Lithuania and the euro

Lithuania is an EU member state which joined the Eurozone by adopting the euro on 1 January 2015.[1]

- European Union (EU) member states

-

5 not in ERM II, but obliged to join the eurozone on meeting convergence criteria (Czech Republic, Hungary, Poland, Romania, and Sweden).

- Non-EU member states

This made it the last of the three Baltic states to adopt the euro, after Estonia (2011) and Latvia (2014). Before then, its currency, the litas, was pegged to the euro at 3.4528 litas to 1 euro.

History

All members of the European Union, except Denmark are required by treaty to join the euro once certain economic criteria have been met. The Lithuanian litas participated in ERM II since 28 June 2004, and was pegged to the euro at a rate of 3.45280 litai = €1. Lithuania originally set 1 January 2007 as their target date for joining the euro, and in March 2006 requested that the European Commission and the European Central Bank conduct an assessment on their readiness to adopt the currency. The Commission's report found that while Lithuania met four of the five criteria, their average annual inflation was 2.7%, exceeding the limit of 2.6%. As a result, the Commission concluded that "there should be no change at present to Lithuania's status as a Member State with a derogation."[2][3] Lithuania is the only country initially to have been denied approval to adopt the euro after requesting a convergence check.[4]

In December 2006, the government approved a new convergence plan, which pushed the expected adoption date to post-2010 due to inflation.[5] In 2007, Prime Minister Gediminas Kirkilas stated that he hoped for adoption around 2010–11.[6][7] Generally high inflation, which reached a peak of 12.7% in June 2008[8] (well above the 4.2% limit of the time),[9] delayed Lithuania's adoption of the euro. By the time of the 2010 European debt crisis, the expected switch over date had been put further back to 2014.[10] Lithuania expressed interest in a suggestion from the IMF that countries which are not able to meet the Maastricht criteria be able to "partially adopt" the euro, using the currency but not getting a seat at the European Central Bank.[11] Interviews with the Foreign Minister and Prime Minister in May and August 2012 respectively highlighted that Lithuania still aimed to join the euro, but would not set a target date until the state of the eurozone post-crisis was clear.[12][13]

During the 2012 Lithuanian parliamentary election campaign, the Social Democrats were reported to prefer delaying the euro adoption, from the previous 2014 target until 1 January 2015.[14] When the second round of the elections were concluded in October, the Social Democrats, the Labour Party and the Order and Justice won a majority and formed the new government, and the coalition parties were expected to accept the proposed delay in adoption of the euro.[15]

When Prime Minister Algirdas Butkevičius presented his new government in December, eurozone accession as soon as possible was mentioned as one of the key priorities for the government. The Prime Minister said: "January 2015 is a feasible date. But things can also turn out, that we may try to adopt the euro together with Latvia in January 2014. Let the first quarter (of 2013) pass, and we'll give it a thought."[16] However, in January 2013, the Prime Minister announced that the government and the Bank of Lithuania had agreed on a target date of 2015.[17] In February 2013, the government of Lithuania approved a plan for euro adoption in 2015.[18] Publicly, Algirdas Butkevičius and Loreta Graužinienė (then Speaker of Seimas) reaffirmed the need of euro adoption in 2015 by mid-January 2014.[19]

According to figures from the Bank of Lithuania, Lithuania had met 4 out of the 5 criteria by October 2013, the exception being the government deficit of 3.2% of GDP, exceeding the limit of 3.0%.[20] The Lithuanian government expected this to decline to 2.9% by the first quarter of 2014.[4][20] In April 2014, the European Parliament's Committee on Economic and Monetary Affairs gave their preliminary consent for Lithuania to join the eurozone on 1 January 2015, having concluded that the country was complying with all the criteria according to economic data from the first months of 2014.[21] Lithuania's parliament approved a euro changeover law in April 2014,[22] and in their biennial reports released on 4 June the European Commission found that the country satisfied the convergence criteria. The European Central Bank did not conclude on whether the country is ready to join the euro area.[23][24][25][26][27] On 16 July, the European Parliament voted in favour of Lithuania adopting the euro.[28][29] On 23 July, the EU Council of Ministers approved the decision, clearing the way for Lithuania to adopt the euro on 1 January 2015.[1][30]

| Convergence criteria | ||||||||

|---|---|---|---|---|---|---|---|---|

| Assessment month | Country | HICP inflation rate[31][nb 1] | Excessive deficit procedure[32] | Exchange rate | Long-term interest rate[33][nb 2] | Compatibility of legislation | ||

| Budget deficit to GDP[34] | Debt-to-GDP ratio[35] | ERM II member[36] | Change in rate[37][38][nb 3] | |||||

| 2012 ECB Report[nb 4] | Reference values | Max. 3.1%[nb 5] (as of 31 Mar 2012) |

None open (as of 31 March 2012) | Min. 2 years (as of 31 Mar 2012) |

Max. ±15%[nb 6] (for 2011) |

Max. 5.80%[nb 7] (as of 31 Mar 2012) |

Yes[39][40] (as of 31 Mar 2012) | |

| Max. 3.0% (Fiscal year 2011)[41] |

Max. 60% (Fiscal year 2011)[41] | |||||||

| 4.2% | Open | 7 years, 10 months | 0.0% | 5.19% | No | |||

| 5.5% | 38.5% | |||||||

| 2013 ECB Report[nb 8] | Reference values | Max. 2.7%[nb 9] (as of 30 Apr 2013) |

None open (as of 30 Apr 2013) | Min. 2 years (as of 30 Apr 2013) |

Max. ±15%[nb 6] (for 2012) |

Max. 5.5%[nb 9] (as of 30 Apr 2013) |

Yes[42][43] (as of 30 Apr 2013) | |

| Max. 3.0% (Fiscal year 2012)[44] |

Max. 60% (Fiscal year 2012)[44] | |||||||

| 2.7% | Open (Closed in June 2013) | 8 years, 10 months | 0.0% | 4.42% | Unknown | |||

| 3.2% | 40.7% | |||||||

| 2014 ECB Report[nb 10] | Reference values | Max. 1.7%[nb 11] (as of 30 Apr 2014) |

None open (as of 30 Apr 2014) | Min. 2 years (as of 30 Apr 2014) |

Max. ±15%[nb 6] (for 2013) |

Max. 6.2%[nb 12] (as of 30 Apr 2014) |

Yes[45][46] (as of 30 Apr 2014) | |

| Max. 3.0% (Fiscal year 2013)[47] |

Max. 60% (Fiscal year 2013)[47] | |||||||

| 0.6% | None | 9 years, 10 months | 0.0% | 3.60% | Yes | |||

| 2.1% | 39.4% | |||||||

- Notes

- The rate of increase of the 12-month average HICP over the prior 12-month average must be no more than 1.5% larger than the unweighted arithmetic average of the similar HICP inflation rates in the 3 EU member states with the lowest HICP inflation. If any of these 3 states have a HICP rate significantly below the similarly averaged HICP rate for the eurozone (which according to ECB practice means more than 2% below), and if this low HICP rate has been primarily caused by exceptional circumstances (i.e. severe wage cuts or a strong recession), then such a state is not included in the calculation of the reference value and is replaced by the EU state with the fourth lowest HICP rate.

- The arithmetic average of the annual yield of 10-year government bonds as of the end of the past 12 months must be no more than 2.0% larger than the unweighted arithmetic average of the bond yields in the 3 EU member states with the lowest HICP inflation. If any of these states have bond yields which are significantly larger than the similarly averaged yield for the eurozone (which according to previous ECB reports means more than 2% above) and at the same time does not have complete funding access to financial markets (which is the case for as long as a government receives bailout funds), then such a state is not be included in the calculation of the reference value.

- The change in the annual average exchange rate against the euro.

- Reference values from the ECB convergence report of May 2012.[39]

- Sweden, Ireland and Slovenia were the reference states.[39]

- The maximum allowed change in rate is ± 2.25% for Denmark.

- Sweden and Slovenia were the reference states, with Ireland excluded as an outlier.[39]

- Reference values from the ECB convergence report of June 2013.[42]

- Sweden, Latvia and Ireland were the reference states.[42]

- Reference values from the ECB convergence report of June 2014.[45]

- Latvia, Portugal and Ireland were the reference states, with Greece, Bulgaria and Cyprus excluded as outliers.[45]

- Latvia, Ireland and Portugal were the reference states.[45]

Public opinion

A poll by Eurobarometer in April 2013 found that 41% of Lithuanians supported switching to the euro, while 55% were opposed. This was a decrease in support of 3% from a year earlier.[4][51] A September 2014 Eurobarometer poll found that 49% of Lithuanians were opposed to the introduction of the euro and 47% supported it.[52]

Opinion polling in the run-up to the adoption of the euro produced a mixed set of results.[53] A Baltic Surveys (Baltijos Tyrimai) face-to-face interview survey for the eurosceptic Europeans United for Democracy party conducted on 14–24 November found that 49% of Lithuanians disagree with their Government's decision to introduce the euro, while 26% of Lithuanians approved (5% fully, 21% rather in favour). 57% of respondents said the Government acted wrongly by introducing the euro without a referendum on the issue.[54] However, a poll conducted by Berent Research Baltic for the Bank of Lithuania between 3 and 26 November showed that 53% of the population were in favour of the new currency while 39% were sceptical.[53]

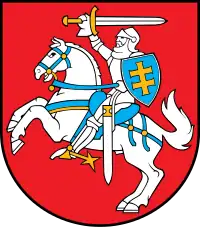

Coin design

The designs of the Lithuanian coins share a similar national side for all denominations, featuring the Vytis symbol and the name of the country, "Lietuva".[55] The design was announced on 11 November 2004 following a public opinion poll conducted by the Bank of Lithuania.[55] It was created by the sculptor Antanas Žukauskas.[56] The only difference between the coins is that the one and two euro coins have vertical lines on the outer circle, the fifty, twenty and ten cent coins have horizontal lines on the outer circle, and the five, two and one cent coins have no lines on the outer circle.[55] In January 2014 it was announced that all coins will have "2015" printed on them to display the year of Lithuania's euro adoption. The Lithuanian Mint was chosen to mint the coins.[55][56]

| €0.01 | €0.02 | €0.05 |

|---|---|---|

|

|

|

| "Vytis" from the Coat of arms of Lithuania | ||

| €0.10 | €0.20 | €0.50 |

.jpg.webp) |

|

|

| "Vytis" from the Coat of arms of Lithuania | ||

| €1.00 | €2.00 | €2 Coin Edge |

|

|

"Freedom, Unity, Prosperity" in Lithuanian |

| "Vytis" from the Coat of arms of Lithuania | ||

For the design of images on the common side and a detailed description of the coins, see euro coins.

Accession to the eurozone

Lithuania officially joined the Eurozone at midnight on the morning of 1 January 2015, with the Lithuanian Central Bank offering an exchange rate of 3.4528 LTL to one euro.[57] Immediately after the start of the New Year, Prime Minister Algirdas Butkevicius made the country's first cash withdrawal in euros.[58] It was reported that nearly all of the nation's cash machines would be dispensing euros within 30 minutes of the New Year. In Brussels, the European Commission building was draped with a banner welcoming Lithuania to the Eurozone.[59]

| Euro adoption day[60] | Changeover plan[60] | Introduction[60][61] | Frontloading[60] | Dual circulation period[60] |

Exchange of LTL cash period[60] | Dual price display[60] | Mint company[60] | Currency circulated (in units)[60] |

|---|---|---|---|---|---|---|---|---|

| 1 January 2015 | A changeover law was passed in April 2014[22] | Big-Bang | Commercial banks starts receiving euro banknotes and coins respectively 2 and 3 months before €-day. Retailers receive coins and banknotes during the last month before €-day. |

15 days | Banks: 12 months (notes) 6 months (coins) Central bank: indefinitely |

Start 30 days after Council approval of euro adoption, equal to 22 Aug.2014, and lasts until 6 or 12 months after adoption | Lithuanian Mint[55] | 132 million banknotes, 370 million coins[62] |

The European Commission recommended in November 2014 that Lithuania extend the legally required dual price display period by six additional months, so that it would last until 31 December 2015.[60] Lithuania did not adopt the recommendation and the required dual price display ended on 1 July 2015.[63]

Rotation of voting rights in the ECB Governing Council

On 17 June 2014 the Deutsche Bundesbank released a statement stating that "Lithuania could cause the ECB Governing Council's voting rights to rotate. The virtually certain introduction of the euro in this small Baltic nation at the beginning of next year would cause the number of national central bank (NCB) governors on the ECB Governing Council to exceed 18 for the first time. It would trigger a changed voting procedure designed to ensure that decisions can still be taken effectively in a growing Eurosystem. This would pave the way for the introduction of a modified voting system similar to that of the US Federal Reserve System."[64]

See also

Notes

- Kosovo is the subject of a territorial dispute between the Republic of Kosovo and the Republic of Serbia. The Republic of Kosovo unilaterally declared independence on 17 February 2008. Serbia continues to claim it as part of its own sovereign territory. The two governments began to normalise relations in 2013, as part of the 2013 Brussels Agreement. Kosovo is currently recognized as an independent state by 98 out of the 193 United Nations member states. In total, 113 UN member states recognized Kosovo at some point, of which 15 later withdrew their recognition.

References

- "Lithuania to adopt the euro on 1 January 2015". Council of the European Union. 23 July 2014. Retrieved 23 July 2014.

- "Commission assesses the state of convergence in Lithuania". European Commission. 16 May 2006. Retrieved 12 January 2014.

- "Euro zone: Slovenia in, Lithuania on hold". 16 May 2006. Retrieved 12 January 2014.

- Milne, Richard; Spiegel, Peter (30 December 2013). "Lithuania shows rare enthusiasm for eurozone membership". Financial Times. Retrieved 12 January 2014.(subscription required)

- "Adoption of the euro in Lithuania". Bank of Lithuania. Archived from the original on 26 January 2006. Retrieved 11 January 2007.

- "Lithuanian PM says aiming for euro by 2010–2011". Forbes. 12 April 2007. Archived from the original on 9 January 2008. Retrieved 3 January 2008.

- Pavilenene, Danuta (8 December 2008). "SEB: no euro for Lithuania before 2013". The Baltic Course. Retrieved 21 December 2008.

- "Inflation and the euro". Eurostat & EuroGeographics for the administrative boundaries. European Central Bank.

- "SEB: no euro for Lithuania before 2013". The Baltic Course. Retrieved 22 December 2008.

- "FEATURE – Crisis, not Greece, makes euro hopefuls cautious". Reuters. 18 January 2010.

- "Lithuanian PM keen on fast-track euro idea". The Baltic Course. 8 April 2009.

- "Lithuania to Adopt Euro When Europe Is Ready, Kubilius Says". Bloomberg. Retrieved 7 September 2013.

- "Foreign Minister: 'Lithuania could adopt the euro after some time'". EurActiv. 23 May 2012.

- Sytas, Andrius; Lowe, Christian (14 October 2012). "Lithuanian voters to give harsh verdict on austerity". reuters. Retrieved 7 September 2013.

- Lannin, Patrick (29 October 2012). "Lithuania PM candidate targets 2015 euro adoption". Reuters. Thomson Reuters.

- "Lithuania's next prime minister still hopes to adopt euro in 2014". 15min.lt. UAB "15min". 11 December 2012. Retrieved 16 December 2012.

- Bradley, Bryan (25 January 2013). "Lithuania Commits to Seek Euro Adoption in 2015". Bloomberg. Retrieved 25 January 2013.

- "Lithuanian government endorses euro introduction plan". 15 min. 25 February 2013. Retrieved 3 March 2013.

- https://www.lrt.lt/naujienos/tavo-lrt/15/33826/a-butkevicius-su-l-grauziniene-sutarta-del-euro

- "Euro adoption criteria and their implementation". Bank of Lithuania. Retrieved 12 January 2014.

- Bankas, Lietuvos (8 April 2014). "The European Parliament's Committee on Economic and Monetary Affairs preliminary approved of the euro adoption in Lithuania". Retrieved 20 April 2014.

- "Lithuania readies for euro adoption". BalticTimes.com. 1 May 2014. Retrieved 1 May 2014.

- "Commission assesses eight EU countries' readiness to join the euro area; proposes that Lithuania join in 2015". European Commission. 4 June 2014. Retrieved 4 June 2014.

- "ECB publishes its Convergence Report 2014". European Central Bank. 4 June 2014. Retrieved 4 June 2014.

- "Convergence Report" (PDF). European Economy. European Commission. 2014. ISSN 1725-3217. Retrieved 4 June 2014.

- "Convergence Report" (PDF). European Central Bank. June 2014. Retrieved 4 June 2014.

- https://www.bbc.com/news/world-europe-27697611 BBC:Lithuania 'ready to join euro' in 2015 – EU Commission, 4.June 2014.

- "European Parliament gives go-ahead for Lithuania to join the euro". European Parliament. 16 July 2014. Retrieved 16 July 2014.

- ELTA, BNS. "European Parliament greenlights Lithuania's euro adoption". delfi.lt. Retrieved 13 April 2018.

- "Lietuvoje keičiama valiuta" (in Lithuanian). Delphi. 23 July 2014.

- "HICP (2005=100): Monthly data (12-month average rate of annual change)". Eurostat. 16 August 2012. Retrieved 6 September 2012.

- "The corrective arm/ Excessive Deficit Procedure". European Commission. Retrieved 2 June 2018.

- "Long-term interest rate statistics for EU Member States (monthly data for the average of the past year)". Eurostat. Retrieved 18 December 2012.

- "Government deficit/surplus data". Eurostat. 22 April 2013. Retrieved 22 April 2013.

- "General government gross debt (EDP concept), consolidated - annual data". Eurostat. Retrieved 2 June 2018.

- "ERM II – the EU's Exchange Rate Mechanism". European Commission. Retrieved 2 June 2018.

- "Euro/ECU exchange rates - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Former euro area national currencies vs. euro/ECU - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Convergence Report May 2012" (PDF). European Central Bank. May 2012. Retrieved 20 January 2013.

- "Convergence Report - 2012" (PDF). European Commission. March 2012. Retrieved 26 September 2014.

- "European economic forecast - spring 2012" (PDF). European Commission. 1 May 2012. Retrieved 1 September 2012.

- "Convergence Report" (PDF). European Central Bank. June 2013. Retrieved 17 June 2013.

- "Convergence Report - 2013" (PDF). European Commission. March 2013. Retrieved 26 September 2014.

- "European economic forecast - spring 2013" (PDF). European Commission. February 2013. Retrieved 4 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2014. Retrieved 5 July 2014.

- "Convergence Report - 2014" (PDF). European Commission. April 2014. Retrieved 26 September 2014.

- "European economic forecast - spring 2014" (PDF). European Commission. March 2014. Retrieved 5 July 2014.

- "Luxembourg Report prepared in accordance with Article 126(3) of the Treaty" (PDF). European Commission. 12 May 2010. Retrieved 18 November 2012.

- "EMI Annual Report 1994" (PDF). European Monetary Institute (EMI). April 1995. Retrieved 22 November 2012.

- "Progress towards convergence - November 1995 (report prepared in accordance with article 7 of the EMI statute)" (PDF). European Monetary Institute (EMI). November 1995. Retrieved 22 November 2012.

- "Introduction of the euro in the more recently acceded member states" (PDF). Eurobarometer. April 2013. p. 66. Retrieved 27 March 2014.

- Flash Eurobarometer 402 survey on "Introduction of the Euro in Lithuania" (PDF), European Commission, Directorate-General for Economic and Financial Affairs and co-ordinated by the Directorate-General for Communication, September 2014, doi:10.2765/88982, ISBN 978-92-79-39786-8

- baltic News Service (15 December 2014). "Conflicting poll results on Lithuanians' enthusiasm for euro". Delfi. Retrieved 6 January 2015.

- SURVEY OF LITHUANIAN POPULATION ON INTRODUCTION OF EURO (PDF), Europeans United for Democracy, November 2014

- "Projects for Lithuanian euro coins already bear the year 2015". Bank of Lithuania. 31 January 2014. Archived from the original on 9 March 2014. Retrieved 9 March 2014.

- "Euro Banknotes and Coins". Retrieved 12 January 2014.

- "Lithuania joins euro zone on January 1, 2015". Sofia Globe. 1 January 2015.

- "Lithuania joins eurozone as its 19th member". Xinhuanet. 1 January 2015.

- Beniusis, Vaidotas (1 January 2015). "Lithuania joins eurozone to seal ties with West". Yahoo News.

- "Fifteenth Report on the practical preparations for the future enlargement of the euro area" (PDF). European Commission. 21 November 2014.

- "Scenarios for adopting the euro". European Commission. Retrieved 7 September 2013.

- "The first Lithuanian euro coins are being minted by order of the Bank of Lithuania". Lietuvos Bankas. 16 June 2014. Archived from the original on 20 August 2014.

- "Etiketėse – kainos bus tik eurais" (in Lithuanian). Lietuvos rytas. 8 June 2015. Retrieved 13 December 2017.

- "How voting rights rotate on the ECB Governing Council". Deutsche Bundesbank – Eurosystem. 19 September 2014.

External links

| Wikimedia Commons has media related to Euro coins of Lithuania. |