Emerging and growth-leading economies

Emerging and growth-leading economies (EAGLEs) are a grouping of key emerging markets developed by BBVA Research. The EAGLE economies are expected to lead global growth in the next 10 years, and to provide important opportunities for investors.

EAGLEs

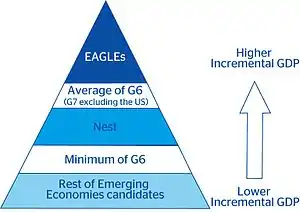

EAGLEs is a grouping acronym created in late 2010 by BBVA Research to identify all emerging economies, whose contribution to world economic growth in the next ten years is expected to be larger than the average of the G6 economies (G7 excluding the U.S.). This is a dynamic concept where country members can change over time according to their forecasted performance relative to developed economies. The membership of the EAGLEs is subjected to a yearly revision and can change according to their forecasted economic performances relative to developed economies.

| EAGLEs members | 2011[1] | 2012[2] | 2013[3] | 2014[4] | 2015[5] | 2016[6] |

|---|---|---|---|---|---|---|

| . | . | |||||

| . | . | . | . | . | . | |

| . | . | . | . | . | . | |

| . | . | |||||

| . | . | . | . | . | . | |

| . | . | . | . | . | . | |

| . | ||||||

| . | ||||||

| . | . | . | . | . | . | |

| . | . | |||||

| . | . | |||||

| . | . | |||||

| . | . | . | . | . | . | |

| . | . | . | . | . | . | |

| . |

| EAGLEs members | 2011[1] | 2012[2] | 2013[3] | 2014[4] | 2015[5] | 2016[6] |

|---|---|---|---|---|---|---|

| . | ||||||

| . | . | . | . | |||

| . | ||||||

| . | . | . | . | |||

| . |

Other economic concepts

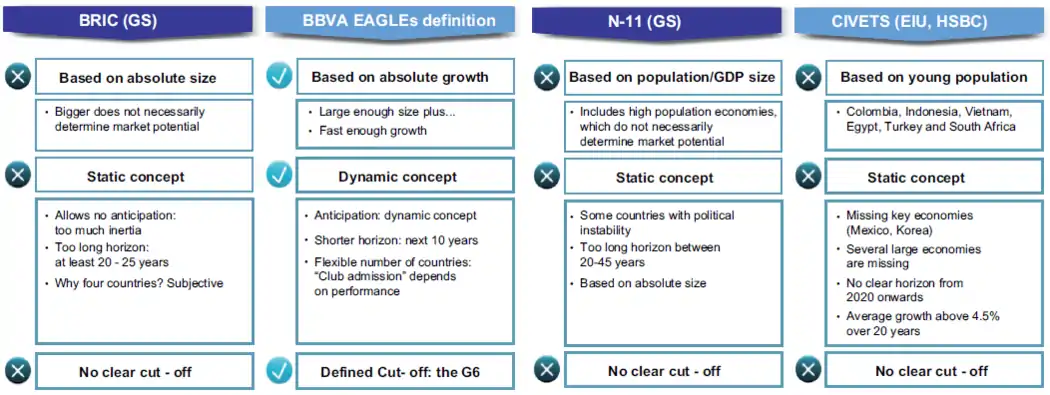

As world economic growth rotates from developed to developing countries, there has been increasing interest in identifying emerging markets that will become global leaders, as well as increasing the lobbying of some countries to be included in the BRIC definition. However, many economists have argued that the BRIC concept (Brazil, Russia, India and China) is outdated and have proposed alternative definitions. The EAGLEs concept is similar to other proposals in going beyond BRICs (such as the CIVETS, Next Eleven or 7 percent club) but its methodology differs from others’ in several ways:

- It gives less relevance to economic size and population, which may be misleading.

- It focuses on the Incremental GDP (IGDP) economies will generate, instead of paying attention to the current or expected size of their GDP. This creates a situation where having big size or a high growth rate is not enough on its own to be a key global player. It is a combination of both that really matters.

- The cut-off is explicit. In order to become an EAGLE member, each country’s expected Incremental GDP in the next 10 years needs to be greater than the one anticipated for the average of the G6 economies, G7 excluding the U.S.

- It is not a closed group and the concept is not linked to an acronym formed by a given set of countries.

- The results are based on a shorter horizon – 10 years – than the ones considered in other cases, ranging from 20 to 50 years.

Over the years there have been several attempts to try to implement the economic concept that will best reflect the potential of emerging markets in the coming years. After BRIC concept was coined by Goldman Sachs in 2001, there were other endeavors to find the best grouping acronym such as: CIVETS, Next Eleven, 7 per cent club and the EAGLEs.

In January 2011, Goldman Sachs decided to re-define its current definition of Emerging Markets and proposed a new term “Growth Markets”. The separation of Growth Markets from Emerging Markets is aimed to show the world’s most dynamic economies – those that are at least contributing 1 per cent to global growth (outside of the Developed World). In the first approach, eight economies have been identified and they were: BRIC economies plus Mexico, South Korea, Turkey and Indonesia. This particular shift in terminology was initially proposed by BBVA Research (later followed by Goldman Sachs) with the aim of switching from the existing static concept to something more dynamic, that could better indicate market potential.

Nest

As part of the EAGLEs proposal, the EAGLEs’ Nest is a second set of countries with expected Incremental GDP in the next decade to be lower than the average of the G6 economies (G7 excluding the U.S.) but higher than Italy’s (G6 Minimum), the country which is anticipated to contribute least to global growth within the G7. The membership of the EAGLEs’ Nest is subject to a yearly revision and can change according to forecasted economic performances.

| Nest members | 2011[1] | 2012[2] | 2013[3] | 2014[4] | 2015[5] | 2016[6] |

|---|---|---|---|---|---|---|

| . | . | |||||

| . | . | . | . | . | . | |

| . | . | . | . | . | ||

| . | . | . | . | . | . | |

| . | ||||||

| . | . | |||||

| . | . | . | ||||

| . | ||||||

| . | ||||||

| . | ||||||

| . | . | |||||

| . | . | . | . | . | . | |

| . | . | . | . | . | . | |

| . | ||||||

| . | . | |||||

| . | . | . | . | . | . | |

| . | . | |||||

| . | . | . | . | . | ||

| . | . | |||||

| . |

| Nest members | 2011[1] | 2012[2] | 2013[3] | 2014[4] | 2015[5] | 2016[6] |

|---|---|---|---|---|---|---|

| . | . | . | . | |||

| . | . | . | . | |||

| . | . | |||||

| . | . | . | . | . | ||

| . | . | . | . | |||

| . | . | . | . | |||

| . | . | . | . | |||

| . | . | |||||

| . | ||||||

| . | . | . | . | . |

Three countries which would otherwise have met the criterion for the Nest were excluded: Iraq and Saudi Arabia because BBVA classifies them as frontier, not emerging markets; Iran was excluded due to sanctions and thus not a suitable target for investors. Iran would have been an EAGLE in 2012 and a nest in 2011 and 2013, Iraq and Saudi Arabia only qualified for the Nest.[3]

Indexes

On September 9, 2011, Dow Jones and BBVA launched two equity indexes that allow investing in leading companies traded in Emerging and Growth-Leading Economies (EAGLEs). There are two indexes, “Dow Jones BBVA EAGLEs[7]” and “Dow Jones BBVA EAGLEs Optimized[8]”, both composed of a set of 50 companies.

The allocation by country is macro driven according to the contribution each EAGLE is going to make to incremental GDP within the group, in the next ten years. It is a dynamic index which changes its composition along with macro forecasts; hence it is an adaptive index when compared with other static peers. Revisions are made annually in March to update the indices compositions according to the latest macroeconomic forecasts. It is also a liquid index which provides a diversified exposure to Emerging Markets. In order to facilitate index replication by foreign investment firms, the sample of 50 companies is chosen from the Dow Jones Global Total Stock Market Index, plus HK and US listed Chinese companies.

References

- Who are the EAGLEs? Driving Global Growth for the Next Ten Years (14 February 2011)

- EAGLEs_Outlook_Annual_Report_2012 (20 February 2012)

- Archived 2013-06-21 at the Wayback Machine EAGLES Economic Outlook. Annual Report 2013 (11 March 2013)

- EAGLES Economic Outlook. Annual Report 2014 (29 March 2014)

- EAGLES Economic Outlook. Annual Report 2015 (13 April 2015)

- EAGLES Economic Outlook. Annual Report 2016 (May 2016)

- Dow Jones BBVA EAGLEs Index Methodology

- Dow Jones BBVA EAGLEs Optimized Index

External links

- Alicia García-Herrero, IESE Insight, Third Quarter The next emerging giants take flight

- Alicia García-Herrero and Stephen Schwartz, Indonesian Journal of Leadership, 15/08/2011 Indonesia's Economy set to fly like an Eagle

- Bettina Wassener. The New York Times. 15/11/2010 New Term for Emerging Economies Is Suggested

- Jon Herskovitz. Reuters. 29/12/2010 Analysis: S.Africa, not just another BRIC in the wall

- James Newman. Business News Americas. 12/11/2010 BBVA adds its EAGLES to the BRIC, CIVETS debate – Regional

- Alicia García-Herrero, Daniel Navia, Mario Nigrinis. BBVA Research 15/12/2010 Why investors should focus on BBVA EAGLEs

- Alma Saavedra. El Economista. 16/11/2010 BBVA Research pone a volar EAGLES (only available in Spanish)

- Actibva. 17/11/2010 Paises EAGLEs: paises que crecerán por encima del G7 en los próximos 10 años (only available in Spanish)

- Globalasia. 18/11/2010 BBVA crea el concepto de países EAGLEs (only available in Spanish)

- Alicia Gonzalez. El Pais. 05/12/2010 Las 'águilas' toman el relevo (only available in Spanish)

- BBVA Research 16/03/2011 EAGLEs Quarterly Report 1Q 2011

- BBVA Research 09/06/2011 EAGLEs Quarterly Report 2Q 2011

- BBVA Research 09/09/2011 EAGLEs Quarterly Report 3Q 2011

- BBVA Research 06/12/2011 EAGLEs Quarterly Report 4Q 2011

- BBVA Research 06/03/2012 EAGLEs Quarterly Report 1Q 2012

- BBVA Research 06/06/2012 EAGLEs Quarterly Report 2Q 2012

- BBVA Research 07/09/2012 EAGLEs Quarterly Report 3Q 2012

- BBVA Research 05/12/2012 EAGLEs Quarterly Report 4Q 2012

- BBVA Research 04/09/2013 EAGLEs Quarterly Report 1Q 2013

- Alicia García-Herrero, Daniel Navia, José Ramón Perea. BBVA Research 16/03/2011 Can Egypt continue to be an EAGLE?

- Alicia García-Herrero, Daniel Navia, Mario Nigrinis. BBVA Research 15/11/2010 BBVA EAGLEs

- Alicia García-Herrero, Daniel Navia, Mario Nigrinis. BBVA Research 12/01/2011 Should South Africa be a BRIC?

- Alicia García-Herrero, Daniel Navia, Mario Nigrinis, Jose Ramón Perea, Alfonso Ugarte. BBVA Research 14/02/2011 Who are the EAGLEs? Driving Global Growth for the Next Ten Years

- EAGLES Economic Outlook. Annual Report 2012. BBVA Research 20/02/2012

- Alicia García-Herrero, Daniel Navia, Mario Nigrinis. BBVA Research 15/12/2010 Why investors should focus on BBVA EAGLEs?

- BBVA Research 12/01/2011 Should South Africa be a BRIC?

- Alicia García-Herrero, Alvaro Ortiz, Mario Nigrinis. BBVA Research 10/02/2012 China is the only global creditor within BBVA EAGLEs

- Alicia García-Herrero, Alvaro Ortiz, David Martínez, Alfonso Ugarte. BBVA Research 16/02/2012 Structural Twin Deficits: A problem of the developed world rather than the emerging one

- Alicia García-Herrero, Alvaro Ortiz, David Martínez. BBVA Research 16/05/2012 Central bank balance sheets in EAGLE countries also growing fast but different composition matters to spell out risks

- Alicia García-Herrero, Alvaro Ortiz, David Martínez. BBVA Research 01/06/2012 Demographic transition in the EAGLEs. A premium and a challenge at the same time