National Bank of Pakistan

National Bank of Pakistan (NBP) (نیشنل بینک آف پاکستان) is a Pakistani government-owned multinational commercial bank which is a subsidiary of State Bank of Pakistan. It is headquartered in Karachi, Pakistan. As of September 2020, it has 1,511 branches across Pakistan with assets of approximately USD 20.2 billion.[2]

| |

| |

| Type | Public |

|---|---|

| PSX: NBP | |

| Industry | Banking |

| Founded | 1949 |

| Headquarters | Karachi Pakistan |

Key people | Arif Usmani, President & CEO |

| Products | Loans, Savings, Consumer Banking, Corporate Banking, Investment Banking |

| Revenue | |

| Total assets | |

| Owner | State Bank of Pakistan (75.20%) |

| Website | www |

The bank provides both commercial and public sector banking services. It is a lead player in the debt-equity market, corporate investment banking, retail and consumer banking, agricultural financing, treasury services.

National Bank of Pakistan has developed a wide range of consumer products, to enhance business and cater to the different segments of society and meet its social responsibilities. Some schemes have been specifically designed for the low to middle-income segments of the population. It has implemented special credit schemes like small finance for agriculture, business and industries, administrator to Qarz-e-Hasna loans to students, self-employment scheme for unemployed persons, public transport scheme. The Bank has expanded its range of products and services to include Shariah Compliant Islamic Banking products. It has also put in place a remittance service for overseas Pakistanis to send their money back to Pakistan. Customer Social Responsibility is a new department which provides social services for Education, health and women empowerment.

For the year 2020, NBP was designated domestic systemically important bank (D-SIB) by the State Bank of Pakistan.[3]

History

- 1949 National Bank of Pakistan (NBP) was established under the National Bank of Pakistan Ordinance of 1949 and was government-owned. NBP acted as an agent of the central bank wherever the State Bank did not have its own branch. It also undertook government treasury operations. Its first branches were in jute growing areas in East Pakistan. Offices in Karachi and Lahore followed.

- 1950 NBP established a branch in Jeddah, Saudi Arabia.

- 1955 By this time NBP had branches in London and Calcutta.

- 1957 NBP established a branch in Baghdad, Iraq.

- 1962 NBP established a branch in Dar es Salaam, Tanganyika.

- 1964 The Iraqi government nationalized NBP's Baghdad branch.

- 1965 The Indian government seized the Calcutta branch on the outbreak of hostilities between India and Pakistan.

- 1967 The Tanzanian government nationalized the Dar es Salaam branch.

- 1971 NBP acquired Bank of China's two branches, one in Karachi and one at Chittagong. At separation of East Pakistan NBP lost its branches there. NBP merged with Eastern Mercantile Bank and with Eastern Bank Corporation.

- 1974 The government of Pakistan nationalized NBP. As part of the concomitant consolidation of the banking sector, NBP acquired Bank of Bahawalpur.

- 1977 NBP opened an offshore brain Cairo.

- 1994 NBP amalgamated Mehran Bank.

- 1997 NBP branch in Ashgabat, Turkmenistan commenced operations.

- 2000 NBP opened a representative office in Almaty, Kazakhstan.

- 2001 State Bank of Pakistan and Bank of England agree to allow only 2 Pakistani banks to operate in the UK. NBP and United Bank agreed to merge their operations to form Pakistan International Bank, of which NBP would own 45% and United Bank 55%.

- 2002 Pakistan International Bank renamed itself United National Bank Limited (UNB). The ownership structure of the UNB remained as before. The only change to the shareholding structure is that UNB had recently been privatized in Pakistan and was now owned 49% by the Government of Pakistan and 51% by a joint foreign consortium of Abu Dhabi.

NBP needed to redefine its role and shed the public sector bank image, for a modern commercial bank. It has offloaded 23.2 percent share in the stock market, and while it has not been completely privatized like the other three public sector banks, partial privatization has taken place. It is now listed on the Karachi Stock Exchange.

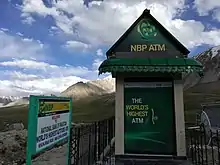

- 2003 NBP opened its branch in Kabul, and the first ATM in Afghanistan was installed there.

- 2005 NBP closed its offshore branch in Cairo.

- 2010 NBP opened its branch in Karaganda (Kazakhstan).

- 2011 NBP opened its representative office in Toronto (Canada).

Operations

A number of initiatives have been taken, in terms of institutional restructuring, changes in the field structure, in policies and procedures, in internal control systems with special emphasis on corporate governance, adoption of Capital Adequacy Standards under Basel III framework, in the upgradation of the IT infrastructure and developing the human resources.

National Bank of Pakistan has built an extensive branch network with 1450 branches in Pakistan and operates in major business centre abroad. The Bank has representative offices in Beijing, Tashkent, Chicago and Toronto . It has agency arrangements with more than 3000 correspondent banks worldwide.

The Bank saw significant growth between 2000 and 2006. In 2016, total assets were estimated at PKR 1,799 billion, with total deposits being PKR 1,657 billion. Pre-tax profit rose to PKR 37.14 billion. Earnings per share have jumped to PKR 10.69. The increase in profit was achieved through strong growth in core banking income. Gross Interest income increased to PKR 114 billion through growth in the loan portfolio as well as increase in spreads. Gross Advances increased to PKR 781 billion. It ranges from providing credit to the unbanked market segment under NBP Karobar, to small and medium enterprises, to agricultural loans, to large corporate customers.

It has taken various measures to facilitate overseas Pakistanis to send their remittances. In 2002 the Bank signed an agreement with Western Union for expanding the base for documented remittances.

Subsidiaries

The NBP's subsidiaries are Taurus Securities Ltd, NBP Exchange Company Ltd, NBP Leasing Ltd, NBP Modaraba Management Company Ltd, and CJSC Bank, Almaty, Kazakhstan. The Bank's joint ventures is United National Bank (UK).[4]Cast – N- Link Products Ltd.[5]

International offices

National Bank of Pakistan branch in Washington, D.C.

NBP also has branches /offices in the United States, UK, Canada, Germany, France, Bahrain, Egypt, Bangladesh, Hong Kong, Japan, South Korea, The People's Republic of China, Afghanistan, Turkmenistan, Kyrgyz Republic, Kazakhstan, Uzbekistan, Azerbaijan and Saudi Arabia.

NBP Fund Management Limited

NBP Funds is a Non-Banking Finance Company jointly owned by National Bank of Pakistan and Fullerton Fund Management Group, Singapore, which in-turn is a wholly owned subsidiary of Temasek Holdings, Singapore.[6]

References

- "NBP Annual Report 2017" (PDF). Retrieved 4 February 2019.

- "Archived copy" (PDF). Archived from the original (PDF) on 2008-04-07. Retrieved 2008-04-24.CS1 maint: archived copy as title (link)

- Reporter, The Newspaper's Staff (2020-09-04). "HBL, NBP, UBL declared important banks". DAWN.COM. Retrieved 2020-09-07.

- nbp.com.pk. "National Bank of Pakistan". nbp.com.pk.

- "Subsidiaries - NBP". www.nbp.com.pk. Retrieved 2020-09-10.

- Desk, News (2019-01-30). "NBP declares half-yearly profit as NBP Funds inaugurates new Islamic savings centre". Global Village Space. Retrieved 2020-05-30.