecture and Building Engineering [8:1], pp. 41–48

- Tseng, Hua-pi (2016). Sugar Cane and the Environment under Dutch Rule in Seventeenth Century Taiwan, in Environmental History in the Making, pp. 189–200

- Estreicher, Stefan K. (2014), 'A Brief History of Wine in South Africa,'. European Review 22(3): pp. 504–537. doi:10.1017/S1062798714000301

- Fourie, Johan; von Fintel, Dieter (2014), 'Settler Skills and Colonial Development: The Huguenot Wine-Makers in Eighteenth-Century Dutch South Africa,'. The Economic History Review 67(4): 932–963. doi:10.1111/1468-0289.12033

- Thompson, Laurence G. (1964), 'The Earliest Chinese Eyewitness Accounts of the Formosan Aborigines,'. Monumenta Serica 23(1): 163–204. Laurence G. Thompson (1964) noted, "The most striking fact about the historical knowledge of Formosa is the lack of it in Chinese records. It is truly astonishing that this very large island, so close to the mainland that on exceptionally clear days it may be made out from certain places on the Fukien coast with the unaided eye, should have remained virtually beyond the ken of Chinese writers down until late Ming times (seventeenth century)."

- Chen, James. "Foreign Direct Investment (FDI)". Investopedia. Retrieved 2019-05-12.

- AsialinkBusiness. "Investment rules in China". Asialink Business. Retrieved 2019-05-12.

- Huang, Yukon. "China's Foreign Investment Law and US-China Trade Friction". Carnegie Endowment for International Peace. Retrieved 2019-05-12.

- "Chinese Restrictions on Foreign Investments – How Will It Impact The US?". Lawyer Monthly | Legal News Magazine. Retrieved 2019-05-12.

- "Trump's Iran sanctions: an explainer on their impact for Europe". ECFR. Retrieved 2019-05-12.

- "Here, there and everywhere: Why some businesses choose multiple corporate citizenships". The Economist. Retrieved 2018-11-25.

- Iriye, Akira; Saunier, Pierre-Yves, eds. (2009). "Transnational". The Palgrave Dictionary of Transnational History. London: Palgrave Macmillan UK. doi:10.1007/978-1-349-74030-7. ISBN 9781349740321.

- Hu, Yao-Su (1992-01-01). "Global or Stateless Corporations are National Firms with International Operations". California Management Review. 34 (2): 107–126. doi:10.2307/41166696. ISSN 0008-1256. JSTOR 41166696.

- Phillip, Blumberg (1990). "The Corporate Entity in an Era of Multinational Corporations". OpenCommons@UConn.

- "Designing a Territorial Tax System: A Review of OECD Systems". Tax Foundation. 2017-08-01. Retrieved 2019-06-22.

- "10 Reasons You Should Not Create a Foreign Subsidiary". Velocity Global. 2015-07-17. Archived from the original on 2018-11-25. Retrieved 2018-11-25.

- "Outsourcing Options for FDI into China - China Briefing News". China Briefing News. 2017-07-12. Archived from the original on 2018-11-25. Retrieved 2018-11-25.

- Mingst, Karen A. (2014). Essentials of international relations. W. W. Norton & Company. p. 310. ISBN 978-0-393-92195-3.

- Mingst, Karen A. (2015). Essentials of international relations. W. W. Norton & Company. p. 311. ISBN 978-0-393-92195-3.

- Gilpin, Robert (1975). Three models of the future. International Organization. p. 39.

- James, Paul (1984). "Australia in the Corporate Image: A New Nationalism". Arena (63): 68. See also, Richard Barnet and Ronald Muller, Global Reach: The Power of Multinational Corporations, New York, Simon and Schuster, 1975, p. 30. On page 21 Barnet and Muller quote the Chairman of the Unilever Corporation as saying: "The Nation-State will not wither away. A positive role will have to be found for it."

- E., Caves, Richard (2007). Multinational enterprise and economic analysis. Cambridge University Press. p. 1. ISBN 9780521677530. OCLC 272997700.

- E., Caves, Richard (2007). Multinational enterprise and economic analysis. Cambridge University Press. p. 69. ISBN 9780521677530. OCLC 272997700.

- Steensgaard, Niels (1982). 'The Dutch East India Company as an Institutional Innovation,'; in Maurice Aymard (ed.), Dutch Capitalism and World Capitalism / Capitalisme hollandais et capitalisme mondial [Studies in Modern Capitalism / Etudes sur le capitalisme moderne], pp. 235–257

- Neal, Larry (2005), 'Venture Shares of the Dutch East India Company,'; in Goetzmann & Rouwenhorst (eds.), The Origins of Value: The Financial Innovations that Created Modern Capital Markets, Oxford University Press, 2005, pp. 165–175

- Wilson, Eric Michael: The Savage Republic: De Indis of Hugo Grotius, Republicanism and Dutch Hegemony within the Early Modern World-System (c.1600–1619). (Martinus Nijhoff, 2008, ISBN 978-9004167889), p. 215–217

- Von Nordenflycht, Andrew, 'The Great Expropriation: Interpreting the Innovation of “Permanent Capital” at the Dutch East India Company,'; in Origins of Shareholder Advocacy, edited by Jonathan G.S. Koppell. (Palgrave Macmillan, 2011), pp. 89–98

- Shiller, Robert: The United East India Company and Amsterdam Stock Exchange [00:01:14], in Economics 252, Financial Markets: Lecture 4 – Portfolio Diversification and Supporting Financial Institutions. (Open Yale Courses, 2011)

- Jonker, Joost; Gelderblom, Oscar; Dari-Mattiacci, Giuseppe; Perotti, Enrico C. (2013), 'The Emergence of the Corporate Form'. (Amsterdam Centre for Law & Economics Working Paper No. 2013-02, 49pp). doi:10.2139/ssrn.2223905

- Jonker, Joost; Gelderblom, Oscar; de Jong, Abe (2013), 'The Formative Years of the Modern Corporation: The Dutch East India Company VOC, 1602–1623,'. The Journal of Economic History 73(4): pp. 1050–1076. doi:10.1017/S0022050713000879

- Funnell, Warwick; Robertson, Jeffrey: Accounting by the First Public Company: The Pursuit of Supremacy. (Routledge, 2014, ISBN 0415716179)

- Vasu, Rajkamal (2017), The Transition to Locked-In Capital in the First Corporations: Venture Capital Financing in Early Modern Europe Archived 2018-04-05 at the Wayback Machine. (Kellogg School of Management, Northwestern University)

- Jeffrey, Alex, and Joe Painter. "Imperialism and Post colonialism." Political Geography: An Introduction to Space and Power. London: SAGE, 2009. 174-75. Print.

- Robins, Nick. "This Imperious Company." The Corporation That Changed the World How the East India Company Shaped the Modern Multinational. London: Pluto, 2006. 24-25. Print.

- Robins, Nick. The Corporation That Changed the World How the East India Company Shaped the Modern Multinational. London: Pluto, 2006. Print.

- Royle, Stephen A. Company, Crown and Colony: The Hudson's Bay Company and Territorial Endeavor in Western Canada. London: I.B. Tauris, 2011. Print.

- Micklethwait, John, and Adrian Wooldridge. 2003. The company: A short history of a revolutionary idea. New York: Modern Library.

- Howe, Stephen. "Empire by Sea." Empire: A Very Short Introduction. Oxford: Oxford UP, 2002. 77-80. Print.

- Angeles, Luis. "Income Inequality and Colonialism" (PDF). European Economic Review 51.5 (2007): 1155-176. Archived from the original (PDF) on 2015-02-07. Cite journal requires

|journal=(help) - Howe, Stephen. "Empire by Sea." Empire: A Very Short Introduction. Oxford: Oxford UP, 2002. 67. Print.

- Jeffrey, Alex, and Joe Painter. "Imperialism and Postcolonialism." Political Geography: An Introduction to Space and Power. London: SAGE, 2009. 175. Print.

- Robins, Nick. The Corporation That Changed the World How the East India Company Shaped the Modern Multinational. London: Pluto, 2006. 145. Print.

- Howe, Stephen. "Empire by Sea." Empire: A Very Short Introduction. Oxford: Oxford UP, 2002. 78-83. Print.

- Bakan, Joel. The Corporation: The Pathological Pursuit of Profit and Power. New York: Free, 2004. Print.

- "Dossier about emerging-market multinationals". D+C, development and cooperation. December 2015. Retrieved 22 December 2019.

- Marc 'Globalization, Power, and Survival: an Anthropological Perspective', pg 484–486. Anthropological Quarterly Vol.79, No. 3. Institute for Ethnographic Research, 2006

- Crotty, Epstein & Kelly (1998). Multinational corps in neo-liberal regime. Cambridge University Press. p. 2.

- Library of the European Parliament Corporate tax avoidance by multinational firms

- Tax Justice Network, Taxing corporations

External links

| Wikiquote has quotations related to: Multinational corporation |