Denmark and the euro

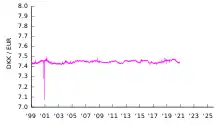

Denmark uses the krone as its currency and does not use the euro, having negotiated the right to opt out from participation under the Maastricht Treaty of 1992. In 2000, the government held a referendum on introducing the euro, which was defeated with 46.8% voting yes and 53.2% voting no. The Danish krone is part of the ERM II mechanism, so its exchange rate is tied to within 2.25% of the euro.

- European Union (EU) member states

-

5 not in ERM II, but obliged to join the eurozone on meeting convergence criteria (Czech Republic, Hungary, Poland, Romania, and Sweden).

- Non-EU member states

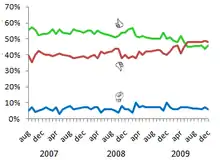

Most of the large political parties in Denmark favour the introduction of the euro and the idea of a second referendum has been suggested several times since 2000. However, some important parties such as the Danish People's Party, Socialist People's Party and Red–Green Alliance do not support joining the currency. Public opinion surveys have shown fluctuating support for the single currency with majorities in favour for some years after the physical introduction of the currency. However, following the financial crisis of 2008, support began to fall, and in late 2011, support for the euro crashed in light of the escalating European sovereign debt crisis.[1]

Denmark borders one eurozone member, Germany, and one EU member that is obliged to adopt the euro in the future, Sweden.

Current Status – ERM II

In the ratification process of the Maastricht Treaty in 1992 the Danish government issued a referendum due to constitutional requirements. The Danish constitution requires 5/6 of the parliament's approval in the case of a transfer of sovereignty cf. art. 20 of Grundloven.[2] If this requirement is not met, it will be necessary to host a referendum. The referendum resulted in 50.7% of the population voting against the ratification of the Maastricht Treaty, while only 49.3% voted in favour. The bourgeois coalition government of Denmark in 1992 consisting of Conservatives Agrarian Liberals and the Social democrats held approximately 80% of the seats in the Danish Parliament and therefore believed that the referendum would easily get approved which was not the case.[3]

The ratification of the Maastricht Treaty needed to be a unanimous decision by all the member states in the EU and the Danish "No" therefore posed a significant issue for the further integration process.[4] Denmark was not the only country issuing a referendum for the ratification of the Maastricht Treaty. In France there was a small majority for the treaty and the Irish population also voted in favour of the ratification of the Treaty. The Danish "No" and the French "Petit oui" are known in scholarly circles as the erosion of the permissive consensus regarding public support for European integration.[5] In the years after Maastricht, the European integration faced more political scrutiny and pro-integration politicians could no longer rely on diffuse support[5]

The solution to the lack of public support for the further European integration in Denmark is known as "the National Compromise". 7 out of 8 parties in the Danish parliament "Folketinget" came together in support of this proposal. The main part of the National Compromise consisted of the request for 4 opt-outs: Union citizenship, Common Security and Defense, Justice and Home Affairs and participation in the last phase of the European Monetary Union. At the European Council summit 11–12 December 1992 in Edinburgh, the European leaders agreed to these four opt-outs.[6]

Today Denmark instead participates in the Exchange Rate Mechanism II (ERM II) with a fluctuation band of ±2.25%. ERM II is a fixed exchange rate regime where the participating countries will have to follow the exchange rate level of the euro. The ERM II is a fixed exchange rate regime, in which the Danish currency and other participating countries' currency are pegged to the euro.[7] Currently Denmark is one of the three countries participating in the ERM II.

This policy marks a continuation of the situation that existed from 1982 to 1999 with regard to the Deutsche Mark, which provided a similar anchor currency for the krone.

The krone has been part of the ERM II mechanism since 1 January 1999, when it replaced the original ERM. This implies it is required to trade within 2.25% either side of a specified rate of 1 euro equal to 7.46038 kroner (making the lower rate 7.29252 and the upper rate 7.62824).[8] This band, 2.25%, is narrower than the 15% band used for most ERM II members. However, the exchange rate has kept within 0.5% of the defined rate, even less than the set limits.

In the ERM II the domestic central bank, Danmarks Nationalbank, and the ECB commits to the stability of the Danish currency within the given fluctuation band. When the Danish currency goes beyond the agreed upon limits, it is up to the domestic Central bank to intervene until the level is back within the fluctuation band. The ECB are obliged to intervene as well if the domestic Central bank is not able to.[9]

The exchange rate of the euro is determined through the supply and demand of the Danish currency relative to euro. To avoid going beyond the fluctuation limits the domestic Central bank has two tools to adjust the money supply and exchange rate. The first tool is intervention through the purchase and selling currencies to adjust the available money level. The second tool is an adjustment of the interest rate.[10]

The European Central Bank is conducting monetary policy independently from the national governments from the eurozone countries and has the aim of price stability. This means that the ERM II countries as well as EMU countries are giving up sovereignty in monetary policies to instead have price stability.[7] When governments lose the autonomy in monetary policy, they lose the ability to respond to domestic economic shocks.[11] Denmark's currency is pegged to the currency of the eurozone which is not an optimal currency area because the participating countries have asymmetric business cycles.[11] Therefore, the monetary policy conducted in the eurozone is not necessarily beneficial for the economic situation in Denmark. The policy-aim of keeping a fixed exchange rate policy is to keep stable economic development and stable prices. Stable prices can be translated into low inflation. Fixed exchange rate policy based on the euro creates a framework for low inflation in the long run.[12] The role of the ECB is set up in the Treaties and the monetary policy conducted should have price stability as its main aim. The ECB has defined price stability as a yearly growth in consumption prices under, but close to 2% in the middle to long run.[12] The policy competences of the ECB are heavily influenced by the German Bundesbank policies and therefore have as main goal to have price stability and to be independent from national governments.[13]

The loss of autonomy in monetary policy in Denmark is not significant, as Denmark has had a fixed exchange rate since the end of the Second World War and has participated in several monetary cooperation systems. Therefore, the adoption of ERM II is not a change in this sense or a loss of autonomy in monetary policy as it has been limited since the creation of the Bretton Woods system.[14] Denmark has even gained more influence in the decision-making process through the EU and the ERM II than it had in previous monetary systems.[14] Even though the Danish central bank governor does not participate in the governing council of the ECB, where the monetary policy and guidelines are formulated and adopted, Denmark have other channels of influence. Even if Denmark did have a seat at the governing council of the ECB, it would not necessarily get more influence. Small member countries in the governing council of the ECB cannot generally expect that they will get an equivalent say compared to larger members due to informal rules and practices.[14] Denmark's finance minister participates in the ECOFIN council in the Council of the European Union and therefore has some interactions with other eurozone countries and participates in the decision-making process in this institution. The tendency of ECOFIN topics increasingly being transferred and therefore more discussed in the Eurogroup meetings is therefore again a limitation for Danish influence on monetary decisions.[14] Denmark does not participate in Eurogroup meetings but participates in preparatory meetings before, and meetings after the actual Eurogroup meeting. Denmark is interested in being kept informed as decisions in these meetings will also affect Denmark's economy. Other channels of influence and interaction with other officials can be done through ESCB framework, IMF, OECD and the Central bank of Denmark also participates in ECB committees. The participation in the ECB committees is essential in the fact that the influence over monetary policy has improved compared to earlier systems.[14]

The ECB can also use adjustment of interest rates to influence the exchange rate of the euro. An exchange rate is determined bilaterally relative to other currencies. If there is higher interest in one country relative to another, it will attract foreign capital and therefore the value of the currency will increase.[15] Due to the fixed exchange rate regime in Denmark, the exchange rate level will always be close to the one of the eurozone's, and then the inflation rates will also be similar. A fixed exchange rate is a suitable tool to bring down inflation.[11] A growth in economic activity can lead to inflation. Inflation in an economy is not necessarily hurtful as it can enable economic growth and create price and wage adjustment.[11][16] There are several attractive elements of low levels of inflation while having too high levels of inflation in the long run will result in the increase of prices due to higher levels of employment. Higher levels of employment and increased prices will also lead to higher wages which will hurt firm's competitiveness on international markets. When firms are less competitive, they will lose market shares and it will lead to an increase of unemployment. In the end, an economy will be worse off with high unemployment just with higher prices and wages.[12]

Besides maintaining low inflation levels, keeping a fixed exchange is also beneficial in other ways. It can reduce transaction costs and exchange rate uncertainty in international trade.[11] The decrease in fluctuations of currency reduces uncertainty for traders and therefore stimulates international trade.[11]

Status of the level of convergence of the Danish economy

| Convergence criteria | ||||||||

|---|---|---|---|---|---|---|---|---|

| Assessment month | Country | HICP inflation rate[17][nb 1] | Excessive deficit procedure[18] | Exchange rate | Long-term interest rate[19][nb 2] | Compatibility of legislation | ||

| Budget deficit to GDP[20] | Debt-to-GDP ratio[21] | ERM II member[22] | Change in rate[23][24][nb 3] | |||||

| 2012 ECB Report[nb 4] | Reference values | Max. 3.1%[nb 5] (as of 31 Mar 2012) |

None open (as of 31 March 2012) | Min. 2 years (as of 31 Mar 2012) |

Max. ±15%[nb 6] (for 2011) |

Max. 5.80%[nb 7] (as of 31 Mar 2012) |

Yes[25][26] (as of 31 Mar 2012) | |

| Max. 3.0% (Fiscal year 2011)[27] |

Max. 60% (Fiscal year 2011)[27] | |||||||

| 2.7% | Open | 13 years, 3 months | -0.4% | 2.39% | Unknown | |||

| 1.8% | 46.5% | |||||||

| 2013 ECB Report[nb 8] | Reference values | Max. 2.7%[nb 9] (as of 30 Apr 2013) |

None open (as of 30 Apr 2013) | Min. 2 years (as of 30 Apr 2013) |

Max. ±15%[nb 6] (for 2012) |

Max. 5.5%[nb 9] (as of 30 Apr 2013) |

Yes[28][29] (as of 30 Apr 2013) | |

| Max. 3.0% (Fiscal year 2012)[30] |

Max. 60% (Fiscal year 2012)[30] | |||||||

| 1.8% | Open | 14 years, 4 months | 0.1% | 1.33% | Unknown | |||

| 4.0% | 45.8% | |||||||

| 2014 ECB Report[nb 10] | Reference values | Max. 1.7%[nb 11] (as of 30 Apr 2014) |

None open (as of 30 Apr 2014) | Min. 2 years (as of 30 Apr 2014) |

Max. ±15%[nb 6] (for 2013) |

Max. 6.2%[nb 12] (as of 30 Apr 2014) |

Yes[31][32] (as of 30 Apr 2014) | |

| Max. 3.0% (Fiscal year 2013)[33] |

Max. 60% (Fiscal year 2013)[33] | |||||||

| 0.4% | Open (Closed in June 2014) | 15 years, 4 months | -0.2% | 1.78% | Unknown | |||

| 0.8% | 44.5% | |||||||

| 2016 ECB Report[nb 13] | Reference values | Max. 0.7%[nb 14] (as of 30 Apr 2016) |

None open (as of 18 May 2016) | Min. 2 years (as of 18 May 2016) |

Max. ±15%[nb 6] (for 2015) |

Max. 4.0%[nb 15] (as of 30 Apr 2016) |

Yes[34][35] (as of 18 May 2016) | |

| Max. 3.0% (Fiscal year 2015)[36] |

Max. 60% (Fiscal year 2015)[36] | |||||||

| 0.2% | None | 17 years, 4 months | -0.1% | 0.8% | Unknown | |||

| 2.1% | 40.2% | |||||||

| 2018 ECB Report[nb 16] | Reference values | Max. 1.9%[nb 17] (as of 31 Mar 2018) |

None open (as of 3 May 2018) | Min. 2 years (as of 3 May 2018) |

Max. ±15%[nb 6] (for 2017) |

Max. 3.2%[nb 18] (as of 31 Mar 2018) |

Yes[37][38] (as of 20 March 2018) | |

| Max. 3.0% (Fiscal year 2017)[39] |

Max. 60% (Fiscal year 2017)[39] | |||||||

| 1.0% | None | 19 years, 4 months | 0.1% | 0.6% | Unknown | |||

| -1.0% (surplus) | 36.4% | |||||||

| 2020 ECB Report[nb 19] | Reference values | Max. 1.8%[nb 20] (as of 31 Mar 2020) |

None open (as of 7 May 2020) | Min. 2 years (as of 7 May 2020) |

Max. ±15%[nb 6] (for 2019) |

Max. 2.9%[nb 21] (as of 31 Mar 2020) |

Yes[40][41] (as of 24 March 2020) | |

| Max. 3.0% (Fiscal year 2019)[42] |

Max. 60% (Fiscal year 2019)[42] | |||||||

| 0.6% | None | 21 years, 4 months | -0.2% | -0.3% | Unknown | |||

| -3.7% (surplus) | 33.2% | |||||||

- Notes

- The rate of increase of the 12-month average HICP over the prior 12-month average must be no more than 1.5% larger than the unweighted arithmetic average of the similar HICP inflation rates in the 3 EU member states with the lowest HICP inflation. If any of these 3 states have a HICP rate significantly below the similarly averaged HICP rate for the eurozone (which according to ECB practice means more than 2% below), and if this low HICP rate has been primarily caused by exceptional circumstances (i.e. severe wage cuts or a strong recession), then such a state is not included in the calculation of the reference value and is replaced by the EU state with the fourth lowest HICP rate.

- The arithmetic average of the annual yield of 10-year government bonds as of the end of the past 12 months must be no more than 2.0% larger than the unweighted arithmetic average of the bond yields in the 3 EU member states with the lowest HICP inflation. If any of these states have bond yields which are significantly larger than the similarly averaged yield for the eurozone (which according to previous ECB reports means more than 2% above) and at the same time does not have complete funding access to financial markets (which is the case for as long as a government receives bailout funds), then such a state is not be included in the calculation of the reference value.

- The change in the annual average exchange rate against the euro.

- Reference values from the ECB convergence report of May 2012.[25]

- Sweden, Ireland and Slovenia were the reference states.[25]

- The maximum allowed change in rate is ± 2.25% for Denmark.

- Sweden and Slovenia were the reference states, with Ireland excluded as an outlier.[25]

- Reference values from the ECB convergence report of June 2013.[28]

- Sweden, Latvia and Ireland were the reference states.[28]

- Reference values from the ECB convergence report of June 2014.[31]

- Latvia, Portugal and Ireland were the reference states, with Greece, Bulgaria and Cyprus excluded as outliers.[31]

- Latvia, Ireland and Portugal were the reference states.[31]

- Reference values from the ECB convergence report of June 2016.[34]

- Bulgaria, Slovenia and Spain were the reference states, with Cyprus and Romania excluded as outliers.[34]

- Slovenia, Spain and Bulgaria were the reference states.[34]

- Reference values from the ECB convergence report of May 2018.[37]

- Cyprus, Ireland and Finland were the reference states.[37]

- Cyprus, Ireland and Finland were the reference states.[37]

- Reference values from the ECB convergence report of June 2020.[40]

- Portugal, Cyprus, and Italy were the reference states.[40]

- Portugal, Cyprus, and Italy were the reference states.[40]

History

Early monetary unions in Denmark (1873–1914)

On 5 May 1873 Denmark with Sweden fixed their currencies against gold and formed the Scandinavian Monetary Union. Prior to this date Denmark used the Danish rigsdaler divided into 96 rigsbank skilling. In 1875, Norway joined this union. A rate of 2.48 kroner per gram of gold, or roughly 0.403 grams per krone was established. An equal valued krone of the monetary union replaced the three legacy currencies at the rate of 1 krone = ½ Danish rigsdaler = ¼ Norwegian speciedaler = 1 Swedish riksdaler. The new currency became a legal tender and was accepted in all three countries. This monetary union lasted until 1914 when World War I brought an end to it. But the name of the currencies in each country remained unchanged.

European Monetary System and pre-euro monetary co-operation

The collapse of the Bretton Woods system destabilised European markets and delayed the wish to have monetary integration in the member states of the European Economic Community.[46] (Today EU). The Bretton Woods system was a system where exchange rates remained stable while having inflation under control.[47] The dollar was pegged to the gold standard and the 14 European participating countries became convertible with the dollar.[47] In the EU, further monetary cooperation and stable exchange rates were considered necessary to facilitate the creation of the internal market.[47] The Werner Report was a draft proposal in the EU framework to have monetary cooperation to facilitate the internal market. This draft was based on a system where all participating countries’ currencies were already fully convertible, and when the Bretton Woods system collapsed, there were no central currency to peg the currencies on and therefore the idea for monetary integration was postponed.[47] The first step toward a more integrated monetary system in Europe was the Basel agreement which created the European Currency Snake.[46] The Smithsonian Agreement was an international agreement outside the EU framework which provided a new dollar standard to which the EEC currencies’ exchange rates were pegged to and where the European currency snake could fluctuate within. The currencies were though still allowed to fluctuate within 2.25% of the new dollar standard.[46] The European Currency Snake entered into force on 24 April 1972 and was a tool to provide monetary stability.[46] As the Currency Snake entered into force during the accession procedure of Denmark, United Kingdom and Ireland, those three currencies entered the system 1 May 1972. Shortly after, the Danish Crown came under speculative attacks and was forced to abandon the system but the joined again a few months later.[46][48] The Smithsonian agreement collapsed in 1973 also due to speculative attacks and the US let the dollar float freely.[49] This development made it unsustainable to maintain the European Currency Snake system. The snake cooperation was negatively impacted by exogenous pressures e.g. oil crises, the weakness of the dollar and differences of economic policy.[46] Participants were forced to abandon the system and some even rejoined e.g. Denmark.[48] In the last year of the operation of the snake, its area was only comprised Germany, the Benelux countries and Denmark.[50]

The next attempt to create monetary stability in the EEC (today EU) was the European Monetary System which was established in 1979.[50] In the beginning Denmark was 1 out of 8 participating countries in the EMS.[50] The EMS created a system of European Currency Unit and an Exchange Rate Mechanism. The system set up a central rate and then bilateral rates were established between members.[50] The EMS was similar to the Bretton Woods system but did not officially have an individual currency at the center, but Germany came to dominate the monetary system, due to Germany's size relative to the other participating countries and their central bank's success with controlling inflation.[47]

The EMS provided a stable system though it was still possible to have adjustable exchange rates and the Danish government used any opportunity to devaluate the currency.[9] The Danish economy experienced economic issues in the 1980s, and the government introduced several economic reforms. The economic issues were triggered by the world-wide recession in 1973-72 which were caused by a combination of the exhaustion of the Fordist production method of mass production and consumption and increase of oil prices due to the Arab-Israeli war.[51] These exogenous shocks hurt the Danish economy hard and the recession caused inflationary pressures. Denmark saw a rise of inflation and unemployment. Inflation kept increasing due to attempts by firms to gain profit by raising prices, while a formal system of wage-price indexation increased levels of wages.[51] The most significant reform was the decision to opt for a fixed exchange rate policy in 1982 and the government stopped devaluating the Danish currency. The currency was then pegged against the German D-mark.[52]

The next step for European monetary integration was the entrance into the third stage of the EMU with the adoption of the Euro. Denmark would not enter the third phase of the EMU with the other EU countries due to the opt-out of the EMU and would therefore not adopt the common currency. In 1998 Denmark entered an agreement with the EU about participating in the Exchange Rate Mechanism II with a narrow fluctuation band of +/- 2.25 pct instead of the +/- 15pct which is the standard fluctuation band in the mechanism.[9] This agreement was negotiated and finalised in the ECOFIN Council 25–27 September 1998.[12] The main difference between ERM and ERM II is that the currencies participating in the ERM II system are no longer linked to bilateral parities with other participating currencies as they were in the original ERM system, but instead linked to the Euro.[14]

Pre-eurozone documents (1992–1999)

The Maastricht Treaty of 1992 required that EU member states join the euro. However, the treaty gave Denmark the right to opt out from participation, which they subsequently did following a referendum on 2 June 1992 in which Danes rejected the treaty. Later that year Denmark negotiated the Edinburgh Agreement, under which Denmark was granted further opt-outs, which led to the Maastricht Treaty being accepted in a referendum on 18 May 1993. As the result, Denmark is not required to join the eurozone. Denmark did however participate in Stage 2 of EMU, which was considered the preparatory phase for the introduction of the euro.[53] As a part of this process, the National Bank of Denmark participated in various aspects of the planning of the euro as it was still considered to be very important for future Danish economic policy. According to a history published by the central bank, "Firstly, it was important to create a solid framework for price stability in the euro area, making it an appropriate anchor for the Danish fixed-exchange-rate policy. Secondly, Denmark had an interest in developing an expedient framework for exchange rate cooperation between the euro area and the non-euro area member states. Thirdly, Denmark had a general interest in the formulation of the ground rules for Stage 3 of EMU to ensure that Denmark would be able to adopt the single currency at a later stage on the same terms as those applying to the initial euro area member states."[53]

Euro referendum (2000)

A referendum held on 28 September 2000 rejected membership of the eurozone. 87.6% of eligible voters turned out, with 46.8% voting yes and 53.2% voting no.[54] Most political parties, media organisations and economic actors in Denmark campaigned in favour of adopting the euro. However, a couple of major parties campaigned against. Had the vote been favourable, Denmark would have joined the eurozone on 1 January 2002, and introduced the banknotes and coins in 2004. The immediate run-up to the referendum saw a significant weakening of the euro vs. the US dollar. Some analysts believe that this resulted in a general weakening of confidence in the new currency, directly contributing to its rejection. The bank believes that the debate was "coloured by the view that, on account of its fixed-exchange-rate policy, Denmark had already reaped some of the benefits of joining the euro area."[55]

Possible second euro referendum

On 22 November 2007, the newly re-elected Danish government declared its intention to hold a new referendum on the abolition of the four exemptions, including exemption from the euro, by 2011.[56] It was unclear if people would vote on each exemption separately, or if people would vote on all of them together.[57] However, the uncertainty, both in terms of the stability of the euro and the establishment of new political structures at the EU level, resulting first from eruption of the Financial Crisis and then subsequently from the related European government-debt crisis, led the government to postpone the referendum to a date after the end of its legislative term. When a new government came to power in September 2011, they outlined in their government manifest, that a euro referendum would not be held during its four-year term, due to a continued prevalence of this uncertainty.[58]

As part of the European elections in 2014, it was argued collectively by the group of pro-European Danish parties (Venstre, Konservative, Social Democrats and Radikale Venstre), that an upcoming euro referendum would not be in sight until the "development dust had settled" from creation of multiple European debt crisis response initiatives (including the establishment of Banking Union, and the Commission's – still in pipeline – proposal package for creating a strengthened genuine EMU). When a new Venstre-led government came to power in June 2015, their government manifest did not include any plans for holding a euro referendum within their four-year legislative term.[59]

There has been some speculation that the result of a Danish referendum would affect the Swedish debate on the euro.[60]

Usage today

The euro can be used in some locations in Denmark, usually in places catering to tourists, such as museums, airports and shops with large numbers of international visitors. However, change is usually given in kroner. Double krone-euro prices are used on all ferries going between Denmark and Germany.

On 10 January 2020, the 500 euro note was phased out in Denmark as part of the fight against money laundering and the financing of terrorism,[61] meaning "handing out, handing in, exchanging, using as payment or transferring" the banknote in Denmark was made illegal.[62] At the time, the banknote was worth 3,737 Danish kroner (DKK), more than three times the highest denomination of the domestic currency, the thousand-kroner banknote.[63] The European Central Bank had stopped issuing the banknote in 2019, but was critical of the law. In an opinion published in February 2019, it argued that it conflicted with the principle of "sincere cooperation" set out in Article IV of the Treaty on European Union, and noted that no ban was planned for other high-value units of currency, such as the highest Swiss franc banknote,[64][65] worth more than 6,500 DKK at the time.[66]

Consequences of adoption of the euro

If Denmark were to adopt the euro, the monetary policy would be transferred from the Danmarks Nationalbank to the ESCB. In theory this would limit the ability of Denmark to conduct an independent monetary policy. However, a study of the history of the Danish monetary policy shows that, "while Denmark does not share a single currency, its central bank has always tracked changes made by the ESCB".[67]

However, whilst outside the euro, Denmark does not have any representation in the ESCB direction. This motivated the support for an adoption of the euro by former Prime Minister Anders Fogh Rasmussen: "De facto, Denmark participates in the euro zone but without having a seat at the table where decisions are made, and that's a political problem".[68] Furthermore, the ESCB does not defend the Danish krone exchange rate. This is done by Danmarks Nationalbank, and the Danish government. In a crisis it can be tough for a small country to defend its exchange rate.

The expected practical advantages of euro adoption are a decrease of transaction costs with the eurozone, a better transparency of foreign markets for Danish consumers, and more importantly a decrease of the interest rates which has a positive effect on growth.[67] However, when joining the euro, Denmark would abandon the possibility to adopt a different monetary policy from the ECB. If ever an economic crisis were to strike specifically the country it would have to rely only on fiscal policy and labour market reforms.

In the wake of the 2010 European sovereign debt crisis European leaders established the European Financial Stability Facility (EFSF) which is a special purpose vehicle[69] aimed at preserving financial stability in Europe by providing financial assistance to eurozone states in difficulty.[70] It has two parts. The first part expands a €60 billion stabilisation fund (European Financial Stabilisation Mechanism).[71] All EU countries contribute to this fund on a pro-rata basis, whether they are eurozone countries or not.[72] The second part, worth €440 billion consists of government-backed loans to improve market confidence. All eurozone economies will participate in funding this mechanism, while other EU members can choose whether to participate. Unlike Sweden and Poland, Denmark has refused to help fund this portion of the EFSF.[73][74] If Denmark joined the eurozone it would then be obliged to help fund the second portion.

Public opinion

green – support of adopting the euro

red – against adopting the euro

blue – undecided

There have been numerous polls on whether Denmark should abolish the krone and join the euro. The actual wording of the questions have varied. In 2008 and 2009 they generally, but not always, showed support among Danes for adopting the euro. Since 2011, polls have consistently shown majority opposition to joining the Eurozone.

| Date | YES | NO | Unsure | Number of participants | Held by | Ref |

|---|---|---|---|---|---|---|

| 29 March – 30 April 2002 | 47% | 33% | 20% | unknown | Eurobarometer | [75] |

| March 2007 | 56% | 39% | 5% | 910 Persons | Greens Analyseinstitut published in Børsen | [76] |

| April 2007 | 53% | 40% | 7% | 910 Persons | Greens Analyseinstitut published in Børsen | [76] |

| November 2007 | 54% | 42% | 4% | unknown | Greens Analyseinstitut published in Børsen | [77] |

| 26 November 2007 | 52% | 39% | 9% | 1016 Danish adults | Vilstrup Synovate published in Politiken | [77] |

| April 2008 | 55% | 38% | 7% | 1009 Danish adults | Greens Analyseinstitut published in Børsen | [78] |

| 5–7 May 2008 | 54% | 42% | 4% | 1009 Danish adults | Greens Analyseinstitut published in Børsen | [78][79] |

| Mid-June 2008 | 40% | 48% | 12% | 1036 Danes | Capacent Epinions | [80] |

| 29 September – 1 October 2008 | 52% | 44% | 4% | 1050 Danish adults | Greens Analyseinstitut published in Børsen | [81] |

| 3–5 November 2008 | 54% | 38% | 8% | 1098 Danish adults | Greens Analyseinstitut published in Børsen | [82] |

| December 2008 | 54% | 40% | 6% | >1000 Danish adults | Greens Analyseinstitut published in Børsen | [83] |

| 5–7 January 2009 | 56% | 38% | 4% | 1307 Danish adults | Greens Analyseinstitut published in Børsen | [83] |

| 2–4 February 2009 | 57% | 39% | 4% | 1124 Danish adults | Greens Analyseinstitut published in Børsen | [84] |

| 11 February 2009 | 42% | 42% | 16% | unknown | Gallup Poll in Berlingske Tidende | [85] |

| 2–4 March 2009 | 52% | 38% | 10% | 1085 Danish adults | Greens Analyseinstitut published in Børsen | [86] |

| 30 March – 1 April 2009 | 51% | 42% | 7% | 1007 Danish adults | Greens Analyseinstitut published in Børsen | [87] |

| 27–29 April 2009 | 52% | 40% | 8% | 1178 Danish adults | Greens Analyseinstitut published in Børsen | [88] |

| 13 May 2009 | 43% | 45% | 11% | unknown | Rambøll | [89] |

| 25–27 May 2009 | 51% | 42% | 7% | 951 Danish adults | Greens Analyseinstitut published in Børsen | [90] |

| September 2009 | 50% | 43% | 7% | 951 Danish adults | Greens Analyseinstitut published in Børsen | [91] |

| October 2009 | 50% | 43% | 7% | 1081 Danish adults | Greens Analyseinstitut published in Børsen | [92] |

| 2–4 November 2009 | 54% | 41% | 5% | 1158 Danish adults | Greens Analyseinstitut published in Børsen | [93] |

| 30 November – 2 December 2009 | 50% | 40% | 10% | 1001 Danish adults | Greens Analyseinstitut published in Børsen | [94] |

| 2–4 January 2010 | 51% | 42% | 7% | 1162 Danish adults | Greens Analyseinstitut published in Børsen | [95] |

| 1–3 February 2010 | 49% | 45% | 6% | 1241 Danish adults | Greens Analyseinstitut published in Børsen | [96] |

| 1–3 March 2010 | 48% | 46% | 6% | 552 Danish adults | Greens Analyseinstitut published in Børsen | [97] |

| 12–14 April 2010 | 52% | 41% | 7% | 988 Danish adults | Greens Analyseinstitut published in Børsen | [98] |

| 3–5 May 2010 | 48% | 45% | 7% | 1004 Danish adults | Greens Analyseinstitut published in Børsen | [99] |

| 11–13 May 2010 | 45% | 43.2% | 11.2% | 1002 Danish adults | Catinét Ritzau published in Fyens | [100] |

| 31 May – 2 June 2010 | 45% | 48% | 7% | 1079 Danish adults | Greens Analyseinstitut published in Børsen | [101] |

| 27 September 2010 | 45% | 48.3% | 6.7% | unknown | Jyllands-Posten | [102] |

| 1 October 2010 | 46% | 48% | 6% | 1025 Danish adults | Greens Analyseinstitut published in Børsen | [103] |

| 1 November 2010 | 44% | 49% | 7% | unknown | Greens Analyseinstitut published in Børsen | [103] |

| 1 December 2010 | 46% | 48% | 6% | 1006 Danish adults | Greens Analyseinstitut published in Børsen | [103] |

| 1 January 2011 | 43% | 50% | 7% | 1336 Danish adults | Greens Analyseinstitut published in Børsen | [103] |

| 1 February 2011 | 43% | 48% | 9% | 1053 Danish adults | Greens Analyseinstitut published in Børsen | [103] |

| 1 March 2011 | 47% | 46% | 7% | 1060 Danish adults | Greens Analyseinstitut published in Børsen | [103] |

| 1 April 2011 | 43% | 50% | 7% | 1286 Danish adults | Greens Analyseinstitut published in Børsen | [103] |

| 1 May 2011 | 44% | 48% | 8% | 1133 Danish adults | Greens Analyseinstitut published in Børsen | [103] |

| 1 August 2011 | 37% | 54% | 9% | 1143 Danish adults | Greens Analyseinstitut published in Børsen | [103] |

| September 2011? | 22.5% | 50.6% | 28.1% | unknown | Danske Bank | [104] |

| 11 October 2011 | 29% | 65% | 6% | 1239 Danes | Greens Analyseinstitut published in Børsen | [105] |

| 4–6 May 2012 | 26% | 67% | 7% | 1092 Danish adults | Greens Analyseinstitut published in Børsen | [106] |

| 24–27 February 2013 | 29% | 64% | 7% | 1004 Danish adults | Greens Analyseinstitut published in Børsen | [107] |

| 3–9 January 2014 | 30% | 62% | 8% | 1199 Danish adults | Greens Analyseinstitut published in Børsen | [108] |

| 25 April – 1 May 2014 | 26% | 66% | 8% | 1235 Danish adults | Greens Analyseinstitut published in Børsen | [109] |

| 25–30 July 2014 | 30% | 64% | 6% | 1298 Danish adults | Greens Analyseinstitut published in Børsen | [110] |

| 22–27 August 2014 | 29% | 64% | 7% | 1222 Danish adults | Greens Analyseinstitut published in Børsen | [111] |

| 24–29 October 2014 | 28% | 64% | 8% | 1139 Danish adults | Greens Analyseinstitut published in Børsen | [112] |

| 21–26 November 2014 | 30% | 61% | 9% | 1165 Danish adults | Greens Analyseinstitut published in Børsen | [113] |

| 23–28 January 2015 | 31% | 61% | 8% | 1242 Danish adults | Greens Analyseinstitut published in Børsen | [114] |

| 20–26 February 2015 | 27% | 64% | 9% | 1179 Danish adults | Greens Analyseinstitut published in Børsen | [115] |

| 24–29 March 2015 | 28% | 62% | 10% | 1232 Danish adults | Greens Analyseinstitut published in Børsen | [116] |

| 22–26 May 2015 | 30% | 60% | 10% | 961 Danish adults | Greens Analyseinstitut published in Børsen | [117] |

| 27 July – 3 August 2015 | 25% | 66% | 9% | 1205 Danish adults | Greens Analyseinstitut published in Børsen | [118] |

| 25–30 September 2015 | 25% | 64% | 11% | 1143 Danish adults | Greens Analyseinstitut published in Børsen | [119] |

| 27 November – 2 December 2015 | 22% | 70% | 8% | 1191 Danish adults | Greens Analyseinstitut published in Børsen | [120] |

| 22 – 27 January 2016 | 22% | 67% | 11% | 1196 Danish adults | Greens Analyseinstitut published in Børsen | [121] |

| 22 February – 1 March 2016 | 21% | 71% | 8% | 1211 Danish adults | Greens Analyseinstitut published in Børsen | [122] |

| 22–30 March 2016 | 22% | 68% | 10% | 1259 Danish adults | Greens Analyseinstitut published in Børsen | [123] |

| 21–27 April 2016 | 20% | 67% | 13% | 1223 Danish adults | Greens Analyseinstitut published in Børsen | [124] |

| 27 May – 2 June 2016 | 22% | 69% | 9% | 1448 Danish adults | Greens Analyseinstitut published in Børsen | [125] |

| 29 July – 3 August 2016 | 21% | 68% | 11% | 1245 Danish adults | Greens Analyseinstitut published in Børsen | [126] |

| 26 August – 1 September 2016 | 21% | 69% | 10% | 1263 Danish adults | Greens Analyseinstitut published in Børsen | [127] |

| 23–29 October 2016 | 23% | 70% | 7% | 1226 Danish adults | Greens Analyseinstitut published in Børsen | [128] |

| 28 October – 2 November 2016 | 24% | 67% | 9% | 1283 Danish adults | Greens Analyseinstitut published in Børsen | [129] |

| 2–7 December 2016 | 29% | 62% | 9% | 1249 Danish adults | Greens Analyseinstitut published in Børsen | [130] |

| 16–21 December 2016 | 26% | 65% | 9% | 1230 Danish adults | Greens Analyseinstitut published in Børsen | [131] |

Greens Analyseinstitut, a public opinion research company, has generally asked "How would you vote at a possible new referendum about participation of Denmark in the common currency?" ("Hvad ville du stemme ved en evt. ny folkeafstemning om Danmarks deltagelse i den fælles valuta?").

- Public support for the euro in Denmark according to Eurobarometer polls[132]

Danish dominions

The Faroe Islands currently use the Faroese króna, a localised version of the Danish krone but legally the same currency. Such notes are normally not accepted by shops in Denmark proper, or foreign exchange bureaus, but exchanged 1:1 in Danish banks. Greenland currently uses ordinary Danish kroner but has considered introducing its own currency, the Greenlandic krone in a system similar to that of the Faroese one.[133] Both continue to use Danish coins.

It remains unclear if Greenland and the Faroe Islands would adopt the euro should Denmark choose to do so. Both are parts of the Kingdom of Denmark, but remain outside the EU. For this reason, they do not take part in EU referenda.

Possible euro coin design

Before Denmark's 2000 referendum on the issue, Danmarks Nationalbank and the Royal Mint were asked by the Ministry of Economics to propose possible designs for the future Danish euro coins.[134] The suggested design was based on the designs of the Danish 10- and 20-krone coins, with Queen Margrethe II on the front, and the 25- and 50-øre coins, switching their back motif (a crown) to the front of the euro coins.

See also

Notes

- Kosovo is the subject of a territorial dispute between the Republic of Kosovo and the Republic of Serbia. The Republic of Kosovo unilaterally declared independence on 17 February 2008. Serbia continues to claim it as part of its own sovereign territory. The two governments began to normalise relations in 2013, as part of the 2013 Brussels Agreement. Kosovo is currently recognized as an independent state by 98 out of the 193 United Nations member states. In total, 113 UN member states recognized Kosovo at some point, of which 15 later withdrew their recognition.

References

- "Danskerne siger nej tak til euroen". Business.dk (in Danish). 27 September 2011. Retrieved 29 September 2011.

- "Danmarks Riges Grundlov". grundloven.dk. Retrieved 24 March 2020.

- Siune, Karen (March 1993). "The Danes said NO to the Maastricht Treaty. The Danish EC Referendum of June 1992". Scandinavian Political Studies. 16 (1): 93–103. doi:10.1111/j.1467-9477.1993.tb00031.x. ISSN 0080-6757.

- "Subscribe to read | Financial Times". Financial Times. Retrieved 24 March 2020. Cite uses generic title (help)

- Harmsen, Robert; Spiering, Menno (2004). Euroscepticism: Party politics, national identity and European integration. Amsterdam: Rodopi. ISBN 1-4237-9199-1. OCLC 70910464.

- Svensson, Palle (March 1994). "The Danish Yes to Maastricht and Edinburgh. The EC Referendum of May 1993". Scandinavian Political Studies. 17 (1): 69–82. doi:10.1111/j.1467-9477.1994.tb00050.x. ISSN 0080-6757.

- "ERM II – the EU's Exchange Rate Mechanism". European Commission – European Commission. Retrieved 24 March 2020.

- Bank, European Central. "Euro central rates and compulsory intervention rates in ERM II". European Central Bank. Retrieved 24 March 2020.

- Hougaard, Jensen; Svend, Erik (2000). Fastkurspolitik, ØMU og valutaspekulation. Economic Policy Research Unit, Institute of Economics, University of Copenhagen. OCLC 784980209.

- "Denmark's fixed exchange rate policy". nationalbanken.dk. Retrieved 24 March 2020.

- PÉTURSSON, THÓRARINN G (2000). "Exchange rate or inflation targeting in monetary policy?" (PDF). Monetary Bulletin 2000/1.

- Pengepolitik i Danmark (3. udgave ed.). København: Danmarks Nationalbank. 2009. ISBN 978-87-87251-70-9. OCLC 837748184.

- Fontan, Clement (4 March 2018). "Frankfurt's double standard: the politics of the European Central Bank during the Eurozone crisis". Cambridge Review of International Affairs. 31 (2): 162–182. doi:10.1080/09557571.2018.1495692. ISSN 0955-7571.

- MARCUSSEN, MARTIN (March 2005). "Denmark and european monetary integration: Out but far from over". Journal of European Integration. 27 (1): 43–63. doi:10.1080/07036330400029918. ISSN 0703-6337. S2CID 154927996.

- Lioudis, Nick. "How Do National Interest Rates Affect Currency Values and Exchange Rates?". Investopedia. Retrieved 24 March 2020.

- Pettinger, Tejvan. "Pros and Cons of Inflation". Economics Help. Retrieved 24 March 2020.

- "HICP (2005=100): Monthly data (12-month average rate of annual change)". Eurostat. 16 August 2012. Retrieved 6 September 2012.

- "The corrective arm/ Excessive Deficit Procedure". European Commission. Retrieved 2 June 2018.

- "Long-term interest rate statistics for EU Member States (monthly data for the average of the past year)". Eurostat. Retrieved 18 December 2012.

- "Government deficit/surplus data". Eurostat. 22 April 2013. Retrieved 22 April 2013.

- "General government gross debt (EDP concept), consolidated - annual data". Eurostat. Retrieved 2 June 2018.

- "ERM II – the EU's Exchange Rate Mechanism". European Commission. Retrieved 2 June 2018.

- "Euro/ECU exchange rates - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Former euro area national currencies vs. euro/ECU - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Convergence Report May 2012" (PDF). European Central Bank. May 2012. Retrieved 20 January 2013.

- "Convergence Report - 2012" (PDF). European Commission. March 2012. Retrieved 26 September 2014.

- "European economic forecast - spring 2012" (PDF). European Commission. 1 May 2012. Retrieved 1 September 2012.

- "Convergence Report" (PDF). European Central Bank. June 2013. Retrieved 17 June 2013.

- "Convergence Report - 2013" (PDF). European Commission. March 2013. Retrieved 26 September 2014.

- "European economic forecast - spring 2013" (PDF). European Commission. February 2013. Retrieved 4 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2014. Retrieved 5 July 2014.

- "Convergence Report - 2014" (PDF). European Commission. April 2014. Retrieved 26 September 2014.

- "European economic forecast - spring 2014" (PDF). European Commission. March 2014. Retrieved 5 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2016. Retrieved 7 June 2016.

- "Convergence Report - June 2016" (PDF). European Commission. June 2016. Retrieved 7 June 2016.

- "European economic forecast - spring 2016" (PDF). European Commission. May 2016. Retrieved 7 June 2016.

- "Convergence Report 2018". European Central Bank. 22 May 2018. Retrieved 2 June 2018.

- "Convergence Report - May 2018". European Commission. May 2018. Retrieved 2 June 2018.

- "European economic forecast - spring 2018". European Commission. May 2018. Retrieved 2 June 2018.

- "Convergence Report 2020" (PDF). European Central Bank. 1 June 2020. Retrieved 13 June 2020.

- "Convergence Report - June 2020". European Commission. June 2020. Retrieved 13 June 2020.

- "European economic forecast - spring 2020". European Commission. 6 May 2020. Retrieved 13 June 2020.

- "Luxembourg Report prepared in accordance with Article 126(3) of the Treaty" (PDF). European Commission. 12 May 2010. Retrieved 18 November 2012.

- "EMI Annual Report 1994" (PDF). European Monetary Institute (EMI). April 1995. Retrieved 22 November 2012.

- "Progress towards convergence - November 1995 (report prepared in accordance with article 7 of the EMI statute)" (PDF). European Monetary Institute (EMI). November 1995. Retrieved 22 November 2012.

- "The European currency snake – Historical events in the European integration process (1945–2014) – CVCE Website". cvce.eu. Retrieved 24 March 2020.

- Oxenford, Matthew (September 2016). "The Evolution of US and European Monetary Policy after Bretton Woods: A historical Overview and Lession for the Future" (PDF). Chatham House.

- Kaelberer, Matthias (2001). Money and power in Europe : the political economy of European monetary cooperation. Albany: State University of New York Press. ISBN 0-7914-4996-3. OCLC 44769076.

- Chen, James. "Smithsonian Agreement". Investopedia. Retrieved 24 March 2020.

- "History of economic and monetary union | Fact Sheets on the European Union | European Parliament". European Parliament. Retrieved 24 March 2020.

- Viborg Andersen, Kim (1994). Reorganizing the Danish welfare state: 1982–93 : a decade of conservative rule. Department of Economics, Politics and Public Administration, Aalborg University. ISBN 87-89426-43-6. OCLC 467807514.

- Abildgren, Kim. (2010). Monetary history of Denmark, 1990–2005. Danmarks Nationalbank. ISBN 978-87-87251-84-6. OCLC 701865891.

- Abildgren, Kim (2010). Monetary History of Denmark 1990–2005 (PDF). Copenhagen: Danmarks Nationalbank. p. 216.

- "Folkeafstemning om euroen den 28. september 2000" (in Danish). Folketinget. 8 August 2006. Retrieved 23 December 2008.

- Abildgren, 221.

- Stratton, Allegra (22 November 2007). "Danes to hold referendum on relationship with EU". The Guardian. London. Retrieved 22 November 2007.

- Dagens Huvudledare (24 November 2007). "Danmark går före". Dagens Nyheter (in Swedish). Retrieved 23 December 2008.

- Brand, Constant (13 October 2011). "Denmark scraps border-control plans". European Voice. Retrieved 18 October 2011.

- "Regeringsgrundlag juni 2015: Sammen for Fremtiden (Government manifest June 2015: Together for the Future)" (PDF) (in Danish). Venstre. 27 June 2015. Archived from the original (PDF) on 1 July 2015.

- Henrik Brors (22 November 2007). "Utspelet kan höja temperaturen i den iskalla svenska EU-debatten". Dagens Nyheter (in Swedish). Retrieved 23 December 2008.

- Brink, Carsten. "500-eurosedlen udfases". finansdanmark.dk (in Danish). Finance Denmark. Retrieved 15 May 2020.

- "Bekendtgørelse af lov om forebyggende foranstaltninger mod hvidvask og finansiering af terrorisme (hvidvaskloven)". retsinformation.dk (in Danish). Retrieved 15 May 2020.

- "500 EUR in DKK on 10 January 2020". wolframalpha.com. WolframAlpha. Retrieved 15 May 2020.

- Schwartzkopff, Frances. "Denmark Ignores ECB to Ban 500-Euro Note in Dirty Money Battle". bloombergquint.com. BloombergQuint. Retrieved 15 May 2020.

- "Opinion on banning the use of euro 500 denomination banknotes and on certain amendments to anti-money laundering legislation" (PDF). ecb.europa.eu. European Central Bank. 12 February 2019. Retrieved 15 May 2020.

- "1000 CHF in DKK in February 2019". wolframalpha.com. WolframAlpha. Retrieved 15 May 2020.

- "How long is the Danish road to the euro?" (PDF). n.d. Archived from the original (PDF) on 9 October 2011. Retrieved 3 November 2018.

- "Rasmussen Says He Isn't Candidate for EU Presidency (Update1)". Bloomberg. 31 March 2008.

- "The Council and the member states decided on a comprehensive package of measures to preserve financial stability in Europe, including a European financial stabilisation mechanism, with a total volume of up to EUR 500 billion."

- "European Financial Stability Facility, the special-purpose vehicle (SPV) set up to support ailing euro-zone countries, is even being run by a former hedgie. But this is one fund that will never short its investments."

- "Media reports said that Spain would ask for support from two EU funds for eurozone governments in financial difficulty: a €60bn ‘European financial stabilisation mechanism', which is reliant on guarantees from the EU budget."

- Moya, Elena (10 May 2010). "Debt crisis Q&A: How the EU bailout will work". The Guardian. London. Retrieved 12 May 2010.

- "France attacks UK over attitude to bail-out fund". EUobserver. 11 May 2010. Retrieved 12 May 2010.

- "EU's lånepakke kan koste Danmark ni milliarder kroner". Politiken (in Danish). 10 May 2010. Archived from the original on 13 May 2010. Retrieved 12 May 2010.

- "Standard Eurobarometer 57 – Public Opinion in the European Union – Denmark National Report" (PDF). n.d. Retrieved 3 November 2018.

- (PDF). 3 December 2007 https://web.archive.org/web/20071203092905/http://img.borsen.dk/img/cms/cmsmedia/514_content_2_5737.pdf. Archived from the original (PDF) on 3 December 2007. Missing or empty

|title=(help) - "Many Danes Willing to Switch to Euro | Angus Reid Global". Archived from the original on 10 January 2008.

- "Danes Still Willing to Adopt Euro | Angus Reid Global". Archived from the original on 8 August 2008.

- "Archived copy". Archived from the original on 7 September 2008. Retrieved 27 August 2008.CS1 maint: archived copy as title (link)

- "Danskerne vil kun af med et EU-forbehold". DR.

- https://img.borsen.dk/img/cms/cmsmedia/693_content_2_8211.pdf Archived 19 March 2009 at the Wayback Machine (in Danish)

- https://img.borsen.dk/img/cms/cmsmedia/857_content_2_3629.pdf Archived 19 March 2009 at the Wayback Machine (in Danish)

- https://img.borsen.dk/img/cms/cmsmedia/877_content_2_7366.pdf Archived 19 March 2009 at the Wayback Machine (in Danish)

- https://img.borsen.dk/img/cms/cmsmedia/881_content_2_5141.pdf Archived 19 March 2009 at the Wayback Machine (in Danish)

- "Support for euro in free fall". Politiken. 11 February 2009.

- https://img.borsen.dk/img/cms/cmsmedia/588_content_2_1524.pdf

- https://img.borsen.dk/img/cms/cmsmedia/370_content_2_8723.pdf

- https://img.borsen.dk/img/cms/cmsmedia/514_content_2_6992.pdf

- "Opbakningen til EU i bakgear". jyllands-posten.dk. 13 May 2009.

- https://img.borsen.dk/img/cms/cmsmedia/426_content_2_6034.pdf

- "EU-forbehold, September 2009" (PDF). n.d. Retrieved 3 November 2018.

- https://img.borsen.dk/img/cms/cmsmedia/857_content_2_3900.pdf

- https://img.borsen.dk/img/cms/cmsmedia/372_content_2_355.pdf

- https://img.borsen.dk/img/cms/cmsmedia/877_content_2_2936.pdf

- https://img.borsen.dk/img/cms/cmsmedia/881_content_2_8045.pdf

- https://img.borsen.dk/img/cms/cmsmedia/962_content_2_7125.pdf

- https://img.borsen.dk/img/cms/cmsmedia/964_content_2_4340.pdf

- https://img.borsen.dk/img/cms/cmsmedia/970_content_2_8243.pdf

- https://img.borsen.dk/img/cms/cmsmedia/981_content_2_8009.pdf

- "Danskere tvivler på euro efter græsk krise – fyens.dk – Indland/Fyn". Archived from the original on 19 July 2011. Retrieved 13 May 2010.

- https://img.borsen.dk/img/cms/cmsmedia/980_content_2_8134.pdf

- "jv.dk – Nyheder – Indland – Voksende modstand mod at indføre euroen".

- "Børsen". Dagbladet Børsen. n.d. Retrieved 3 November 2018.

- "Rungande danskt nej till euron". Svenska Dagbladet. 27 September 2011.

- Dyrskjøt, Mette (11 October 2011). "Tilslutningen til euroen styrtdykker". Dagbladet Børsen.

- "Archived copy" (PDF). Archived from the original (PDF) on 20 January 2013. Retrieved 3 August 2015.CS1 maint: archived copy as title (link)

- "Archived copy" (PDF). Archived from the original (PDF) on 8 May 2013. Retrieved 3 August 2015.CS1 maint: archived copy as title (link)

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2246_content_2_4038.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2269_content_2_8163.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2266_content_2_4310.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2237_content_2_8347.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2267_content_2_383.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2236_content_2_2914.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2273_content_2_7574.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2234_content_2_9873.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2235_content_2_4175.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2237_content_2_3922.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2266_content_2_4456.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2257_content_2_2527.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2233_content_2_7472.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2267_content_2_426.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2236_content_2_8928.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2273_content_2_7207.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2234_content_2_9335.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2235_content_2_9357.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2237_content_2_2539.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2266_content_2_347.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2269_content_2_1898.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2257_content_2_8410.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2246_content_2_5116.pdf

- https://img.borsen.dk/img/cms/tuksi4/media/cmsmedia/2233_content_2_9796.pdf

- "PublicOpinion". European Commission.

- Parliament of Denmark, 2006–2007 session, law no. 42

- "Illustration af danske euromønter / EU-Oplysningen". 21 December 2014. Archived from the original on 21 December 2014.