Liquidity trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt which yields so low a rate of interest."[1]

| Part of a series on |

| Macroeconomics |

|---|

|

|

A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Among the characteristics of a liquidity trap are interest rates that are close to zero and changes in the money supply that fail to translate into changes in the price level.[2]

Origin and definition of the term

John Maynard Keynes, in his 1936 General Theory,[1] wrote the following:

There is the possibility...that, after the rate of interest has fallen to a certain level, liquidity-preference may become virtually absolute in the sense that almost everyone prefers cash to holding a debt which yields so low a rate of interest. In this event the monetary authority would have lost effective control over the rate of interest. But whilst this limiting case might become practically important in future, I know of no example of it hitherto.

This concept of monetary policy's potential impotence[3] was first suggested in the works of British economist John Hicks,[4] inventor of IS–LM modeling.[note 1] In fact, Nobel laureate Paul Krugman, in his work on monetary policy, follows the original formulations[note 2] of Hicks:

A liquidity trap may be defined as a situation in which conventional monetary policies have become impotent, because nominal interest rates are at or near zero: injecting monetary base into the economy has no effect, because [monetary] base and bonds are viewed by the private sector as perfect substitutes.[2]

In a liquidity trap, people are indifferent between bonds and cash because the rates of interest both financial instruments provide to their holder is practically equal: The interest on cash is zero and the interest on bonds is near-zero. Hence, the central bank cannot affect the interest rate any more (through augmenting the monetary base) and has lost control over it.[5]

Elaboration

In Keynes' description of a liquidity trap, people simply do not want to hold bonds and prefer other, non-liquid forms of money instead. Because of this preference, after converting bonds into cash,[note 3] this causes an incidental but significant decrease to the bonds' prices and a subsequent increase to their yields. However, people prefer cash no matter how high these yields are or how high the central bank sets the bond's rates (yields).[6]

Post-Keynesian economist Hyman Minsky posited[7] that "after a debt deflation that induces a deep depression, an increase in the money supply with a fixed head count of other [financial] assets may not lead to a rise in the price of other assets." This naturally causes interest rates on assets that are not considered "almost perfectly liquid" to rise. In which case, as Minsky had stated elsewhere,[8]

The view that the liquidity-preference function is a demand-for-money relation permits the introduction of the idea that in appropriate circumstances the demand for money may be infinitely elastic with respect to variations in the interest rate… The liquidity trap presumably dominates in the immediate aftermath of a great depression or financial crisis.

Historical debate

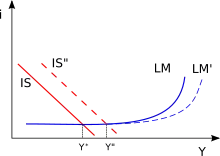

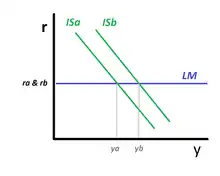

In the wake of the Keynesian revolution in the 1930s and 1940s, various neoclassical economists sought to minimize the effect of liquidity-trap conditions. Don Patinkin[9] and Lloyd Metzler[10] invoked the existence of the so-called "Pigou effect",[11] in which the stock of real money balances is ostensibly an argument of the aggregate demand function for goods, so that the money stock would directly affect the "investment saving" curve in IS/LM analysis. Monetary policy would thus be able to stimulate the economy even when there is a liquidity trap.

Monetarists, most notably Milton Friedman, Anna Schwartz, Karl Brunner, Allan Meltzer and others, strongly condemned any notion of a "trap" that did not feature an environment of a zero, or near-zero, interest rate across the whole spectrum of interest rates, i.e. both short- and long-term debt of the government and the private sector. In their view, any interest rate different from zero along the yield curve is a sufficient condition to eliminate the possibility of the presence of a liquidity trap.[note 4]

In recent times, when the Japanese economy fell into a period of prolonged stagnation, despite near-zero interest rates, the concept of a liquidity trap returned to prominence.[12] Keynes's formulation of a liquidity trap refers to the existence of a horizontal demand-curve for money at some positive level of interest rates; yet, the liquidity trap invoked in the 1990s referred merely to the presence of zero or near-zero interest-rates policies (ZIRP), the assertion being that interest rates could not fall below zero.[note 5] Some economists, such as Nicholas Crafts, have suggested a policy of inflation-targeting (by a central bank that is independent of the government) at times of prolonged, very low, nominal interest-rates, in order to avoid a liquidity trap or escape from it.[13]

Some Austrian School economists, such as those of the Ludwig von Mises Institute, reject Keynes' theory of liquidity preference altogether. They argue that lack of domestic investment during periods of low interest-rates is the result of previous malinvestment and time preferences rather than liquidity preference.[14] Chicago school economists remain critical of the notion of liquidity traps.[15]

Keynesian economists, like Brad DeLong and Simon Wren-Lewis,maintain that the economy continues to operate within the IS-LM model, albeit an "updated" one,[16] and the rules have "simply changed."[17]

Global financial crisis of 2008

During the Global Financial Crisis, in the period 2008-10, as short-term interest rates for the various central banks in the United States and Europe moved close to zero, economists such as Paul Krugman argued that much of the developed world, including the United States, Europe, and Japan, was in a liquidity trap.[18] He noted that tripling of the monetary base in the US between 2008 and 2011 failed to produce any significant effect on domestic price indices or dollar-denominated commodity prices,[19] a notion supported by others, such as Scott Sumner.[20]

Post-Keynesians respond[21] that the confusion by "mainstream economists" between conditions of a liquidity trap, as defined by Keynes and in the Post-Keynesian framework, and conditions of near-zero or zero interest rates, is intentional and ideologically motivated in ostensibly attempting to support monetary over fiscal policies. They argue that, quantitative easing programs in the United States, and elsewhere, caused the prices of financial assets to rise across the board and interest rates to fall; yet, a liquidity trap cannot exist, according to the Keynesian definition, unless the prices on imperfectly safe financial assets are falling and their interest rates are rising.[22] The rise in the monetary base did not affect interest rates or commodity prices.[23]

Taking the precedent of the Global Financial Crisis of 2008, critics[24] of the mainstream definition of a liquidity trap point out that the central bank of the United States never, effectively, lost control of the interest rate. Whereas the United States did experience a liquidity trap in the period 2009/10, i.e. in "the immediate aftermath" of the crisis,[note 6] the critics of the mainstream definition claim[21] that, after that period, there is no more of any kind of a liquidity trap since government and private-sector bonds are "very much in demand".[6] This goes against Keynes' point as Keynes stated that "almost everyone prefers cash to holding a debt",[1] however modern finance has the concept of cash and cash equivalents, and so Treasurys may be treat as cash equivalent, and not "debt", for liquidity purposes by some.[25]

Notes

- The model depicts and tracks the intersection of the "investment–saving" (IS) curve with the "liquidity preference–money supply" (LM) curve. At the intersection, according to the mainstream, Neo-Keynesian analysis, simultaneous equilibrium occurs in both interest and financial-assets markets

- Hicks, subsequently and a few years before his passing, repudiated the IS/LM model, describing it as an "impoverished" representation of Keynesian economics. See Hicks (1981)

- Whereby "cash" includes both currency and bank accounts, aka M1

- See "Monetarism and the liquidity trap

- The assumption being that no one would lend 100 dollars unless they were to get at least 100 dollars back, although we have seen in the 21st century the introduction, without any problem in demand, of negative interest-rates. See e.g. "Why negative interest rates sometimes succeed" by Gemma Tetlow, Financial Times, 5 September 2016

- During approximately 2009/10, the interest rates on risky financial assets failed to respond to Fed intervention, as demonstrated by the TED spread history. See TED rate for the period 2007/16

References

- Keynes, John Maynard (1936) The General Theory of Employment, Interest and Money, United Kingdom: Palgrave Macmillan, 2007 edition, ISBN 978-0-230-00476-4

- Krugman, Paul R. (1998) "It's baack: Japan's Slump and the Return of the Liquidity Trap," Archived 24 May 2013 at the Wayback Machine Brookings Papers on Economic Activity

- Gordon, Robert J. (2009). Macroeconomics (Eleventh ed.). Boston: Pearson Addison Wesley. ISBN 9780321552075.

- Hicks, John R. (1937) "Mr Keynes and the Classics: A Suggested Interpretation", Econometrica, Vol. 5, No. 2, April 1937, pp. 147-159

- Krugman, Paul R. (14 July 2010). "Nobody Understands The Liquidity Trap". The New York Times.

- Pilkington, Philip (2014) "Paul Krugman Does Not Understand the Liquidity Trap", Naked Capitalismwebsite, 23 July 2014

- Minsky, Hyman (1986 [2008]) Stabilizing an Unstable Economy, 1st edition: Yale University Press, 1986; reprint: McGraw Hill, 2008, ISBN 978-0-07-159299-4

- Minsky, Hyman (1975 [2008]) John Maynard Keynes, McGraw-Hill Professional, New York, 2008, ISBN 978-0-07-159301-4

- Patinkin, Don (September 1948). "Price Flexibility and Full Employment". The American Economic Review. 38 (4): 543–564. JSTOR 591.

- Metzler, Lloyd (1951) "Wealth, Saving and the Rate of Interest", Journal of Political Economy, 59(2), pp. 93-116

- Pigou, Arthur Cecil (1943). "The Classical Stationary State". Economic Journal. 53 (212): 343–351. doi:10.2307/2226394. JSTOR 2226394.

- Antonopoulou, Sophia N. (2009) "The Global Financial Crisis", The International Journal of Inclusive Democracy, Vol. 5, No. 4 / Vol. 6, No. 1, Autumn 2009/Winter 2010

- Crafts, Nicholas (12 May 2013). "Escaping liquidity traps: Lessons from the UK's 1930s escape". CEPR. Retrieved 2 March 2018.

- "The Liquidity-Trap Myth" by Richard C.B. Johnsson, The Mises Institute, 13 May 2003

- Sumner, Scott (25 March 2011). "Why Japan's QE didn't 'work'". The Money Illusion website. Retrieved 3 June 2011.

- Krugman, Paul R. (9 October 2011). "IS-LMentary". The New York Times.

- Krugman, Paul R. (7 January 2017). "The Shock of the Normal". The New York Times.

- Krugman, Paul R. (17 March 2010) "How much of the world is in a liquidity trap?", The New York Times

- Krugman, Paul R. (7 October 2011). "Way Off Base". The New York Times.

- Sumner, Scott (11 September 2010). "The other money illusion". The Money Illusion website. Retrieved 3 June 2011.

- Pilkington, Philip (2013) "What is a Liquidity Trap?", Fixing the economists website, 4 July 2013

- Mitchell, William (2012) "The on-going crisis has nothing to do with a supposed liquidity trap", 28 June 2012

- Wray, L. Randall (2013) "Reconciling the Liquidity Trap With MMT: Can DeLong and Krugman Do the Full Monty With Deficit Owls?", Economonitor, 1 May 2013

- Roche, Cullen (2014) "Would Keynes Have Called this a “Liquidity Trap”?", Pragmatic Capitalism website, 23 March 2014

- Cashin, David; Ferris, Erin E. Syron; Klee, Elizabeth. "Treasury safety, liquidity, and money premium dynamics: Evidence from recent debt limit impasses" (PDF). Finance and Economics Discussion Series 2020-008. Washington: Board of Governors of the Federal Reserve System. doi:10.17016/FEDS.2020.008.

Further reading

- Boianovsky, Mauro (2003). "The IS-LM Model and the Liquidity Trap Concept: from Hicks to Krugman" (PDF). History of Political Economy, Duke University Press. Archived from the original (PDF) on 2017-08-29. Retrieved 2017-10-16.

- Eggertsson, Gauti H. (2008). "Liquidity Trap" (2nd ed.). The New Palgrave Dictionary of Economics Online.

- Hicks, John R. (1981) "IS-LM: An Explanation", Journal of Post Keynesian Economics, Volume 3, 1980, Issue 2