Global recession

A global recession is recession that affects many countries around the world—that is, a period of global economic slowdown or declining economic output.

.svg.png.webp)

Definitions

The International Monetary Fund defines a global recession as "a decline in annual per‑capita real World GDP (purchasing power parity weighted), backed up by a decline or worsening for one or more of the seven other global macroeconomic indicators: Industrial production, trade, capital flows, oil consumption, unemployment rate, per‑capita investment, and per‑capita consumption".[1][2]

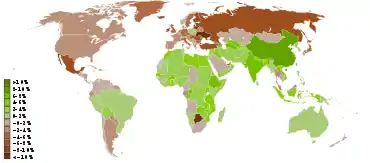

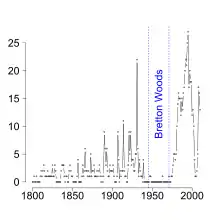

According to this definition, since World War II there were only four global recessions (in 1975, 1982, 1991 and 2009), all of them only lasting a year (although the 1991 recession would have lasted until 1993 if the IMF had used normal exchange rate weighted per‑capita real World GDP rather than the purchasing power parity weighted per‑capita real World GDP).[1][2] The 2009 global recession, also known as the Great Recession, was by far the worst of the four postwar recessions, both in terms of the number of countries affected and the decline in real World GDP per capita.[1][2]

Before April 2009, the IMF argued that a global annual real GDP growth rate of 3.0 percent or less was "equivalent to a global recession".[3][4] By this measure, there were six global recessions since 1970: 1974–75,[5] 1984–85,[5] 1990–93,[6] 1996,[6] 2008–09,[6] and 2018–19.[7]

Overview

Informally, a national recession is a period of declining economic output. In a 1974 New York Times article, Julius Shiskin suggested several rules of thumb to identify a recession, which included two successive quarterly declines in gross domestic product (GDP), a measure of the nation's output.[8] This two-quarter metric is now a commonly held definition of a recession. In the United States, the National Bureau of Economic Research (NBER) is regarded as the authority which identifies a recession and which takes into account several measures in addition to GDP growth before making an assessment. In many developed nations (but not the United States), the two-quarter rule is also used for identifying a recession.[9]

Whereas a national recession is identified by two quarters of decline, defining a global recession is more difficult, because a Developing country is expected to have a higher GDP growth than a Developed country.[10] According to the IMF, the real GDP growth of the emerging and developing countries is on an uptrend and that of advanced economies is on a downtrend since late 1980s. The world growth is projected to slow from 5% in 2007 to 3.75% in 2008 and to just over 2% in 2009. Downward revisions in GDP growth vary across regions. Among the most affected are commodity exporters, and countries with acute external financing and liquidity problems. If a global recession were to occur in its full magnitude, an estimated 100 million jobs would be lost around the world, with total lost capital hovering at US$120 trillion. Countries in East Asia (including China) have suffered smaller declines because their financial situations are more robust. They have benefited from falling commodity prices and they have initiated a shift toward macroeconomic policy easing.[10]

The IMF estimates that global recessions occur over a cycle lasting between eight and ten years. During what the IMF terms the past three global recessions of the last three decades, global per capita output growth was zero or negative.[6]

See also

- 2000s energy crisis

- 2007–08 world food price crisis

- Financial crisis of 2007–08

- Great Recession

- Great Depression

- Coronavirus recession

References

- "What's a Global Recession?". The Wall Street Journal. 22 April 2009. Retrieved 17 September 2013.

- "World Economic Outlook - April 2009: Crisis and Recovery" (PDF). Box 1.1 (page 11-14). IMF. 24 April 2009. Retrieved 17 September 2013.

- "The world economy Bad, or worse". Economist.com. 2008-10-09. Retrieved 2009-04-15.

- Lall, Subir. "IMF Predicts Slower World Growth Amid Serious Market Crisis," International Monetary Fund, April 9, 2008.

- http://www.imf.org/external/pubs/ft/weo/2009/update/01/index.htm IMF Jan 2009 update

- "Global Recession Risk Grows as U.S. `Damage' Spreads. Jan 2008". Bloomberg.com. 2008-01-28. Retrieved 2009-04-15.

- "World Economic Outlook (WEO) April 2013: Statistical appendix - Table A1 - Summary of World Output" (PDF). IMF. 16 April 2013. Retrieved 16 April 2013.

- Achuthan, Lakshman (2008-05-06). "The risk of redefining recession, Lakshman Achuthan and Anirvan Banerji, Economic Cycle Research Institute, May 7, 2008". Money.cnn.com. Retrieved 2009-04-15.

- Japan's Economy Shrinks 0.4%, Confirming Recession By Jason Clenfield

- "IMF World Economic Outlook (WEO) Update - Rapidly Weakening Prospects Call for New Policy Stimulus - November 2008". Imf.org. 2008-11-06. Retrieved 2009-04-15.

External links

- The Thirty-Five Most Tumultuous Years in Monetary History: Shocks and Financial Trauma, by Robert Aliber. Presented at the IMF

- Business Cycle Expansions and Contractions The National Bureau Of Economic Research

- Independent Analysis of Business Cycle Conditions - American Institute for Economic Research (AIER)