Dutch East India Company

The Dutch East India Company, officially the United East India Company (Dutch: Vereenigde Oostindische Compagnie; VOC; Indonesian: Kompeni), was a megacorporation founded by a government-directed amalgamation of several rival Dutch trading companies (voorcompagnieën) in the early 17th century.[9][10] It was established on 20 March 1602, as a chartered company to trade with Mughal India[11] in the early modern period, from which 50% of textiles and 80% of silks were imported, chiefly from its most developed region known as Bengal Subah.[12][13][14][15][16] In addition, the company traded with Indianised Southeast Asian countries when the Dutch government granted it a 21-year monopoly on the Dutch spice trade.

Company logo | |

Company flag | |

Native name |

|

|---|---|

| Type | Publicly traded company |

| Industry | Proto-conglomerate[lower-alpha 2] |

| Fate | Dissolved |

| Predecessor | Voorcompagnieën/Pre-companies (1594–1602)[lower-alpha 3]

|

| Founded | 20 March 1602,[8] by a government-directed amalgamation of the voorcompagnieën/pre-companies |

| Founder | Johan van Oldenbarnevelt and the States-General |

| Defunct | 1 January 1800 |

| Headquarters |

|

Area served |

|

Key people |

|

| Products | Spices,[2] silk, porcelain, metals, livestock, tea, grain, rice, soybeans, sugarcane,[3][4] wine,[5][6][7] coffee |

The company has been often labelled a trading company (i.e. a company of merchants who buy and sell goods produced by other people) or sometimes a shipping company. However, the VOC was in fact an early-modern corporate model of vertically integrated global supply chain[2][5] and a proto-conglomerate, diversifying into multiple commercial and industrial activities such as international trade (especially intra-Asian trade),[1][17][18][19][20][21] shipbuilding, and both production and trade of East Indian spices,[2] Indonesian coffee, Formosan sugarcane,[3][4] and South African wine.[5][6][7] The company was a transcontinental employer and a corporate pioneer of outward foreign direct investment at the dawn of modern capitalism. In the early 1600s, by widely issuing bonds and shares of stock to the general public,[lower-alpha 6] VOC became the world's first formally listed public company.[lower-alpha 7][lower-alpha 8][23][24][25][26][27][28][29]

With its pioneering institutional innovations and powerful roles in global business history, the company is often considered by many to be the forerunner of modern corporations. In many respects, modern-day corporations are all the 'direct descendants' of the VOC model.[31][34][35][36][37] It was its 17th-century institutional innovations and business practices that laid the foundations for the rise of giant global corporations in subsequent centuries[30][31][32][38] – as a highly significant and formidable socio-politico-economic force of the modern-day world[39][40][41][42][43] – to become the dominant factor in almost all economic systems today. It also served as the direct model for the organisational reconstruction of the English/British East India Company in 1657.[44][45][46][47][29][48] The company, for nearly 200 years of its existence (1602–1800), had effectively transformed itself from a corporate entity into a state or an empire in its own right.[lower-alpha 9] One of the most influential and extensively researched business enterprises in history, the VOC's world has been the subject of a vast amount of literature that includes both fiction and nonfiction works.

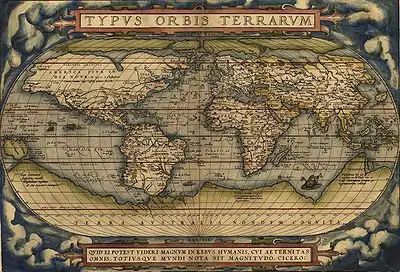

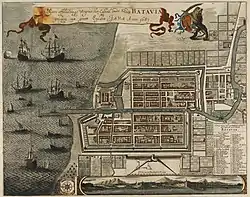

The company was historically an exemplary company-state[lower-alpha 10] rather than a pure for-profit corporation. Originally a government-backed military-commercial enterprise, the VOC was the wartime brainchild of leading Dutch republican statesman Johan van Oldenbarnevelt and the States-General. From its inception in 1602, the company was not only a commercial enterprise but also effectively an instrument of war in the young Dutch Republic's revolutionary global war against the powerful Spanish Empire and Iberian Union (1579–1648). In 1619, the company forcibly established a central position in the Javanese city of Jayakarta, changing the name to Batavia (modern-day Jakarta). Over the next two centuries the company acquired additional ports as trading bases and safeguarded their interests by taking over surrounding territory.[52] To guarantee its supply, the company established positions in many countries and became an early pioneer of outward foreign direct investment.[lower-alpha 11] In its foreign colonies, the VOC possessed quasi-governmental powers, including the ability to wage war, imprison and execute convicts,[56] negotiate treaties, strike its own coins, and establish colonies.[57] With increasing importance of foreign posts, the company is often considered the world's first true transnational corporation.[lower-alpha 12][58] Along with the Dutch West India Company (WIC/GWIC), the VOC was seen as the international arm of the Dutch Republic and the symbolic power of the Dutch Empire. To further its trade routes, the VOC-funded exploratory voyages, such as those led by Willem Janszoon (Duyfken), Henry Hudson (Halve Maen), and Abel Tasman, revealed largely unknown landmasses to the western world. In the Golden Age of Netherlandish cartography (c. 1570s–1670s), VOC navigators and cartographers helped shape geographical knowledge of the world as we know it today.

Socio-economic changes in Europe, the shift in power balance, and less successful financial management resulted in a slow decline of the VOC between 1720 and 1799. After the financially disastrous Fourth Anglo-Dutch War (1780–1784), the company was nationalised in 1796,[59] and finally dissolved on 31 December 1799. All assets were taken over by the government with VOC territories becoming Dutch government colonies.

The company has been criticised for its monopolistic policy, exploitation, colonialism, uses of violence, and slavery.

Company name, logo, and flag

%252C_Hoorn.jpg.webp)

In Dutch, the name of the company is Vereenigde Oostindische Compagnie or Verenigde Oost-Indische Compagnie, literally the "United East Indian Company", which is abbreviated to VOC. The company's monogram logo was possibly the first globally recognised corporate logo.[34] The logo of the VOC consisted of a large capital 'V' with an O on the left and a C on the right leg. It appeared on various corporate items, such as cannons and coins. The first letter of the hometown of the chamber conducting the operation was placed on top . The monogram, versatility, flexibility, clarity, simplicity, symmetry, timelessness, and symbolism are considered notable characteristics of the VOC's professionally designed logo. Those elements ensured its success at a time when the concept of the corporate identity was virtually unknown.[34][60][61] An Australian vintner has used the VOC logo since the late 20th century, having re-registered the company's name for the purpose.[62] The flag of the company was red, white, and blue, with the company logo embroidered on it.

Around the world, and especially in English-speaking countries, the VOC is widely known as the 'Dutch East India Company'. The name 'Dutch East India Company' is used to make a distinction from the [British] East India Company (EIC) and other East Indian companies (such as the Danish East India Company, French East India Company, Portuguese East India Company, and the Swedish East India Company). The company's alternative names that have been used include the 'Dutch East Indies Company', 'United East India Company', 'United East Indian Company', 'United East Indies Company', 'Jan Company', or 'Jan Compagnie'.[63][64]

History

Origins

Before the Dutch Revolt, Antwerp had played an important role as a distribution centre in northern Europe. After 1591, however, the Portuguese used an international syndicate of the German Fuggers and Welsers, and Spanish and Italian firms, that used Hamburg as the northern staple port to distribute their goods, thereby cutting Dutch merchants out of the trade. At the same time, the Portuguese trade system was unable to increase supply to satisfy growing demand, in particular the demand for pepper. Demand for spices was relatively inelastic; therefore, each lag in the supply of pepper caused a sharp rise in pepper prices.

In 1580, the Portuguese crown was united in a personal union with the Spanish crown, with which the Dutch Republic was at war. The Portuguese Empire therefore became an appropriate target for Dutch military incursions. These factors motivated Dutch merchants to enter the intercontinental spice trade themselves. Further, a number of Dutchmen like Jan Huyghen van Linschoten and Cornelis de Houtman obtained first hand knowledge of the "secret" Portuguese trade routes and practices, thereby providing opportunity.[65]

The stage was thus set for the four-ship exploratory expedition by Frederick de Houtman in 1595 to Banten, the main pepper port of West Java, where they clashed with both the Portuguese and indigenous Javanese. Houtman's expedition then sailed east along the north coast of Java, losing twelve crew members to a Javanese attack at Sidayu and killing a local ruler in Madura. Half the crew were lost before the expedition made it back to the Netherlands the following year, but with enough spices to make a considerable profit.[66]

In 1598, an increasing number of fleets were sent out by competing merchant groups from around the Netherlands. Some fleets were lost, but most were successful, with some voyages producing high profits. In March 1599, a fleet of eight ships under Jacob van Neck was the first Dutch fleet to reach the 'Spice Islands' of Maluku, the source of pepper, cutting out the Javanese middlemen. The ships returned to Europe in 1599 and 1600 and the expedition made a 400 percent profit.[66]

In 1600, the Dutch joined forces with the Muslim Hituese on Ambon Island in an anti-Portuguese alliance, in return for which the Dutch were given the sole right to purchase spices from Hitu.[67] Dutch control of Ambon was achieved when the Portuguese surrendered their fort in Ambon to the Dutch-Hituese alliance. In 1613, the Dutch expelled the Portuguese from their Solor fort, but a subsequent Portuguese attack led to a second change of hands; following this second reoccupation, the Dutch once again captured Solor in 1636.[67]

East of Solor, on the island of Timor, Dutch advances were halted by an autonomous and powerful group of Portuguese Eurasians called the Topasses. They remained in control of the Sandalwood trade and their resistance lasted throughout the 17th and 18th centuries, causing Portuguese Timor to remain under the Portuguese sphere of control.[68][69]

Formative years

At the time, it was customary for a company to be funded only for the duration of a single voyage and to be liquidated upon the return of the fleet. Investment in these expeditions was a very high-risk venture, not only because of the usual dangers of piracy, disease and shipwreck, but also because the interplay of inelastic demand and relatively elastic supply[70] of spices could make prices tumble, thereby ruining prospects of profitability. To manage such risk, the forming of a cartel to control supply would seem logical. In 1600, the English were the first to adopt this approach by bundling their resources into a monopoly enterprise, the English East India Company, thereby threatening their Dutch competitors with ruin.[71]

In 1602, the Dutch government followed suit, sponsoring the creation of a single "United East Indies Company" that was also granted monopoly over the Asian trade. For a time in the seventeenth century, it was able to monopolise the trade in nutmeg, mace, and cloves and to sell these spices across European kingdoms and emperor Akbar the Great's Mughal Empire at 14-17 times the price it paid in Indonesia;[72] while Dutch profits soared, the local economy of the Spice Islands was destroyed. With a capital of 6,440,200 guilders,[73] the new company's charter empowered it to build forts, maintain armies, and conclude treaties with Asian rulers. It provided for a venture that would continue for 21 years, with a financial accounting only at the end of each decade.[71]

In February 1603, the company seized the Santa Catarina, a 1500-ton Portuguese merchant carrack, off the coast of Singapore.[74] She was such a rich prize that her sale proceeds increased the capital of the VOC by more than 50%.[75]

Also in 1603, the first permanent Dutch trading post in Indonesia was established in Banten, West Java, and in 1611, another was established at Jayakarta (later "Batavia" and then "Jakarta").[76] In 1610, the VOC established the post of Governor General to more firmly control their affairs in Asia. To advise and control the risk of despotic Governors General, a Council of the Indies (Raad van Indië) was created. The Governor General effectively became the main administrator of the VOC's activities in Asia, although the Heeren XVII, a body of 17 shareholders representing different chambers, continued to officially have overall control.[67]

VOC headquarters were located in Ambon during the tenures of the first three Governors General (1610–1619), but it was not a satisfactory location. Although it was at the centre of the spice production areas, it was far from the Asian trade routes and other VOC areas of activity ranging from Africa to India to Japan.[77][78] A location in the west of the archipelago was thus sought. The Straits of Malacca were strategic but became dangerous following the Portuguese conquest, and the first permanent VOC settlement in Banten was controlled by a powerful local ruler and subject to stiff competition from Chinese and English traders.[67]

In 1604, a second English East India Company voyage commanded by Sir Henry Middleton reached the islands of Ternate, Tidore, Ambon and Banda. In Banda, they encountered severe VOC hostility, sparking Anglo-Dutch competition for access to spices.[76] From 1611 to 1617, the English established trading posts at Sukadana (southwest Kalimantan), Makassar, Jayakarta and Jepara in Java, and Aceh, Pariaman and Jambi in Sumatra, which threatened Dutch ambitions for a monopoly on East Indies trade.[76]

In 1620, diplomatic agreements in Europe ushered in a period of co-operation between the Dutch and the English over the spice trade.[76] This ended with a notorious but disputed incident known as the 'Amboyna massacre', where ten Englishmen were arrested, tried and beheaded for conspiracy against the Dutch government.[79] Although this caused outrage in Europe and a diplomatic crisis, the English quietly withdrew from most of their Indonesian activities (except trading in Banten) and focused on other Asian interests.

Growth

In 1619, Jan Pieterszoon Coen was appointed Governor-General of the VOC. He saw the possibility of the VOC becoming an Asian power, both political and economic. On 30 May 1619, Coen, backed by a force of nineteen ships, stormed Jayakarta, driving out the Banten forces; and from the ashes established Batavia as the VOC headquarters. In the 1620s almost the entire native population of the Banda Islands was driven away, starved to death, or killed in an attempt to replace them with Dutch plantations.[80] These plantations were used to grow nutmeg for export. Coen hoped to settle large numbers of Dutch colonists in the East Indies, but implementation of this policy never materialised, mainly because very few Dutch were willing to emigrate to Asia.[81]

Another of Coen's ventures was more successful. A major problem in the European trade with Asia at the time was that the Europeans could offer few goods that Asian consumers wanted, except silver and gold. European traders therefore had to pay for spices with the precious metals, which were in short supply in Europe, except for Spain and Portugal. The Dutch and English had to obtain it by creating a trade surplus with other European countries. Coen discovered the obvious solution for the problem: to start an intra-Asiatic trade system, whose profits could be used to finance the spice trade with Europe. In the long run this obviated the need for exports of precious metals from Europe, though at first it required the formation of a large trading-capital fund in the Indies. The VOC reinvested a large share of its profits to this end in the period up to 1630.[82]

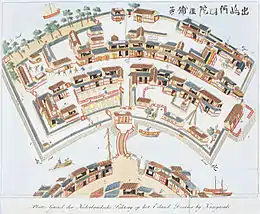

The VOC traded throughout Asia, benefiting mainly from Bengal. Ships coming into Batavia from the Netherlands carried supplies for VOC settlements in Asia. Silver and copper from Japan were used to trade with the world's wealthiest empires, Mughal India and Qing China, for silk, cotton, porcelain, and textiles. These products were either traded within Asia for the coveted spices or brought back to Europe. The VOC was also instrumental in introducing European ideas and technology to Asia. The company supported Christian missionaries and traded modern technology with China and Japan. A more peaceful VOC trade post on Dejima, an artificial island off the coast of Nagasaki, was for more than two hundred years the only place where Europeans were permitted to trade with Japan.[83] When the VOC tried to use military force to make Ming dynasty China open up to Dutch trade, the Chinese defeated the Dutch in a war over the Penghu islands from 1623 to 1624, forcing the VOC to abandon Penghu for Taiwan. The Chinese defeated the VOC again at the Battle of Liaoluo Bay in 1633.

The Vietnamese Nguyen Lords defeated the VOC in a 1643 battle during the Trịnh–Nguyễn War, blowing up a Dutch ship. The Cambodians defeated the VOC in the Cambodian–Dutch War from 1643 to 1644 on the Mekong River.

In 1640, the VOC obtained the port of Galle, Ceylon, from the Portuguese and broke the latter's monopoly of the cinnamon trade. In 1658, Gerard Pietersz. Hulft laid siege to Colombo, which was captured with the help of King Rajasinghe II of Kandy. By 1659, the Portuguese had been expelled from the coastal regions, which were then occupied by the VOC, securing for it the monopoly over cinnamon. To prevent the Portuguese or the English from ever recapturing Sri Lanka, the VOC went on to conquer the entire Malabar Coast from the Portuguese, almost entirely driving them from the west coast of India. When news of a peace agreement between Portugal and the Netherlands reached Asia in 1663, Goa was the only remaining Portuguese city on the west coast.[84]

In 1652, Jan van Riebeeck established a resupply outpost at the Cape of Storms (the southwestern tip of Africa, now Cape Town, South Africa) to service company ships on their journey to and from East Asia. The cape was later renamed Cape of Good Hope in honour of the outpost's presence. Although non-company ships were welcome to use the station, they were charged exorbitantly. This post later became a full-fledged colony, the Cape Colony, when more Dutch and other Europeans started to settle there.

Through the seventeenth century VOC trading posts were also established in Persia, Bengal, Malacca, Siam, Formosa (now Taiwan), as well as the Malabar and Coromandel coasts in India. Direct access to mainland China came in 1729 when a factory was established in Canton.[85] In 1662, however, Koxinga expelled the Dutch from Taiwan[86] (see History of Taiwan).

In 1663, the VOC signed the "Painan Treaty" with several local lords in the Painan area that were revolting against the Aceh Sultanate. The treaty allowed the VOC to build a trading post in the area and eventually to monopolise the trade there, especially the gold trade.[87]

By 1669, the VOC was the richest private company the world had ever seen, with over 150 merchant ships, 40 warships, 50,000 employees, a private army of 10,000 soldiers, and a dividend payment of 40% on the original investment.[88]

Many of the VOC employees inter-mixed with the indigenous peoples and expanded the population of Indos in pre-colonial history.[89][90]

Reorientation

Around 1670, two events caused the growth of VOC trade to stall. In the first place, the highly profitable trade with Japan started to decline. The loss of the outpost on Formosa to Koxinga in the 1662 Siege of Fort Zeelandia and related internal turmoil in China (where the Ming dynasty was being replaced with the China's Qing dynasty) brought an end to the silk trade after 1666. Though the VOC substituted Mughal Bengal's for Chinese silk other forces affected the supply of Japanese silver and gold. The shogunate enacted a number of measures to limit the export of these precious metals, in the process limiting VOC opportunities for trade, and severely worsening the terms of trade. Therefore, Japan ceased to function as the lynchpin of the intra-Asiatic trade of the VOC by 1685.[91]

Even more importantly, the Third Anglo-Dutch War temporarily interrupted VOC trade with Europe. This caused a spike in the price of pepper, which enticed the English East India Company (EIC) to enter this market aggressively in the years after 1672. Previously, one of the tenets of the VOC pricing policy was to slightly over-supply the pepper market, so as to depress prices below the level where interlopers were encouraged to enter the market (instead of striving for short-term profit maximisation). The wisdom of such a policy was illustrated when a fierce price war with the EIC ensued, as that company flooded the market with new supplies from India. In this struggle for market share, the VOC (which had much larger financial resources) could wait out the EIC. Indeed, by 1683, the latter came close to bankruptcy; its share price plummeted from 600 to 250; and its president Josiah Child was temporarily forced from office.[92]

However, the writing was on the wall. Other companies, like the French East India Company and the Danish East India Company also started to make inroads on the Dutch system. The VOC therefore closed the heretofore flourishing open pepper emporium of Bantam by a treaty of 1684 with the Sultan. Also, on the Coromandel Coast, it moved its chief stronghold from Pulicat to Negapatnam, so as to secure a monopoly on the pepper trade at the detriment of the French and the Danes.[93] However, the importance of these traditional commodities in the Asian-European trade was diminishing rapidly at the time. The military outlays that the VOC needed to make to enhance its monopoly were not justified by the increased profits of this declining trade.[94]

Nevertheless, this lesson was slow to sink in and at first the VOC made the strategic decision to improve its military position on the Malabar Coast (hoping thereby to curtail English influence in the area, and end the drain on its resources from the cost of the Malabar garrisons) by using force to compel the Zamorin of Calicut to submit to Dutch domination. In 1710, the Zamorin was made to sign a treaty with the VOC undertaking to trade exclusively with the VOC and expel other European traders. For a brief time, this appeared to improve the company's prospects. However, in 1715, with EIC encouragement, the Zamorin renounced the treaty. Though a Dutch army managed to suppress this insurrection temporarily, the Zamorin continued to trade with the English and the French, which led to an appreciable upsurge in English and French traffic. The VOC decided in 1721 that it was no longer worth the trouble to try to dominate the Malabar pepper and spice trade. A strategic decision was taken to scale down the Dutch military presence and in effect yield the area to EIC influence.[95]

The 1741 Battle of Colachel by warriors of Travancore under Raja Marthanda Varma defeated the Dutch. The Dutch commander Captain Eustachius De Lannoy was captured. Marthanda Varma agreed to spare the Dutch captain's life on condition that he joined his army and trained his soldiers on modern lines. This defeat in the Travancore-Dutch War is considered the earliest example of an organised Asian power overcoming European military technology and tactics; and it signalled the decline of Dutch power in India.[96]

The attempt to continue as before as a low volume-high profit business enterprise with its core business in the spice trade had therefore failed. The company had however already (reluctantly) followed the example of its European competitors in diversifying into other Asian commodities, like tea, coffee, cotton, textiles, and sugar. These commodities provided a lower profit margin and therefore required a larger sales volume to generate the same amount of revenue. This structural change in the commodity composition of the VOC's trade started in the early 1680s, after the temporary collapse of the EIC around 1683 offered an excellent opportunity to enter these markets. The actual cause for the change lies, however, in two structural features of this new era.

In the first place, there was a revolutionary change in the tastes affecting European demand for Asian textiles, coffee and tea, around the turn of the 18th century. Secondly, a new era of an abundant supply of capital at low interest rates suddenly opened around this time. The second factor enabled the company easily to finance its expansion in the new areas of commerce.[97] Between the 1680s and 1720s, the VOC was therefore able to equip and man an appreciable expansion of its fleet, and acquire a large amount of precious metals to finance the purchase of large amounts of Asian commodities, for shipment to Europe. The overall effect was approximately to double the size of the company.[98]

The tonnage of the returning ships rose by 125 percent in this period. However, the company's revenues from the sale of goods landed in Europe rose by only 78 percent. This reflects the basic change in the VOC's circumstances that had occurred: it now operated in new markets for goods with an elastic demand, in which it had to compete on an equal footing with other suppliers. This made for low profit margins.[99] Unfortunately, the business information systems of the time made this difficult to discern for the managers of the company, which may partly explain the mistakes they made from hindsight. This lack of information might have been counteracted (as in earlier times in the VOC's history) by the business acumen of the directors. Unfortunately by this time these were almost exclusively recruited from the political regent class, which had long since lost its close relationship with merchant circles.[100]

Low profit margins in themselves do not explain the deterioration of revenues. To a large extent the costs of the operation of the VOC had a "fixed" character (military establishments; maintenance of the fleet and such). Profit levels might therefore have been maintained if the increase in the scale of trading operations that in fact took place had resulted in economies of scale. However, though larger ships transported the growing volume of goods, labour productivity did not go up sufficiently to realise these. In general the company's overhead rose in step with the growth in trade volume; declining gross margins translated directly into a decline in profitability of the invested capital. The era of expansion was one of "profitless growth".[101]

Specifically: "[t]he long-term average annual profit in the VOC's 1630–70 'Golden Age' was 2.1 million guilders, of which just under half was distributed as dividends and the remainder reinvested. The long-term average annual profit in the 'Expansion Age' (1680–1730) was 2.0 million guilders, of which three-quarters was distributed as dividend and one-quarter reinvested. In the earlier period, profits averaged 18 percent of total revenues; in the latter period, 10 percent. The annual return of invested capital in the earlier period stood at approximately 6 percent; in the latter period, 3.4 percent."[101]

Nevertheless, in the eyes of investors the VOC did not do too badly. The share price hovered consistently around the 400 mark from the mid-1680s (excepting a hiccup around the Glorious Revolution in 1688), and they reached an all-time high of around 642 in the 1720s. VOC shares then yielded a return of 3.5 percent, only slightly less than the yield on Dutch government bonds.[102]

Decline and fall

After 1730, the fortunes of the VOC started to decline. Five major problems, not all of equal weight, explain its decline over the next fifty years to 1780:[103]

- There was a steady erosion of intra-Asiatic trade because of changes in the Asiatic political and economic environment that the VOC could do little about. These factors gradually squeezed the company out of Persia, Suratte, the Malabar Coast, and Bengal. The company had to confine its operations to the belt it physically controlled, from Ceylon through the Indonesian archipelago. The volume of this intra-Asiatic trade, and its profitability, therefore had to shrink.

- The way the company was organised in Asia (centralised on its hub in Batavia), that initially had offered advantages in gathering market information, began to cause disadvantages in the 18th century because of the inefficiency of first shipping everything to this central point. This disadvantage was most keenly felt in the tea trade, where competitors like the EIC and the Ostend Company shipped directly from China to Europe.

- The "venality" of the VOC's personnel (in the sense of corruption and non-performance of duties), though a problem for all East India Companies at the time, seems to have plagued the VOC on a larger scale than its competitors. To be sure, the company was not a "good employer". Salaries were low, and "private-account trading" was officially not allowed. Not surprisingly, it proliferated in the 18th century to the detriment of the company's performance.[104] From about the 1790s onward, the phrase perished under corruption (vergaan onder corruptie, also abbreviated VOC in Dutch) came to summarise the company's future.

- A problem that the VOC shared with other companies was the high mortality and morbidity rates among its employees. This decimated the company's ranks and enervated many of the survivors.

- A self-inflicted wound was the VOC's dividend policy. The dividends distributed by the company had exceeded the surplus it garnered in Europe in every decade from 1690 to 1760 except 1710–1720. However, in the period up to 1730 the directors shipped resources to Asia to build up the trading capital there. Consolidated bookkeeping therefore probably would have shown that total profits exceeded dividends. In addition, between 1700 and 1740 the company retired 5.4 million guilders of long-term debt. The company therefore was still on a secure financial footing in these years. This changed after 1730. While profits plummeted the bewindhebbers only slightly decreased dividends from the earlier level. Distributed dividends were therefore in excess of earnings in every decade but one (1760–1770). To accomplish this, the Asian capital stock had to be drawn down by 4 million guilders between 1730 and 1780, and the liquid capital available in Europe was reduced by 20 million guilders in the same period. The directors were therefore constrained to replenish the company's liquidity by resorting to short-term financing from anticipatory loans, backed by expected revenues from home-bound fleets.

Despite these problems, the VOC in 1780 remained an enormous operation. Its capital in the Republic, consisting of ships and goods in inventory, totalled 28 million guilders; its capital in Asia, consisting of the liquid trading fund and goods en route to Europe, totalled 46 million guilders. Total capital, net of outstanding debt, stood at 62 million guilders. The prospects of the company at this time therefore were not hopeless, had one of the plans for reform been undertaken successfully. However, the Fourth Anglo-Dutch War intervened. British naval attacks in Europe and Asia reduced the VOC fleet by half; removed valuable cargo from its control; and eroded its remaining power in Asia. The direct losses of the VOC during the war can be calculated at 43 million guilders. Loans to keep the company operating reduced its net assets to zero.[105]

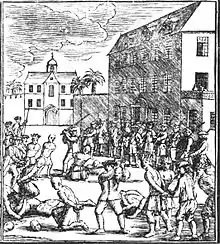

From 1720 on, the market for sugar from Indonesia declined as the competition from cheap sugar from Brazil increased. European markets became saturated. Dozens of Chinese sugar traders went bankrupt, which led to massive unemployment, which in turn led to gangs of unemployed coolies. The Dutch government in Batavia did not adequately respond to these problems. In 1740, rumours of deportation of the gangs from the Batavia area led to widespread rioting. The Dutch military searched houses of Chinese in Batavia for weapons. When a house accidentally burnt down, military and impoverished citizens started slaughtering and pillaging the Chinese community.[106] This massacre of the Chinese was deemed sufficiently serious for the board of the VOC to start an official investigation into the Government of the Dutch East Indies for the first time in its history.

After the Fourth Anglo-Dutch War, the VOC was a financial wreck. After vain attempts at reorganisation by the provincial States of Holland and Zeeland, it was nationalised by the new Batavian Republic on 1 March 1796.[107] The VOC charter was renewed several times, but was allowed to expire on 31 December 1799.[107] Most of the possessions of the former VOC were subsequently occupied by Great Britain during the Napoleonic wars, but after the new United Kingdom of the Netherlands was created by the Congress of Vienna, some of these were restored to this successor state of the Dutch Republic by the Anglo-Dutch Treaty of 1814.

Organisational structure

.jpg.webp)

The VOC is generally considered to be the world's first truly transnational corporation and it was also the first multinational enterprise to issue shares of stock to the public. Some historians such as Timothy Brook and Russell Shorto consider the VOC as the pioneering corporation in the first wave of the corporate globalisation era.[34][35] The VOC was the first multinational corporation to operate officially in different continents such as Europe, Asia and Africa. While the VOC mainly operated in what later became the Dutch East Indies (modern Indonesia), the company also had important operations elsewhere. It employed people from different continents and origins in the same functions and working environments. Although it was a Dutch company its employees included not only people from the Netherlands, but also many from Germany and from other countries as well. Besides the diverse north-west European workforce recruited by the VOC in the Dutch Republic, the VOC made extensive use of local Asian labour markets. As a result, the personnel of the various VOC offices in Asia consisted of European and Asian employees. Asian or Eurasian workers might be employed as sailors, soldiers, writers, carpenters, smiths, or as simple unskilled workers.[108] At the height of its existence the VOC had 25,000 employees who worked in Asia and 11,000 who were en route.[109] Also, while most of its shareholders were Dutch, about a quarter of the initial shareholders were Zuid-Nederlanders (people from an area that includes modern Belgium and Luxembourg) and there were also a few dozen Germans.[110]

The VOC had two types of shareholders: the participanten, who could be seen as non-managing members, and the 76 bewindhebbers (later reduced to 60) who acted as managing directors. This was the usual set-up for Dutch joint-stock companies at the time. The innovation in the case of the VOC was that the liability of not just the participanten but also of the bewindhebbers was limited to the paid-in capital (usually, bewindhebbers had unlimited liability). The VOC therefore was a limited liability company. Also, the capital would be permanent during the lifetime of the company. As a consequence, investors that wished to liquidate their interest in the interim could only do this by selling their share to others on the Amsterdam Stock Exchange.[111] Confusion of confusions, a 1688 dialogue by the Sephardi Jew Joseph de la Vega analysed the workings of this one-stock exchange.

The VOC consisted of six Chambers (Kamers) in port cities: Amsterdam, Delft, Rotterdam, Enkhuizen, Middelburg and Hoorn. Delegates of these chambers convened as the Heeren XVII (the Lords Seventeen). They were selected from the bewindhebber-class of shareholders.[112]

Of the Heeren XVII, eight delegates were from the Chamber of Amsterdam (one short of a majority on its own), four from the Chamber of Zeeland, and one from each of the smaller Chambers, while the seventeenth seat was alternatively from the Chamber of Middelburg-Zeeland or rotated among the five small Chambers. Amsterdam had thereby the decisive voice. The Zeelanders in particular had misgivings about this arrangement at the beginning. The fear was not unfounded, because in practice it meant Amsterdam stipulated what happened.

The six chambers raised the start-up capital of the Dutch East India Company:

| Chamber | Capital (Guilders) |

|---|---|

| Amsterdam | 3,679,915 |

| Middelburg | 1,300,405 |

| Enkhuizen | 540,000 |

| Delft | 469,400 |

| Hoorn | 266,868 |

| Rotterdam | 173,000 |

| Total: | 6,424,588 |

The raising of capital in Rotterdam did not go so smoothly. A considerable part originated from inhabitants of Dordrecht. Although it did not raise as much capital as Amsterdam or Middelburg-Zeeland, Enkhuizen had the largest input in the share capital of the VOC. Under the first 358 shareholders, there were many small entrepreneurs, who dared to take the risk. The minimum investment in the VOC was 3,000 guilders, which priced the company's stock within the means of many merchants.[113]

Among the early shareholders of the VOC, immigrants played an important role. Under the 1,143 tenderers were 39 Germans and no fewer than 301 from the Southern Netherlands (roughly present Belgium and Luxembourg, then under Habsburg rule), of whom Isaac le Maire was the largest subscriber with ƒ85,000. VOC's total capitalisation was ten times that of its British rival.

The Heeren XVII (Lords Seventeen) met alternately six years in Amsterdam and two years in Middelburg-Zeeland. They defined the VOC's general policy and divided the tasks among the Chambers. The Chambers carried out all the necessary work, built their own ships and warehouses and traded the merchandise. The Heeren XVII sent the ships' masters off with extensive instructions on the route to be navigated, prevailing winds, currents, shoals and landmarks. The VOC also produced its own charts.

In the context of the Dutch-Portuguese War the company established its headquarters in Batavia, Java (now Jakarta, Indonesia). Other colonial outposts were also established in the East Indies, such as on the Maluku Islands, which include the Banda Islands, where the VOC forcibly maintained a monopoly over nutmeg and mace. Methods used to maintain the monopoly involved extortion and the violent suppression of the native population, including mass murder.[114] In addition, VOC representatives sometimes used the tactic of burning spice trees to force indigenous populations to grow other crops, thus artificially cutting the supply of spices like nutmeg and cloves.[115]

Shareholder activism and governance issues

The seventeenth-century Dutch businessmen, especially the VOC investors, were possibly the history's first recorded investors to seriously consider the corporate governance's problems.[116][117] Isaac Le Maire, who is known as history's first recorded short seller, was also a sizeable shareholder of the VOC. In 1609, he complained of the VOC's shoddy corporate governance. On 24 January 1609, Le Maire filed a petition against the VOC, marking the first recorded expression of shareholder activism. In what is the first recorded corporate governance dispute, Le Maire formally charged that the VOC's board of directors (the Heeren XVII) sought to "retain another's money for longer or use it ways other than the latter wishes" and petitioned for the liquidation of the VOC in accordance with standard business practice.[118][119][120] Initially the largest single shareholder in the VOC and a bewindhebber sitting on the board of governors, Le Maire apparently attempted to divert the firm's profits to himself by undertaking 14 expeditions under his own accounts instead of those of the company. Since his large shareholdings were not accompanied by greater voting power, Le Maire was soon ousted by other governors in 1605 on charges of embezzlement, and was forced to sign an agreement not to compete with the VOC. Having retained stock in the company following this incident, in 1609 Le Maire would become the author of what is celebrated as "first recorded expression of shareholder advocacy at a publicly traded company".[121][122][123]

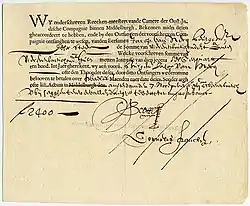

In 1622, the history's first recorded shareholder revolt also happened among the VOC investors who complained that the company account books had been "smeared with bacon" so that they might be "eaten by dogs." The investors demanded a "reeckeninge," a proper financial audit.[124] The 1622 campaign by the shareholders of the VOC is a testimony of genesis of corporate social responsibility (CSR) in which shareholders staged protests by distributing pamphlets and complaining about management self enrichment and secrecy.[125]

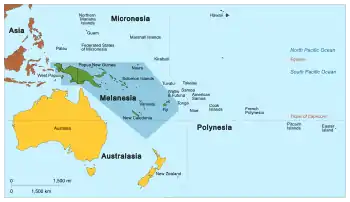

Main trading posts, settlements, and colonies

Mauritius

- Dutch Mauritius (1638–1658; 1664–1710)

South Africa

- Dutch Cape Colony (1652–1806)

Asia

Indonesia

Indian subcontinent

- Dutch Coromandel (1608–1825)

- Dutch Suratte (1616–1825)

- Dutch Bengal (1627–1825)

- Dutch Ceylon (1640–1796)

- Dutch Malabar (1661–1795)

Japan

- Hirado, Nagasaki (1609–1641)

- Dejima, Nagasaki (1641–1853)

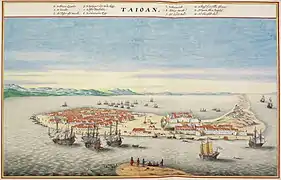

Taiwan

- Anping (Fort Zeelandia)

- Tainan (Fort Provincia)

- Wang-an, Penghu, Pescadores Islands (Fort Vlissingen; 1620–1624)

- Keelung (Fort Noord-Holland, Fort Victoria)

- Tamsui (Fort Antonio)

Malaysia

- Dutch Malacca (1641–1795; 1818–1825)

Thailand

- Ayutthaya (1608–1767)

Vietnam

- Thǎng Long/Tonkin (1636–1699)

- Hội An (1636–1741)

Conflicts and wars involving the VOC

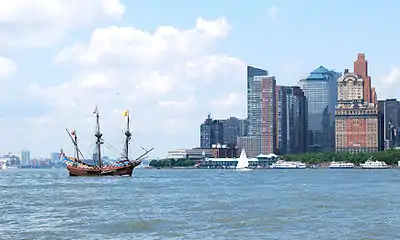

The history of VOC commercial conflict, for example with the British East India Company (EIC), was at times closely connected to Dutch military conflicts. The commercial interests of the VOC (and more generally the Netherlands) were reflected in military objectives and the settlements agreed by treaty. In the Treaty of Breda (1667) ending the Second Anglo-Dutch War, the Dutch were finally able to secure a VOC monopoly for nutmeg trade, ceding the island of Manhattan to the British while gaining the last non-VOC controlled source of nutmeg, the island of Rhun in the Banda islands.[126] The Dutch later re-captured Manhattan, but returned it along with the colony of New Netherland in the Treaty of Westminster (1674) ending the Third Anglo-Dutch War. The British also gave up claims on Suriname as part of the Treaty of Westminster. There was also an effort to compensate the war-related losses of the Dutch West India Company in the mid-17th Century by the profits of the VOC, though this was ultimately blocked.

Historical roles and legacy

The Netherlands United East Indies Company (Verenigde Oostindische Compagnie, or VOC), founded in 1602, was the world's first multinational, joint-stock, limited liability corporation – as well as its first government-backed trading cartel. Our own East India Company, founded in 1600, remained a coffee-house clique until 1657, when it, too, began selling shares, not in individual voyages, but in John Company itself, by which time its Dutch rival was by far the biggest commercial enterprise the world had known.

(...) As populations grew, more robust legal and financial infrastructures began to develop across Europe. Those infrastructures, combined with advances in shipping technology, made large-scale trade feasible for the first time. In 1602, the Dutch East India Company was formed. It was a new type of institution: the first multinational company, and the first to issue public stock. These innovations allowed a single company to mobilize financial resources from a large number of investors and create ventures at a scale that had previously only been possible for monarchs.

In terms of global business history, the lessons from the VOC's successes or failures are critically important. In his book Amsterdam: A History of the World's Most Liberal City (2013), American author and historian Russell Shorto summarises the VOC's importance in world history: "Like the oceans it mastered, the VOC had a scope that is hard to fathom. One could craft a defensible argument that no company in history has had such an impact on the world. Its surviving archives – in Cape Town, Colombo, Chennai, Jakarta, and The Hague – have been measured (by a consortium applying for a UNESCO grant to preserve them) in kilometers. In innumerable ways the VOC both expanded the world and brought its far-flung regions together. It introduced Europe to Asia and Africa, and vice versa (while its sister multinational, the West India Company, set New York City in motion and colonized Brazil and the Caribbean Islands). It pioneered globalisation and invented what might be the first modern bureaucracy. It advanced cartography and shipbuilding. It fostered disease, slavery, and exploitation on a scale never before imaged."[35]

A pioneering early model of the multinational corporation in its modern sense,[137][138][139][140] the company is also considered to be the world's first true transnational corporation. In the early 1600s, the VOC became the world's first formally listed public company because it was the first corporation to be ever actually listed on a formal stock exchange. The VOC had a massive influence on the evolution of the modern corporation by creating an institutional prototype for subsequent large-scale business enterprises (in particular large corporations like multinational/transnational/global corporations) and their rise to become a highly significant socio-politico-economic force of the modern world as we know it today.[141][39][142][41][143][144] In many respects, modern-day publicly listed global companies (including Forbes Global 2000 companies)[145] are all 'descendants' of a business model pioneered by the VOC in the 17th century. Like modern-day major corporations,[146] in many ways, the post-1657 English/British East India Company's operational structure was a derivative of the earlier VOC model.[44][45][47][29][48]

During its golden age, the company played crucial roles in business, financial,[lower-alpha 14] socio-politico-economic, military-political, diplomatic, ethnic, and exploratory maritime history of the world. In the early modern period, the VOC was also the driving force behind the rise of corporate-led globalization,[151][2] corporate power, corporate identity, corporate culture, corporate social responsibility, corporate ethics, corporate governance, corporate finance, corporate capitalism, and finance capitalism. With its pioneering institutional innovations and powerful roles in world history,[152] the company is considered by many to be the first major, first modern,[lower-alpha 15][154][155][156] first global, most valuable,[157][158] and most influential corporation ever seen.[lower-alpha 16][34][35][36] The VOC was also arguably the first historical model of the megacorporation.

Pioneering institutional innovations and impacts on modern-day global business practices and financial system

The defining characteristics of the modern corporation, all of which emerged during the Dutch cycle, include: limited liability for investors, free transferability of investor interests, legal personality and centralised management. Although some of these characteristics were present to a certain extent in the fourteenth-century Genoese societas comperarum of the first cycle, the first wholly cognisable modern limited liability public company was the VOC. The organisational structures and corporate practices of the VOC were closely paralleled by the English East India Company and served as the direct model for all of the later mercantile trading companies of the second cycle, including those of Italy, France, Portugal, Denmark, and Brandenburg-Prussia.

— Eric Michael Wilson, in "The Savage Republic" (2008)[163]

In 1602 shares in the Dutch Vereenigde Oost-Indische Compagnie (VOC, better known as the Dutch East India Company) were issued, suddenly creating what is usually considered the world's first publicly traded company. (...) There are other claimants to the title of first public company, including a twelfth-century water mill in France and a thirteenth-century company intended to control the English wool trade, Staple of London. Its shares, however, and the manner in which those shares were traded, did not truly allow public ownership by anyone who happened to be able to afford a share. The arrival of VOC shares was therefore momentous, because as Fernand Braudel pointed out, it opened up the ownership of companies and the ideas they generated, beyond the ranks of the aristocracy and the very rich, so that everyone could finally participate in the speculative freedom of transactions. By expanding ownership of its company pie for a certain price and a tentative return, the Dutch had done something historic: they had created a capital market.

The VOC played a crucial role in the rise of corporate-led globalisation,[165] corporate governance, corporate identity,[166] corporate social responsibility, corporate finance, modern entrepreneurship, and financial capitalism.[167][168][36] During its golden age, the company made some fundamental institutional innovations in economic and financial history. These financially revolutionary innovations allowed a single company (like the VOC) to mobilise financial resources from a large number of investors and create ventures at a scale that had previously only been possible for monarchs. In the words of Canadian historian and sinologist Timothy Brook, "the Dutch East India Company – the VOC, as it is known – is to corporate capitalism what Benjamin Franklin's kite is to electronics: the beginning of something momentous that could not have been predicted at the time."[34] The birth and growth of the VOC (especially in the 17th century) is considered by many to be the official beginning of the corporate globalisation era with the rise of large-scale business enterprises (multinational/transnational corporations in particular) as a highly formidable socio-politico-economic force[169][170][171][34] that significantly affects people's lives in every corner of the world today,[39][40][42][172][41][173][43] whether for better or worse.[33] As the world's first publicly traded company and first listed company (the first company to be ever listed on an official stock exchange), the VOC was the first company to issue stock and bonds to the general public. Considered by many experts to be the world's first truly (modern) multinational corporation,[174] the VOC was also the first permanently organised limited-liability joint-stock company, with a permanent capital base.[lower-alpha 18][176] The VOC shareholders were the pioneers in laying the basis for modern corporate governance and corporate finance. The VOC is often considered as the precursor of modern corporations, if not the first truly modern corporation.[177] It was the VOC that invented the idea of investing in the company rather than in a specific venture governed by the company. With its pioneering features such as corporate identity (first globally recognised corporate logo), entrepreneurial spirit, legal personhood, transnational (multinational) operational structure, high and stable profitability, permanent capital (fixed capital stock),[178] freely transferable shares and tradable securities, separation of ownership and management, and limited liability for both shareholders and managers, the VOC is generally considered a major institutional breakthrough[179] and the model for large corporations that now dominate the global economy.[180]

The stock market – the daytime adventure serial of the well-to-do – would not be the stock market if it did not have its ups and downs. (...) Apart from the economic advantages and disadvantages of stock exchanges – the advantage that they provide a free flow of capital to finance industrial expansion, for instance, and the disadvantage that they provide an all too convenient way for the unlucky, the imprudent, and the gullible to lose their money – their development has created a whole pattern of social behavior, complete with customs, language, and predictable responses to given events. What is truly extraordinary is the speed with which this pattern emerged full blown following the establishment, in 1611, of the world's first important stock exchange – a roofless courtyard in Amsterdam – and the degree to which it persists (with variations, it is true) on the New York Stock Exchange in the nineteen-sixties. Present-day stock trading in the United States – a bewilderingly vast enterprise, involving millions of miles of private telegraph wires, computers that can read and copy the Manhattan Telephone Directory in three minutes, and over twenty million stockholder participants – would seem to be a far cry from a handful of seventeenth-century Dutchmen haggling in the rain. But the field marks are much the same. The first stock exchange was, inadvertently, a laboratory in which new human reactions were revealed. By the same token, the New York Stock Exchange is also a sociological test tube, forever contributing to the human species' self-understanding. The behaviour of the pioneering Dutch stock traders is ably documented in a book entitled "Confusion of Confusions," written by a plunger on the Amsterdam market named Joseph de la Vega; originally published in 1688 (...)

Business ventures with multiple shareholders became popular with commenda contracts in medieval Italy (Greif, 2006, p. 286), and Malmendier (2009) provides evidence that shareholder companies date back to ancient Rome. Yet the title of the world's first stock market deservedly goes to that of seventeenth-century Amsterdam, where an active secondary market in company shares emerged. The two major companies were the Dutch East India Company and the Dutch West India Company, founded in 1602 and 1621. Other companies existed, but they were not as large and constituted a small portion of the stock market.

— Edward P. Stringham and Nicholas A. Curott, in "The Oxford Handbook of Austrian Economics" [On the Origins of Stock Markets] (2015)[182]

The VOC was a driving force behind the rise of Amsterdam as the first modern model of international financial centres[lower-alpha 19] that now dominate the global financial system. With their political independence, huge maritime and financial power,[184][185] Republican-period Amsterdam and other Dutch cities – unlike their Southern Netherlandish cousins and predecessors such as Burgundian-rule Bruges[186] and Habsburg-rule Antwerp[187][188][189] – could control crucial resources and markets directly, sending their combined fleets to almost all quarters of the globe.[190][191] During the 17th century and most of the 18th century, Amsterdam had been the most influential financial centre of the world.[192][193][194][195][196] The VOC also played a major role in the creation of the world's first fully functioning financial market,[197] with the birth of a fully fledged capital market.[198] The Dutch were also the first who effectively used a fully-fledged capital market (including the bond market and the stock market) to finance companies (such as the VOC and the WIC). It was in the 17th-century Dutch Republic that the global securities market began to take on its modern form. And it was in Amsterdam that the important institutional innovations such as publicly traded companies, transnational corporations, capital markets (including bond markets and stock markets), central banking system, investment banking system, and investment funds (mutual funds) were systematically operated for the first time in history. In 1602 the VOC established an exchange in Amsterdam where VOC stock and bonds could be traded in a secondary market. The VOC undertook the world's first recorded IPO in the same year. The Amsterdam Stock Exchange (Amsterdamsche Beurs or Beurs van Hendrick de Keyser in Dutch) was also the world's first fully-fledged stock exchange. While the Italian city-states produced first formal bond markets, they did not develop the other ingredient necessary to produce a fully fledged capital market: the formal stock market.[199] The Dutch East India Company (VOC) became the first company to offer shares of stock. The dividend averaged around 18% of capital over the course of the company's 200-year existence. The launch of the Amsterdam Stock Exchange by the VOC in the early 1600s, has long been recognised as the origin of 'modern' stock exchanges that specialise in creating and sustaining secondary markets in the securities (such as bonds and shares of stock) issued by corporations.[200] Dutch investors were the first to trade their shares at a regular stock exchange. The process of buying and selling these shares of stock in the VOC became the basis of the first official (formal) stock market in history.[159][201] It was in the Dutch Republic that the early techniques of stock-market manipulation were developed. The Dutch pioneered stock futures, stock options, short selling, bear raids, debt-equity swaps, and other speculative instruments.[202] Amsterdam businessman Joseph de la Vega's Confusion of Confusions (1688)[203] was the earliest book about stock trading.

Impacts on social, economic, financial, political, and military history of the Netherlands

(...) I don't understand why you're all being so negative and unpleasant. Let's just be happy with each other. Let's just say "the Netherlands can do it" again: that VOC mentality. Look across our borders. Dynamism! Don't you think?

— Jan Pieter Balkenende, then Dutch Prime Minister, reacted to the criticism of his government policy during the parliamentary debate, September 2006[lower-alpha 20][206][207]

(...) The charter of the Dutch East India Company stipulated that any Dutch citizen could buy shares in the company. Many did grasp this opportunity. And they were not only wealthy merchants! Among these first shareholders were corn dealers, grocers, bakers, brewers, tailors, seamstresses, sail makers, carpenters, cobblers and servants. One of the most modest participants was the Mayor of Amsterdam's maid. Her name was Grietje Dirksdochter. Grietje saw a tipping point in Dutch history. This new opening provided ordinary people like her not only with the opportunity of becoming a shareholder of a mere shipping company. It provided her with the opportunity of becoming a shareholder of the Dutch Golden Age. Of an exciting era of social development and economic growth. She was taking part in a new, dynamic economy.

— Queen Máxima of the Netherlands, a former investment banker, speech at fourth annual Morningstar Investment Conference in Amsterdam, March 2014[208]

The idea of a highly competitive and organised (active mainly in Greater India but headquartered in the United Provinces of the Netherlands) Dutch government-backed privately financed military-commercial enterprise was the wartime brainchild of the leading republican statesman Johan van Oldenbarnevelt and the States-General in the late 1590s. In 1602, the "United" East India Company (VOC) was formed by a government-directed consolidation/amalgamation of several rival Dutch trading companies or the so-called voorcompagnieën.[209] It was a time when the newly formed Dutch Republic was in the midst of their eighty-year-long revolutionary global war (1579–1648) against the mighty Spanish Empire, a foremost superpower of the early modern world, and its Iberian Union (1580–1640).[210][211][212][213] And therefore, from the beginning, the VOC was not only a business enterprise but also an instrument of war. In other words, the VOC was a fully functioning military-political-commercial complex in its own right rather than a pure trading company or shipping company.[lower-alpha 21][215][216][51]

(...) Only a unique federal state such as the Dutch Republic could have dreamed up a federal company structure. The VOC combined flexibility with strength, giving the Dutch a huge advantage in the competition to dominate maritime trade to Asia. Within a few decades, the VOC proved itself to be the most powerful trading corporation in the seventeenth-century world and the model for the large-scale business enterprises that now dominate the global economy.

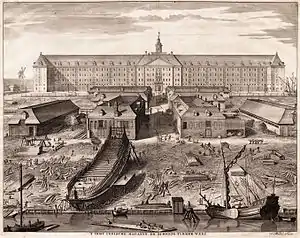

In the early modern period, the VOC was the largest private employer in the Low Countries. The company was a major force behind the financial revolution[lower-alpha 22][218][219] and economic miracle[220][221][222] of the young Dutch Republic in the 17th century. During their Golden Age, the Dutch Republic (or the Northern Netherlands), as the resource-poor and obscure cousins of the more urbanised Southern Netherlands, rose to become the world's leading economic and financial superpower.[lower-alpha 23][225][226][227][228][229] Despite its lack of natural resources (except for water and wind power) and its comparatively modest size and population, the Dutch Republic dominated global market in many advanced industries[230] such as shipbuilding, shipping, water engineering, printing and publishing, map making, pulp and paper, lens-making, sugarcane refining, overseas investment,[231][232][233] financial services, and international trade. The Dutch Republic was an early industrialized nation-state in its Golden Age. The 17th-century Dutch mechanical innovations/inventions such as wind-powered sawmills and Hollander beaters helped revolutionize shipbuilding and paper (including pulp)[lower-alpha 24] industries in the early modern period. The VOC's shipyards also contributed greatly to the Dutch domination of global shipbuilding and shipping industries during the 1600s.[lower-alpha 25] "By seventeenth century standards," as Richard Unger affirms, Dutch shipbuilding "was a massive industry and larger than any shipbuilding industry which had preceded it."[236] By the 1670s the size of the Dutch merchant fleet probably exceeded the combined fleets of England, France, Spain, Portugal, and Germany.[237] Until the mid-1700s, the economic system of the Dutch Republic (including its financial system) was the most advanced and sophisticated ever seen in history.[238][239] From about 1600 to 1720, the Dutch had the highest per capita income in the world, at least double that of neighbouring countries at the time.[240]

However, in a typical multicultural society of the Netherlands (home to one million citizens with roots in the former colonies Indonesia, Suriname and the Antilles),[241] the VOC's history (and especially its dark side) has always been a potential source of controversy. In 2006 when the Dutch Prime Minister Jan Pieter Balkenende referred to the pioneering entrepreneurial spirit and work ethics of the Dutch people and Dutch Republic in their Golden Age, he coined the term "VOC mentality" (VOC-mentaliteit in Dutch).[lower-alpha 26] For Balkenende, the VOC represented Dutch business acumen, entrepreneurship, adventurous spirit, and decisiveness. However, it unleashed a wave of criticism, since such romantic views about the Dutch Golden Age ignores the inherent historical associations with colonialism, exploitation and violence. Balkenende later stressed that "it had not been his intention to refer to that at all".[243] But in spite of criticisms, the "VOC-mentality", as a characteristic of the selective historical perspective on the Dutch Golden Age, has been considered a key feature of Dutch cultural policy for many years.[243]

Roles in the history of the global economy and international relations

Its [the VOC's] fame as the first public company, which heralded the transition from feudalism to modern capitalism,[lower-alpha 27] and its remarkable financial success for nearly two centuries ensure its importance in the history of capitalism.

— Warwick Funnell and Jeffrey Robertson, in "Accounting by the First Public Company" (2014)[244]

(...) Here [17th-century Ternate, North Maluku, Indonesia], surely, was a very early, fully operational manifestation of international integration, the embryonic form of today's ubiquitous globalisation. We would recognise its constituent elements. Here was the tenuous but well-structured supply-chain, extended all the way from Banda to Amsterdam, via numerous ports and functionaries, administered with brutal efficiency by the Dutch East India Company, perhaps the first business organisation that bears resemblance to today's multinational corporations. The company raised money by issuing shares. It had the first widely-recognised commercial logo. Even without today's computers, the company's officials were linked through a hierarchy of regular detailed reporting and accounting. Production was brought together in plantations and processed in 'factories'. Near-subsistence agriculture was replaced with scale and quality control, supervised by the perkeniers with an incentivising profit-sharing deal with the company. Customer feedback was insistently relayed to producers: 'small nutmegs are of no value'. This mighty machine produced 3000 tons of nutmeg annually and transported it across hazardous waters to deliver it to the burghers of Holland and on to the rest of Europe's spice-hungry upper-class. Ad hoc trade between nations, with goods passing through many hands, many owners and many markets, was replaced by 'straight-through' processing by a single entity – the Dutch East India Company.

.jpg.webp)

The VOC was a transcontinental employer and an early pioneer of outward foreign direct investment at the dawn of modern capitalism. In his book The Ecology of Money: Debt, Growth, and Sustainability (2013), Adrian Kuzminski notes, "The Dutch, it seems, more than anyone in the West since the palmy days of ancient Rome, had more money than they knew what to do with. They discovered, unlike the Romans, that the best use of money was to make more money. They invested it, mostly in overseas ventures, utilising the innovation of the joint-stock company in which private investors could purchase shares, the most famous being the Dutch East India Company."[249] The VOC's intercontinental activities played a major role to the Dutch Republic's prosperity, as well as it could awaken socio-economic dynamism elsewhere.[250][251][246] Wherever Dutch capital went, urban features were developed, economic activities expanded, new industries established, new jobs created, trading companies operated, swamps drained, mines opened, forests exploited, canals constructed, mills turned, and ships were built. In the early modern period, the Dutch were pioneering capitalists who raised the commercial and industrial potential of underdeveloped or undeveloped lands whose resources they exploited, whether for better or worse. For example, the native economies of pre-VOC-era Taiwan[lower-alpha 28] and South Africa were virtually undeveloped or were in almost primitive states. In many way, recorded economic history of Taiwan and South Africa began with the golden age of the VOC in the 17th century. It was VOC people who established and developed the first urban areas in the history of Taiwan (Tainan) and South Africa (including Cape Town, Stellenbosch, and Swellendam).

The VOC existed for almost 200 years from its founding in 1602, when the States-General of the Netherlands granted it a 21-year monopoly over Dutch operations in Asia until its demise in 1796. During those two centuries (between 1602 and 1796), the VOC sent almost a million Europeans to work in the Asia trade on 4,785 ships, and netted for their efforts more than 2.5 million tons of Asian trade goods. By contrast, the rest of Europe combined sent only 882,412 people from 1500 to 1795, and the fleet of the English (later British) East India Company, the VOC's nearest competitor, was a distant second to its total traffic with 2,690 ships and a mere one-fifth the tonnage of goods carried by the VOC. The VOC enjoyed huge profits from its spice monopoly through most of the 17th century.[253] By 1669, the VOC was the richest company the world had ever seen, with over 150 merchant ships, 40 warships, 50,000 employees, a private army of 10,000 soldiers, and a dividend payment of 40% on the original investment.[254][255]

A CorporNation's vast global influence[256] enables it to function simultaneously in two realms: a for-profit company, and as a force that can shape the geopolitical landscape. Google isn't the only CorporNation; Goldman Sachs is clearly in that category – as the Greek political crisis has revealed, the company has been a partner in deceit with governments that used financial alchemy to disguise deficits as off-balance sheet baubles. Wal-Mart functioned as a CorporNation during Katrina. CorporNations aren't new. Indeed, they are as old as capitalism, going back to the Dutch East India Company, which was chartered in 1602, became the world's first global company and transformed Holland into a colonial power as it dominated the East.

A chartered company, the first with publicly traded stocks, and—within a few decades of its foundation—the richest company in the world, the VOC was not merely a business interest. It constituted a politogen, even a state in itself. By 1669, it commanded over two hundred ships, a quarter of them warships, and ten thousand soldiers. The Dutch state had granted the VOC law-making, war-making, and judicial authority. It founded colonies that proved to be fully functioning, if not fully independent, states that lasted for centuries. It deported and imported populations to build new societies dedicated to a productive economy, it annihilated horizontal communities, and toppled preexisting local states. (...) One of the VOC's most groundbreaking achievements was to organize, practically alone, an intercontinental cycle of accumulation that was vital to the emergence of global capitalism and the modern state.

In terms of military-political history, the VOC, along with the Dutch West India Company (WIC/GWIC), was seen as the international arm of the Dutch Republic and the symbolic power of the Dutch Empire. The VOC was historically a military-political-economic complex rather than a pure trading company (or shipping company). The government-backed but privately financed company was effectively a state in its own right, or a state within another state.[lower-alpha 29] For almost 200 years of its existence, the VOC was a key non-state geopolitical player in Eurasia.[1] The company was much an unofficial representative of the States General of the United Provinces in foreign relations of the Dutch Republic with many states, especially Dutch-Asian relations. The company's territories were even larger than some countries.

The VOC had seminal influences on the modern history of many countries and territories around the world such as New Netherland (New York),[258] Indonesia, Malaysia, India, Sri Lanka, Australia, New Zealand, South Africa, Mauritius, Taiwan, and Japan.[259]

Artistic, scientific, technological, and cultural legacies of the VOC World

(...) Much has also been learned about the VOC and Dutch colonial societies. Moreover, the TANAP (Towards a New Age of Partnership, 2000–2007) project has created momentum for research on the relationship between the VOC and indigenous societies. In contrast, the role of the VOC in cultural history and especially in the history of visual and material culture has not yet attracted comparable interest. To be sure, journals and other travel accounts (some even with illustrations) by soldiers, shippers, and VOC officials among others have been utilized as sources.

— Michael North & Thomas DaCosta Kaufmann, in "Mediating Netherlandish Art and Material Culture in Asia" (2014)[260]

As information and knowledge exchange network

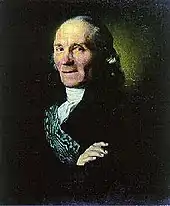

_-_Nationalmuseum_-_15723.tif.jpg.webp)

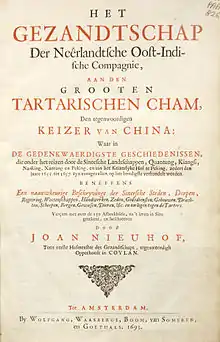

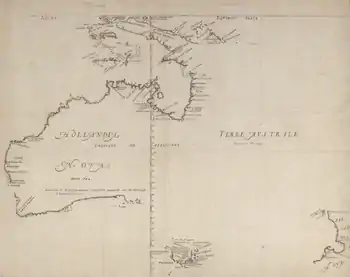

During the Dutch Golden Age, the Dutch – using their expertise in doing business, cartography, shipbuilding, seafaring and navigation – traveled to the far corners of the world, leaving their language embedded in the names of many places. Dutch exploratory voyages revealed largely unknown landmasses to the civilised world and put their names on the world map. During the Golden Age of Dutch exploration (c. 1590s–1720s) and the Golden Age of Netherlandish cartography (c. 1570s–1670s), Dutch-speaking navigators, explorers, and cartographers were the undisputed firsts to chart/map many hitherto largely unknown regions of the earth and the sky. The Dutch came to dominate the map-making and map printing industry by virtue of their own travels, trade ventures, and widespread commercial networks.[271] As Dutch ships reached into the unknown corners of the globe, Dutch cartographers incorporated new geographical discoveries into their work. Instead of using the information themselves secretly, they published it, so the maps multiplied freely. For almost 200 years, the Dutch dominated world trade.[272] Dutch ships carried goods, but they also opened up opportunities for the exchange of knowledge.[273] The commercial networks of the Dutch transnational companies, Dutch transnational companies, e.g. the VOC and West India Company (WIC/GWIC), provided an infrastructure which was accessible to people with a scholarly interest in the exotic world.[274][275][276][277][278][279] The VOC's bookkeeper Hendrick Hamel was the first known European/Westerner to experience first-hand and write about Joseon-era Korea.[lower-alpha 30] In his report (published in the Dutch Republic) in 1666 Hendrick Hamel described his adventures on the Korean Peninsula and gave the first accurate description of daily life of Koreans to the western world.[280][281][282] The VOC trade post on Dejima, an artificial island off the coast of Nagasaki, was for more than two hundred years the only place where Europeans were permitted to trade with Japan. Rangaku (literally 'Dutch Learning', and by extension 'Western Learning') is a body of knowledge developed by Japan through its contacts with the Dutch enclave of Dejima, which allowed Japan to keep abreast of Western technology and medicine in the period when the country was closed to foreigners, 1641–1853, because of the Tokugawa shogunate's policy of national isolation (sakoku).

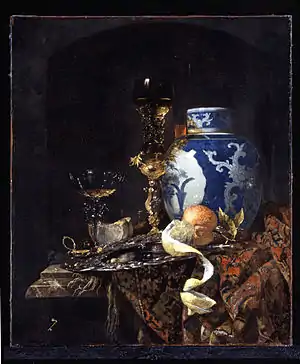

Influences on Dutch Golden Age art

From 1609 the VOC had a trading post in Japan (Hirado, Nagasaki), which used local paper for its own administration. However, the paper was also traded to the VOC's other trading posts and even the Dutch Republic. Many impressions of the Dutch Golden Age artist Rembrandt's prints were done on Japanese paper. From about 1647 Rembrandt sought increasingly to introduce variation into his prints by using different sorts of paper, and printed most of his plates regularly on Japanese paper. He also used the paper for his drawings. The Japanese paper types – which was actually imported from Japan by the VOC – attracted Rembrandt with its warm, yellowish colour.[292] They are often smooth and shiny, whilst Western paper has a more rough and matt surface.[293] Moreover, the VOC's imported Chinese export porcelain and Japanese export porcelain wares are often depicted in many Dutch Golden Age genre paintings, especially in Jan Vermeer's paintings.[34]

Formation of religious and ethnic groups within the VOC World

Contributions in the Age of Exploration

(...) The Dutch polity of the seventeenth century was famously unconcerned with territorial expansion: as long as the frontier operated effectively as a defensive shield, no extra land was deemed necessary.

.jpg.webp)

The Dutch East India Company (VOC) was also a major force behind the Golden Age of Dutch exploration and discovery (c. 1590s–1720s). The VOC-funded exploratory voyages such as those led by Willem Janszoon (Duyfken), Henry Hudson (Halve Maen) and Abel Tasman revealed largely unknown landmasses to the civilised world. Also, during the Golden Age of Dutch/Netherlandish cartography (c. 1570s–1670s), VOC navigators, explorers, and cartographers[lower-alpha 31] helped shape cartographic and geographic knowledge of the modern-day world.[295][296][297]

Halve Maen's exploratory voyage and role in the formation of New Netherland

In 1609, English sea captain and explorer Henry Hudson was hired by the VOC émigrés running the VOC located in Amsterdam[298] to find a north-east passage to Asia, sailing around Scandinavia and Russia. He was turned back by the ice of the Arctic in his second attempt, so he sailed west to seek a north-west passage rather than return home. He ended up exploring the waters off the east coast of North America aboard the vlieboot Halve Maen. His first landfall was at Newfoundland and the second at Cape Cod.

Hudson believed that the passage to the Pacific Ocean was between the St. Lawrence River and Chesapeake Bay, so he sailed south to the Bay then turned northward, traveling close along the shore. He first discovered Delaware Bay and began to sail upriver looking for the passage. This effort was foiled by sandy shoals, and the Halve Maen continued north. After passing Sandy Hook, Hudson and his crew entered the narrows into the Upper New York Bay. (Unbeknownst to Hudson, the narrows had already been discovered in 1524 by explorer Giovanni da Verrazzano; today, the bridge spanning them is named after him.[299]) Hudson believed that he had found the continental water route, so he sailed up the major river which later bore his name: the Hudson. He found the water too shallow to proceed several days later, at the site of present-day Troy, New York.[300]

Upon returning to the Netherlands, Hudson reported that he had found a fertile land and an amicable people willing to engage his crew in small-scale bartering of furs, trinkets, clothes, and small manufactured goods. His report was first published in 1611 by Emanuel Van Meteren, an Antwerp émigré and the Dutch Consul at London.[298] This stimulated interest[301] in exploiting this new trade resource, and it was the catalyst for Dutch merchant-traders to fund more expeditions.