Johnsonburg Area School District

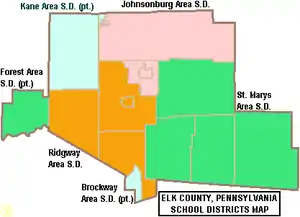

The Johnsonburg Area School District is a diminutive, rural, public school district serving parts of Elk County, Pennsylvania. It encompasses the communities of Johnsonburg, Ridgway Township, and Jones Township. Johnsonburg Area School District encompasses 227 square miles (590 km2). According to 2000 federal census data, it serves a resident population of 7,526. In 2009, the district residents’ per capita income was $16,810, while the median family income was $42,131.[5] In the Commonwealth, the median family income was $49,501[6] and the United States median family income was $49,445, in 2010.[7] According to District officials, in school year 2007-08 the Johnsonburg Area School District provided basic educational services to 705 pupils through the employment of 56 teachers, 32 full-time and part-time support personnel, and 4 administrators. Johnsonburg Area School District received more than $6.2 million in state funding in school year 2007-08.

| Johnsonburg Area School District | |

|---|---|

| |

| Address | |

315 High School Road Johnsonburg , Elk County , 15845 | |

| Information | |

| Type | Public |

| School board | 9 locally elected members |

| Superintendent | Mr. Dennis Crotzer (3 year contract July 1, 2011) |

| School number | (814) 965-2556 |

| Principal | Mr. Brock Benson, JHS/HS |

| Principal | Mrs. Jennifer Hobbs, ES |

| Head teacher | Mrs. Rebecca Kreckel, Special Edusation Supervisor |

| Faculty | 49 teachers [1] |

| Grades | K-12 |

| Age | 5 years to 21 years for special education |

| Number of pupils | 639 pupils (2009-10)[2] |

| • Kindergarten | 51 |

| • Grade 1 | 56 |

| • Grade 2 | 36 |

| • Grade 3 | 38 |

| • Grade 4 | 53 |

| • Grade 5 | 56 |

| • Grade 6 | 40 |

| • Grade 7 | 46 |

| • Grade 8 | 46 |

| • Grade 9 | 48 |

| • Grade 10 | 43 |

| • Grade 11 | 59 |

| • Grade 12 | 58 |

| • Grade 13 | 41 |

| • Other | Enrollment projected to be 500 in 2019[3] |

| Budget | $10,669,124 2012-13[4] |

| per pupil spending | $13,458 in 2008 |

| per pupil spending | $15,061.49 in 2010 |

| Website | http://johnsonburgareaschooldistrict.com/ |

The district operates one elementary school and one junior/senior high school.

Governance

Johnsonburg Area School District is governed by 9 individually elected board members (serve four-year terms), the Pennsylvania State Board of Education, the Pennsylvania Department of Education and the Pennsylvania General Assembly.[8] The federal government controls programs it funds like Title I funding for low-income children in the Elementary and Secondary Education Act and the No Child Left Behind Act, which mandates the district focus resources on student success in acquiring reading and math skills.

The Commonwealth Foundation for Public Policy Alternatives Sunshine Review gave the school board and district administration a " C-" for transparency based on a review of "What information can people find on their school district's website". It examined the school district's website for information regarding; taxes, the current budget, meetings, school board members names and terms, contracts, audits, public records information and more.[9]

Academic achievement

Johnsonburg Area School District was ranked 276th out of 498 Pennsylvania school districts by the Pittsburgh Business Times in 2012.[10] The ranking was based on student academic achievement as demonstrated on the last three years of the PSSAs for: reading, writing math and science.[11] The PSSAs are given to all children in grades 3rd through 8th and the 11th grade in high school. Adapted examinations are given to children in the special education programs.

- 2011 - 278th[12]

- 2010 - 293rd[13]

- 2009 - 334th

- 2008 - 359th

- 2007 - 380th out of 501 school districts.[14]

In 2012, the Pittsburgh Business Times also reported an Overachievers Ranking for 498 Pennsylvania school districts. Johnsonburg Area School District ranked 92nd. In 2011, the district was 85th.[15] The editor describes the ranking as: "a ranking answers the question - which school districts do better than expectations based upon economics? This rank takes the Honor Roll rank and adds the percentage of students in the district eligible for free and reduced-price lunch into the formula. A district finishing high on this rank is smashing expectations, and any district above the median point is exceeding expectations."[16]

In 2010 through 2012, Johnsonburg Area School District achieved AYP status under No Child Left Behind.[17] In 2011, 94 percent of the 500 Pennsylvania Public School Districts achieved the No Child Left Behind Act progress level of 72% of students reading on grade level and 67% of students demonstrating on grade level math. In 2011, 46.9 percent of Pennsylvania school districts achieved Adequate Yearly Progress (AYP) based on student performance. An additional 37.8 percent of school districts made AYP based on a calculated method called safe harbor, 8.2 percent on the growth model and 0.8 percent on a two-year average performance. Johnsonburg Area School District has achieved AYP status each year since 2003.

Graduation rate

In 2012, the graduation rate was 90%. In 2011, the graduation rate was 87.5%.[18] In 2010, the Pennsylvania Department of Education issued a new, 4-year cohort graduation rate. High School's rate was 87% for 2010.[19]

- According to traditional graduation rate calculations

High school

Johnsonburg Area High School is located at 315 High School Road, Johnsonburg. According to the National Center for Education Statistics, in 2010, the school reported an enrollment of 342 pupils in grades 7th through 12th, with 147 pupils eligible for a federal free or reduced-price lunch. The school employed 26 teachers, yielding a student–teacher ratio of 13:1.[24] According to a report by the Pennsylvania Department of Education, 100% of the teachers were rated "Highly Qualified" under No Child Left Behind. Three teachers have emergency certification.[25]

In 2010 through 2012, Johnsonburg Area High School achieved AYP status.[26][27]

- PSSA Results

11th Grade Reading

- 2012 - 68% on grade level, (18% below basic). State - 67% of 11th graders are on grade level.[28]

- 2011 - 64% (7% below basic). State - 69.1%[29]

- 2010 - 69% (19% below basic). State - 66%[30]

- 2009 - 70% (14% below basic). State - 65%[31]

- 2008 - 55% (16% below basic). State - 65%[32]

- 2007 - 67% (20% below basic). State - 65%[33]

11th Grade Math:

- 2012 - 68% on grade level (18% below basic). In Pennsylvania, 59% of 11th graders are on grade level.[34]

- 2011 - 57% (14% below basic). State - 60.3%.[35]

- 2010 - 67% (17% below basic). State - 59%[36]

- 2009 - 56% (21% below basic). State - 56%.[37]

- 2008 - 46% (30% below basic). State - 56%[38]

- 2007 - 43% (43% below basic). State - 53%[39]

11th Grade Science:

College remediation rate

According to a Pennsylvania Department of Education study released in January 2009, 16% of the Johnsonburg Area High School graduates required remediation in mathematics and or reading before they were prepared to take college level courses in the Pennsylvania State System of Higher Education or community colleges.[44] Less than 66% of Pennsylvania high school graduates, who enroll in a four-year college in Pennsylvania, will earn a bachelor's degree within six years. Among Pennsylvania high school graduates pursuing an associate degree, only one in three graduate in three years.[45] Per the Pennsylvania Department of Education, one in three recent high school graduates who attend Pennsylvania's public universities and community colleges takes at least one remedial course in math, reading or English.

Dual enrollment

Johnsonburg Area High School offers a dual enrollment program to juniors and seniors. This state program permits the high school students to take courses, at local higher education institutions, to earn college credits. Students remain enrolled at their high school. The courses count towards high school graduation requirements and towards earning a college degree. The students continue to have full access to activities and programs at their high school. The college credits are offered at a deeply discounted rate. The state offered a small grant to assist students in costs for tuition, fees and books.[46] Under the Pennsylvania Transfer and Articulation Agreement, many Pennsylvania colleges and universities accept these credits for students who transfer to their institutions.[47]

AP courses

The high school offers AP (advanced placement) English, AP Psychology, AP Calculus and AP Chemistry courses which require extra instructional time by the student. AP final course grades are weighted 1.25 credit. Students may take the College Board's Advanced Placement exam in the spring for a fee. If they earn a score of 3 or better they may be awarded college credits at their college or university.

Graduation requirements

Johnsonburg Area School Board has determined that a pupil must earn 24 credits to graduate, including: a required class every year in math, English, social studies, science, Physical Education and electives.[48] Juniors must have earned at least twenty-one credits towards graduation to be promoted to seniors.

By law, all Pennsylvania secondary school students must complete a project as a part of their eligibility to graduate from high school. The type of project, its rigor and its expectations are set by the individual school district.[49] All students in grades 9 through 12 are required to provide a minimum of 32 hours approved hours before graduation. The time increases to 44 hours beginning with the graduating class of 2014. Students may earn one hour of community service by successfully completing an extracurricular season or activity. It is required that students serve eleven hours per year.[50]

By Pennsylvania School Board regulations, for the graduating class of 2016, students must demonstrate successful completion of secondary level course work in Algebra I, Biology, English Composition, and Literature for which the Keystone Exams serve as the final course exams. Students’ Keystone Exam scores shall count for at least one-third of the final course grade.[51][52][53] In 2011, Pennsylvania high school students field tested the Algebra 1, Biology and English Lit exams. The statewide results were: Algebra 1 38% on grade level, Biology 35% on grade level and English Lit - 49% on grade level.[54] Individual student, school or district reports were not made public, although they were reported to district officials by the Pennsylvania Department of Education.

SAT scores

From January to June 2011, 35 Johnsonburg students took the SAT exams. The district's Verbal Average Score was 465. The Math average score was 492. The Writing average score was 447.[55] Pennsylvania ranked 40th among states with SAT scores: Verbal - 493, Math - 501, Writing - 479.[56] In the United States 1.65 million students took the exam in 2011. They averaged 497 (out of 800) verbal, 514 math and 489 in writing.[57]

Seventh and Eighth grades

According to District policy, failure of two core subjects in seventh and eighth grade can result in retention of the student in that grade for another school year.

- PSSA results

|

8th Grade Reading

|

8th Grade Math:

|

8th Grade Science:

- 2012 - 72% on grade level (5% below basic). State - 59%

- 2011 - 62% (8% below basic). State – 58.3%

- 2010 - 59% (22% below basic). State – 57%[62]

- 2009 - 63% (14% below basic). State - 55%[63]

- 2008 - 68% (10% below basic). State - 52%[64]

|

7th Grade Reading

|

7th Grade Math:

|

Elementary school

Johnsonburg Area Elementary School is located at 1356 Wilcox Road, Johnsonburg. According to the National Center for Education Statistics, in 2010, the school reported an enrollment of 312 pupils in grades kindergarten through 6th, with 156 pupils receiving a federal free or reduced-price lunch due to family poverty. The school employed 23 teachers, yielding a student–teacher ratio of 14:1.[65] According to a report by the Pennsylvania Department of Education, 100% of its teachers were rated "Highly Qualified" under No Child Left Behind.[66] In 2010 and 2011, Johnsonburg Area Elementary School achieved AYP status.[67]

|

6th Grade Reading:

|

6th Grade Math:

|

|

5th Grade Reading:

|

5th Grade Math:

|

|

|

- 4th Grade Science

- 2012 - 94%, 53% advanced. State - 82%

- 2011 - 93%, 61% advanced (4% below basic), State – 82.9%

- 2010 - 92%, 62% advanced (0% below basic), State - 81%

- 2009 - 95%, (0% below basic), State - 83%

- 2008 - 97%, 48% advanced (0% below basic), State - 81%

|

|

Special education

In December 2010, the District administration reported that 100 pupils or 15% of the district's pupils received Special Education services, with 60% of the identified students having a specific learning disability. In December 2009, the District administration reported that 111 pupils or 17% of the district's pupils received Special Education services[72]

In order to comply with state and federal Individuals with Disabilities Education Act rules and regulations, the school district engages in identification procedures to ensure that eligible students receive an appropriate educational program consisting of special education and related services, individualized to meet student needs. At no cost to the parents, these services are provided in compliance with state and federal law; and are reasonably calculated to yield meaningful educational benefit and student progress .[73] To identify students who may be eligible for special education services, various screening activities are conducted on an ongoing basis. These screening activities include: review of group-based data (cumulative records, enrollment records, health records, report cards, ability and achievement test scores); hearing, vision, motor, and speech/language screening; and review by the Special Education administration. When screening results suggest that the student may be eligible, the District seeks parental consent to conduct a multidisciplinary evaluation. Parents who suspect their child is eligible may verbally request a multidisciplinary evaluation from a professional employee of the District or contact the district's Special Education Department.[74][75][76]

In 2010, the state of Pennsylvania provided $1,026,815,000 for special education services. This funding is in addition to the state's basic education per pupil funding, as well as, all other state and federal funding.[77] The Pennsylvania Special Education funding system assumes that 16% of the district's students receive special education services. It also assumes that each student's needs accrue the same level of costs.[78] The state requires each district to have a three-year special education plan to meet the unique needs of its special education students.[79] Overidentification of students, in order to increase state funding, has been an issue in the Commonwealth. Some districts have more than 20% of its students receiving special education services while others have 10% supported through special education.[80]

The Johnsonburg Area School District received a $454,325 supplement for special education services in 2010.[81] For the 2011–12 and 2012-13 school years, all Pennsylvania public school districts received the same level of funding for special education that they received in 2010-11. This level funding is provided regardless of changes in the number of pupils who need special education services and regardless of the level of services the respective students required.[82][83]

Gifted education

Johnsonburg Area School District Administration reported that 22 or 3.19% of its students were gifted in 2009.[84] The district calls its gifted program - The GREAT (gifted, resourceful, enriched, achieving and talent) program. By law, the district must provide mentally gifted programs at all grade levels. The referral process for a gifted evaluation can be initiated by teachers or parents by contacting the student's building principal and requesting an evaluation. All requests must be made in writing. To be eligible for mentally gifted programs in Pennsylvania, a student must have a cognitive ability of at least 130 as measured on a standardized ability test by a certified school psychologist. Other factors that indicate giftedness will also be considered for eligibility.[85][86]

Wellness policy

Johnsonburg Area School Board established a district wellness policy in June 2006.[87] The policy deals with nutritious meals served at school, the control of access to some foods and beverages during school hours, age appropriate nutrition education for all students, and physical education for students K-12. The policy is in response to state mandates and federal legislation (P.L. 108 – 265). The law dictates that each school district participating in a program authorized by the Richard B. Russell National School Lunch Act (42 U.S.C. 1751 et seq) or the Child Nutrition Act of 1966 (42 U.S.C. 1771 et seq) "shall establish a local school wellness policy by School Year 2006." The Board was also to appoint a local Wellness Committee which was to provide periodic reports to the Superintendent.

The legislation placed the responsibility of developing a wellness policy at the local level so the individual needs of each district can be addressed. According to the requirements for the Local Wellness Policy, school districts must set goals for nutrition education, physical activity, campus food provision, and other school-based activities designed to promote student wellness. Additionally, districts were required to involve a broad group of individuals in policy development and to have a plan for measuring policy implementation. Districts were offered a choice of levels of implementation for limiting or prohibiting low nutrition foods on the school campus. In final implementation these regulations prohibit some foods and beverages on the school campus.[88] The Pennsylvania Department of Education required the district to submit a copy of the policy for approval.

Johnsonburg Area School District offers both a free school breakfast and a free or reduced-price lunch to low-income children. The program is funded with federal dollars through the USDA.[89]

Highmark Healthy High 5 grant

In 2011, Johnsonburg Area High School received a Highmark Healthy High 5 grant of $10,000 which was used to support the schools Healthy Habits Program.[90] Beginning in 2006, Highmark Foundation engaged in a 5-year, $100 million program to promote lifelong healthy behaviors in children and adolescents through local nonprofits and schools.

Budget

Pennsylvania public school districts budget and expend funds according to procedures mandated by the Pennsylvania Department of Education (PDE). An annual operating budget is prepared by school district administrative officials. A uniform form is furnished by the PDE and submitted to the board of school directors for approval prior to the beginning of each fiscal year on July 1.

Under Pennsylvania's Taxpayer Relief Act, Act 1 of the Special Session of 2006, all school districts of the first class A, second class, third class and fourth class must adopt a preliminary budget proposal. The proposal must include estimated revenues and expenditures and the proposed tax rates. This proposed budget must be considered by the Board no later than 90 days prior to the date of the election immediately preceding the fiscal year. The preliminary budget proposal must also be printed and made available for public inspection at least 20 days prior to its adoption. The board of school directors may hold a public hearing on the budget, but are not required to do so. The board must give at least 10 days’ public notice of its intent to adopt the final budget according to Act 1 of 2006.[91]

In 2011, the average teacher salary in Jonsonburg Area School District was $63,862.07 a year, while the cost of the benefits teachers receive was $16,242.44 per employee, for a total annual average teacher compensation of $70,104.51.[92] According to a study conducted at the American Enterprise Institute, in 2011, public school teachers’ total compensation is roughly 50 percent higher than they would likely receive in the private sector. The study found that the most generous benefits that teachers receive are not accounted for in many studies of compensation, including: pension, retiree health benefits and job security.[93]

In 2009, the district reported employing 67 teachers and administrators with a median salary of $62,200 and a top salary of $104,282.[94] The teacher's work day is seven hours and thirty minutes with 185 days in the contract year (180 for student instruction). Teacher receive a daily planning period and a duty-free lunch period. Additionally, the teachers receive a defined benefit pension, health insurance (at the cost of $20 per pay to employee), life insurance, professional development reimbursement, 2 paid personal days (which accumulate to 6 days), 3 paid bereavement days, 10 paid sick days, and other benefits. Upon retirement the employee is paid for unused sick days as a bonus.[95] The Johnsonburg teachers union receives 5 days with pay to attend to union business outside of the district.[96]

In 2007, the district employed 53 teachers. The average teacher salary in the district was $55,120 for 180 days worked.[97] As of 2007, Pennsylvania ranked in the top 10 states in average teacher salaries. When adjusted for cost of living Pennsylvania ranked fourth in the nation for teacher compensation.[98]

Audit In 2007 the Pennsylvania Auditor General conducted a performance audit of the District. Multiple serious findings were reported to the Pennsylvania Department of Education, the Pennsylvania Ethics Commission, the Johnsonburg Area School Board and the District's administration, including repeated, ethical violations by school board members.[99] In December 2010, the Pennsylvania Auditor General conducted a performance audit of the District. Multiple serious findings were reported to the School Board and the District's administration, including ethical violations by school board members.[100]

Per pupil Sending In 2008, the Johnsonburg Area School District administration reported that per pupil spending was $13,458 which ranked 139th among Pennsylvania's 501 school districts. In 2010, the per pupil spending had increased to $15,680.73.[101] Among the states, Pennsylvania's total per pupil revenue (including all sources) ranked 11th at $15,023 per student, in 2008-09.[102] In 2007, the Pennsylvania per pupil total expenditures was $12,759.[103] The U.S. Census Bureau reports that Pennsylvania spent $8,191 per pupil in school year 2000-01.[104]

Johnsonburg Area School District administrative costs per pupil in 2008 was $1,259.78 per pupil which ranked 18th among Pennsylvania's 500 school districts. The lowest administrative cost per pupil in Pennsylvania was $398 per pupil.[105] The Pennsylvania School Boards Association collects and maintains statistics on salaries of public school district employees in Pennsylvania. According to the association's report, the average salary for a superintendent, for the 2007-08 school year, was $122,165. Superintendents and administrators receive a benefit package commensurate with that offered to the district's teachers' union.[106]

Reserves In 2010, Johnsonburg Area School District reported a balance of zero in its unreserved-designated fund. The unreserved-undesignated fund balance was reported as $3,415,365.00.[107] In 2010, Johnsonburg Area Administration reported an increase to $1,193,012 in the unreserved-undesignated fund balance and $1,997,374 in the reserved account. Pennsylvania school district reserve funds are divided into two categories – designated and undesignated. The undesignated funds are not committed to any planned project. Designated funds and any other funds, such as capital reserves, are allocated to specific projects. School districts are required by state law to keep 5 percent of their annual spending in the undesignated reserve funds to preserve bond ratings. According to the Pennsylvania Department of Education, from 2003 to 2010, as a whole, Pennsylvania school districts amassed nearly $3 billion in reserved funds.[108]

Tuition Students who live in the District's attendance area may choose to attend one of Pennsylvania's 157 public charter schools. A student living in a neighboring public school district or a foreign exchange student may seek admission to Area School District. For these cases, the Pennsylvania Department of Education sets an annual tuition rate for each school district. It is the amount the public school district pays to a charter school for each resident student that attends the charter and it is the amount a nonresident student's parents must pay to attend the District's schools. The 2012 tuition rates are Elementary School - $9,218.98, High School - $10,098.23.[109]

Johnsonburg Area School District is funded by a combination of: a local earned income tax, a property tax, a real estate transfer tax 0.5%, a per capita tax, coupled with substantial funding from the Commonwealth of Pennsylvania and the federal government.[110] The district receives payments in lieu of taxes from the state and local government of $26,000 and tuition payments of $50,000. Interest earnings on accounts also provide nontax income to the district. In the Commonwealth of Pennsylvania, pension income and Social Security income are exempted from state personal income tax and local earned income tax, regardless of the level of the individual's personal wealth.[111]

State basic education funding

For the 2012-13 school year, Johnsonburg Area School District received $4,957,798.[112] The Governor's Executive Budget for 2012-2013 includes $9.34 billion for kindergarten through 12th grade public education, including $5.4 billion in basic education funding, which is an increase of $49 million over the 2011-12 budget. The state also provides $100 million for the Accountability Block Grant (ABG). Johnsonburg Area School District received $63,755 in ABG funds. The state will also provide $544.4 million for School Employees’ Social Security and $856 million for School Employees’ Retirement fund called PSERS.[113] This amount is a $21,823,000 increase (0.34%) over the 2011-2012 appropriations for Basic Education Funding, School Employees' Social Security, Pupil Transportation, Nonpublic and Charter School Pupil Transportation. Since taking office,

In 2011-12, Johnsonburg Area School District received a $4,894,043 allocation, of state Basic Education Funding.[114][115] Additionally, Johnsonburg Area School District received $63,755 in Accountability Block Grant funding. The enacted Pennsylvania state Education budget included $5,354,629,000 for the 2011-2012 Basic Education Funding appropriation. This amount is a $233,290,000 increase (4.6%) over the enacted State appropriation for 2010-2011.[116] The highest increase in state basic education funding was awarded to Duquesne City School District, which got a 49% increase in state funding for 2011-12.[117] In 2010, the district reported that 304 students received free or reduced-price lunches, due to the family meeting the federal poverty level.[118]

In the 2010-2011 budget year, the Commonwealth of Pennsylvania provided a 2% increase in Basic Education Funding for a total of $5,091,762. Among the public school districts in Elk County, the highest increase went to Saint Marys Area School District which got a 6.02% increase. One hundred fifty Pennsylvania school districts received the base 2% increase. The highest increase in 2010-11 went to Kennett Consolidated School District in Chester County which received a 23.65% increase in state funding.[119] The state's hold harmless policy regarding state basic education funding continued where a district received at least the same amount as the year before, even where enrollment had significantly declined. The amount of increase each school district received was set by Governor Edward Rendell and then Secretary of Education Gerald Zahorchak, as a part of the state budget proposal given each February. This was the second year of Governor Rendell's policy to fund some districts at a far greater rate than others.

In the 2009-2010 budget year, the Commonwealth of Pennsylvania provided a 2% increase in Basic Education Funding for a total of $4,991,923 to Johnsonburg Area School District. Among the districts in Elk County, the highest increase went to Saint Marys Area School District which got a 6.66%. The state Basic Education Funding to the district in 2008-09 was $4,894,042.71. Ninety school districts received a 2% increase. Muhlenberg School District in Berks County received a 22.31% increase in state basic education funding in 2009.[120] The amount of increase each school district received was set by Governor Edward G. Rendell and the Secretary of Education Gerald Zahorchak, as a part of the state budget proposal.[121] According to the Pennsylvania Department of Education, 294 district students received free or reduced-price lunches due to low family income in the 2007–2008 school year.[122]

Accountability Block Grants

Beginning in 2004-2005, the state launched the Accountability Block Grant school funding. This program has provided $1.5 billion to Pennsylvania's school districts. The Accountability Block Grant program requires that its taxpayer dollars are focused on specific interventions that are most likely to increase student academic achievement. These interventions include: teacher training, all-day kindergarten, lower class size K-3rd grade, literacy and math coaching programs that provide teachers with individualized job-embedded professional development to improve their instruction, before or after school tutoring assistance to struggling students. For 2010-11, Johnsonburg Area School District applied for and received $173,046 in addition to all other state and federal funding. The district uses the funding to provide full-day kindergarten, Intensive instruction for struggling students during the school day, Professional Development and Tutoring before/after school, weekends.[123][124]

Classrooms for the Future grant

The Classroom for the Future state program provided districts with hundreds of thousands of extra state funding to buy laptop computers for each core curriculum high school class (English, Science, History, Math) and paid for teacher training to optimize the computers use. The program was funded from 2006-2009. The School District did not apply to participate in 2006-07. In 2007-08 the district received $102,039. The district received $45,413 in 2008-09.[125] In Elk County the highest award was given to Saint Marys Area School District. The highest funding statewide was awarded to Philadelphia City School District in Philadelphia County - $9,409,073. In 2010, Classrooms for the Future funding was curtailed statewide due to a massive state financial crisis.

Other grants

Johnsonburg Area School District did not participate in: PA DEP Environmental Education grants, Science Its Elementary grants, Education Assistance Grants, 2012 Striving Readers Comprehensive Literacy grant, nor the 21st Century learning grants.

Federal Stimulus grant

The district received an extra $1,510,552 in ARRA - Federal Stimulus money to be used in specific programs like special education and meeting the academic needs of low-income students.[126] The funding was limited to the 2009–10 and 2010-2011 school years.[127] Due to the temporary nature of the funding, schools were repeatedly advised to use the funds for one-time expenditures like acquiring equipment, making repairs to buildings, training teachers to provide more effective instruction or purchasing books and software.

Race to the Top grant

Johnsonburg Area School District officials did not apply for the federal Race to the Top grant which would have provided several hundred thousand dollars in additional federal funding to improve student academic achievement.[128] Participation required the administration, the school board and the local teachers' union to sign an agreement to prioritize improving student academic success. In Pennsylvania, 120 public school districts and 56 charter schools agreed to participate.[129] Pennsylvania was not approved for the grant. The failure of districts to agree to participate was cited as one reason that Pennsylvania was not approved.[130][131][132]

Community Foundation Grant

In December 2011, the District received a $10,000 grant from the Elk County Community Foundation. The funds were used to purchase new technology equipment and upgrading some of the current technology equipment.

Real estate taxes

Property tax rates in 2012-13 were set by the school board at 30.8000 mills plus Oil/Gas/Mineral tax - 80.0000 mills.[133] Johnsonburg Area School District is one of 3 districts statewide to levy the Oil/Gas/Mineral tax millage. A mill is $1 of tax for every $1,000 of a property's assessed value. Irregular property reassessments have become a serious issue in the commonwealth as it creates a significant disparity in taxation within a community and across a region. Property taxes, in the Commonwealth of Pennsylvania, apply only to real estate - land and buildings. The property tax is not levied on cars, business inventory, or other personal property. Certain types of property are exempt from property taxes, including: places of worship, places of burial, private social clubs, charitable and educational institutions and government property. Additionally, service related, disabled US military veterans may seek an exemption from paying property taxes. Pennsylvania school district revenues are dominated by two main sources: 1) Property tax collections, which account for the vast majority (between 75-85%) of local revenues; and 2) Act 511 tax collections, which are around 15% of revenues for school districts.[134] When the school district includes municipalities in two counties, each of which has different rates of property tax assessment, a state board equalizes the tax rates between the counties.[135] In 2010, miscalculations by the State Tax Equalization Board (STEB) were widespread in the Commonwealth and adversely impacted funding for many school districts, including those that did not cross county borders.[136]

- 2011-12 - 30.8000 mills plus Oil/Gas/Mineral tax - 80.0000 mills[137]

- 2010-11 - 30.8000 mills plus Oil/Gas/Mineral tax - 80.0000 mills[138]

- 2009-10 - 30.8000 mills plus Oil/Gas/Mineral tax - 80.0000 mills[139]

- 2008-09 - 30.8000 mills plus Oil/Gas/Mineral tax - 80.0000 mills[140]

- 2007-08 - 30.7900 mills plus Oil/Gas/Mineral tax - 80.1800 mills[141]

- 2006-07 - 30.8000 mills plus Oil/Gas/Mineral tax - 80.0000 mills.[142]

According to a report prepared by the Pennsylvania Department of Education, the total real estate taxes collected by all school districts in Pennsylvania rose from $6,474,133,936 in 1999-00 to $10,438,463,356 in 2008-09 and to $11,153,412,490 in 2011.[143] The average yearly property tax paid by Elk County residents amounts to about 2.89% of their yearly income. Elk County is ranked 668th of the 3143 United States counties for property taxes as a percentage of median income.[144]

Act 1 Adjusted Index

The Act 1 of 2006 Index regulates the rates at which each school district can raise property taxes in Pennsylvania. Districts are not allowed to raise taxes above that index unless they allow voters to vote by referendum, or they seek an exception from the state Department of Education. The base index for the 2011-2012 school year is 1.4 percent, but the Act 1 Index can be adjusted higher, depending on a number of factors, such as property values and the personal income of district residents. Act 1 included 10 exceptions, including: increasing pension costs, increases in special education costs, a catastrophe like a fire or flood, increase in health insurance costs for contracts in effect in 2006 or dwindling tax bases. The base index is the average of the percentage increase in the statewide average weekly wage, as determined by the PA Department of Labor and Industry, for the preceding calendar year and the percentage increase in the Employment Cost Index for Elementary and Secondary Schools, as determined by the Bureau of Labor Statistics in the U.S. Department of Labor, for the previous 12-month period ending June 30. For a school district with a market value/personal income aid ratio (MV/PI AR) greater than 0.4000, its index equals the base index multiplied by the sum of .75 and its MV/PI AR for the current year.[145] In June 2011, the Pennsylvania General Assembly eliminated six of the ten exceptions to the Act 1 Index.[146] Several exceptions were maintained: 1) costs to pay interest and principal on indebtedness incurred prior to September 4, 2004 for Act 72 schools and prior to June 27, 2006 for non-Act 72 schools; 2) costs to pay interest and principal on electoral debt; 3) costs incurred in providing special education programs and services (beyond what is already paid by the State); and 4) costs due to increases of more than the Index in the school's share of payments to PSERS (PA school employees pension fund) taking into account the state mandated PSERS contribution rate.[147][148]

The School District Adjusted Index for the Johnsonburg Area School District 2006-2007 through 2011-2012.[149]

|

|

For the 2012-13 budget year, Johnsonburg Area School Board did not apply for exceptions to exceed the Act 1 Index. For 2012-2013, 274 school districts adopted a resolution certifying that tax rates would not be increased above their index; 223 school districts adopted a preliminary budget leaving open the option of exceeded the Index limit. For the exception for pension costs, 194 school districts received approval to exceed the Index. For special education costs, 129 districts received approval to exceed the tax limit. For the exception for pension costs, 194 school districts received approval to exceed the Index. For special education costs, 129 districts received approval to exceed the tax limit.[153]

For the 2011-12 school year, the Johnsonburg Area School Board did not apply for an exception to exceed the Act 1 Index. Each year, the Johnsonburg Area School Board has the option of adopting either 1) a resolution in January certifying they will not increase taxes above their index or 2) a preliminary budget in February. A school district adopting the resolution may not apply for referendum exceptions or ask voters for a tax increase above the inflation index. A specific timeline for these decisions is published annually, by the Pennsylvania Department of Education.[154]

According to a state report, for the 2011-2012 school year budgets, 247 school districts adopted a resolution certifying that tax rates would not be increased above their index; 250 school districts adopted a preliminary budget. Of the 250 school districts that adopted a preliminary budget, 231 adopted real estate tax rates that exceeded their index. Tax rate increases in the other 19 school districts that adopted a preliminary budget did not exceed the school district's index. Of the districts who sought exceptions: 221 used the pension costs exemption and 171 sought a Special Education costs exemption. Only 1 school district sought an exemption for Nonacademic School Construction Project, while 1 sought an exception for Electoral debt for school construction.[155]

Johnsonburg Area School Board did not apply for any exceptions to exceed the Act 1 index for the budget in 2011.[156] For 2009-10 school budget, the school board also did not apply for exceptions to exceed the Index.[157] In the Spring of 2010, 135 Pennsylvania school boards asked to exceed their adjusted index. Approval was granted to 133 of them and 128 sought an exception for pension costs increases.[158]

Property tax relief

In 2010, property tax relief for 1,425 approved residents of Johnsonburg Area School District was set at $198.[159] In 2009, the Homestead/Farmstead Property Tax Relief from gambling for the Johnsonburg Area School District was $201 per approved permanent primary residence. In the district, 1,415 property owners applied for the tax relief. Among Elk County's public school districts, the highest tax relief went to Johnsonburg Area School District.[160] The highest property tax relief, among Pennsylvania school districts, went to the homesteads of Chester Upland School District of Delaware County which received $632 per approved homestead in 2010. Chester-Upland School District has consistently been the top recipient since the programs inception.[161] The relief was subtracted from the total annual school property tax bill. Property owners apply for the relief through the county Treasurer's office. Farmers can qualify for a farmstead exemption on building used for agricultural purposes. The farm must be at least 10 contiguous acres (40,000 m2) and must be the primary residence of the owner. Farmers can qualify for both the homestead exemption and the farmstead exemption. In Beaver County, 62% of eligible property owners applied for property tax relief in 2009.[162]

Additionally, the Pennsylvania Property Tax/Rent Rebate program is provided for low income Pennsylvanians aged 65 and older; widows and widowers aged 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 for homeowners. The maximum rebate for both homeowners and renters is $650. Applicants can exclude one-half (1/2) of their Social Security income, consequently people who have an income of substantially more than $35,000 may still qualify for a rebate. Individuals must apply annually for the rebate. This tax rebate can be taken in addition to Homestead/Farmstead Property Tax Relief. In 2012, Pennsylvania Secretary of the Treasury reported issuing more than half a million property tax rebates totaling $238 million.[163] The program is funded by the Pennsylvania Lottery. Property tax rebates are increased by an additional 50 percent for senior households in the state, so long as those households have incomes under $30,000 and pay more than 15% of their income in property taxes.[164]

Property taxes in Pennsylvania are relatively high on a national scale. According to the Tax Foundation, Pennsylvania ranked 11th in the U.S. in 2008 in terms of property taxes paid as a percentage of home value (1.34%) and 12th in the country in terms of property taxes as a percentage of income (3.55%).[165]

Extracurriculars

The district offers a variety of clubs, activities and an extensive and costly sports program. Eligibility for participation is determined by school board policy. Students failing up to 2 courses may still participate in accordance with Pennsylvania Interscholastic Athletic Association (PIAA) policies.[166][167]

By Pennsylvania law, all K-12 students residing in the district, including those who attend a private nonpublic school, cyber charter school, charter school and those homeschooled, are eligible to participate in the extracurricular programs, including all athletics. They must meet the same eligibility rules as the students enrolled in the district's schools.[168]

Extracurriculars

The district offers the following: Drama Club FFA (Future Farmers of America) French Club National Honor Society Photography Club Stand Tall Varsity Club Student Council Yearbook Club

Sports

The District funds:

|

|

- Junior high school sports

|

|

According to PIAA directory July 2012 [169]

References

- National Center for Education Statistics, Common Core of Data - Johnsonburg Area School District, 2012

- Pennsylvania Department of Education, Enrollment and Projections by LEA, 2010

- Pennsylvania Department of Education, Enrollment and Projections by school district, July 2010

- Cherry, Heather, Public walking at elementary school extended, Ridgeway Record, April 5, 2012

- US Census Bureau, American Fact Finder, 2009

- US Census Bureau (2010). "American Fact Finder, State and County quick facts". Archived from the original on 2014-10-06.

- US Census Bureau (September 2011). "Income, Poverty, and Health Insurance Coverage in the United States: 2010" (PDF).

- Pennsylvania Public School Code Governance 2010

- The Commonwealth Foundation for Public Policy Alternatives. "The Pennsylvania Project". Archived from the original on July 16, 2011. Retrieved May 20, 2010.

- Pittsburgh Business Times (April 6, 2012). "Guide to Pennsylvania Schools Statewide ranking". Archived from the original on October 16, 2012.

- "Statewide Honor Roll Rankings 2012". Pittsburgh Business Times. April 5, 2012. Archived from the original on October 23, 2012.

- "Statewide Honor Roll Rankings 2011". Pittsburgh Business Times. April 2011. Archived from the original on 2011-07-23.

- Pittsburgh Business Times (April 30, 2010). "Statewide Honor Roll Rankings 2010".

- "Three of top school districts in state hail from Allegheny County". Pittsburgh Business Times. May 23, 2007. Archived from the original on July 18, 2011.

- Pittsburgh Business Times, Statewide Overachivers Ranking Information, April 6, 2012

- "Overachiever statewide ranking". Pittsburgh Business Times. May 6, 2010.

- Pennsylvania Department of Education, Johnsonburg Area School District Academic report Card 2012, September 21, 2012

- Pennsylvania Department of Education (September 21, 2012). "Johnsonburg Area School District AYP Data Table 2012". Archived from the original on March 4, 2016. Retrieved July 5, 2012.

- Pennsylvania Department of Education (March 15, 2011). "New 4-year Cohort Graduation Rate Calculation Now Being Implemented". Archived from the original on September 14, 2010.

- Pennsylvania Department of Education (2011). "Johnsonburg Area School District Academic Achievement Report Card Data table". Archived from the original on 2016-03-04. Retrieved 2012-07-05.

- The Times-Tribune (June 27, 2010). "PA School District Statistical Snapshot Database 2008-09".

- The Times-Tribune (June 25, 2009). "County School Districts Graduation Rates 2008".

- Pennsylvania Partnerships for Children (2008). "High School Graduation rate 2007" (PDF). Archived from the original (PDF) on 2012-05-07. Retrieved 2012-07-05.

- National Center for Education Statistics, Common Care Data - Johnsonburg Area High School, 2010

- Pennsylvania Department of Education, Professional Qualifications of Teachers Johnsonburg Area High School, September 29, 2011

- Pennsylvania Department of Education, Johnsonburg Area High School Academic Report Card 2011, September 29, 2011

- Pennsylvania Department of Education, Johnsonburg Area High School Academic Report Card 2012, September 21, 2012

- Pennsylvania Department of Education (September 29, 2012). "2011-2012 PSSA and AYP Results".

- Pennsylvania Department of Education (September 29, 2011). "2010-2011 PSSA and AYP Results".

- Pennsylvania Department of Education (2010). "2009-2010 PSSA and AYP Results".

- The Times-Tribune (September 14, 2009). "Grading Our Schools database, 2009 PSSA results".

- Pennsylvania Department of Education (August 15, 2008). "2007-2008 PSSA and AYP Results".

- Pennsylvania Department of Education (2007). "PSSA Math and Reading results".

- Pittsburgh Post Gazette (October 15, 2012). "How is your school doing?".

- Pennsylvania Department of Education (September 29, 2011). "Johnsonburg Area High School Academic Achievement Report Card 2011" (PDF).

- Pennsylvania Department of Education, Johnsonburg Area High School Academic Achievement Report Card 2010, October 20, 2010

- Pennsylvania Department of Education, Johnsonburg Area High School Academic Achievement Report Card 2009, September 14, 2009

- Pennsylvania Department of Education, Johnsonburg Area High School Academic Achievement Report Card 2008, August 15, 2008

- Pennsylvania Department of Education, Johnsonburg Area High School Academic Achievement Report Card, 2007

- Pennsylvania Department of Education (September 21, 2012). "Johnsonburg Area Junior Senior High School Academic Achievement Report Card 2012". Missing or empty

|url=(help) - Pennsylvania Department of Education (September 29, 2011). "2010-2011 PSSA results in Science".

- The Times-Tribune (2009). "Grading Our Schools database, 2009 Science PSSA results".

- Pennsylvania Department of Education (2008). "Report on PSSA Science results by school and grade 2008".

- Pennsylvania Department of Education (January 20, 2009). "Pennsylvania College Remediation Report". Archived from the original on May 3, 2012.

- National Center for Education Statistics, IPEDS Integrated Postsecondary Education Data System, 2008

- Pennsylvania Department of Education (2010). "Dual Enrollment Guidelines".

- Commonwealth of Pennsylvania (March 2010). "Pennsylvania Transfer and Articulation Agreement".

- Johnsonburg Area School Administration, Course Offerings 2012, January 2012

- Pennsylvania State Board of Education. "Pennsylvania Code §4.24 (a) High school graduation requirements".

- Johnsonburg Area School Board, Graduation Requirements Policy 217, March 10, 2011

- Pennsylvania Department of Education (2010). "Keystone Exam Overview" (PDF).

- Pennsylvania Department of Education (September 2011). "Pennsylvania Keystone Exams Overview". Archived from the original on 2012-03-17.

- Pennsylvania State Board of Education (2010). "Rules and Regulation Title 22 PA School Code CH. 4".

- Pennsylvania Department of Education (2011). "Keystone Exams".

- Pennsylvania Department of Education (2011). "Public School SAT Scores 2011". Archived from the original on 2011-10-15.

- College Board (September 2011). "SAT Scores State By State - Pennsylvania". Archived from the original on 2011-10-08.

- "While U.S. SAT scores dip across the board, N.J. test-takers hold steady". September 2011.

- Pennsylvania Department of Education (August 15, 2008). "Reading and Math PSSA 2008 by Schools".

- Pennsylvania Department of Education (September 21, 2012). "Johnsonburg Area Junior Senior High School Academic Achievement Report Card 2012" (PDF). Archived from the original (PDF) on March 4, 2016. Retrieved March 24, 2013.

- Pennsylvania Department of Education Report (September 14, 2010). "2010 PSSAs: Reading, Math, Writing Results".

- Pennsylvania Department of Education (2009). "2009 PSSAs: Reading, Math, Writing and Science Results".

- Pennsylvania Department of Education Report (August 2010). "Science PSSA 2010 by Schools".

- Pennsylvania Department of Education Report (August 2009). "Science PSSA 2009 by Schools".

- Pennsylvania Department of Education Report (August 15, 2008). "Science PSSA 2008 by Schools".

- National Center for Education Statistics, Common Care Data – Johnsonburg Area Elementary School, 2010

- Pennsylvania Department of Education, Professional Qualifications of Teachers Johnsonburg Area Elementary School, September 29, 2011

- Pennsylvania Department of Education, Johnsonburg Area Elementary School AYP Overview, September 29, 2011

- Pennsylvania Department of Education (September 21, 2012). "Johnsonburg Area Elementary School Academic Achievement Report Card 2012" (PDF).

- Pennsylvania Department of Education, Johnsonburg Area Elementary School Academic Achievement Report Card 2011, September 29, 2011

- Pennsylvania Department of Education, Johnsonburg Area Elementary School Academic Achievement Report Card 2011, September 14, 2009

- Pennsylvania Department of Education, Johnsonburg Area Elementary School Academic Achievement Report Card 2008, August 15, 2008

- Pennsylvania Bureau of Special Education Services (2009–2010). "Johnsonburg Area School District Special Education Data Report LEA Performance on State Performance Plan (SPP) Targets". Archived from the original on 2011-08-24.

- Pennsylvania Bureau of Special Education (2008). "Pennsylvania Parent Guide to Special Education Services".

- Pennsylvania Department of Education - School District Administration (January 6, 2011). "Procedural Safeguards Notice". Missing or empty

|url=(help) - Pennsylvania Department of Education, Bureau of Special Education (September 2005). "Gaskin Settlement Agreement Overview Facts Sheet" (PDF). Archived from the original (PDF) on 2007-10-20.

- Johnsonburg Area School District Administration (2012). "Johnonburg Area School District Special Education annual notices Child Find, Screening and Evaluation Procedures, Special Education Programs and Services".

- Pennsylvania Department of Education. "Pennsylvania Special Education Funding".

- Senator Patrick Browne (November 1, 2011). "Senate Education Committee Holds Hearing on Special Education Funding & Accountability". Archived from the original on July 23, 2012.

- Pennsylvania Department of Education Amy Morton, Executive Deputy Secretary (November 11, 2011). "Public Hearing: Special Education Funding & Accountability Testimony". Archived from the original on April 22, 2012.

- Baruch Kintisch Education Law Center (November 11, 2011). "Public Hearing: Special Education Funding & Accountability Testimony" (PDF). Archived from the original (PDF) on April 22, 2012.

- Pennsylvania Department of Education (July 2010). "Special Education Funding from Pennsylvania State_2010-2011".

- Pennsylvania Department of Education (2011). "Special Education Funding 2011-2012 Fiscal Year".

- Pennsylvania Department of Education, Investing in PA kids, April 2012

- Pennsylvania Department of Education (Revised December 1, 2009 Child Count (Collected July 2010)). "Gifted Students as Percentage of Total Enrollment by School District/Charter School" (PDF). Archived from the original (PDF) on March 4, 2016. Check date values in:

|date=(help) - Pennsylvania Department of Education and Pennsylvania School Board. "CHAPTER 16. Special Education For Gifted Students". Retrieved February 4, 2011.

- Pennsylvania Department of Education (March 26, 2010). "Special Education for Gifted Students Notice of Parental rights" (PDF). Archived from the original (PDF) on March 4, 2016.

- Johnsonburg Area School Board Policy Manual, Student Wellness Policy 246, June 8, 2006

- Pennsylvania Department of Education – Division of Food and Nutrition. (July 2008). "Nutrition Standards for Competitive Foods in Pennsylvania Schools for the School Nutrition Incentive".

- Pennsylvania Hunger Action Center, The Pennsylvania School Breakfast Report Card, 2009

- Highmark Foundation, 2011 School Challenge Grants, 2011

- Pennsylvania General Assembly, Taxpayer Relief Act, Act 1 of the Special Session of 2006, June 27, 2006

- Pennsylvania Department of Education (2012). "Investing in Pennsylvania Students". Archived from the original on 2013-10-01.

- American Enterprise Institute (2011). "Assessing the Compensation of Public School Teachers". Archived from the original on 2013-01-03.

- Asbury Park Press (2009). "PA. Public School Salaries". Archived from the original on 2012-07-21.

- Johnsonburg Area School Board (2010). "Johnsonburg Area School District Teacher Union Employment Contract 2010". Archived from the original on 2012-06-16.

- "Pennsylvania Public Schools Teachers' Union Contracts". April 27, 2012. Archived from the original on October 22, 2011.

- Fenton, Jacob., Average classroom teacher salary in Elk County, 2006-07, The Morning Call |date=March 2009

- PA Delaware County Times, Teachers need to know enough is enough, April 20, 2010.

- Pennsylvania Auditor General (January 2007). "Johnsonburg Area School District Elk County, Pennsylvania Performance Audit Report" (PDF).

- Pennsylvania Auditor General (December 2010). "Johnsonburg Area School District Elk County, Pennsylvania Performance Audit Report" (PDF).

- Pennsylvania Department of Education (2010). "2009-10 Selected Data - 2009-10 Total Expenditures per ADM".

- United States Census Bureau (2009). "States Ranked According to Per Pupil Elementary-Secondary Public School System Finance Amounts: 2008-09" (PDF).

- US Census Bureau (2009). "Total and current expenditures per pupil in fall enrollment in public elementary and secondary education, by function and state or jurisdiction: 2006-07".

- "Public Education Finances 2000-01 Annual Survey of Local Government Finances" (PDF). US Census Bureau. March 2003.

- Fenton, Jacob. (February 2009). "Pennsylvania School District Data: Will School Consolidation Save Money?". The Morning Call. Archived from the original on 2011-10-08.

- Pennsylvania School Board Association (October 2009). "Public School Salaries 11th Annual". Archived from the original on 2008-10-05.

- Pennsylvania Department of Education. "Fund Balances by Local Education Agency 1997 to 2008".

- Murphy, Jan., Pennsylvania's public schools boost reserves, CentreDaily Times, September 22, 2010

- Pennsylvania Department of Education (May 2012). "Pennsylvania Public School District Tuition Rates".

- Penn State Cooperative Extension (2010). "What are the Local Taxes in Pennsylvania?, Local Tax Reform Education Project". Archived from the original on 2010-10-27.

- Pennsylvania Department of Revenue (April 2010). "Personal Income Taxation Guidelines". Archived from the original on 2009-12-13.

- Senator Jake Corman (June 28, 2012). "Pennsylvania Education funding by Local School District" (PDF). Archived from the original (PDF) on July 30, 2012.

- Pennsylvania General Assembly Sen Jake Corman (June 29, 2012). "SB1466 of 2012 General Fund Appropriation".

- PA Senate Appropriations Committee (June 28, 2011). "School District 2011-12 Funding Report". Archived from the original on September 10, 2013.

- Pennsylvania Department of Education (July 2011). "Basic Education Funding".

- Pennsylvania Department of Education (June 30, 2011). "Basic Education Funding".

- Pennsylvania Department of Education (June 30, 2011). "Basic Education Funding 2011-2012 Fiscal Year".

- Pennsylvania Department of Education, District Allocations Report 2009, 2009-10

- Pennsylvania House Appropriations Committee Education Budget information (June 30, 2010). "PA Basic Education Funding-Printout2 2010-2011" (PDF).

- Pennsylvania Department of Education (October 2009). "Funding Allocations by district".

- Pennsylvania Office of Budget (February 2009). "Governor's Budget Proposal 2009 Pennsylvania Department of Education Budget Proposal 2009". Archived from the original on 2009-12-24.

- Pennsylvania Department of Education, Funding Report by LEA, 2009

- Pennsylvania Department of Education (2010). "Accountability Block Grant report Grantee list 2010".

- Pennsylvania Department of Education (2008). "Accountability Block Grant Mid Year report".

- Pennsylvania Auditor General (December 22, 2008). "Classrooms for the Future grants audit" (PDF).

- Commonwealth of Pennsylvania (2009). "Elk County ARRA FUNDING Report". Archived from the original on 2011-03-07.

- "School stimulus money". Pittsburgh Post-Gazette. March 12, 2009.

- Pennsylvania Department of Education (December 9, 2009). "Race To The Top Webinar powerpoint for districts December 2009" (PDF). Archived from the original (PDF) on July 4, 2013. Retrieved July 6, 2012.

- Governor's Press Office release (January 20, 2010). "Pennsylvania's 'Race to the Top' Fueled by Effective Reforms, Strong Local Support".

- Race to the Top Fund, U.S. Department of Education, March 29, 2010.

- Gerald Zahorchak (December 2008). "Pennsylvania Race to the Top Letter to Superintendents" (PDF).

- Pennsylvania Department of Education (January 19, 2009). "Pennsylvania Race to the Top -School Districts Title I Allocations 2009-10".

- Deloia, Gina (June 14, 2012). "School district approves budget without tax hike". The Ridgeway record.

- Pennsylvania Department of Education (2004). "Act 511 Tax Report".

- State Tax Equalization Board (2011). "State Tax Equalization Board About US". Archived from the original on 2012-11-14.

- Pennsylvania Auditor General office - Bureau of Audits (February 2011). "A Special Performance Audit of the Pennsylvania State Tax Equalization Boards" (PDF).

- Pennsylvania Department of Education (2011). "Real Estate Tax Rates by School District 2011-12 Real Estate Mills".

- Pennsylvania Department of Education (2010). "Real Estate Tax Millage by School District".

- Pennsylvania Department of Education (2010). "Financial Elements Reports".

- Pennsylvania Department of Education (2009). "Financial Elements Reports 2008-09 Real Estate Mills".

- Pennsylvania Department of Education (2008). "Real Estate Tax Millage by School District".

- Pennsylvania Department of Education (2006). "Real Estate Tax Millage by School District".

- Pennsylvania Department of Education, Pennsylvania School Finances - Summaries of Annual Financial Report Data 2010-11, 2011

- Tax-rates.org., County Property Taxes 2012, 2012

- Pennsylvania Department of Education (2010). "2010-11 Act 1 of 2006 Referendum Exception Guidelines".

- Kaitlynn Riely (August 4, 2011). "Law could restrict school construction projects". Pittsburgh Post-Gazette.

- Pennsylvania General Assembly (June 29, 2011). "SB330 of 2011".

- Eric Boehm (July 1, 2011). "Property tax reform final piece of state budget". PA Independent. Archived from the original on July 4, 2011.

- Pennsylvania Department of Education (May 2010). "Special Session Act 1 of 2006 School District Adjusted Index for 2006-2007 through 2010-2011".

- Pennsylvania Department of Education, 2011-2012 School District Adjusted Index, May 2010

- Pennsylvania Department of Education, 2012-2013 School District Adjusted Index, May 2011

- Pennsylvania Department of Education, 2013-2014 School District Adjusted Index, May 2012

- Pennsylvania Department of Education, Report on Referendum Exceptions For School Year 2012-2013, March 30, 2012

- Pennsylvania Department of Education (2011). "Special Session Act 1 of 2006 the Taxpayer Relief Act information".

- Pennsylvania Department of Education (April 2011). "Report on Exceptions".

- Pennsylvania Department of Education (May 2010). "Report on Referendum Exceptions for 2010-2011".

- Pennsylvania Department of Education (May 2009). "Report on Referendum Exceptions for 2009-2010".

- Scarcella, Frank; Pursell, Tricia (May 25, 2010). "Local school tax assessments exceed state averages". The Daily Item.

- Pennsylvania Department of Education, Tax Relief per Homestead, May 1, 2010

- Tax Relief per Homestead, Pennsylvania Department of revenue, May 1, 2009.

- Tax Relief per Homestead 2009, Pennsylvania Department of Education Report, May 1, 2009

- Pennsylvania Auditor General Office, Special Report Pennsylvania Property Tax Relief, 2-23-2010.

- Elias, Joe., Pennsylvania Treasury Department to issue $238 million in property tax rebates, The Harrisburg Patriot-News, |June 30, 2012

- Pennsylvania Department of Revenue., Property Tax/Rent Rebate Program, June 2012

- New Census Data on Property Taxes on Homeowners, Tax Foundation, September 22, 2009.

- Johnsonburg Area School Board (February 13, 2003). "Interscholastic Athletics Policy 123". Archived from the original on May 9, 2009. Retrieved July 6, 2012.

- Johnsonburg Area School Board (February 13, 2003). "Extracurricular Activities Policy 122". Archived from the original on May 9, 2009. Retrieved July 6, 2012.

- Pennsylvania Office of the Governor Press Release (November 10, 2005). "Home-Schooled, Charter School Children Can Participate in School District Extracurricular Activities". Archived from the original on October 13, 2012. Retrieved July 6, 2012.

- Pennsylvania Interscholastic Athletics Association (2012). "PIAA School Directory".